Content

-

Weekly Highlights

- Market Commentary

- Durable Goods

- Risks

As the unprecedented rally in the flat rolled spot market continues, the agony for buyers is intensifying and expanding across the industry. This week, there have been reports of transactions at $1,000/st for HRC, and the January future briefly traded above that level. There is seemingly significant demand at any price, driven by those who waited to buy over the fall and now have no choice but to pay up and those who produce products where the steel price is only a small component of the final product pricing. However, this kind of demand will not last forever, and rather than try to predict where and when prices will peak, we encourage buyers to focus on price levels where there is sustainable demand to support prices. This week we will focus on the incremental steel buyer, discussing two new market dynamics for them, and how busheling may support prices going forward.

With indexes moving up to the highest levels since 2008, mills have shown no inclination to relent, leaving a trail of damaged buyers. Initially, the price rally shocked steel consumers, as their input costs rose and they could not buy material fast enough to restock. However, as prices accelerate even higher and available steel disappears, service centers were forced into a similar distress. They now must choose between holding no inventory and not servicing customers (i.e. halting their business operation) and putting the costliest inventory in a decade on their floor to service customers, risking massive losses in the future should prices fall. This dynamic is far from the fundamental supply and demand factors that have been driving prices this fall, and weakens future demand as these businesses will take financial losses in the months ahead. Other marginal buyers in the steel sector that will pull back demand as prices rise are the industries that use steel as a low cost input to produce competitively priced final products. These industries will substitute away from steel to other viable inputs.

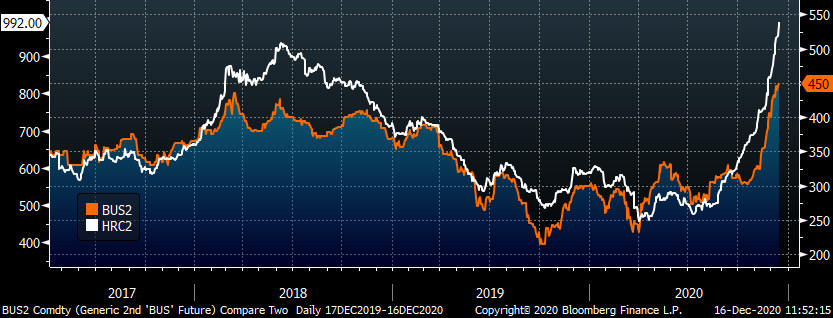

These scenarios for both incremental steel buyers – distributors and price sensitive end users – represent diminished demand at higher prices. This leads us to the question – at what prices is there a sustainable level of demand? The below chart compares the 2nd month future for both HRC (white) and busheling (orange).

Historically, the two prices track very closely, with select periods where HRC increases faster and stays higher for longer. The Section 232 induced rally in 2018 is an example, and the subsequent decline in HRC prices occurred until prices fell back in line with the historical spread above scrap near $700/st in early 2019. Using a similar spread, current scrap prices would put support above $800 for HRC. While this means little for buyers in need of material today and a spot price nearing $1,000, it is significant for those who are locking in tons and prices for the long term. The forward curve is pricing the second half of 2021 below $750, representing a significant opportunity if buyer willing to commit to a fixed price for the back half of next year, removing many of the risks discussed above.

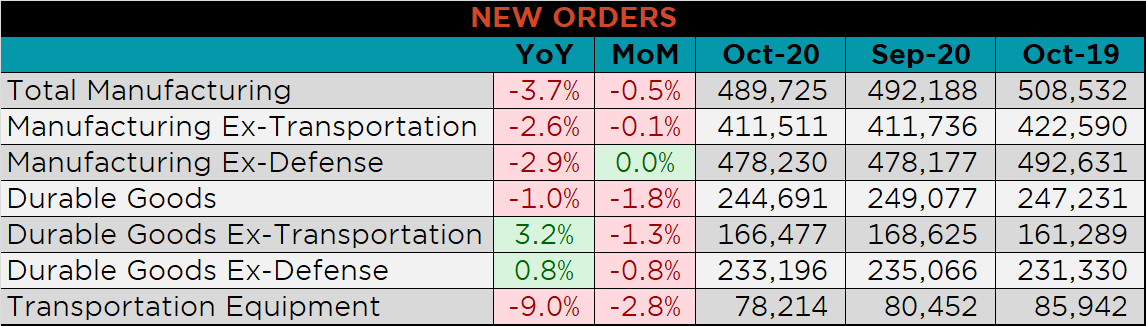

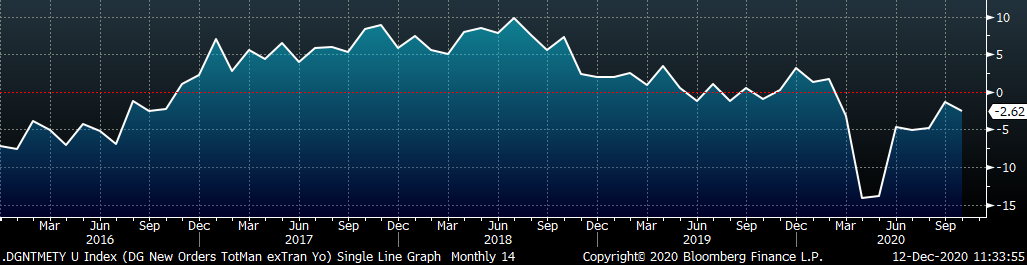

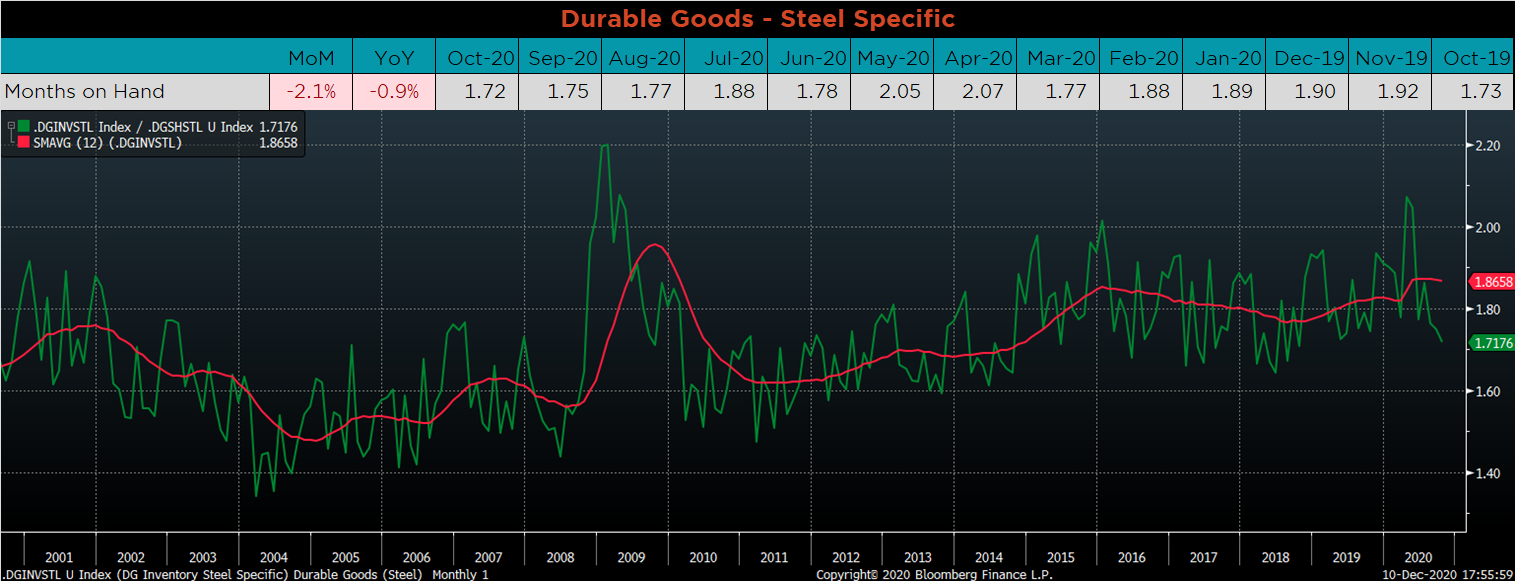

Below are final October new orders from the Durable Goods report. New orders for manufactured goods were down 3.7% compared to October 2019 and down 0.5% compared to last month. Manufacturing ex-transportation new orders were down 2.6% YoY, and each month has been below 2019 levels since February. The final chart looks at the months on hand (inventory divided by shipments) for durable goods categories that are steel intensive. MOH moved slightly lower in October, as monthly shipments increased and inventories declined slightly.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

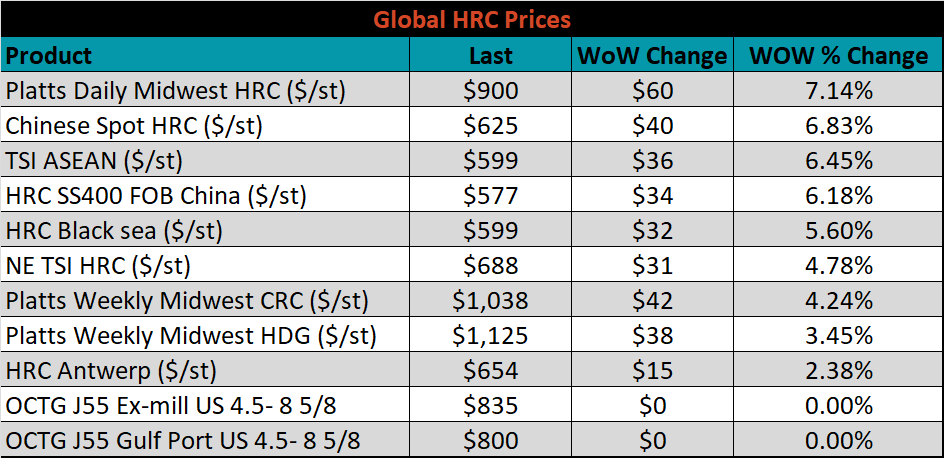

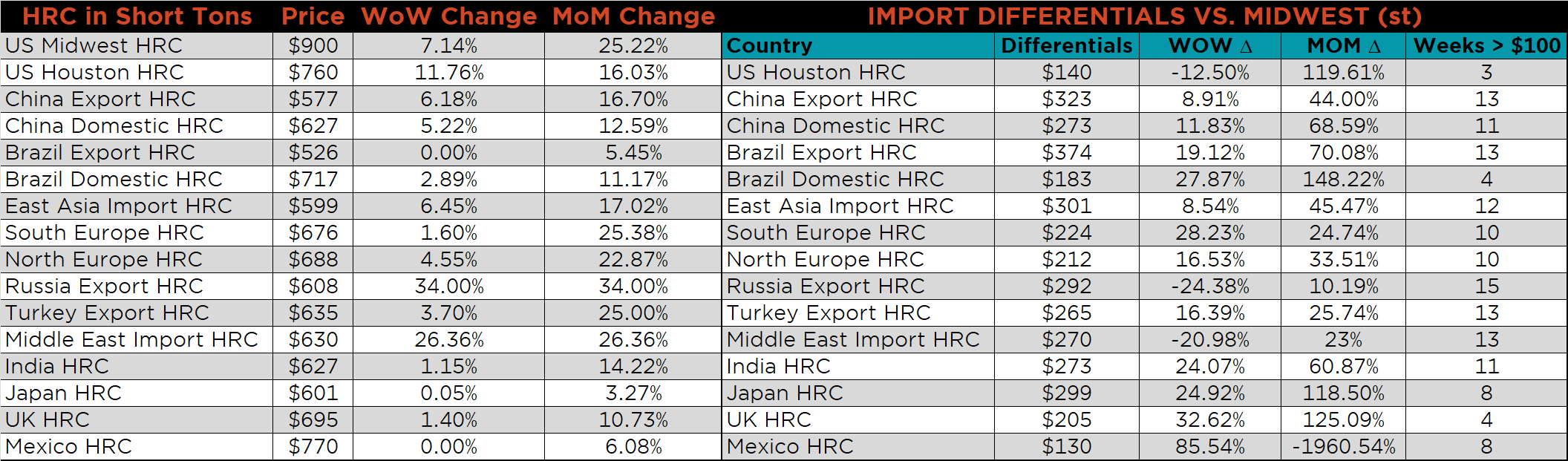

The Platts TSI Daily Midwest HRC Index increased by $60 to $900.

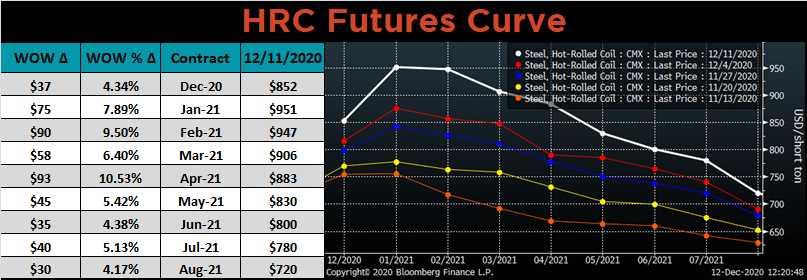

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. Last week, the entire curve shifted significantly higher again. In just under one month, the first quarter of 2021 has increased in value by more than $200.

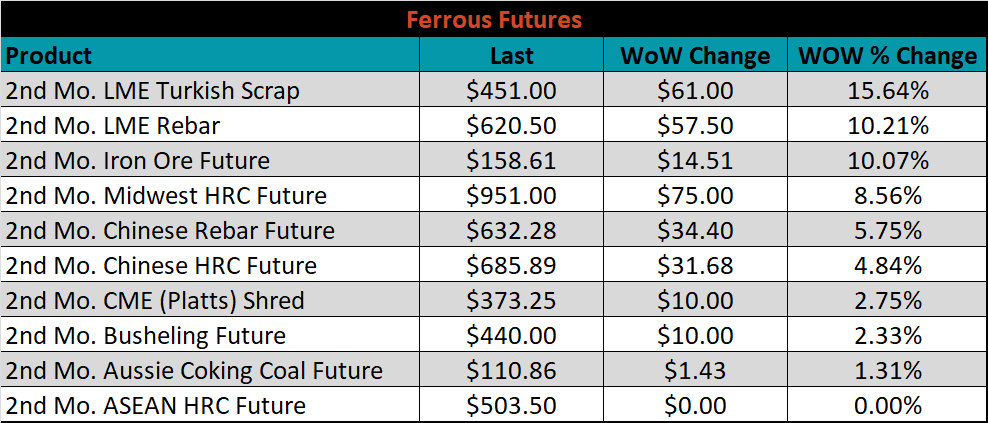

January ferrous futures were all higher, led by Turkish scrap, up 15.6%.

The global flat rolled indexes were all higher, led by Midwest HRC, up 7.1%.

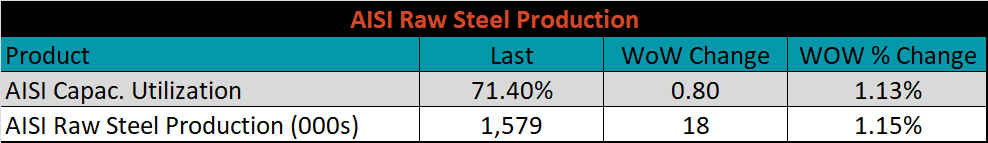

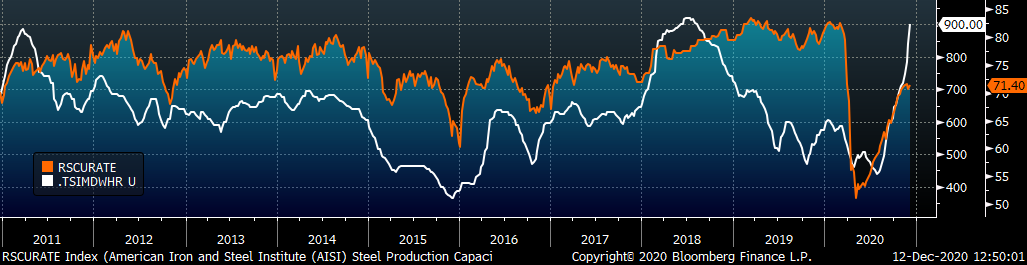

The AISI Capacity Utilization rate increased 0.8% to 71.4%. HRC prices have closely tracked the recovery of the AISI Steel Capacity Utilization Rate. Recently, the rate plateaued, suggesting a worsening shortage, and provided support of the recent meteoric rise in the already hot spot market.

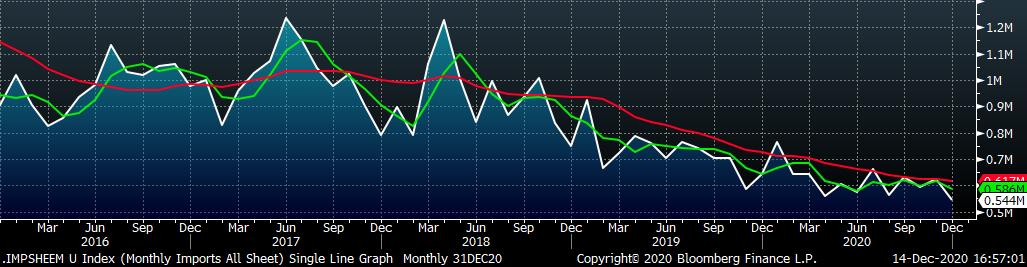

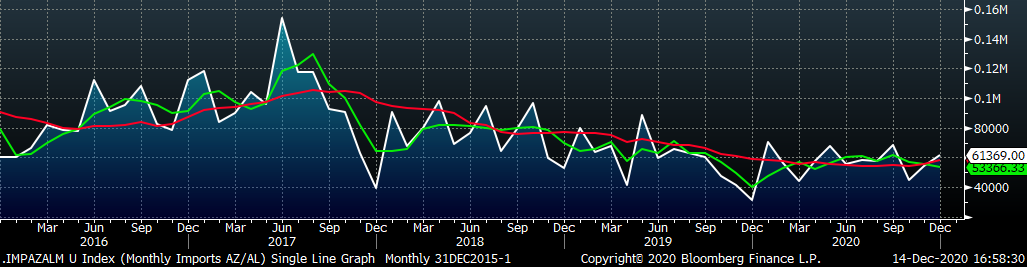

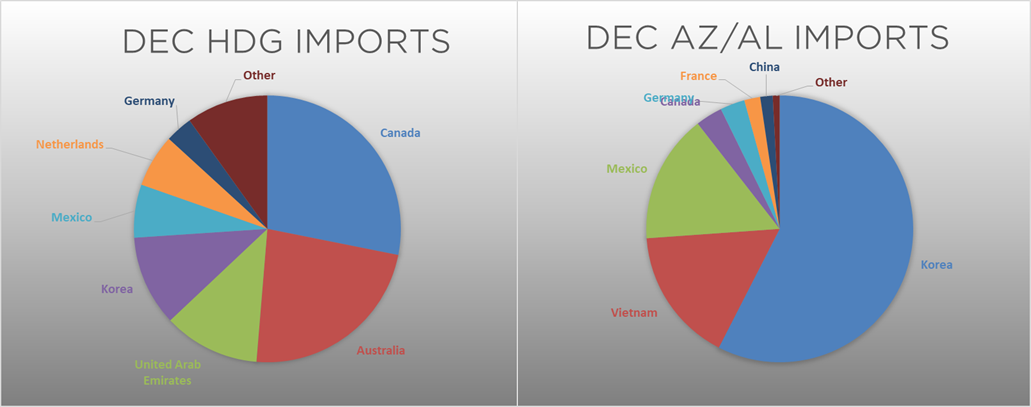

December flat rolled import license data is forecasting a decrease of 103k to 544k MoM.

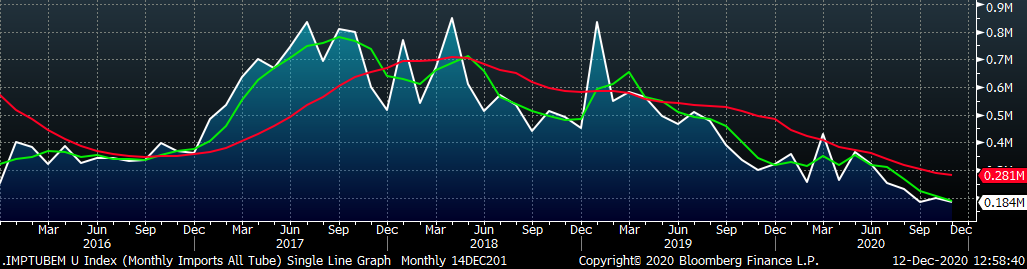

Tube imports license data is forecasting an increase of 80k to 265k in December.

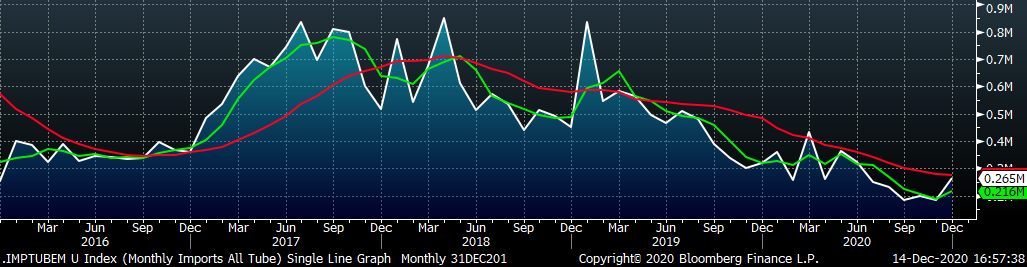

December AZ/AL import license data is forecasting a 7k increase to 61k.

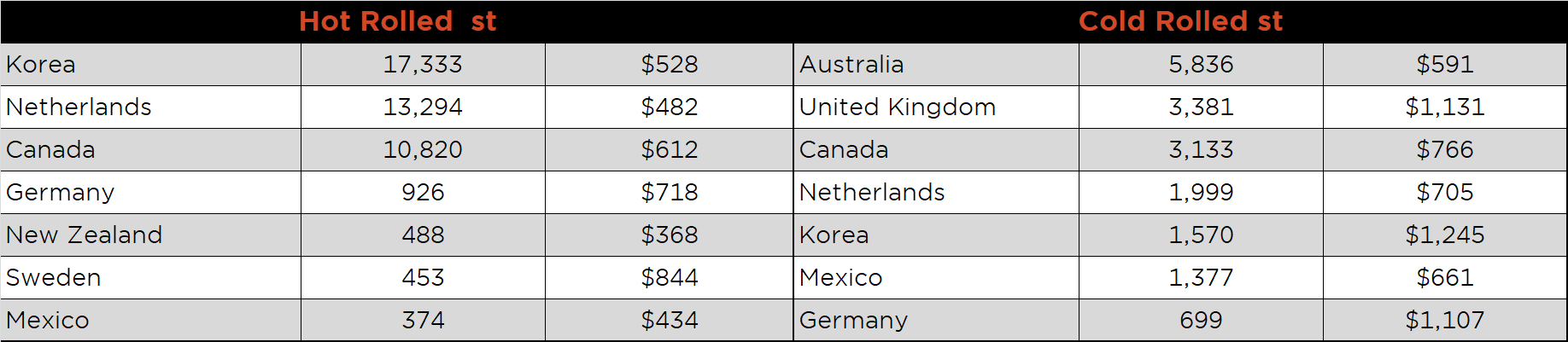

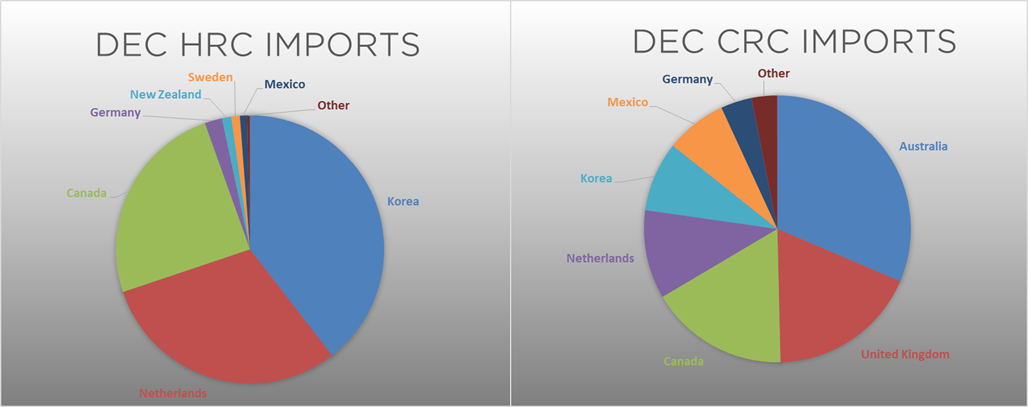

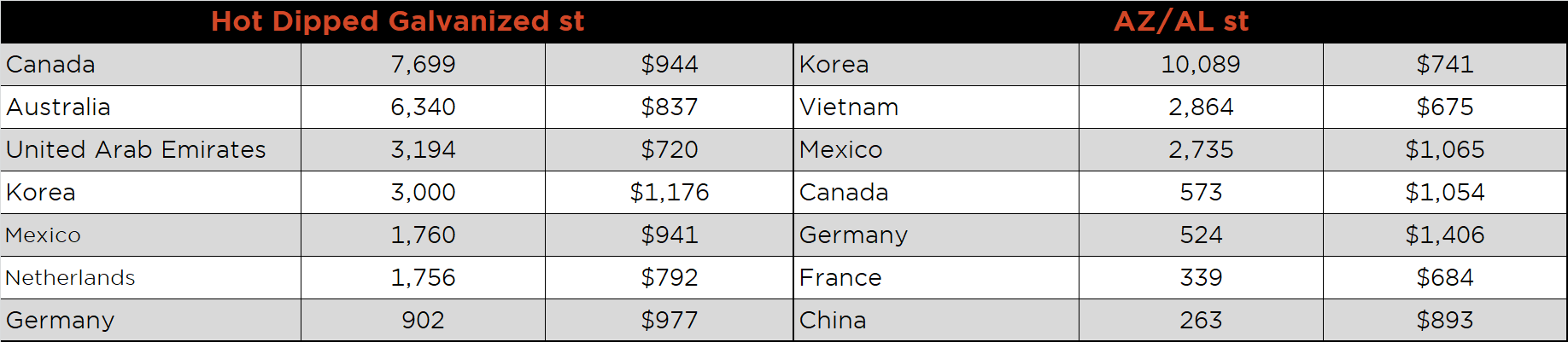

Below is November import license data through December 8, 2020.

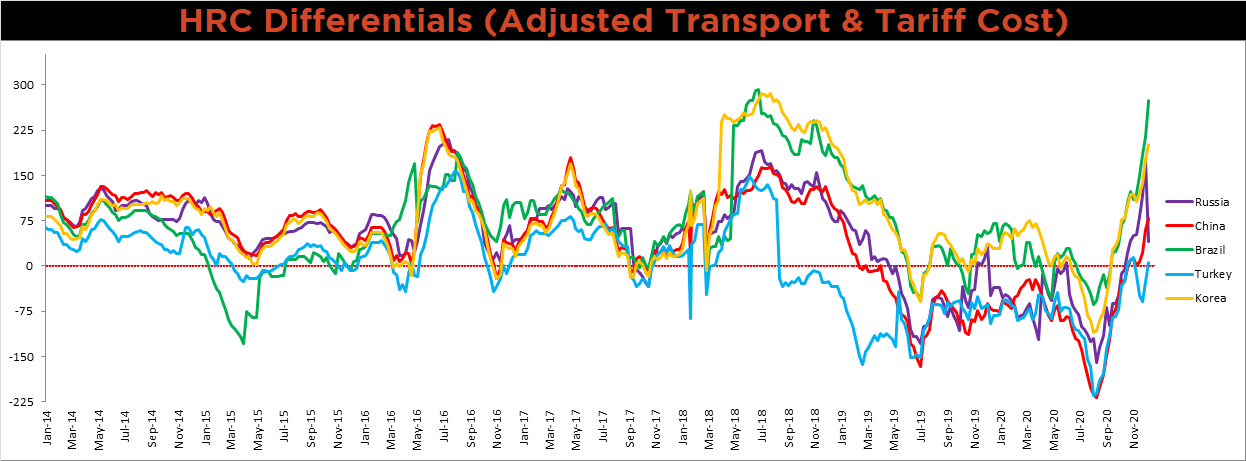

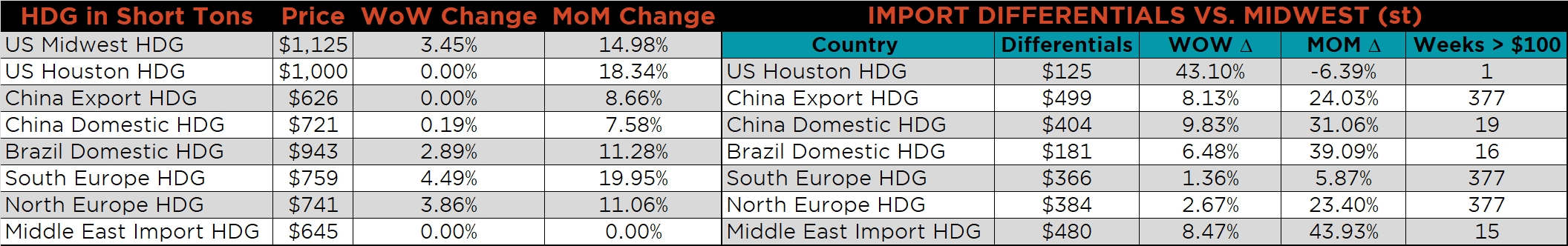

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All the watched differentials moved significantly higher, with the exception of Russia.

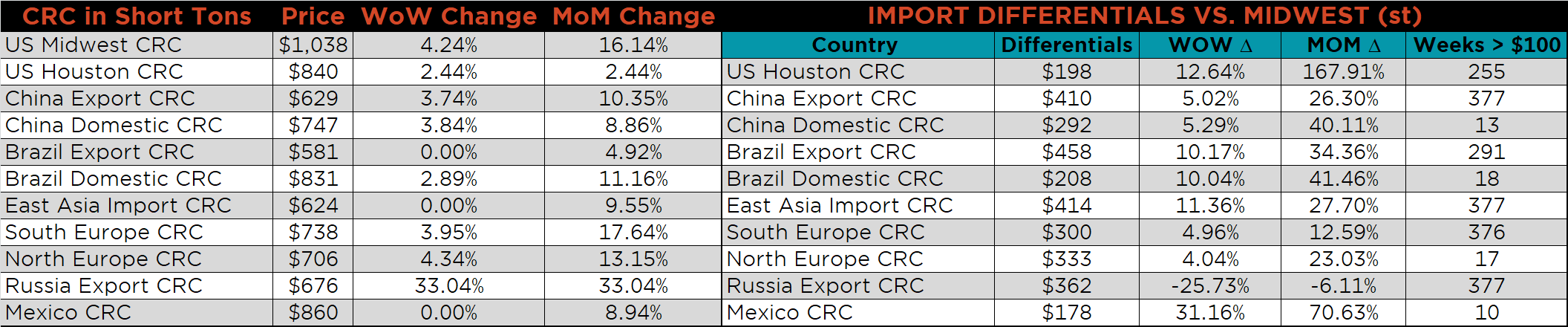

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC, CRC and HDG prices were up 7.1%, 4.2% and 3.4%, respectively. Globally, the Russian HRC price was up 34%!

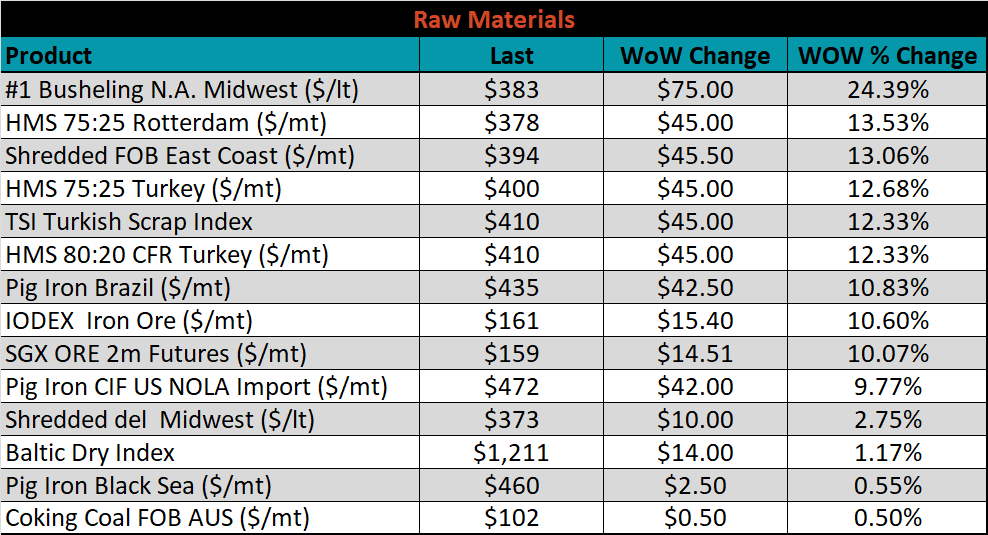

Raw material prices were all significantly higher, led by Midwest busheling, up 24.4%.

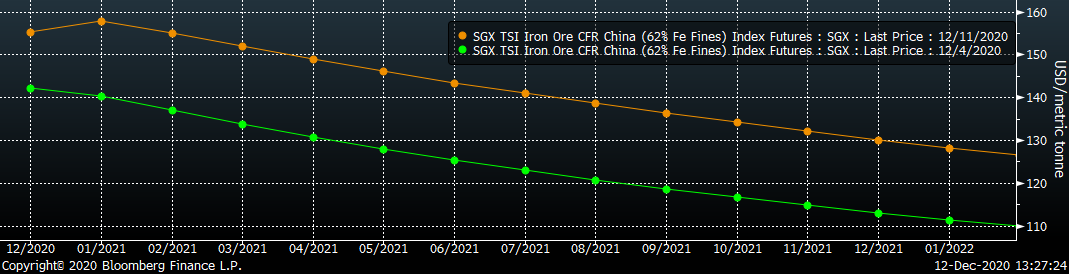

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the curve jumped significantly higher across all expirations.

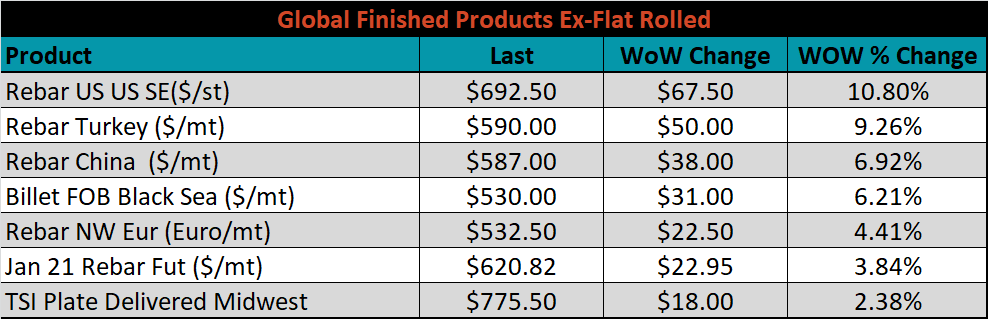

The ex-flat rolled prices are listed below.

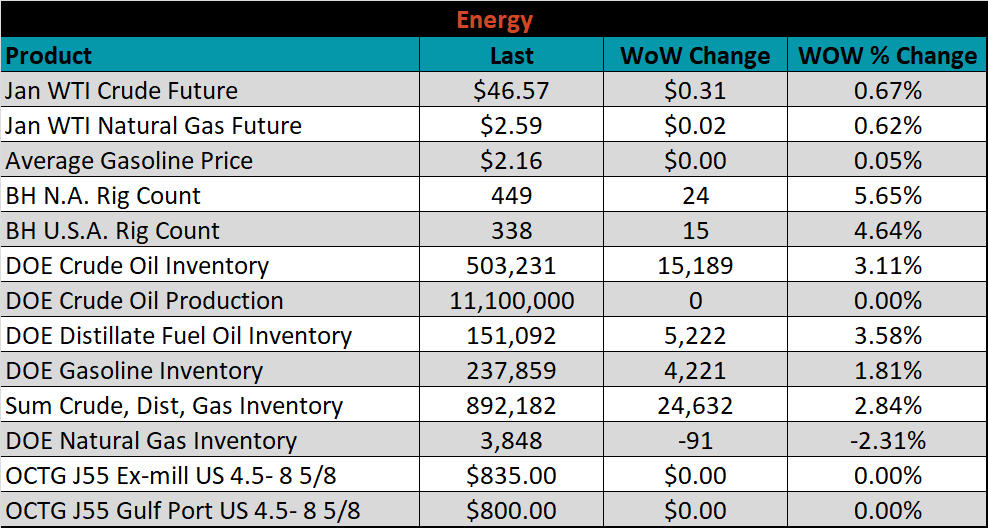

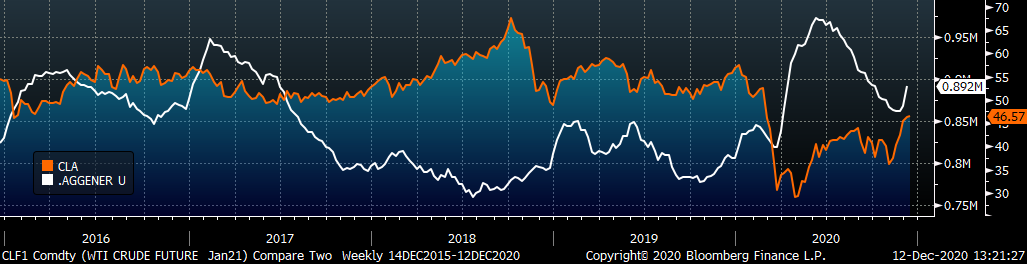

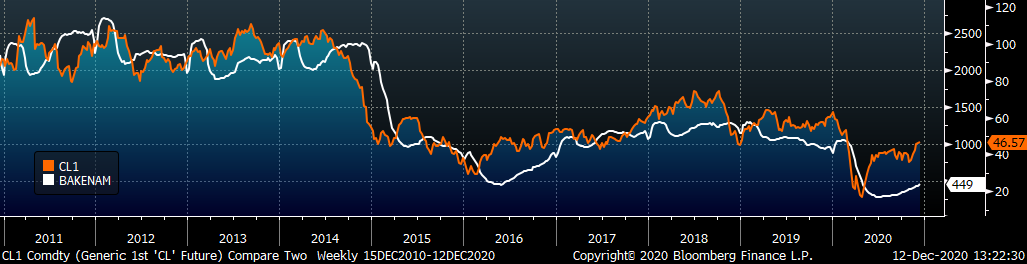

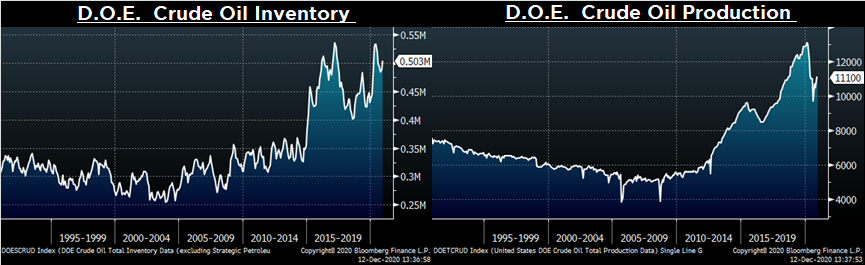

Last week, the January WTI crude oil future gained another $0.31 or 0.7% to $46.57/bbl. The aggregate inventory level was up 2.8% and crude oil production remains at 11.1m bbl/day. The Baker Hughes North American was up 24 rigs and U.S. rig count was up 15 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: