Content

-

Weekly Highlights

- Market Commentary

- Risks

As we near the end of the year with the price still accelerating higher, let’s take a step back and remember how we got here. When the pandemic and economic shutdown hit in the spring, mills pulled off production as steel distributors and consumers stopped ordering and taking material. The market spent the summer with depressed prices and excess supply. Production remained limited moving into the fall, with only about half of the idled capacity returning, and demand recovering. Prices moved higher during the fall at the fastest pace in at least the last decade, and over the past month, accelerated to the highest level since 2008 with the market in a structural shortage. To understand how these dynamics will evolve moving into 2021, we will review the significant upside and downside risks, with the magnitude and importance of each informing our view.

Upside Risks:

Higher share of discretionary income allocated to goods from steel intensive industries – The pandemic changed many behaviors, but this is the most important and lasting dynamic for the steel market. People are now spending more on goods (homes, cars, RVs, planes, boats, appliances etc.) rather than services, which will support steel prices at any level.

Strengthening global flat rolled and raw material prices – global ferrous markets are experiencing similar shortages, with demand and stimulus from China leading the way. The sustainability of this strength throughout 2021 is uncertain, but it appears intact for the near term, with rising scrap prices and further economic recovery.

Unplanned & extended planned outages – With the recent M&A activity among North American steel producers, domestic supply is more easily controlled by just four companies. There is significant doubt as to if and when Cleveland Cliffs will bring back its recently acquired ArcelorMittal furnaces, which maintains tightness in the spot market. Additionally, as mills try to “catch up” with orders, they are running their assets at full capacity, increasing the likelihood of unplanned outages.

Low current import levels – Imports have been near historically low levels for most of 2020, and global supply shortages will restrict how much material can actually be brought into the U.S. domestic market over the next several months. Currently, new import material will not arrive until the beginning of summer at the earliest.

Declining/low inventory levels at end users and service centers – The current shortage was in part driven by buyers refraining from restocking during the late summer among the uncertainty from the pandemic. Supply chain inventories have been depleted and backlogs for products containing steel are extending. Demand for goods (discussed above) will prolong the restocking effort, supporting prices even if they decline next year.

Broad increases in commodity prices due to a weakening US Dollar – A weak US Dollar makes commodities, priced in dollars, more attractive to buyers using foreign currencies. From the pandemic lows, commodity prices have rallied significantly including copper, aluminum, iron ore, scrap, zinc, nickel and silver.

Limited spot transactions skewing market indexes to extreme levels – spot price indexes are reflective of qualifying physical transactions. As fewer transactions occur at higher prices, single transactions have a more significant weight in the total average, moving the indexes to extreme levels. As some of these indexes are used in physical supply contracts, these readings can have significant impacts on companies within the market.

Downside Risks:

Increased domestic production capacity – Many market participants point to looming supply increases when deeming the price rally as unsustainable. While we agree that this will be a headwind for prices next year, we do not believe that it will have a significant impact until the second half of 2021. It will take time for service centers and end users to restock, and current production levels are still down 10% from a year ago.

Increasing price differentials leading to higher imports – Price differentials are conducive to higher levels of imports. However, global supply shortages are increasing delivered offer prices for imports, and extending lead times for any meaningful import support. Global price weakness next year would make importing more attractive, leading to more foreign material in the domestic market.

Steel consumers substitute to lower cost alternatives – A portion of the steel consuming community consists of price sensitive buyers, who refrain from purchasing material, or substitute to different products, at certain elevated prices. The higher the price goes, the more companies chose to withhold purchases.

Steel buyers and consumers “double ordering” to more than cover steel needs – Companies caught off guard by the current shortage may be placing multiple orders for the same material as means to ensure that they at least get something. However, this inflates current order books and backlogs as orders may be canceled when the necessary material is delivered. This could accelerate the price to the downside, if this is a significant portion of current order books.

Coronavirus induced economic shutdowns – Recent developments out of the U.K. show a strand of the coronavirus that spreads more easily. While there has recently been encouraging developments regarding a vaccine, further shutdowns driven by the spread of Covid-19 could have significant effects on steel demand.

Weak labor, energy and construction markets – While many segments of the economy are in full recovery mode, both the energy and construction markets have lagged, with oil prices depressed and non-residential construction spending weakening. The unemployment rate remains elevated, depressing consumer spending and confidence.

Reduction and/or removal of domestic trade barriers – A shift back to more normalized relationships with trading partners is more likely under a Biden administration, increasing the prospects that quotas and tariffs will be removed for many steel exporting countries. However, this has not been highlighted as a priority, likely pushing back any immediate effects.

In short, we believe this rally still has room to go. We expect prices to be lower over the course of 2021, compared to current levels, but believe that the market expectations for future prices are too low. The market is pricing in a rapid decline in prices, which does not take into account the strength in demand from a recovering economy and changes in consumer behavior.

This will be the last Week Over Week report for the year. We will return the first week of 2021. Have a happy and safe holiday!

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

The Platts TSI Daily Midwest HRC Index increased by $50 to $950.

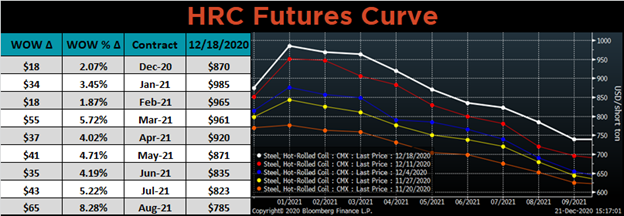

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. Last week, the entire curve shifted higher.

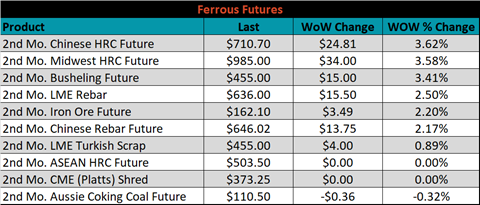

January ferrous futures were mostly higher, led by Chinese HRC, up 3.6%.

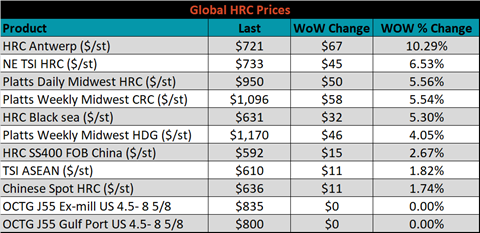

The global flat rolled indexes were all higher, led by Antwerp HRC, up 10.3%.

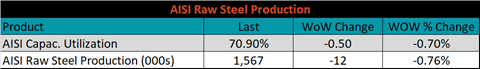

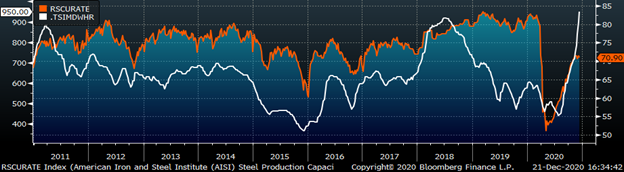

The AISI Capacity Utilization rate decreased 0.5% to 70.9%.

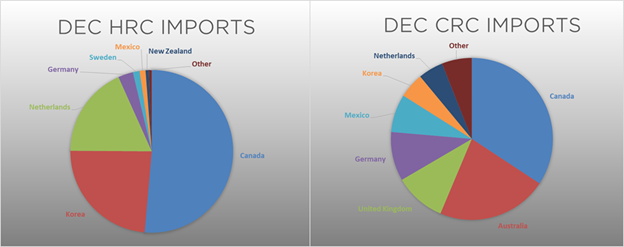

December flat rolled import license data is forecasting a decrease of 73k to 572k MoM.

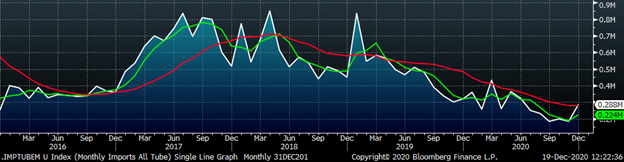

Tube imports license data is forecasting an increase of 103k to 288k in December.

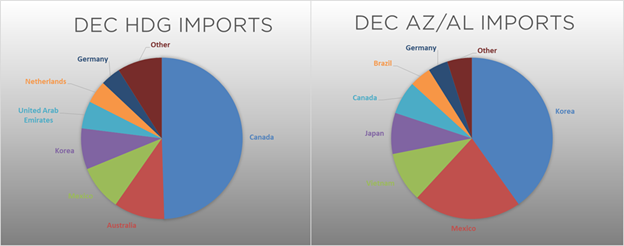

December AZ/AL import license data is forecasting a 4k increase to 56k.

Below is November import license data through December 15, 2020.

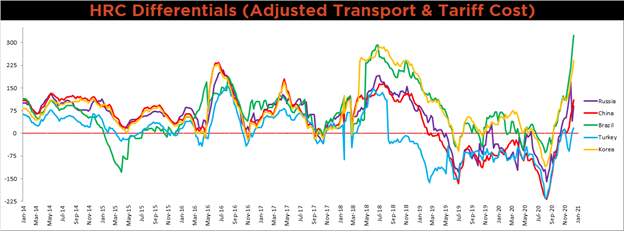

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All the watched differentials moved significantly higher. Typically, differentials at these levels would lead to a significant increase in imported steel; however, global shortages in supply minimize this threat as each listed country works to supply their respective markets.

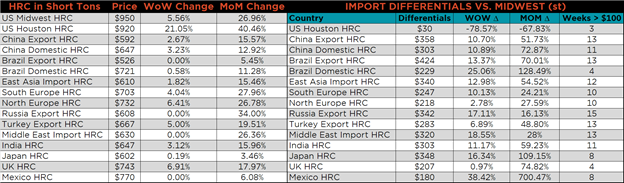

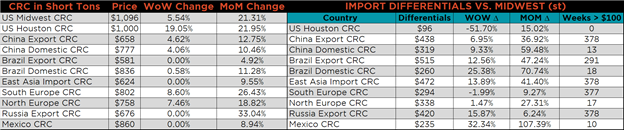

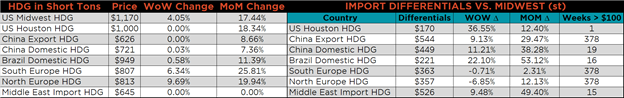

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC, CRC and HDG prices were up 5.6%, 5.5% and 4%, respectively. Globally, the Southern and Northern European CRC prices were up 8.6% and 7.5%, respectively.

Raw material prices were mostly higher. Rotterdam HMS was up 10.7%, while Aussie coking coal was down 1.5%.

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the curve shifted higher across all expirations.

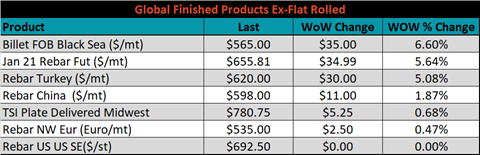

The ex-flat rolled prices are listed below.

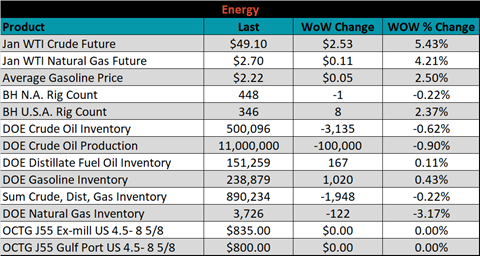

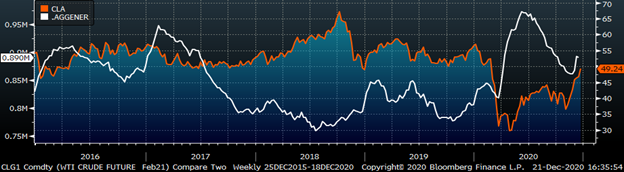

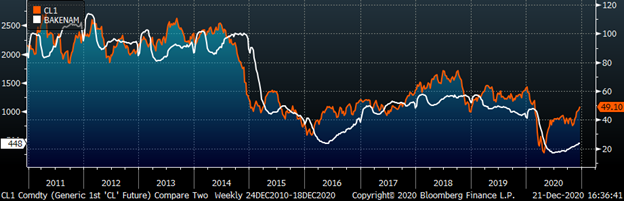

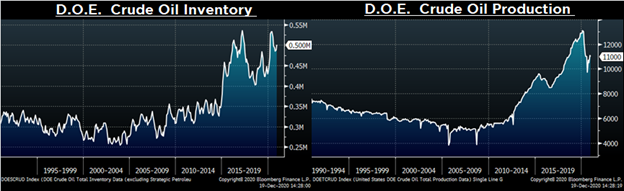

Last week, the January WTI crude oil future gained another $2.53 or 5.4% to $49.10/bbl. The aggregate inventory level was down 0.2% and crude oil production is down to 11m bbl/day. The Baker Hughes North American was down 1 rig, while the U.S. rig count was up 8 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: