Content

-

Weekly Highlights

- Market Commentary

- Risks

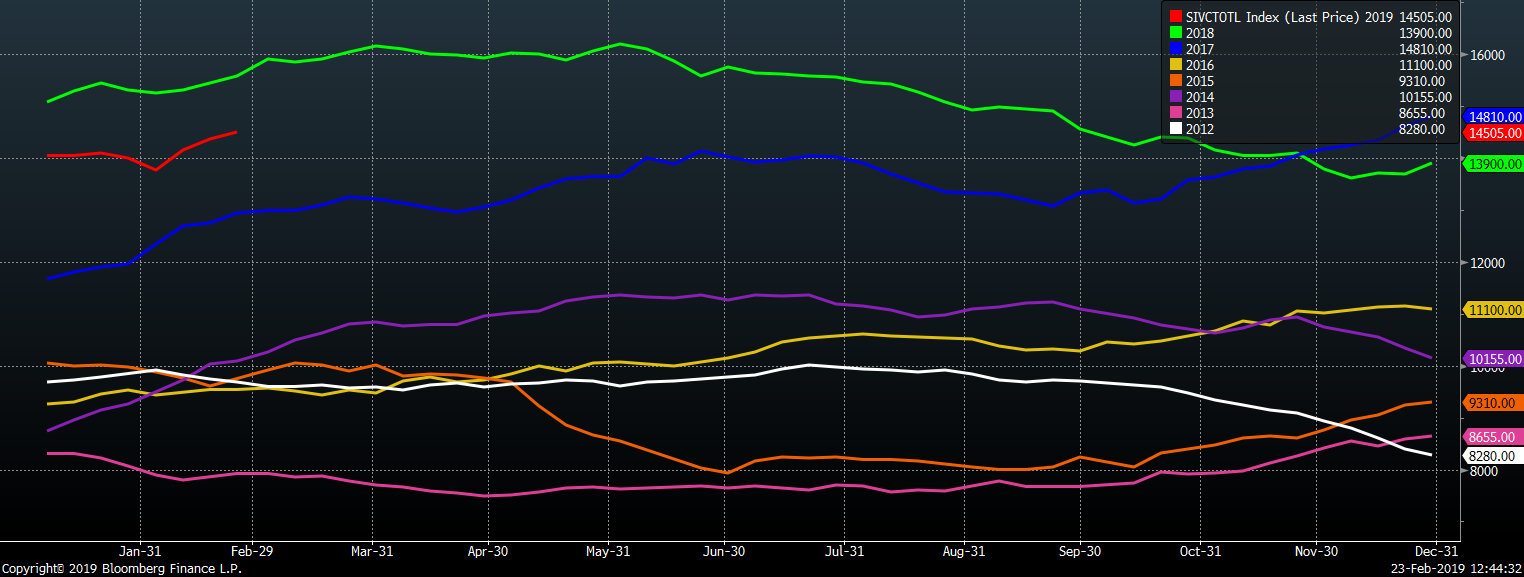

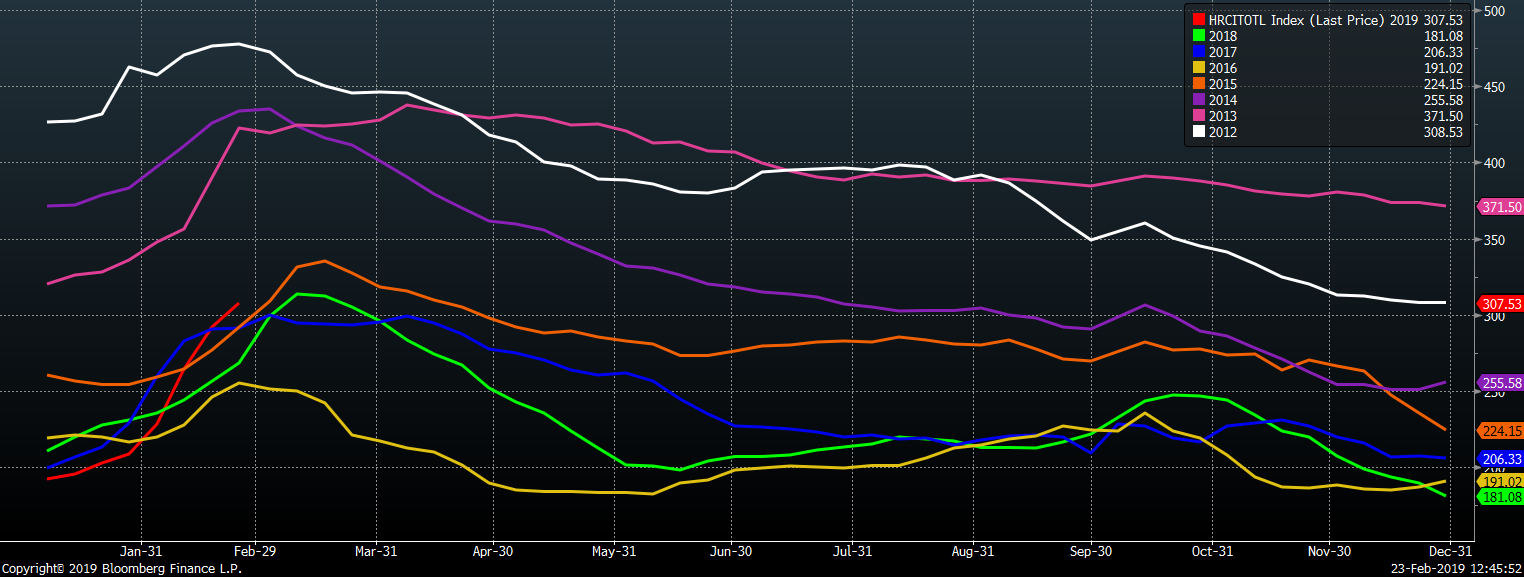

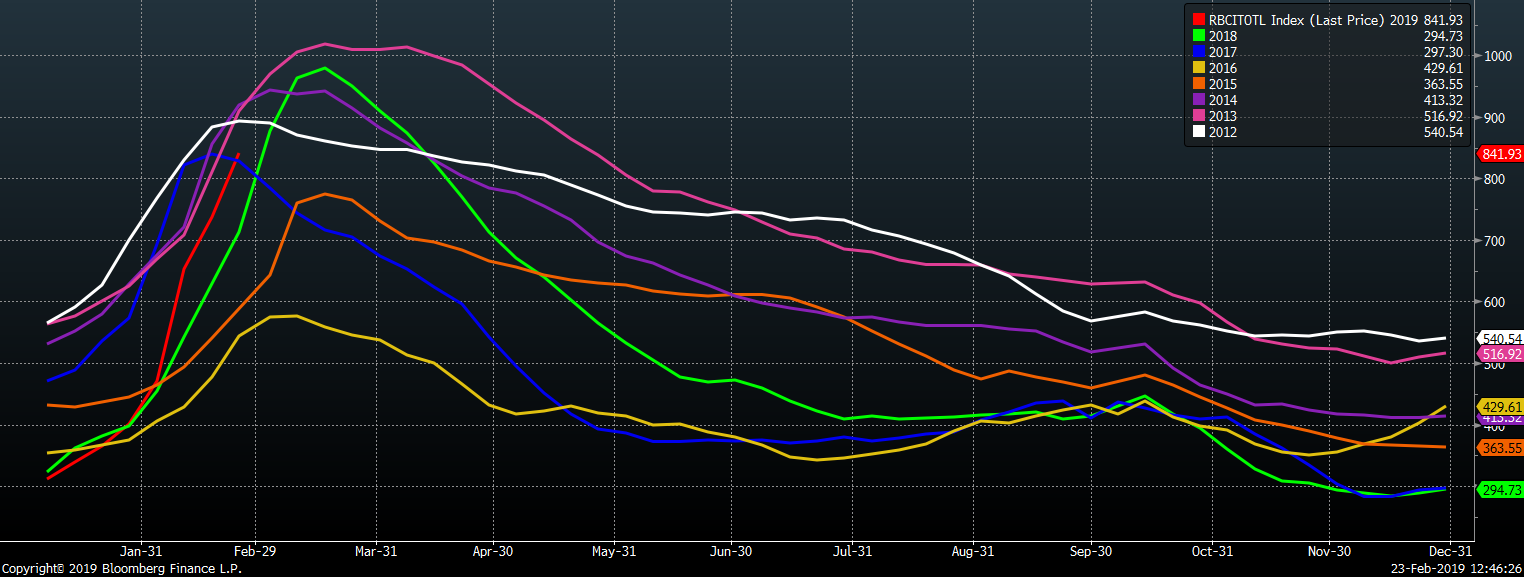

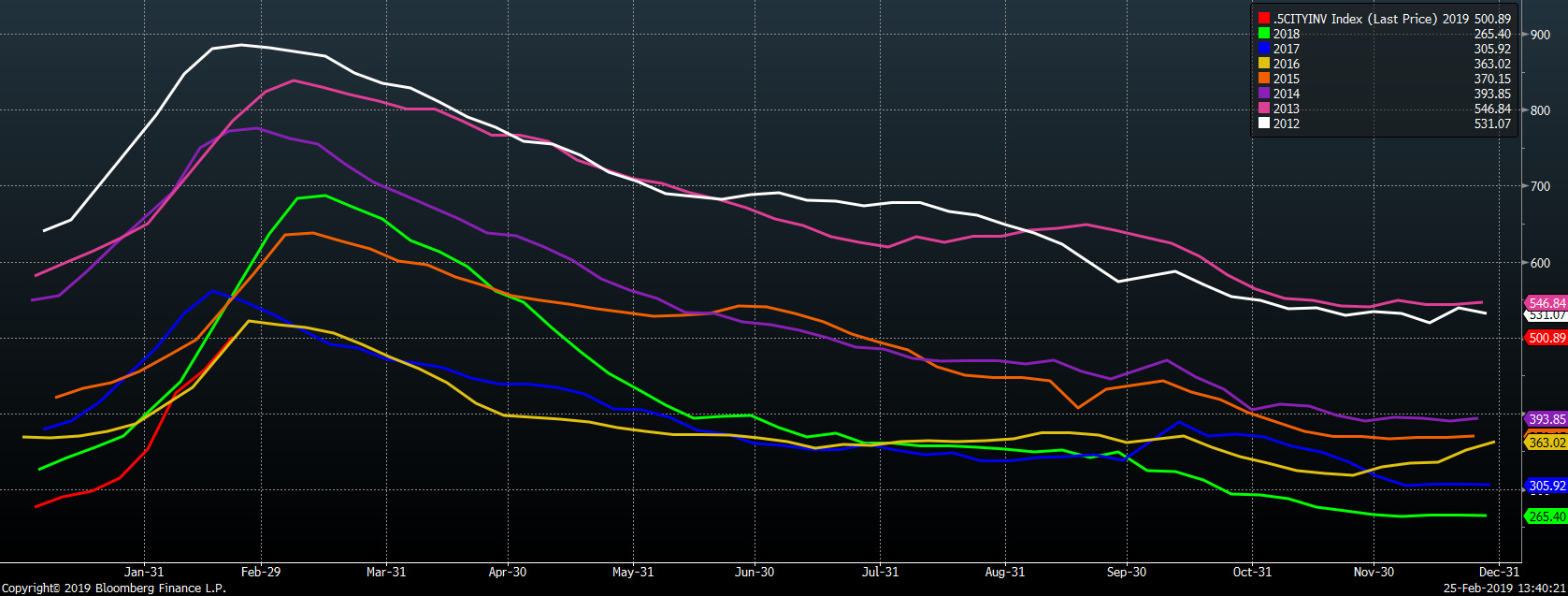

Service centers rapidly destocked inventory in January. This has both bullish and bearish implications. From a bullish standpoint, this sharp cut in service center supply leaves them with lean inventory forcing them to procure more steel from the mills. From the bearish point of view, the destocking resulted in ultra-low lead times for domestic mills to start the year. The mills have announced two price increases and are slowly gaining some traction, but the major issue is what this destocking means not only for the health of the service centers, but also their price expectations for 2019. We know collectively, service centers suffered from inventory write-downs and losses through the back half of 2018 and this resulted in some service centers tripping covenants with their lenders. These issues combined with slowing demand, risks associated with the removal of steel tariffs, higher interest costs and tightening of available credit insurance are likely to result in risk aversion amongst distributors. Point being, a decreased inventory level in the space might persist until there is resolution in regards to government policy, demand picks back up and/or flat rolled prices fall to an attractive level. If this is the case, how far can flat rolled prices move without the influx of capital from service centers restocking?

In the steel market, we see downside risks outweighing upside risks warranting a prudent and risk-averse purchasing and inventory management strategy

Upside Risks:

Downside Risks:

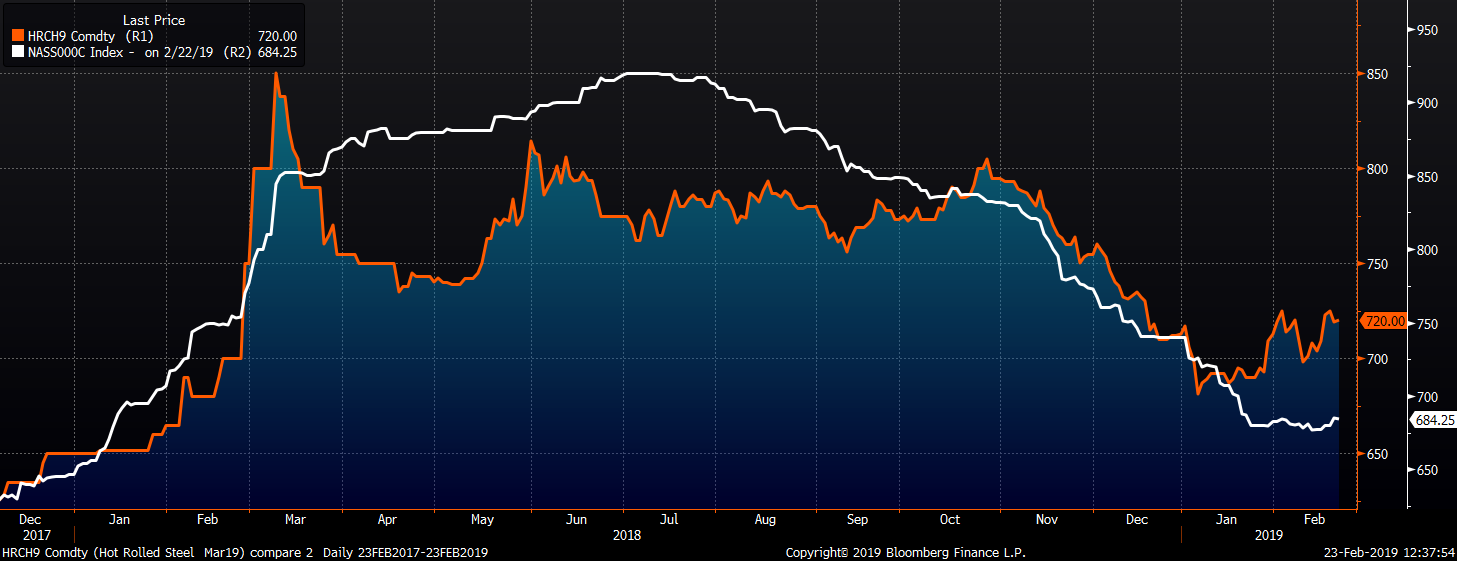

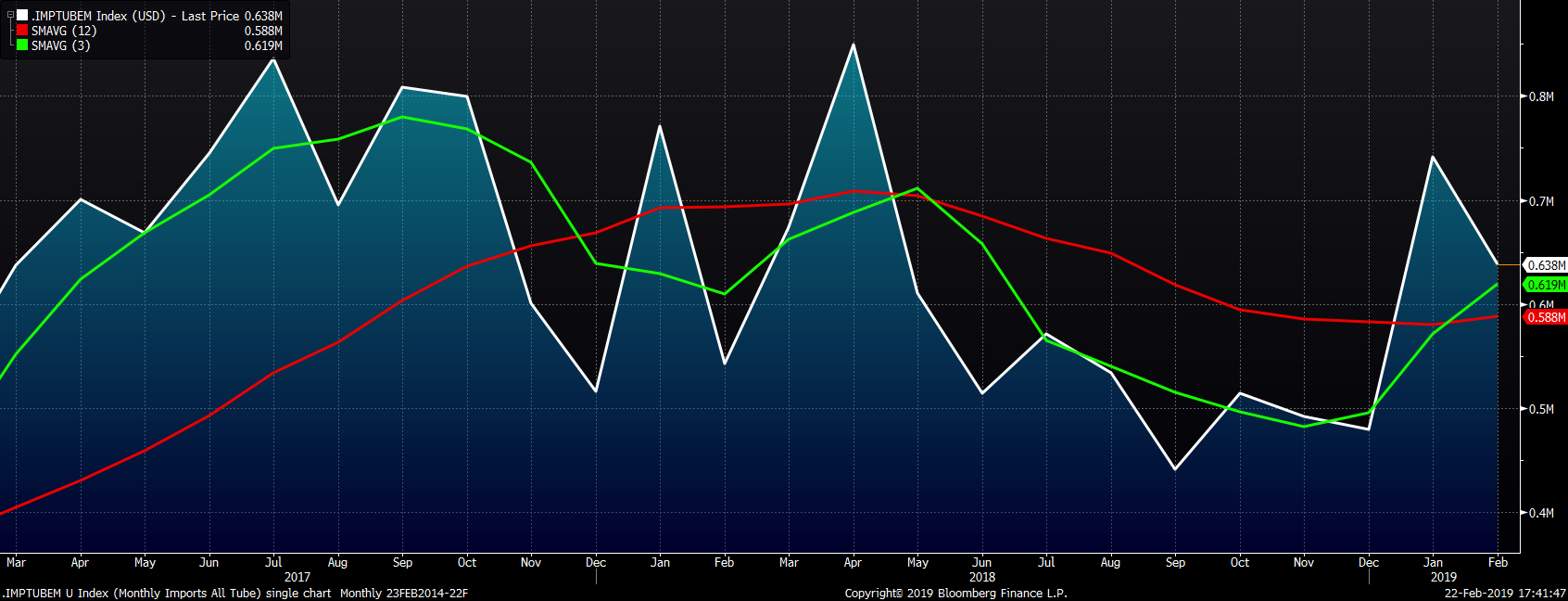

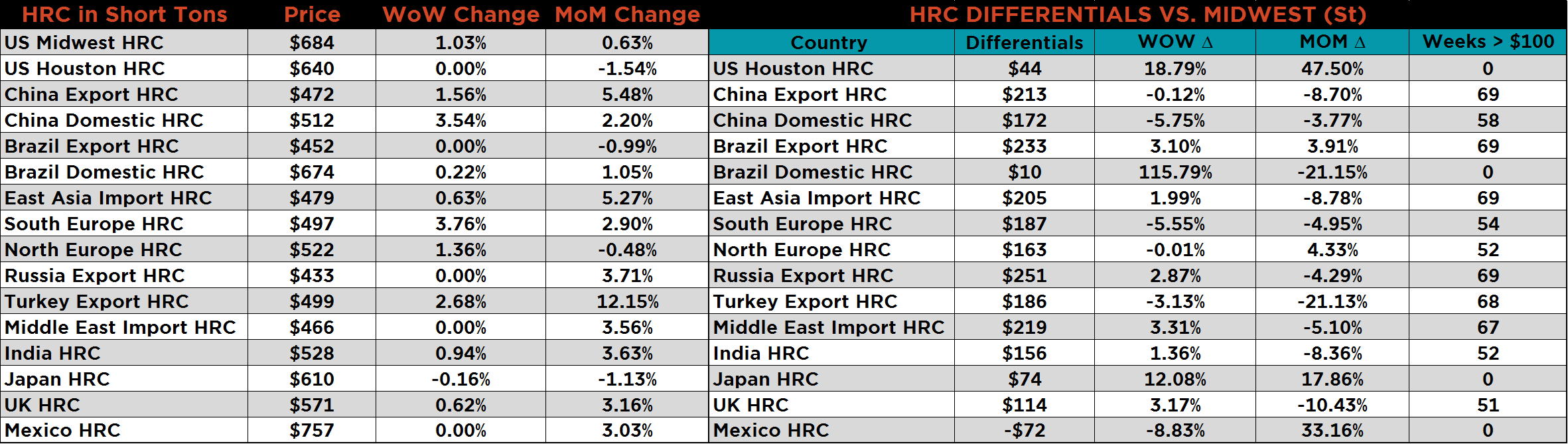

Week over week, the March CME Midwest HRC future gained $11 to $720 while the Platts TSI Daily Midwest HRC Index was up $7 to $684.25.

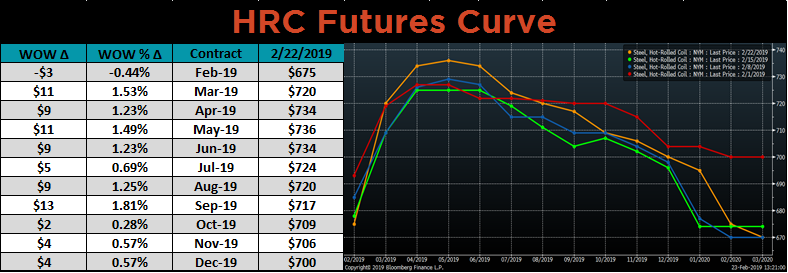

The CME Midwest HRC futures curve shown below with last Friday’s settlements in orange.

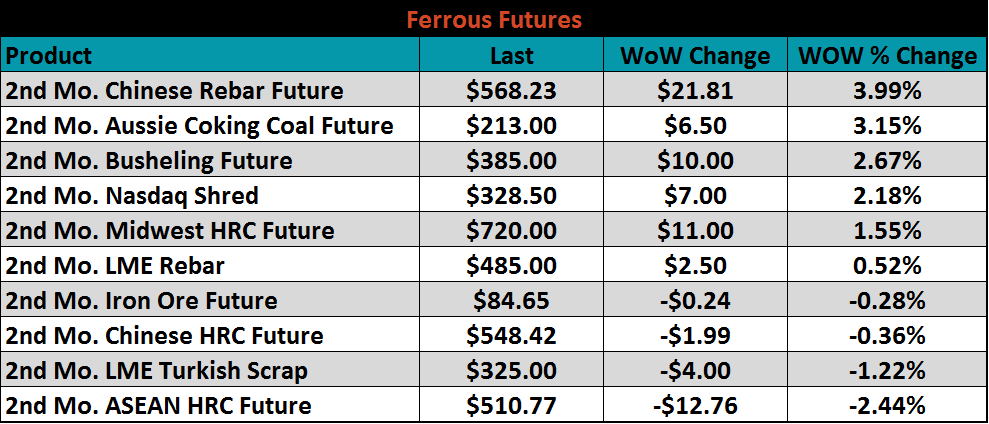

March ferrous futures were mixed. The Chinese rebar future gained 4%, while the ASEAN HRC future lost 2.4%.

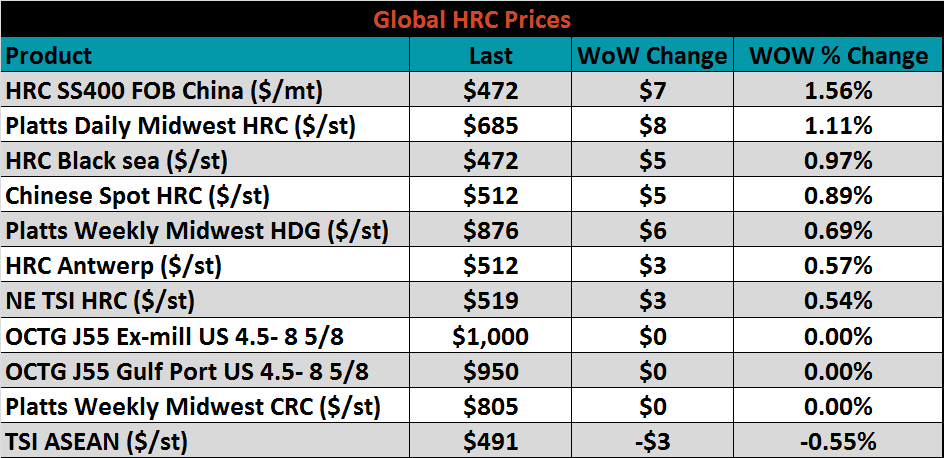

Flat rolled indexes were mixed with much lower volatility than previous weeks. Chinese and Midwest HR saw gains on the week.

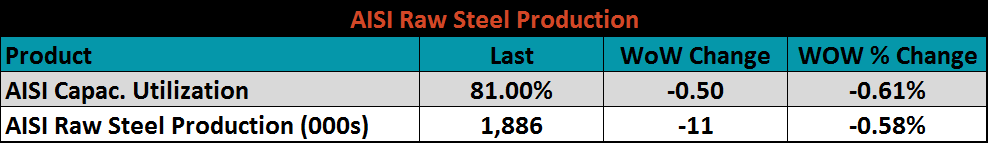

The AISI Capacity Utilization Rate decreased to 81%.

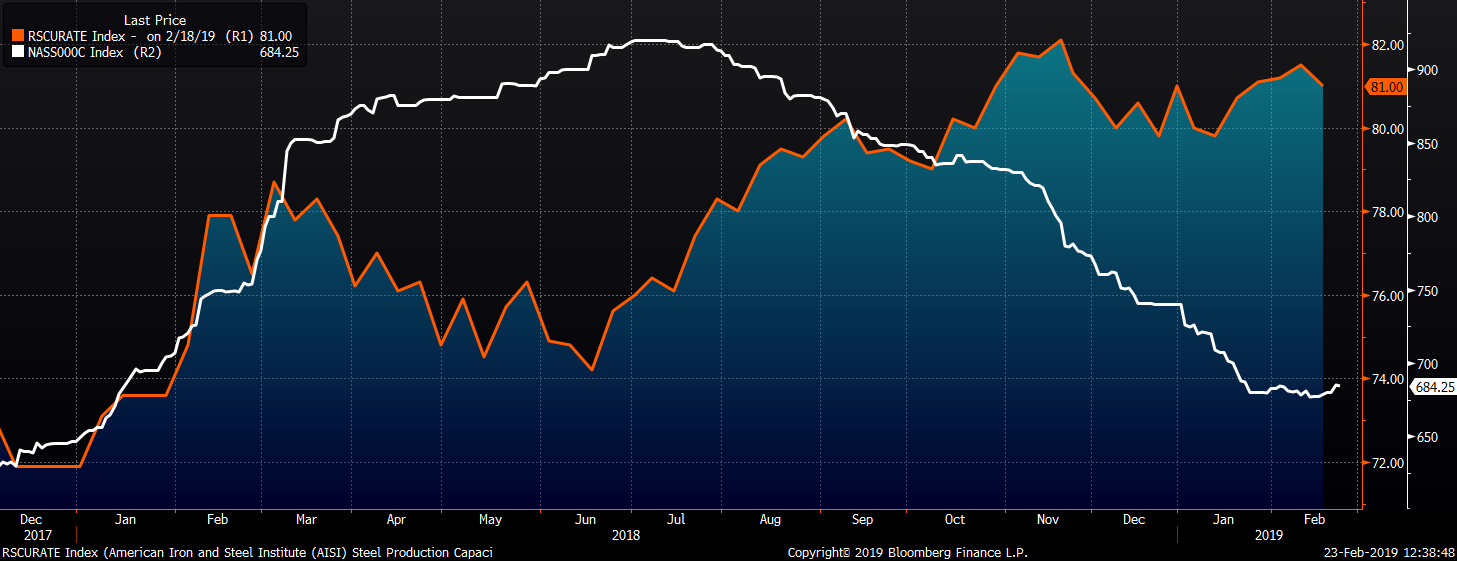

February flat rolled import licenses are forecast to fall 86k tons MoM to 695k while January flat rolled import licenses are forecast to fall 14k MoM tons to 782k.

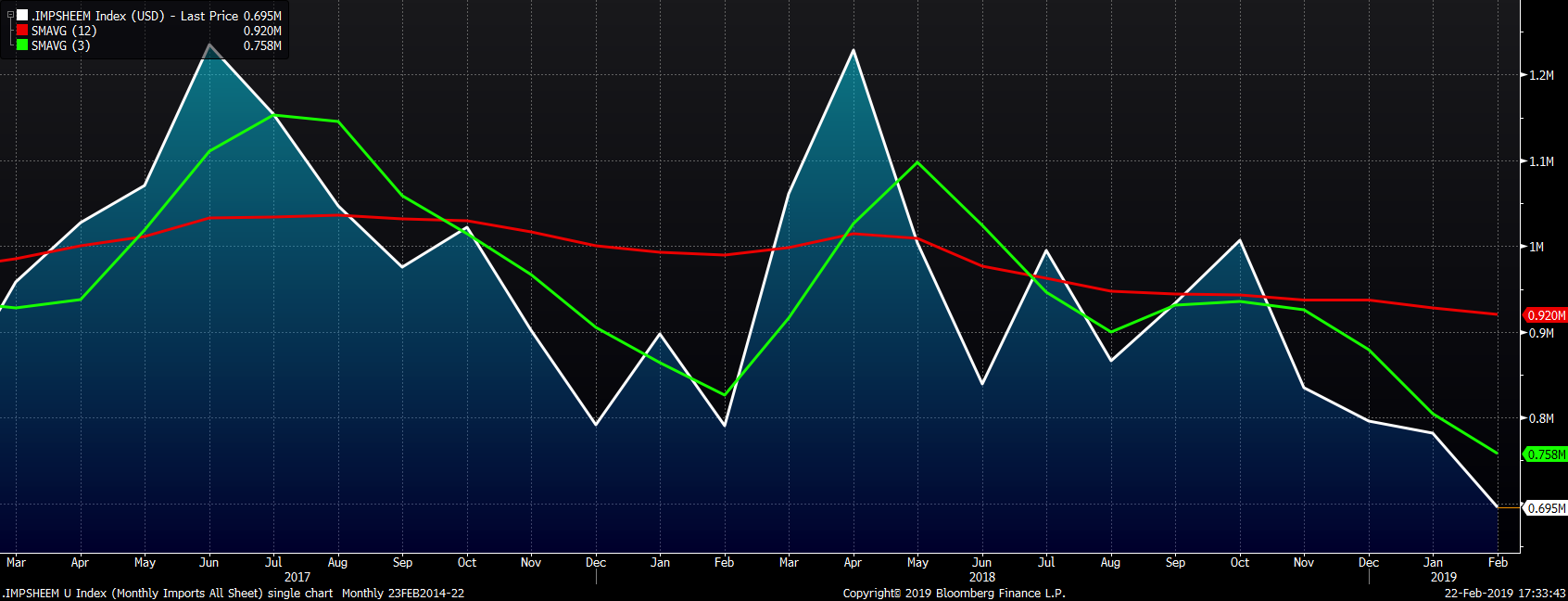

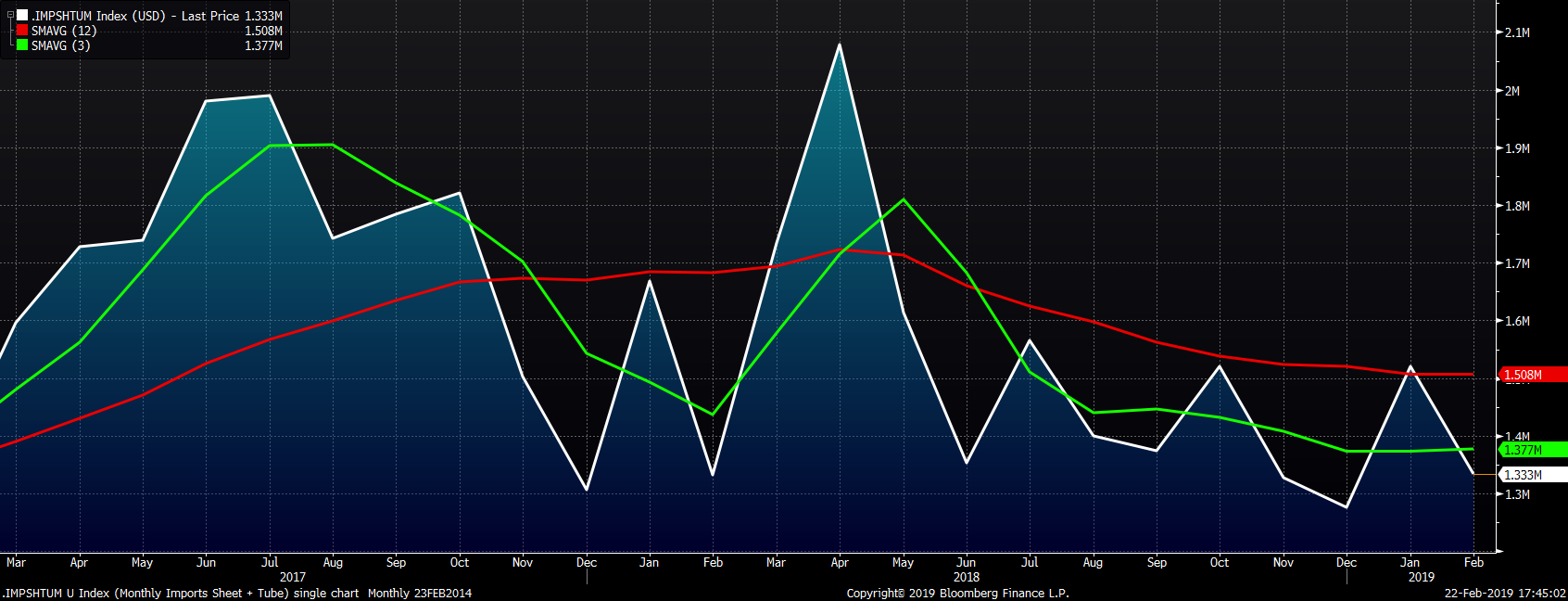

February tube import license data is forecasted to fall 104k to 638k tons MoM after a sharp rise in January.

The combined flat and tube import license forecast looks to fall almost 190k tons in February after a 240k MoM increase forecast in January due to a big increase in tubular products, much of which was imported from Korea.

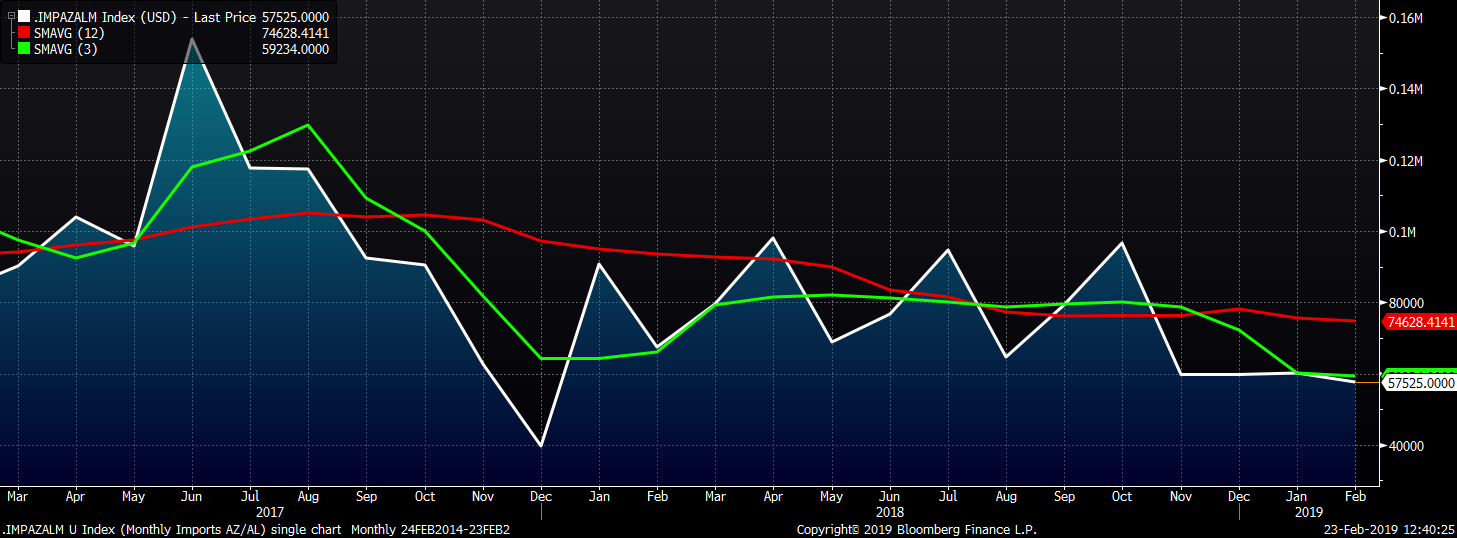

AZ/AL import licenses have become well entrenched around 60k with February licenses forecast at 58k. This would be the fourth consecutive month with galvalume imports around 60k.

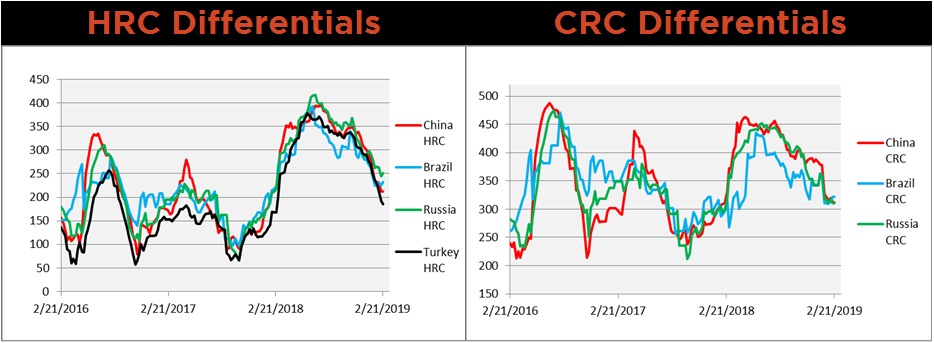

Below are HRC and CRC Midwest vs. each country’s export price differentials using pricing from SBB Platts. Chinese, Russian and Brazilian HR price differentials ticked up slightly, while the Turkish HR differential continued to decline.

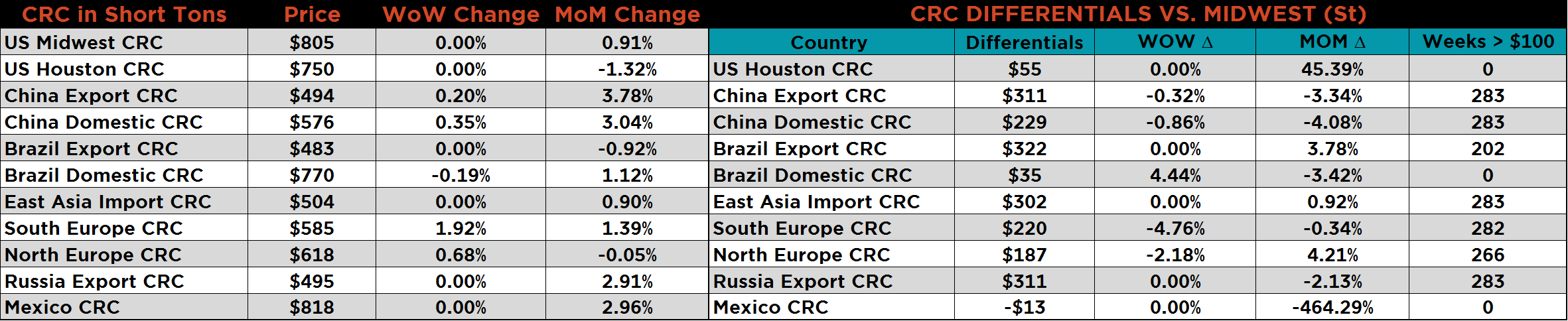

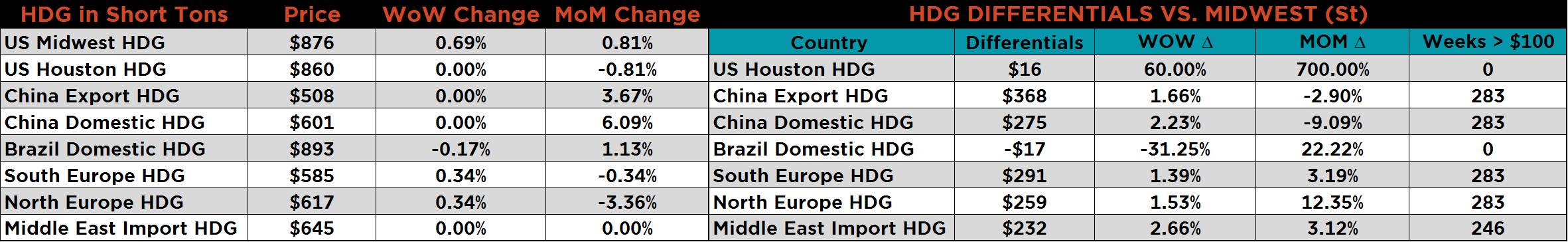

SBB Platt’s HRC, CRC and HDG WoW pricing is below. The Midwest HRC and HDG price rose slightly, while the CRC price was unchanged. Southern European and Chinese domestic HRC prices gained 3.8% and 3.5%, respectively. Southern European CRC prices gained 1.9%.

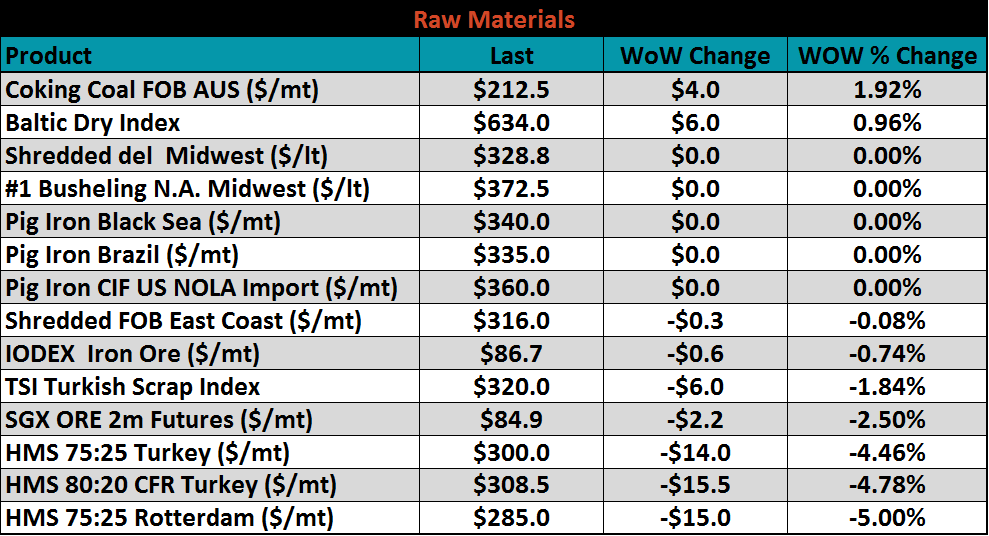

Scrap prices were under pressure with scrap in Rotterdam and Turkey falling 4.5% – 5% in response to iron ore prices’ continued retreat from recent highs.

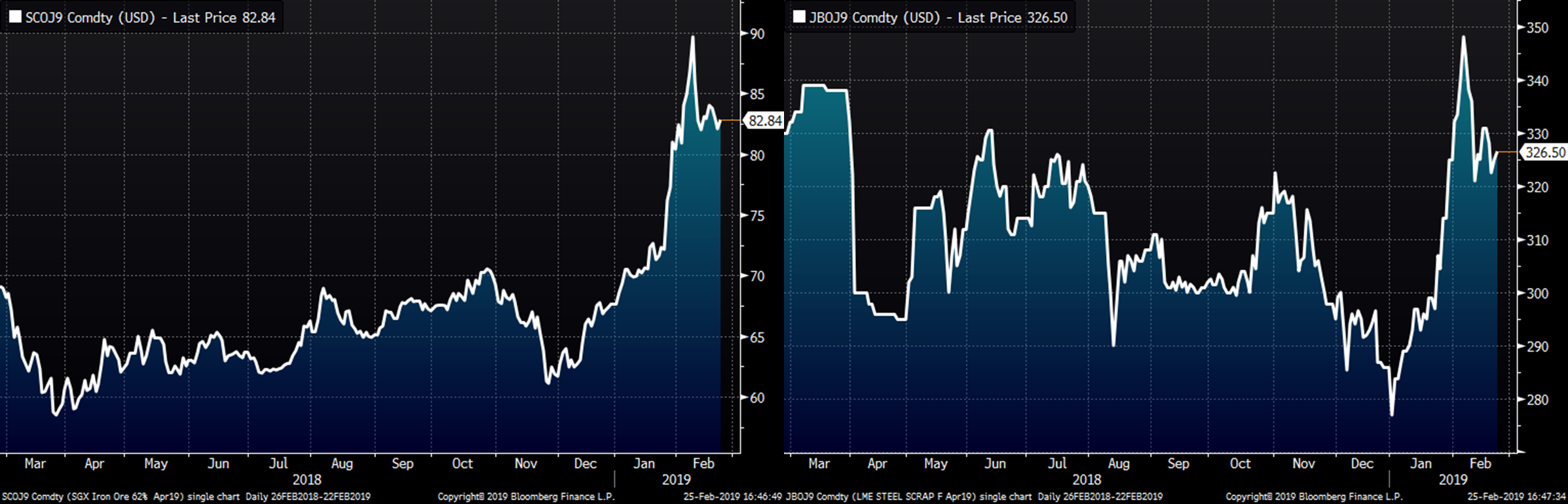

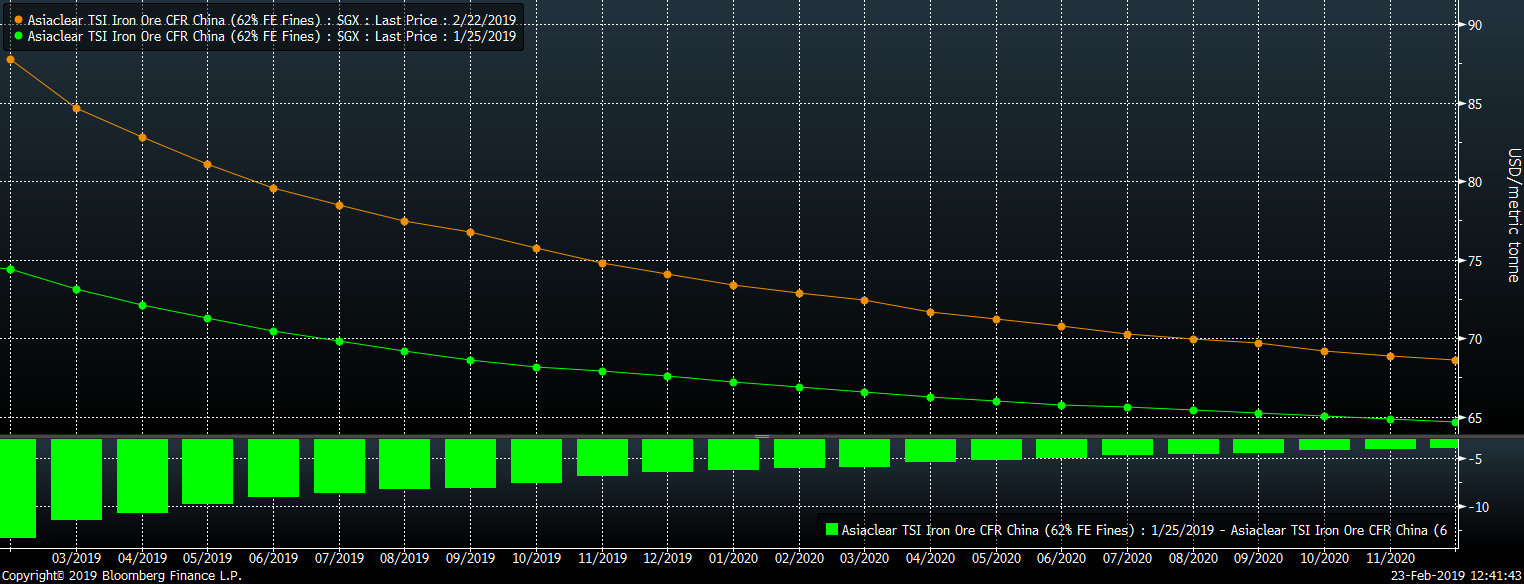

The April SGX iron ore future lost $0.08 to $84.82 while the April Turkish scrap future lost $4.50 to $326.50.

The SGX iron ore futures curve has continued to rally significantly with the front of the curve steepening, and then leveling off in the later months.

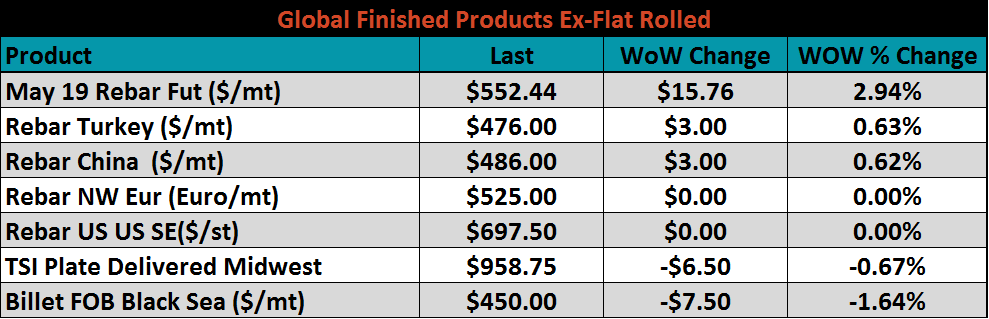

Ex-flat rolled prices are shown below. The May Chinese rebar future rose 3%, while Black Sea billet lost 1.6%.

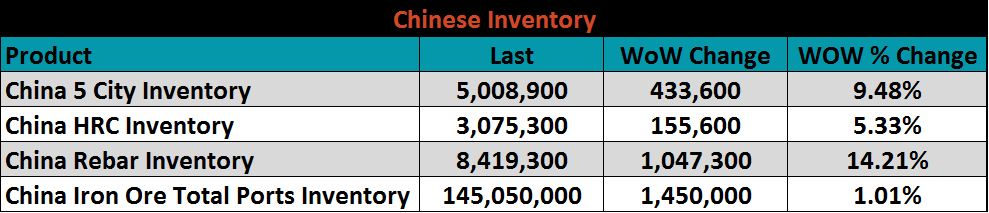

Below are inventory levels for Chinese finished steel products and iron ore. HRC and rebar inventory levels are at their highest level for this week since 2014.

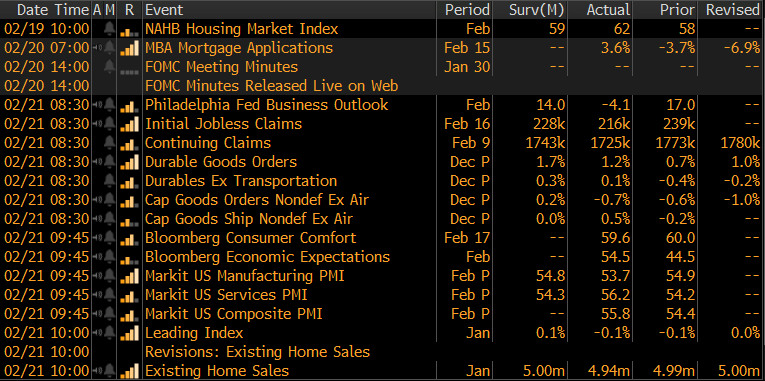

The February Philadelphia Fed Index badly missed the expected 14 printing -4.1 and falling into contraction for the first time since May 2016. Preliminary December Durable Goods Orders were below expectations and Capital Goods Orders Nondefense Ex-Aircraft were negative for the second consecutive month. January Existing Home Sales fell to a 4.94m SAAR missing expectations of a 5m home SAAR.

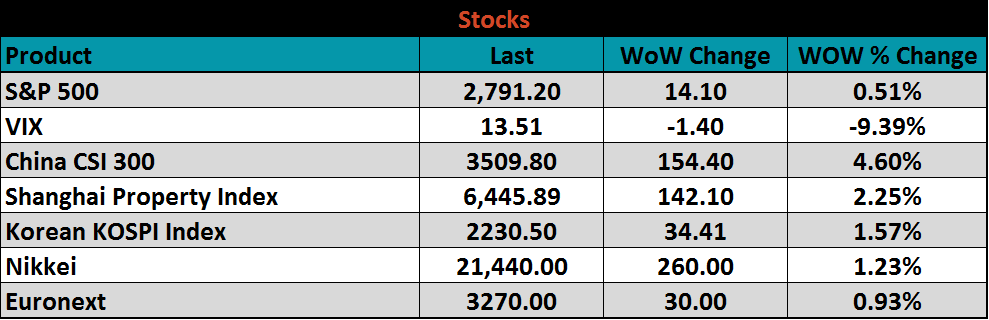

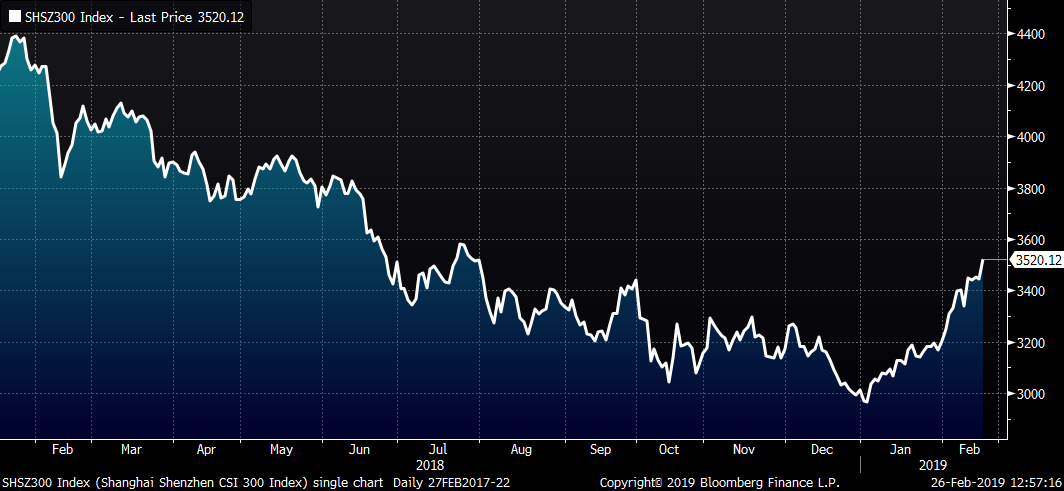

Global stock markets all rose. The S&P 500 was up 0.5% while the Chinese CSI 300 gained 4.6%. China’s CSI 300 is up 18.5% YTD.

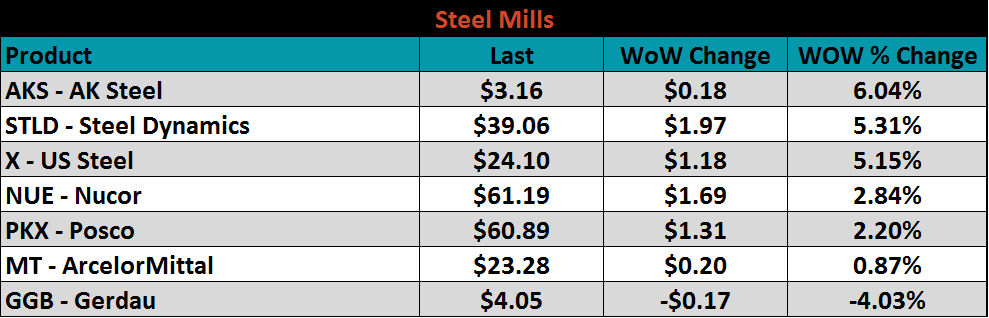

Steel mill stocks were mostly higher last week. AK Steel gained 6%, while Gerdau was down 4%.

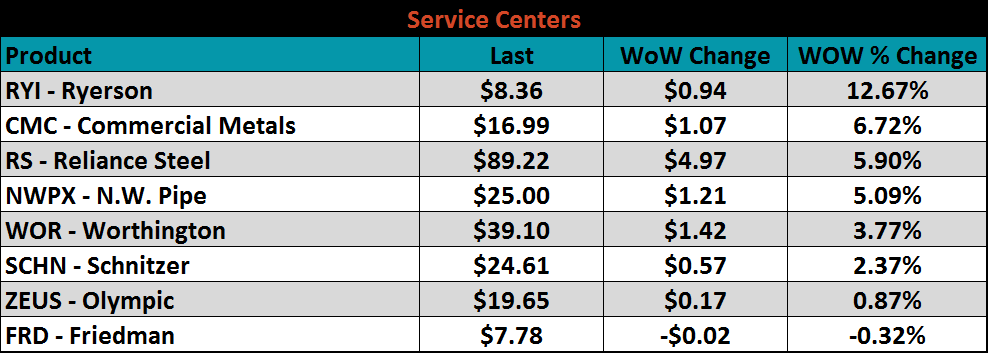

Service center stocks were mostly higher. Ryerson led the way gaining 12.7%.

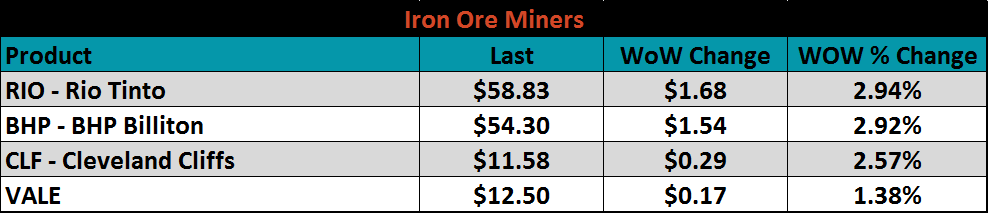

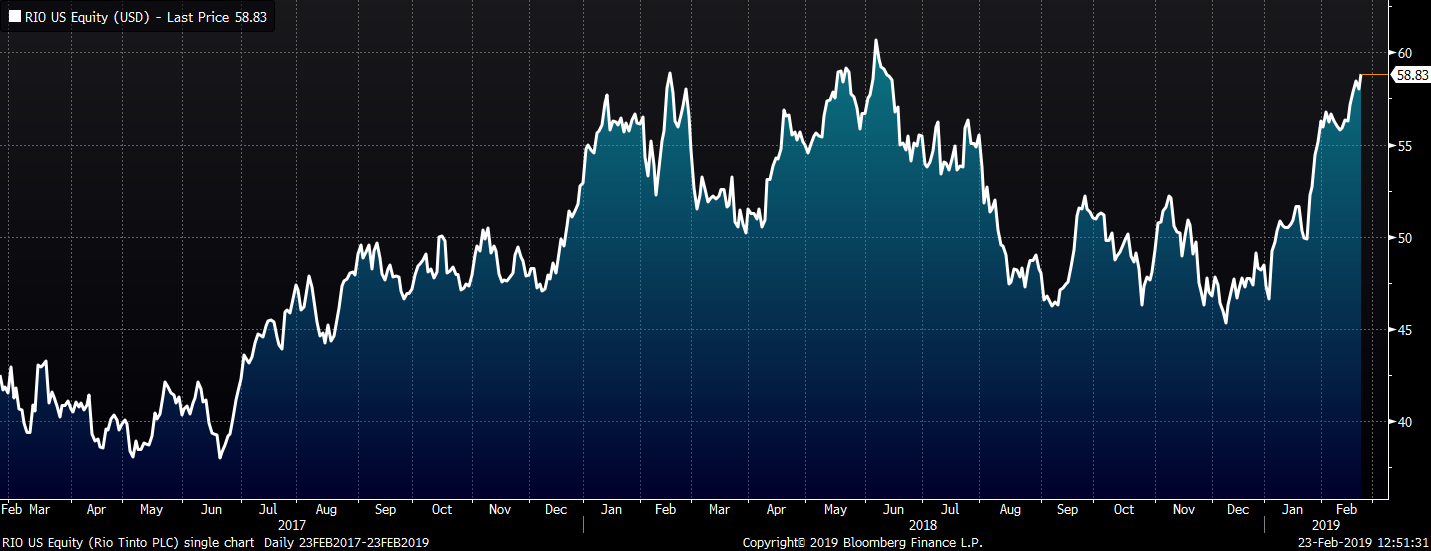

Mining’s stocks are listed below. Rio Tinto and BHP Billiton were each up 2.9%.

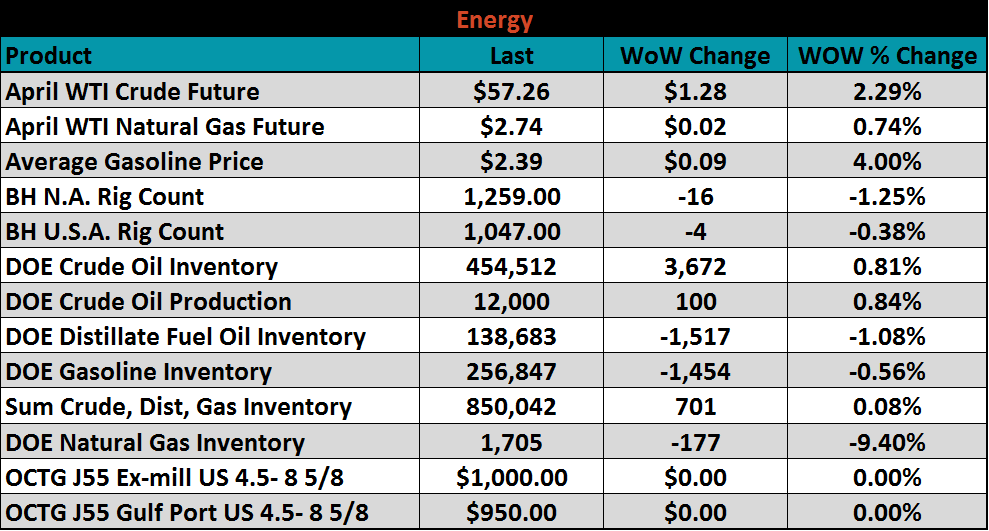

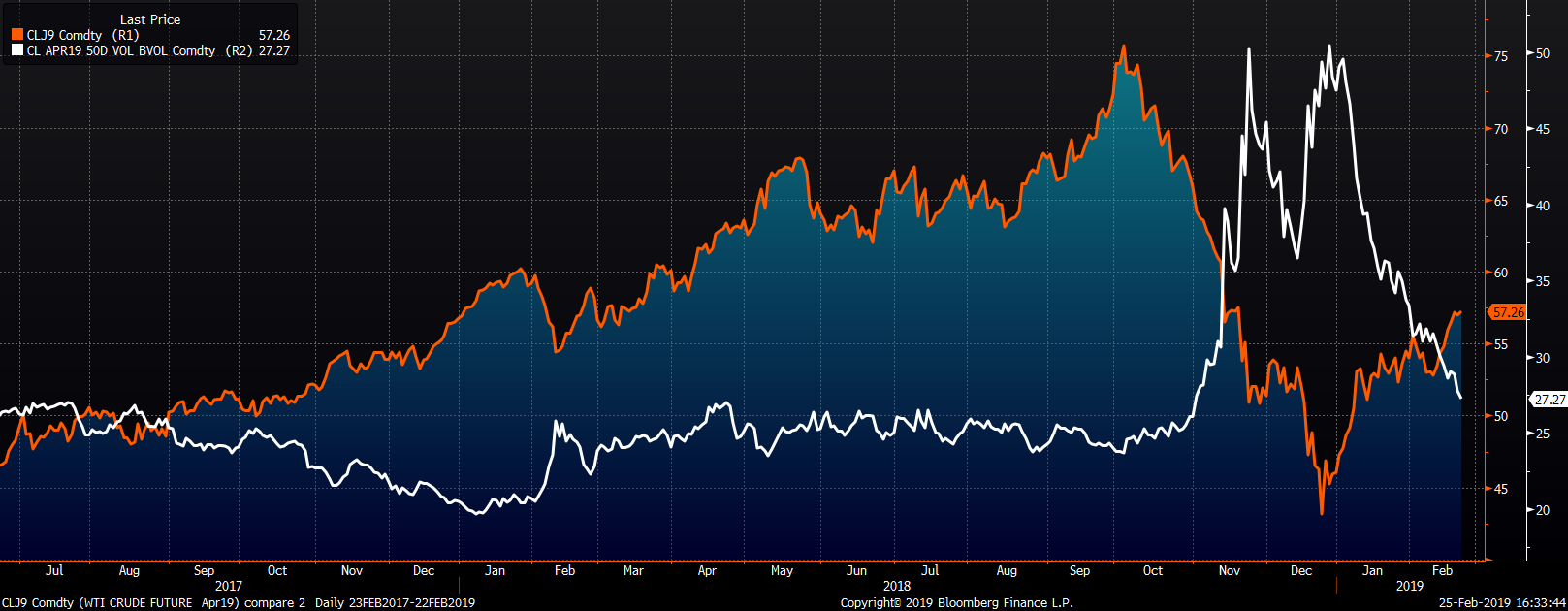

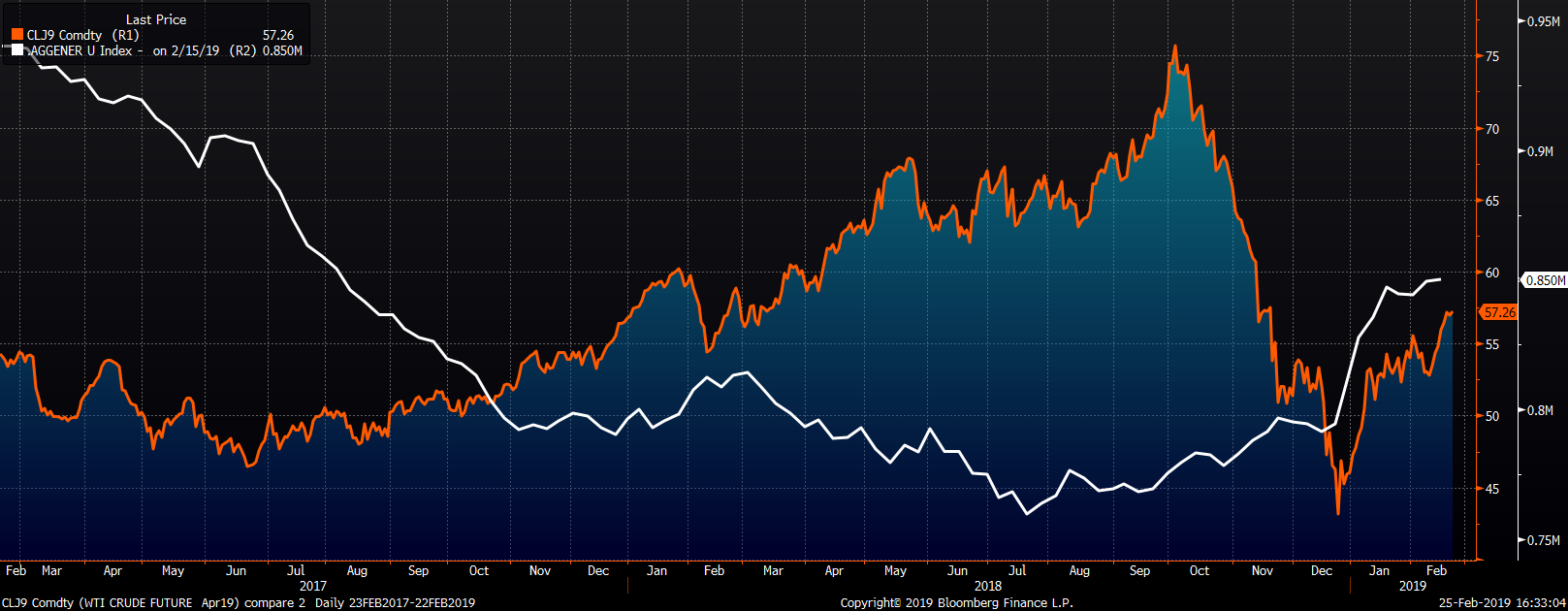

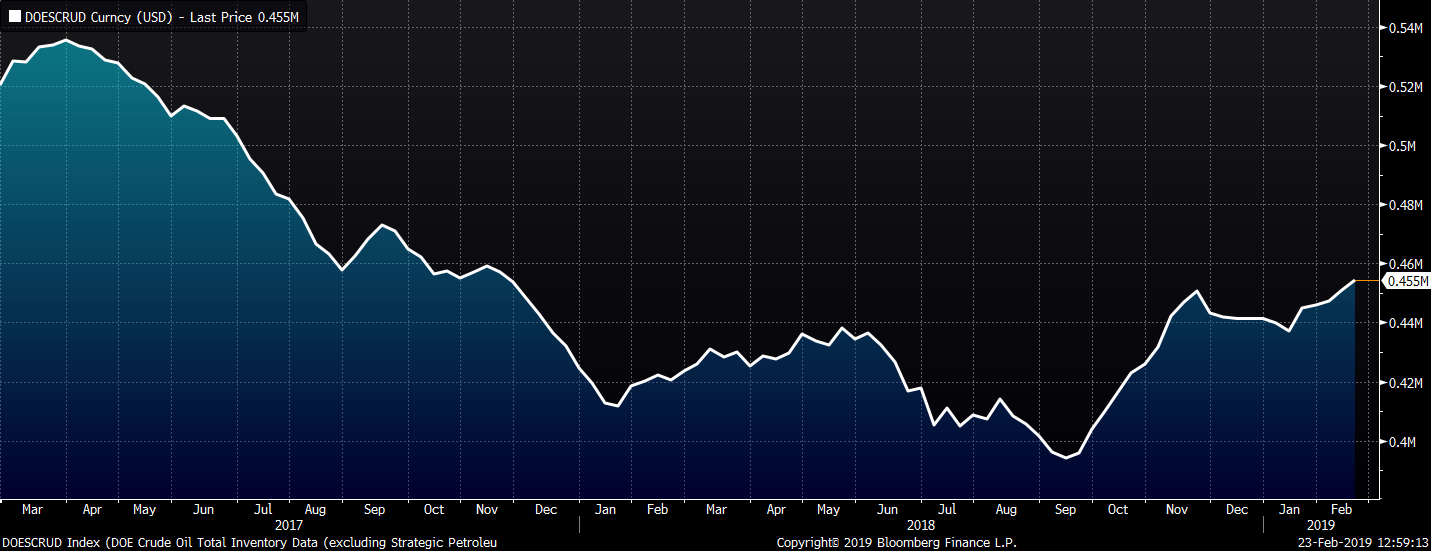

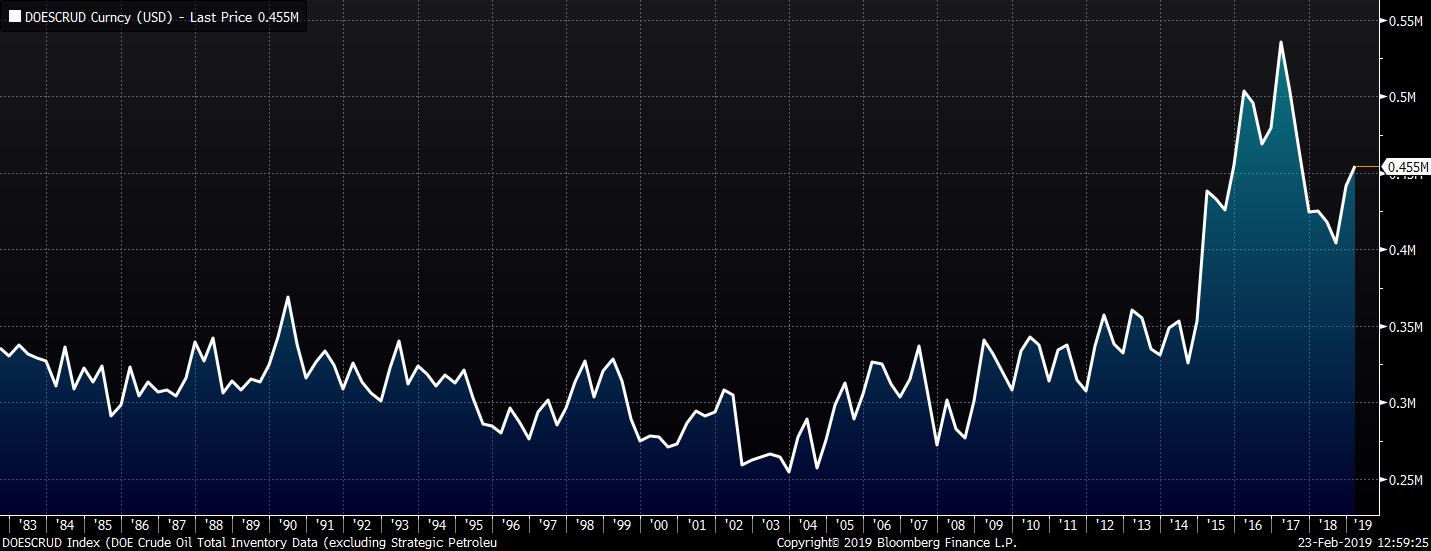

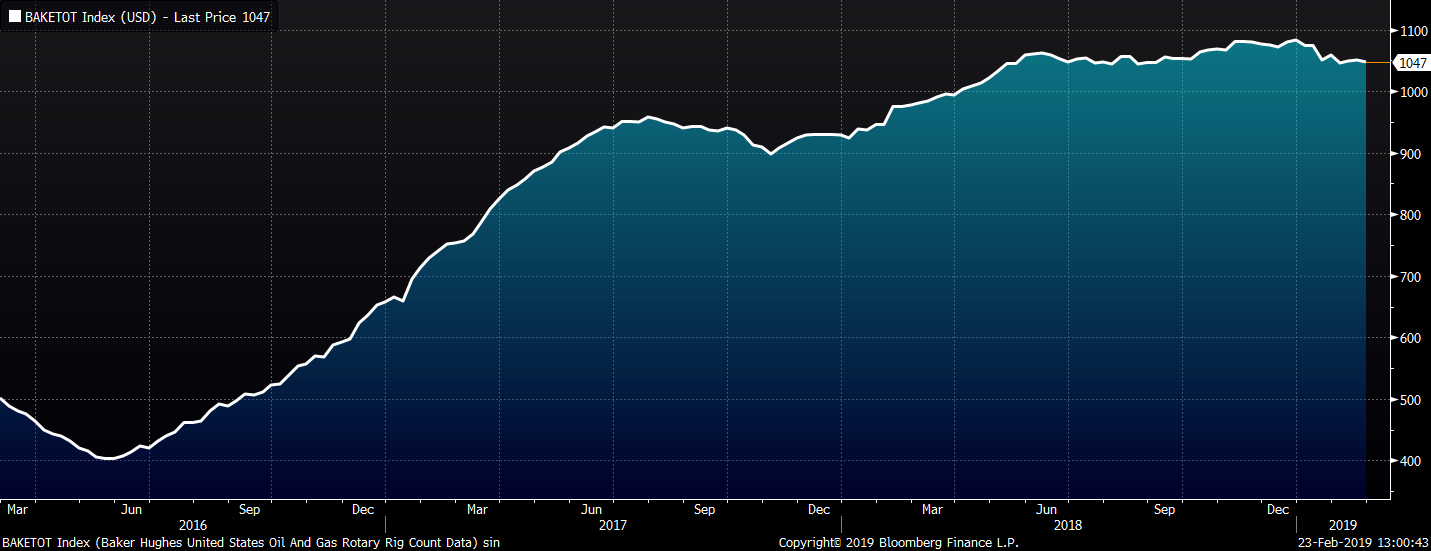

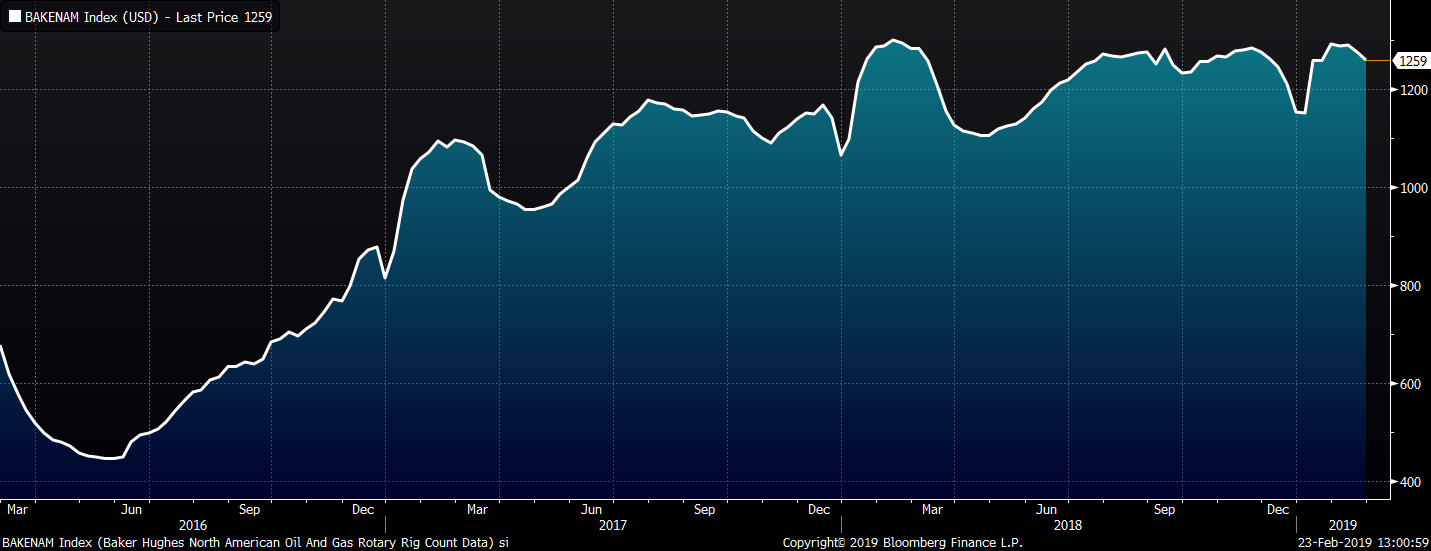

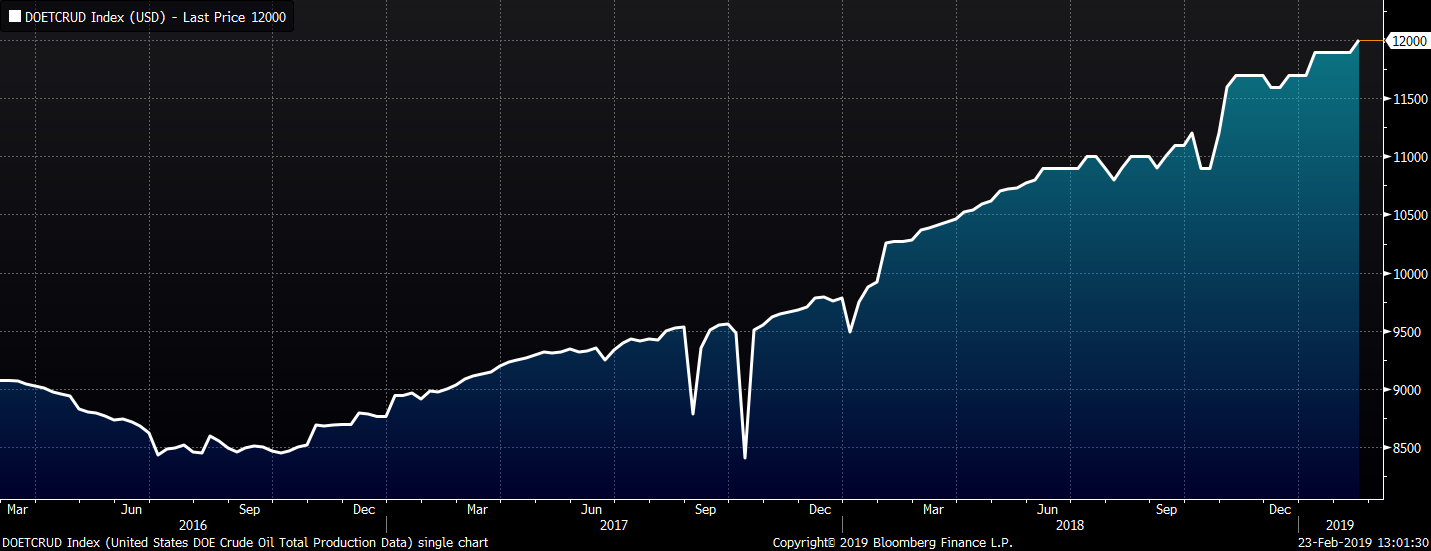

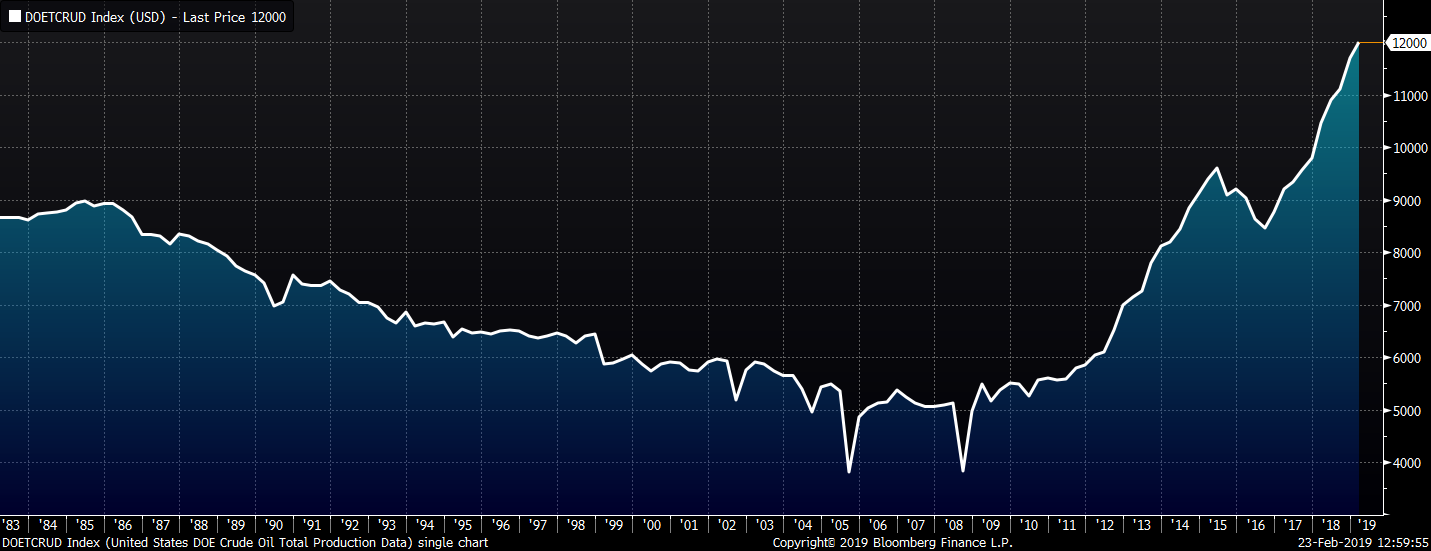

Last week, the April WTI crude oil future gained $1.28 or 2.3% to $57.26/bbl. Crude oil inventory rose 0.8%, while distillate and gasoline inventories fell 1.1% and 0.6%, respectively. The aggregate inventory level rose slightly. Crude oil production increased to 12m bbl/day. The U.S. rig count lost 4 rigs while the North American rig count lost 16 rigs. The April natural gas future gained $0.02 or 0.7% to $2.74/mmBtu. Natural gas inventory fell 9.4%.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely.

Upside Risks:

Downside Risks: