Content

-

Weekly Highlights

- Market Commentary

- Risks

After a slight lull in the HRC price rally over the past two weeks, spot indexes continued marching higher this week, with seemingly enough strength to push prices north of $1,250/st in the next few weeks. The dynamics within the spot market remain tight, with mills struggling to catch up on order books, leaving them several weeks behind and lead times extended into May for the scarce spot HRC availability. As inventory levels have collapsed across the steel market supply chain over the past year, this week we will discuss how sentiment and behavioral biases can influence restocking decisions, affecting prices in both directions at different points in the cycle.

As prices increase, the decision to restock becomes more difficult, and is different for companies depending where they function in the supply chain. The big challenge for mills right now, and in the months ahead, will be to secure the raw material stock needed to produce their finished product. Because of the currently wide price spread between HRC and raw material prices, the mills’ ability to capture expected profits is based simply on operating efficiency and continuously restocking the necessary metallic, which have been limited in supply.

However, the decision for service centers and steel consumers is different, because their profitability is based on spreads over inventory values as well as the price elasticity of their customers’ demand. Now that service centers and end users have sold the majority of their inventories and realized massive gains, their future profitability will be based on their ability to pass elevated prices to their customers. As long as elevated prices can be passed through, there is little need to restock and hold significant inventories. Once demand diminishes and prices peak, buyers will face the impossible decision of determining a price to restock. In declining markets, there is a feedback loop for buyers, who get rewarded for waiting to buy because prices and lead times are both falling, allowing for lower prices for the same delivery timeframe if purchases are delayed. However, with increasing price environments, buyers tend to also delay restocking, because recent historical prices have anchored them in believing that “reasonable” price levels are much lower. This perpetuates price rallies as depleted inventories of marginal spot buyers cause them to pay even higher prices, a dynamic we have seen over the past several months.

Finally, a market participant’s price outlook can significantly alter decision making, with real consequences for their business. For example, if a buyer thinks prices are too high, they will hold off on buying until prices move to a more “reasonable” level. But in this current market, what is that level? If prices fall 30% from the current level, will buyers feel good about purchasing $875 HRC, more than $200 above the recent average? By looking at historical prices and past markets to inform today’s purchasing decisions, there is a chance that new information from the current market is not being included or considered. In the weeks ahead, this report will dive into the possibility that the post-pandemic steel market is significantly different than recent history. In the meantime, we suggest everyone in the market account for new information in their forward looking “price models” to get ahead of the next large price move.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

The Platts TSI Daily Midwest HRC Index increased by $12 to $1,211.75.

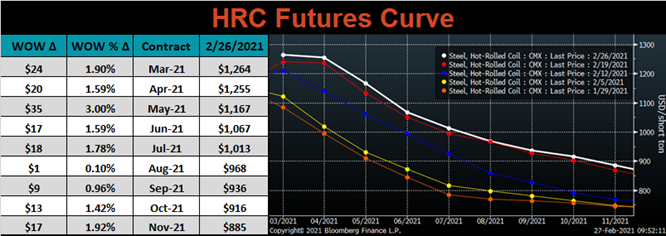

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. Last week, the entire curve shifted slightly higher across all expirations.

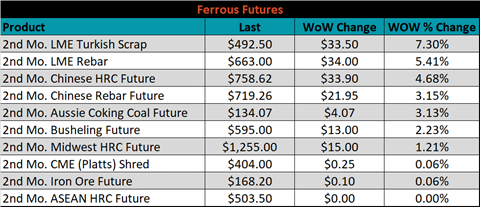

April ferrous futures were mixed. Iron ore gained 4.4%, while Aussie coking coal lost another 5.8%.

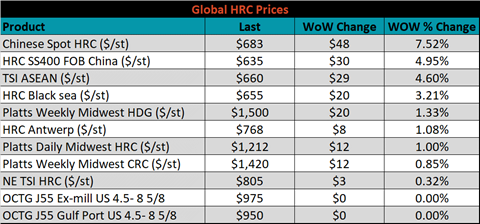

Global flat rolled indexes were all higher, led by Chinese Spot HRC, up 7.5%.

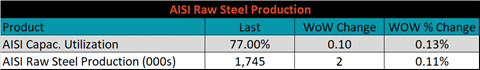

The AISI Capacity Utilization rate increased 0.1% to 77%.

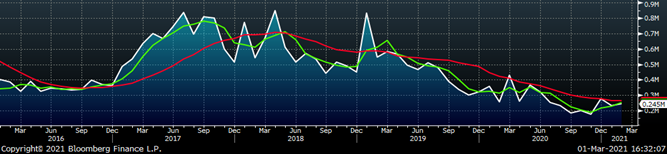

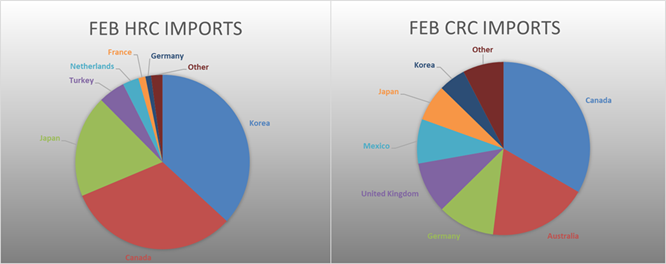

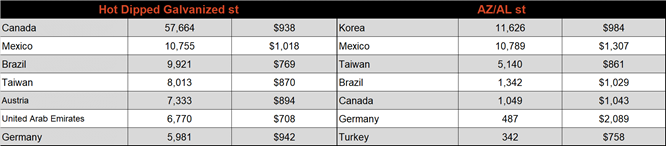

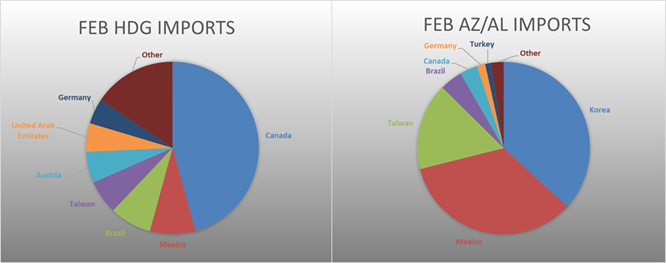

February flat rolled import license data is forecasting an increase of 125k to 677k MoM.

Tube imports license data is forecasting an increase of 14k to 245k in February.

February AZ/AL import license data is forecasting a decrease of 22k to 37k.

Below is January import license data through February 23, 2021.

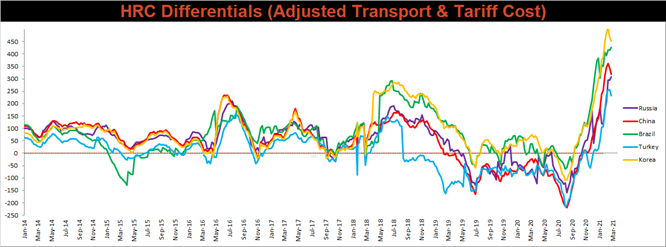

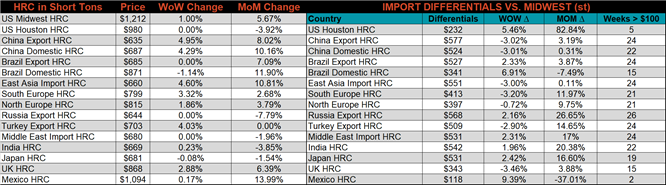

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The differentials decreased for Korea, Turkey, and China, with their respective export prices increasing more significantly than the U.S. domestic price.

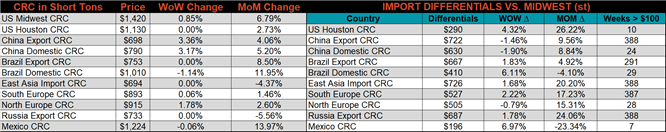

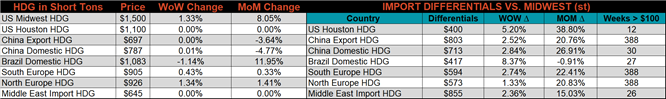

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HDG, HRC & CRC prices were up 1.3%, 1% and 0.9%, respectively. Globally, the Chinese HRC export price was up 5%.

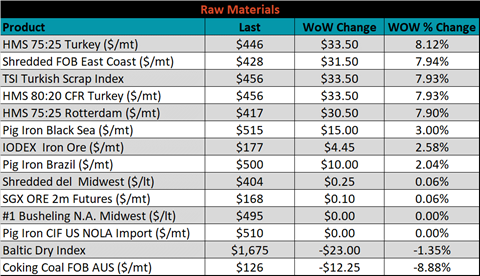

Raw material prices were mostly higher, led by Turkish HMS, up 8.1%, while Aussie coking coal was down another 8.9%.

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, backwardation in the curve steepened. The front increased and the back decreased, with the July expiration acting as an “unchanged” fulcrum.

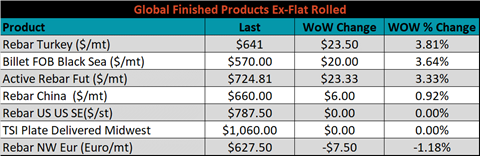

The ex-flat rolled prices are listed below.

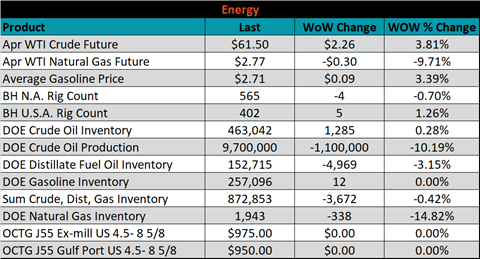

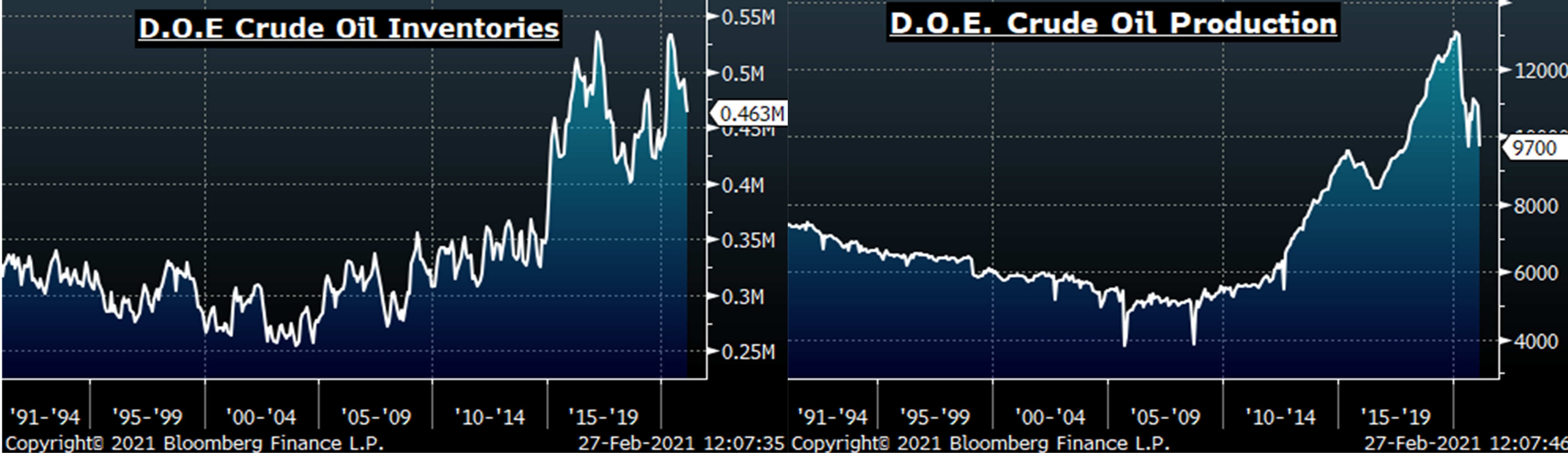

Last week, the April WTI crude oil future lost $2.26 or 3.8% to $61.50/bbl. The aggregate inventory level was down another 0.4% and crude oil production decreased to 9.7m bbl/day. The Baker Hughes North American rig count was down 4 rigs, while the U.S. rig count was up 5 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: