Content

-

Weekly Highlights

- Market Commentary

- Risks

For those who are short steel or short ferrous futures, 2021 has yet to offer any reprieve from the historic price rally of 2020. Over the past two holiday weeks, it appeared that small cracks were forming in select markets in the ferrous space. Chinese HRC and iron ore prices pulled back from their recent highs in December, the first sign of any weakness in months. However, the start of this week initiated another leg in the ferrous price rally, driven by moves higher in scrap prices. The busheling forward curve move 10% higher on Monday, with expectations of prices moving well above $500 in January. The HRC curve followed this move higher on Tuesday, with the February expiration moving up $79 in one day! The rally is still very much intact, despite the holiday market lull. Turning to the physical market, we continue to see limited spot material, with extended lead times and shockingly high offer prices. Mills are looking toward $1,100 per ton for HRC offers. Additionally, we are starting to see mills only producing select types of spot tons that are easier for them to make, increasing profitability and reducing stress on their assets. They continue to hold significant control of the market. One threat to this control moving into next year is foreign material competing in the domestic market. This week we will look at how pricing will influence the significance of this threat.

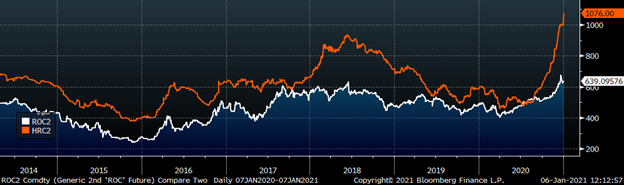

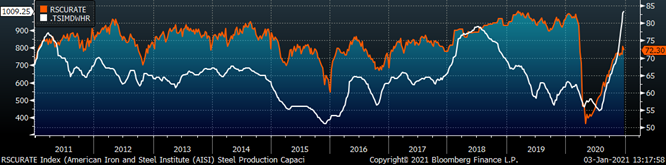

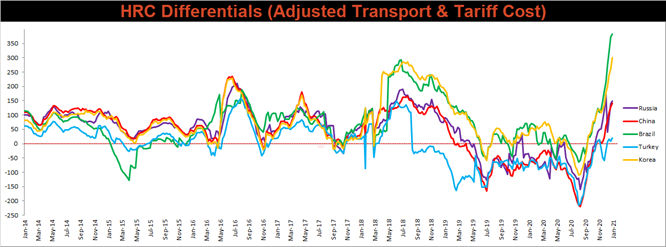

As domestic HRC prices push up to higher levels, the threat of lower priced imports becomes more prominent. The below chart compares the rolling 2nd month HRC futures for both domestic USA (orange) and China (white) markets in US dollars per short ton.

During the beginning of the current price rally in early fall, the Chinese HRC price moved up at a similar pace as the domestic price, more or less holding the historic relationship between the two and signaling global pricing strength. Over the past month, the domestic price accelerated while the Chinese HRC price stalled, creating one of the widest spreads between the two in recent history. Also during this time, China shifted from briefly being a net importer of steel to a net exporter, returning to a normal status in global trade relationships. This means there will be more tons in the global market, and with price differentials expanding, increasing the likelihood that they move to the domestic market.

For those in need of steel, this is a sign of hope. Unfortunately for them, it will not provide immediate relief due to lead times, current pricing and the amount of material needed to resolve the current shortage. Current import offers are for tons that will arrive in the second quarter at the earliest. However, import prices remain elevated to a point where the forward curve provides a better buying opportunity i.e. buyers are better off buying futures, and attempting to secure material from domestic producers in the second quarter. Many expect that because prices have increased so rapidly over the past several months that they will also fall at a similar pace. This thought process ignores fundamental market factors, such as supply and demand levels. The price increased due to demand significantly outpacing a constricted supply, accumulating a deficit of several million tons. For prices to fall at the same pace, the market will need to be oversupplied by several millions of tons, a circumstance that not even a few months of elevated imports can generate.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

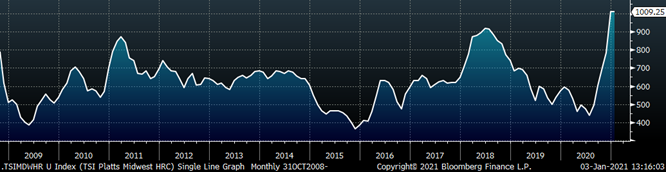

The Platts TSI Daily Midwest HRC Index increased by $9.75 to $1009.25.

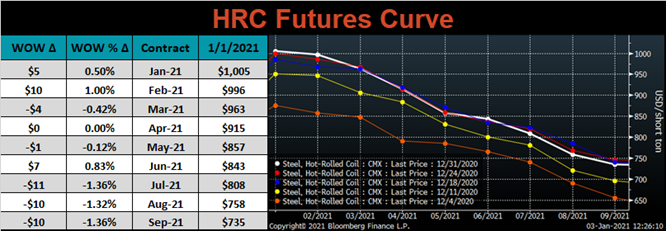

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. Last week, the curve did not change.

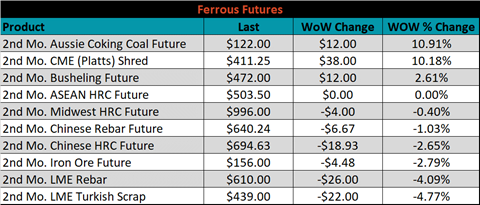

February ferrous futures were mixed. Aussie coking coal was up 10.9%, while Turkish scrap was down 4.8%.

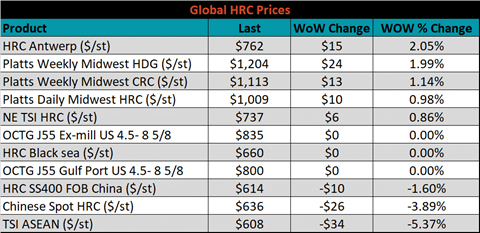

Global flat rolled indexes were mixed. Antwerp HRC was up another 4.7%, while TSI ASEAN was down 5.4%.

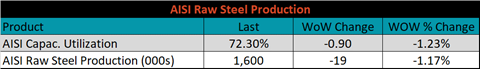

The AISI Capacity Utilization rate decreased 0.9% to 72.3%.

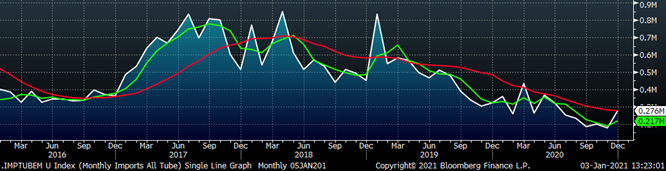

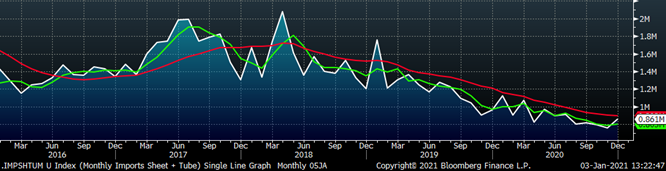

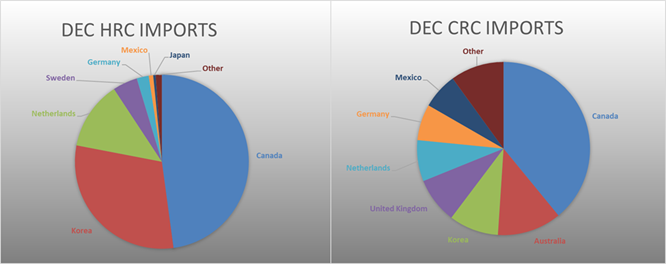

December flat rolled import license data is forecasting an increase of 4k to 585k MoM.

Tube imports license data is forecasting an increase of 100k to 276k in December.

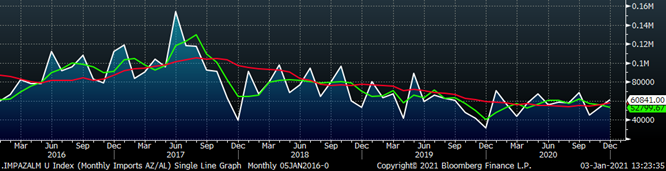

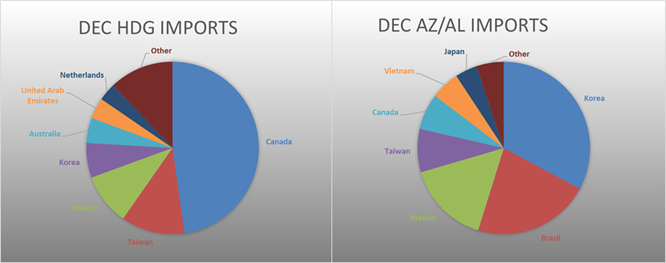

December AZ/AL import license data is forecasting a 4k increase to 56k.

Below is December import license data through December 29, 2020.

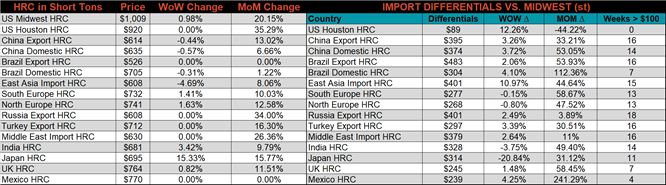

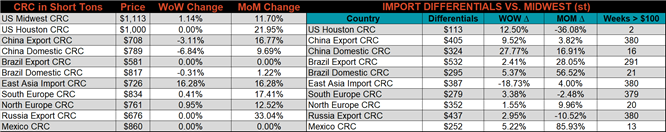

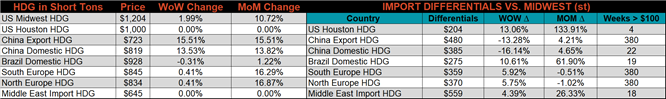

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All the watched differentials moved significantly higher.

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HDG, CRC and HRC prices were up 2%, 1.1% and 1%, respectively. Globally, the Japanese domestic HRC price was up 15.3%, while the East Asian HRC Import price was down 4.7%.

Raw material prices were mostly higher. Midwest shredded was up 10.2%, while February iron ore futures were down 2.8%.

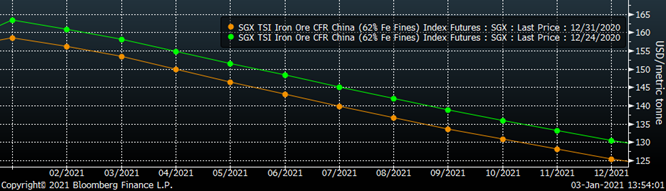

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the curve shifted lower across all expirations.

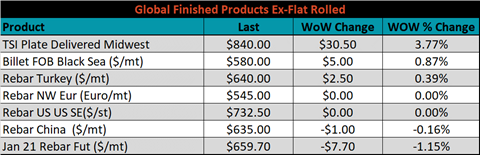

The ex-flat rolled prices are listed below.

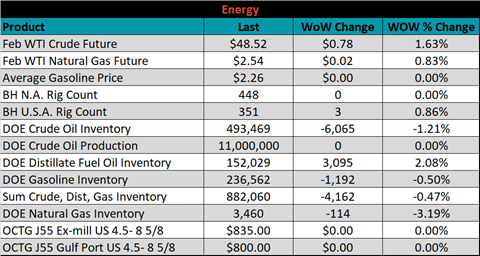

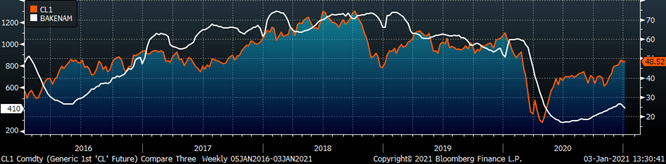

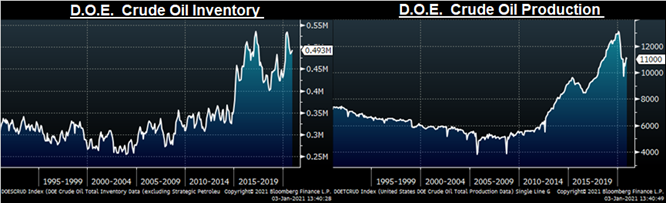

Last week, the February WTI crude oil future gained $0.78 or 1.6% to $48.52/bbl. The aggregate inventory level was down 0.5% and crude oil production was flat at 11m bbl/day. The Baker Hughes North American rig count was unchanged, while the U.S. rig count was up 3 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: