Content

-

Weekly Highlights

- Market Commentary

- Risks

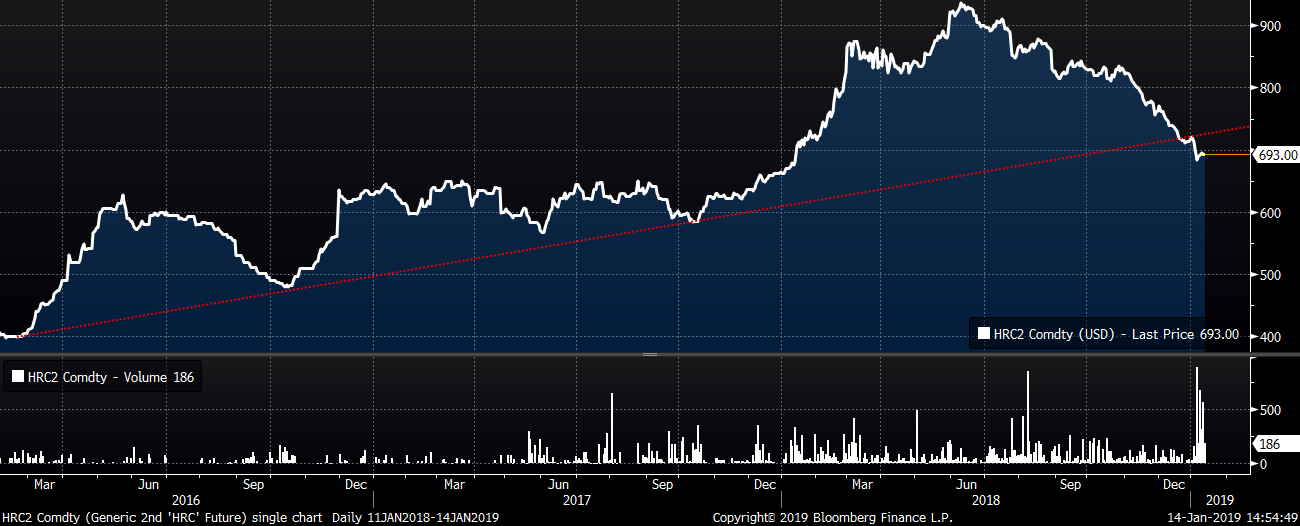

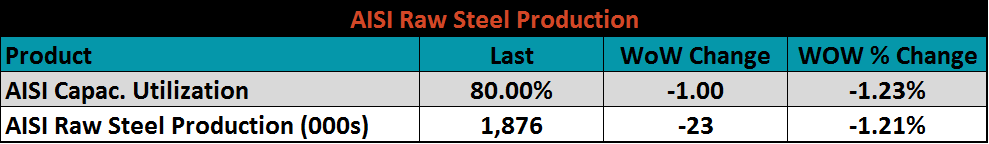

The 2nd month CME HRC future fell another $8 to $693 as of Friday’s settlement. Volume has picked up dramatically in the future since 2019. Technically, a longterm trendline break followed with heavy volume is more reliable than a break with light volume.

The January CME busheling future settled at $372.11 down $29.35 MoM. RFQs picked up last week, but whether that is due to the return from the holidays or finally a pick-up in new orders will be known as the current week plays out. The government remained shutdown, which means certain data remained unreleased, including steel import data. Construction spending, durable goods and housing data are other pieces of information that remain in the dark, however, it was reported on CNBC.com that December home sales were down 18% YoY according to housing research and analytics firm John Burn Real Estate Consulting.

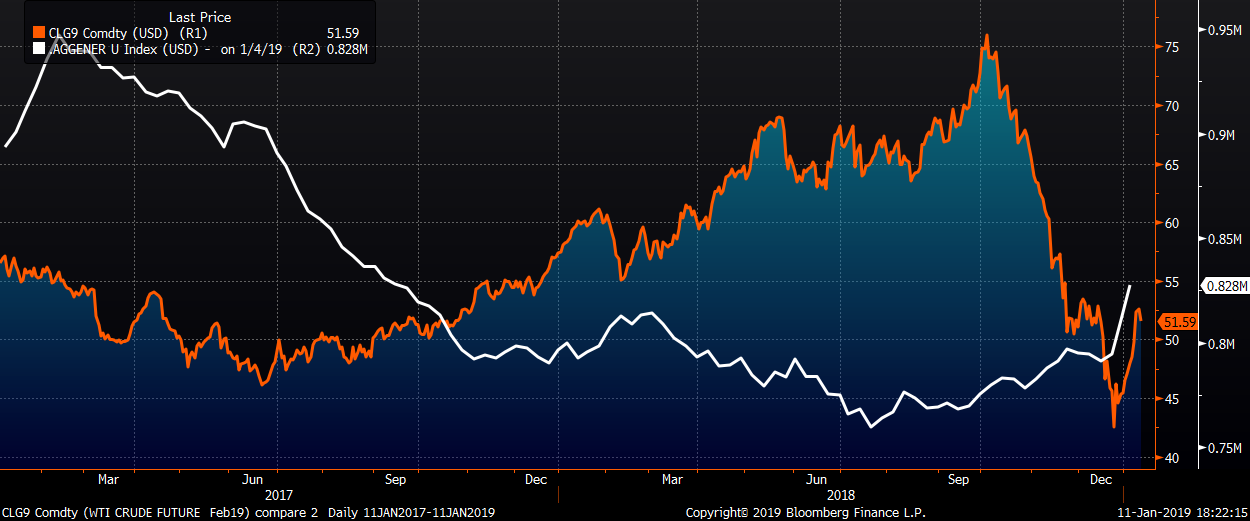

Downside risks continue to be in charge as rumors surfaced at the end of the week of domestic mills, most notably two integrated mills, had started to price tons aggressively lower. Hot rolled prices continued to move higher in China and oil saw a nice rebound closing the week $3.63 or 7.7% higher to $51.59.

Upside Risks:

Downside Risks:

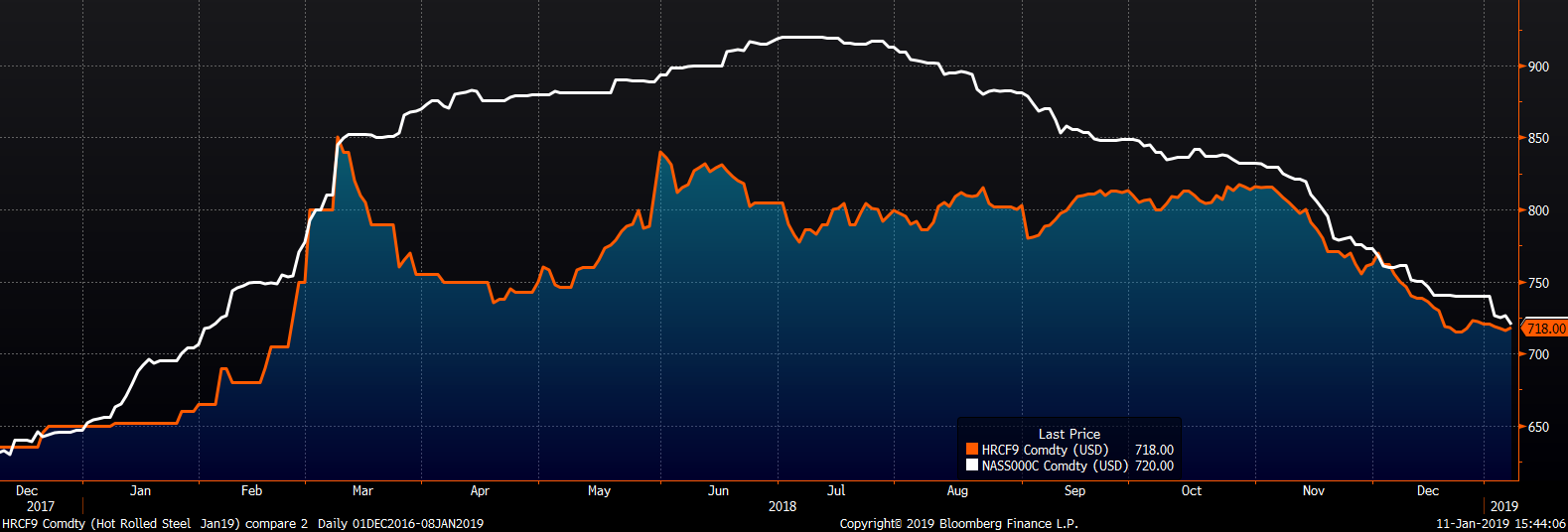

The February CME HRC future increased $1 to $718 and the Platts TSI Daily Midwest HRC Index was down $4.75 to $720.

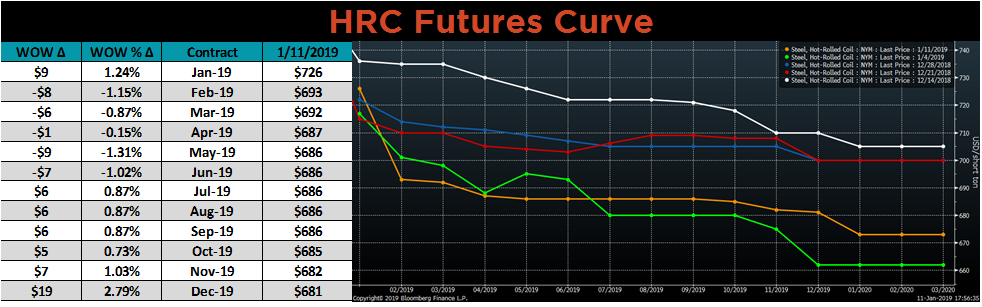

The CME Midwest HRC futures curve is shown below with last Friday’s settlements in orange. The first half of 2019 moved lower while the back half rebounded.

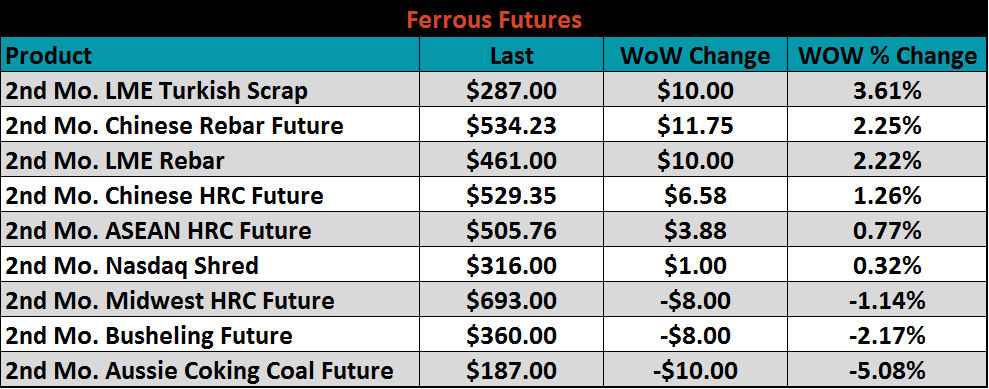

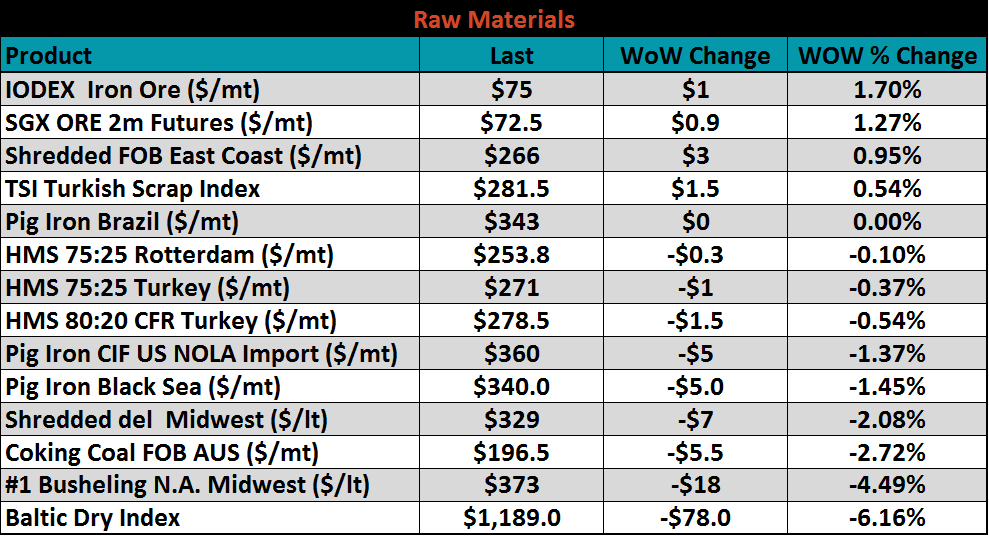

February ferrous futures are listed below. Australian coking coal futures saw losses of 5.1%, while LME Turkish scrap saw gains of 3.6%.

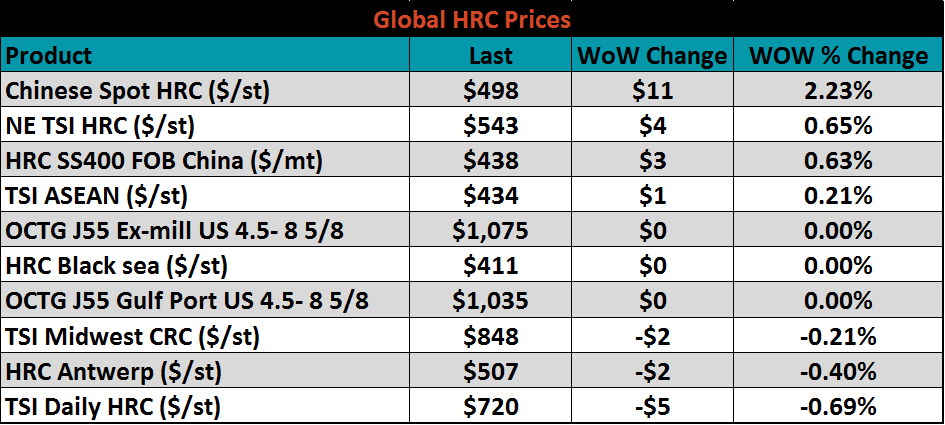

Flat rolled indexes were mixed. Chinese Spot HRC was up $11 or 2.2% WoW.

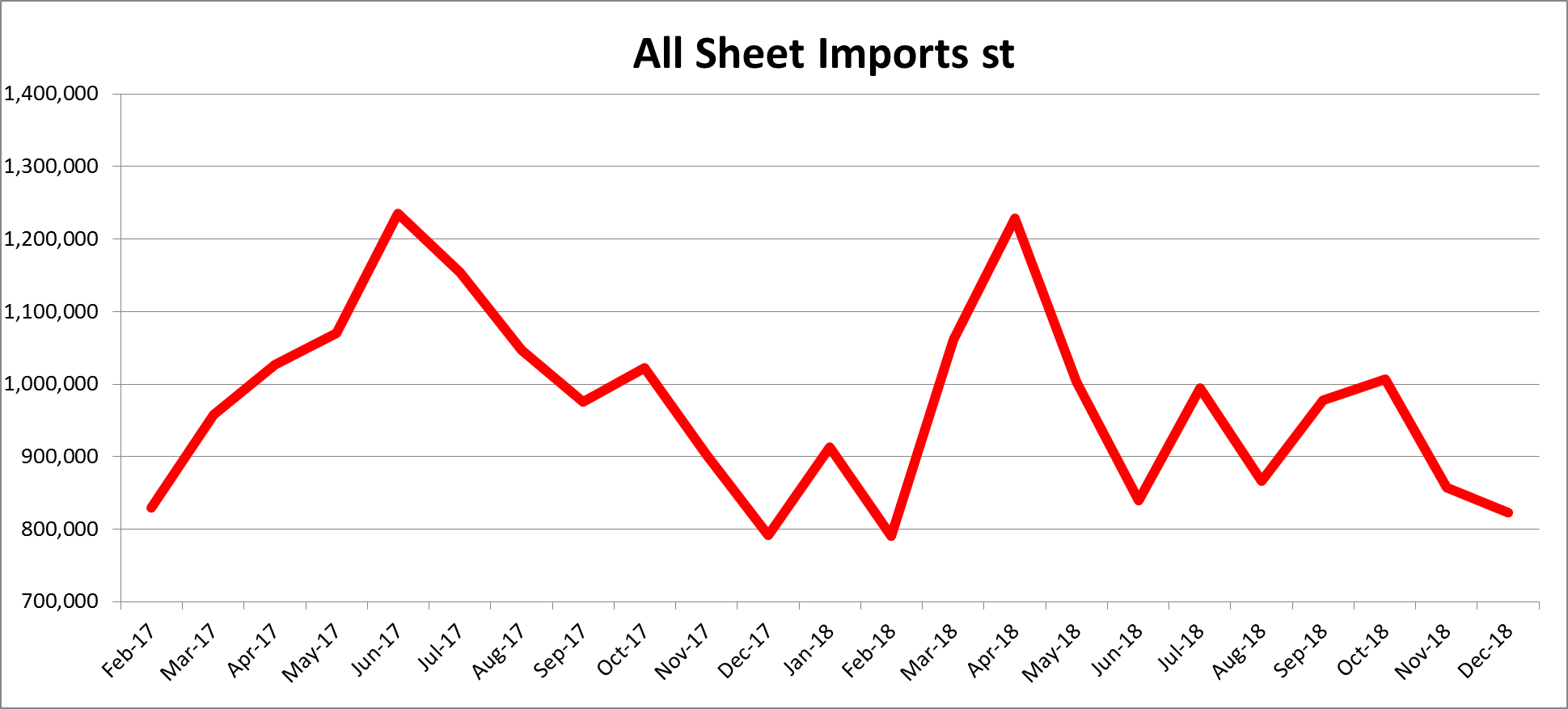

The AISI Capacity Utilization Rate decreased to 80%.

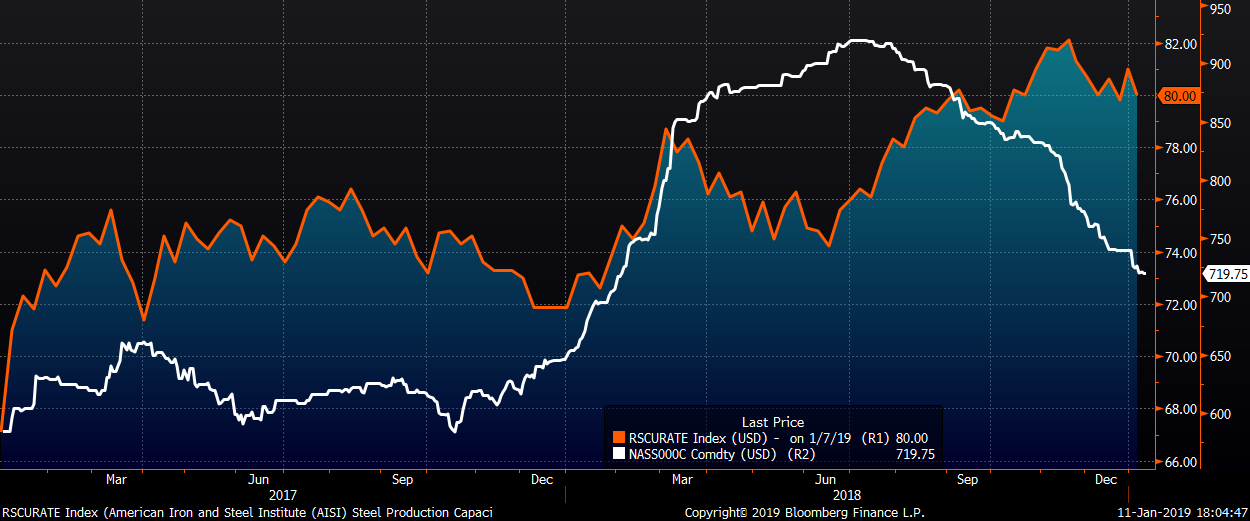

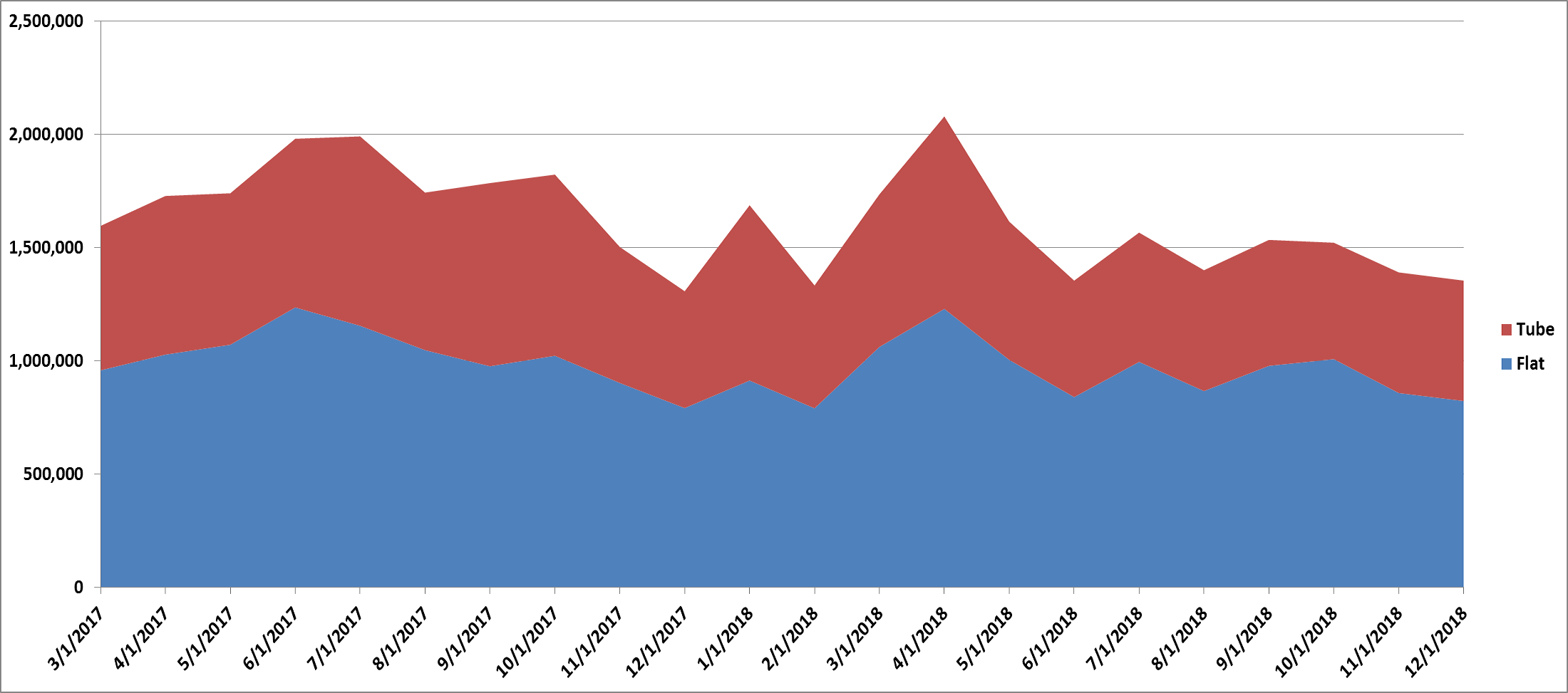

Import license data has been delayed by the shutdown. The last report we saw on December 18 showed December flat rolled import license data forecasting a 35k ton MoM decrease to 822k.

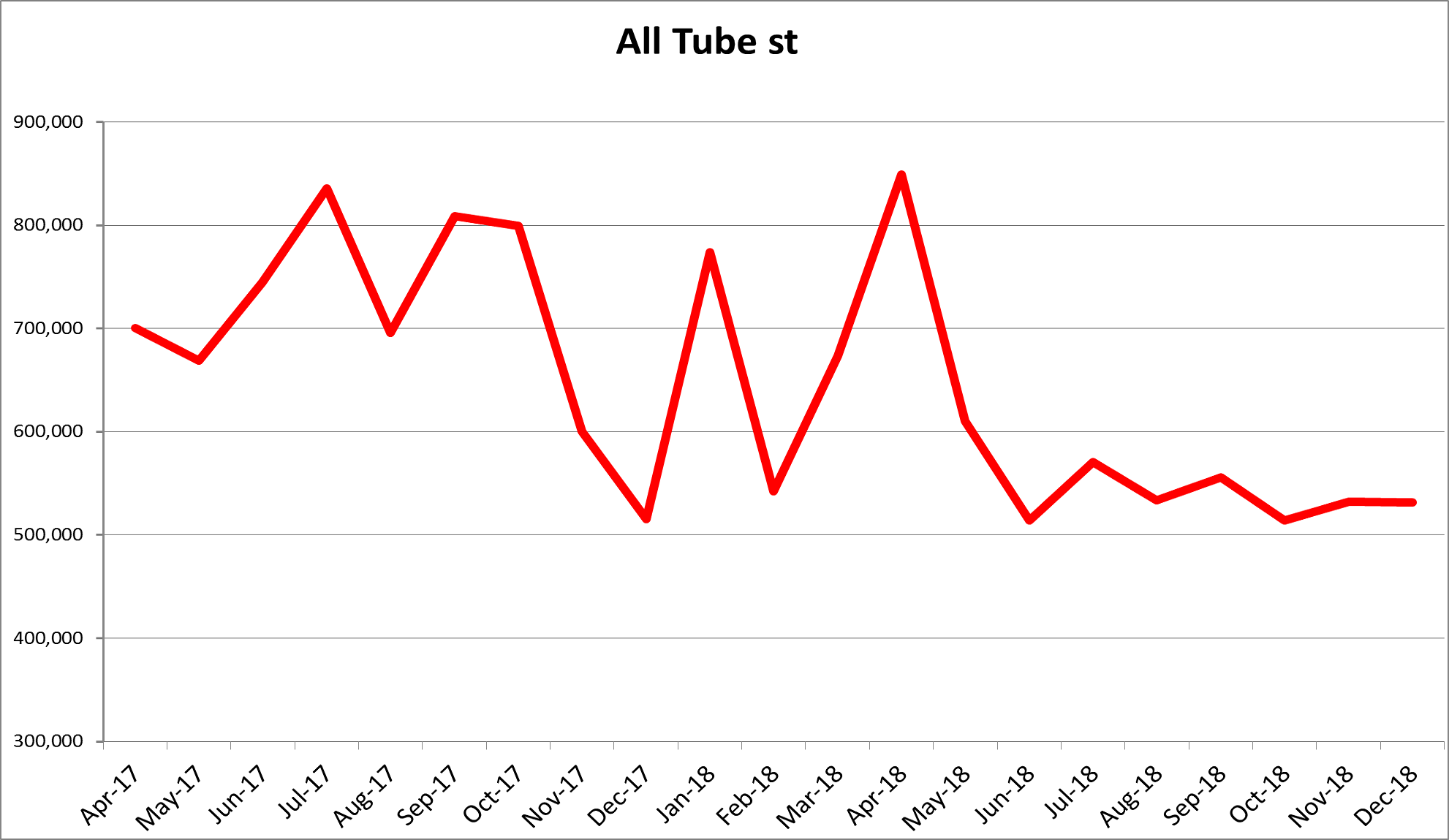

December’s tube import license data is forecasting little change MoM at 531k tons.

December’s combined flat rolled and tube import license data is forecasting 1.35m tons, slightly lower MoM.

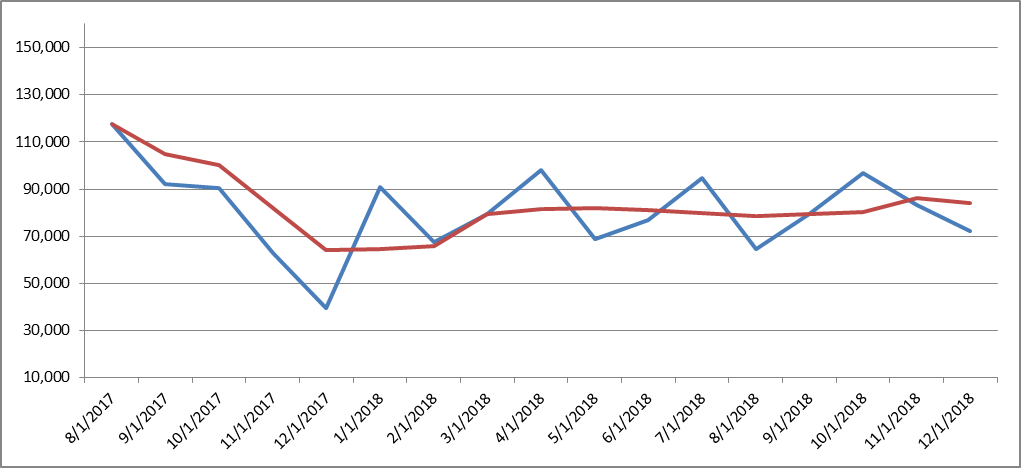

December AZ/AL import licenses are projecting a decrease of 11k tons MoM to 72k.

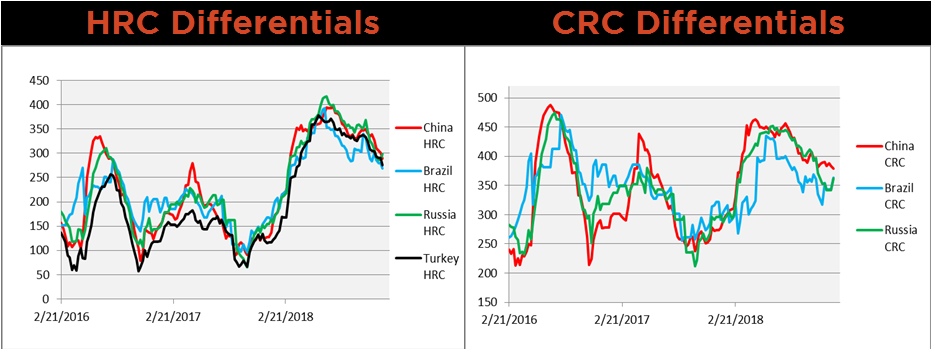

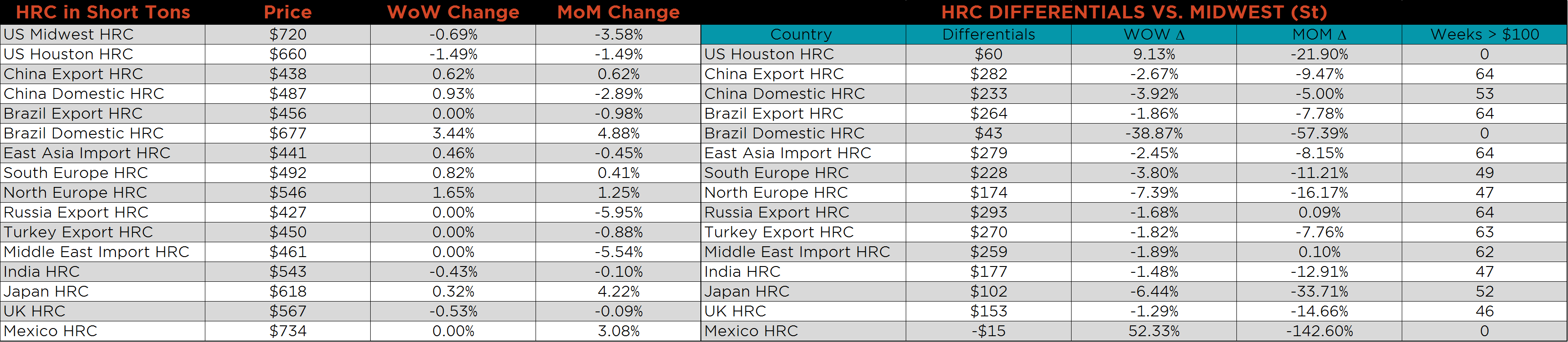

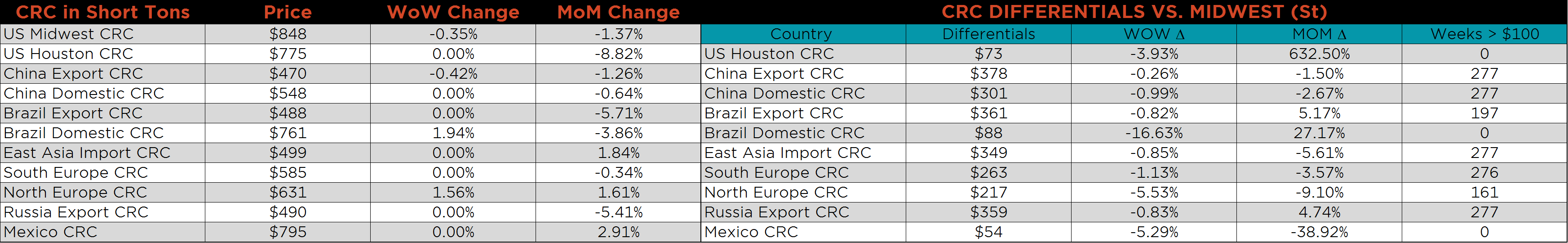

Below are HRC and CRC Midwest vs. each country’s export price differentials using pricing from SBB Platts. HRC differentials continued to decline, while Brazilian and Russian CRC differentials increased slightly.

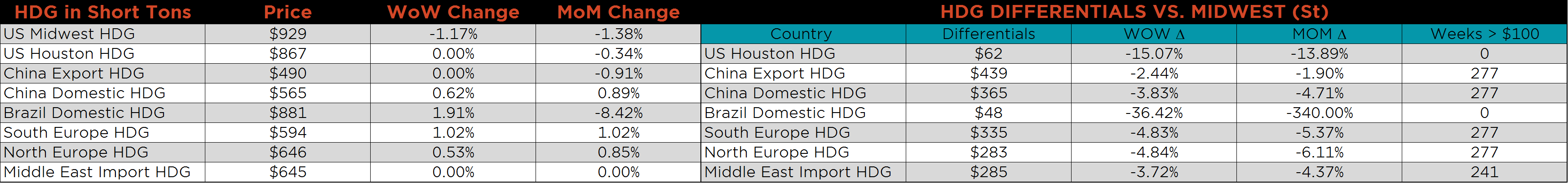

SBB Platt’s HRC, CRC and HDG WoW pricing is below. The U.S. Midwest HRC price was down 0.7%, the Midwest CRC price fell 0.4% and the Midwest HDG price was down 1.2%. The Brazilian domestic HRC price was up 3.4% while the CRC and HDG domestic prices were both up 1.9%.

Listed below are ferrous raw materials WoW price changes. Coking coal was down 2.7% while #1 busheling and Midwest shred were down 4.5% and 2.1%, respectively.

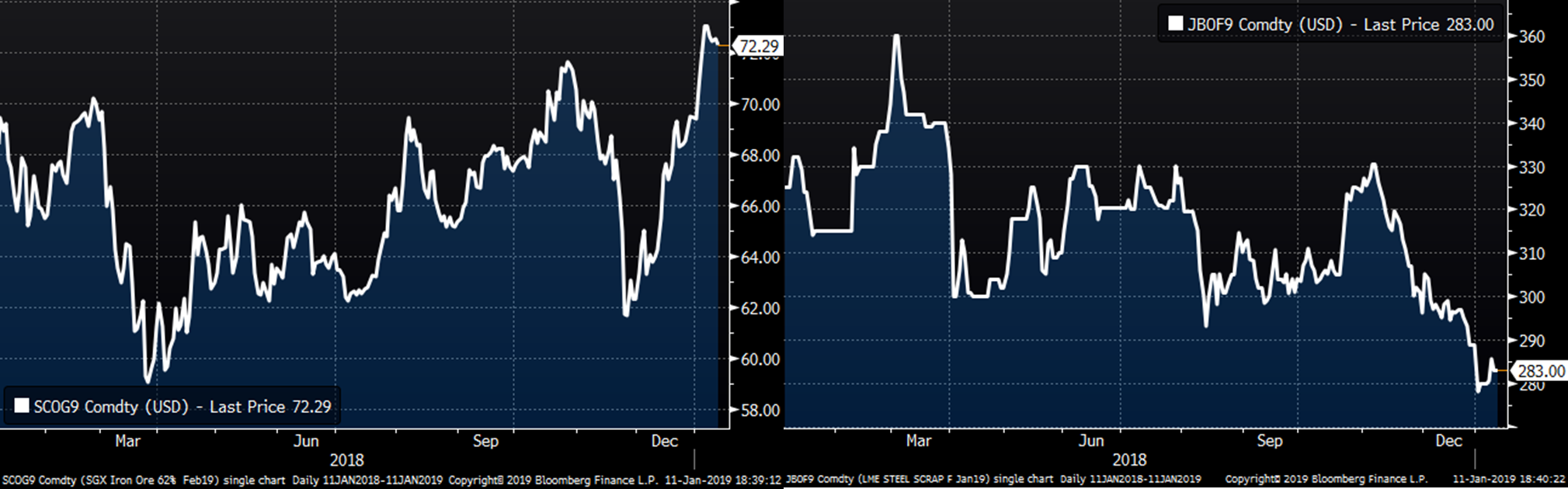

The February SGX iron ore future gained $0.40 to $72.29 while the January Turkish scrap future fell $3 to $283.00.

The SGX iron ore futures curve has rallied significantly with the front of the curve opening up sharply over the past month.

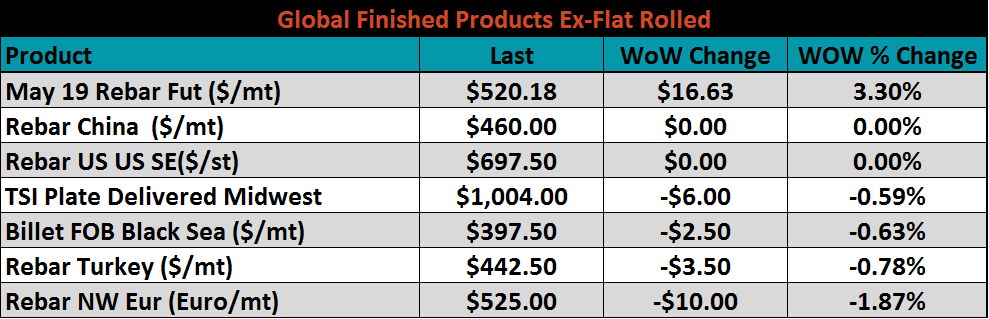

Ex-flat rolled prices were mixed with the May Shanghai rebar future up 3.3%, while Northwest European rebar fell 1.9% WoW.

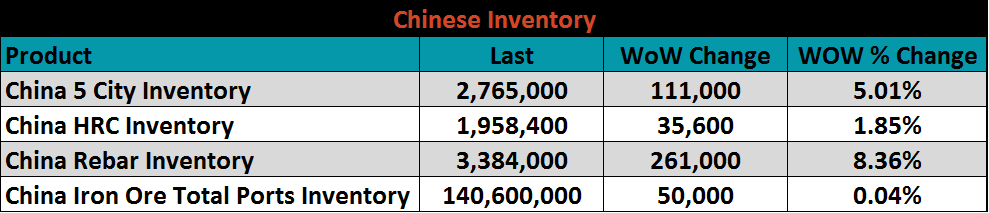

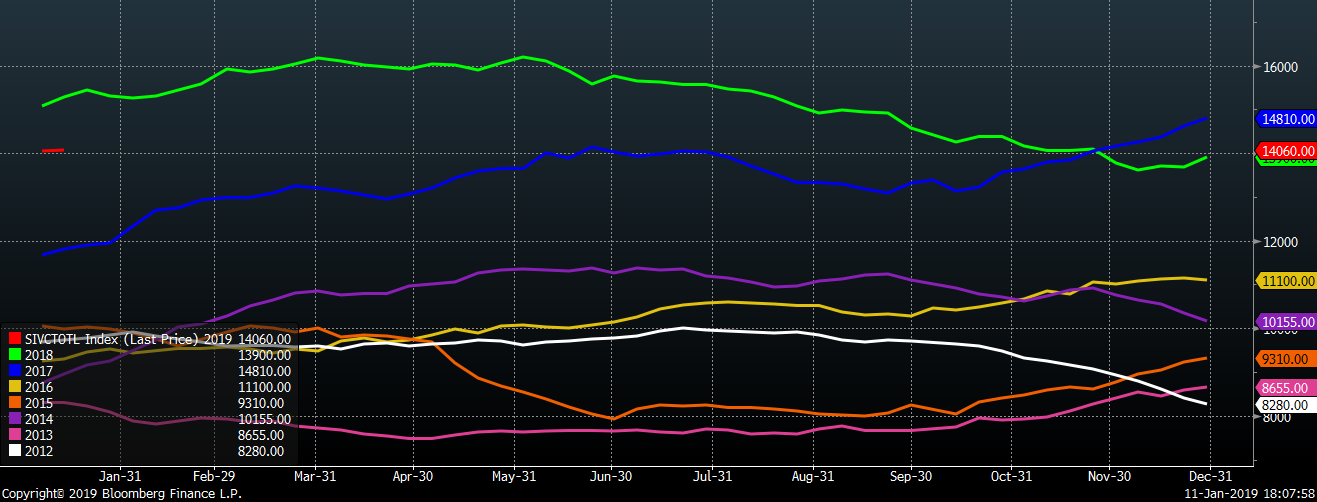

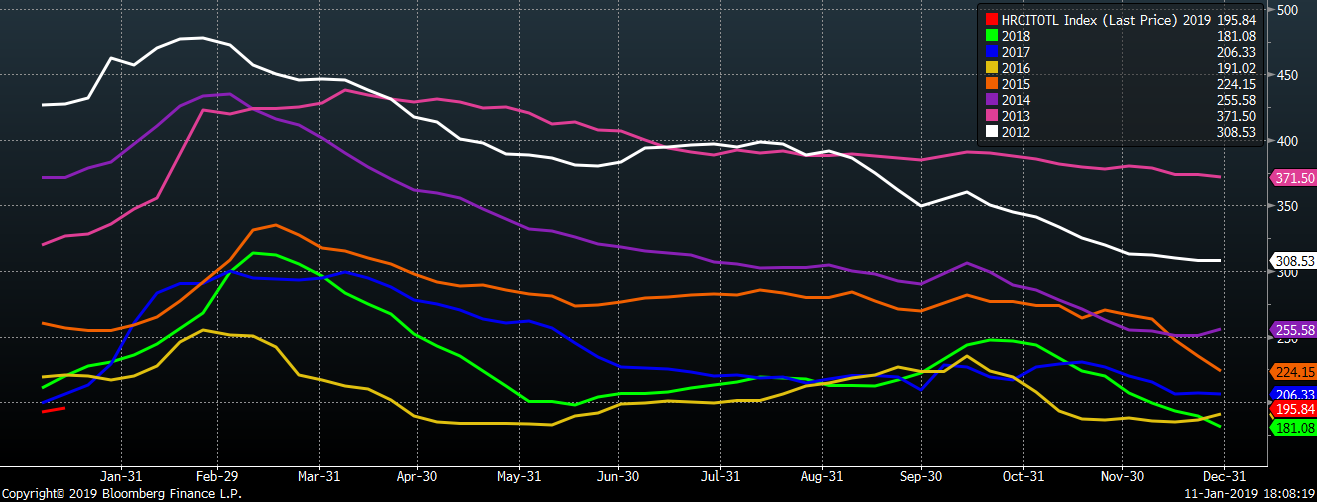

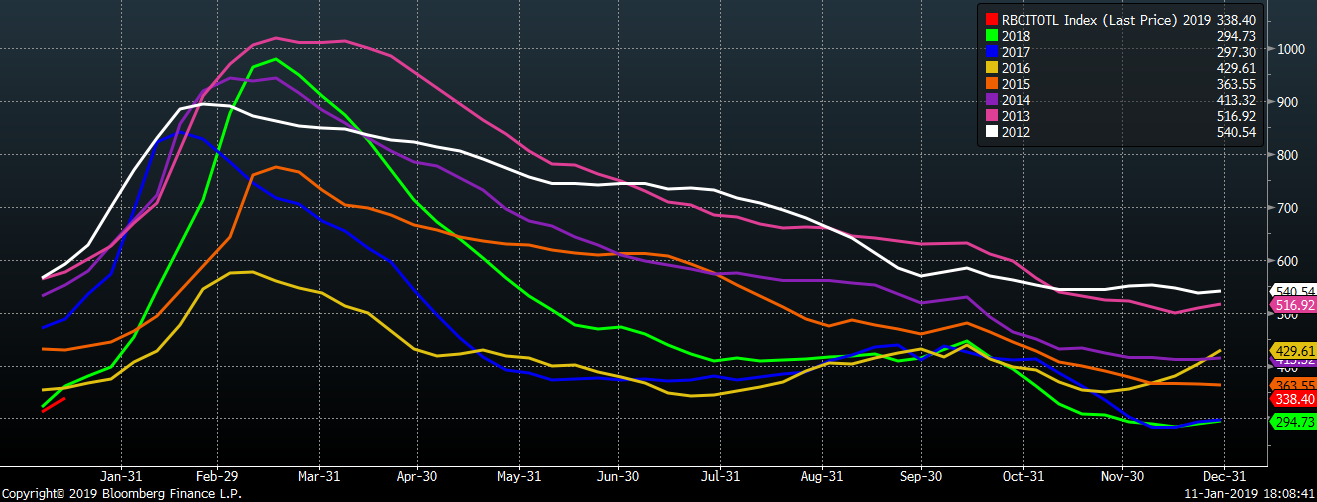

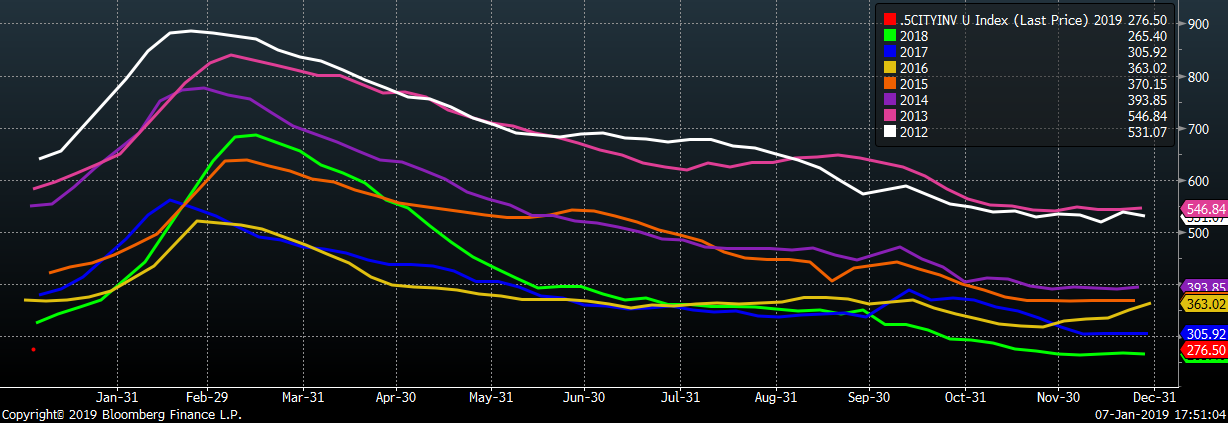

Below are inventory levels for Chinese finished steel products and iron ore. Chinese rebar and HRC inventory rose 8.4% and 1.9%, respectively, while the 5-city inventory level was not updated at time of publishing. This is the beginning of the seasonal ramp up heading into the spring and summer construction season. The finished steel inventory levels are at their lowest respective levels dating back to 2012.

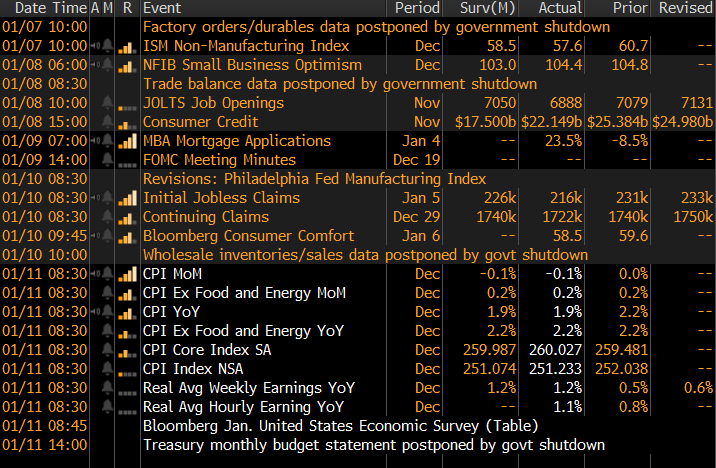

Last week’s economic data is posted to the right. Average hourly earnings rose by 0.3% to 1.1% YoY. The December CPI Ex-Food and Energy was up 2.2%, unchanged MoM and in line with expectations. The NFIB Small Business Optimism Index fell slightly to 104.4, but beat expectations of a fall to 103. The FOMC meeting minutes indicated there was more debate about slowing the rate of interest rate increases than first thought.

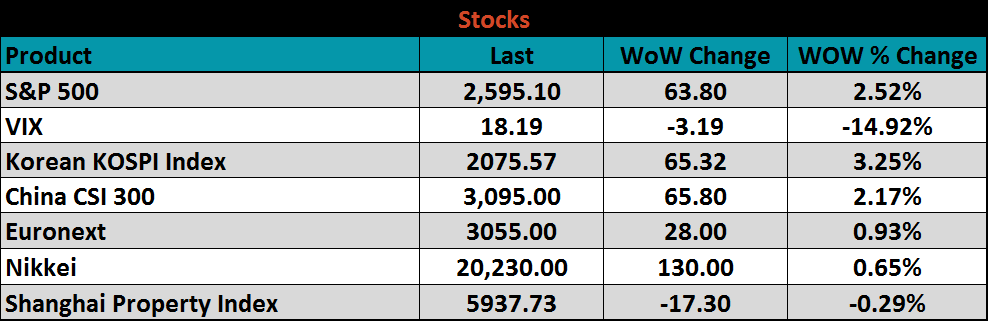

The S&P 500 rose 2.5% while the Korean KOSPI Index and Chinese CSI 300 were up 3.3% and 2.2%, respectively.

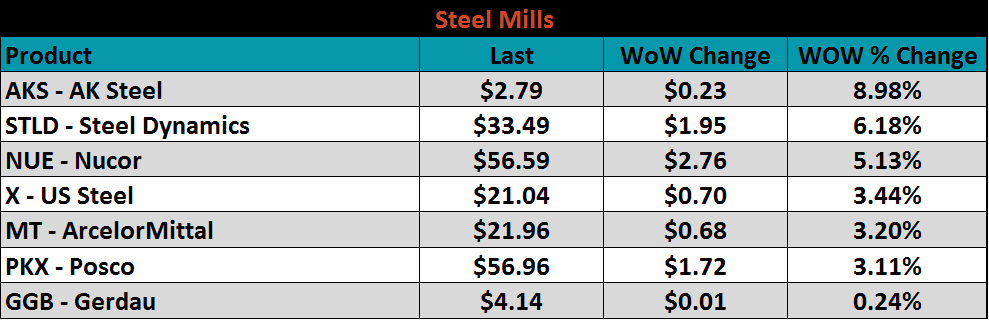

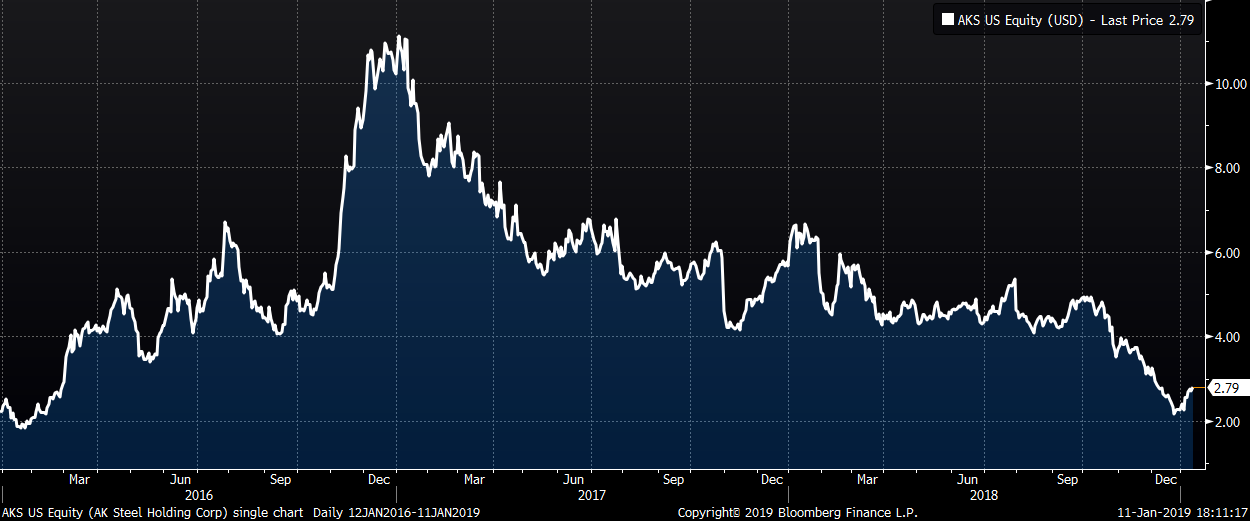

Steel mill stocks saw additional gains led by AK Steel and Steel Dynamics up 9% and 6.2%, respectively.

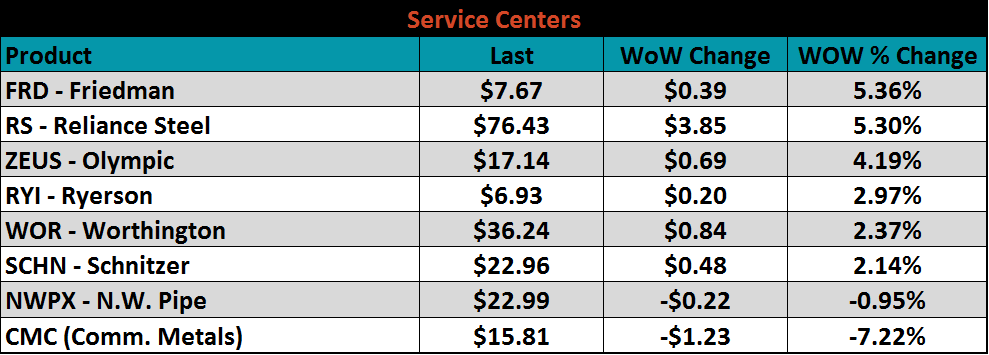

Service center stock’s WoW performance is shown below. Friedman and Reliance led the group each up 5.4% and 5.3%, respectively, while Commercial Metals was down 7.2%.

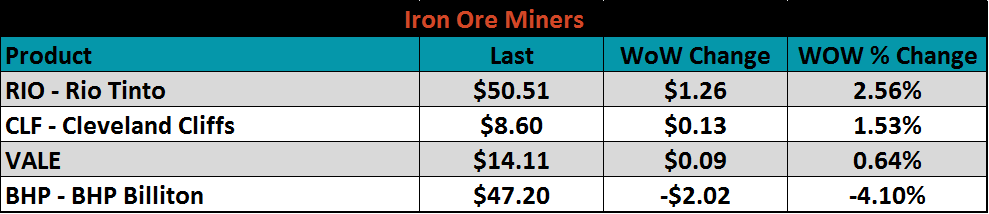

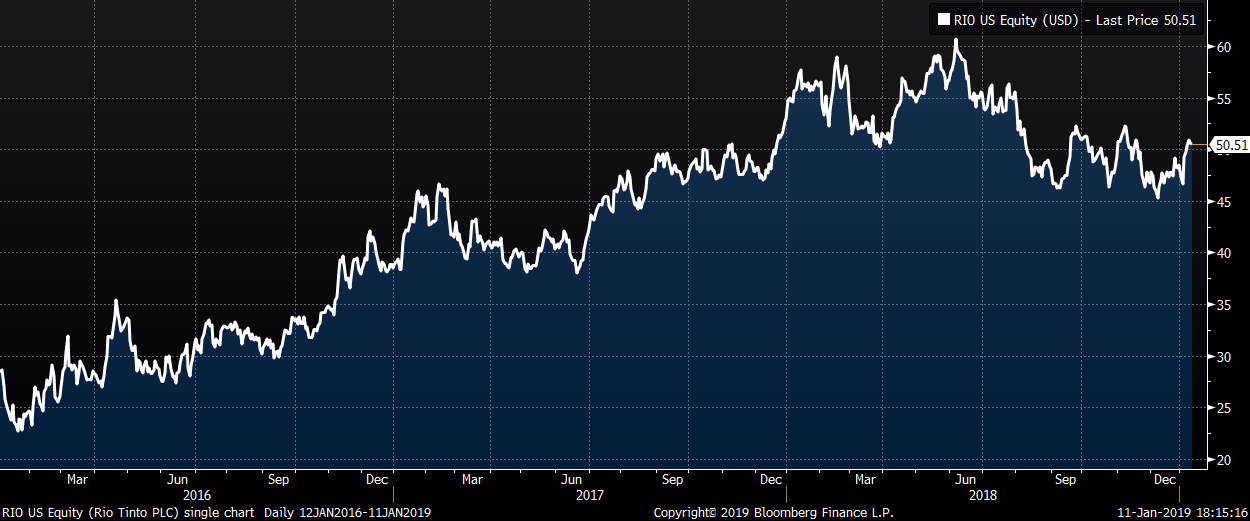

Mining’s stocks performances were mixed with Rio Tinto up 2.6%, while BHP Billiton down 4.1%.

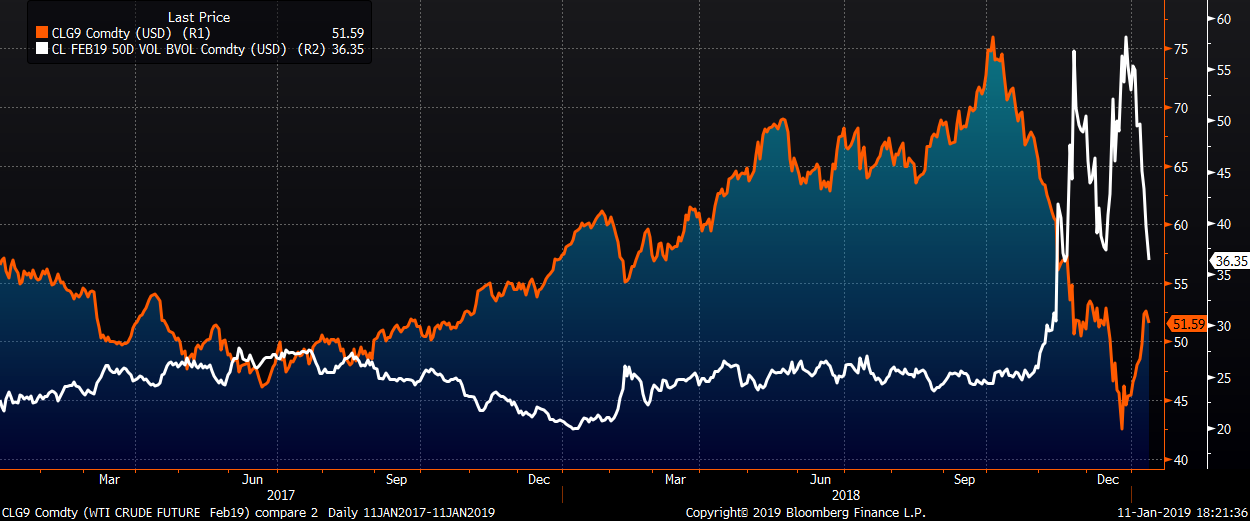

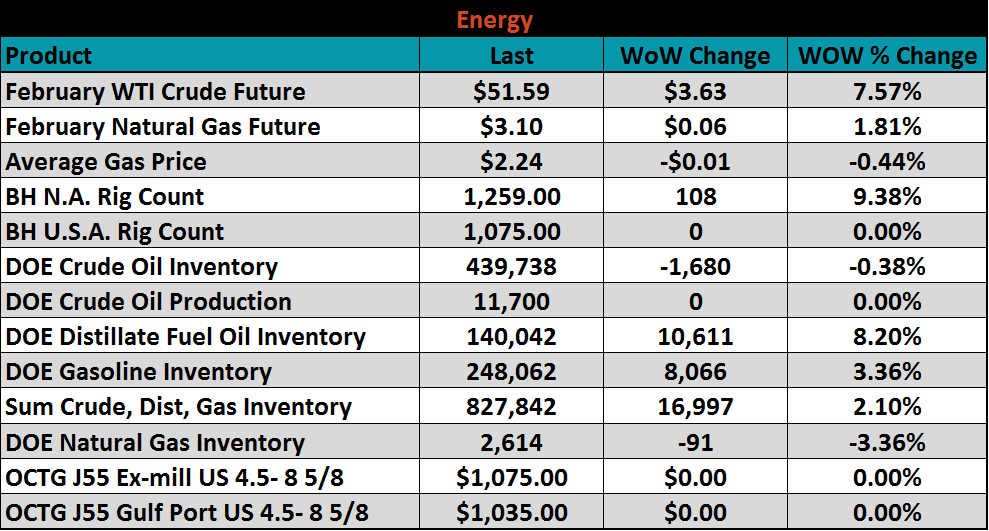

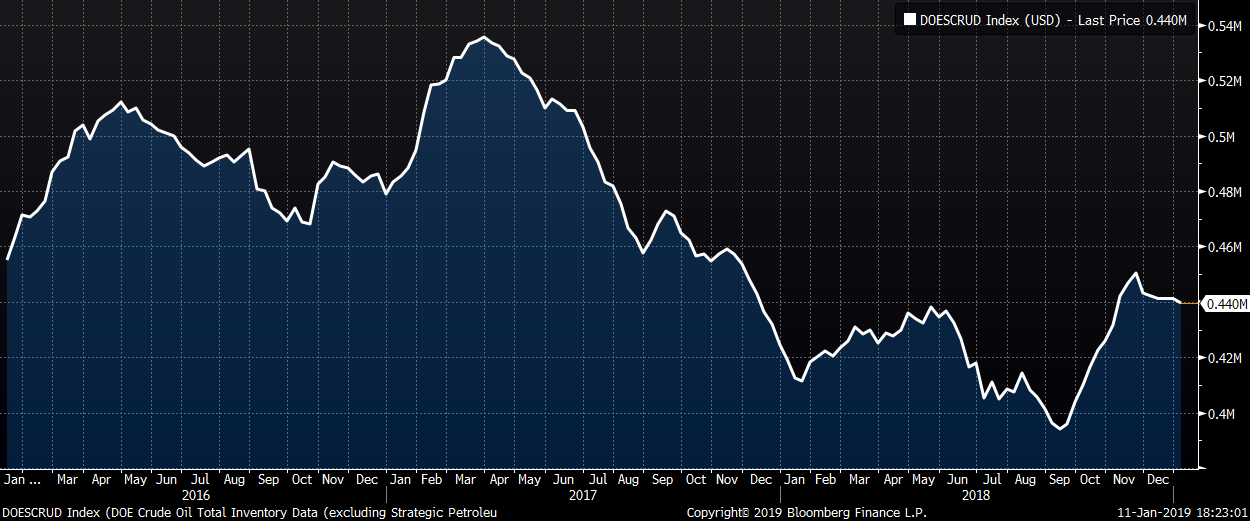

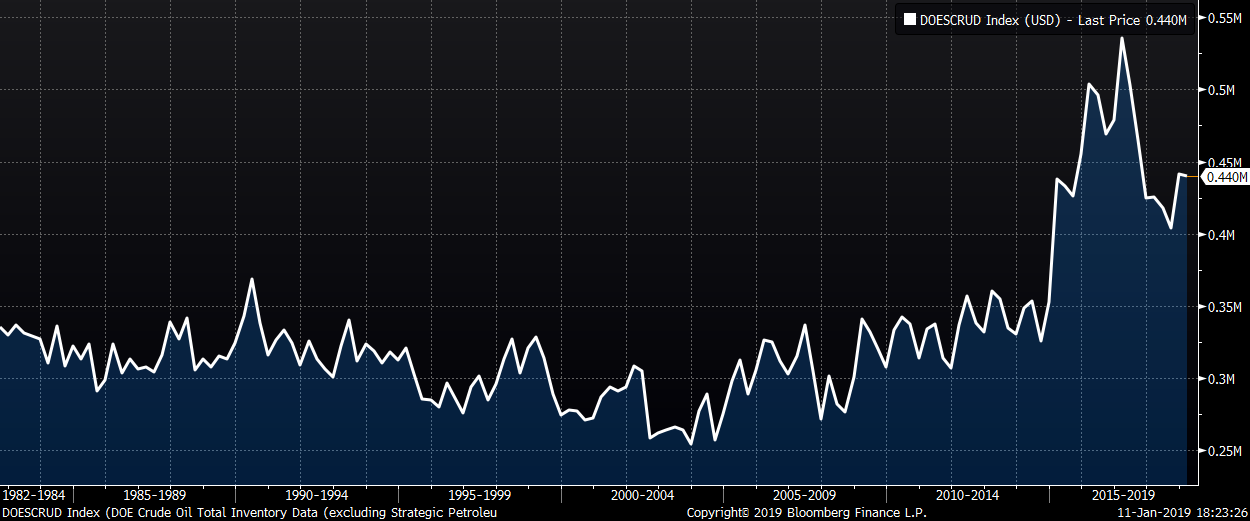

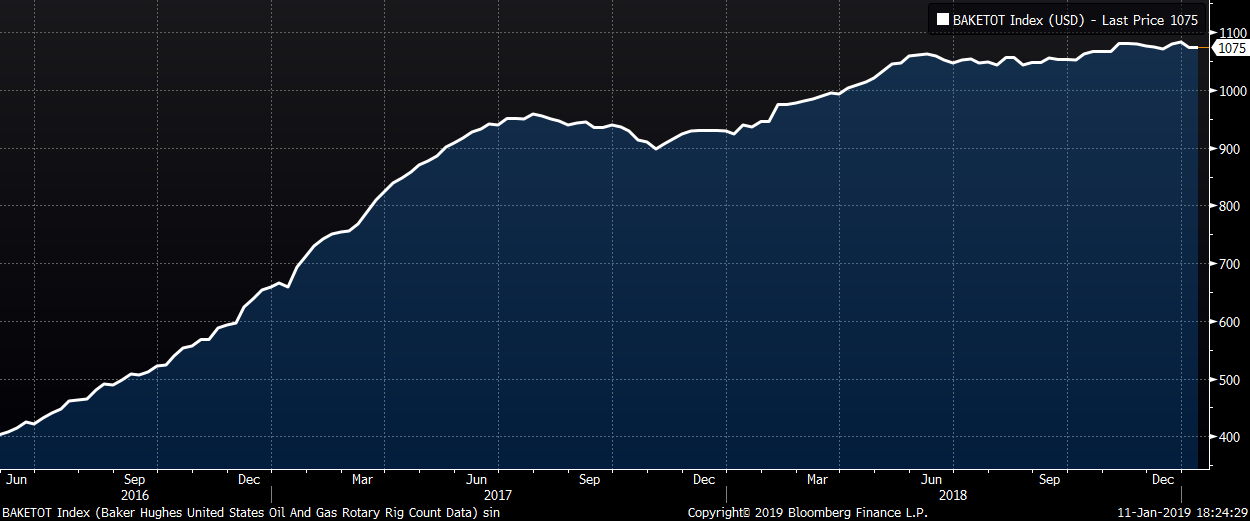

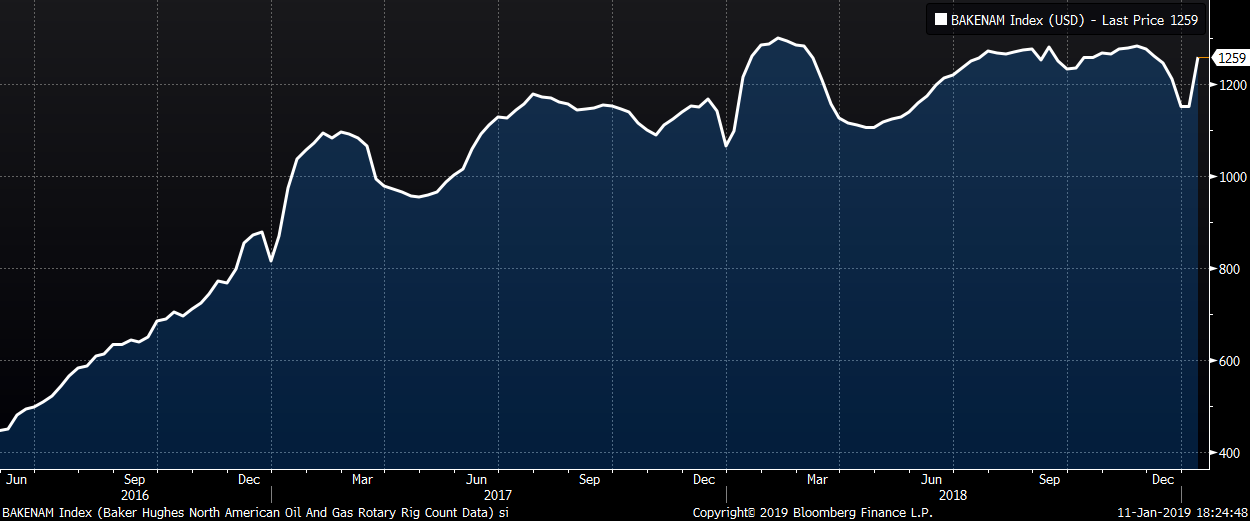

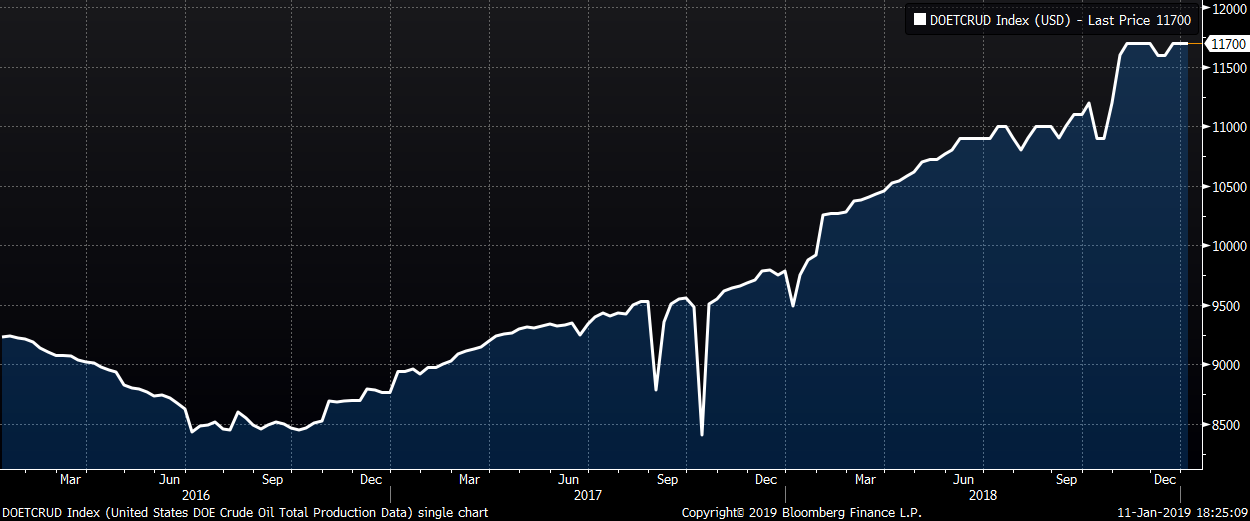

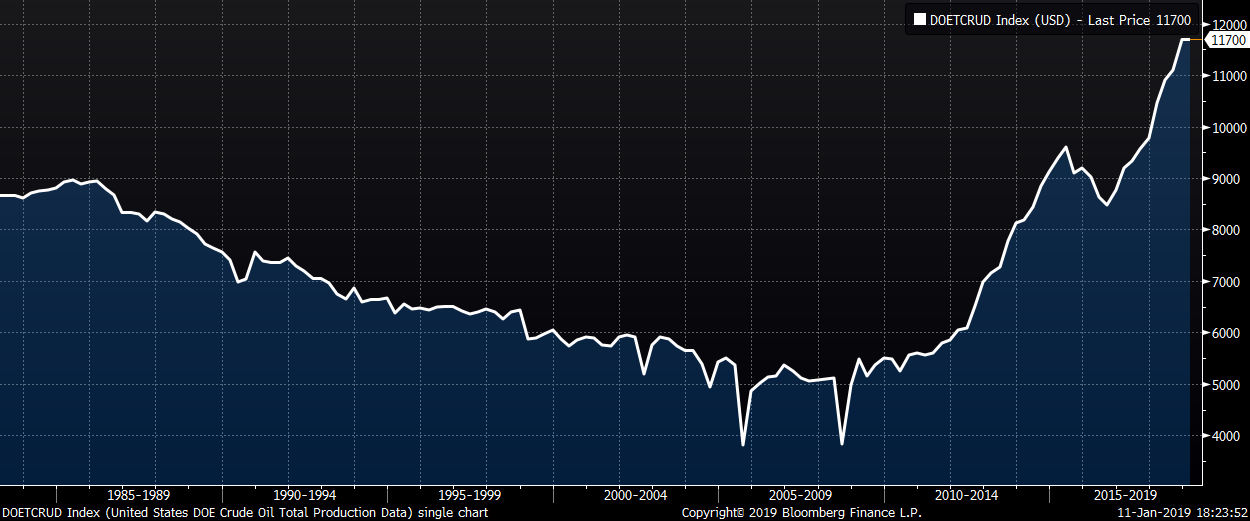

The February WTI crude oil future gained $3.63 or 7.57% to $51.59/bbl. Crude oil inventory was down 0.4%, while distillate and gasoline inventory added 8.2% and 3.4%, respectively. The aggregate inventory level was up 2.1%. Crude oil production was unchanged at 11.7m bbl/day. The U.S. rig count was unchanged while the North American added 108 rigs, all from Canada. The February natural gas future rose $0.06 or 1.8% to $3.10/mmBtu. Natural gas inventory fell 3.4%.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely.

Upside Risks:

Downside Risks: