Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

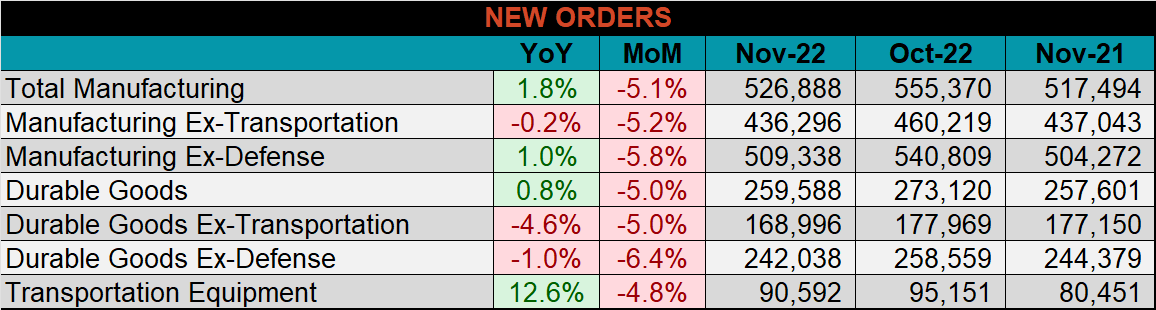

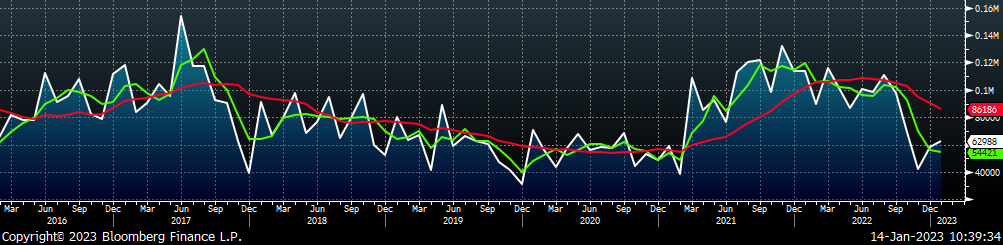

The final November durable goods report echoed recent economic data which shows that demand within the manufacturing sector is clearly being impacted by Fed policy. While current activity remains above pre-pandemic levels, it has come off the recent peak, with both new orders and shipments falling 4 out of the last 5 months. Compared to November last year, total manufacturing new orders were up 1.8%, but down 5.1% compared to October. While still growing YoY, this is the lowest percentage increase since February of 2021, 21 months ago.

Additionally, the chart below shows YoY percentage change in new orders for manufacturing excluding transportation actually decreased slightly, down 0.2%. This is the first YoY decrease in 23 months.

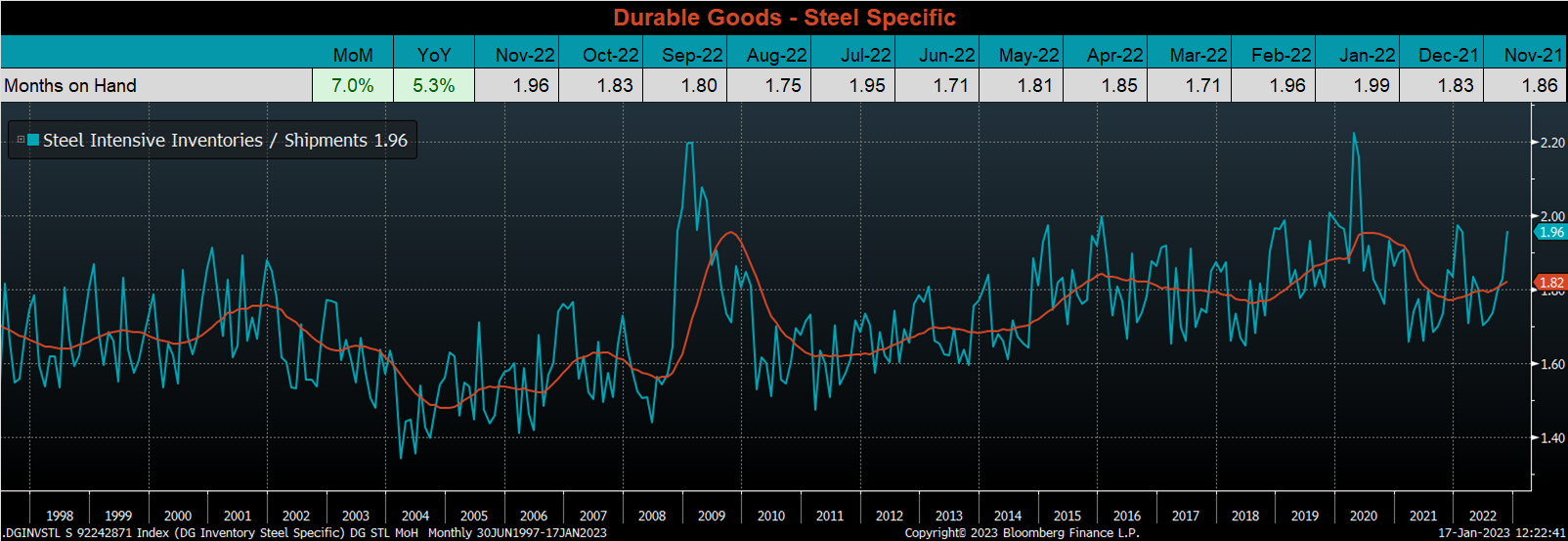

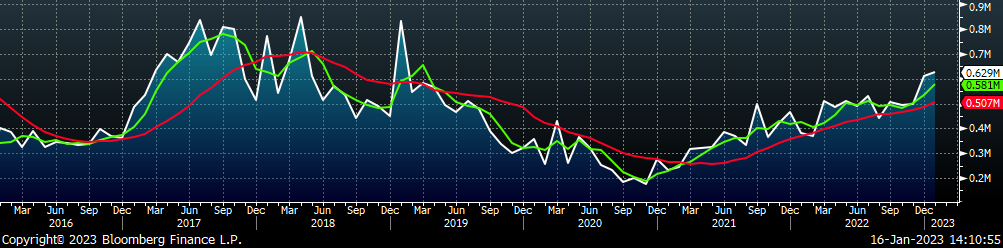

The chart below looks at the months on hand (inventory divided by shipments) using steel intensive catagories from the November durable goods report. MoH increased further this month, and was driven by the sharp drop in shipments, down 6.7% and unchanged inventories. While normal seasonality does play a role, this overarching trend will need to be watched closely as Spring approaches.

Upside Risks:

Downside Risks:

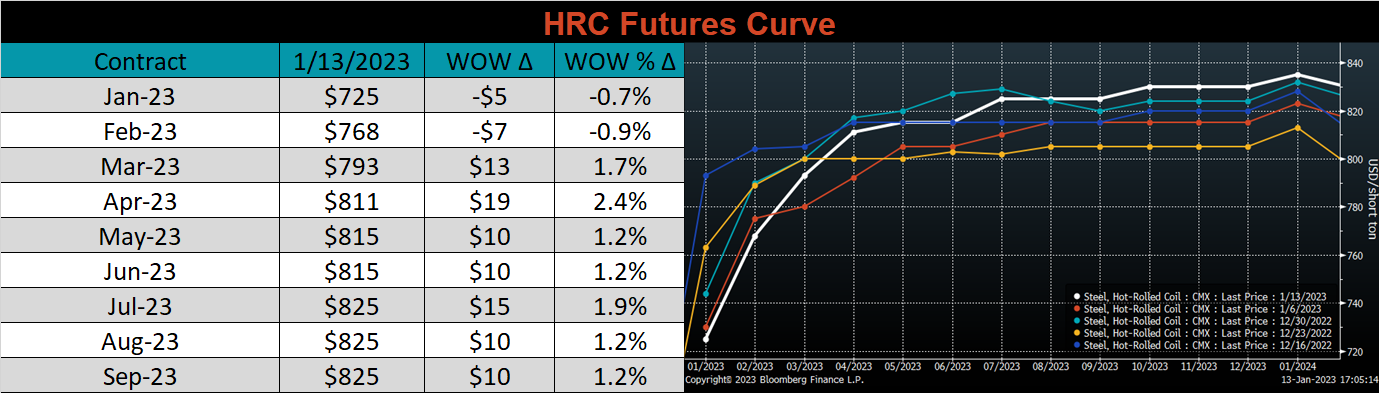

The Platts TSI Daily Midwest HRC Index was up another $10 this week, ending at $730.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The front of the curve ended the week lower, while the back of the curve increased.

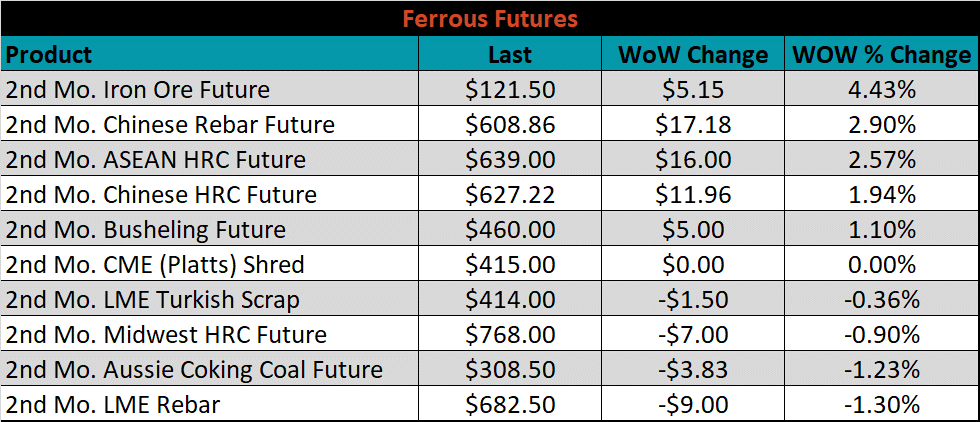

The 2nd month ferrous futures were mostly higher. Iron ore gained 4.4%, while LME Rebar lost 1.3%.

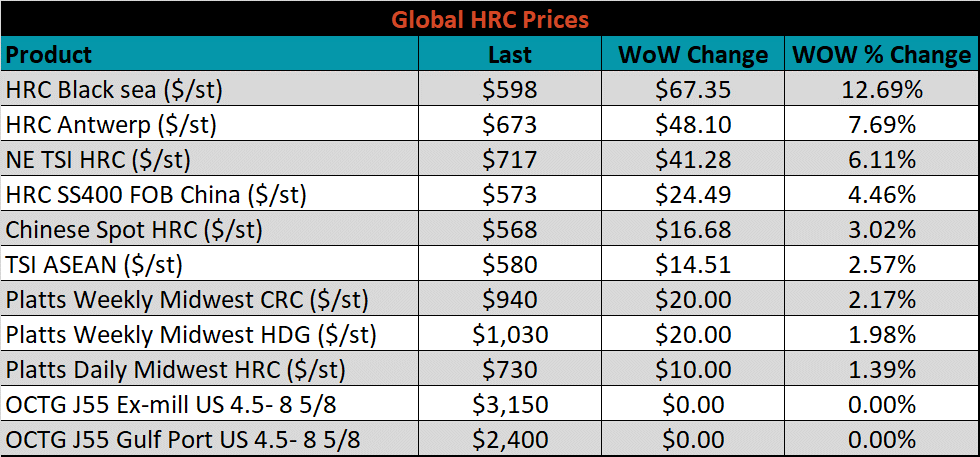

Global flat rolled indexes were all higher this week, led this time by Black Sea HRC, up 12.7%.

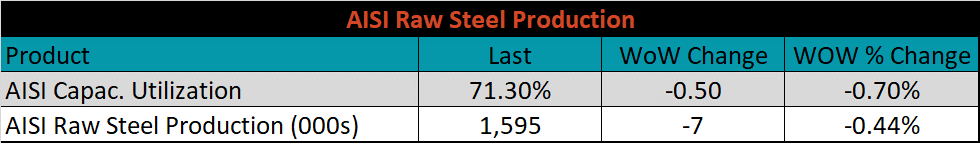

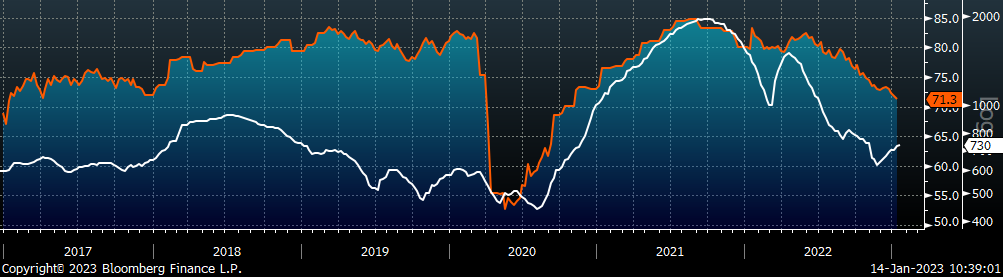

The AISI Capacity Utilization was down another 0.5% to 71.3%.

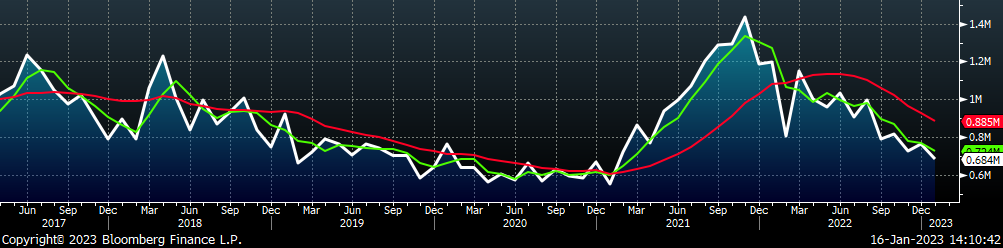

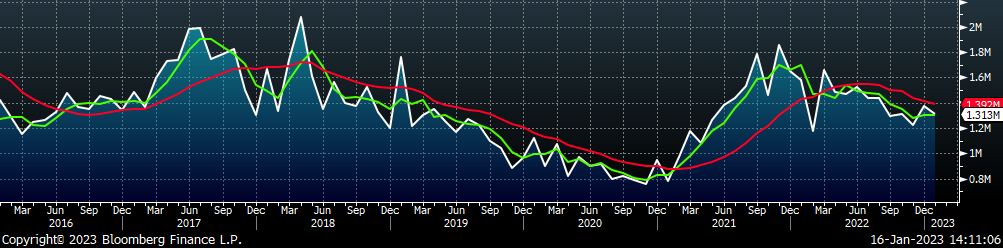

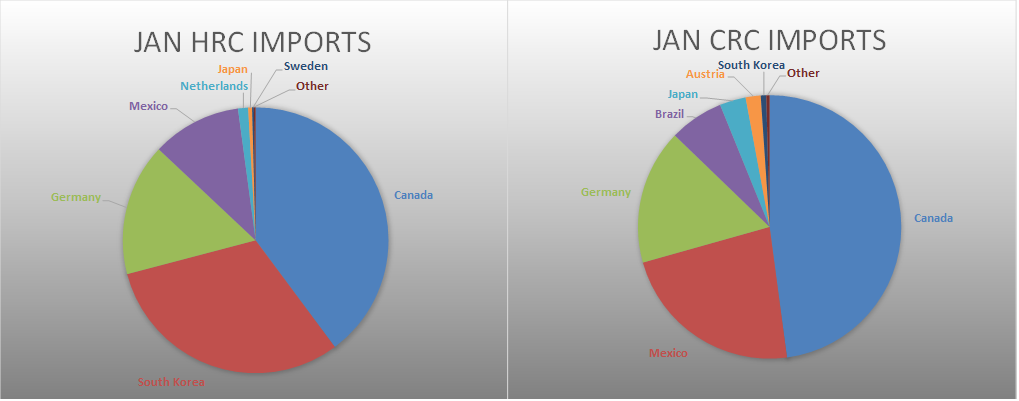

January flat rolled import license data is forecasting a decrease of 78k to 684k MoM.

Tube imports license data is forecasting an increase of 16k to 629k in January.

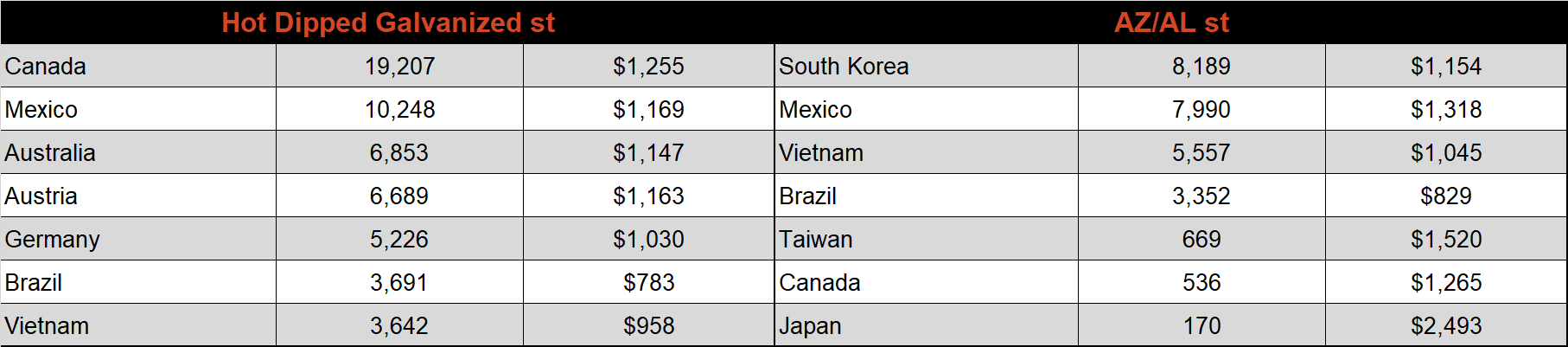

December AZ/AL import license data is forecasting an increase of 5k to 63k.

Below is December import license data through January 2nd, 2023.

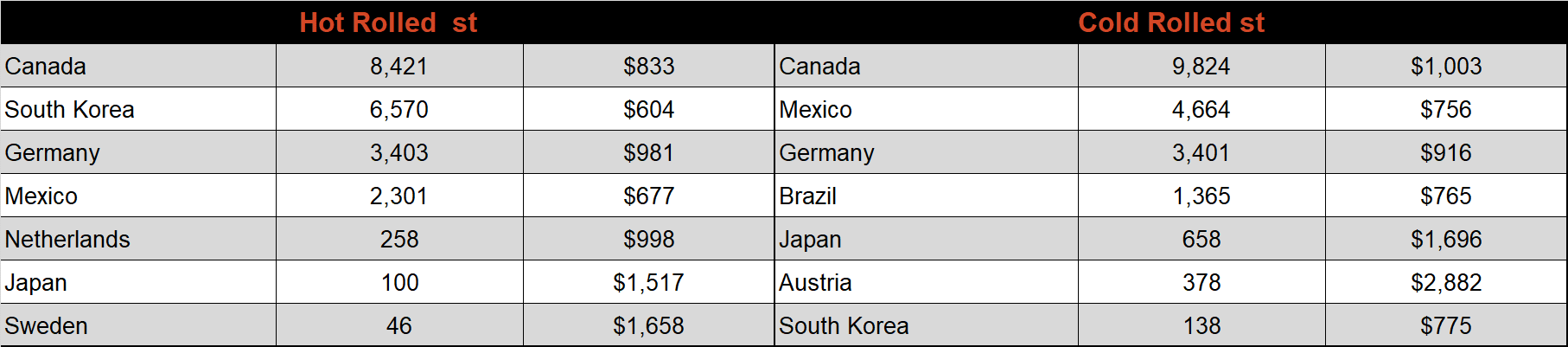

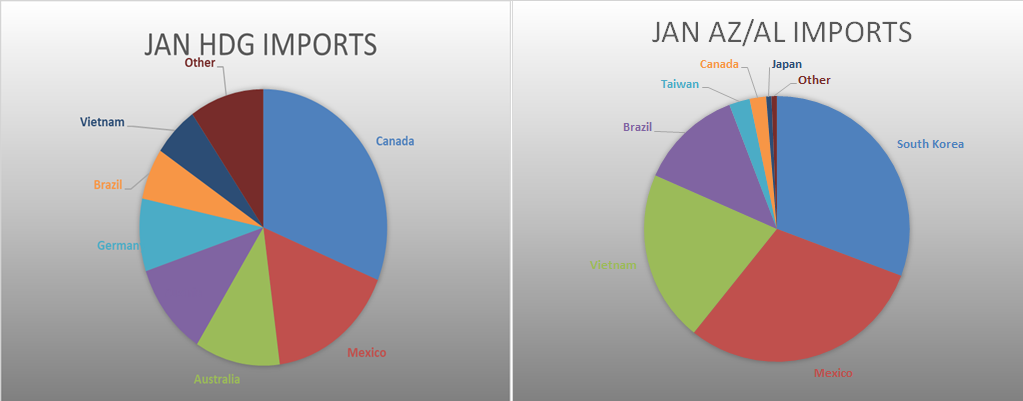

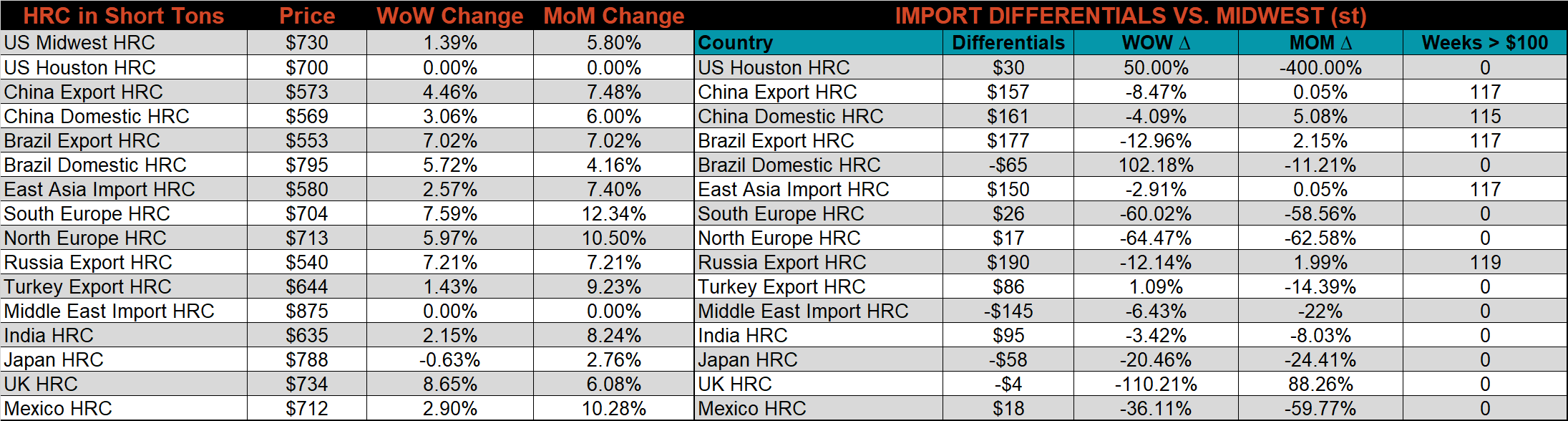

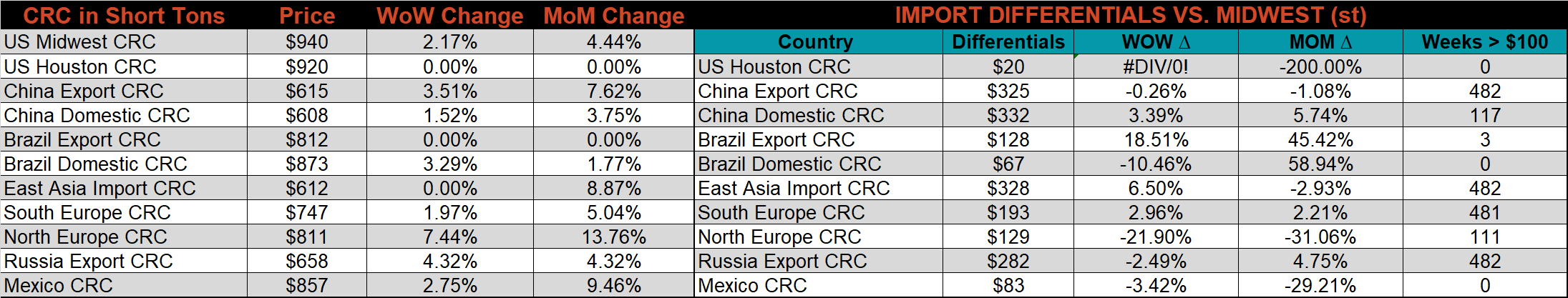

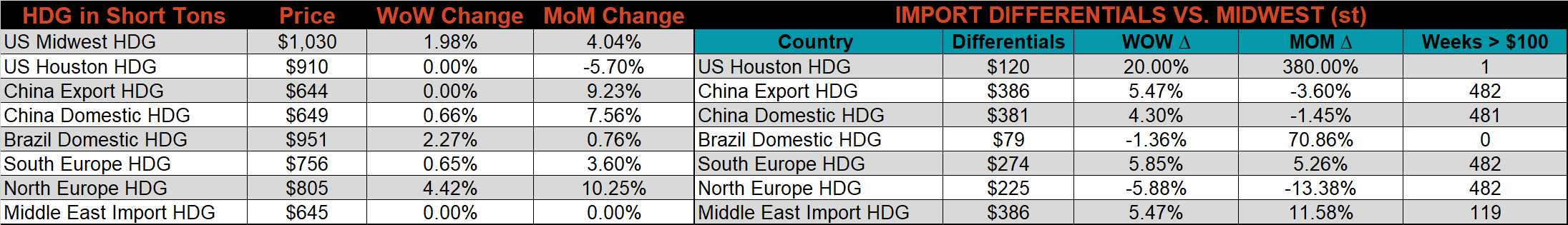

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All of the watched differentials decreased last week, as most global prices increased more significantly than domestic prices.

Global prices were mostly higher again this week, led by UK HRC, up 8.7%.

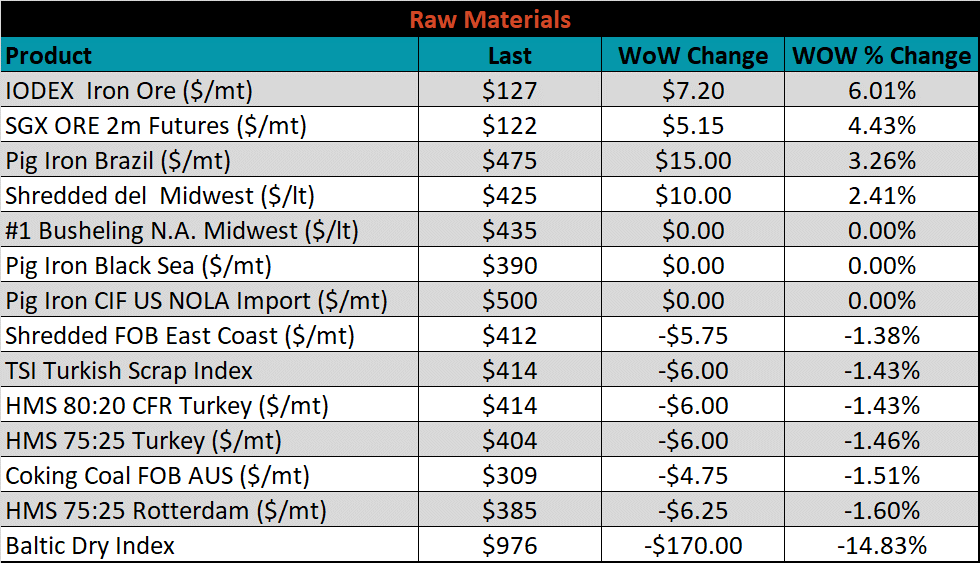

Raw material prices were mixed this week, with the IODEX up 6%, while Rotterdam HMS was down 1.6%. The Baltic Dry Index was down sharply again this week as well, falling another 14.8%.

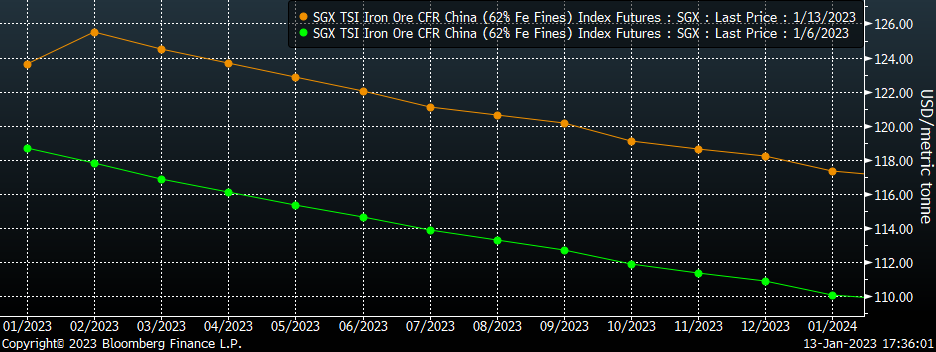

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Iron ore was significantly higher last week, as additional reports out of China suggest that demand for steel will be strong in the beginning of the year.

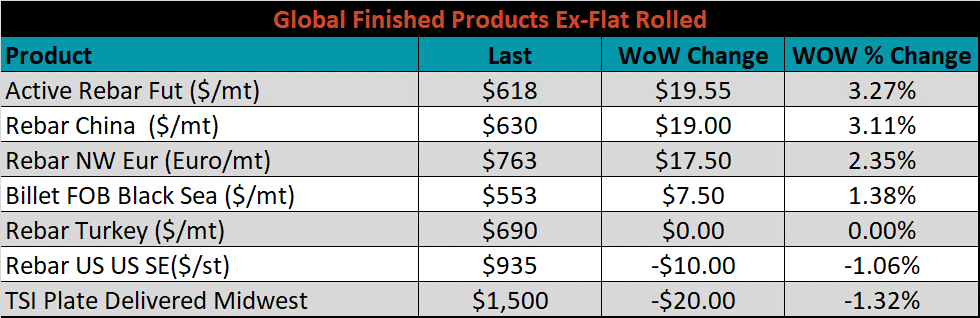

The ex-flat rolled prices are listed below.

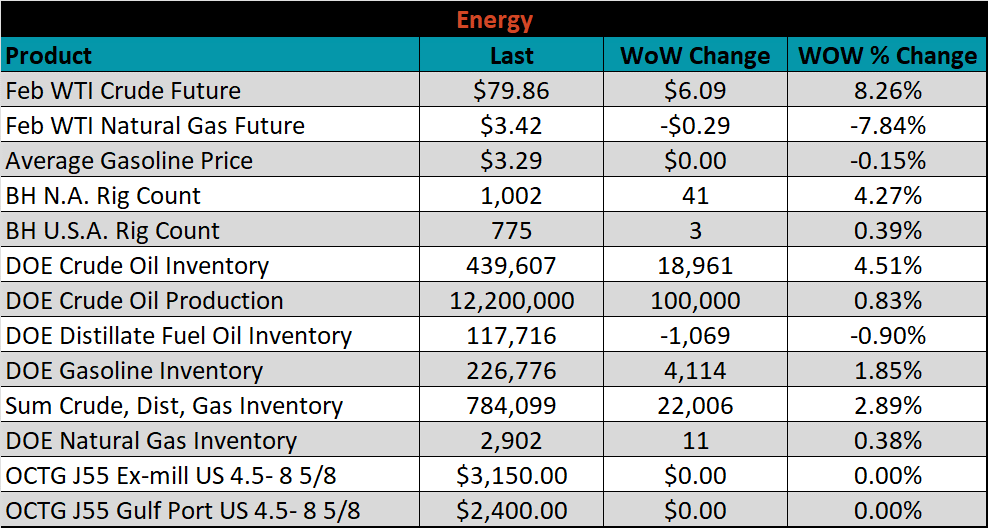

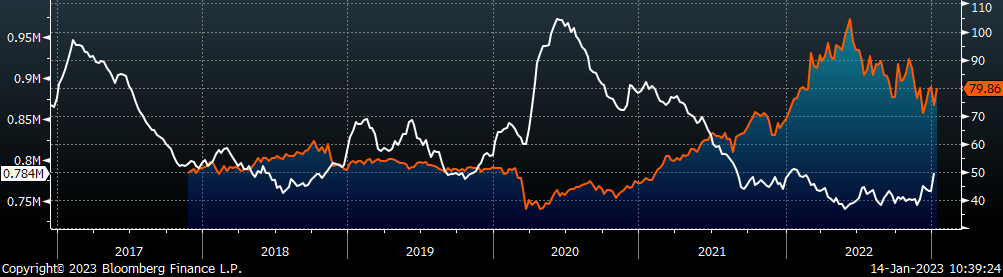

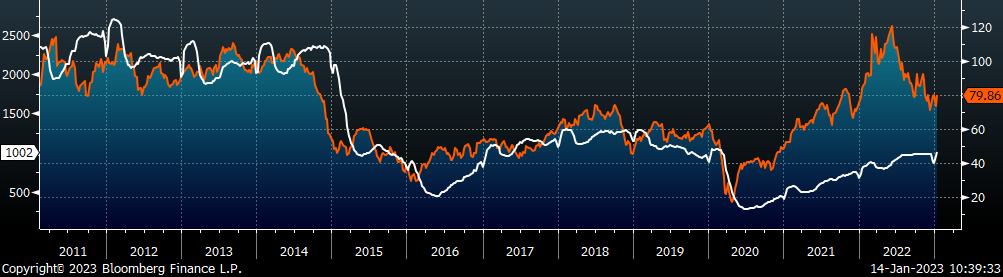

Last week, the Febuary WTI crude oil future gained $6.09 or 8.3% to $79.86/bbl. The aggregate inventory level was up 2.9%. The Baker Hughes North American rig count was up sharply, by another 41 rigs, and the U.S. rig count increased by 3 rigs.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: