Content

-

Weekly Highlights

- Market Commentary

- Durable Goods

- Risks

Strength in the domestic HRC spot market continued last week, despite signs of cracks in global ferrous markets, as the spot HRC price pushes to new historical highs. The range of spot HRC transactions is currently wide, with offers and purchases occurring anywhere from $1,060 to $1,200 depending on location, lead times and product specifications. Additionally, the buying process has changed due the tightness and price level in the spot market, creating an auction should spot tons become available. Buyers have a better chance at securing material if they submit inquiries about availability already agreeing to elevated prices, rather than requesting quotes for their desired material. This is yet another example of the market pricing strength that mills are currently enjoying. However, as the price continues to move higher, new downside risks emerge, while others grow in prevalence. This week we will address those risks while providing our outlook as to their importance and the expected timing of their influence on the market.

Last week we saw one driver of the strong headline ISM PMI was the strength in the supplier deliveries subindex, driven by tightness in manufacturing supply chains and part shortages. This is apparent in the steel market as well, with deliveries disrupted by truck, rail and barge availability. Additionally, credit markets have tightened due to a pullback by credit insurance companies and elevated prices causing limits to be hit with lower tonnage volumes. With prices doubling since last summer, credit limits will be hit with half as many tons as before. These constraints could create a headwind for the price rally, as slower steel shipments allow mills to catch up on delayed orders. However, mills are still several weeks behind on orders, meaning it will take at least a month for this to affect spot market pricing.

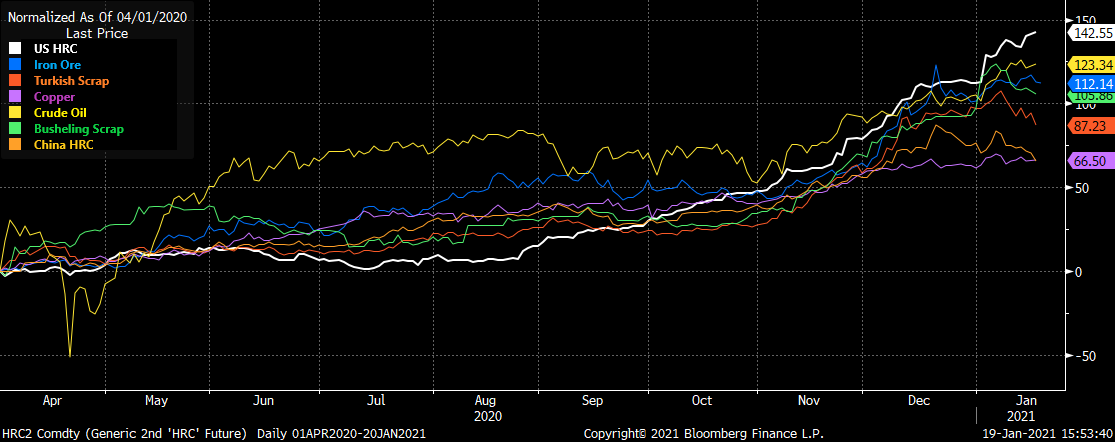

We are also seeing the first signs of cracks in other global commodity markets, which have been remarkably strong leading into this year. The below chart shows the percentage change of relevant commodity pricing since April 1st, 2020.

The domestic HRC price recovery lagged that of many other markets during the summer last year, but it has recently strengthened to overtake those markets on a percentage basis. Moreover, important global ferrous markets such as iron ore, Turkish scrap and Chinese HRC have pulled back from their highs reached over the past month. Because none of these markets are directly linked to the domestic market, we do not expect this to have an immediate effect on the ongoing rally. However, further weakness in the months ahead may be a signal that global demand is slowing. The good signs for HRC bulls are lead times that are still extended near the longest levels on record and end user demand that is strengthening at elevated price levels, signaling that lower prices are unlikely for at least the next two months. Additionally, the steepness in the future curve provides a good buying opportunity, especially in the fourth quarter, where the curve seems undervalued.

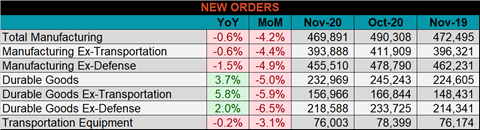

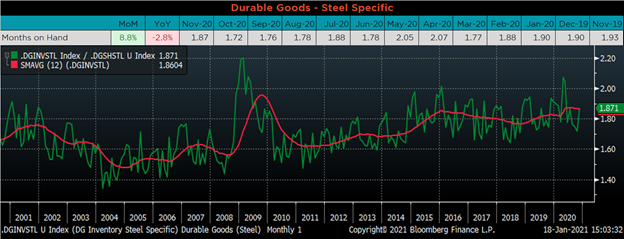

Below are final November new orders from the Durable Goods report. New orders for manufactured goods were down 0.6% compared to November 2019 and down 4.2% compared to last month. Manufacturing ex-transportation new orders were down 0.6% YoY, and each month has been below 2019 levels since February. The final chart looks at the months on hand (inventory divided by shipments) for durable goods categories that are steel intensive. MOH moved higher this month, back in line with the recent trend, as inventories were flat and shipments declined in line with seasonal expectations.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

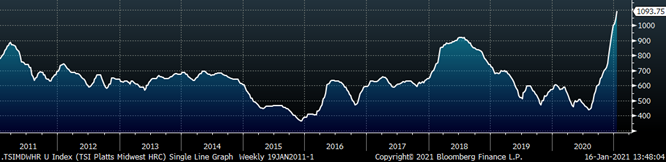

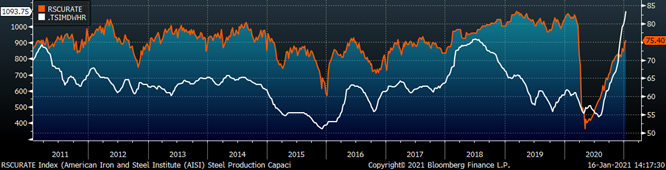

The Platts TSI Daily Midwest HRC Index increased by $51 to $1093.75.

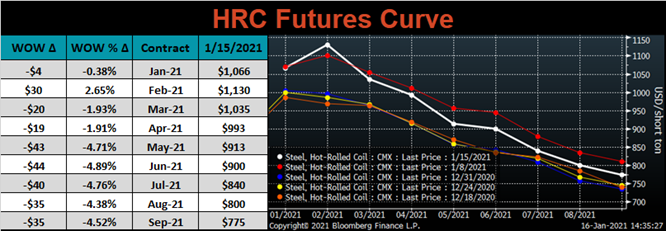

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. Last week, the curve moved lower at every expiration, except for February.

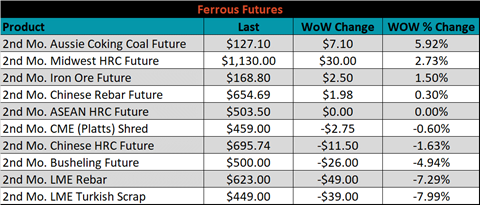

February ferrous futures were mixed. Turkish scrap was down 8%, while Aussie coking coal was up 5.9%.

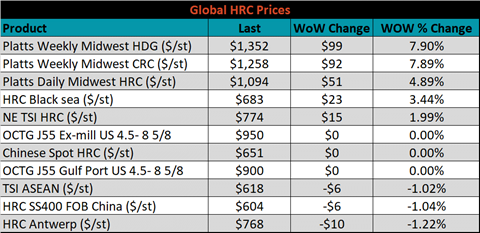

Global flat rolled indexes were mixed. Midwest HDG was up 7.9%, while the Antwerp HRC was down 1.2%.

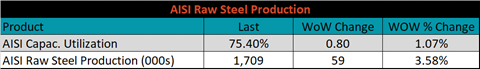

The AISI Capacity Utilization rate increased 0.8% to 75.4%.

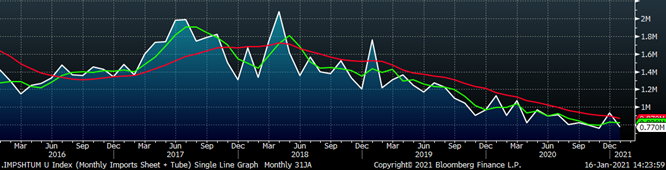

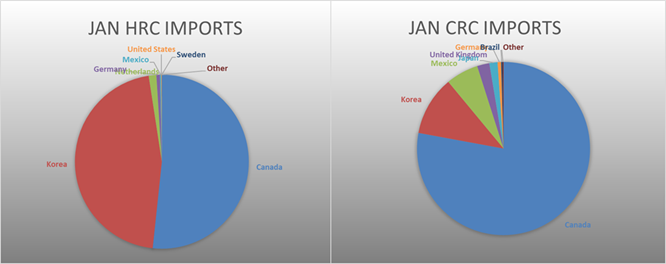

January flat rolled import license data is forecasting a decrease of 104k to 547k MoM.

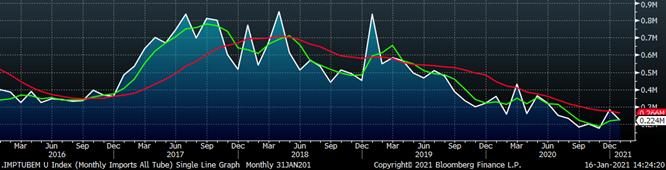

Tube imports license data is forecasting a decrease of 58k to 224k in January.

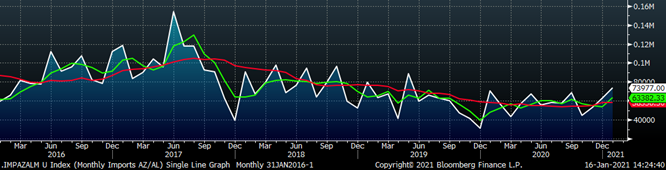

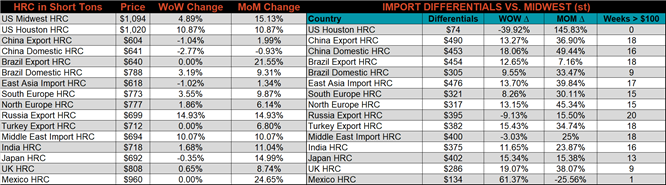

January AZ/AL import license data is forecasting a 11k increase to 74k.

Below is January import license data through January 12, 2021.

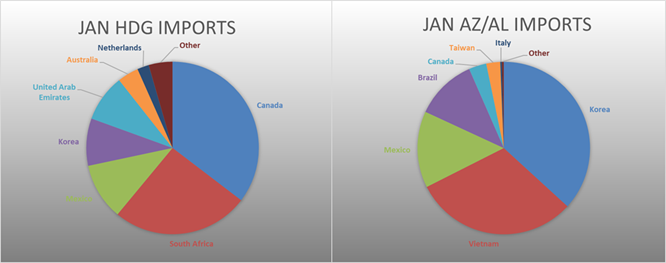

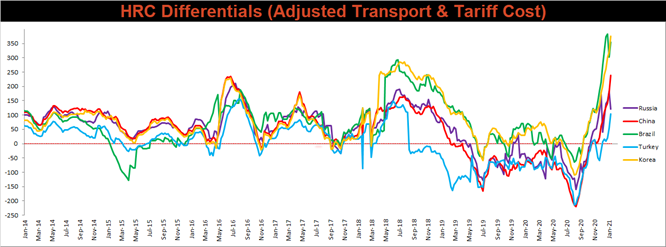

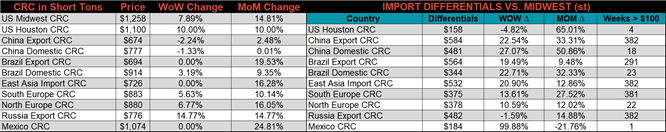

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All the watched differentials moved higher, except for the Russian differential, which was down over $60.

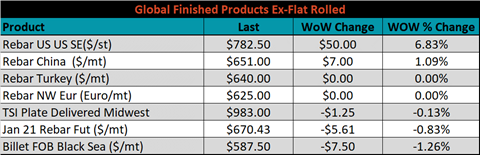

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HDG, CRC and HRC prices were up 7.9%, 7.9% and 4.9%, respectively. Globally, the Russian Export HRC and CRC prices were up 14.9% and 14.8%, respectively.

Raw material prices were mixed. Aussie coking coal was up 20.6%, while Rotterdam HMS scrap was down 5.5%.

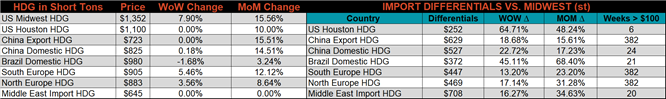

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the back of the curve shifted lower, while the front was unchanged.

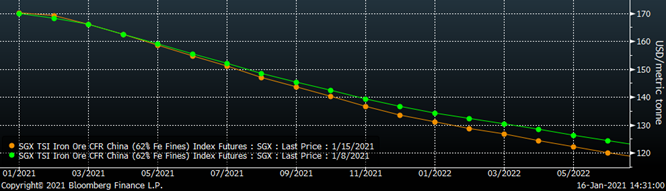

The ex-flat rolled prices are listed below.

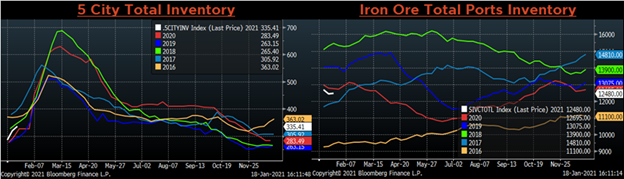

Below are inventory levels for Chinese finished steel products and iron ore. HRC and rebar inventories have started rising in line with seasonal expectations as colder weather halts construction activity. Iron ore port inventory remains near last year’s level, while prices remain over $170 per ton after a year of extraordinary demand from Chinese producers.

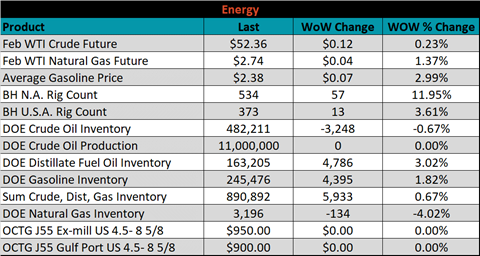

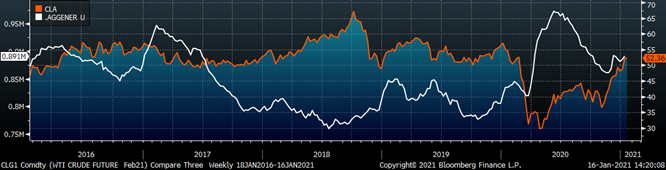

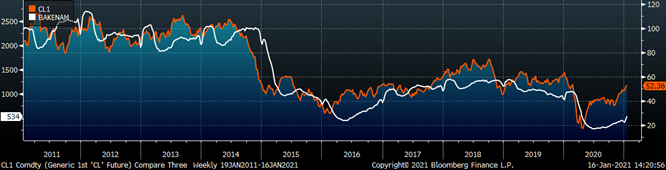

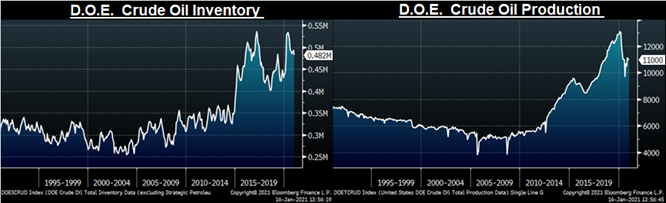

Last week, the February WTI crude oil future gained another $0.12 or 0.23% to $52.36/bbl. The aggregate inventory level was up 0.7% and crude oil production remains at 11m bbl/day. The Baker Hughes North American rig count was up by another 57 rigs, and the U.S. rig count was up 13 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: