Content

-

Weekly Highlights

- Market Commentary

- Risks

The consequences of the government shutdown are unclear. More information about the reach of the shutdown continues to emerge daily. In addition to the 800k government workers furloughed or simply working without pay, there is upwards of four million contract workers affected by the shutdown. This report has been most directly affected by the shutdown by the lack of economic data provide by the government. Data regarding steel imports, residential housing, construction spending, auto sales and durable goods are some of the major reports missing and these reports (ex-imports) provide significant information about the condition of steel demand.

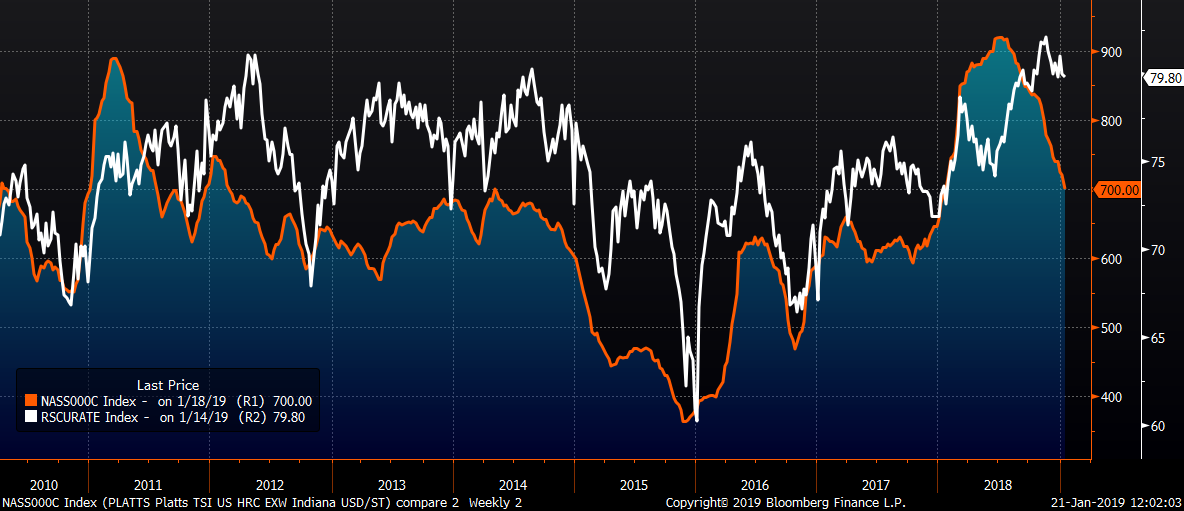

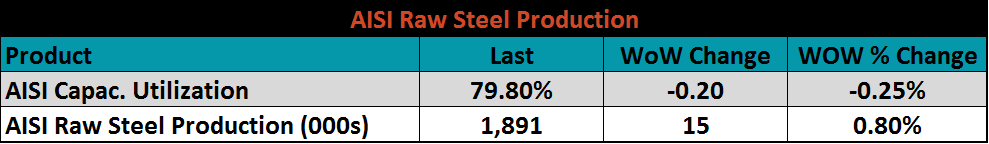

On the supply side, the AISI Steel Production Capacity Utilization and Raw Steel Production data showed the utilization rate fell to 79.8% with production of 1.89 m short tons for the week ending January 11th. In fact, the utilization rate has remained above 78% since late July.

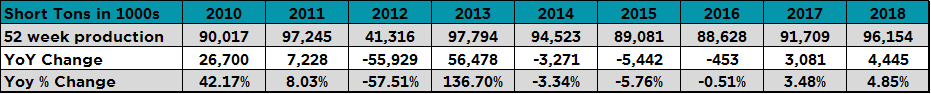

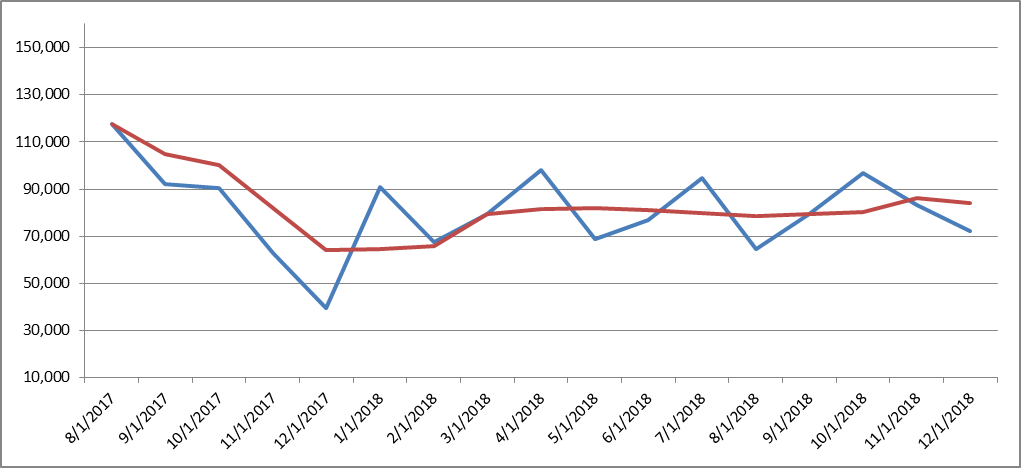

This table sums up the weekly AISI raw steel production data on an annual basis. In 2018, the AISI mills produced 96.2m tons, a 4.5m or 4.9% YoY increase. Service center data shows YoY shipments are up 3.9% with December inventory up 5.5%. New domestic mills (JSW and Granite City) have added supply and are competing with incumbent mills for customer orders with even more production planned to come online in the near future.

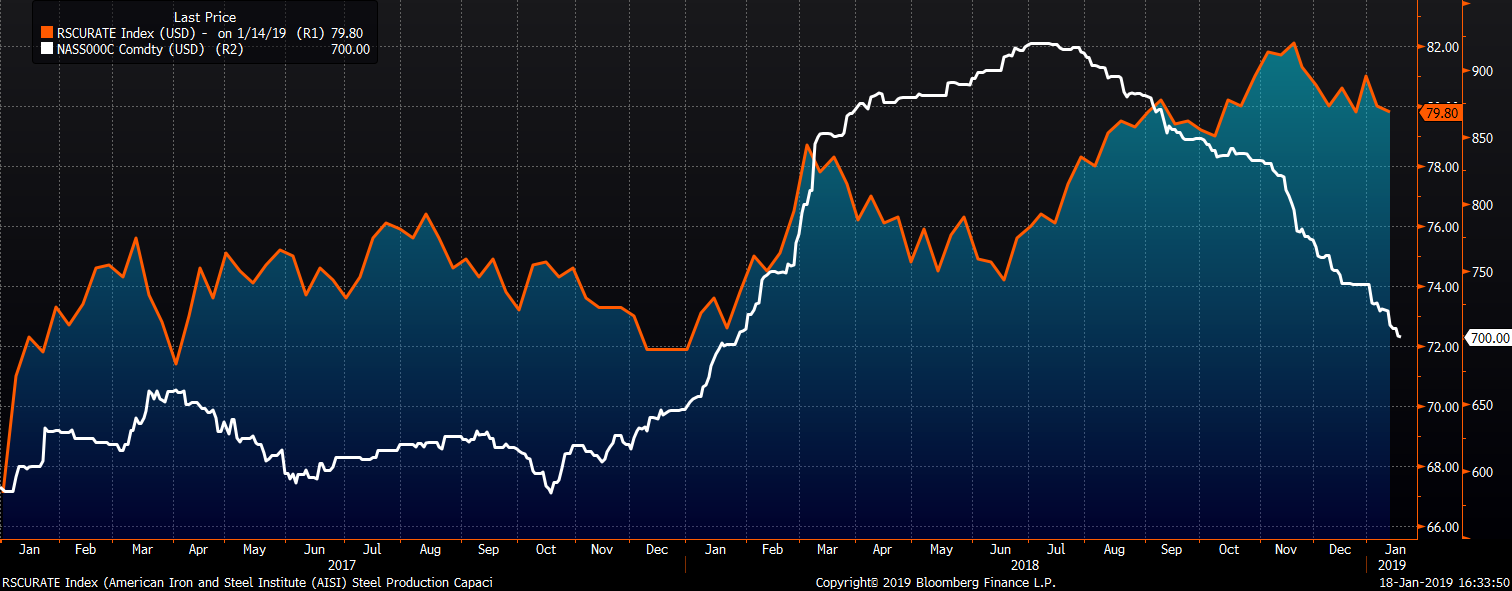

This chart compares the Platts Daily HRC Index with the AISI Capacity Utilization Rate. The production rate looks to be too high when compared to the sharp drop in flat rolled prices. It appears the domestic mills have been melting too much steel for too many months and have yet to respond to slowing demand. One major upside price risk for steel prices is any decrease in production, planned or unplanned. Whether or not the mills take down production is a major unknown.

Considering the sunk costs and political ramifications, it is highly unlikely that U.S. Steel would shut down Granite City after just reopening it. U.S. Steel is working through an asset revitalization plan, which could limit some production at different mills as this maintenance occurs. Nucor and Steel Dynamics could easily slow their EAF production, but they run the risk of giving up market share if they do. The addition of Granite City and introduction of JSW coincides with what looks to be a surplus of steel combined with a slowdown in demand. Service centers saw a build in their inventory in December and we are expecting an unseasonably slow January. Taken together the conclusion is there is too much steel. The steel industry looks to have entered a period of an ultra-competitive supply side where incumbent mills are playing defense with their customer’s orders against these additional tons and new entrants.

This type of environment makes it very difficult for a price increase to take hold as the mill making the announcement runs the risk that the other mills take their customer’s orders while they ask for higher prices. Another interesting supply-side dynamic is as the price in Asia has been improving and the domestic price has been falling, the import differential had been converging toward a level that drastically slows import orders. A price increase would widen the differential and push some purchase orders to international mills.

Another interesting factor in the steel supply-side is that service center data showed a sizable increase in inventory in December. This cost of this inventory is much higher than current spot and service centers have been working to draw down these inventory levels. A price increase could give these service centers the opportunity to unload this inventory, which would likely lead to less orders going to the domestic mills. This would extend the time mills would have to hold out from getting orders to make the increase stick and with lead times at ultra-low levels, again it looks difficult to pull off. However, if there is follow through with demand coming back to life, the service centers will have to restock after they sell their current tons. Again though, the current supply-side dynamics provide for a low probability of success of a mill price increase.

In the steel market, we see downside risks outweighing upside risks warranting a prudent and risk-averse purchasing and inventory management strategy.

The following issues provide the foundation of our view:

Upside Risks:

Downside Risks:

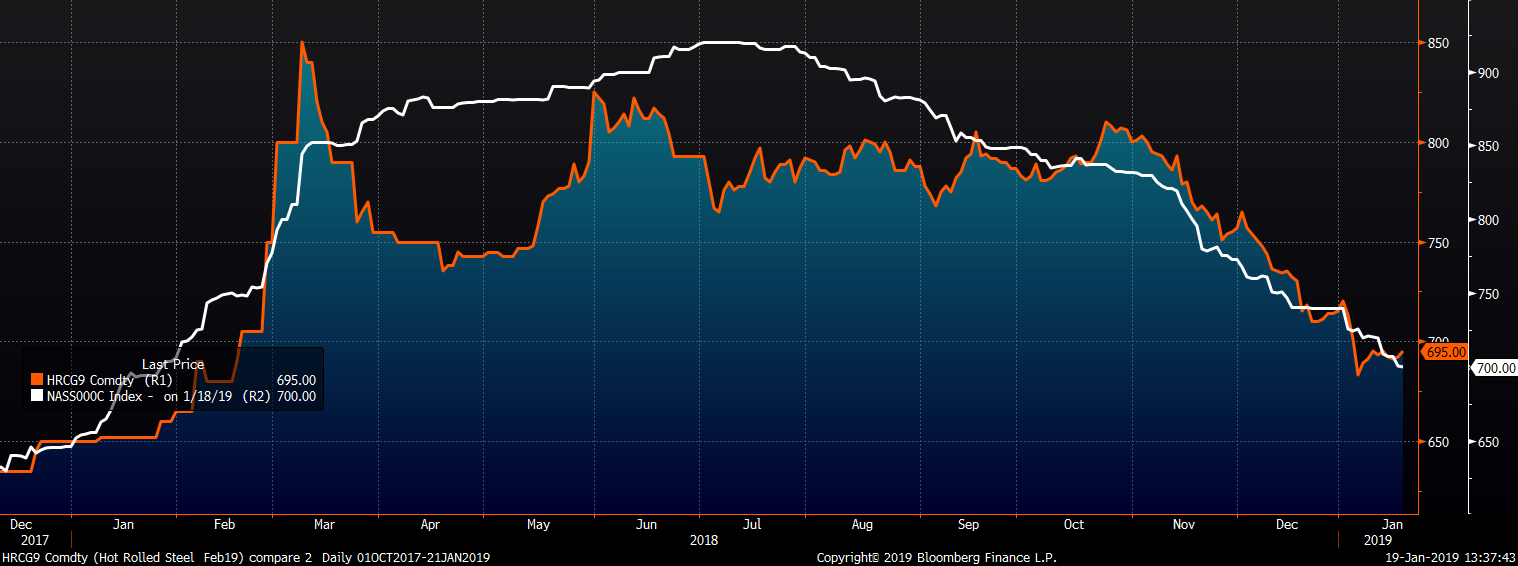

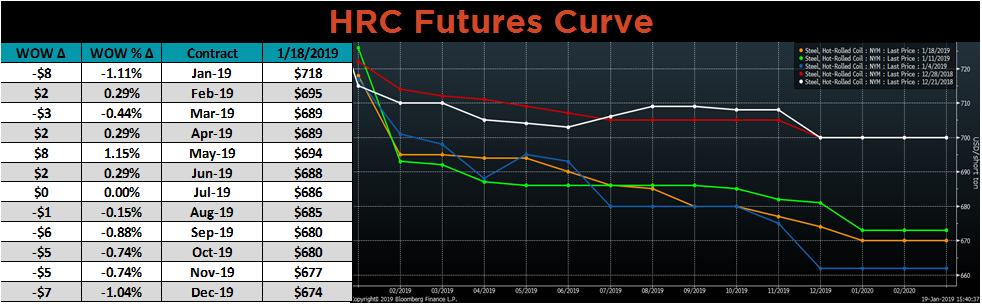

The February CME HRC future rose $2 to $695 and the Platts TSI Daily Midwest HRC Index was down $19.75 to $700.

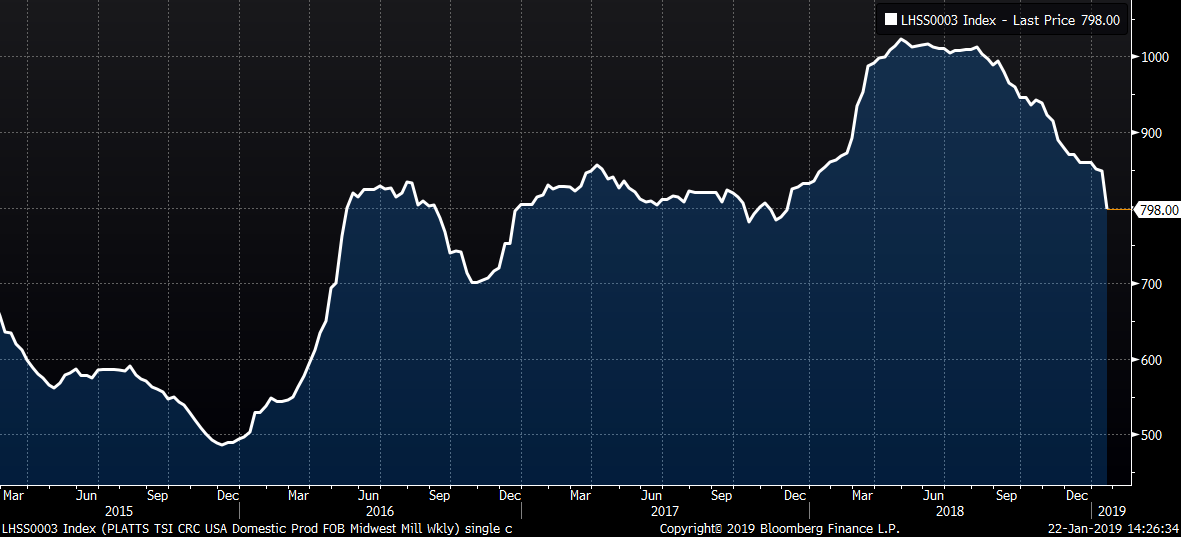

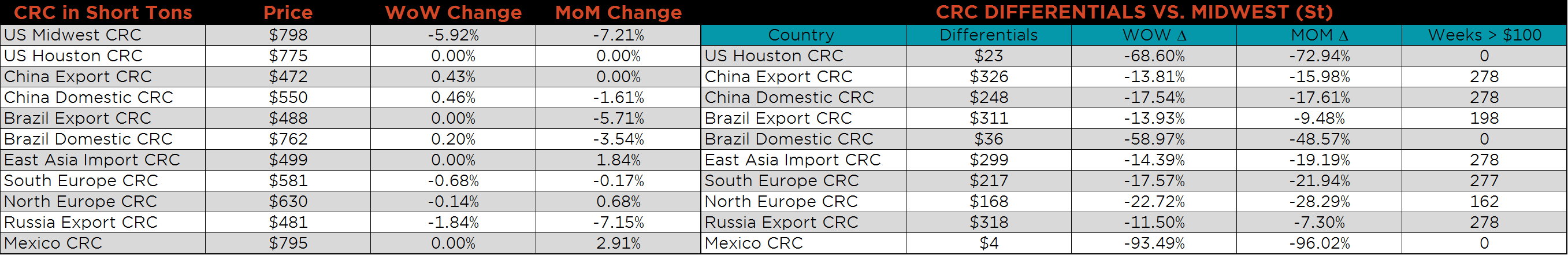

The Platts Midwest CRC Index fell $50 last week!

The CME Midwest HRC futures curve is below with last Friday’s settlements in orange. There was little change last week.

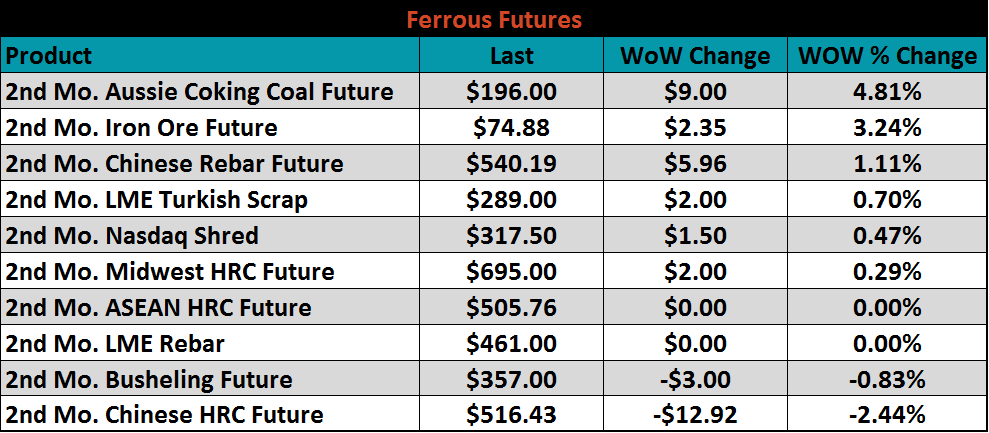

February ferrous futures are listed below. Australian coking coal futures saw gains of 4.8%, while Chinese HRC futures saw losses of 2.4%, however the active May contract gained $9 to $515.3 on the week.

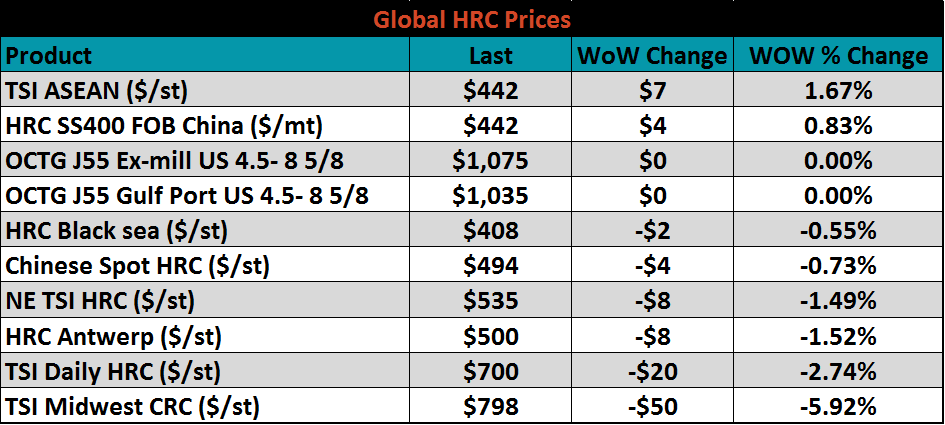

Flat rolled indexes were mixed, with TSI ASEAN up 1.7% while the TSI Midwest CRC down 5.9% and the Platts Midwest HRC Index fell 2.7%.

The AISI Capacity Utilization Rate decreased to 79.8%.

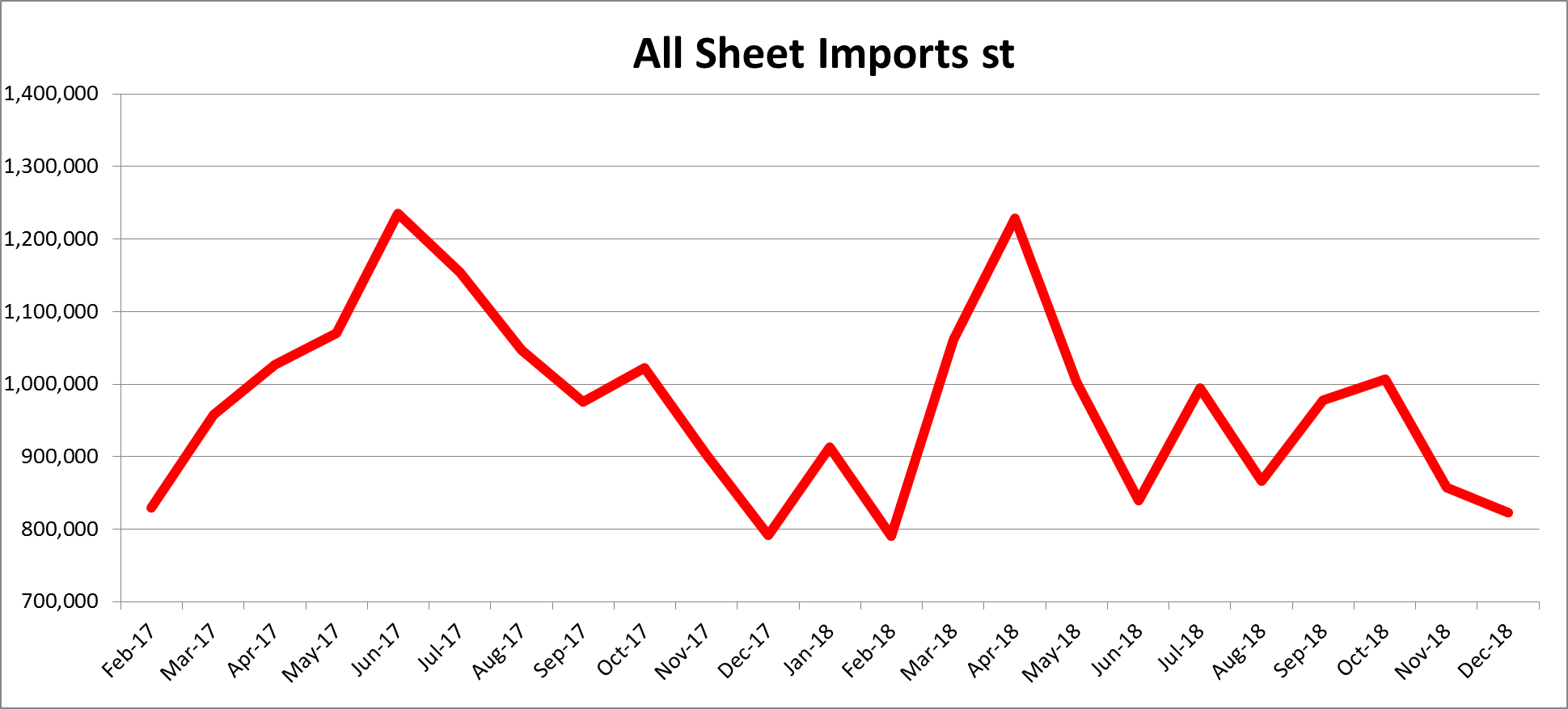

Import license data has been delayed by the shutdown. The last report we saw on December 18 showed December flat rolled import license data forecasting a 35k ton MoM decrease to 822k.

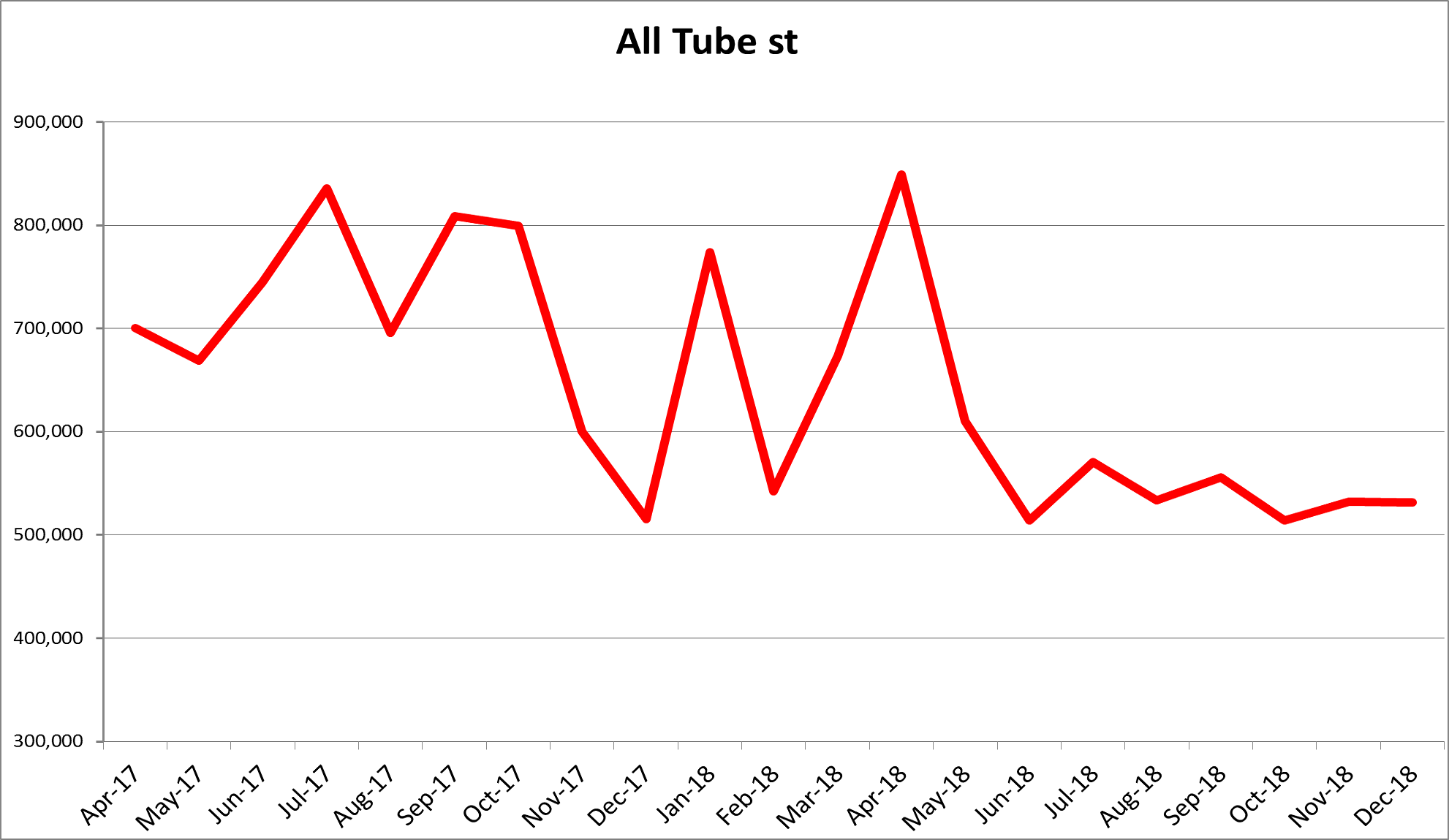

December’s tube import license data is forecasting little change MoM at 531k tons.

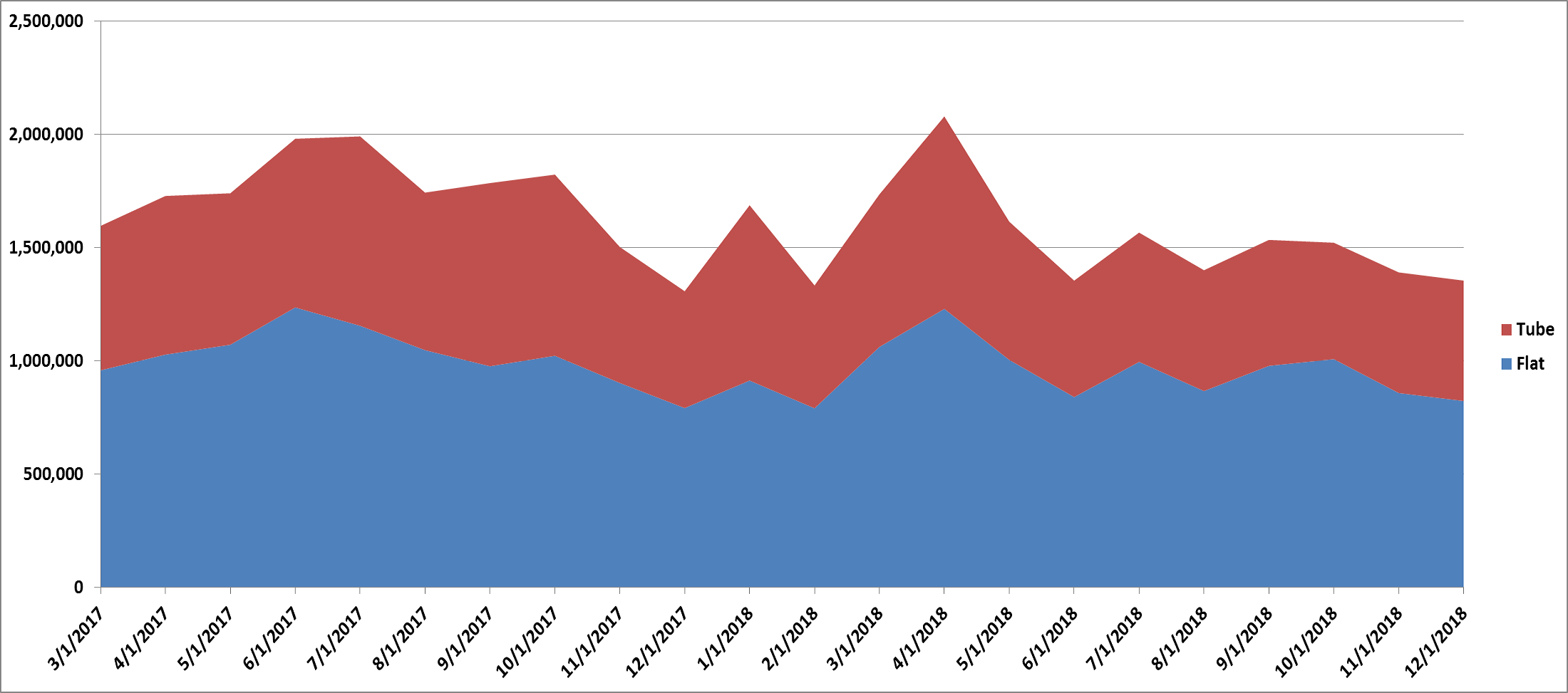

December’s combined flat rolled and tube import license data is forecasting 1.35m tons, slightly lower MoM.

December AZ/AL import licenses are projecting a decrease of 11k tons MoM to 72k.

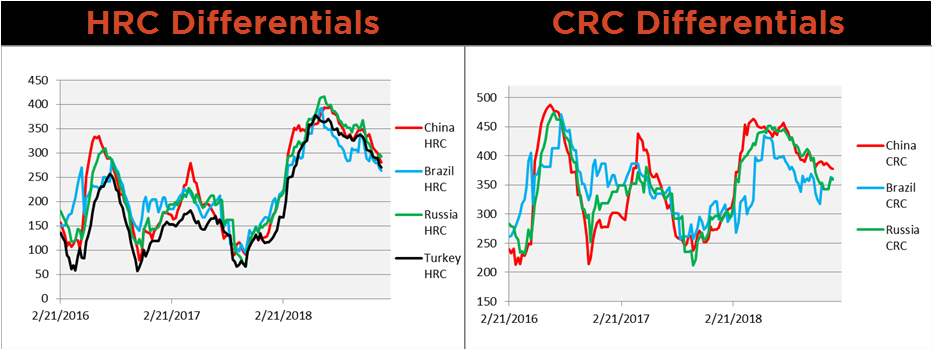

Below are HRC and CRC Midwest vs. each country’s export price differentials using pricing from SBB Platts. Both HRC and CRC are down WoW.

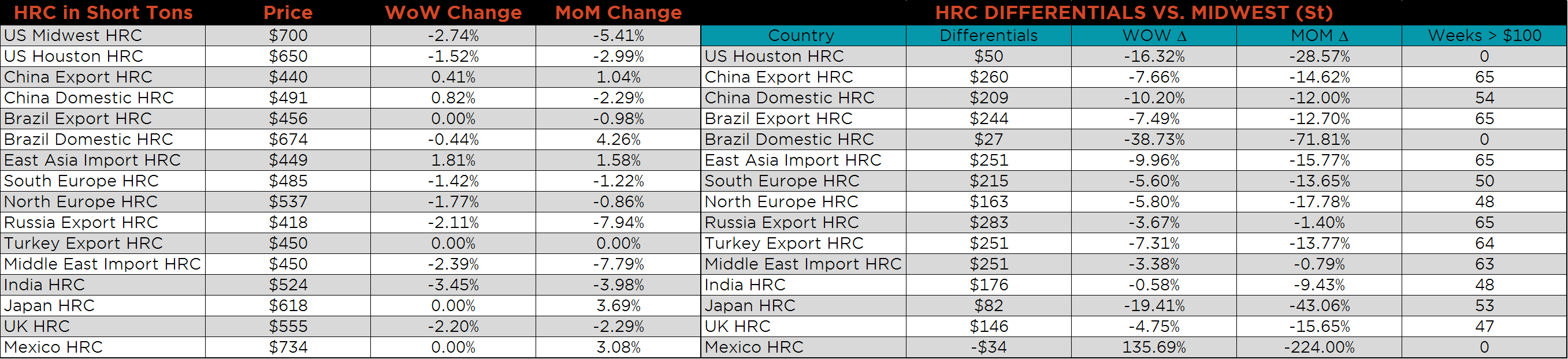

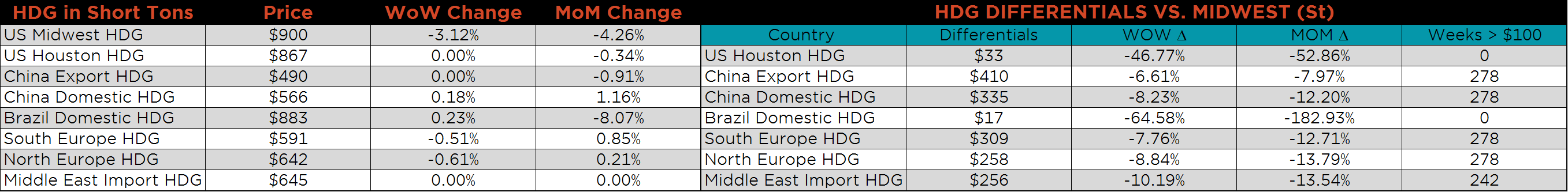

SBB Platt’s HRC, CRC and HDG WoW pricing is below. The U.S. Midwest HRC price was down 2.7%, the Midwest CRC price fell 5.9% and the Midwest HDG price was down 3.1%. The East Asian Import HRC price was up 1.8%, while the Indian and Middle East Import HRC prices fell 3.5% and 2.4%, respectively.

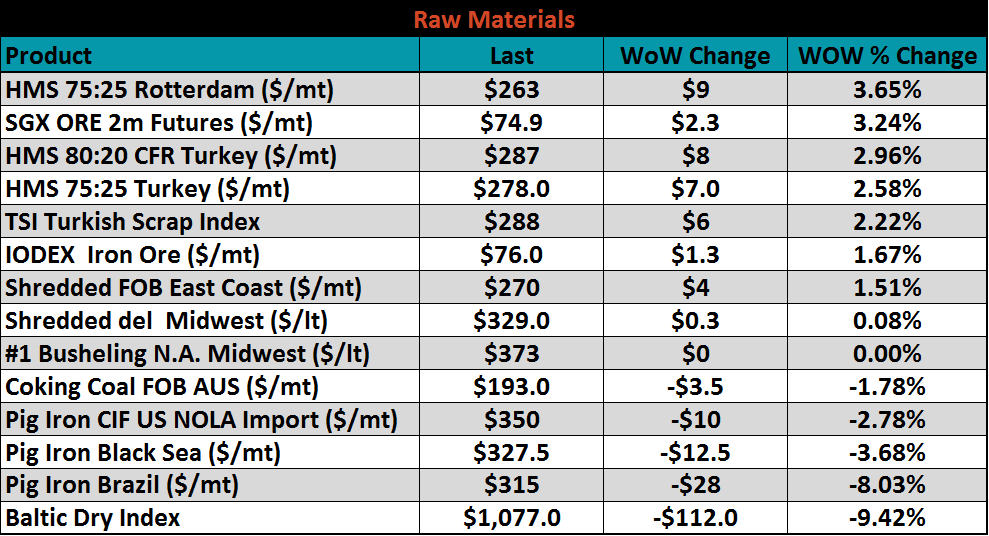

Listed below are ferrous raw materials WoW price changes. Brazilian pig iron was down 8%, while Rotterdam HMS was up 3.7% and the 2m SGX Ore future was up 3.2%

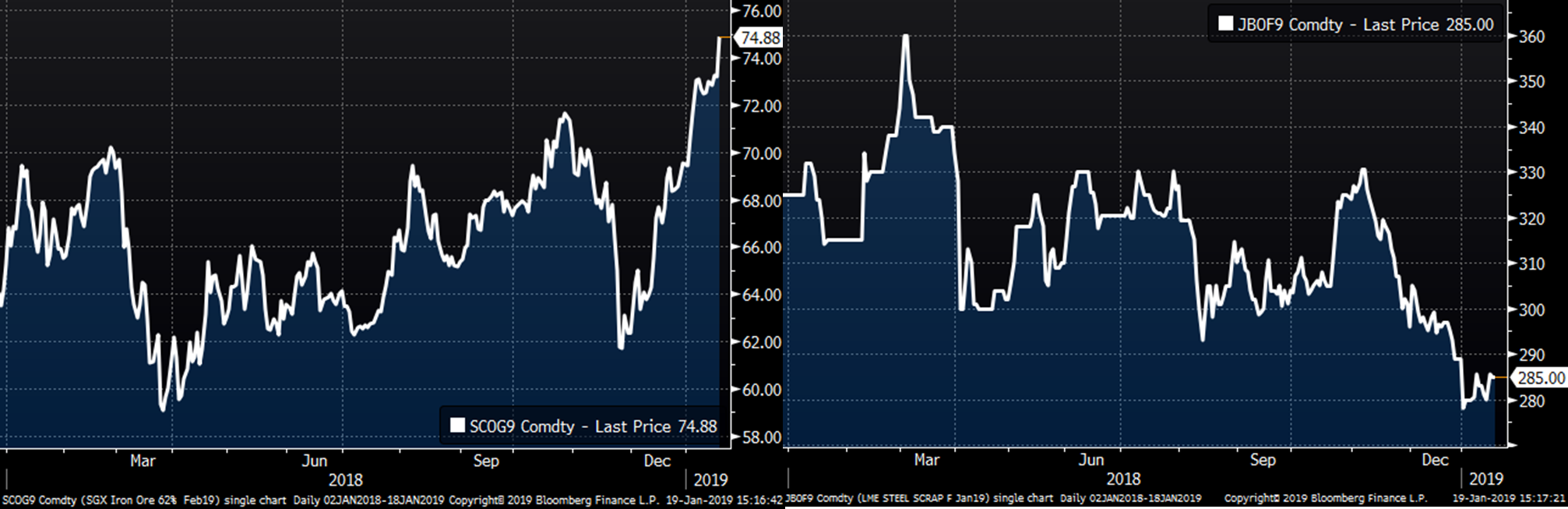

The February SGX iron ore future gained $2.59 to $74.88 while the February Turkish scrap future fell $2 to $285.00.

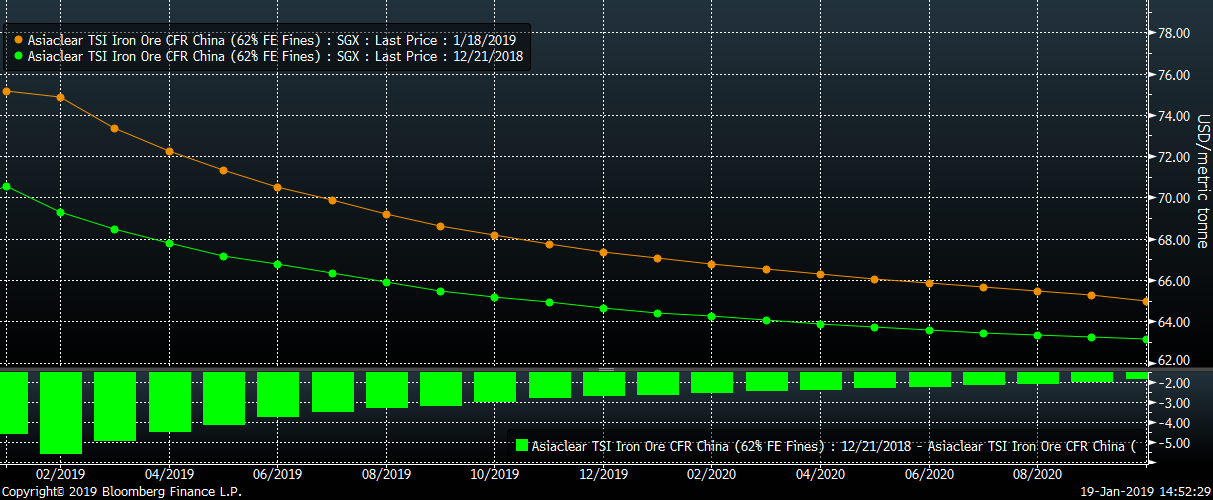

The SGX iron ore futures curve has rallied significantly with the front of the curve opening up slightly more than the later dated futures over the past month.

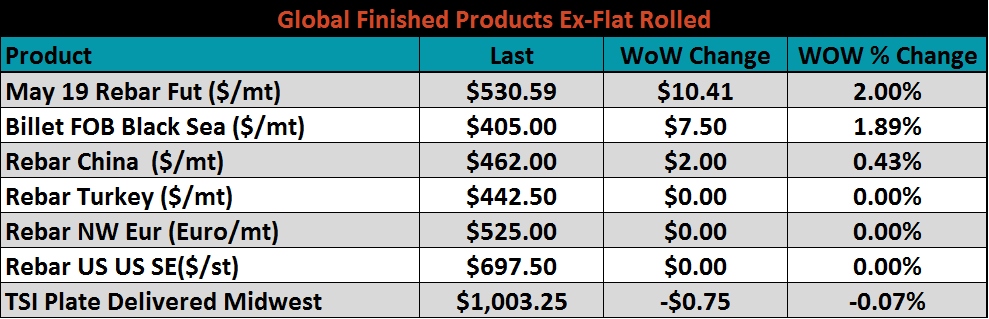

Ex-flat rolled prices were mixed with the May Shanghai rebar future up 2% WoW.

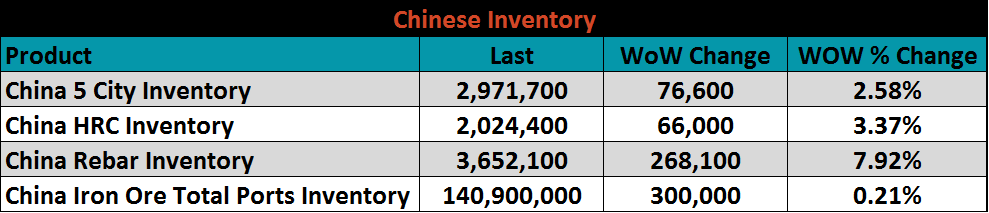

Below are inventory levels for Chinese finished steel products and iron ore. Chinese rebar and HRC inventory rose 7.9% and 3.4%, respectively. 5-city inventory level rose 2.6%.

Last week’s economic data is to the right. MBA mortgage applications were down to 13.5%, while the NAHB Housing Market Index was up to 58, beating expectations. The Philadelphia Fed Business Outlook rose to 17.0 from last week’s revision of 9.1. The Empire Manufacturing Index fell far below expectations to 3.9 from last month’s revised reading up 11.5.

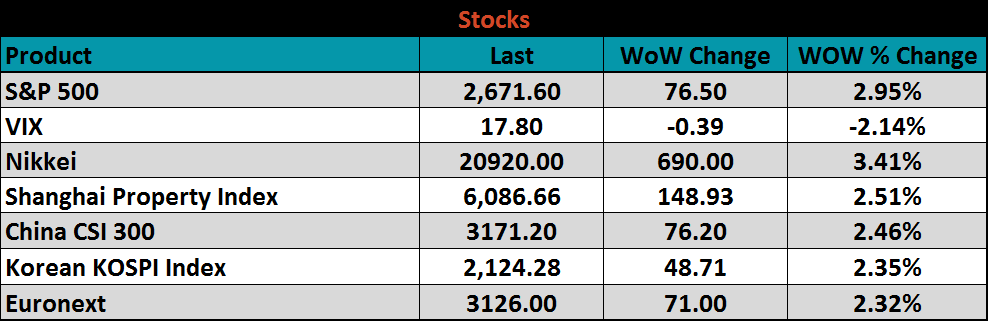

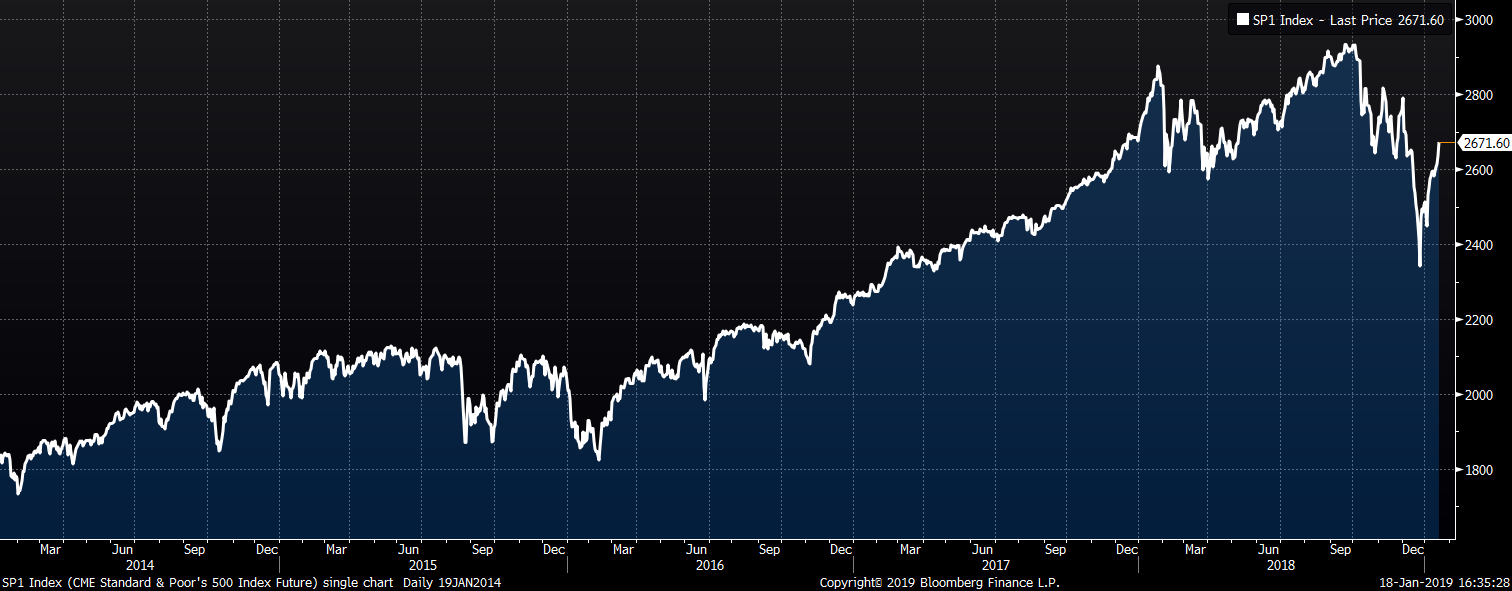

The S&P 500 rose 3% while the Chinese CSI 300 and Korean KOSPI Index were up 2.5% and 2.4%, respectively.

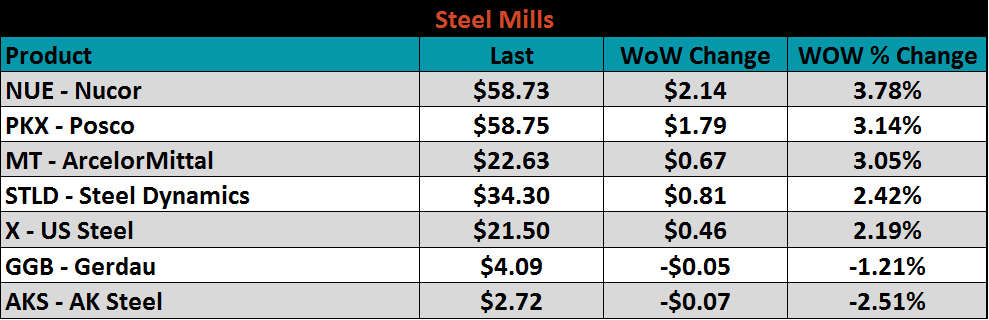

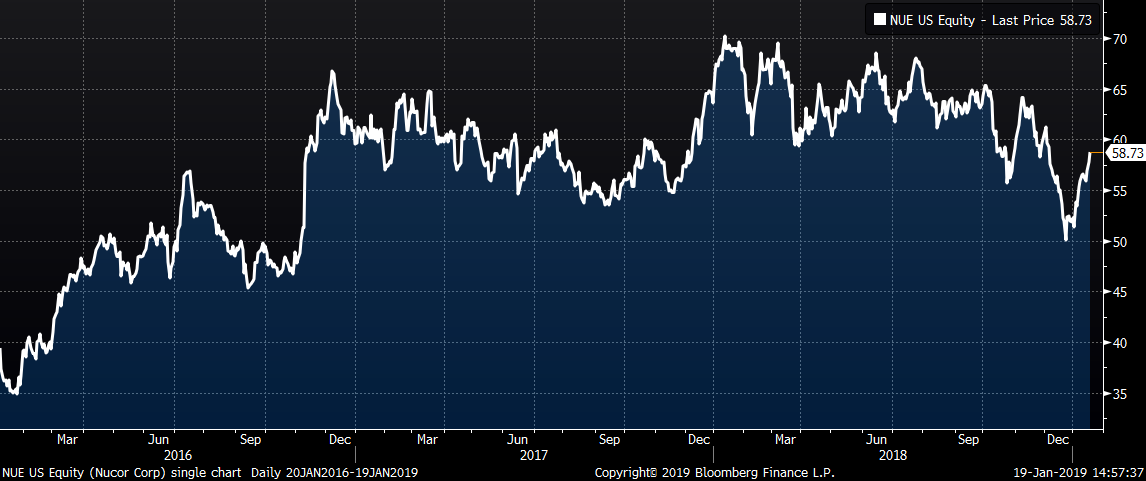

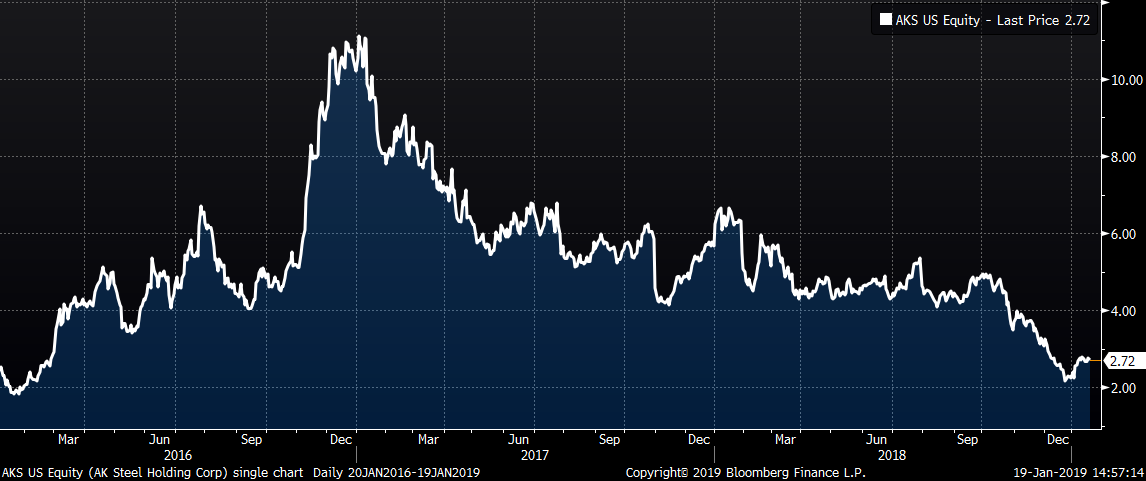

Steel mill stocks were mixed with Nucor up 3.8%, while AK Steel down 2.5%.

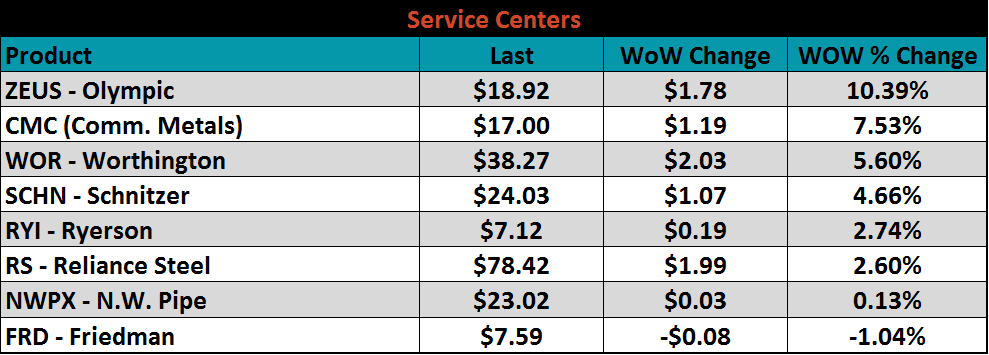

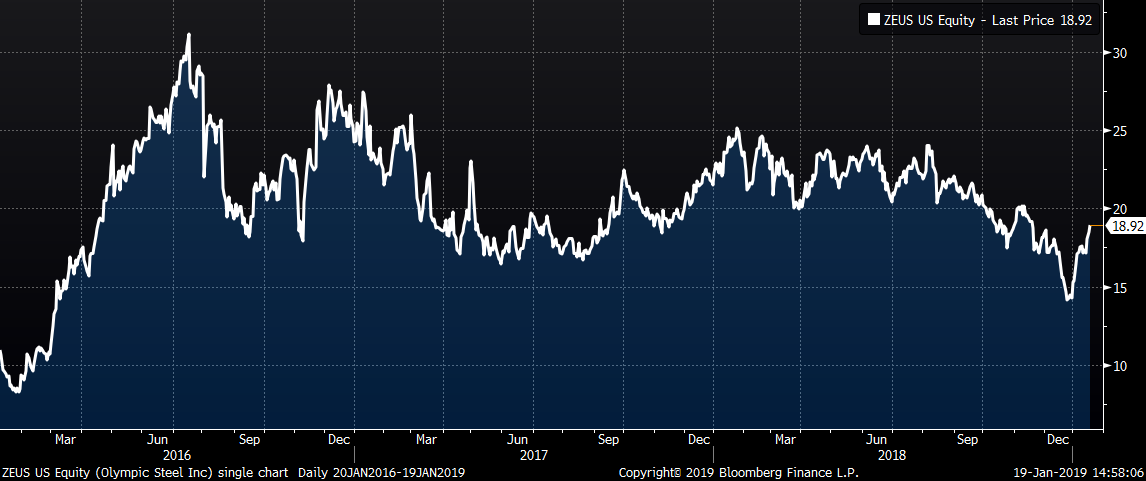

Service center stock’s WoW performance is shown below. Olympic Steel and Commercial Metals were up 10.4% and 7.5%, respectively.

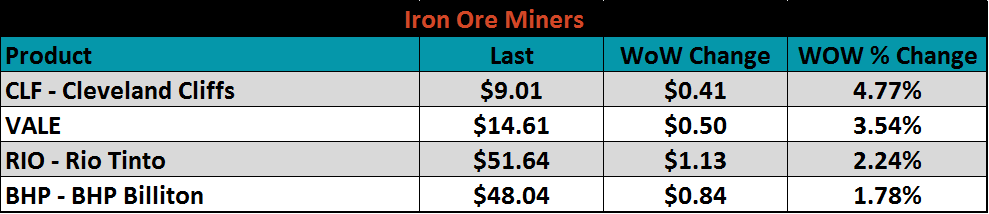

Mining’s stocks were all higher with Cleveland Cliffs leading the group, up 4.8% WoW.

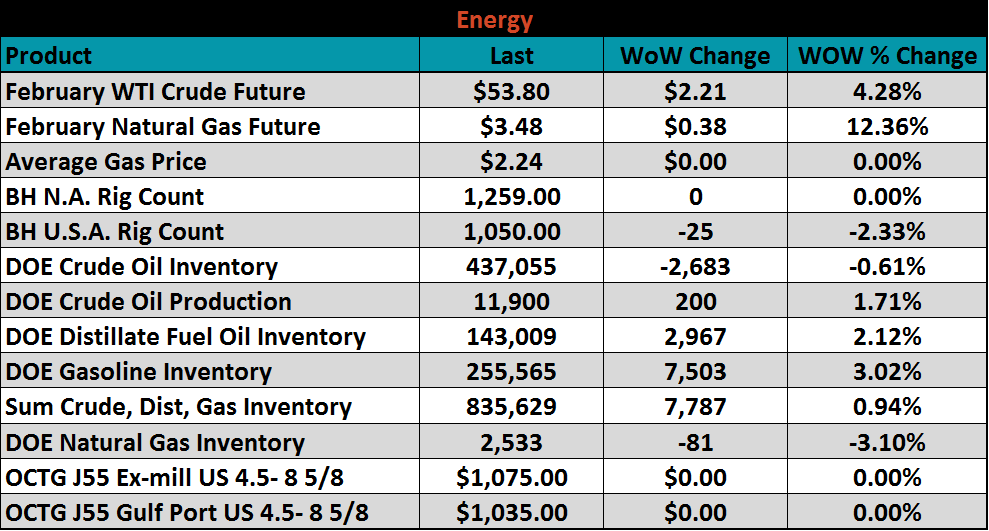

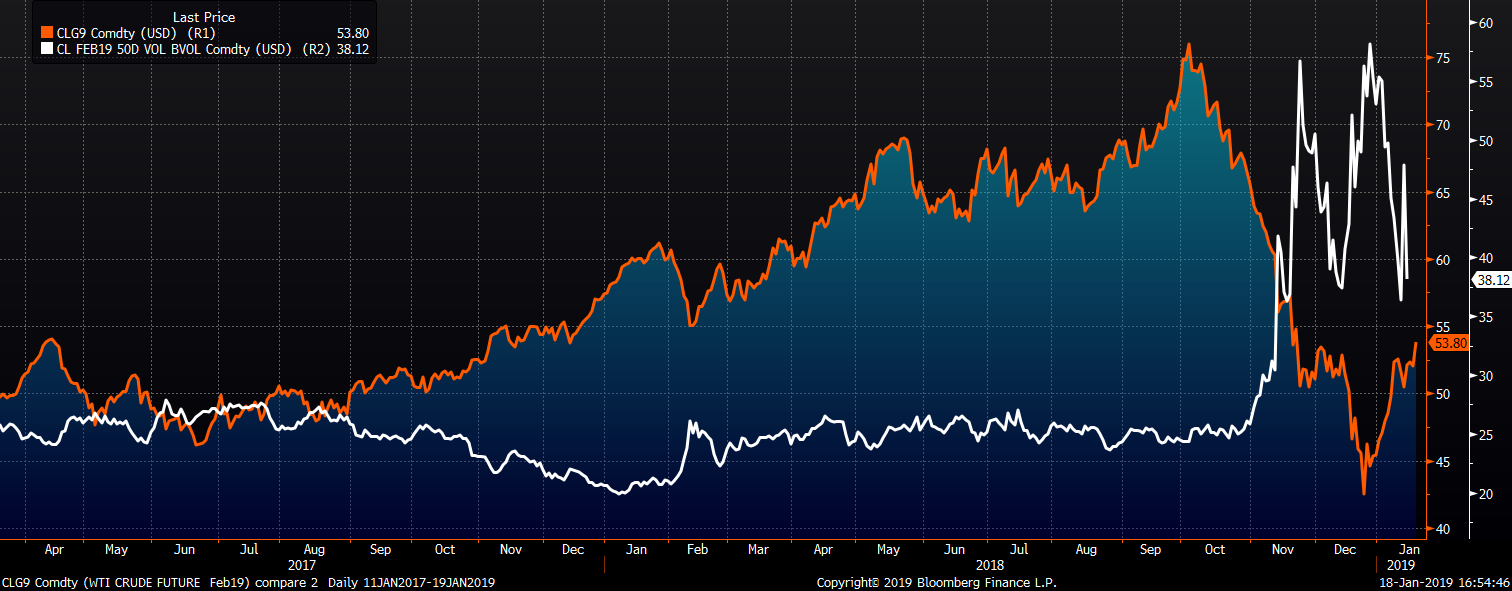

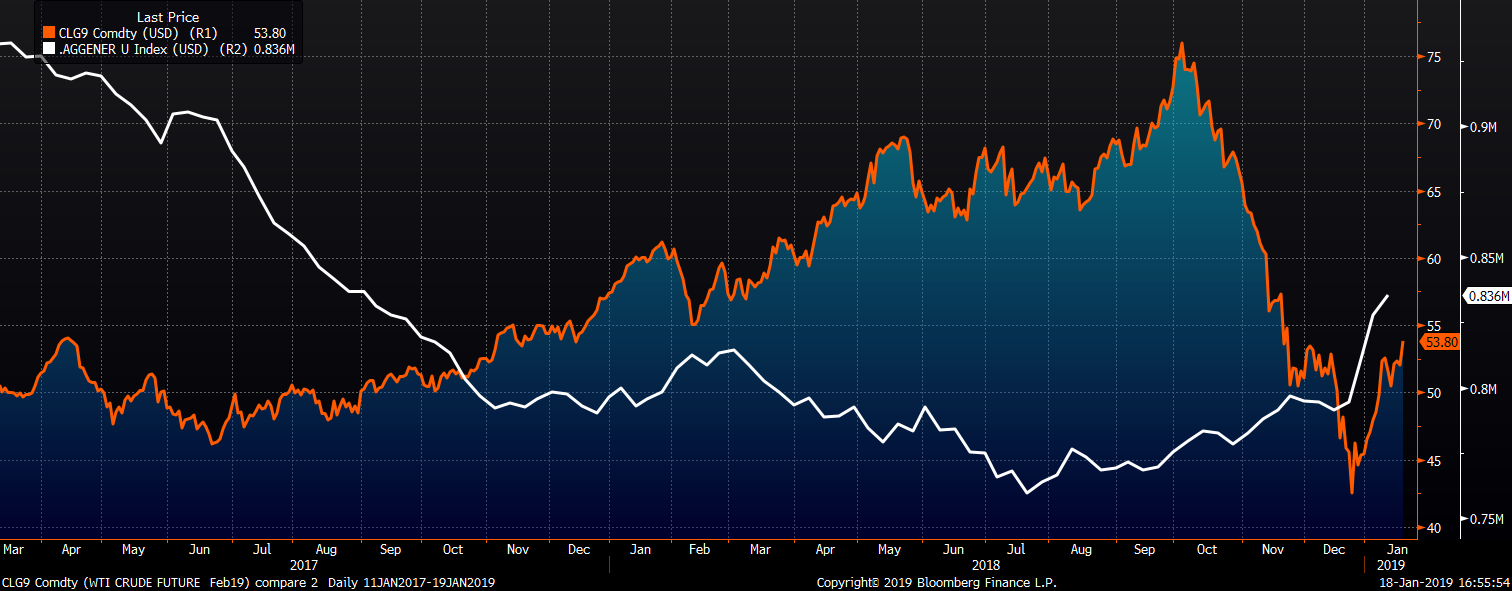

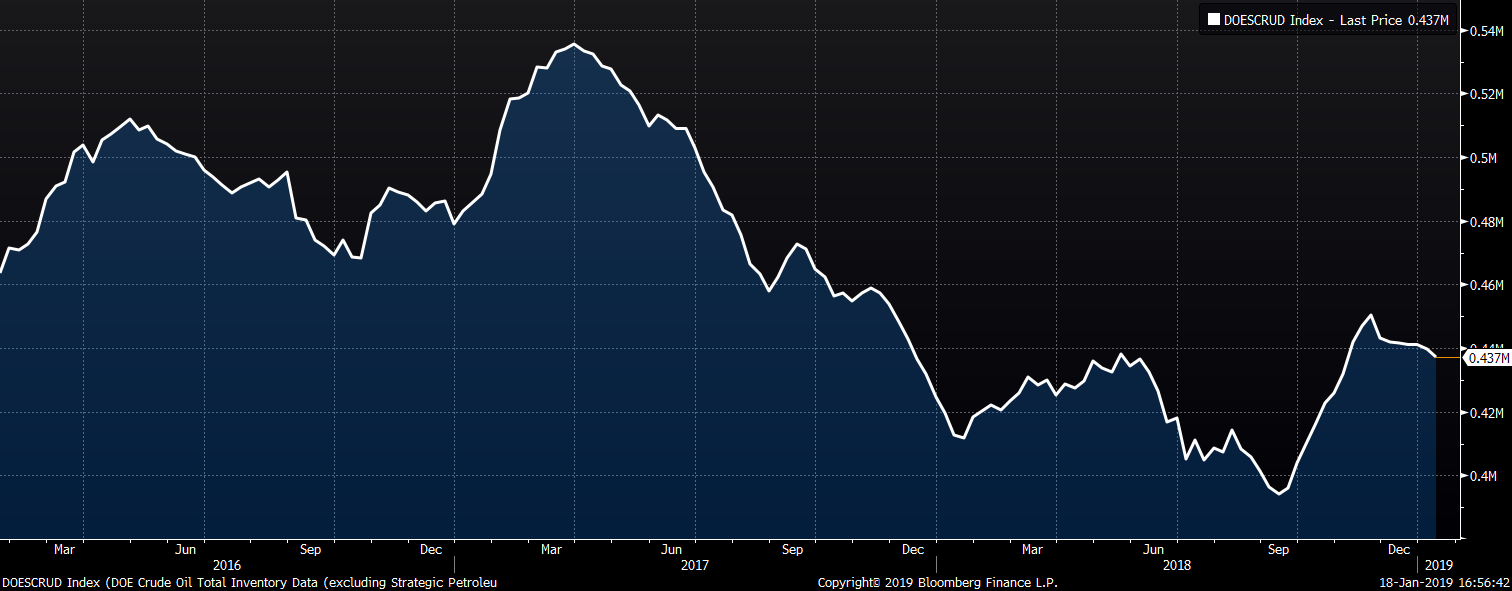

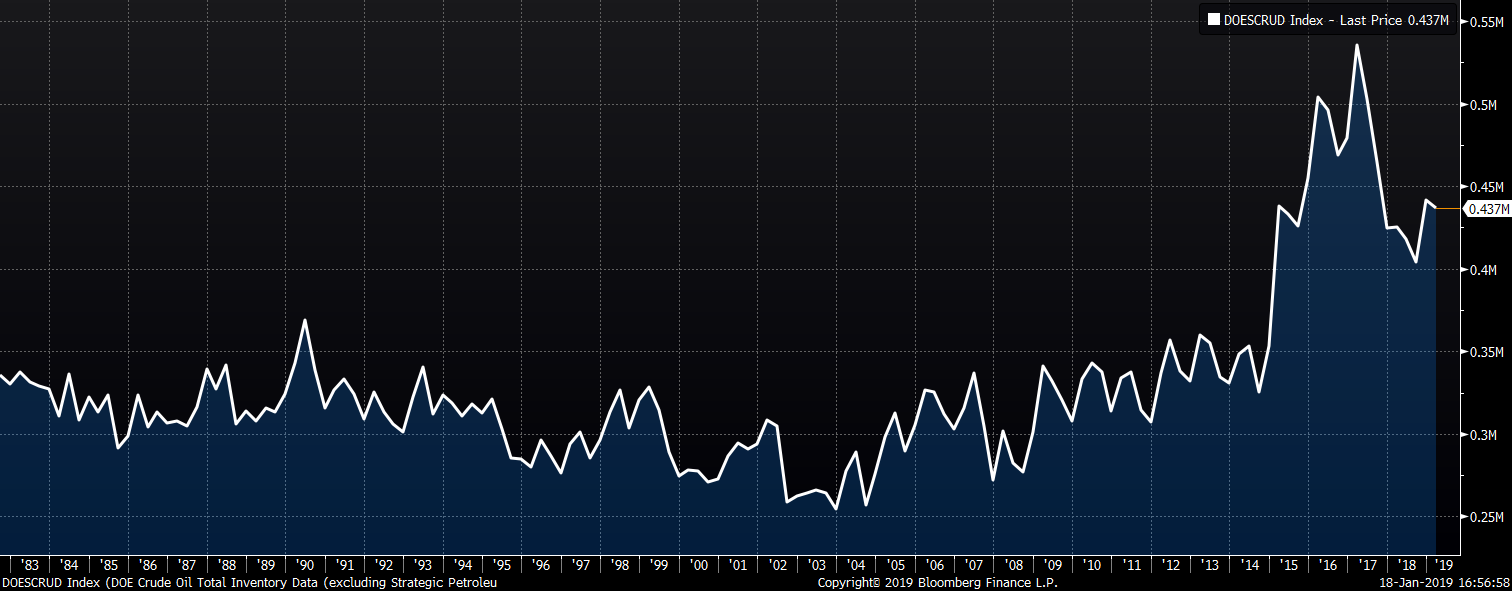

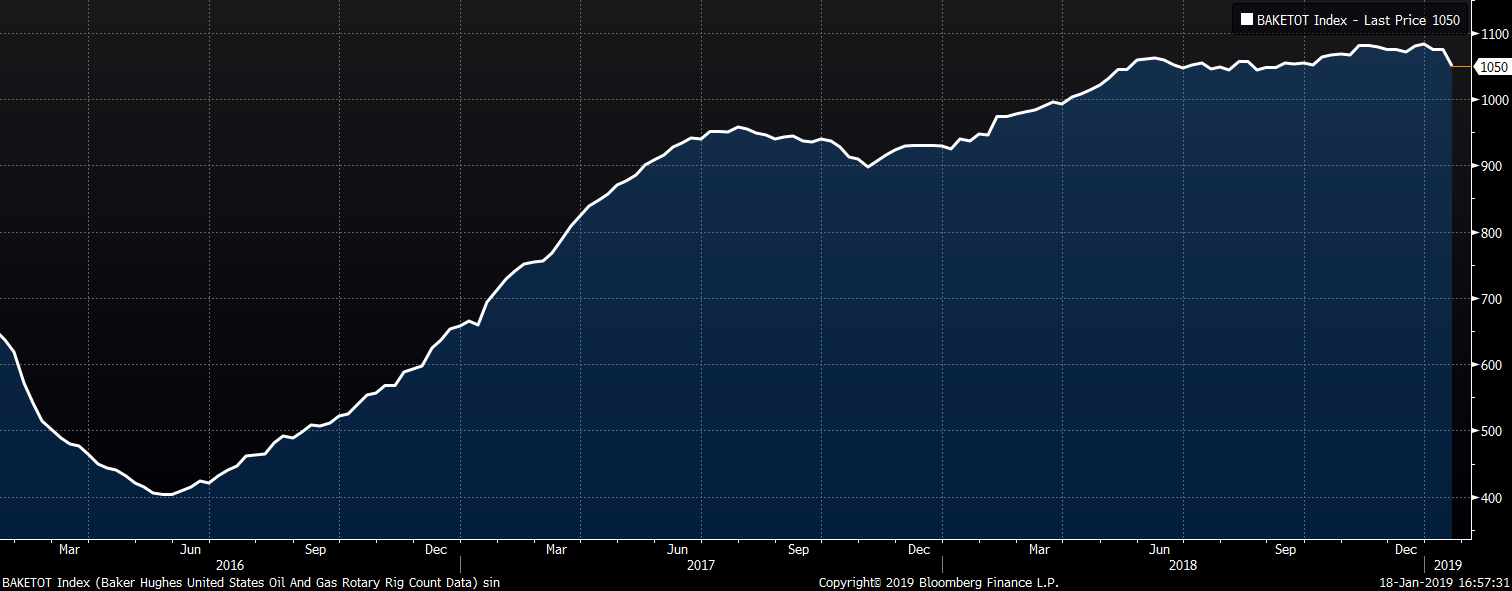

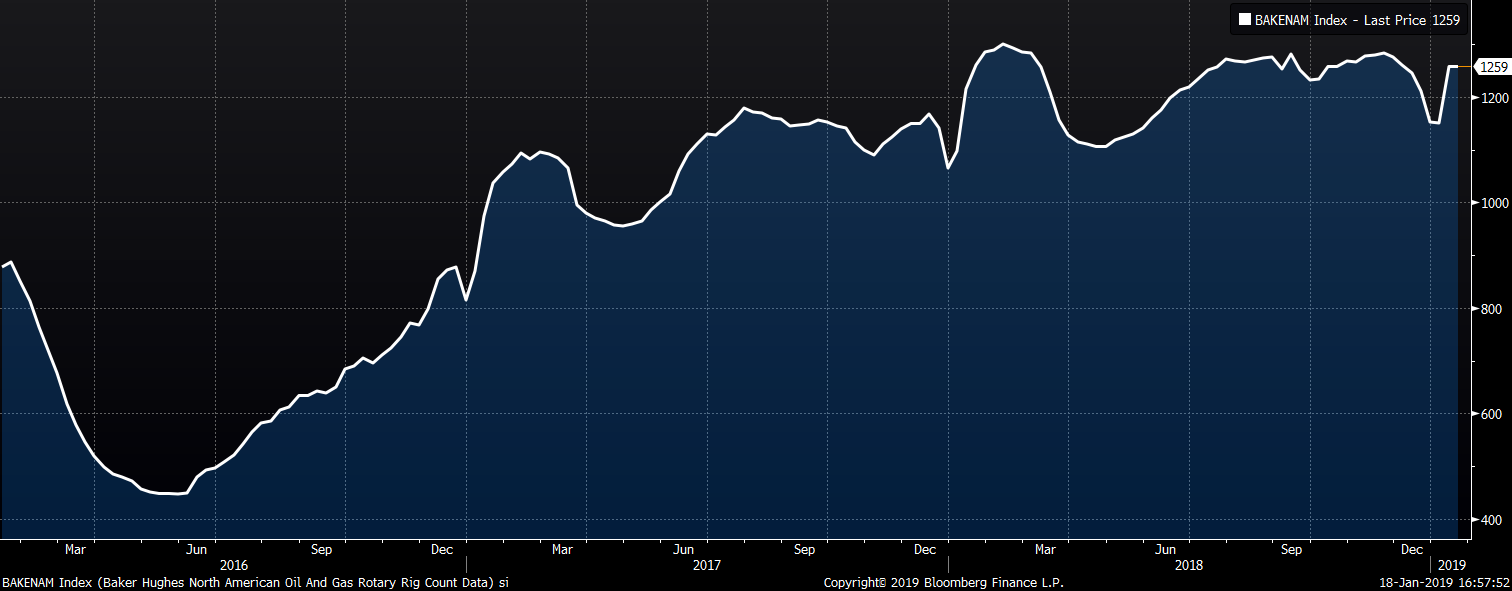

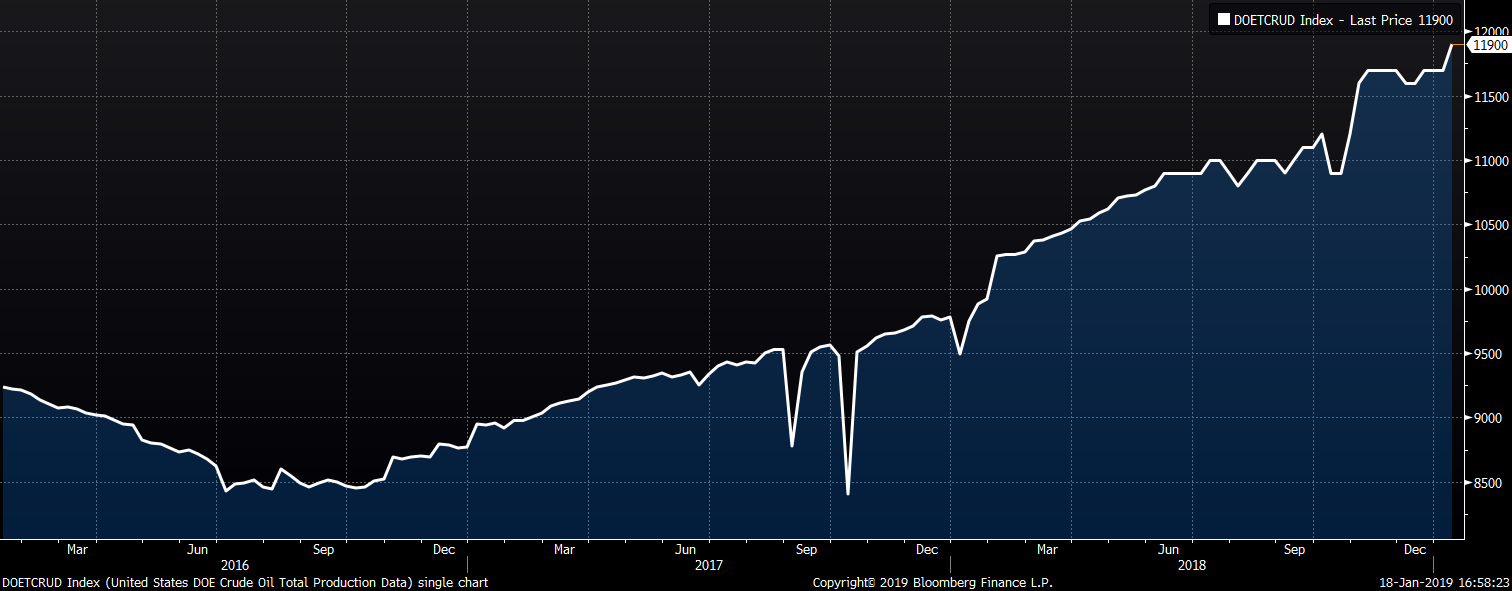

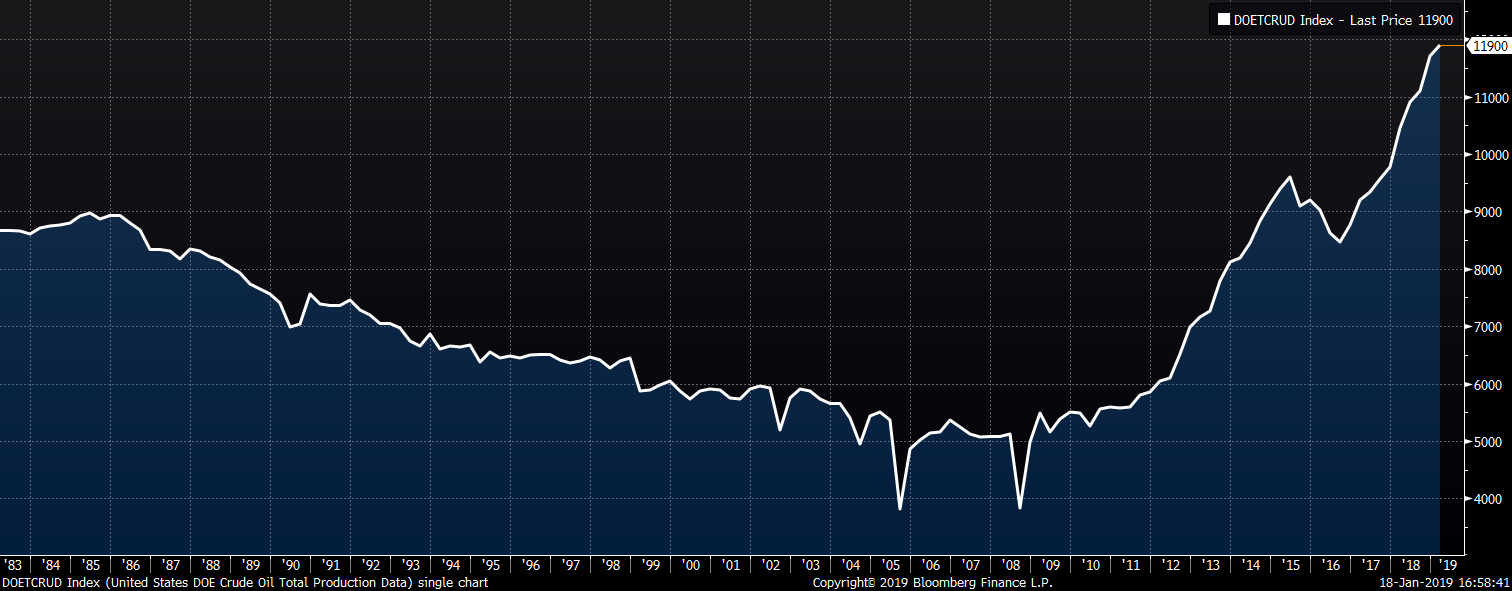

The February WTI crude oil future gained $2.21 or 4.3% to $53.80/bbl. Crude oil inventory was down 0.6%, while gasoline and distillate inventory added 3% and 2.1%, respectively. The aggregate inventory level was up 0.9% to its highest level since late 2017. Crude oil production rose to 11.9m bbl/day. The U.S. rig count decreased by twenty-five, while the North American rig count was unchanged. The February natural gas future rose $0.38 or 12.4% to $3.48/mmBtu. Natural gas inventory fell 3.1%.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely.

Upside Risks:

Downside Risks: