Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

Conversations around the physical steel market continue to revolve around one topic: when will prices stop falling? A better way to frame this might be, what is standing in the way of mills ability to increase prices?

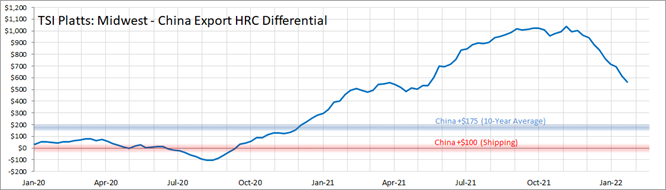

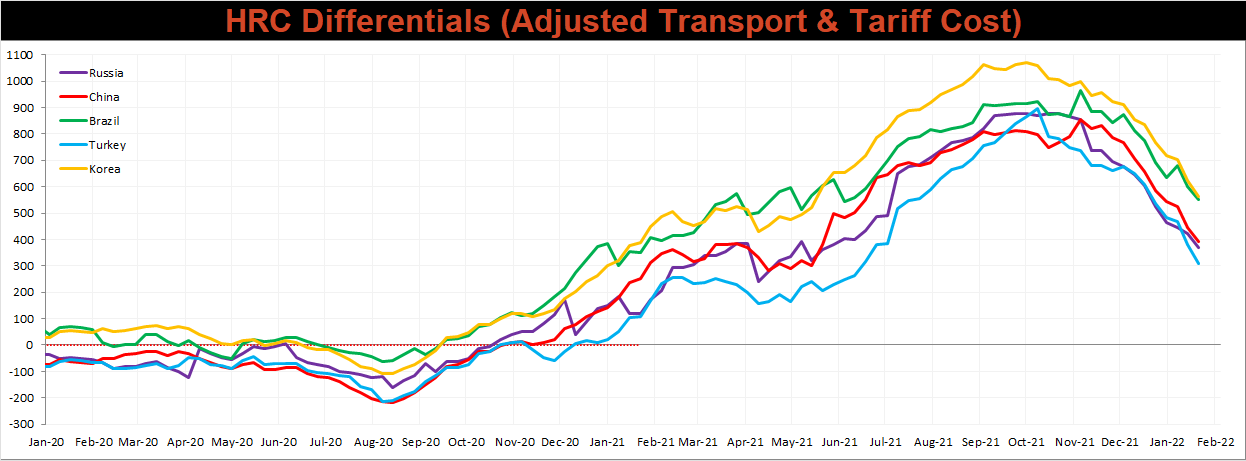

Thinking about it from that perspective, even though HRC is nearly 30% off its recent peak in September, the U.S. domestic price remains $300-600 above every other global price (adjusted for transportation). The chart below shows the U.S. – China export HRC differential ~$400 above its historical average and ~$575 above breakeven.

It bears repeating that while no one knows the date or price at which imports will fully converge with the domestic price, the time horizon moves dramatically forward if global prices are stable or rising, which has been the case for the Chinese export price. The missing piece of the equation, however, is the fact that while differentials were climbing to historic heights, domestic buyers were desperately attempting to capture the spread as a profit, even double or triple-ordering in some cases. The result has led to a dramatic increase in sustained levels of imports and a steel buying community that is now clearly over-inventoried. Because of this, there is no reason to believe domestic mills have the power to cause this differential to change course.

Up to this point, everything may sound like doom and gloom for the domestic market. However, as we noted in last week’s report, mills are still experiencing record levels of profitability, and while current price differentials continue to be a significant headwind to higher prices in the next couple of months, domestic producers have a perspective that is far further down the road. The most important factor will always be demand, and by all reports, even though growth in 2022 may be slowing, it will be above pre-pandemic levels. Inventory levels are high, but buyer inactivity in the face of strong demand will bring them down at a faster pace than we’ve ever seen. Waiting for lower prices in today’s environment may feel good now, but it is a gamble, and your backlog and its margin are the bet.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

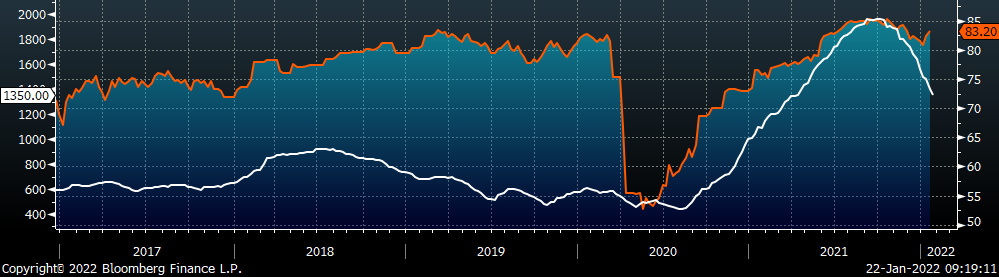

The Platts TSI Daily Midwest HRC Index decreased by another $50 to $1,350.

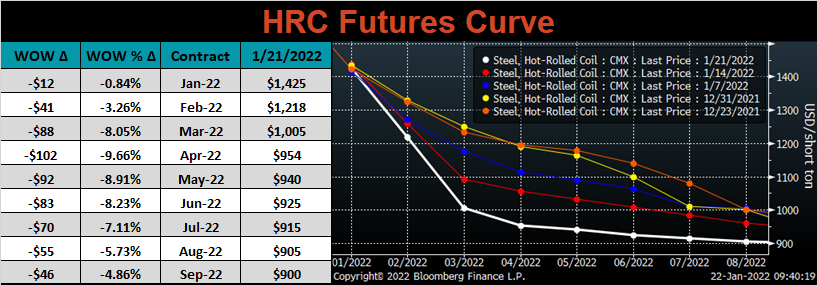

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The entire curve shifted lower, most significantly in the middle (March – July), causing further flattening beyond the March 2022 expiration.

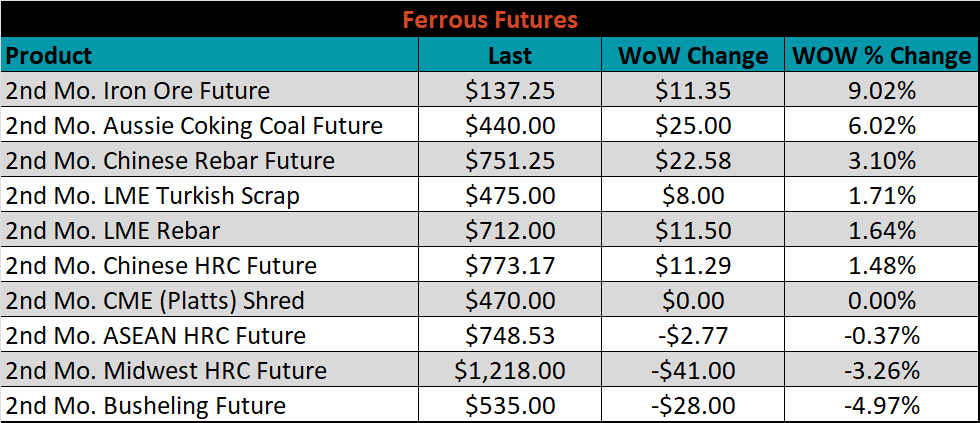

February ferrous futures were mixed. Iron ore gained 9%, while busheling lost 5%.

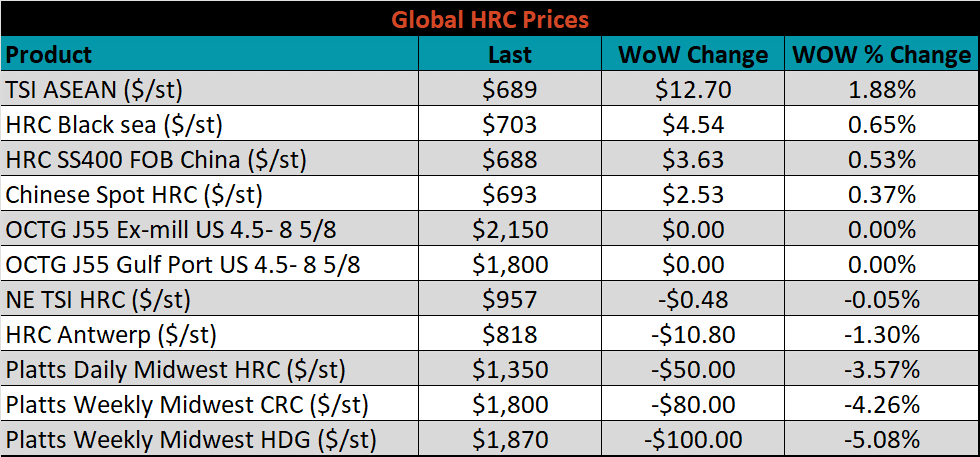

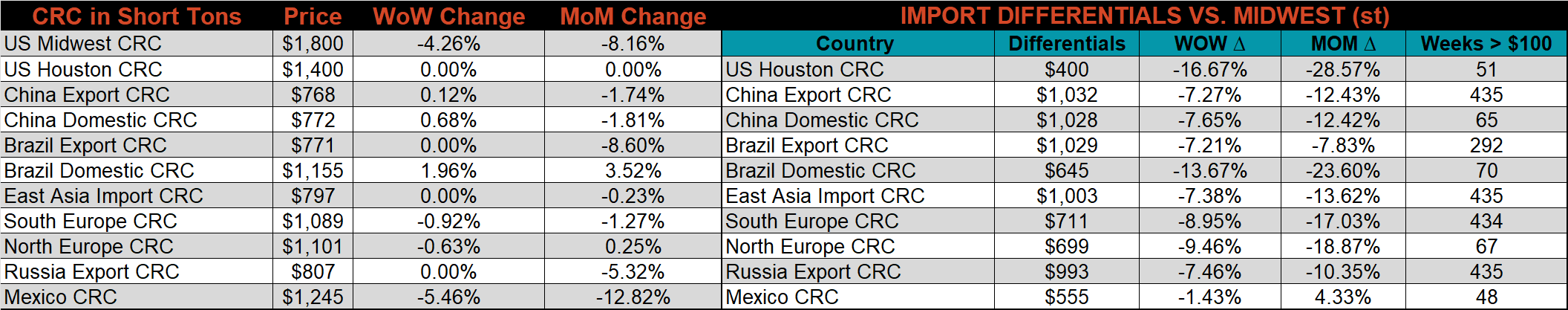

Global flat rolled indexes were mixed, with TSI ASEAN up 1.9% and Midwest HDG down 5.1%.

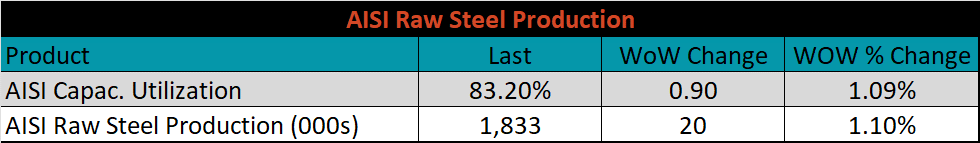

The AISI Capacity Utilization rose another 0.9% to 83.2%.

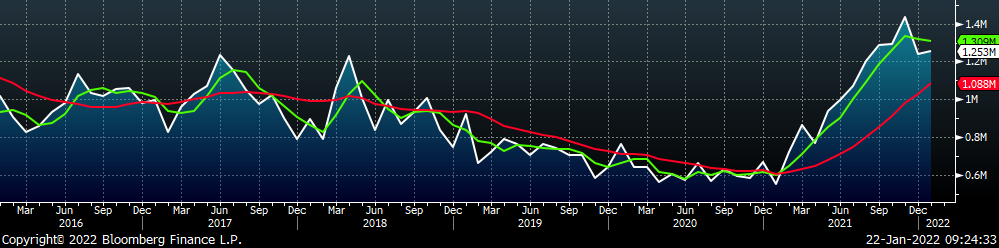

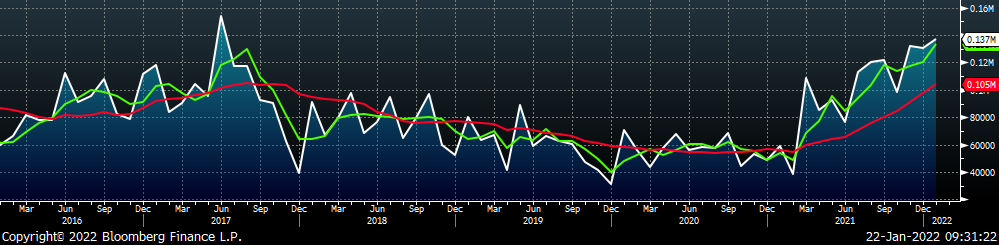

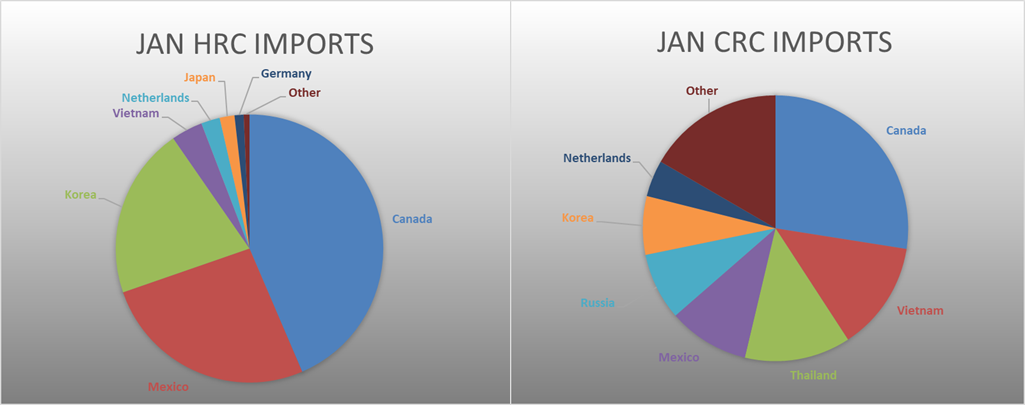

January flat rolled import license data is forecasting an increase of 16k to 1.25M MoM.

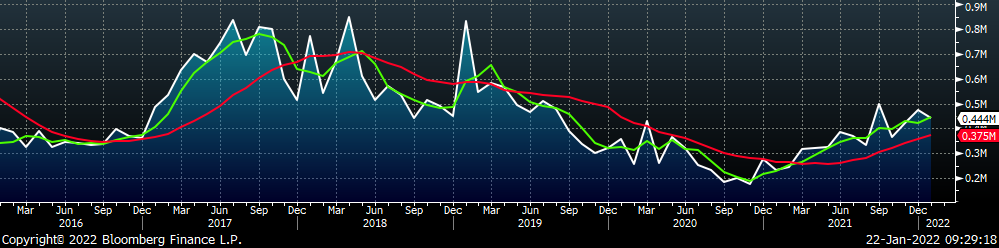

Tube imports license data is forecasting a decrease of 32k to 444k in January.

January AZ/AL import license data is forecasting an increase of 7k to 137k.

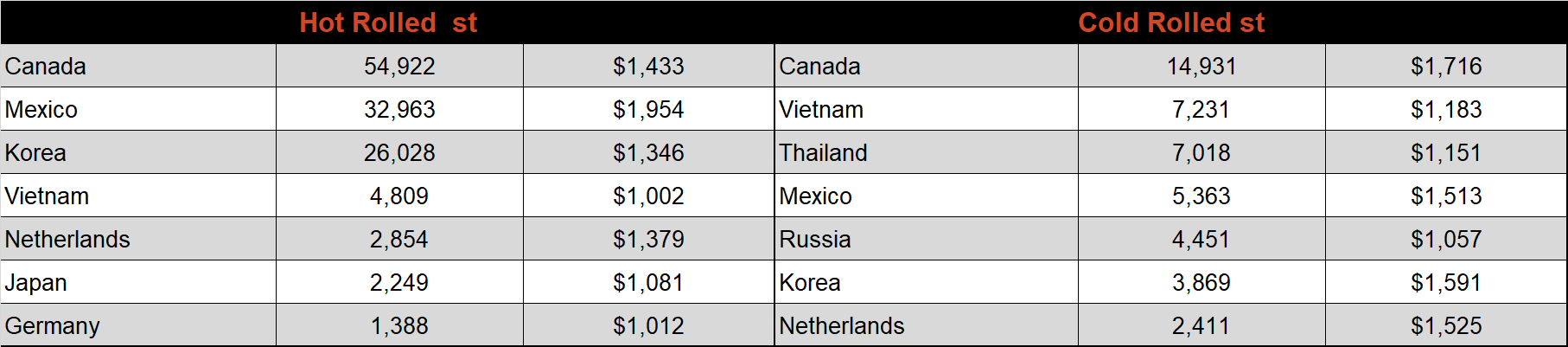

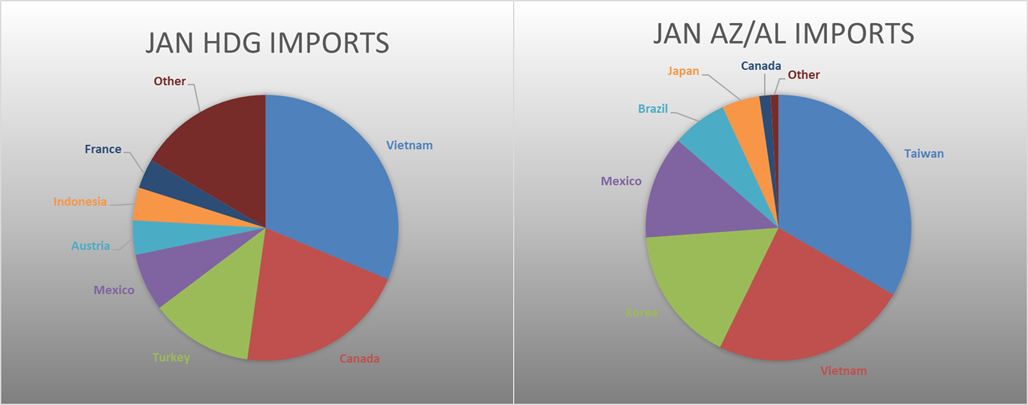

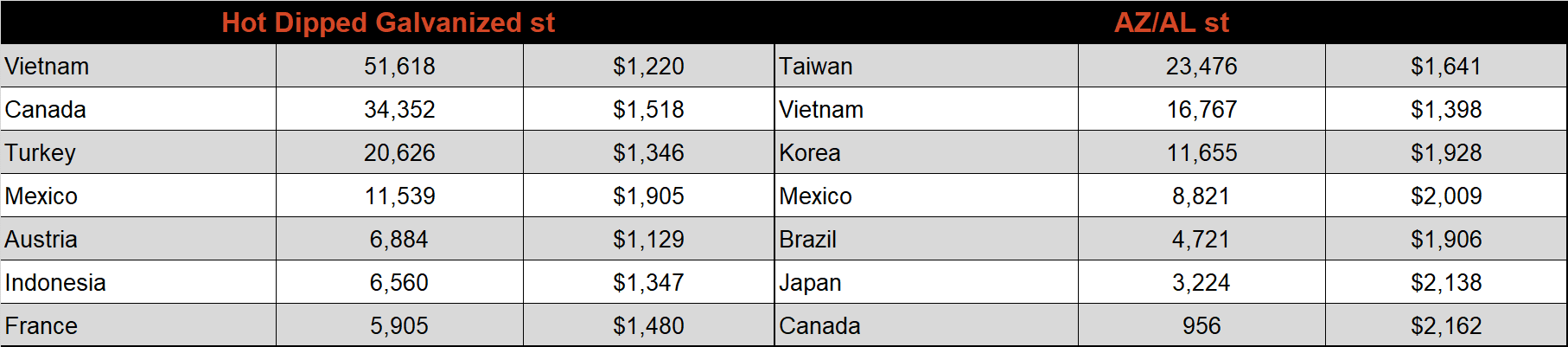

Below is December import license data through January 17th, 2022.

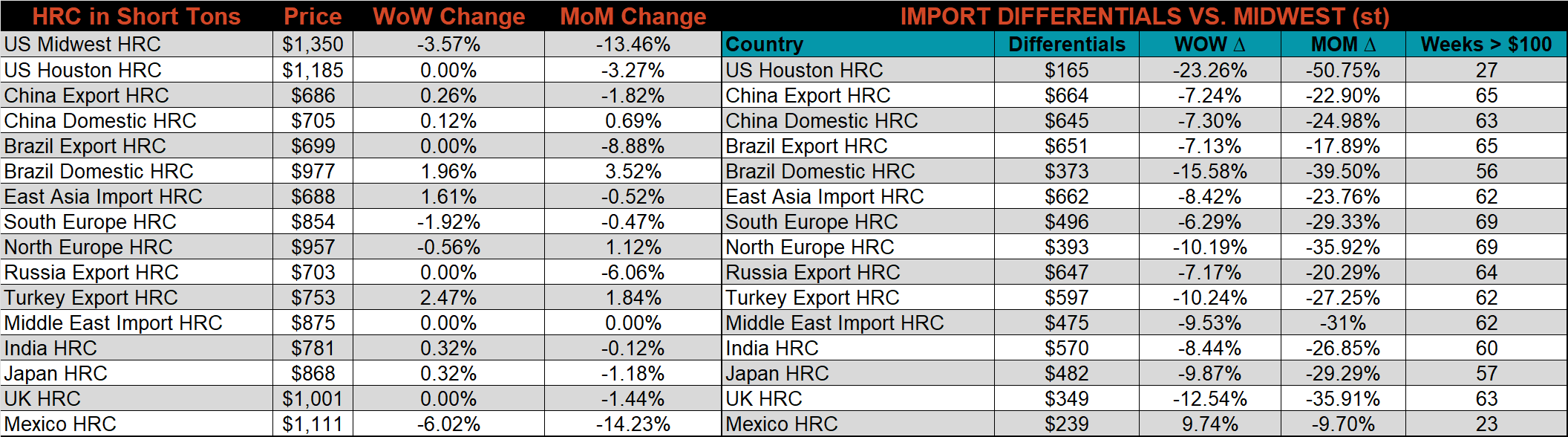

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All the watched countries differentials decreased again this week, most significantly the Turkish, Chinese, and Korean, as all their prices increased while the U.S. domestic price continue to fall.

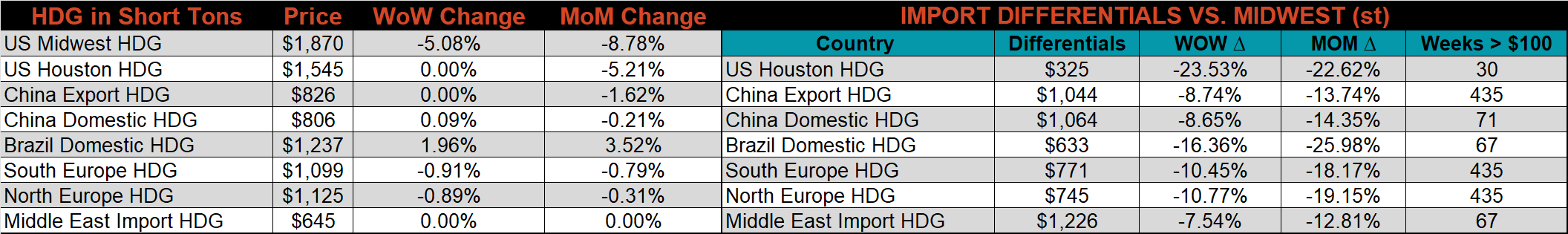

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HDG, CRC & HRC prices were all lower this week, down 5.1%, 4.3% and 3.6%, respectively. Outside of the U.S., the Turkish HRC export price was up 2.5%.

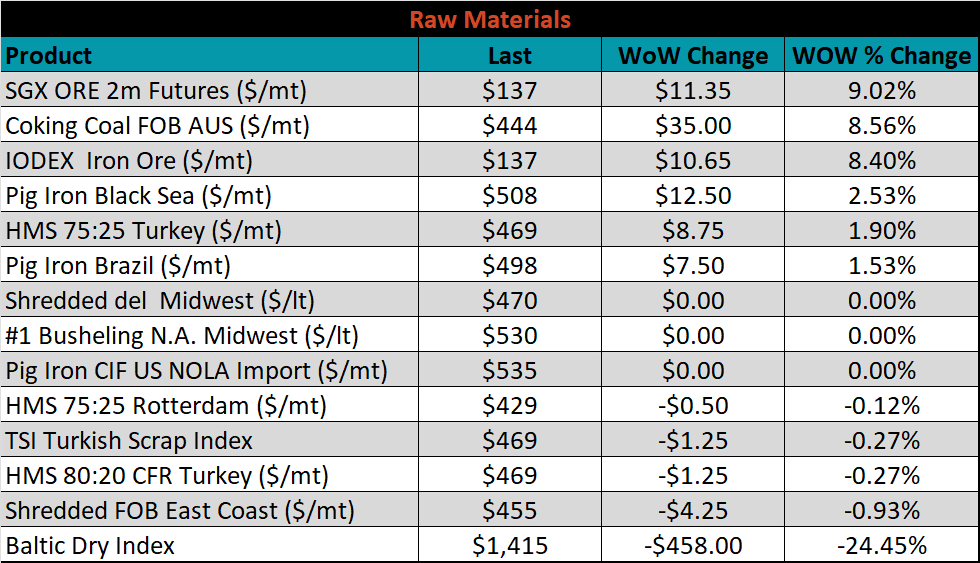

Raw material prices were mixed. Aussie coking coal was up 8.6%, while Turkish Scrap was down 0.3%.

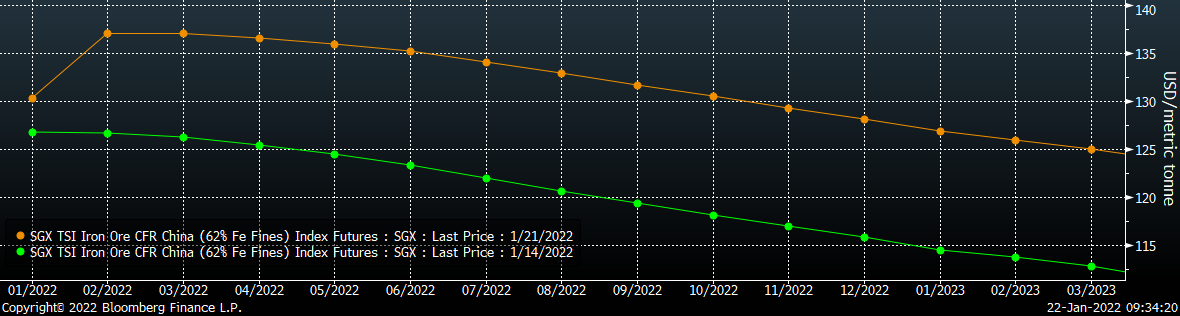

Below is the iron ore future curve with Friday’s settlements in green, and the prior week’s settlements in orange. Last week, the entire curve exploded higher. Prolonged elevated prices should be supportive of global HRC prices, especially in Southeast Asia, where much of the production is BOF based.

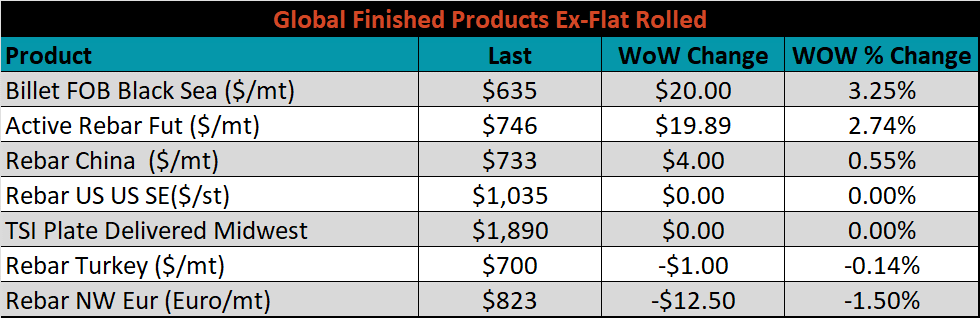

The ex-flat rolled prices are listed below.

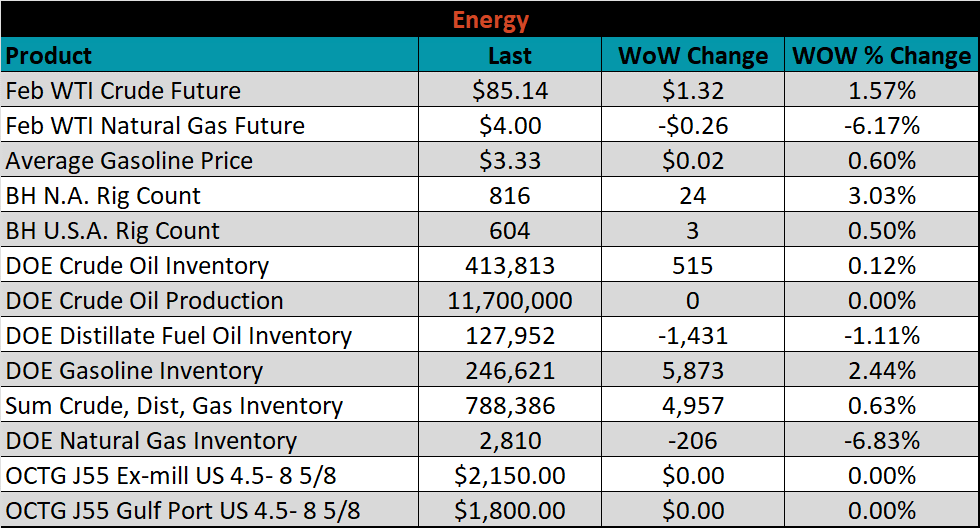

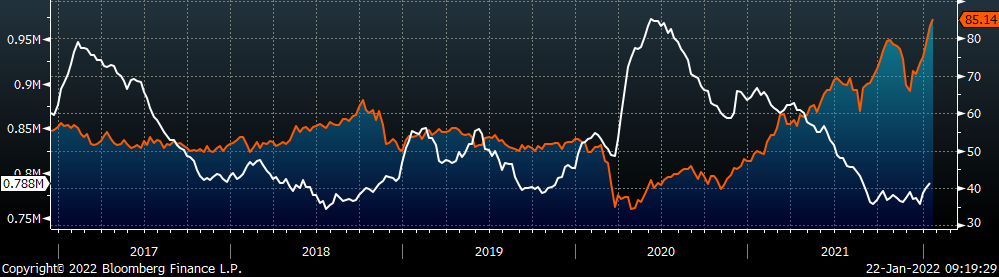

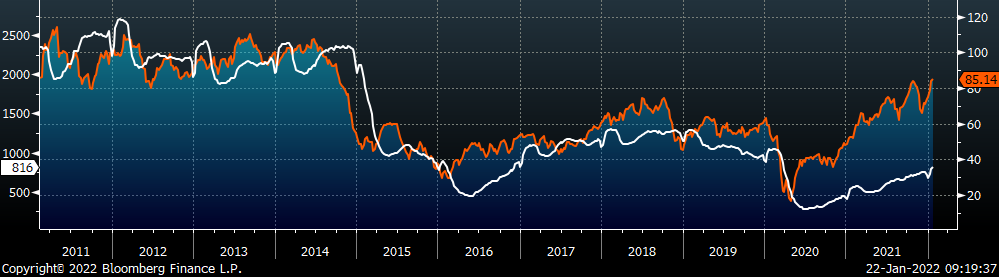

Last week, the February WTI crude oil future gained another $1.32 or 1.6% to $85.14/bbl. The aggregate inventory level was up 0.6%, while crude oil production remains at 11.7m bbl/day. The Baker Hughes North American rig count was up by another 24 rigs, and the U.S. rig count was up 3 rigs.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: