Content

-

Weekly Highlights

- Market Commentary

- Risks

As ferrous prices climbed over the last few months, this report has commented on demand outlook into 2020 as well as inventory levels at different prices. With the spot market little changed over the last week near $600/st, buyers need to start deciding whether they are willing to replace their outbound inventory with higher priced material. We have repeatedly pointed to demand as a driver of buyers’ willingness to pay these prices, and the recent coronavirus scare may influence this outlook. While demand in the steel sector is difficult to gauge and forecast, some indicators may help develop a better understanding.

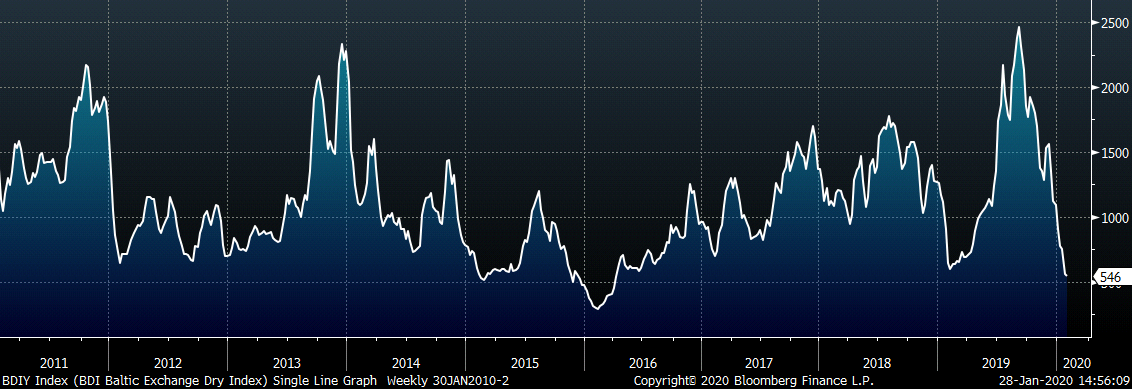

The Baltic Dry Index is shown below, indicating changes in global shipping costs for dry commodities (such as iron ore and steel), which is a barometer of global demand.

The significant drop in the Baltic Dry index was partially driven by iron ore prices declining from their extreme levels last summer. The emergence of the coronavirus in China has recently pressured the index and disrupted global financial markets. The largest impacts have been seen in energy and industrial metal prices due to expectations of decreasing demand for transportation and construction. With this demand indicator at low levels compared to the previous 10 years, it is reasonable to expect the coronavirus to cause weakness in domestic metals markets as well.

However, the domestic physical and future markets have not reacted throughout the scare. Low import levels over the past 6 months have isolated the domestic market from global prices as more orders have shifted to domestic mills. This prevents demand shocks, like the current coronavirus outbreak, from influencing the steel market in the United States.

The duration and severity of the virus could be significantly more contained than the SARS outbreak, which reduced demand in 2003. If the coronavirus outbreak is short-lived and contained, financial markets will quickly revert to their pre-virus levels and the impact on current economic demand will be minimal. Any decline in demand due to the virus is likely to be delayed, shifting it into the future. Moreover, demand within the steel market is unlikely to be affected and buying decisions will be based on low on inventories that have to be restocked at the spot price. If this buying happens across the under inventoried supply chain at the same time, it will push prices higher for those who wait. The market is dynamic, and just because prices are available today, does not mean that they will be there tomorrow.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

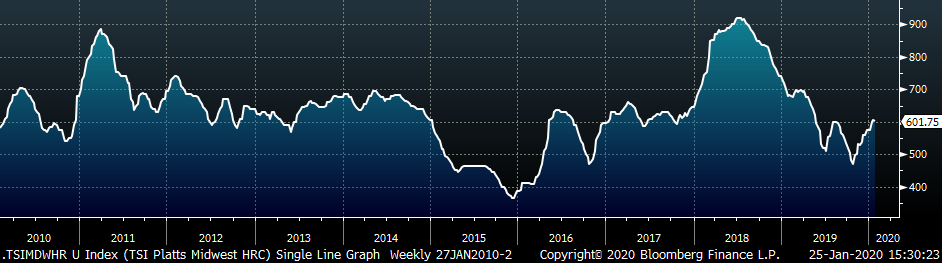

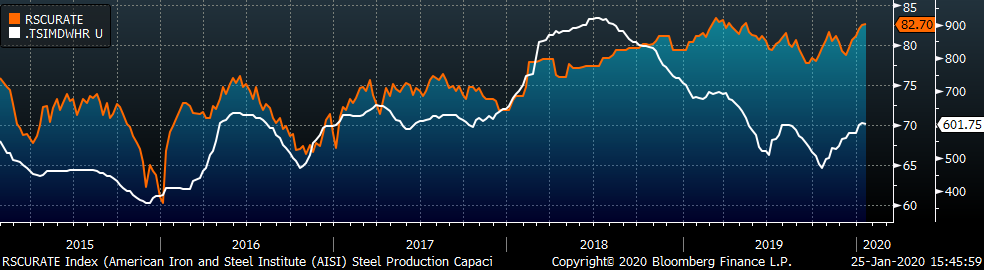

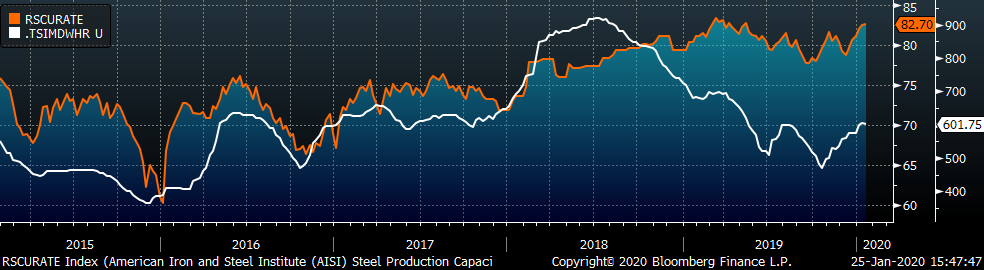

The Platts TSI Daily Midwest HRC Index was down $3.25 to $601.75.

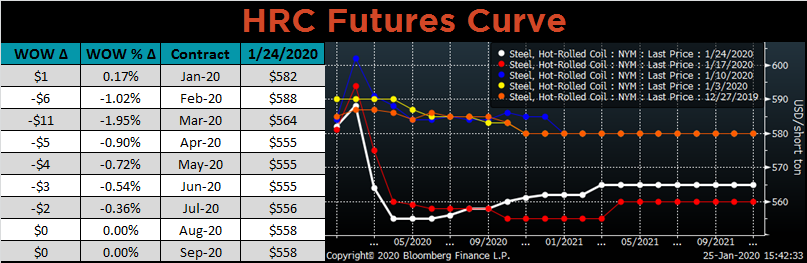

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The curve shifted slightly lower in the first half of 2020, while showing very little change in the back.

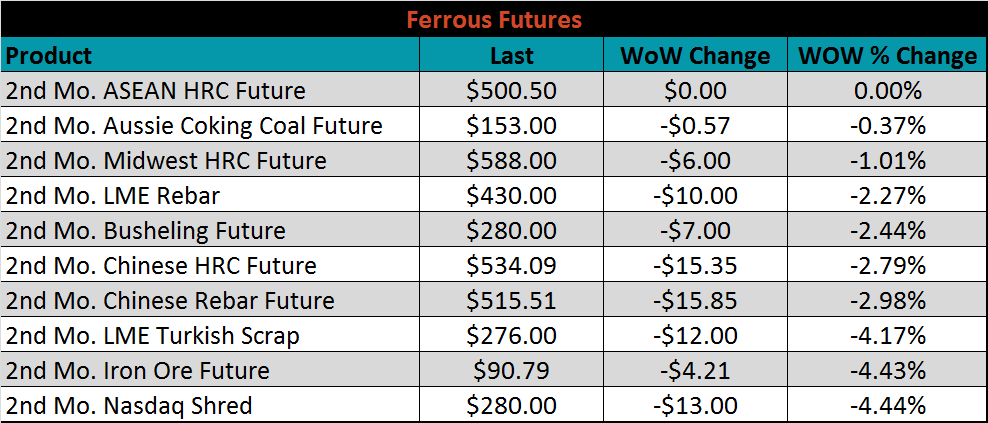

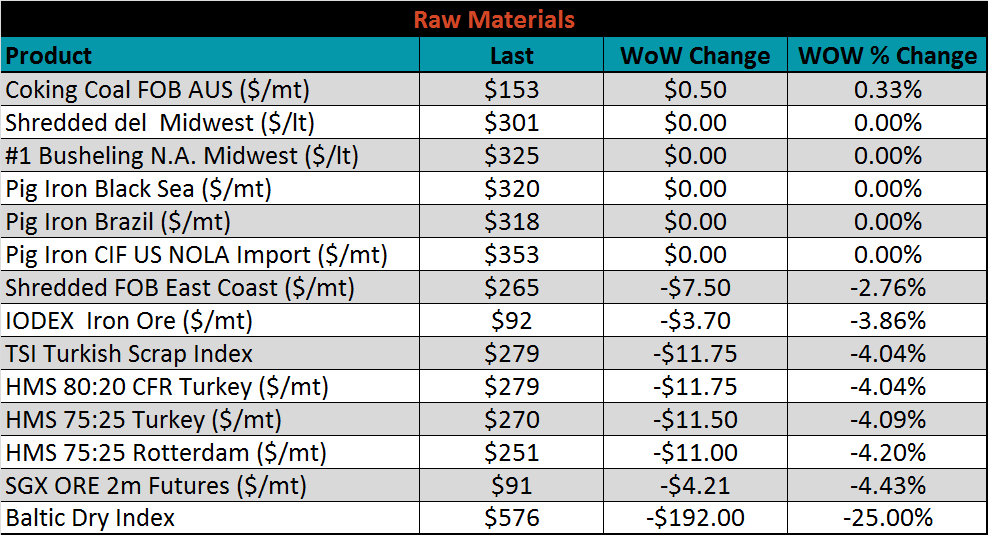

March ferrous futures were mostly lower. The Nasdaq shred, iron ore and Turkish scrap futures each lost over 4%.

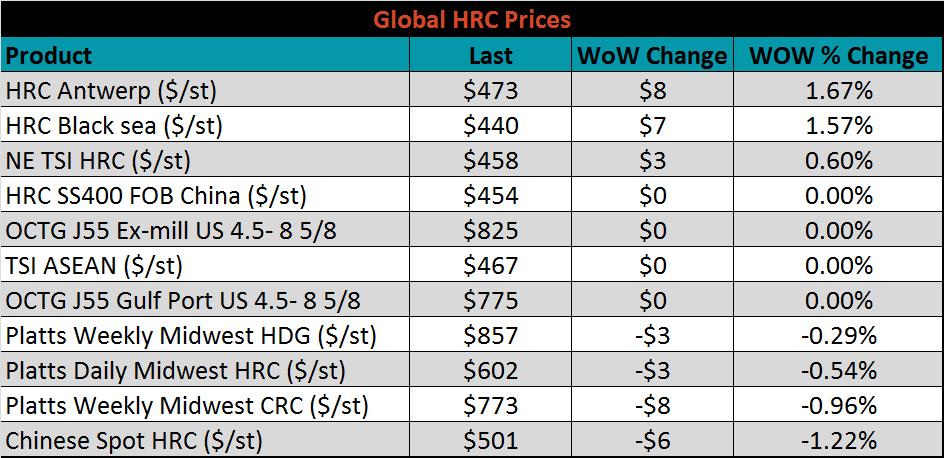

The global flat rolled indexes were mixed. TSI Antwerp HRC was up 1.7%, while Chinese spot HRC was down 1.2%.

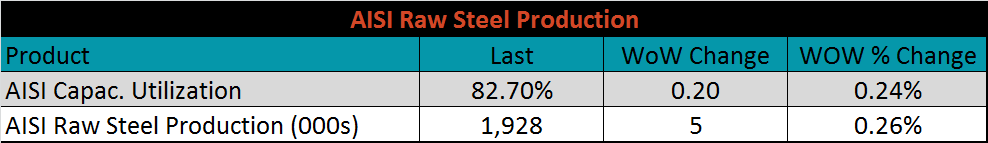

The AISI Capacity Utilization Rate was up 0.2% to 82.7% and raw steel production continues to grind higher.

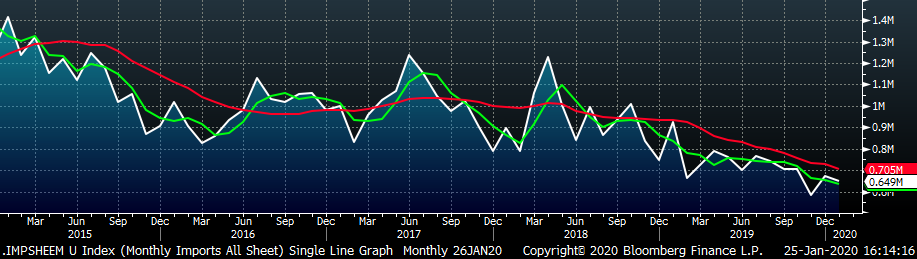

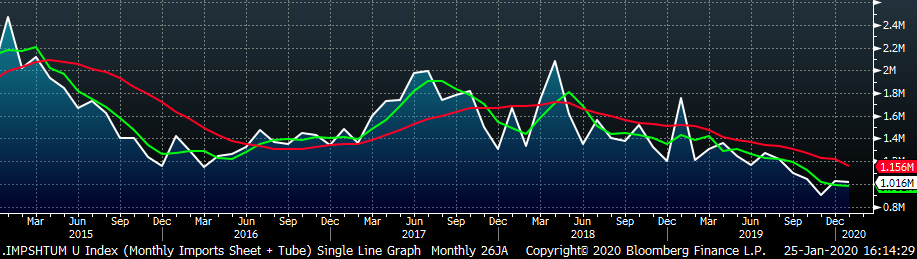

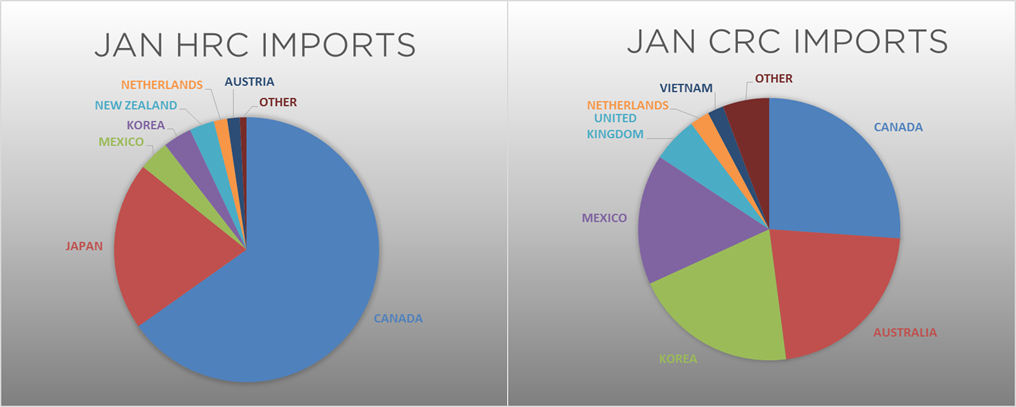

January flat rolled import license data is forecasting a decrease of 25k to 649k MoM.

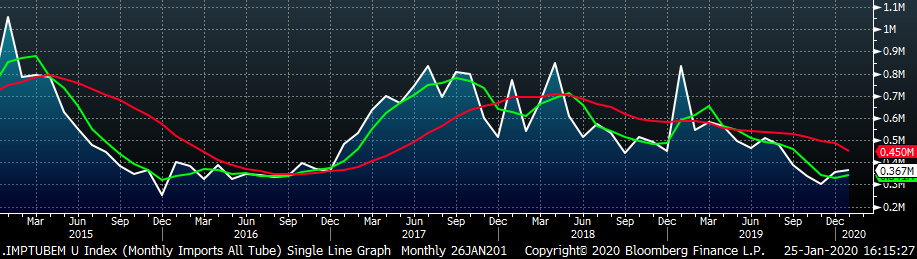

Tube imports license data is forecasting a MoM increase of 8k to 367k tons in January.

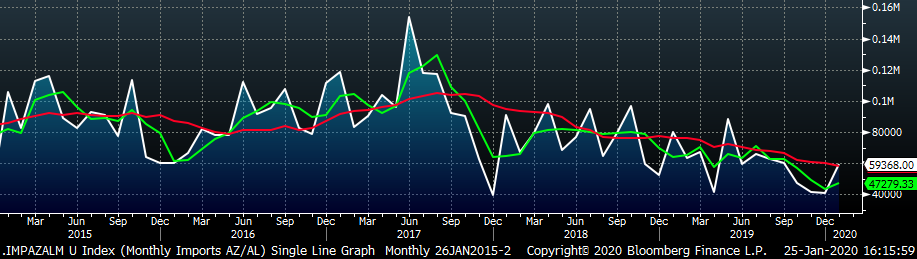

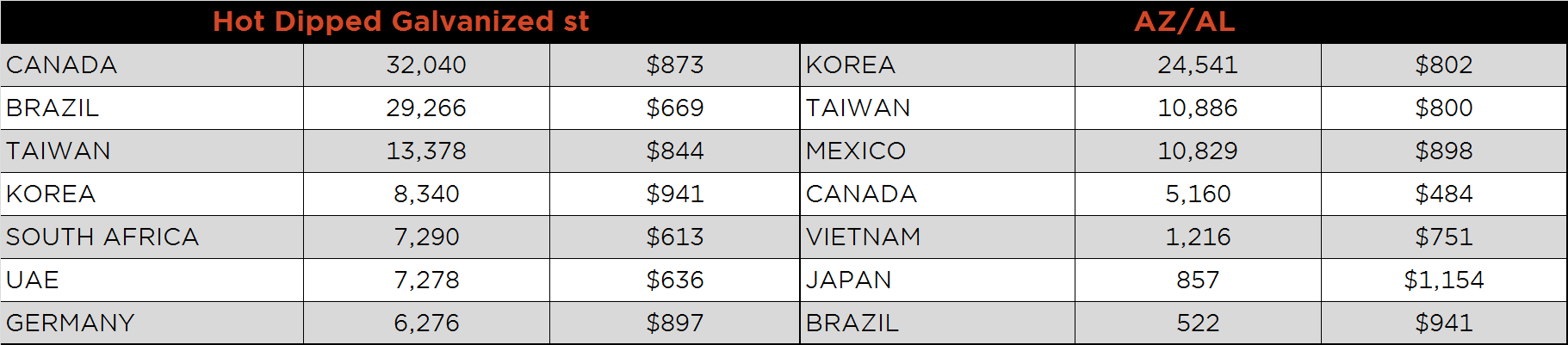

AZ/AL import license data is forecasting an increase of 13k in January to 59k.

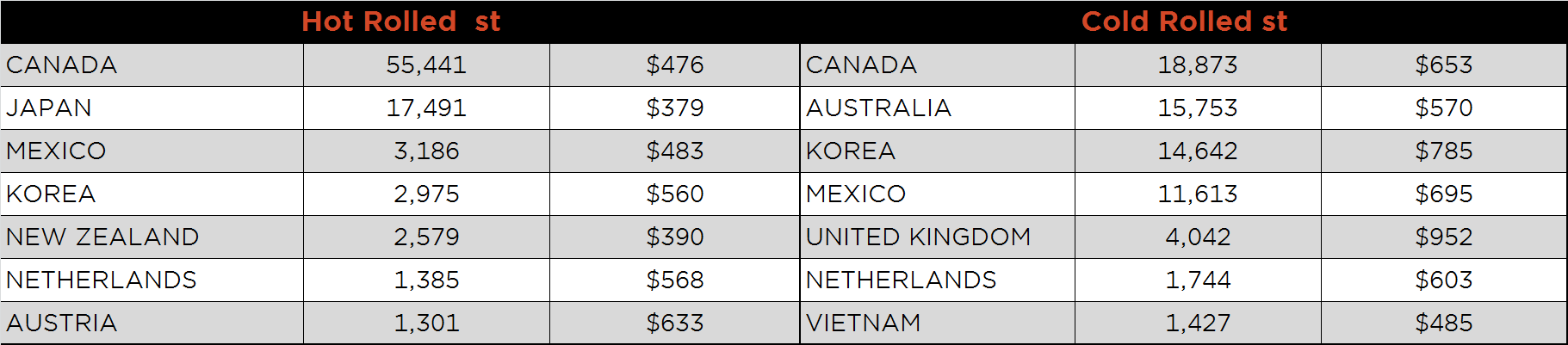

Below is January import license data through January 21, 2020.

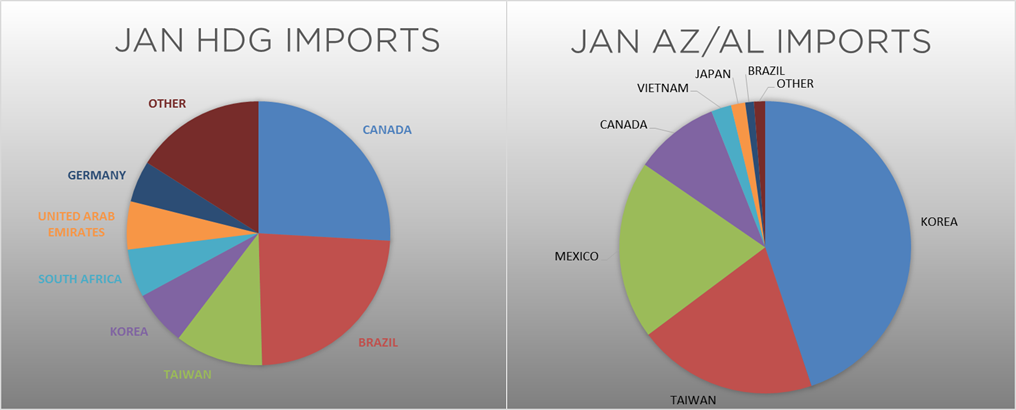

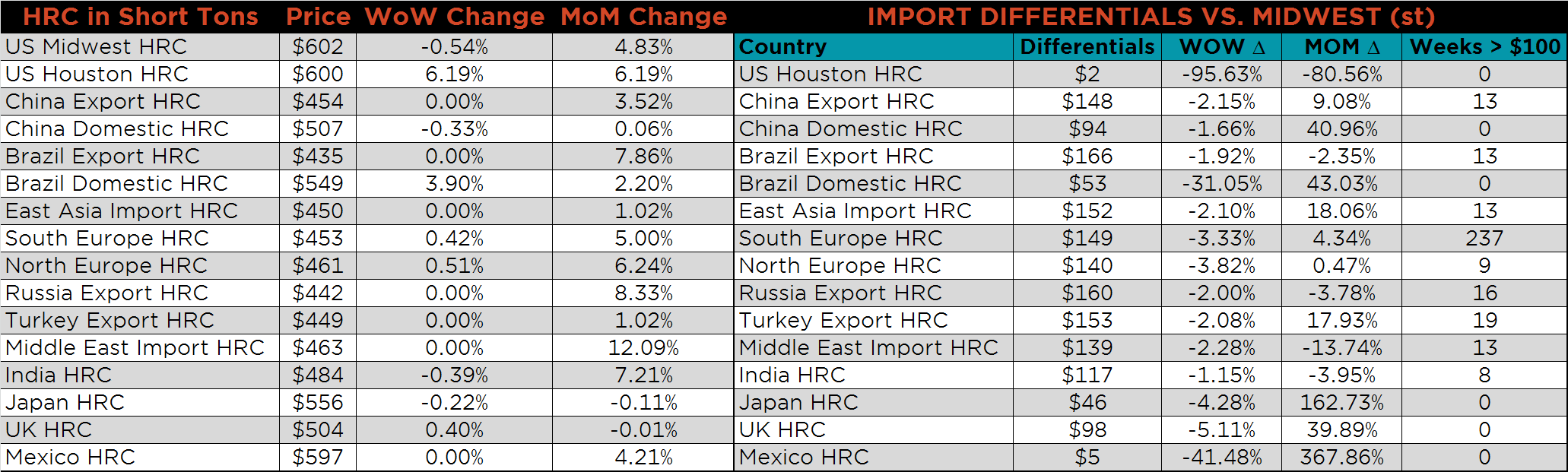

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All the differentials were slightly lower this week.

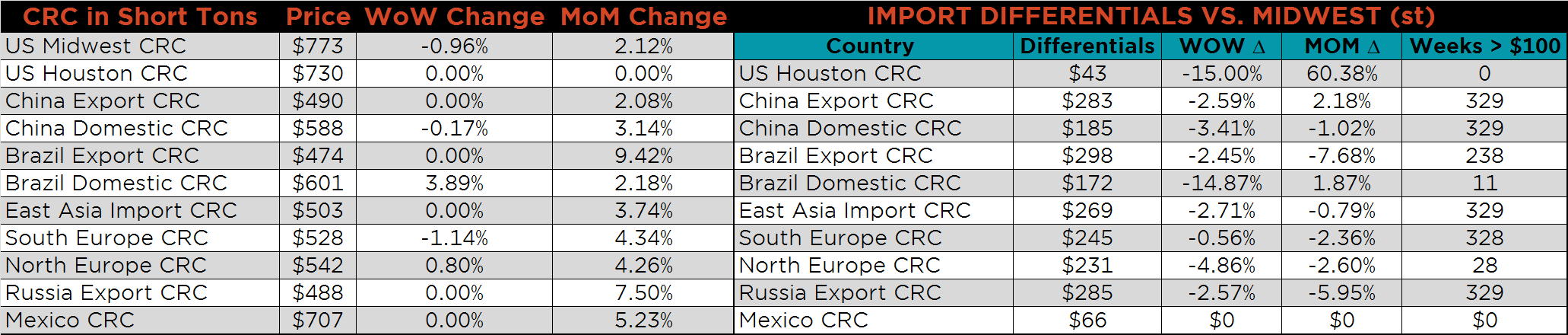

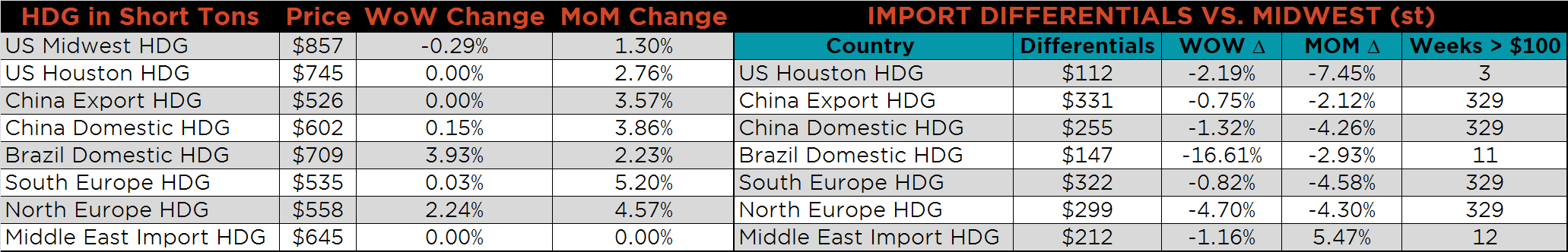

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest CRC, HRC and HDG prices were all down, 1%, 0.5% and 0.3%, respectively. Globally, export prices changed very little.

Raw material prices were flat or lower, led by SGX ore, down 4.4%.

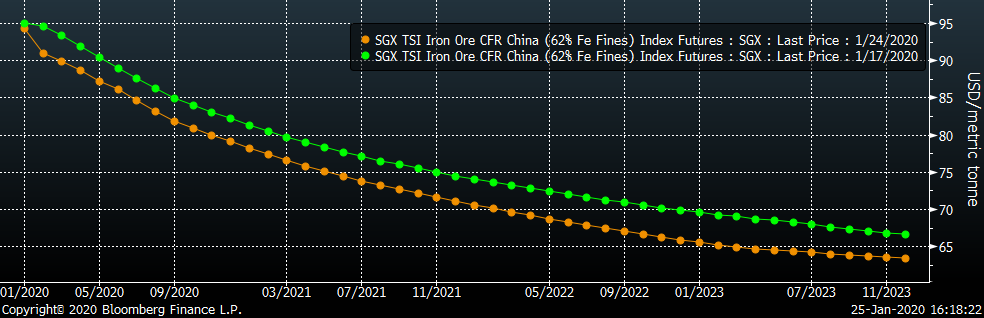

Below is the iron ore future curve with Friday’s settlments in orange, and the prior week’s settlements in green. The entire curve shifted lower again this week.

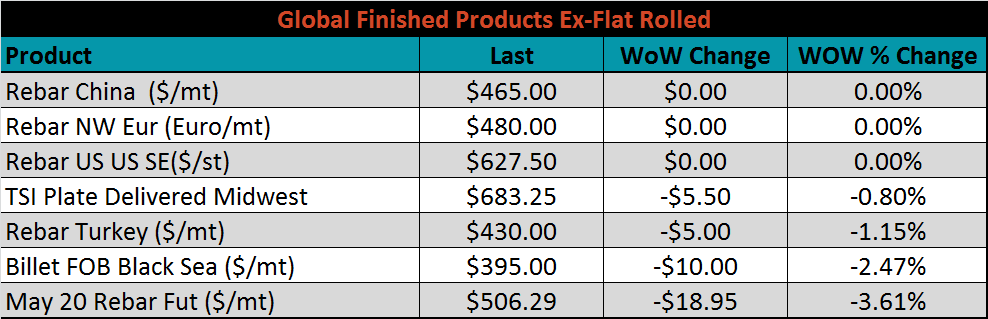

The ex-flat rolled prices are listed below.

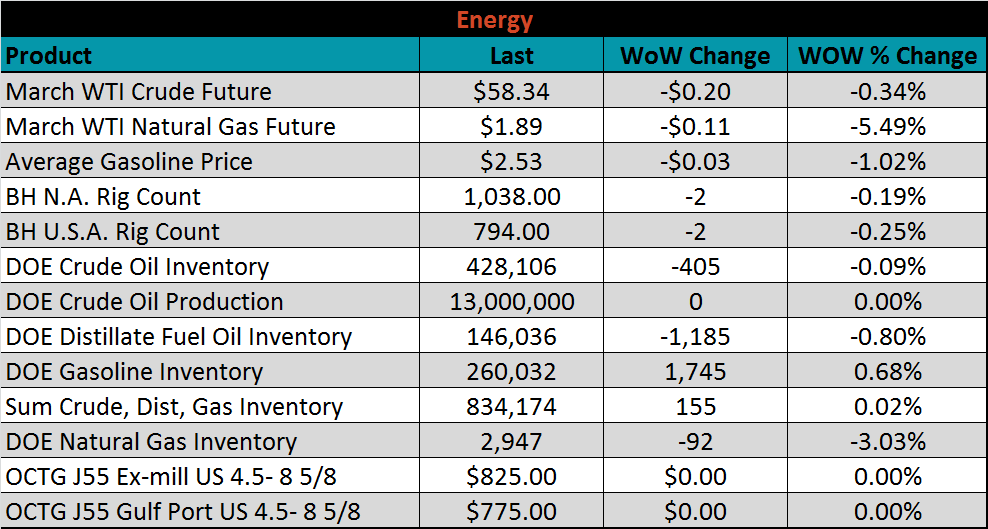

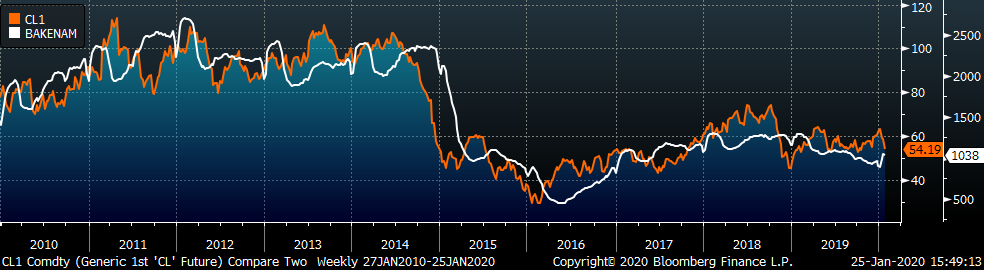

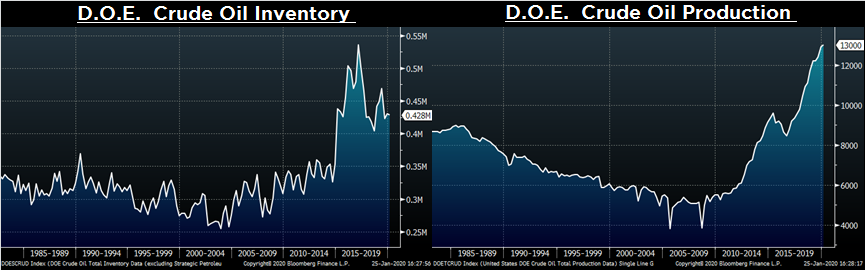

Last week, the March WTI crude oil future lost $0.20 or 0.3% to $58.34/bbl. The aggregate inventory level was essentially flat and crude oil production remains at 13m bbl/day. The Baker Hughes North American rig count and U.S. rig count were each down two rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: