Content

-

Weekly Highlights

- Market Commentary

- Risks

The U.S. government has reopened as we anxiously await all of the import and economic data withheld since mid-December. The data should come out fast and furious any day dominating the news cycle. Most critical will be the reports on steel imports, durable goods and residential construction data.

The steel news cycle saw two major developments occur last week. The first was California Steel Industries announced a $40 price increase on flat rolled products. As of Tuesday afternoon (1/29), Nucor, US Steel and ArcelorMittal have also announced price increases of $40 per ton. The second was a dam break at one of Vale’s Brazilian mining operations that caused massive flooding, 65 deaths, hundreds more missing and devastating environmental damage. It is uncertain how this will affect Vale’s production and the global iron ore trade, but iron ore futures have moved sharply higher in response closing at $83.40/t, the highest level since March 2017.

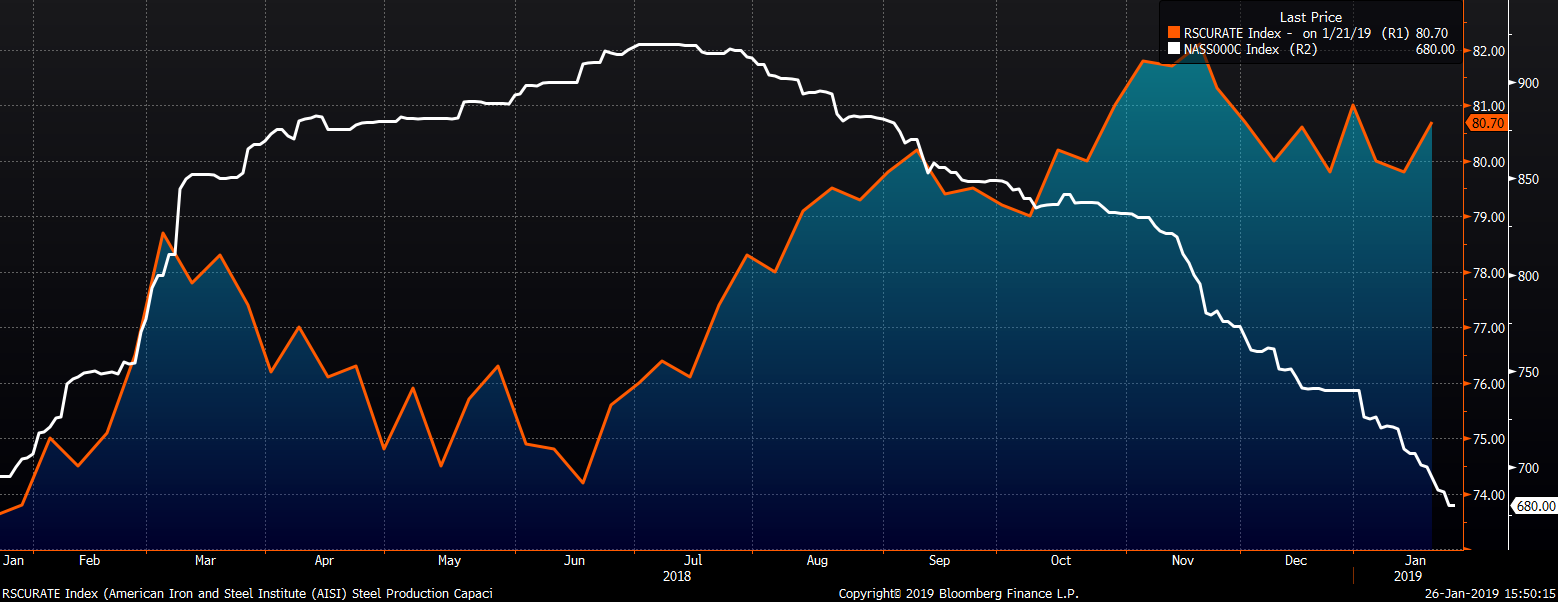

Last week, this report looked at the increase in YoY AISI production, service center inventory and the increase in capacity with the addition of Granite City and JSW asking the question “is there simply too much steel.” How will the market react to these price increases is the top question the industry faces right now. The analysis starts with the buy side. How will OEM’s react? Has their new orders slowed materially to the point that their months-on-hand have risen and they don’t need to restock and can simply buy hand-to-mouth or are they short stock and therefore faced with another scramble to buy?

What is the health of the service center industry? Did the sharp drop in flat rolled prices dramatically weaken their balance sheets? Are they in trouble with their lenders and if so do they have the capital to push into restocking at higher prices or will they be the first to unload their higher priced inventory?

The analysis jumps to the supply side and its very complicated. Can mini-mills hold out for higher prices or will their ultra-low lead times force them to sell at a discount to spot in order to fill their mills? Is there a “turf war” with incumbent fighting to keep their customer’s purchase orders while the additional capacity works to take those customers’ orders away? Can the mills keep the discipline necessary to make this price increase a success given the current dynamics?

These are the questions and we will start getting feedback and answers in the coming days.

The following issues provide the foundation of our view:

Upside Risks:

Downside Risks:

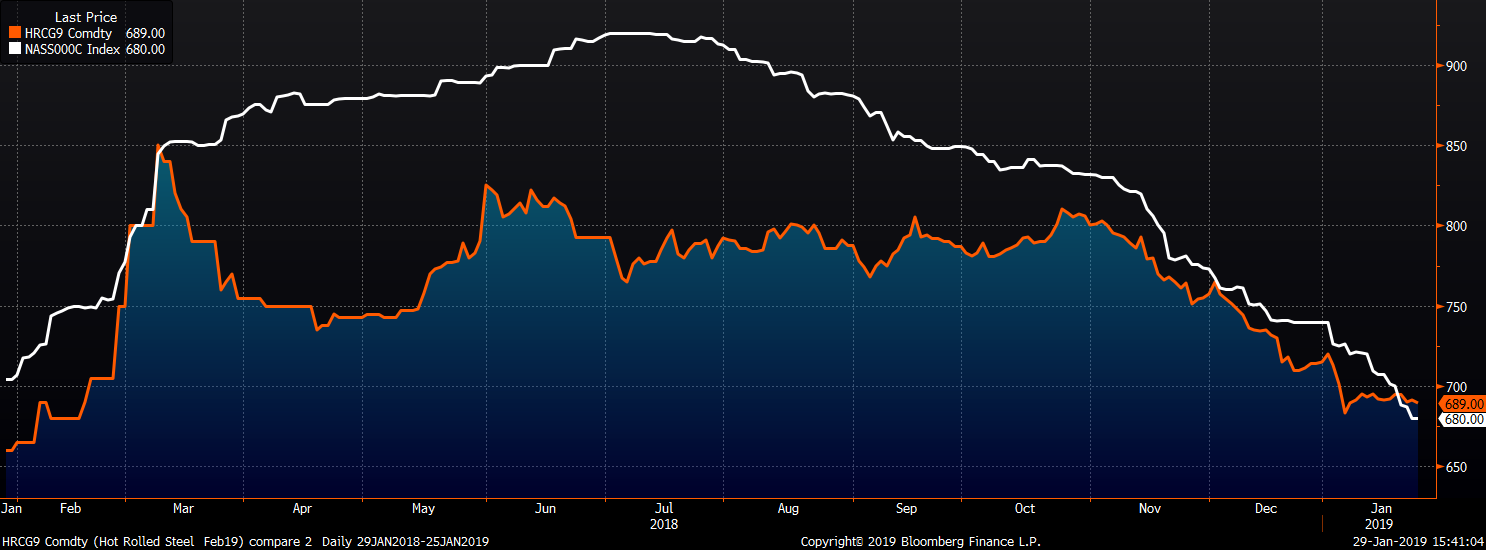

The February CME HRC future fell $6 to $689, while the Platts TSI Daily Midwest HRC Index was down $20 to $680.

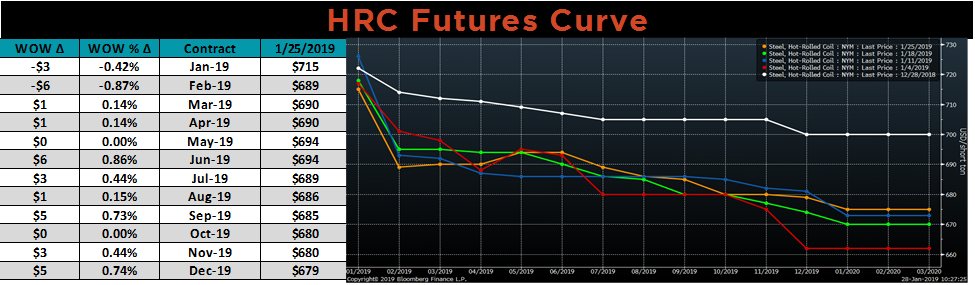

The CME Midwest HRC futures curve is below with last Friday’s settlements in orange. There was little change last week.

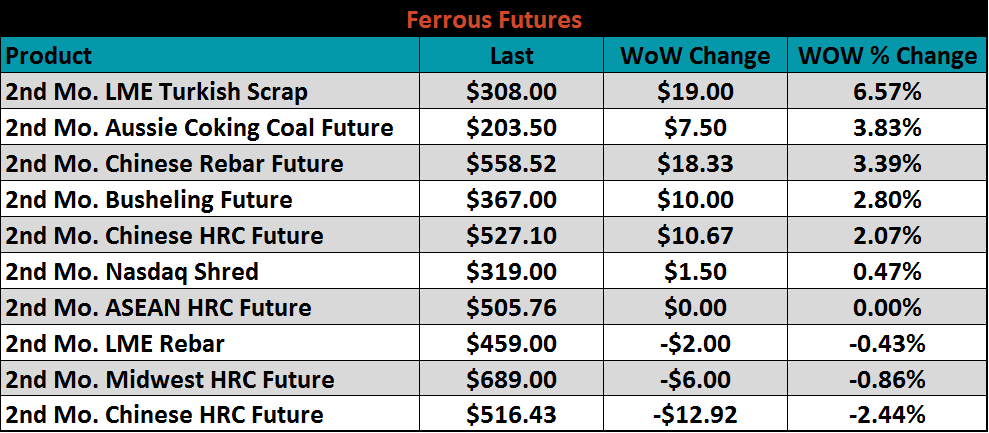

February ferrous futures are listed below. There was a nice rally across the space with scrap, coal and finished steel prices in China moving higher. Iron ore’s week over week decrease doesn’t reflect the after session gain that took place in reaction to Vale’s dam failure in Brazil.

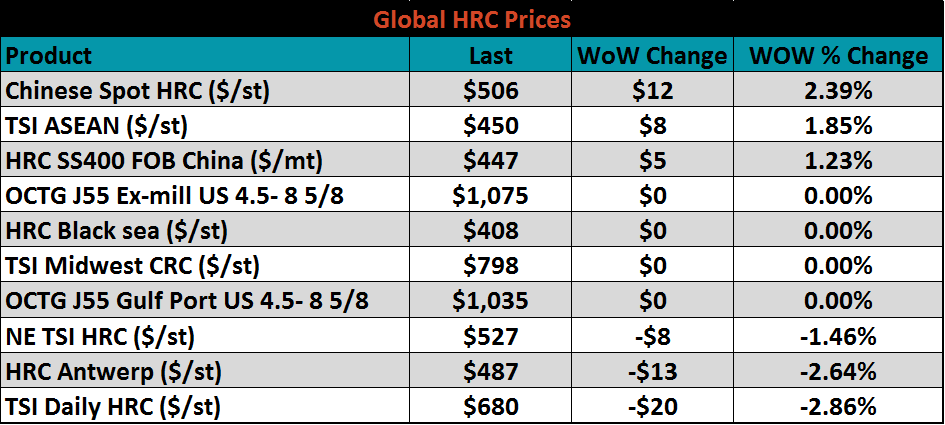

Flat rolled indexes were mixed. Asia saw gains, while Europe and the U.S. moved lower.

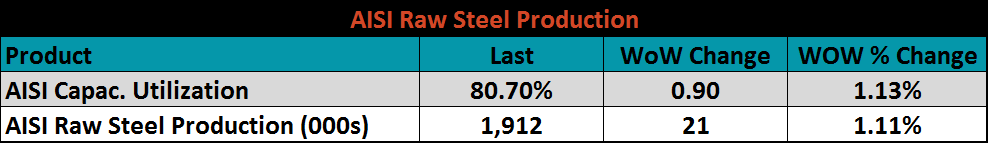

The AISI Capacity Utilization Rate decreased to 79.8%.

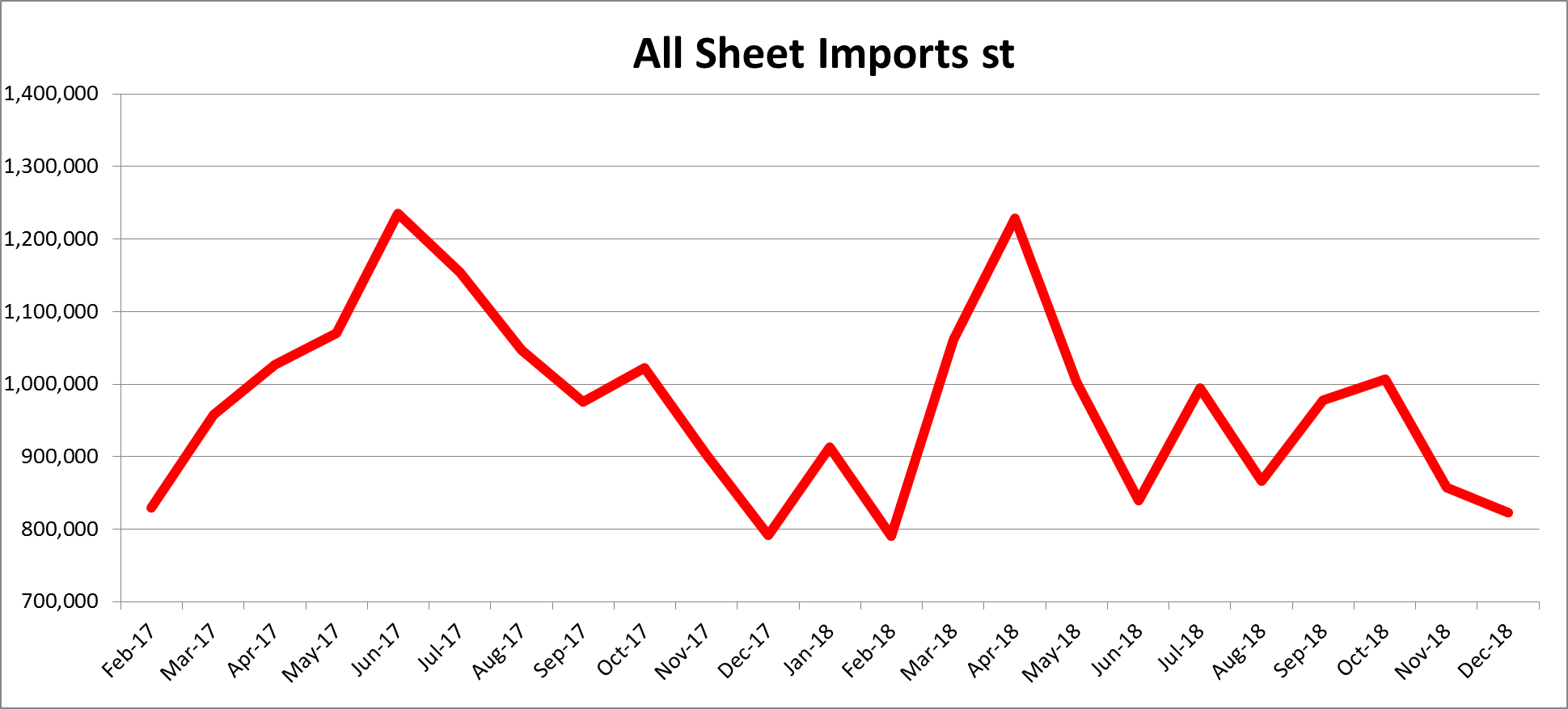

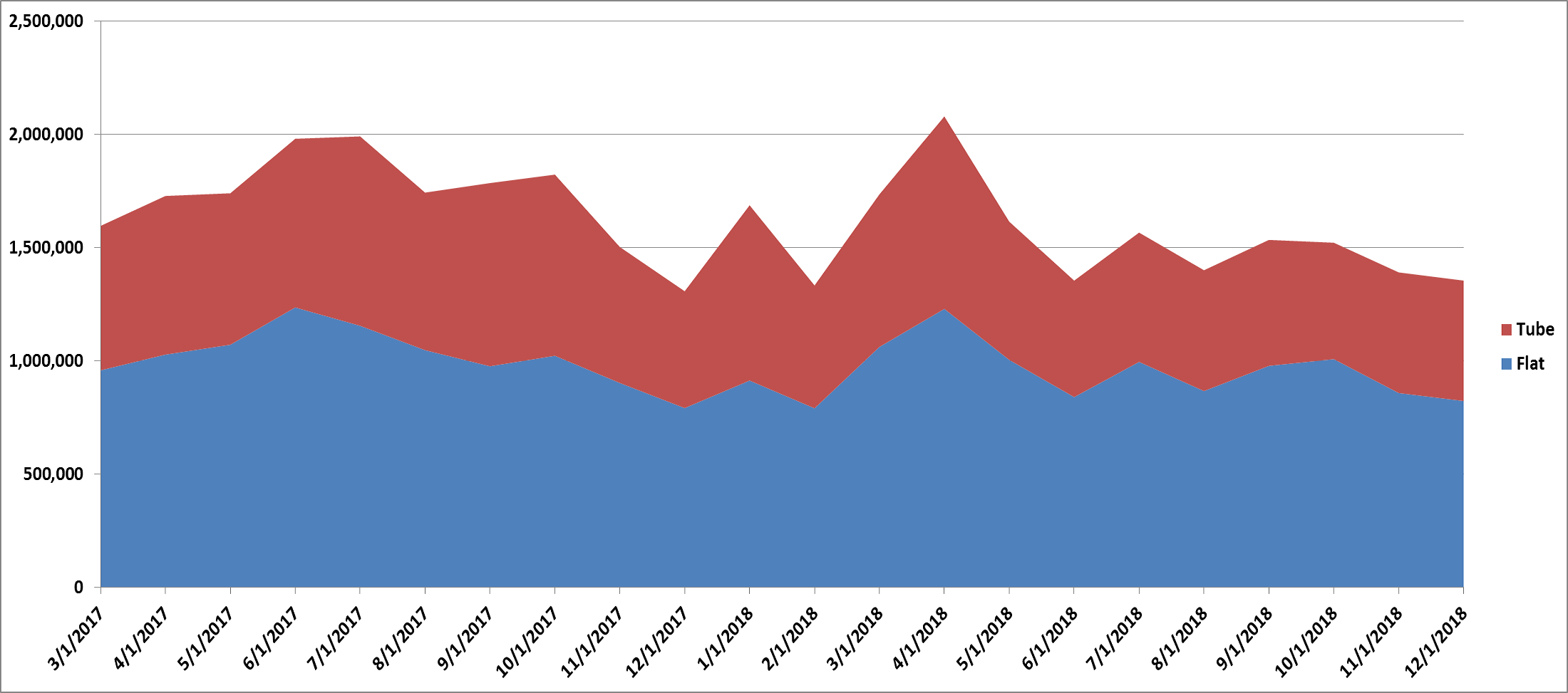

Import license data has been delayed by the shutdown. The last report we saw on December 18 showed December flat rolled import license data forecasting a 35k ton MoM decrease to 822k.

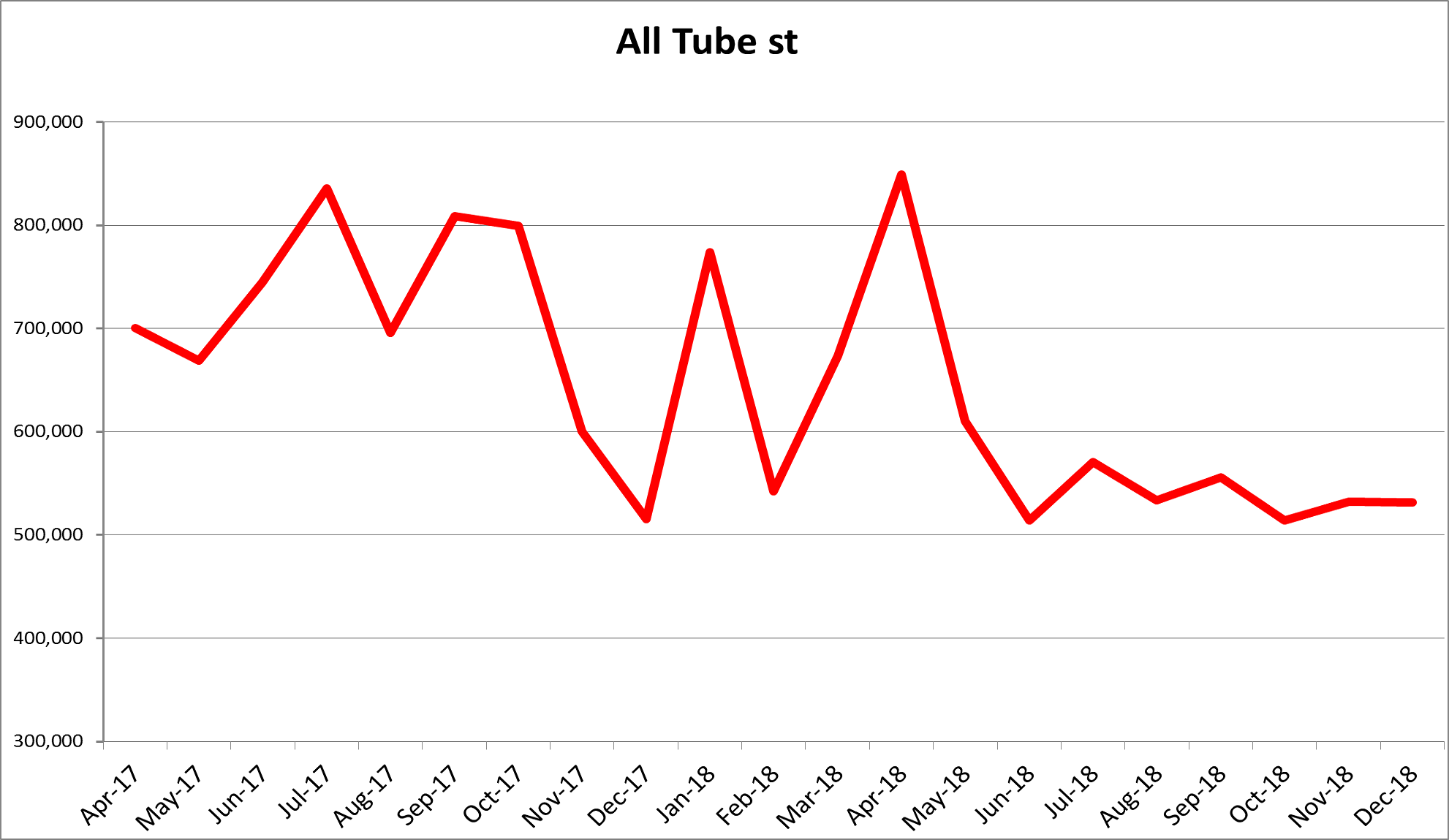

December’s tube import license data is forecasting little change MoM at 531k tons.

December’s combined flat rolled and tube import license data is forecasting 1.35m tons, slightly lower MoM.

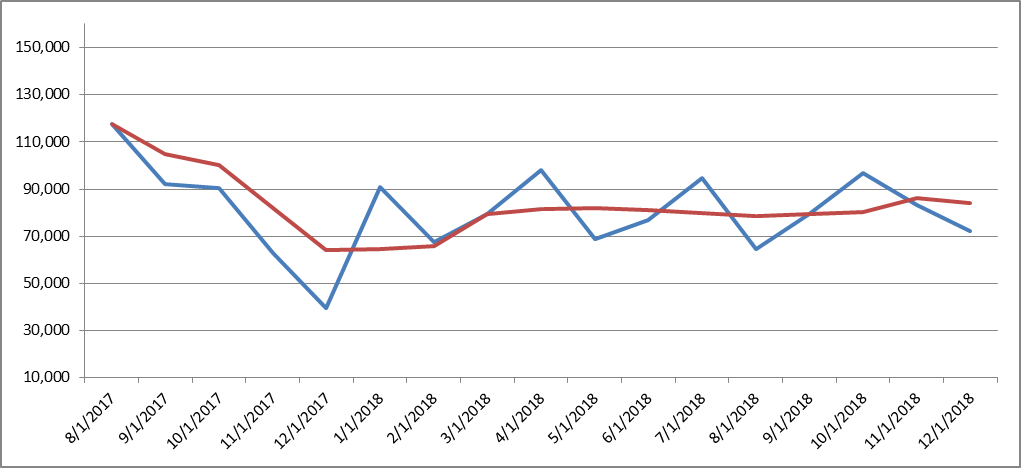

December AZ/AL import licenses are projecting a decrease of 11k tons MoM to 72k.

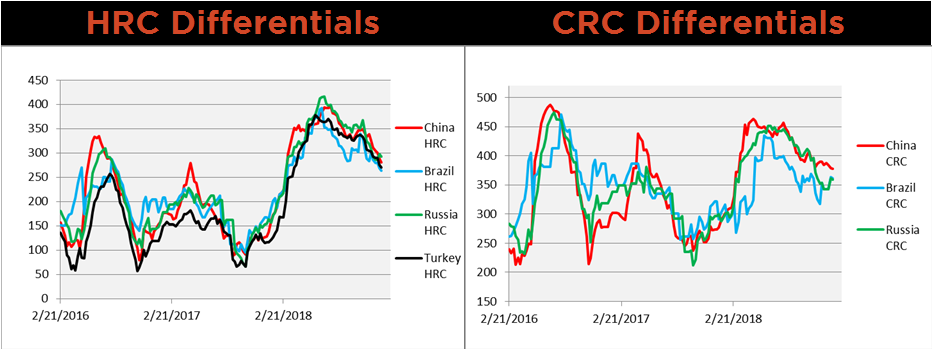

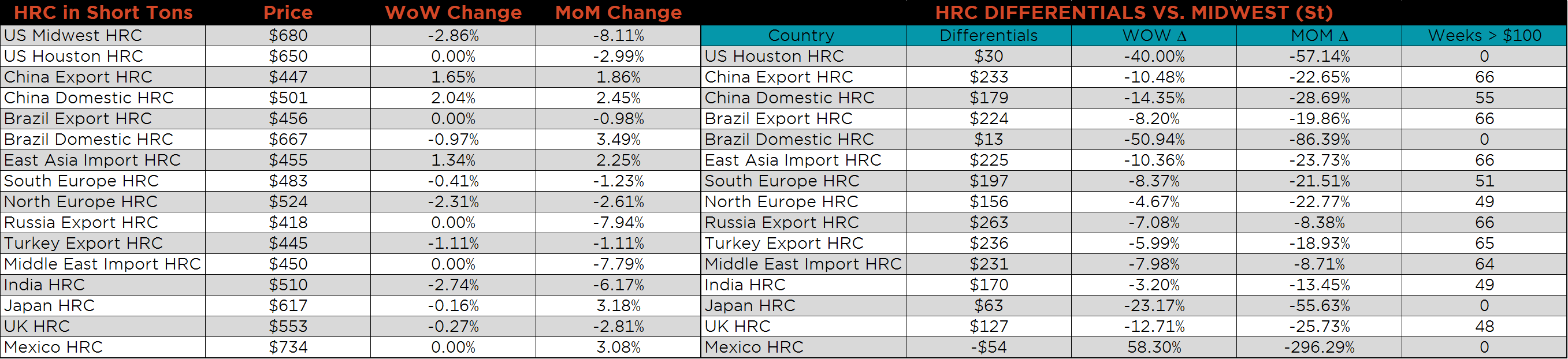

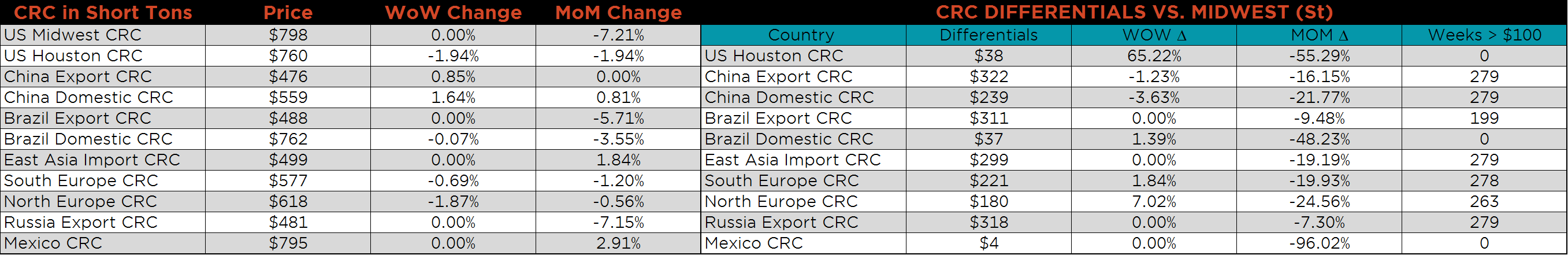

Below are HRC and CRC Midwest vs. each country’s export price differentials using pricing from SBB Platts. Both HRC and CRC are down WoW.

SBB Platt’s HRC, CRC and HDG WoW pricing is below. The U.S. Midwest HRC price was down 2.9% and the Midwest HDG price fell 3.4% while the Midwest CRC price was unchanged. The Northern European and Indian HRC prices were both down 2.7% and 2.3%, respectively. The Northern European CRC price was down 1.9%, while the Chinese Domestic CRC price was up 1.8%. Global HDG prices showed very little weekly change.

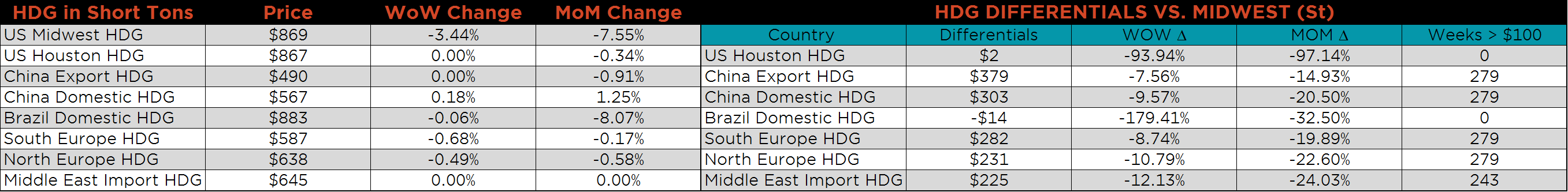

Listed below are ferrous raw materials WoW price changes. Scrap saw a broad based rally and coking coal gained 3.9%.

The March SGX iron ore future was down $0.26 to $73.11, while the February Turkish scrap future gained $13 to $308.00.

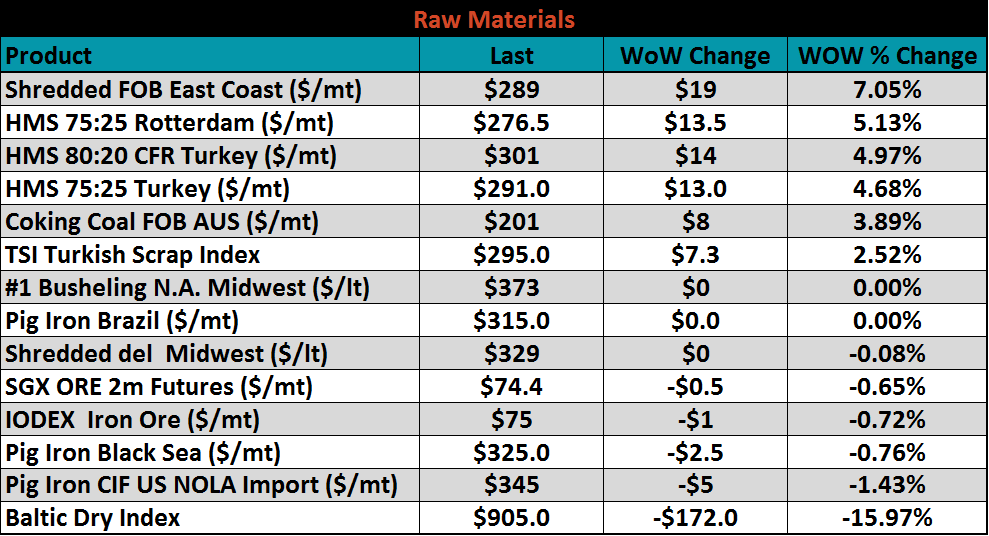

The SGX iron ore futures curve has rallied significantly with the front of the curve opening up slightly more than the later dated futures over the past month.

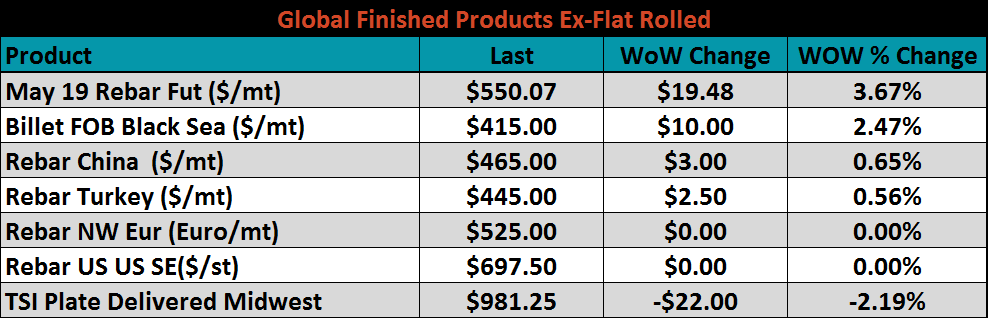

Ex-flat rolled prices were mixed with the May Shanghai rebar future up 3.7%, while Midwest plate was down 2.2%.

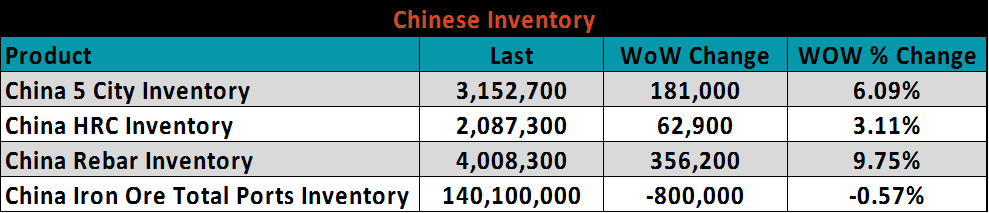

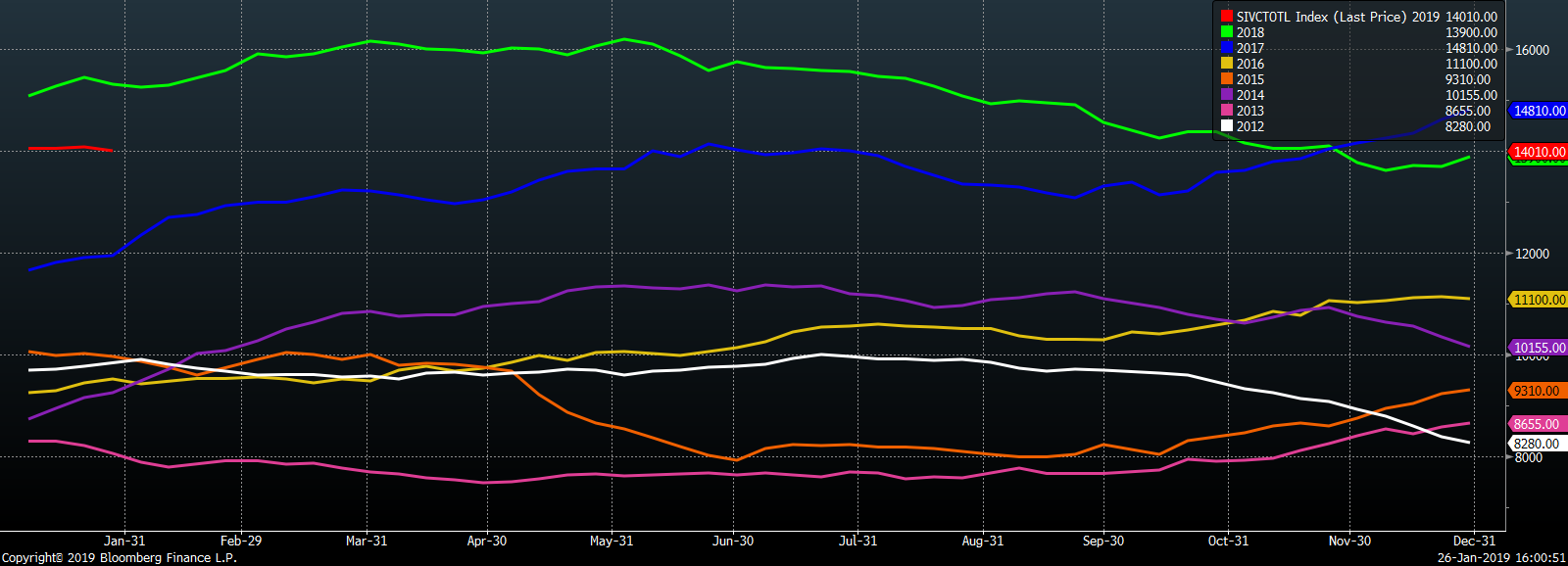

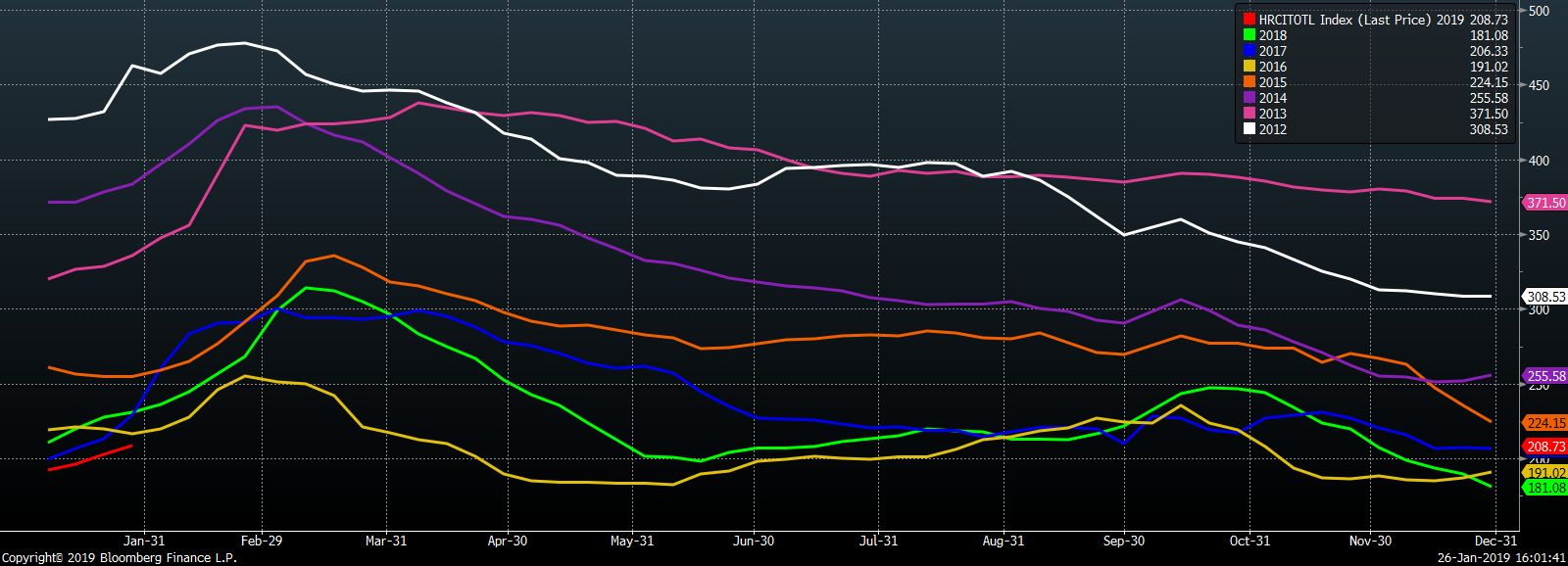

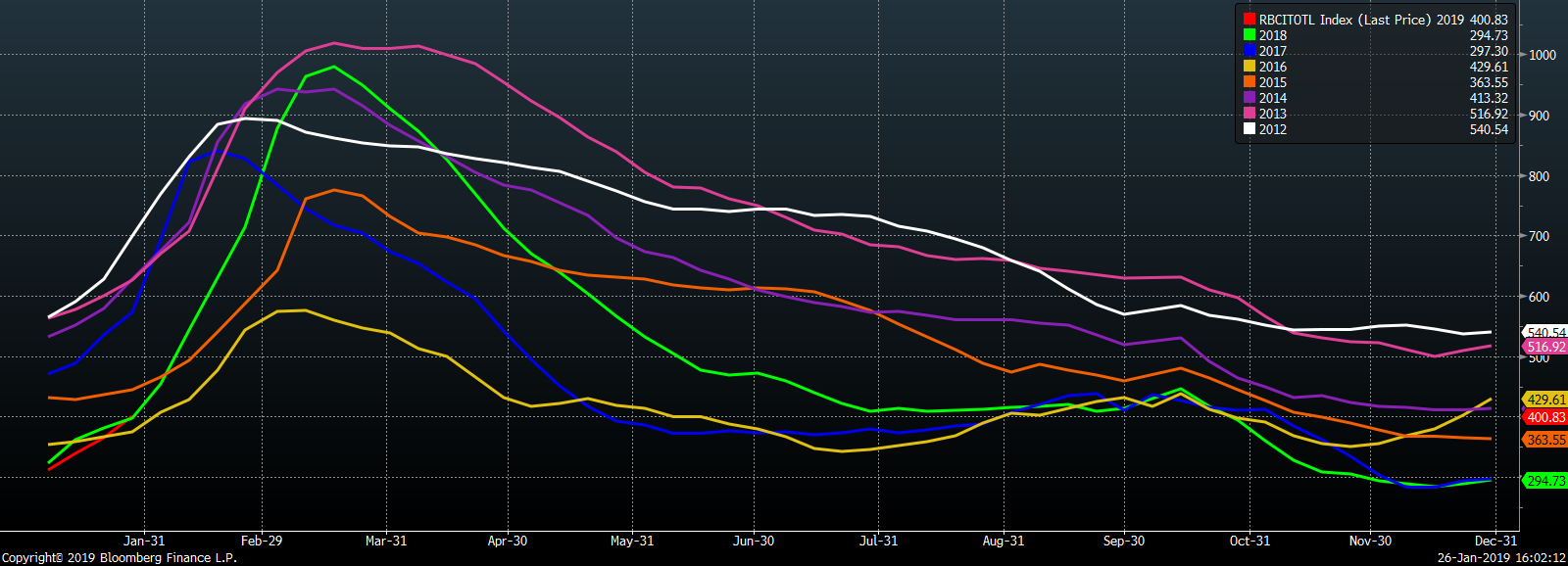

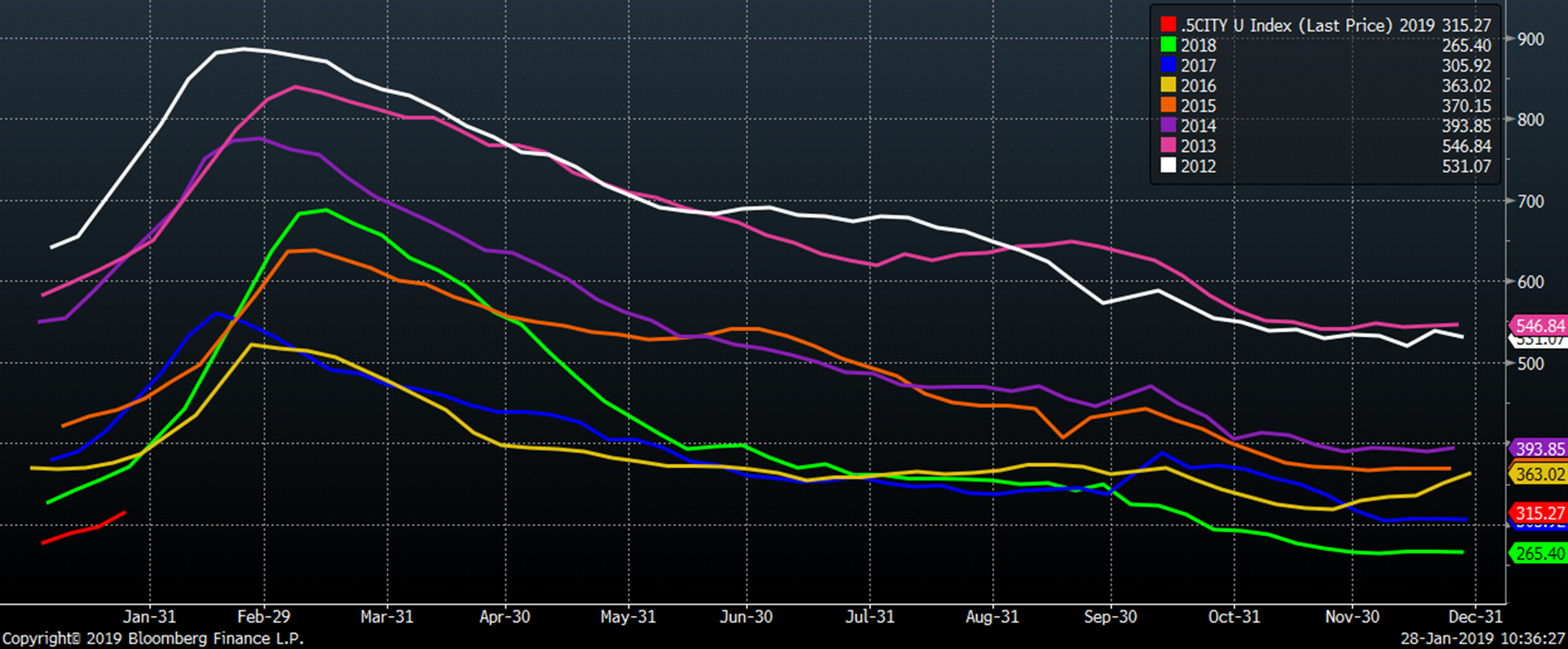

Below are inventory levels for Chinese finished steel products and iron ore. Chinese rebar and HRC inventory rose 9.7% and 3.1%, respectively. 5-City inventory level rose 6.1%. Even with these increases HRC and 5-City inventory levels remain at the lowest level for this week since 2012.

Last week’s economic data is below. The January K.C. Fed Manufacturing Activity Index printed 5, which ended up being down MoM after December was revised higher to 6. The Richmond Fed Manufacturing Index printed -2, up from last month’s -8. December existing home sales fell to a 4.99m annualized rate and missed expectations of a 5.24m rate.

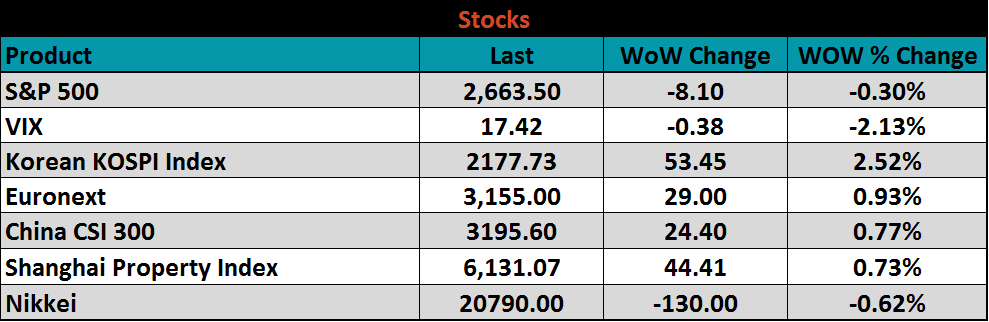

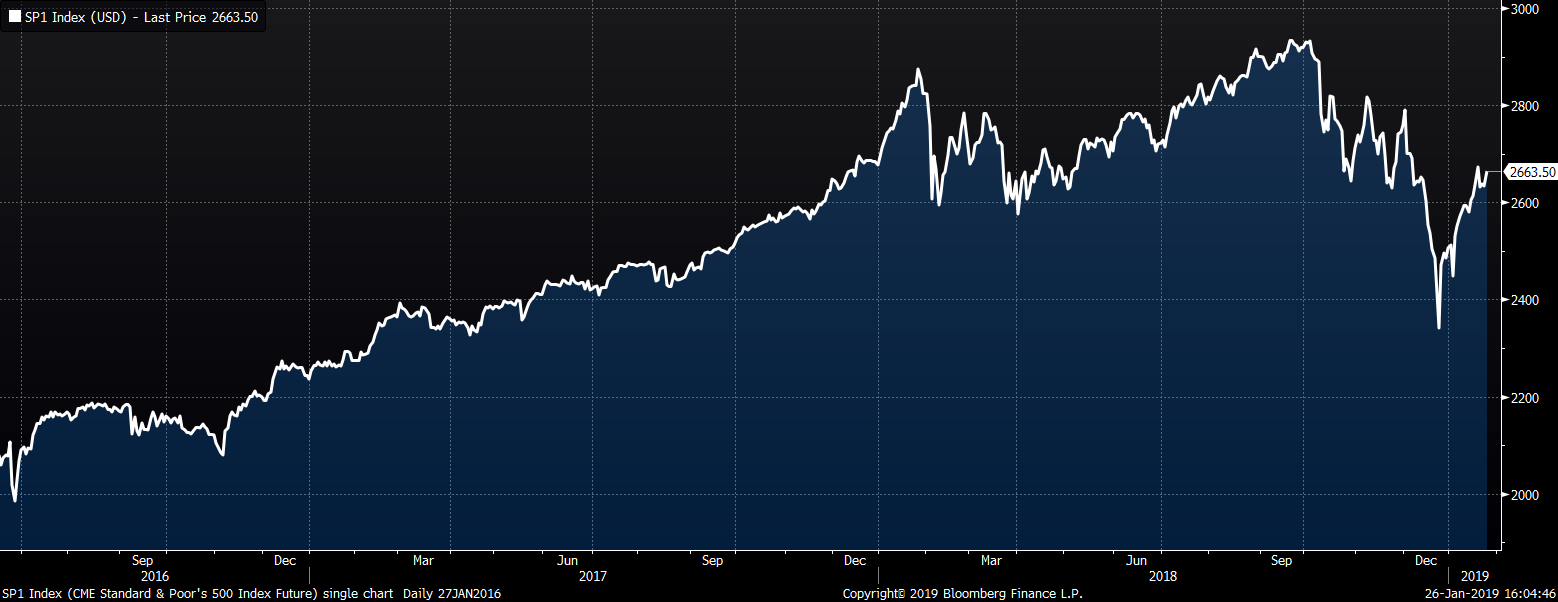

The S&P 500 was down slightly 0.3%, while the Korean KOSPI Index was up 2.5%

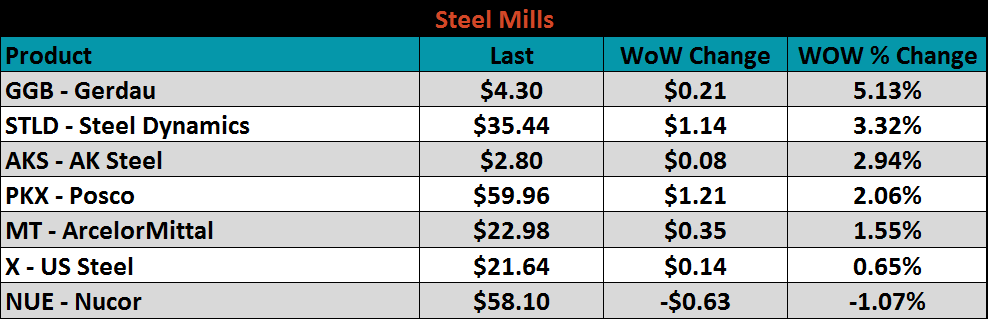

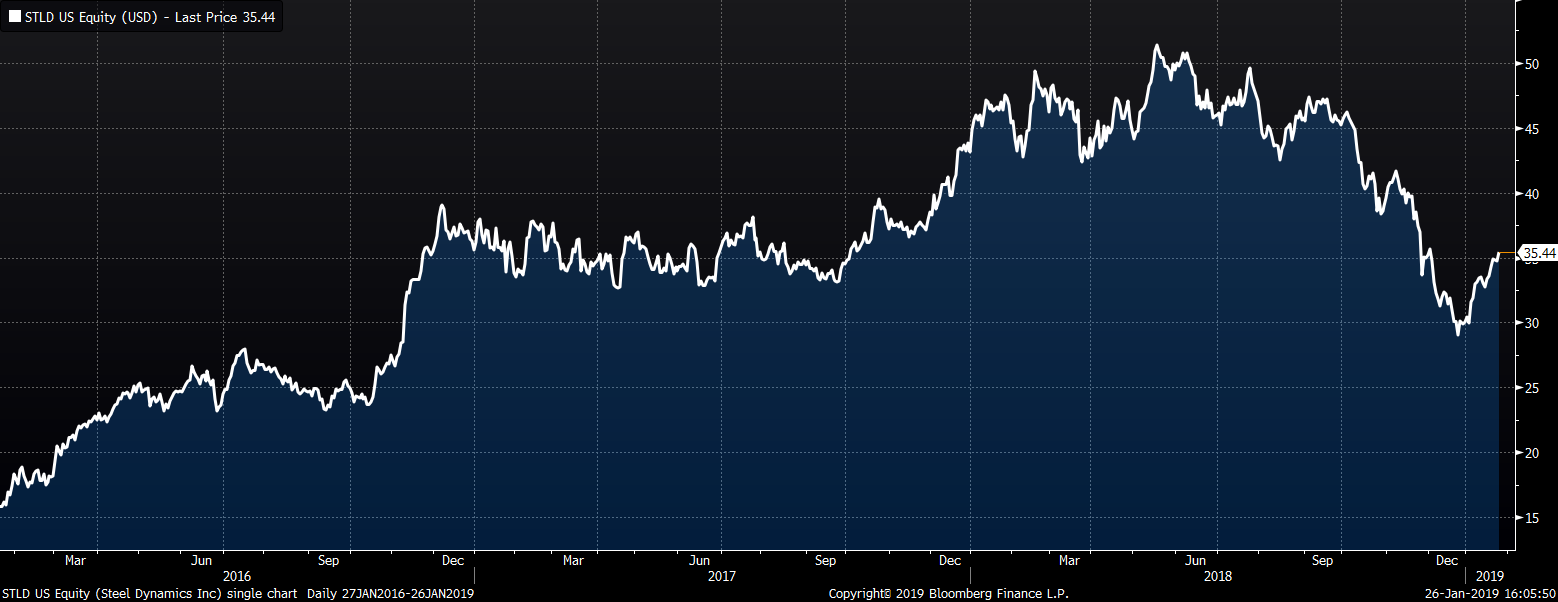

Steel mill stocks were mostly higher. Gerdau and Steel Dynamics were up 5.1% and 3.3%, respectively.

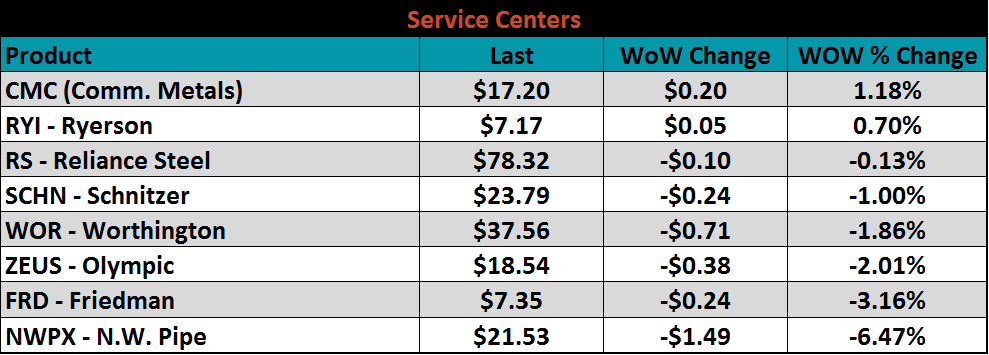

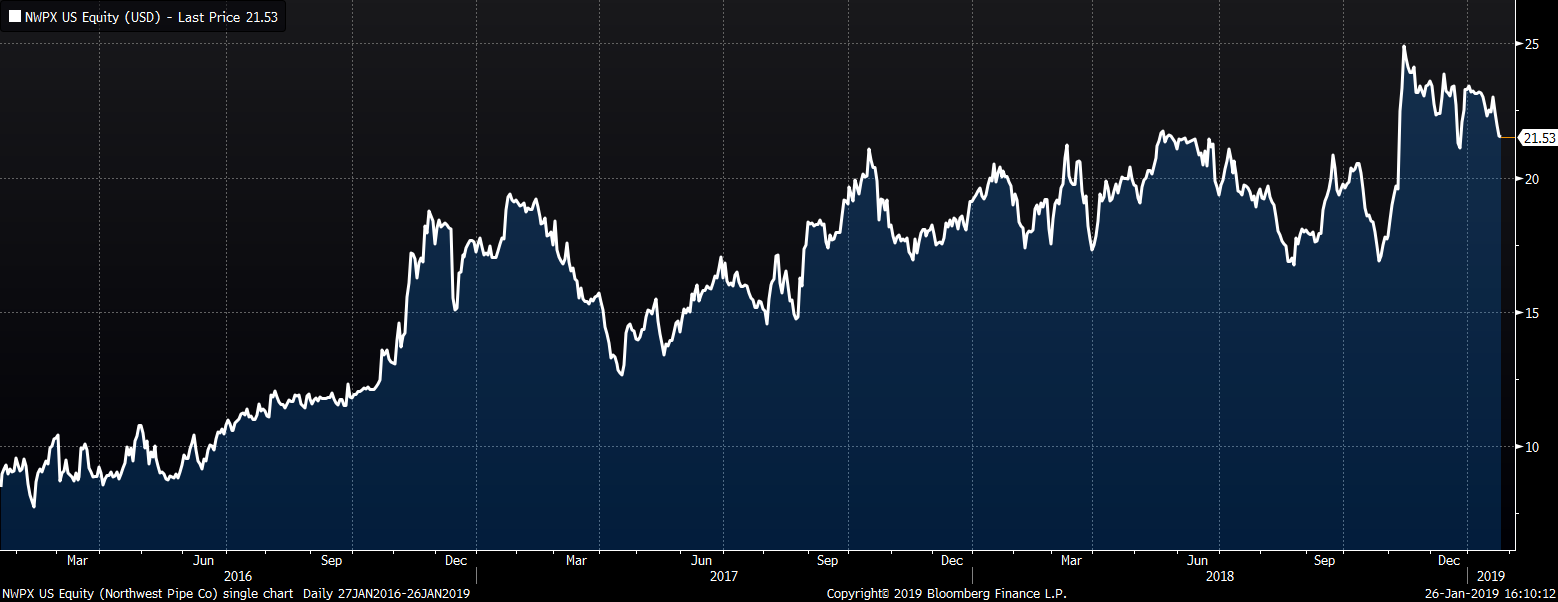

Service center stock’s weekly performances were mostly lower. Northwest Pipe Co. was down 6.5%.

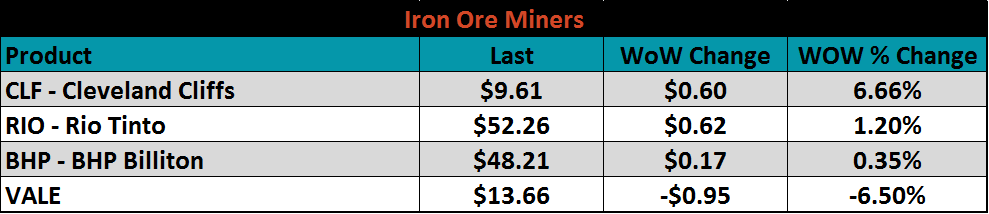

Mining’s stocks were mixed with Cleveland Cliffs up 6.7%, while Vale was down 6.5% WoW.

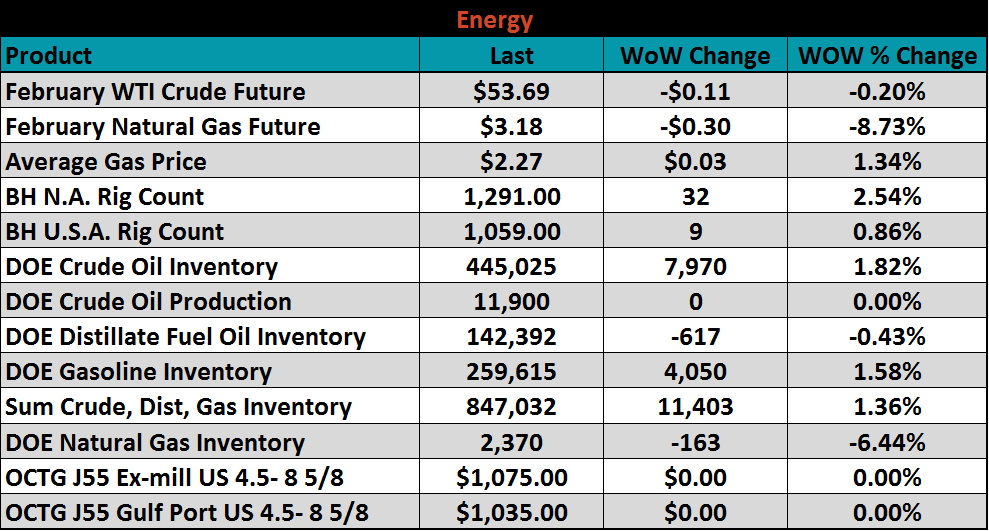

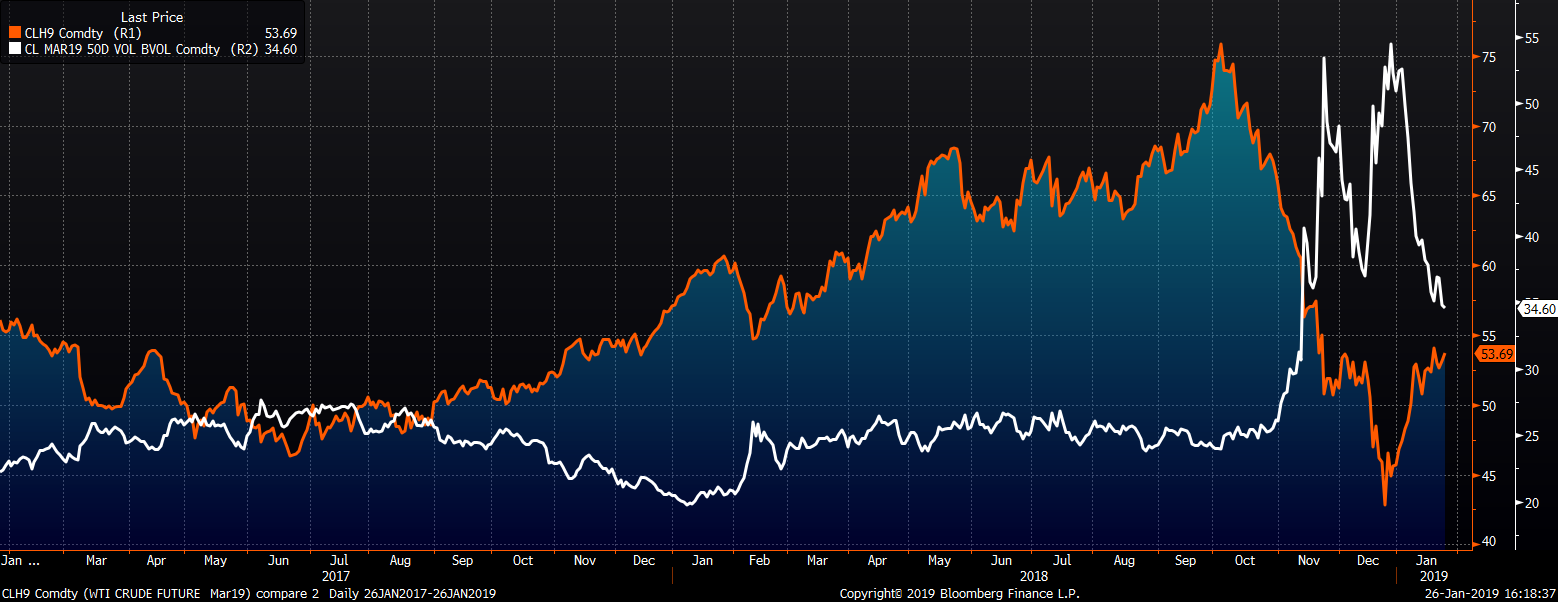

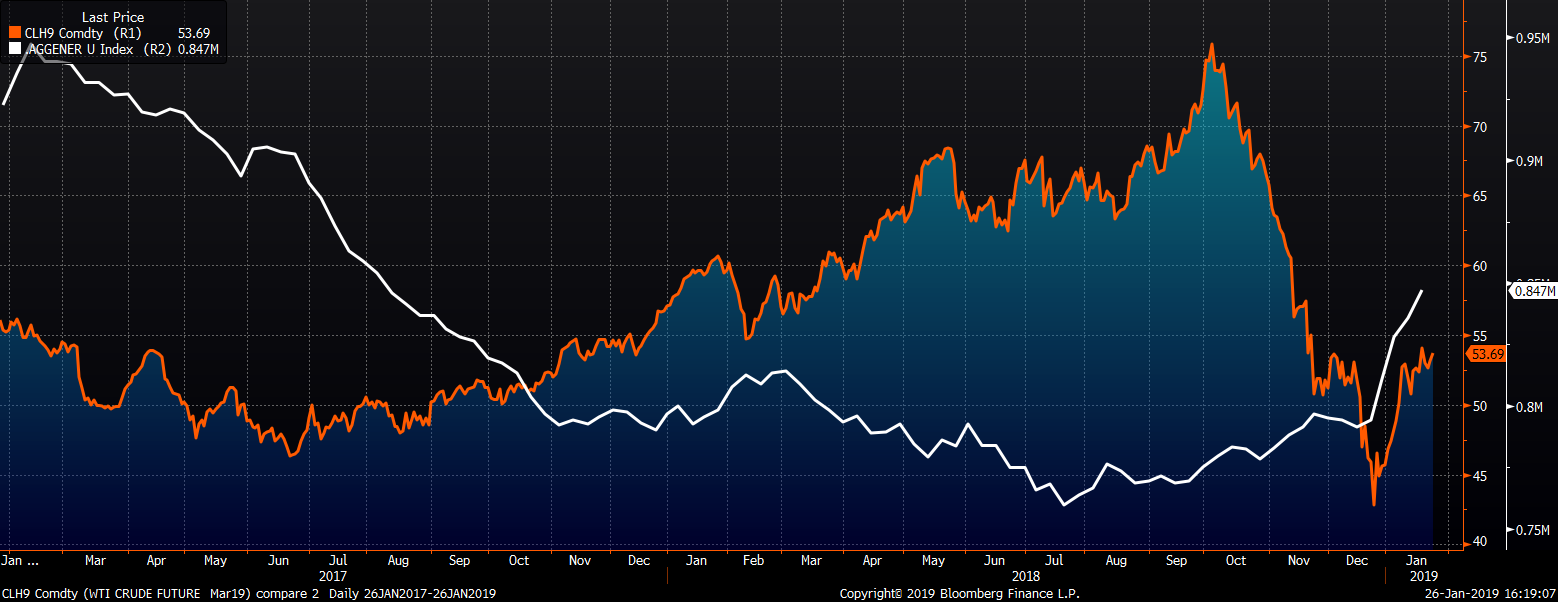

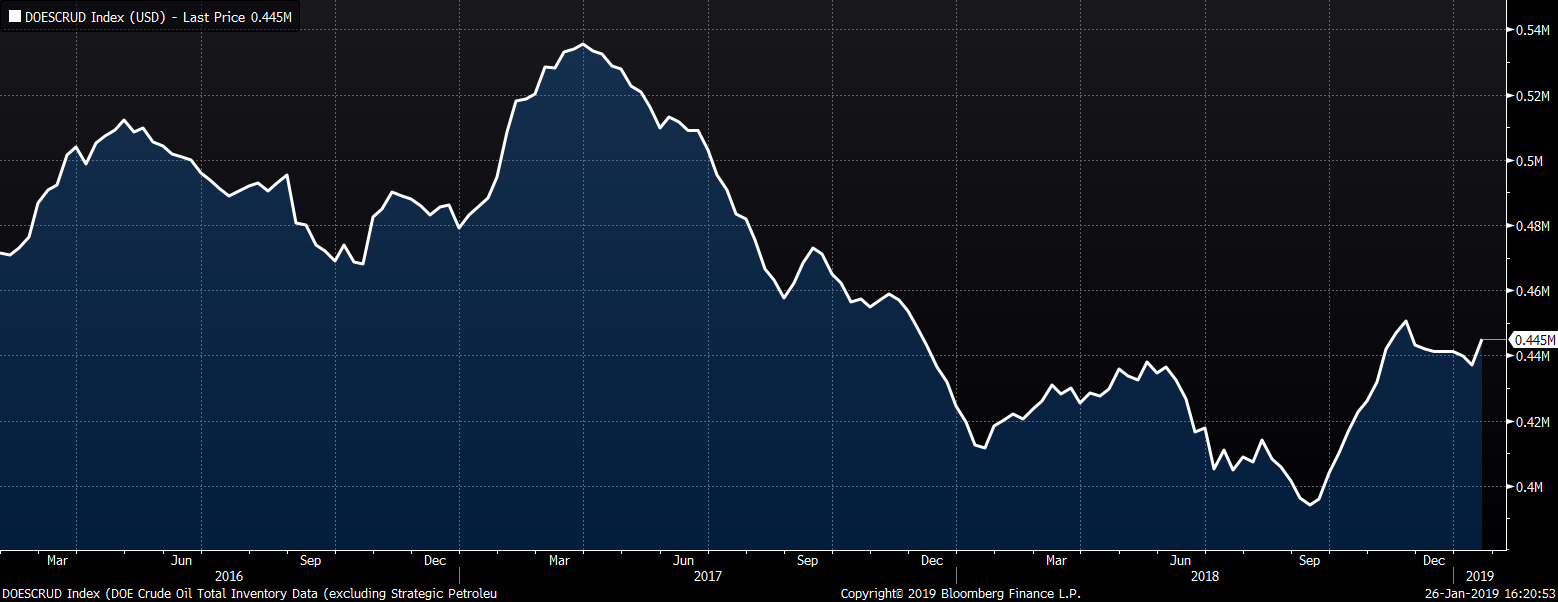

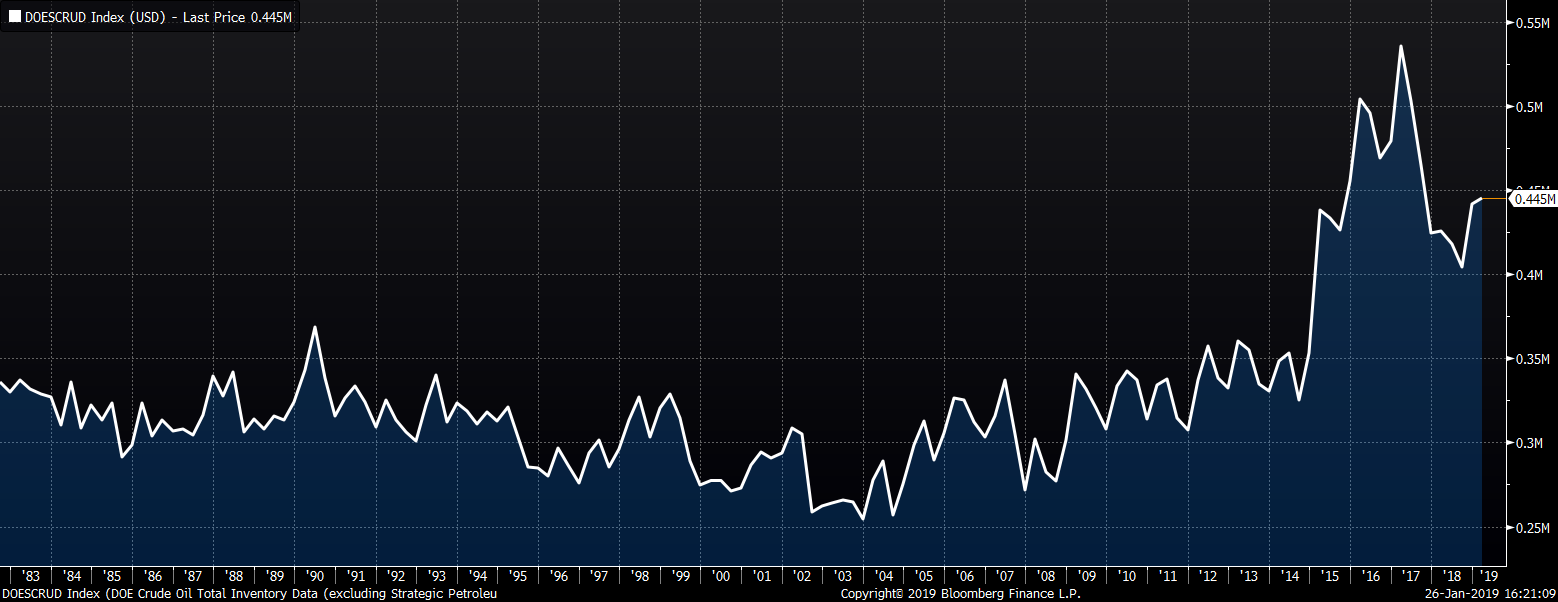

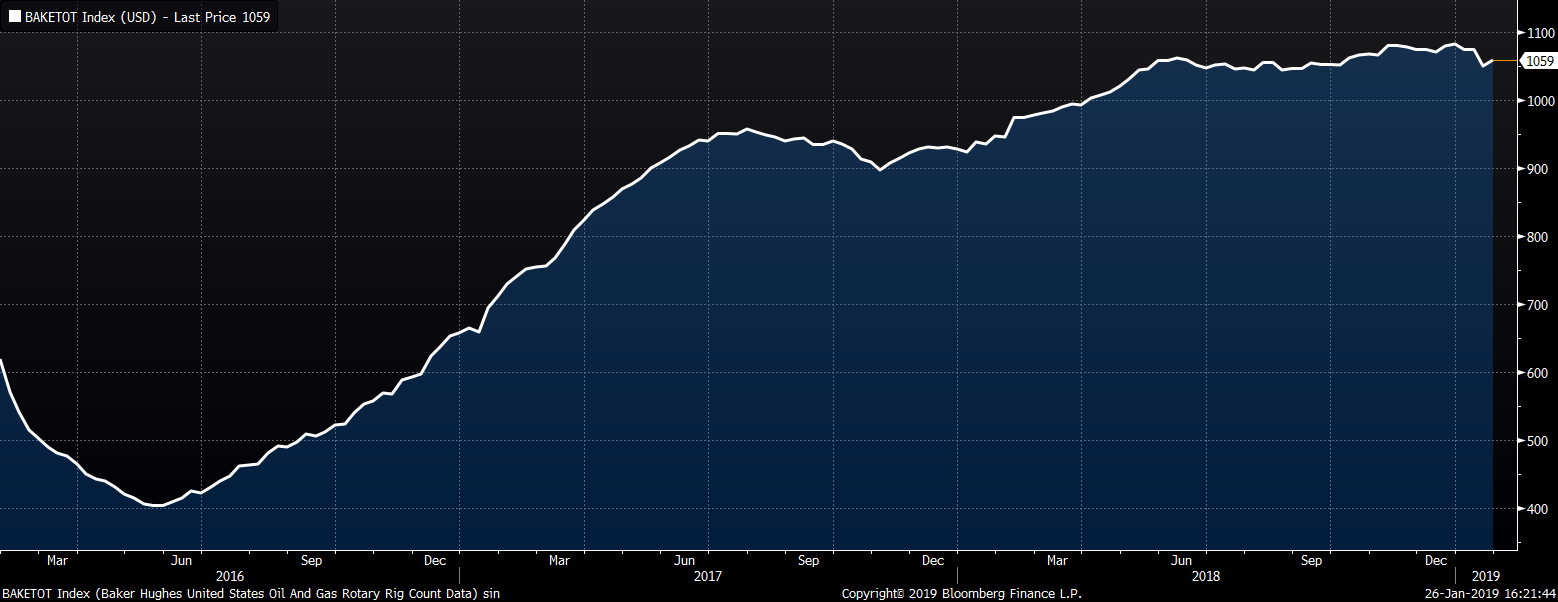

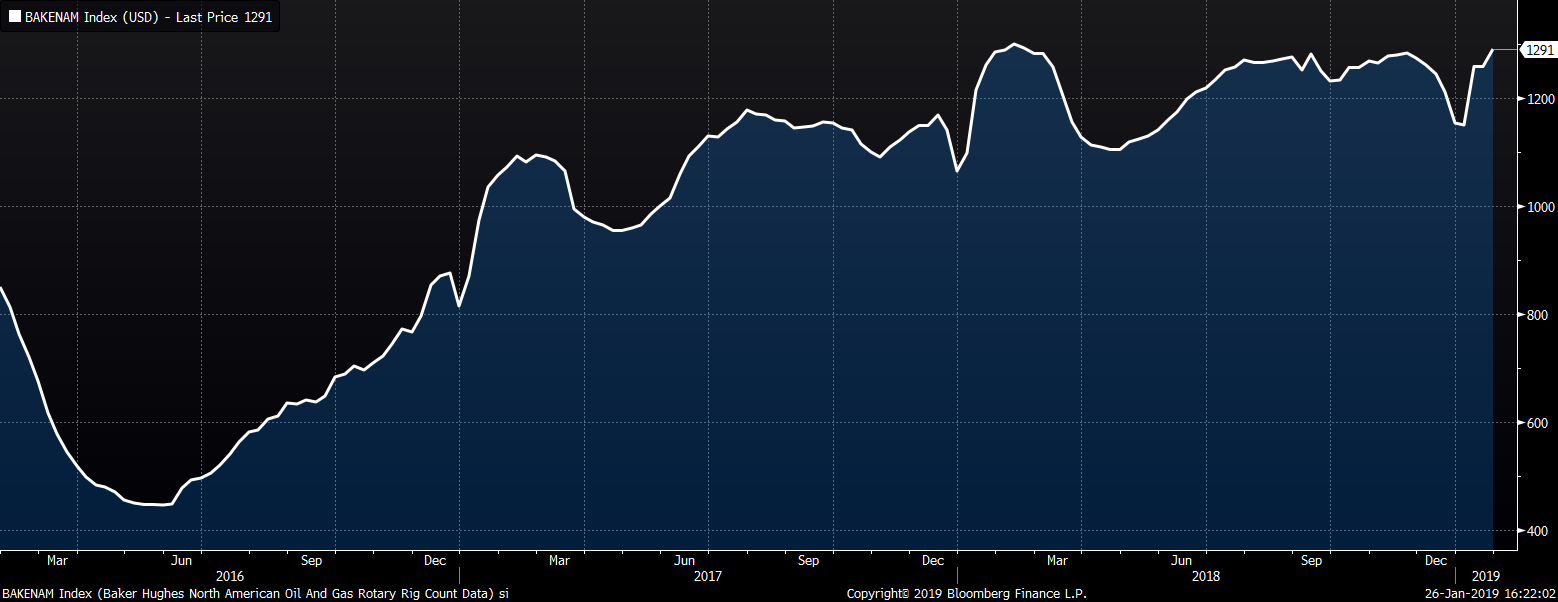

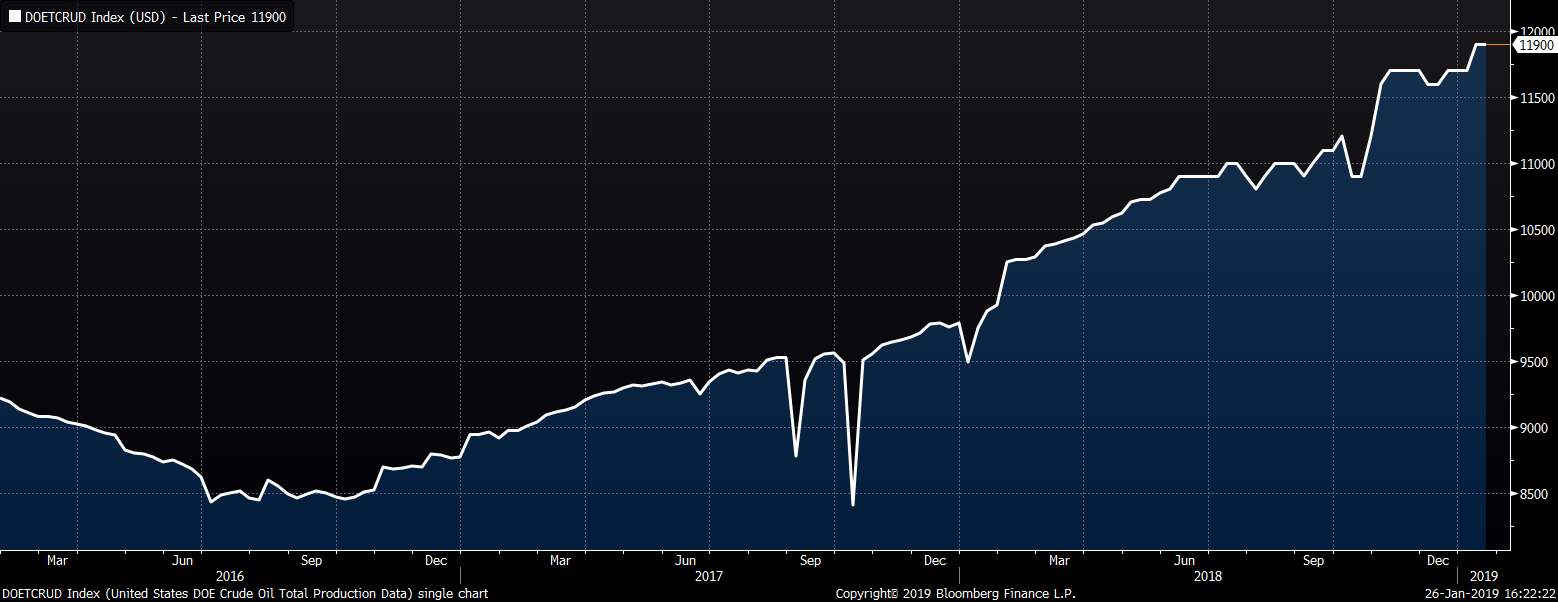

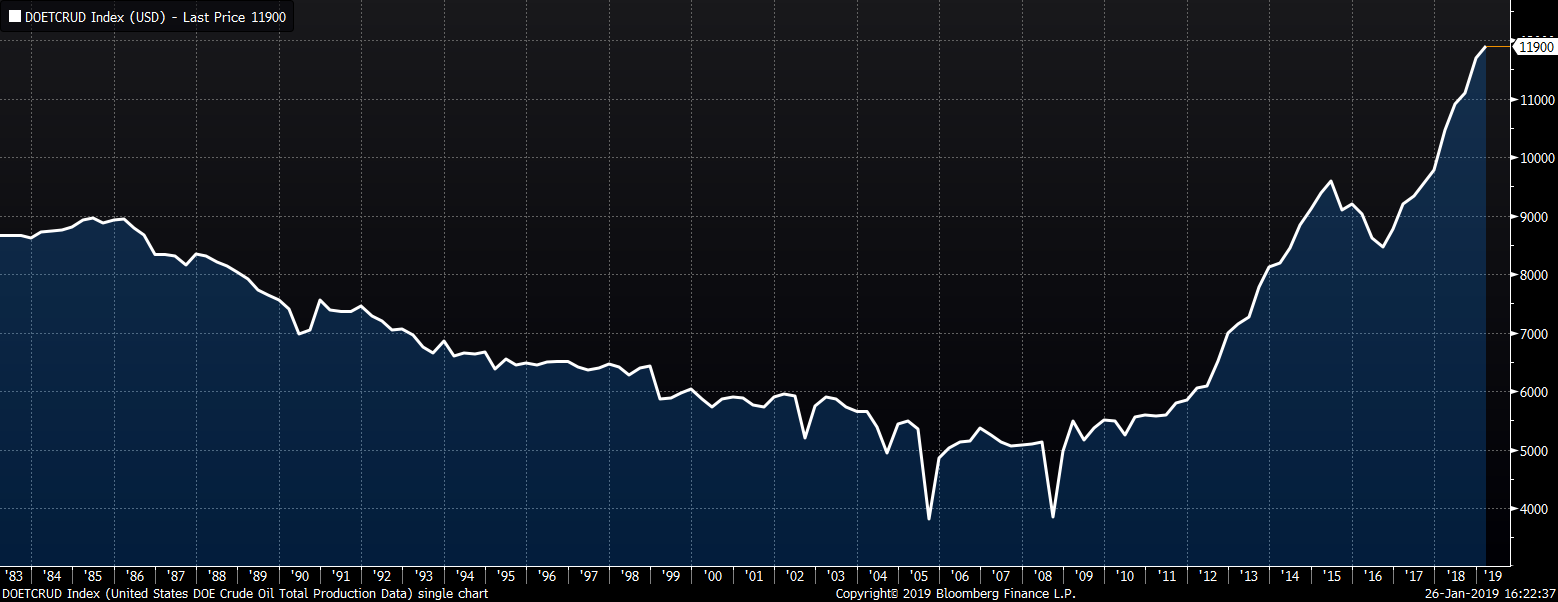

The March WTI crude oil future lost $0.11 or 0.2% to $53.69/bbl. Crude oil and gasoline inventories were up 1.8% and 1.6%, respectively, while distillate inventory was down 0.4%. The aggregate inventory level was up 1.4%. Crude oil production remains at 11.9m bbl/day. The U.S. rig count increased by nine rigs while the North American rig count rose by thirty-two rigs. The February natural gas future lost $0.30 or 8.7% to $3.18/mmBtu. Natural gas inventory fell 6.4%.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely.

Upside Risks:

Downside Risks: