Content

-

Weekly Highlights

- Market Commentary

- Risks

Activity in the physical domestic ferrous market over the last week was muted, as buyers are reluctant to pay high spot prices for material at elevated lead times, while producers refuse to chase orders at lower prices. Mills may be turning away orders at lower prices for two reasons: 1) their order books are strong as displayed by extended lead times, or 2) they are trying to hold higher spot prices for at least another week until their contract orders are priced based on the spot index in the second week of the month. While the former explanation would be bullish for prices, the latter would reveal gaps in order books and signal weaker prices ahead. Either way, buyers have made it clear that they believe they can wait for lower prices to restock, and several recent developments within the financial markets support that position.

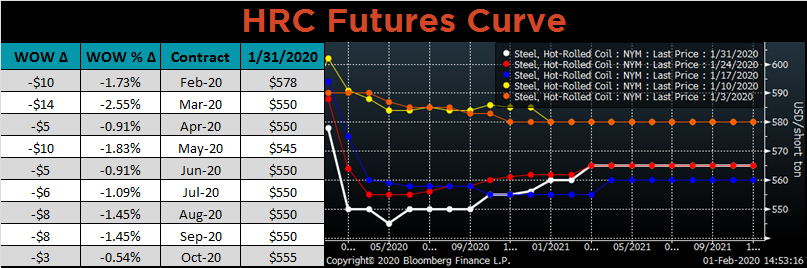

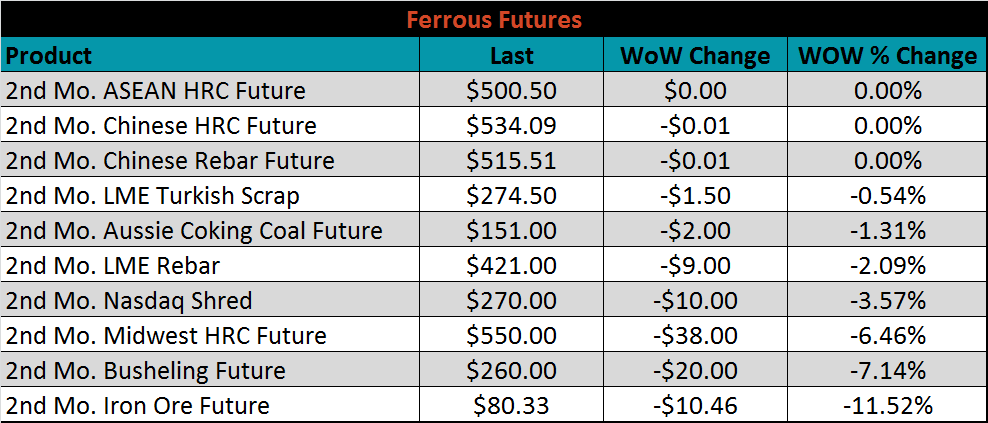

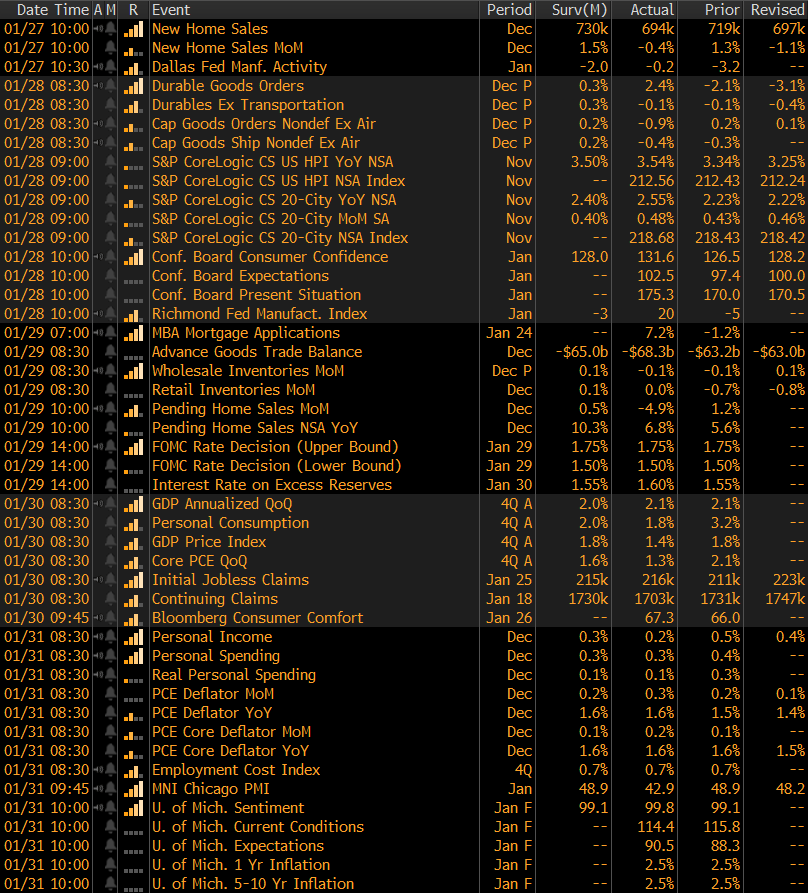

The outbreak of the coronavirus in China, and the associated hit to global demand, shocked financial markets over the last two weeks, with commodity prices falling most significantly: copper down 12%, oil down 8%, and aluminum down 7%, to name a few. Interest rates were also hit, with the yield on the 10 year US bond falling 31 basis points. Specific to the ferrous metal complex, iron ore futures were down 13%, and busheling scrap futures were down 9%. The expectation remains for February scrap to be down $20. Additionally, the HRC future curve remains in backwardation, with spot prices higher than expirations further back on the curve signaling the market expects lower prices in the future. With all of these factors adding to the negative sentiment for the steel buyer, their strategy of delaying spot purchases seems fitting.

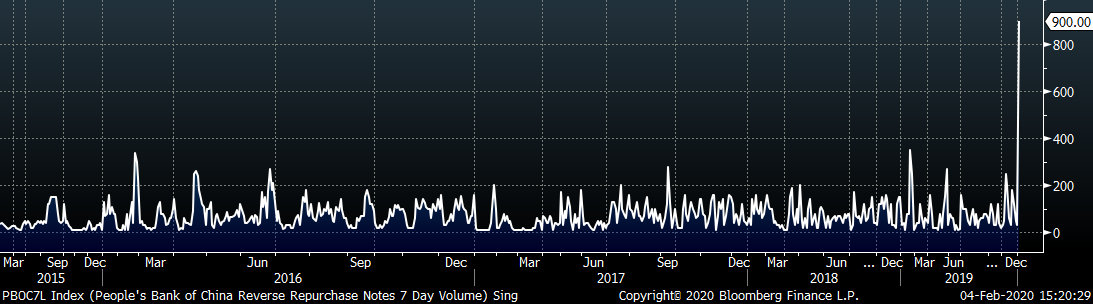

However, second order consequences of many of the above factors should also be taken into account in order to develop a long-term outlook. For example, with the decline in interest rates, the probability has increased of the Federal Reserve cutting their benchmark interest rate, which is simulative to capital-intensive sectors such as steel. Lower raw material prices will offer some protection for mills’ metal margin, at least initially, and allow them to offer slightly lower prices and maintain profitability. Finally, as the economic and market effects of the coronavirus outbreak are hitting China the hardest, we must consider how the Chinese government will react. Historically, the central government has acted swiftly to maintain financial stability and stimulate demand during times of stress within their economic system. As the country returns from its Lunar New Year, we are already seeing some of these actions. The chart below shows the People’s Bank of China injecting massive liquidity into the financial system through reverse repo transactions early this week.

These, and other actions by governments and central banks will protect the global economy during the crisis, and will be simulative to global demand even after the crisis has receded. While lower domestic prices may occur over the next few weeks, fundamental factors within the market remain stable, and this dip could be an effective buying opportunity. Specifically, buying on the forward curve at prices $50/st below the historical average is attractive.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

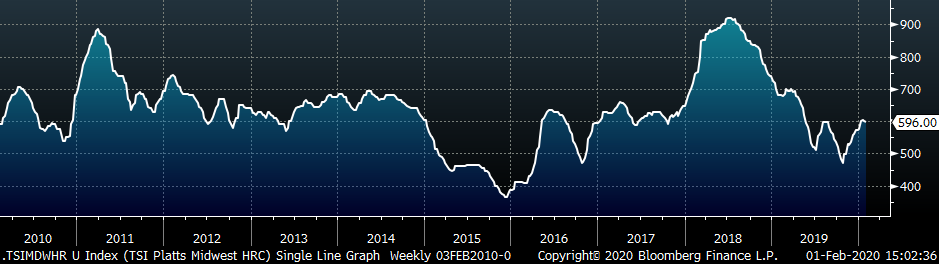

The Platts TSI Daily Midwest HRC Index was down $5.75 to $596.

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The curve shifted lower in the front, while the rest of the curve remained flat.

March ferrous futures were mostly lower. The iron ore future lost 11.5%.

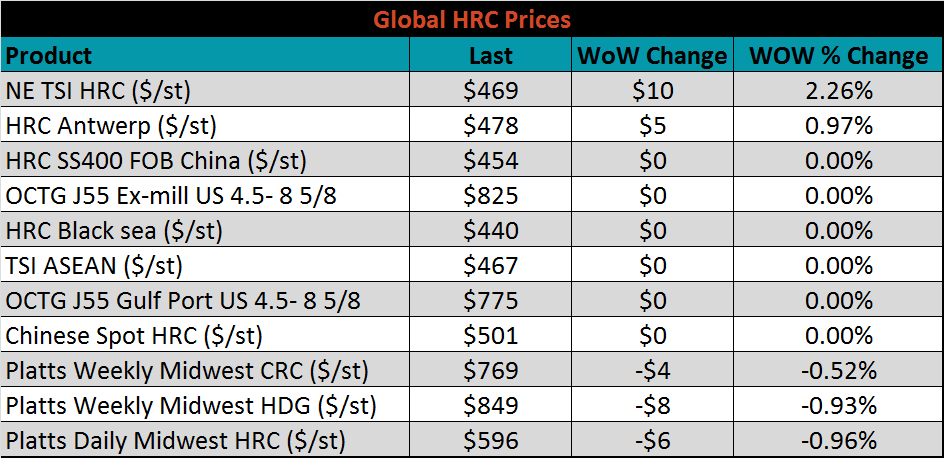

The global flat rolled indexes were mixed. Northern European TSI HRC was up 2.3%, while Platts Daily HRC was down 1%.

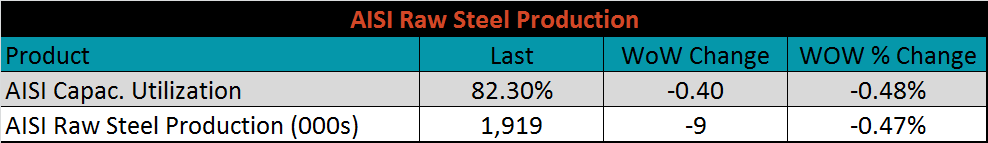

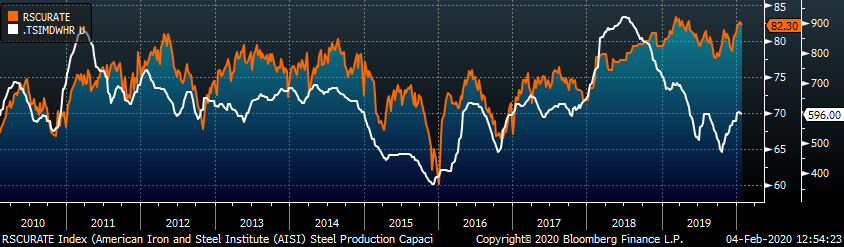

The AISI Capacity Utilization Rate was down 0.4% to 82.3%.

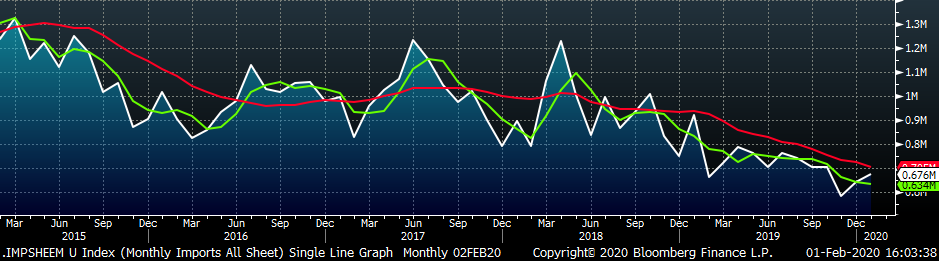

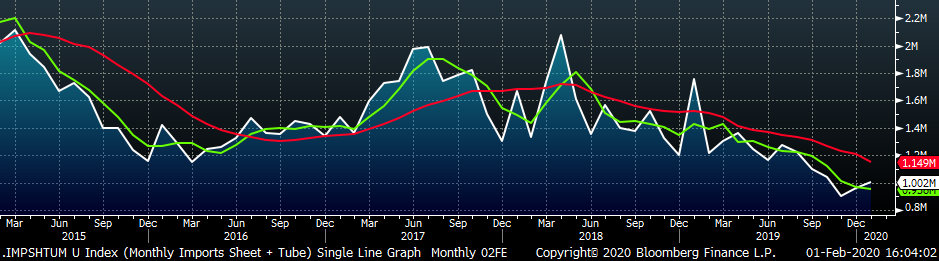

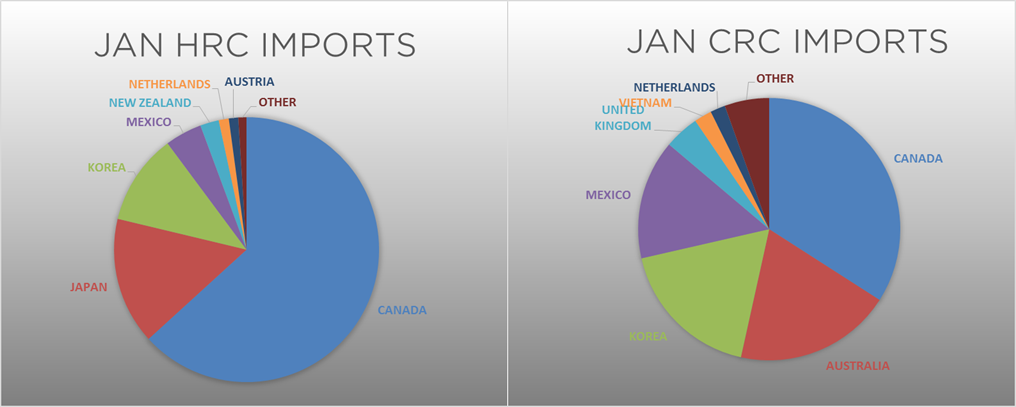

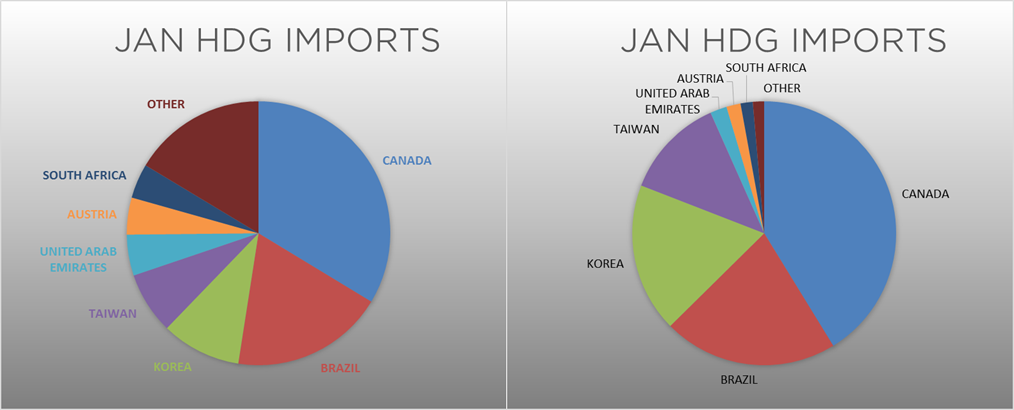

January flat rolled import license data is forecasting an increase of 34k to 676k MoM.

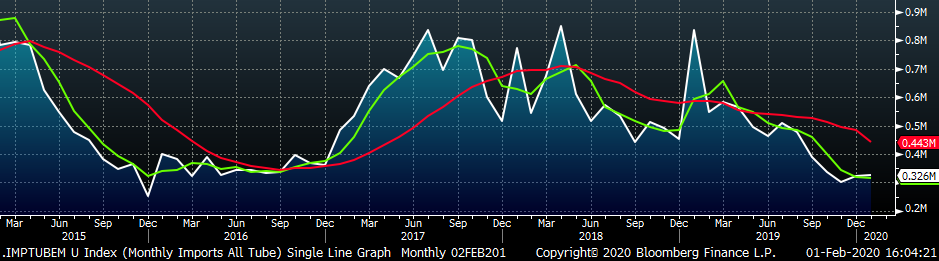

Tube imports license data is forecasting a MoM increase of 5k to 326k tons in January.

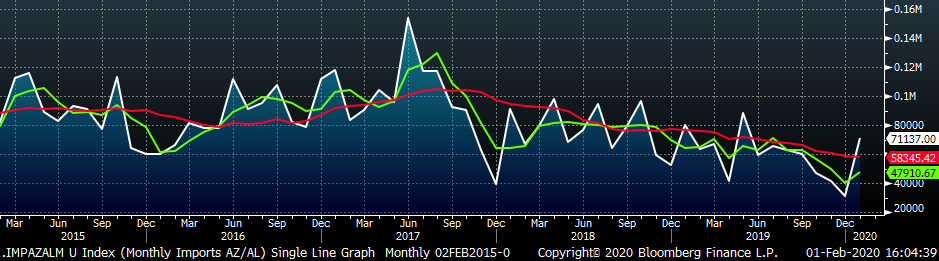

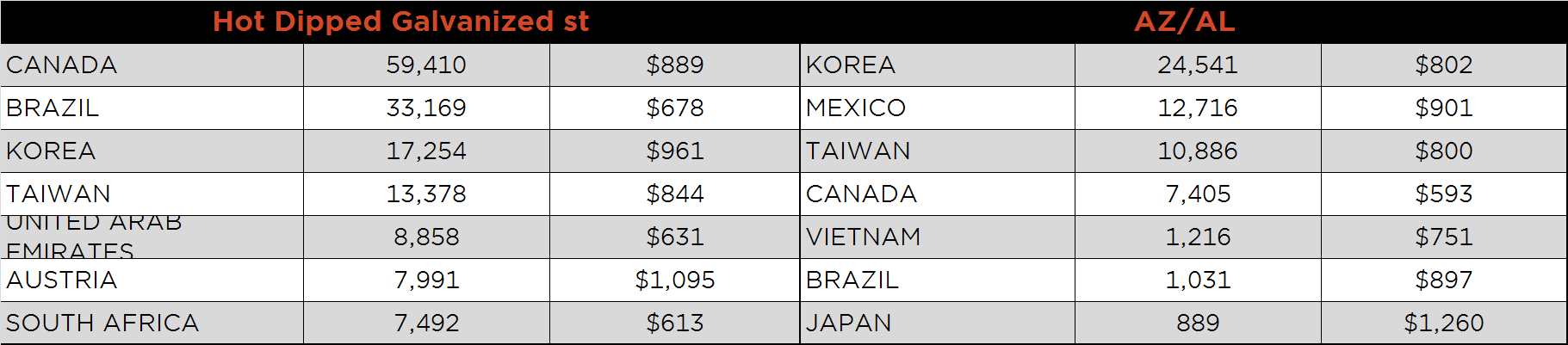

AZ/AL import license data is forecasting an increase of 40k in January to 71k.

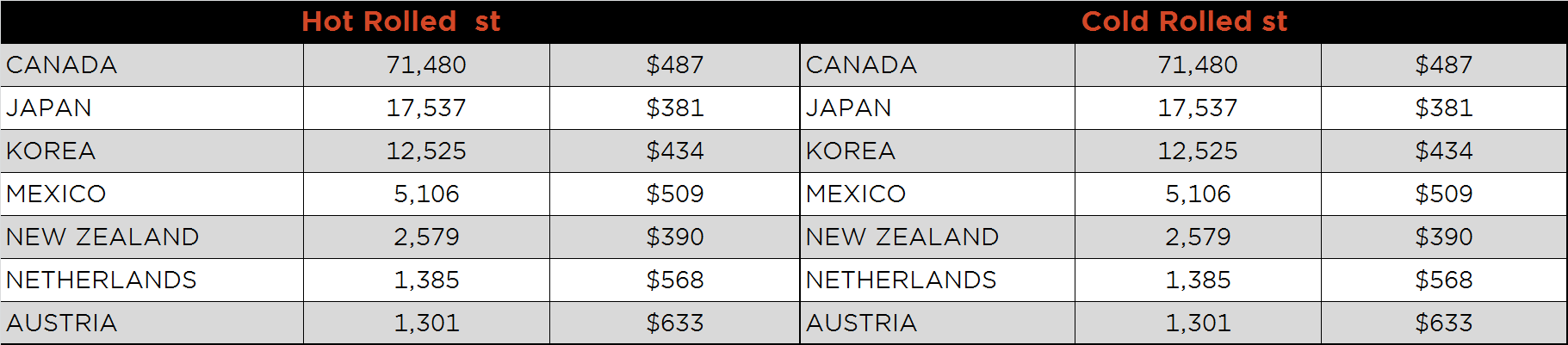

Below is January import license data through January 28, 2020.

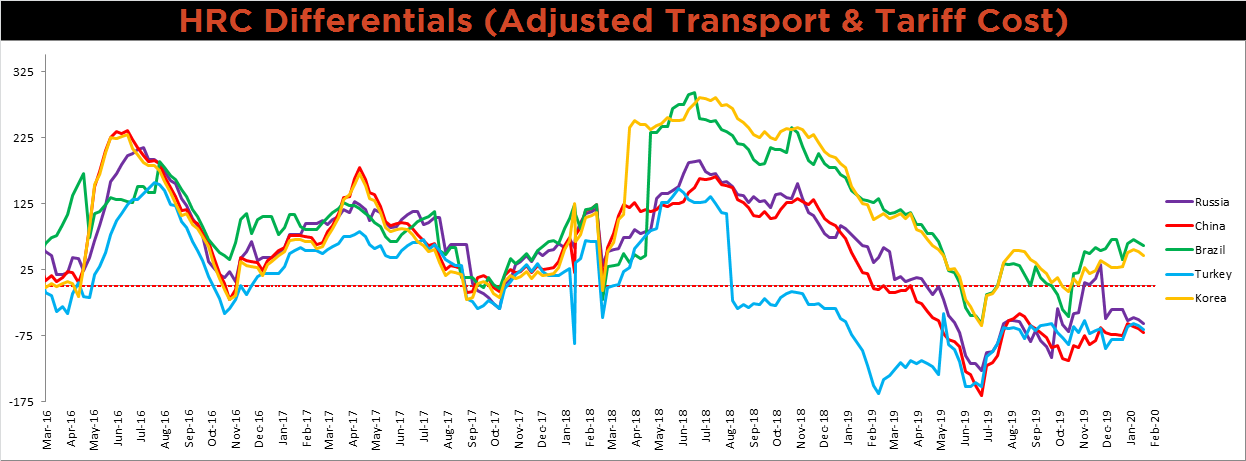

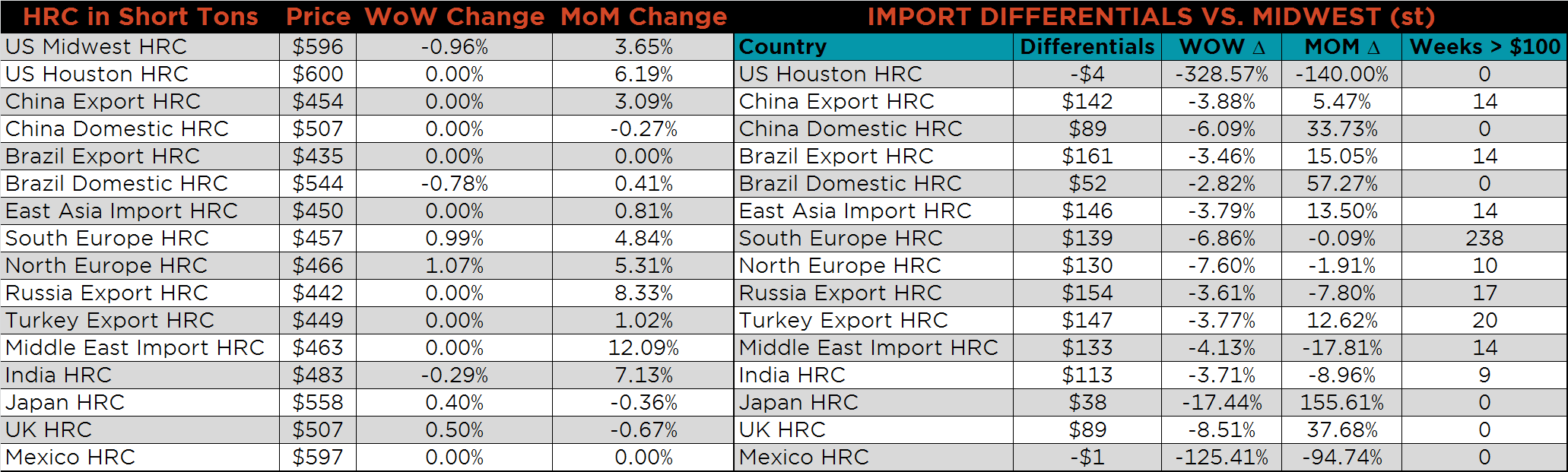

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All the differentials continued to move slightly lower this week.

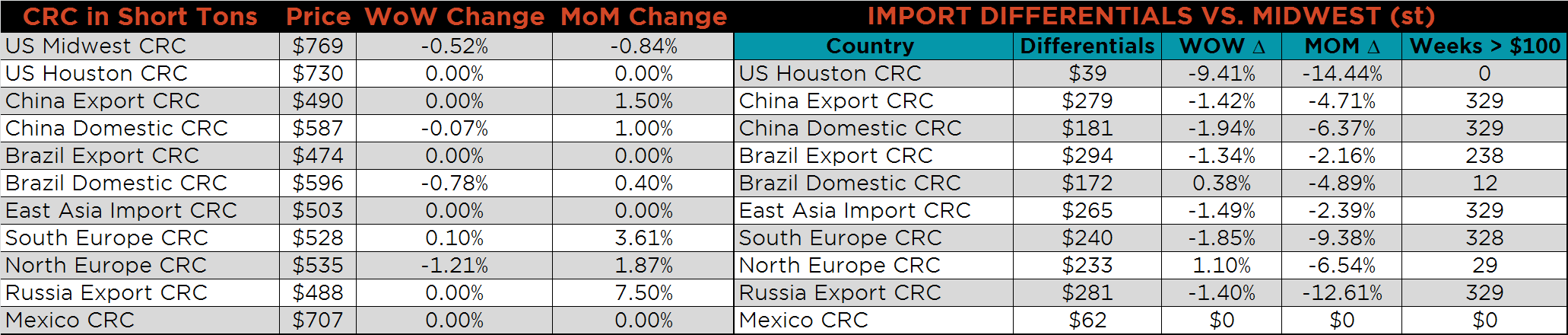

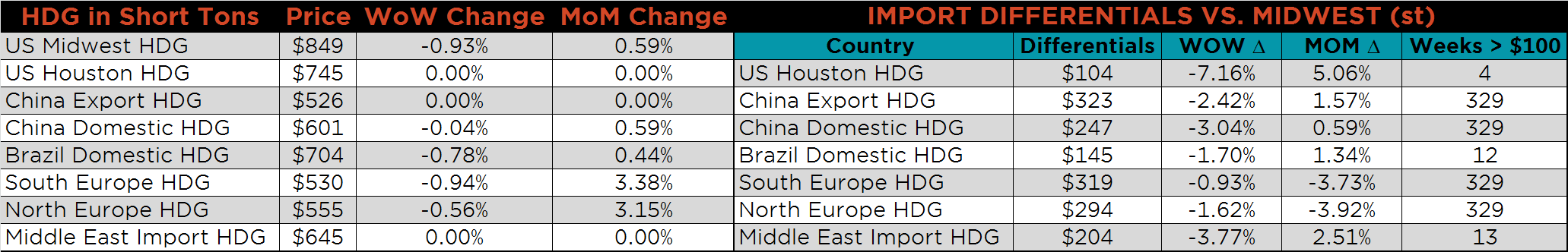

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC, HDG and CRC prices were all down, 1%, 0.9% and 0.5%, respectively. The current Chinese HRC price is not being reported due to the Lunar New Year celebration, but the expectation is a significantly lower price due to the coronavirus.

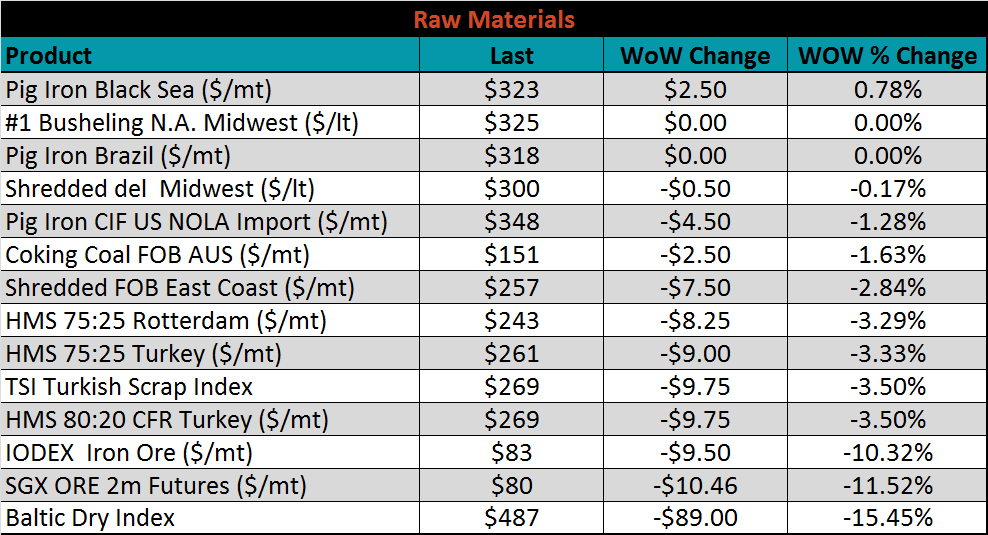

Raw material prices were mostly flat or lower, led by SGX ore, down 11.5%.

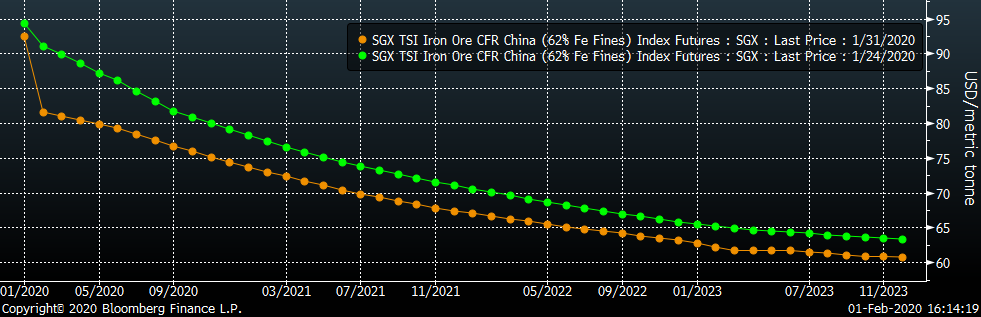

Below is the iron ore future curve with Friday’s settlments in orange, and the prior week’s settlements in green. The entire curve shifted lower again this week, most significantly in the front where prices were down nearly $10.

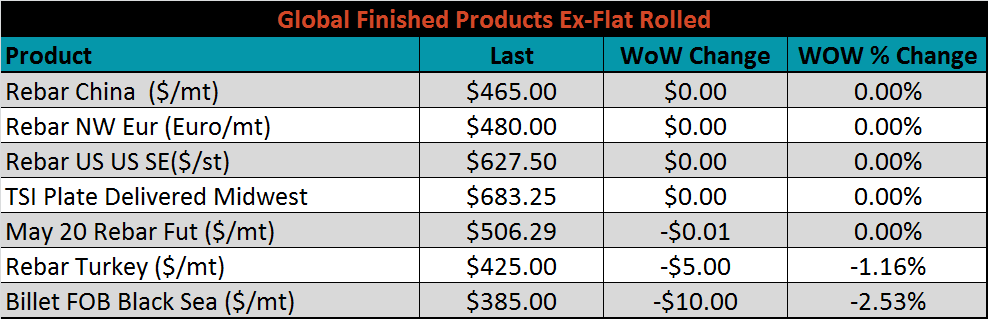

The ex-flat rolled prices are listed below.

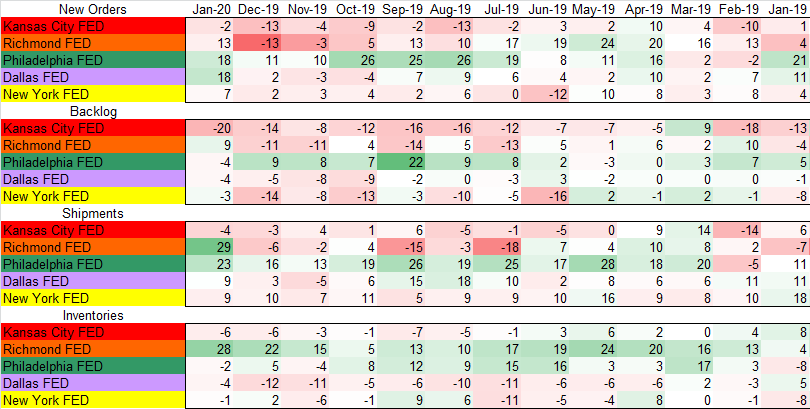

The January Regional Fed Manufacturing subindexes show strength in New Orders, rebounding from a clear lack of demand in December and November. Additionally, Shipments were mostly higher, while the Backlog of orders and Inventories remain low.

The January Richmond Fed Manufacturing Index printed significantly higher than expectations of -3 to 20, compared to December’s -5 print. While the Chicago PMI printed significantly below expectations of 48.9 to 42.9, compared to December’s 48.9 print.

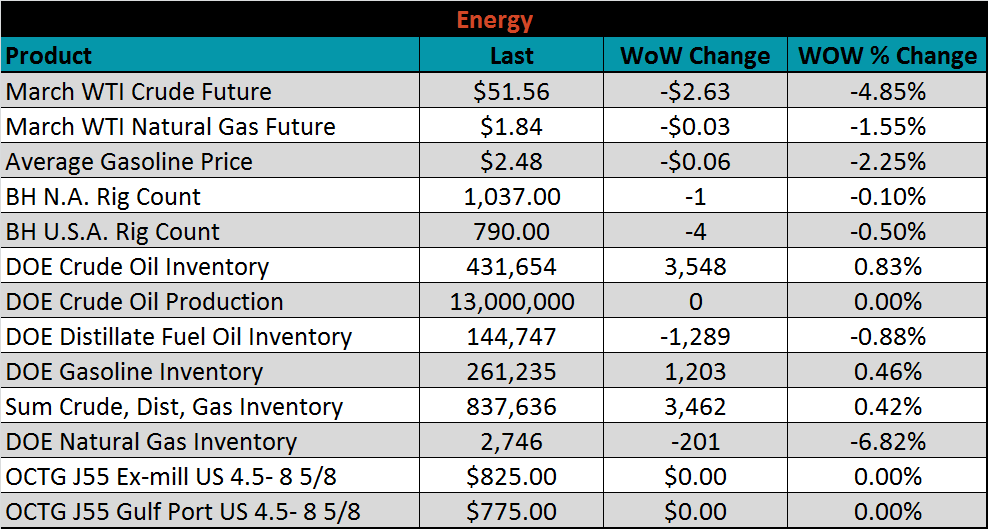

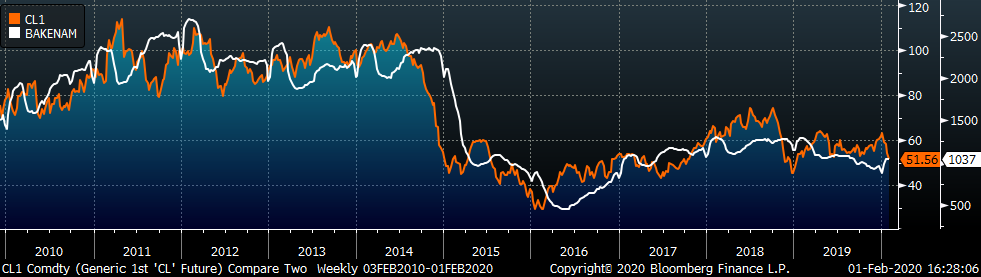

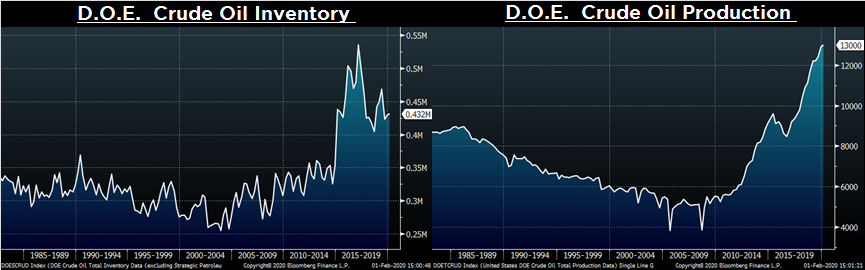

Last week, the March WTI crude oil future lost $2.63 or 4.9% to $51.56/bbl. The aggregate inventory level was down 0.9% and crude oil production remains at 13m bbl/day. The Baker Hughes North American rig count was down one rig and U.S. rig count was down four rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: