Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

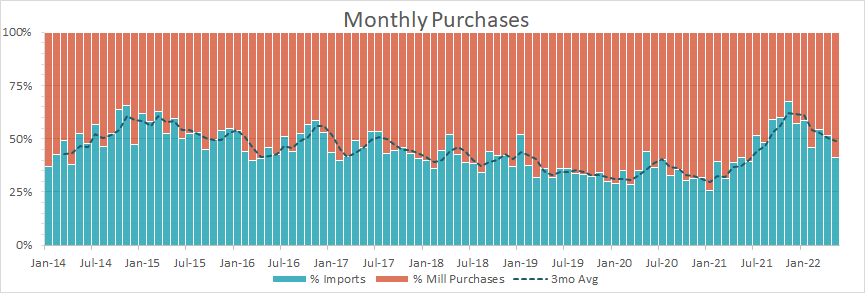

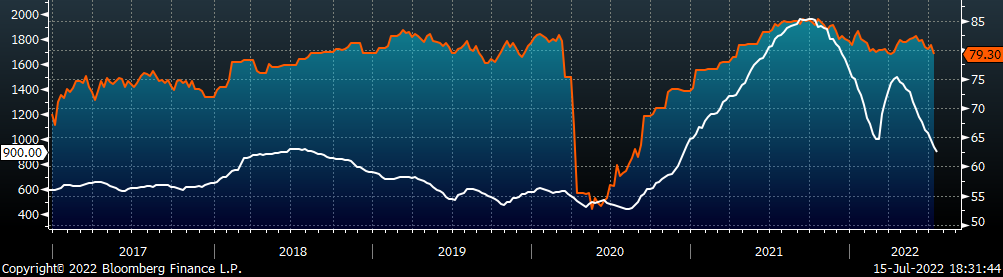

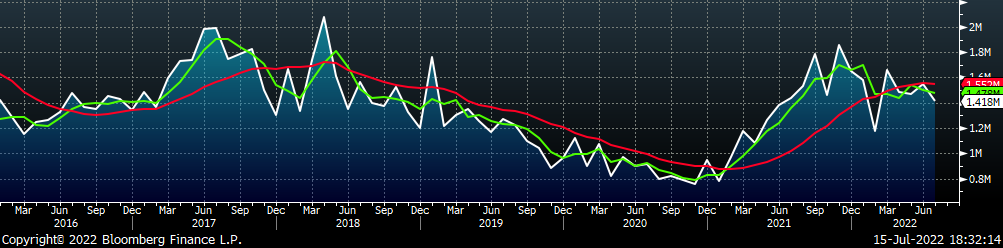

The chart below is a breakdown of the monthly purchases of flat rolled steel within the domestic market from either mills (orange) or imports (blue), with the dashed line representing the 3-month moving average. A higher percentage of import buys reflects decreased pricing power for domestic mills.

Import data shows a steady reduction in arrivals and that buyers are relying on the domestic mills more than they have at any point over the last year. In the past, this would imply that mills have increased leverage in the open market. However, as supply chains have started to ease, inventories have increased and reduced the mill’s pricing power. We saw a similar dynamic emerge in December 2021 & January 2022 when domestic mill market share was growing but their pricing power was diminishing because of an overhang in inventory. Like then, the spot price for US HRC may continue to converge with support levels in the absence of a bullish catalyst. Furthermore, if the ongoing trend of declining imports continues, domestic mills may find themselves in a strong negotiating position when the supply/demand dynamics improve. This would leave the US HRC price vulnerable to a significant rebound.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

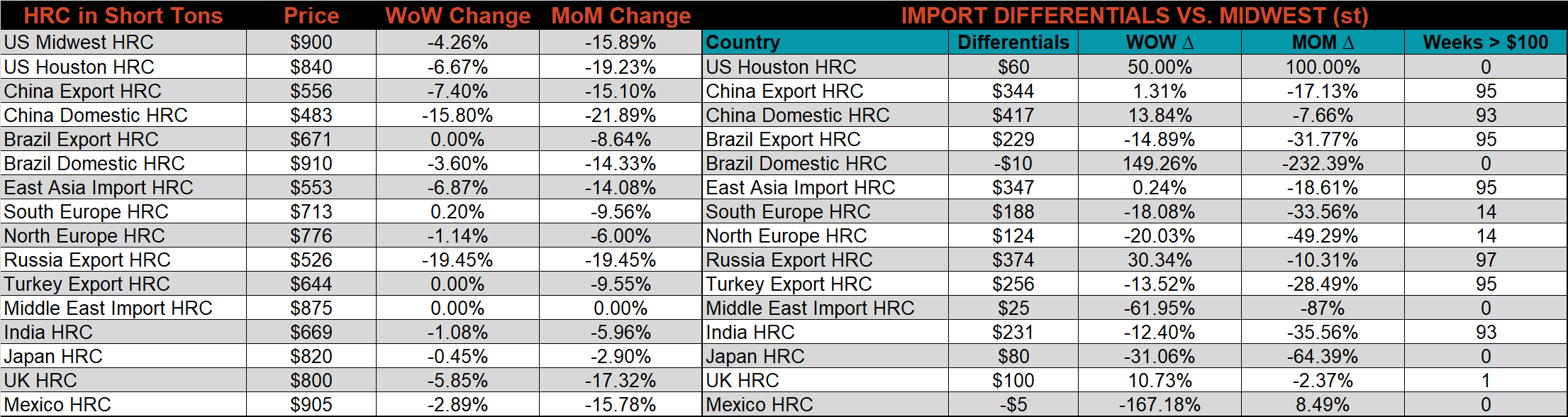

The Platts TSI Daily Midwest HRC Index was down $40 to $900.

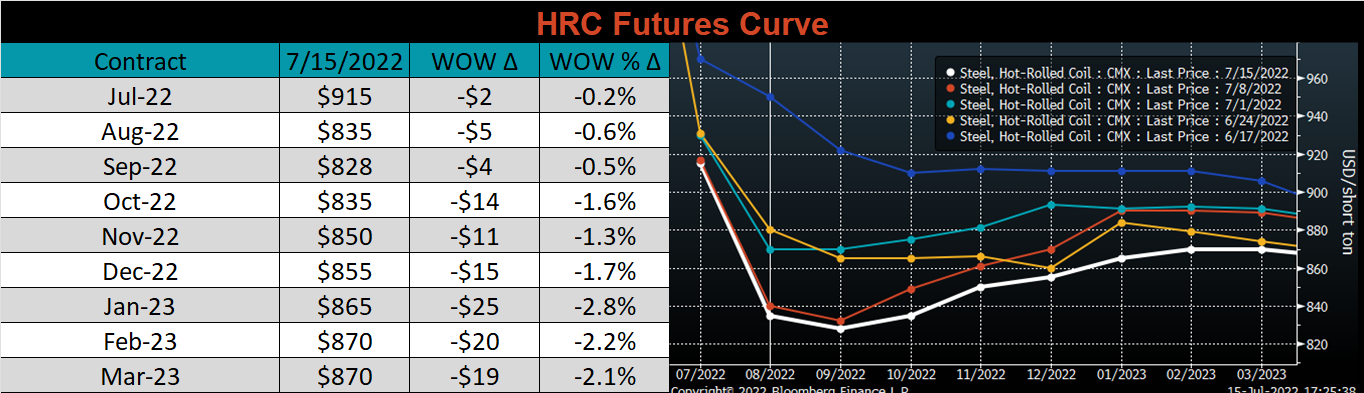

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The back of the curve was under the most pressure last week, which caused a reduction in contango.

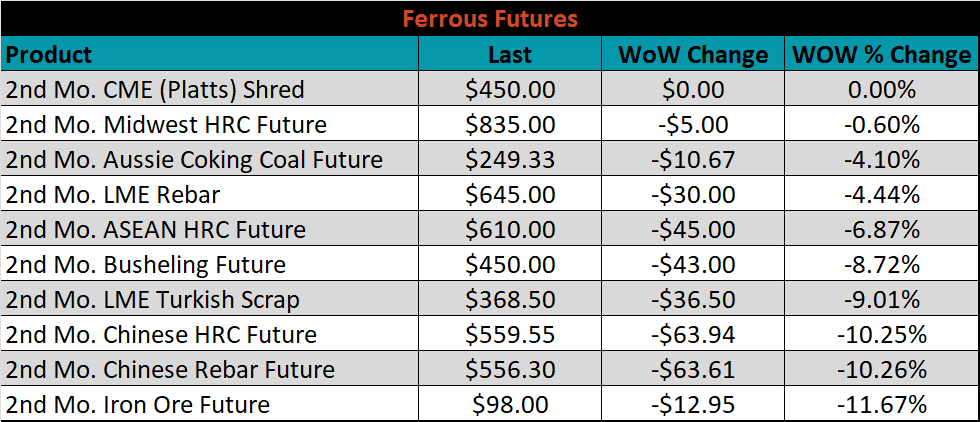

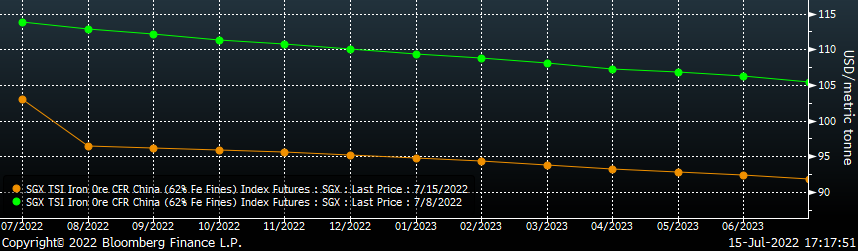

The 2nd month ferrous futures ended the week lower across the board. Iron Ore moved below $100 for the first time in 31 weeks, down 11.7%.

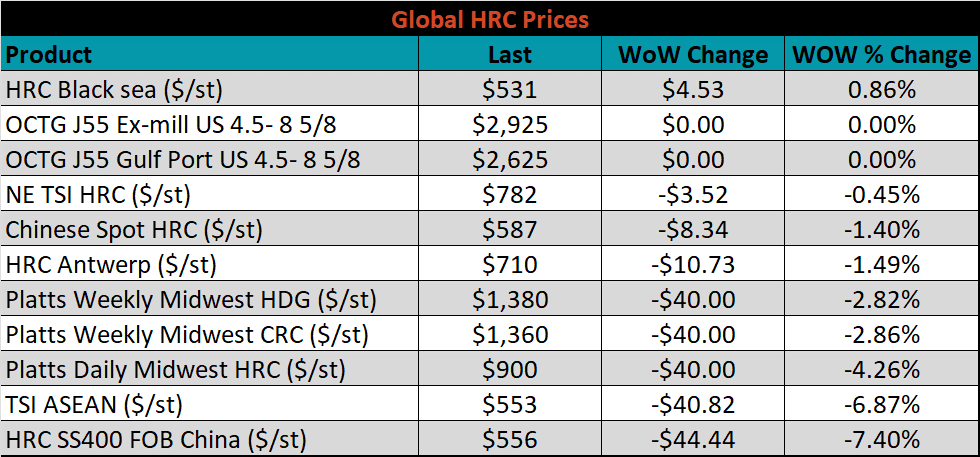

Global flat rolled indexes moved mostly lower, led again by Chinese export HRC, down 7.4%, while Black Sea HRC was up 0.9%.

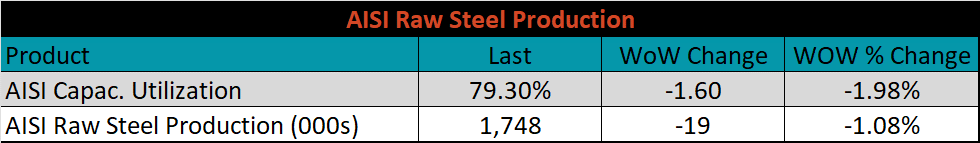

The AISI Capacity Utilization was down 1.6% to 79.3%.

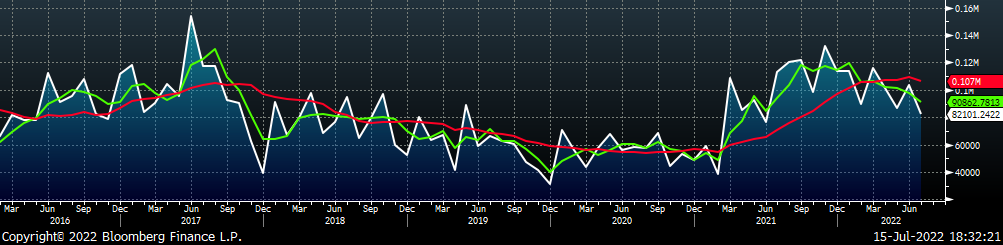

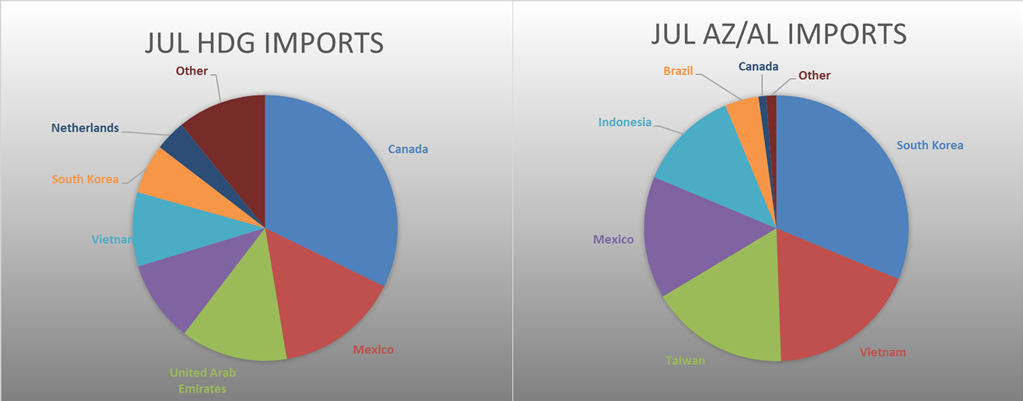

July flat rolled import license data is forecasting a decrease of 49k to 909k MoM.

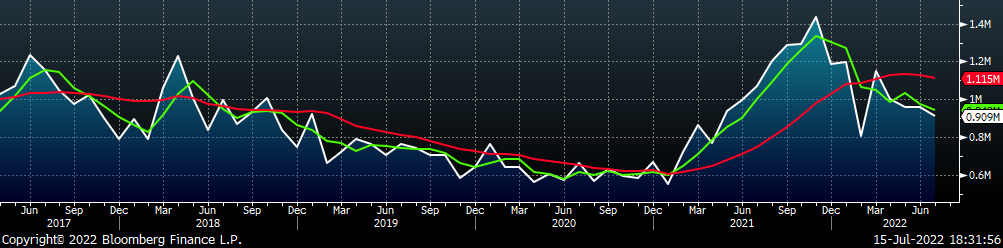

Tube imports license data is forecasting a decrease of 79k to 508k in July.

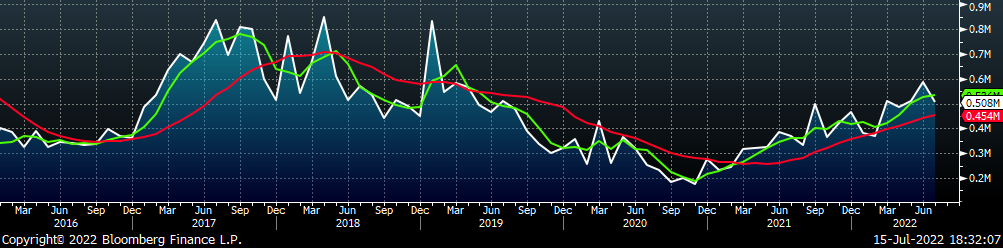

July AZ/AL import license data is forecasting a decrease of 21k to 82k.

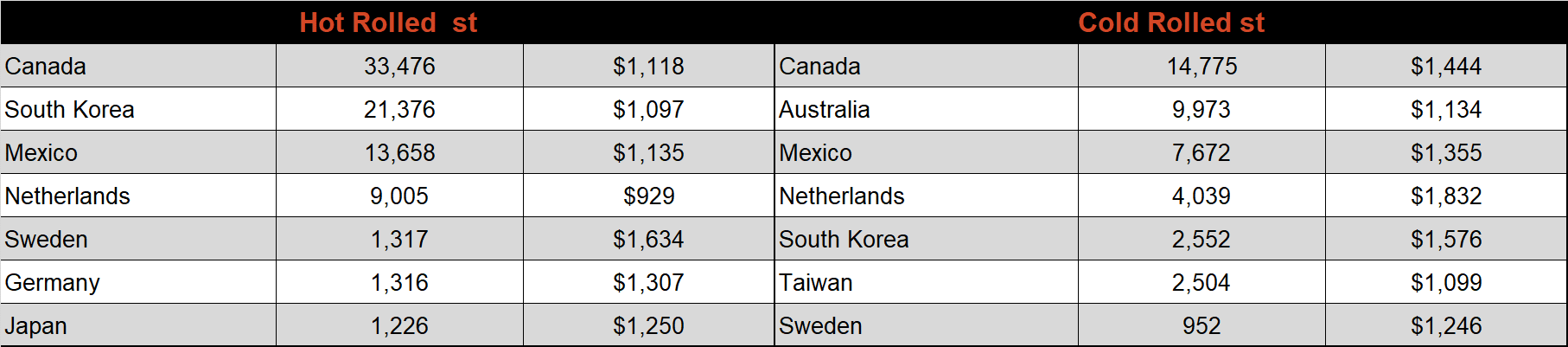

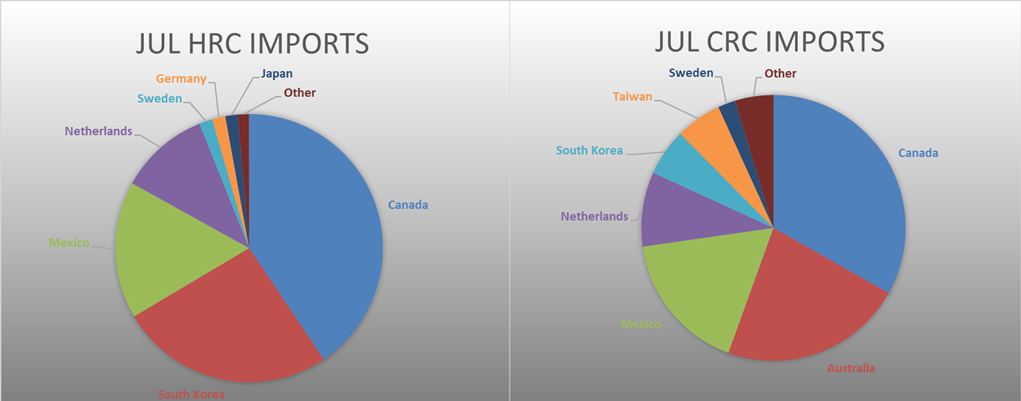

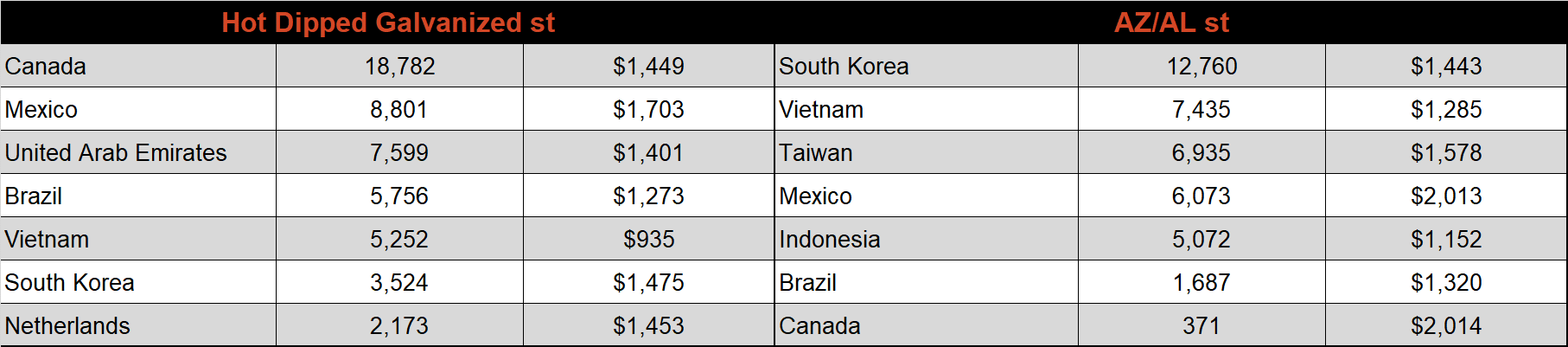

Below is July import license data through July 11th, 2022.

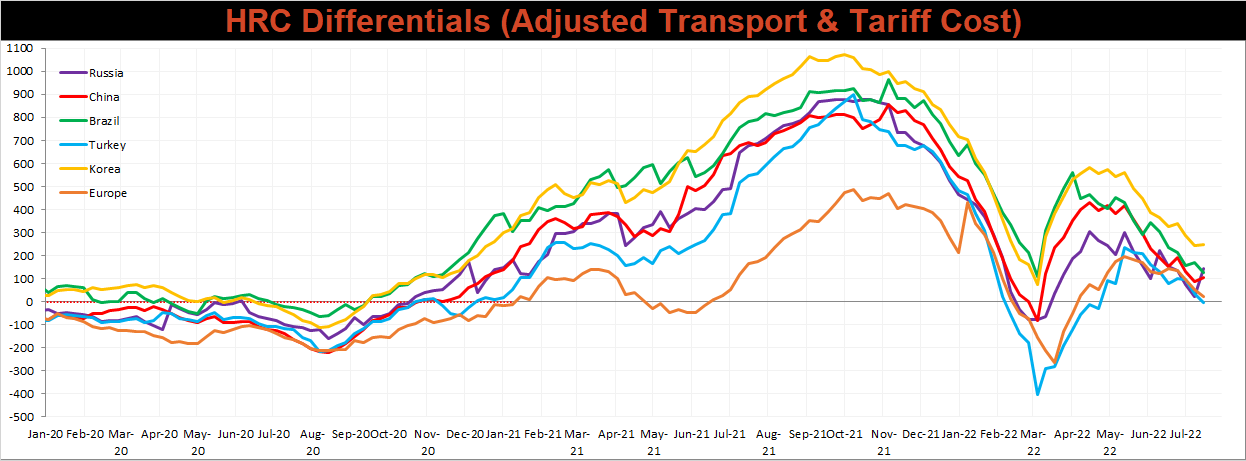

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials increased for China, Russia, and Korea, as their corresponding prices fell more significantly that the U.S. domestic price.

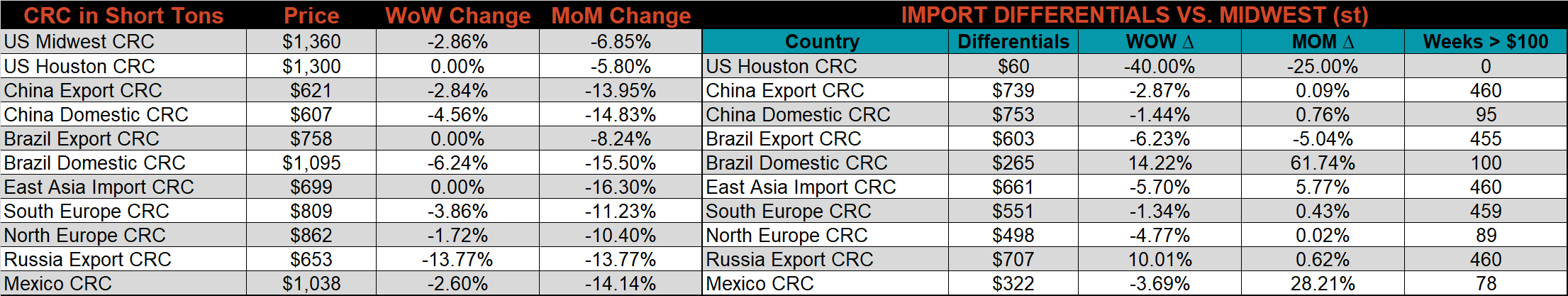

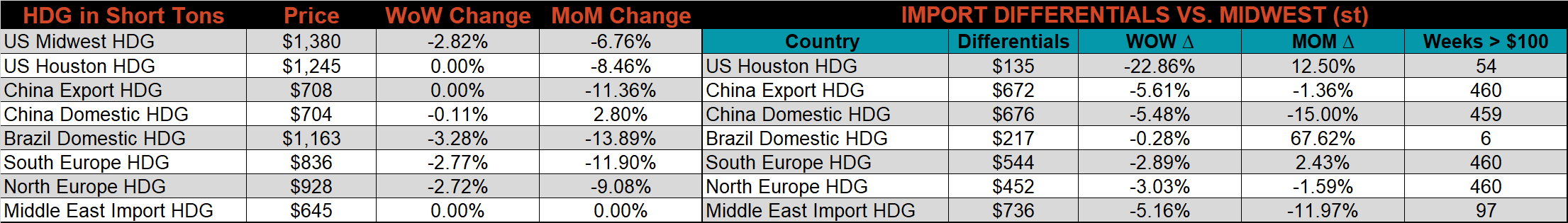

SBB Platt’s HRC, CRC, and HDG pricing is below. The Midwest HRC price was down 4.3%, CRC fell 2.9%, and HDG fell 2.8%. The Russian HRC export price fell the most, down 19.5% WoW.

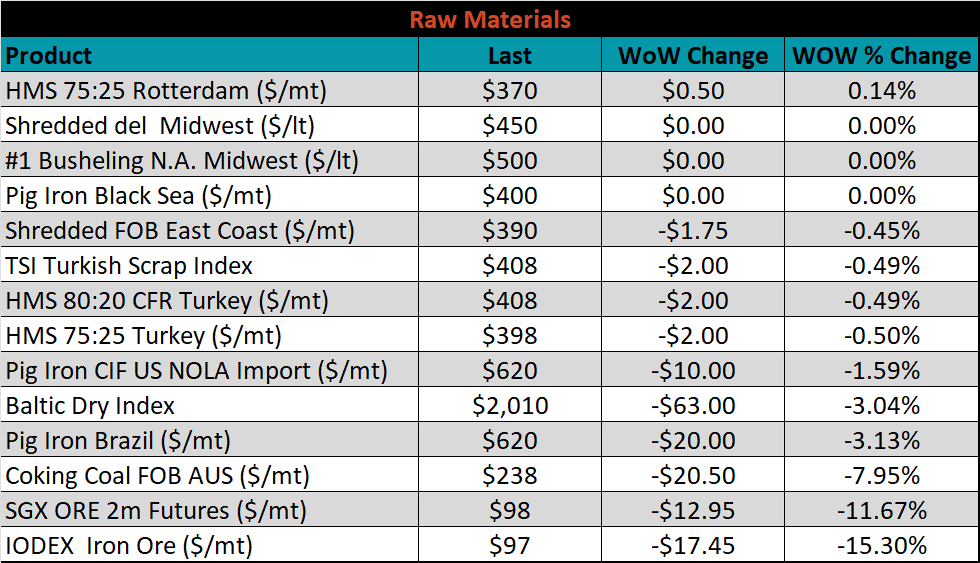

Raw material prices fell across the board except for HMS 75:25 Rotterdam, which was up 0.1%. Losses were led by the IODEX iron ore index, which was down 15.3%.

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve shifted sharply lower, most significantly in the front of the curve.

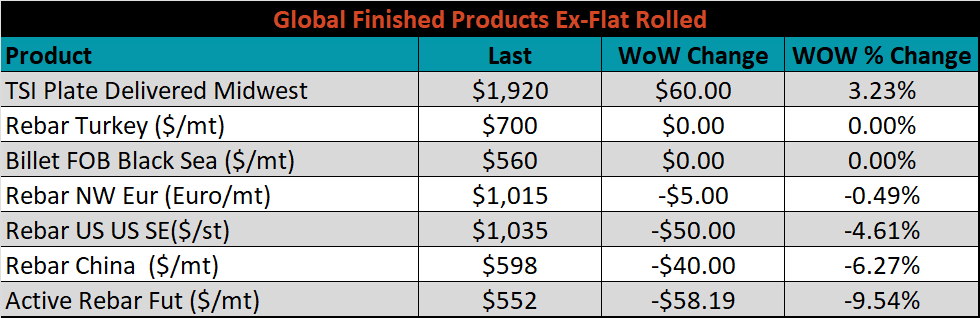

The ex-flat rolled prices are listed below.

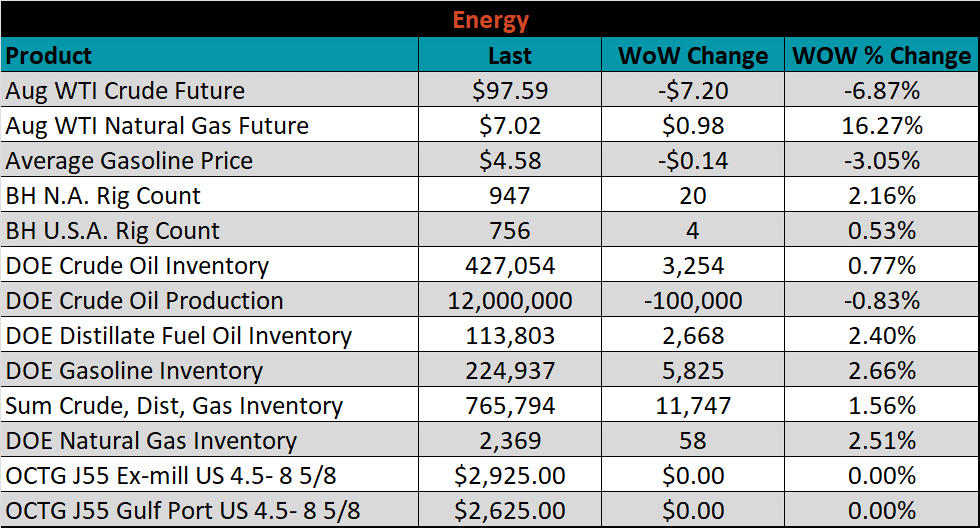

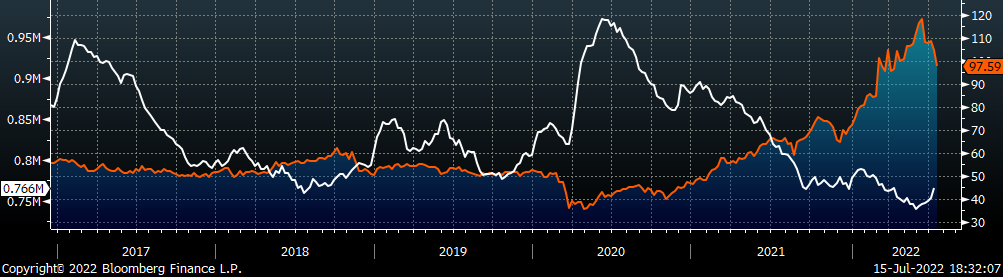

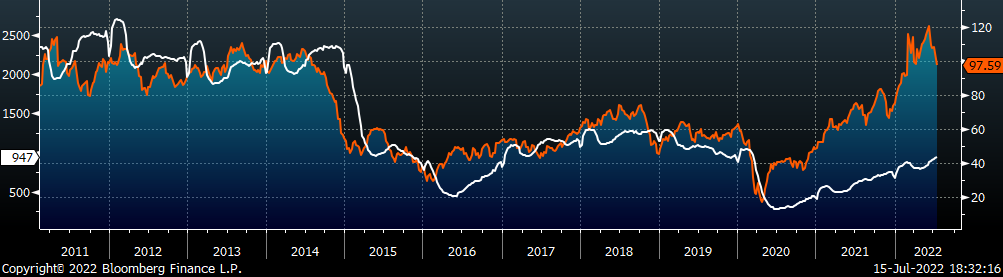

Last week, the August WTI crude oil future fell $7.20 or 6.9% to $97.59/bbl. The aggregate inventory level increased 1.6%. The Baker Hughes North American rig count increased 20 rigs, while the U.S. rig count increased 4 rigs.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: