Content

-

Weekly Highlights

- Market Commentary

- Risk

Discussions in the domestic steel market recently have revolved around the recent mill price increases, and whether they have support in the market. Unsurprisingly, mills have stated in their earnings calls over the last few weeks that they see market support and have captured the majority of the increases. This belief, along with apparently higher scrap prices in August and beyond, may encourage the mills to push an additional price increase. While mill profitability on the marginal ton produced has recovered, it remains at low levels and mills are still looking to boost it with additional increases. However, this is only a one sided, skewed view of the steel market, and to better understand the demand side, we look at steel purchasers’ activity.

We have found mills are less willing to negotiate on price recently and there has been a wide range of transacted prices. However, activity has been extremely limited as most buyers are uncertain exactly what is the spot price. Moreover, several end users have expressed doubt that the increases will stick and are reluctant to make purchases. While this appears to paint a gloomy picture for demand within the market, there are secondary consequences that lead to an alternative conclusion. Purchasers only buying what is absolutely needed will lead to lean inventories across the supply chain. If this happens across the end user base, any extension of lead times will result in a flurry of buying activity in order to maintain operations. Restocking becomes attractive, and sometimes necessary, while lead times extend and prices increase.

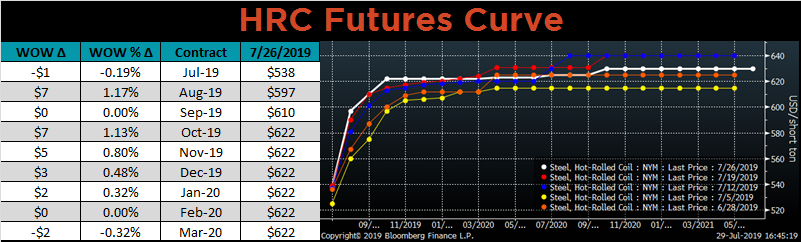

Historically, the futures curve has been a poor predictor of price. Nevertheless, it does accurately reflect current expectations of the future spot price. The curve remains in contango, with the spot price well below the prices expected in the next few months. Looking into the fourth quarter and next year, the market is expecting the Midwest HRC price to move above $620. This would mean that mills successfully achieved and captured their increases, and they may have ammo to push for more.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

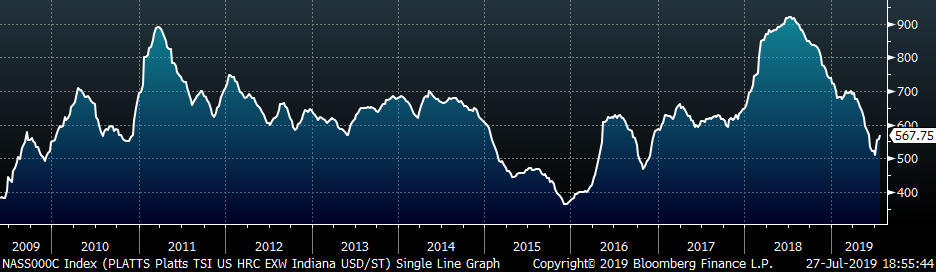

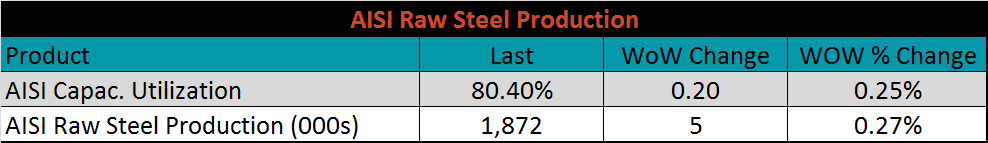

The Platts TSI Daily Midwest HRC Index was up $11 to $567.75.

The CME Midwest HRC futures curve is shown below with last Friday’s settlements in white. The curve has flattened over the previous three weeks.

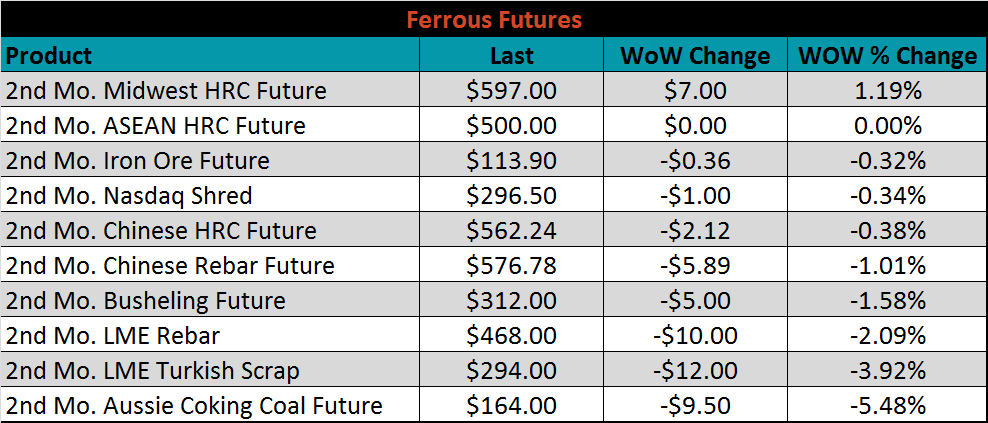

August ferrous futures were mostly lower. Coking coal lost 5.5%, while Midwest HRC gained 1.2%.

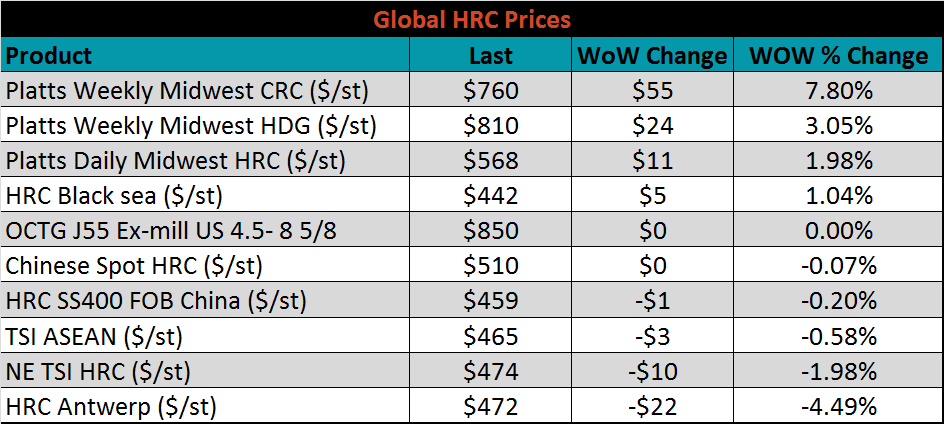

The global flat rolled indexes were mixed. Platts Midwest CRC index was up 7.8%, while Antwerp HRC was down 4.5%.

The AISI Capacity Utilization Rate rose another 0.3% last week to 80.4% above the 80% goal set by the Trump administration after four weeks of declines. Strength in price, profitability and demand should facilitate increased short-term production, especially if imports are subdued.

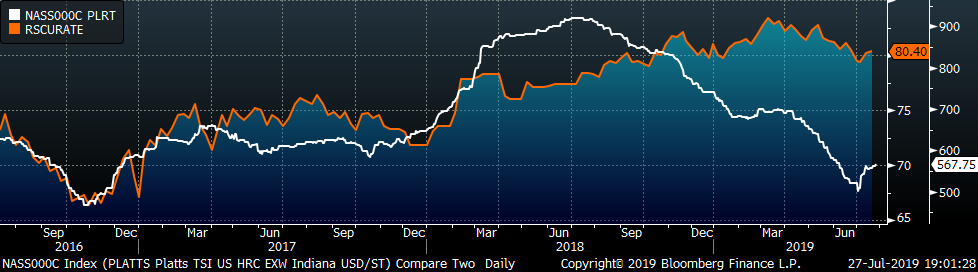

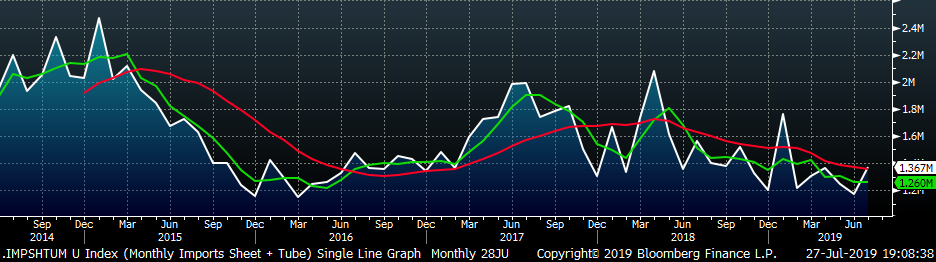

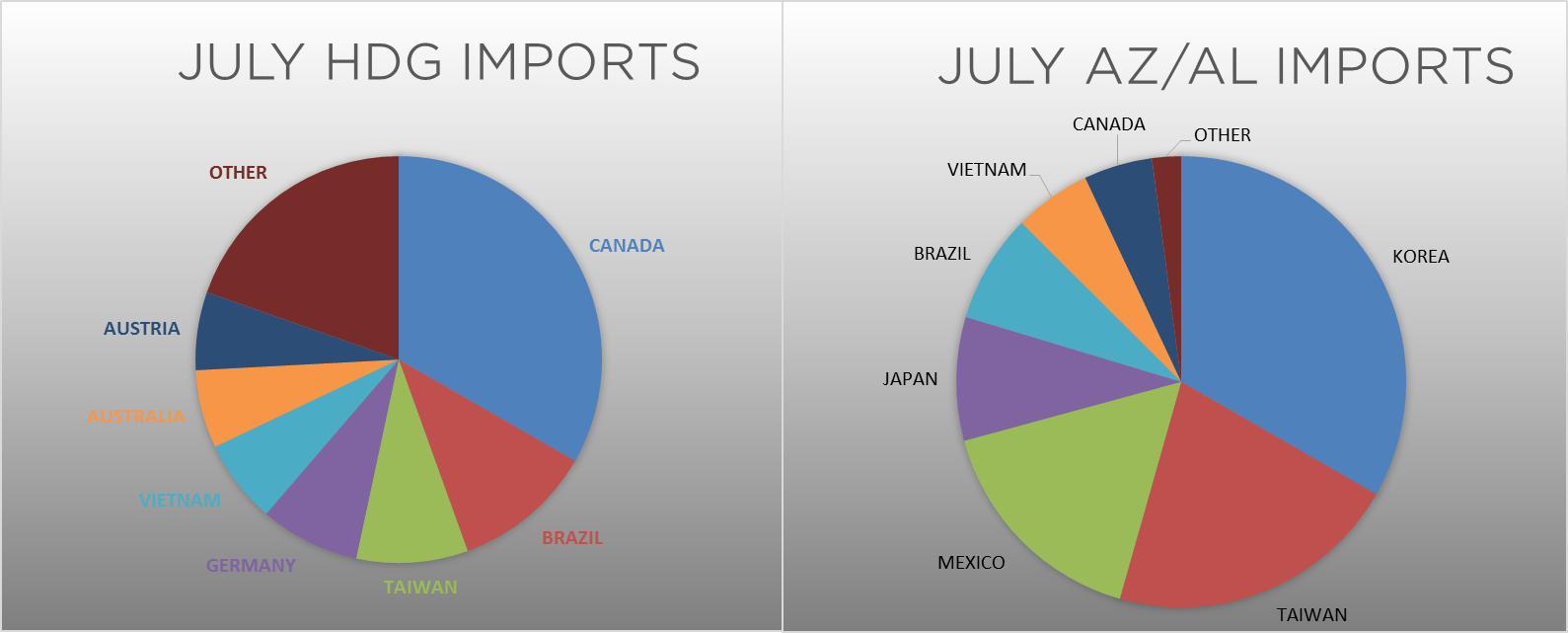

July flat rolled import license data is forecasting an increase to 783k, up 80k MoM.

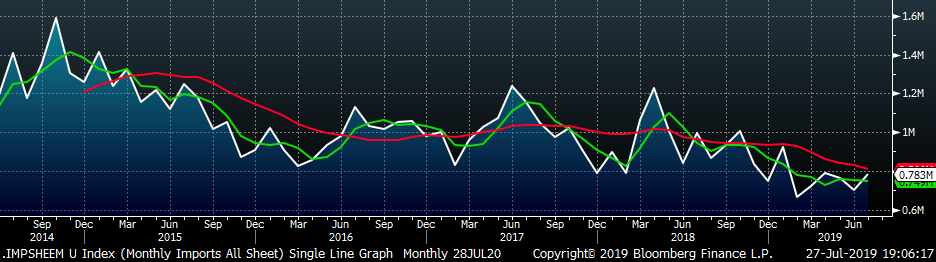

Tube import license data is forecasting a MoM increase of 119k to 584k tons in July.

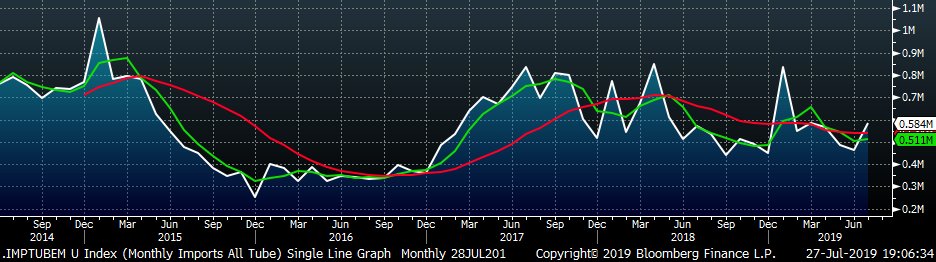

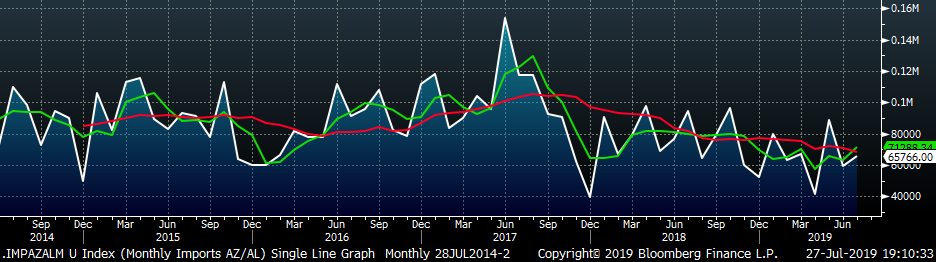

AZ/AL import licenses forecast an increase of 6k MoM to 66k in July.

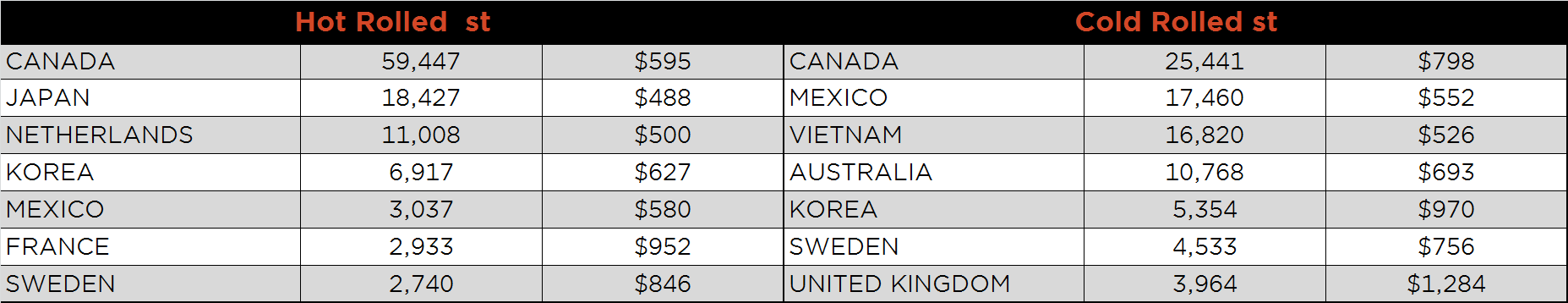

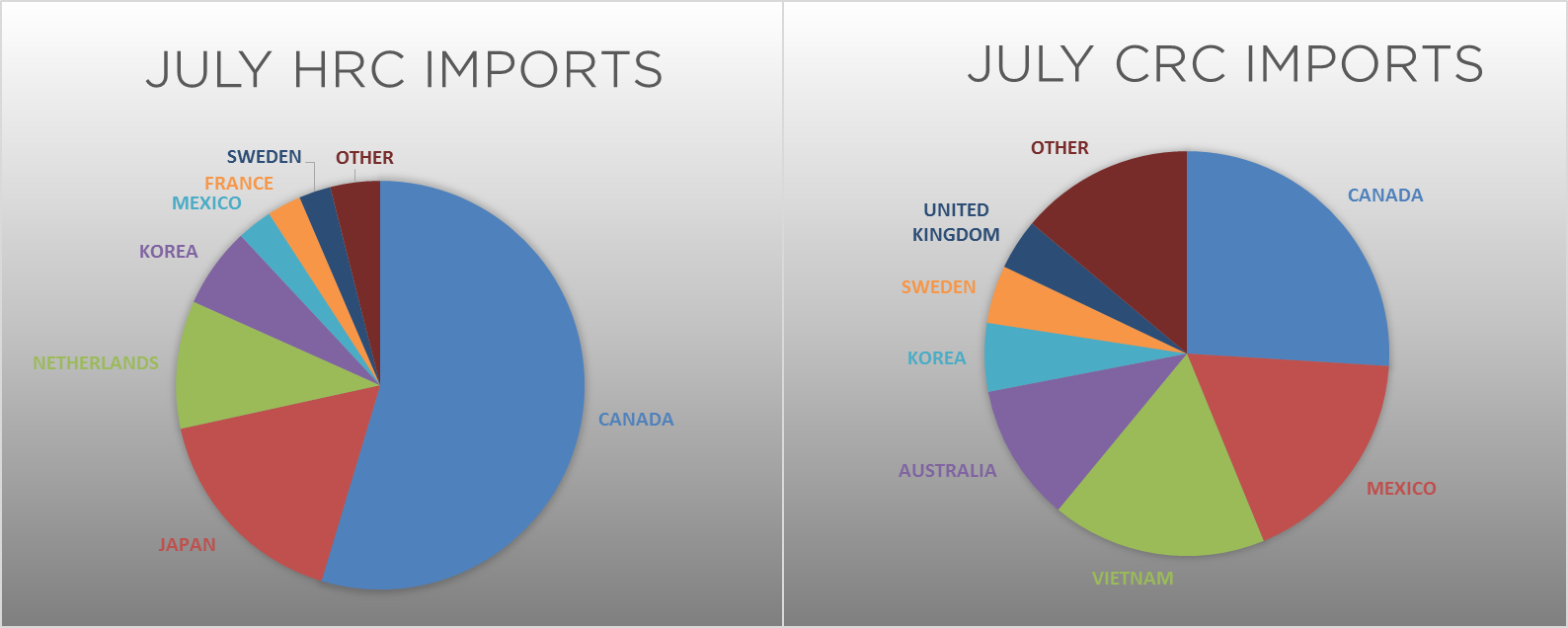

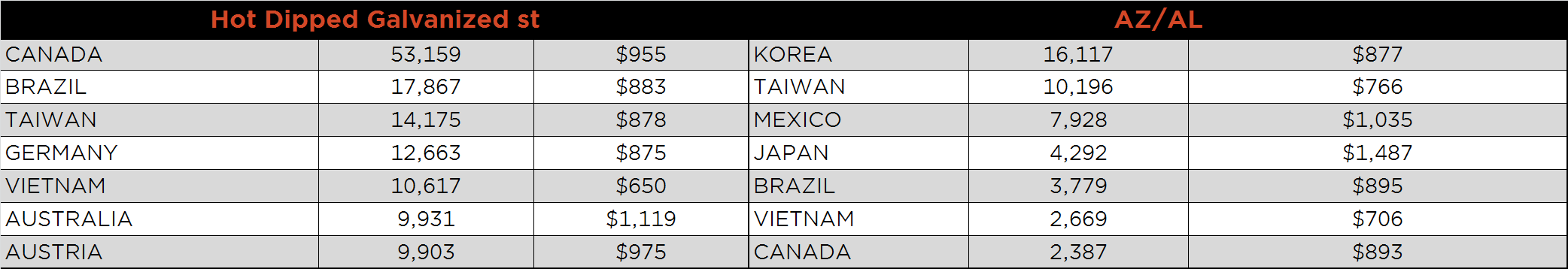

Below is June import license data through July 23, 2019.

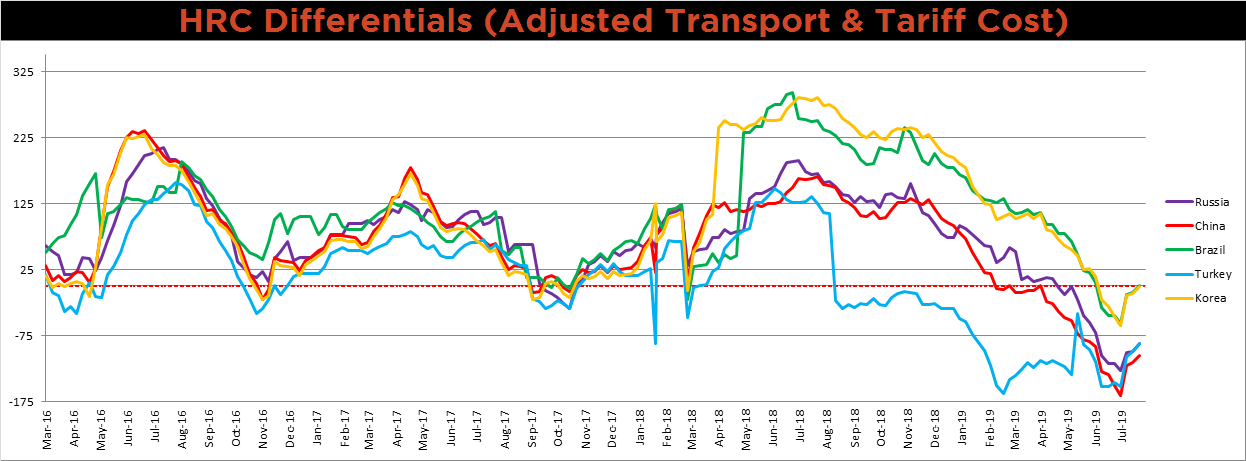

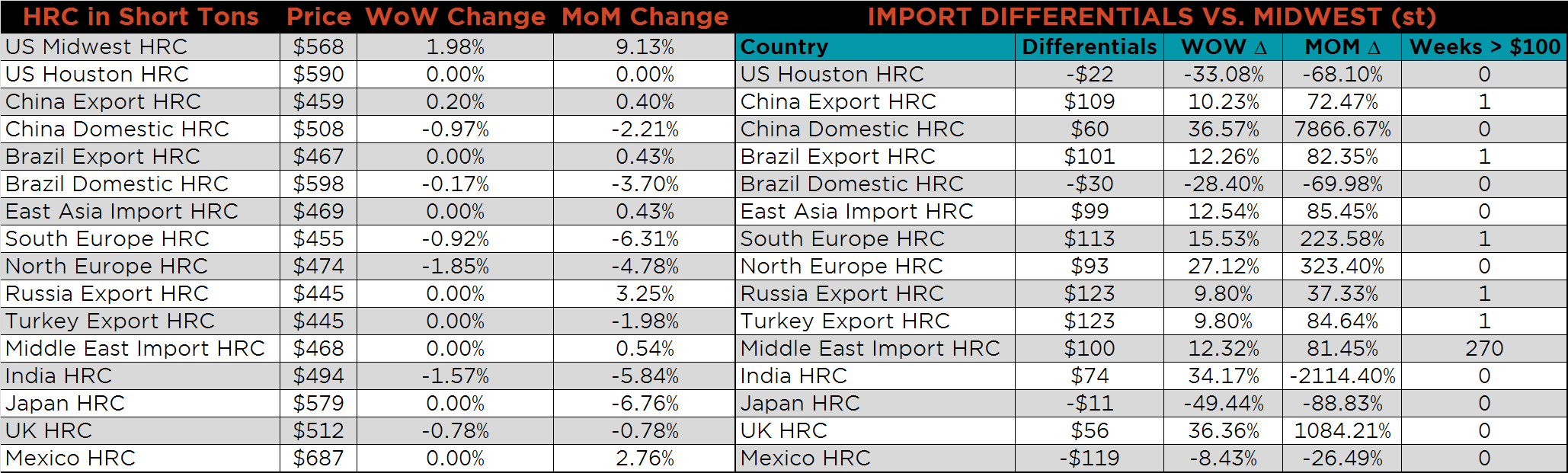

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The price differentials have all moved higher over the last three weeks as the domestic price continues to rise against a global market influenced heavily by stable Chinese export prices.

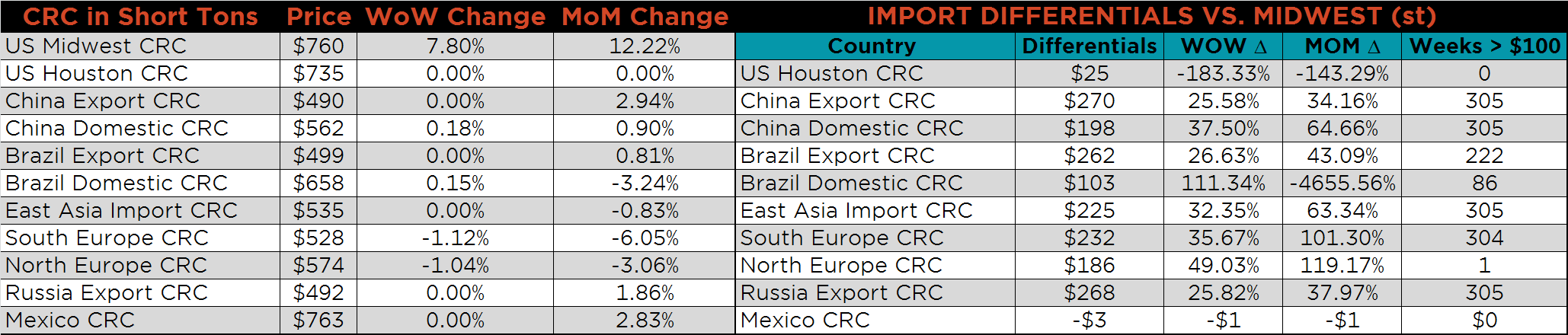

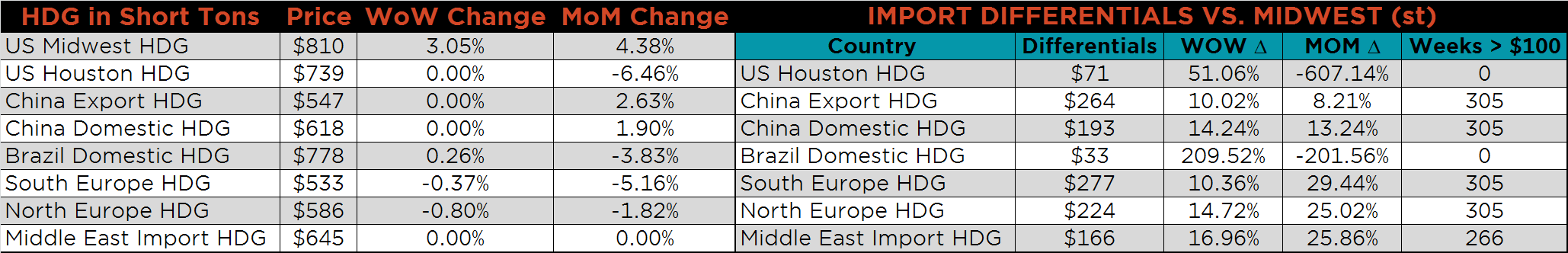

SBB Platt’s HRC, CRC and HDG pricing is below. Midwest CRC, HDG and HRC were all higher on the week, up 7.8%, 3% and 2%, respectively. Global prices showed very little change on the week.

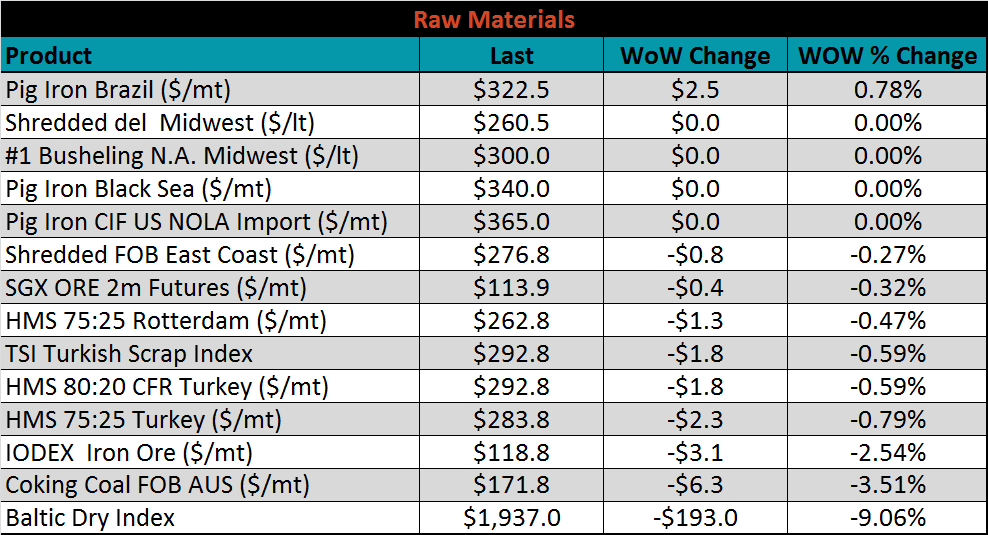

Raw material prices were mostly lower. Coking coal was down the most, 3.5%, while Brazilian pig iron rose 0.8%.

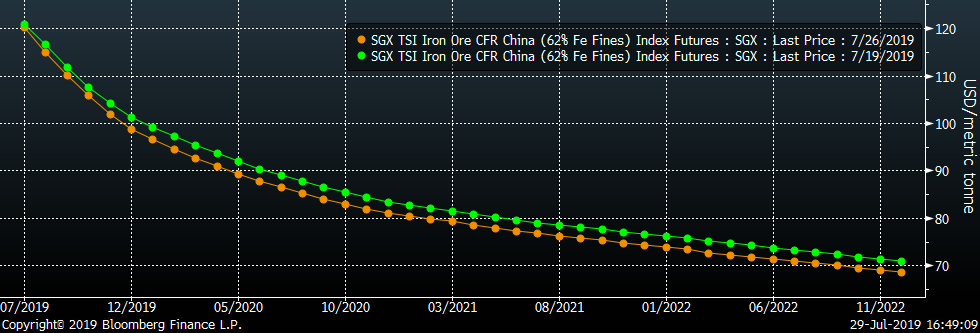

Below is the iron ore future curve with Friday’s settlments in orange, and the prior week’s settlements in green. Spot prices remanin elevated, and the curve continues to display steep backwardatation. Looking into the future, there is no demand at the current spot price for iron ore as Chinese mill profitability is fading.

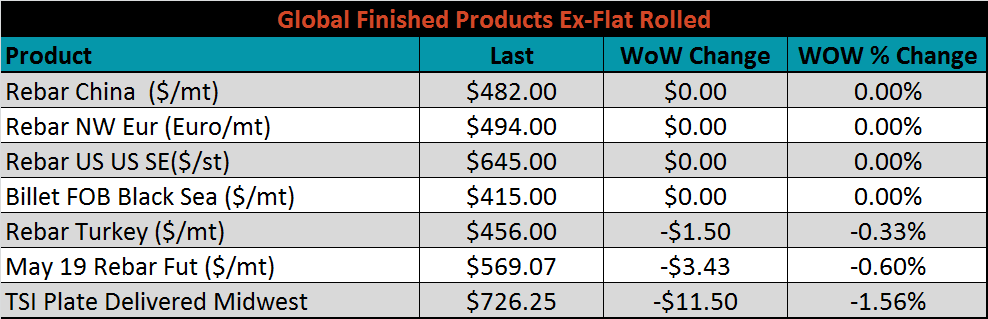

The ex-flat rolled prices are listed below.

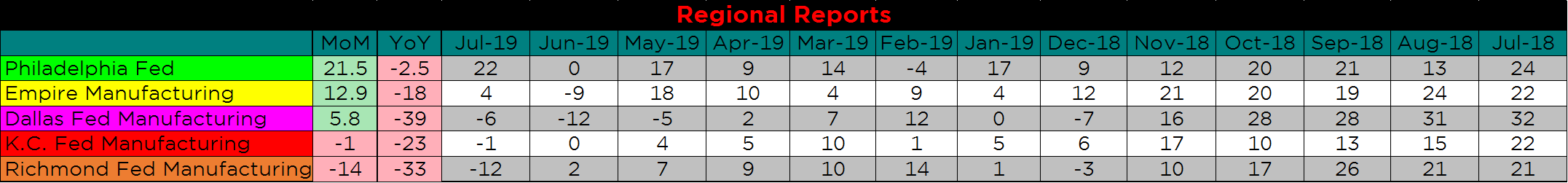

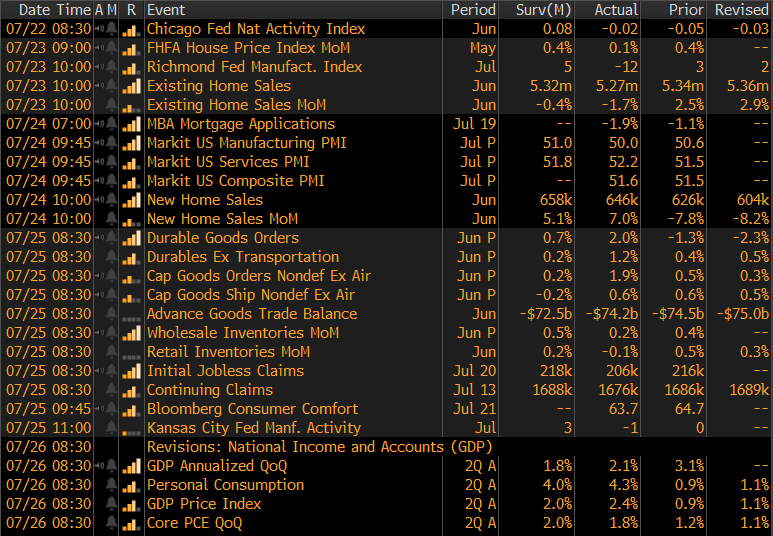

The remainder of the pertinent economic data is to the right. The upcoming FOMC decision remains the talk of Wall Street and Washington D.C. The market has received all but a guarantee for a rate cut from FED chair Jerome Powell and other voting members at next week’s FOMC meeting. Lower rates should be supportive for the general economy, and provide additional working capital funding for many steel intensive sectors.

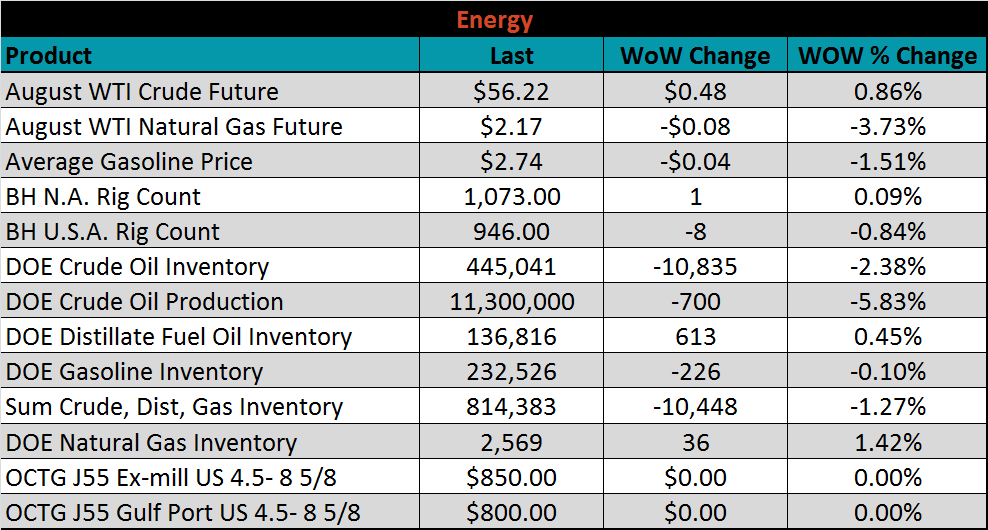

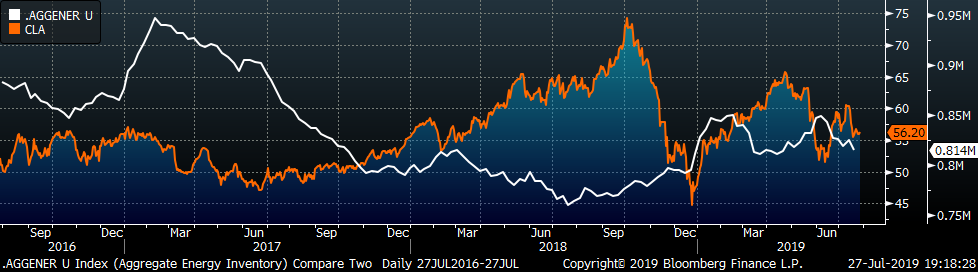

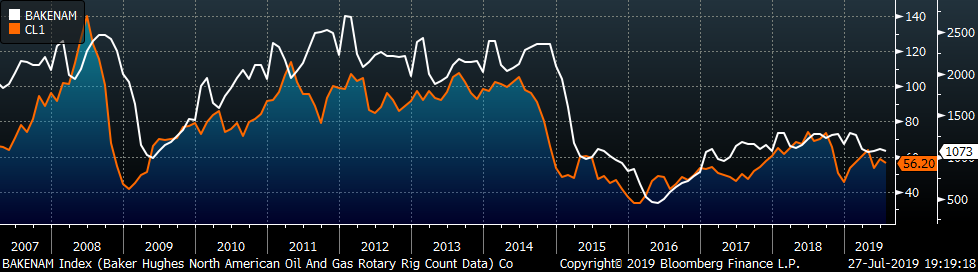

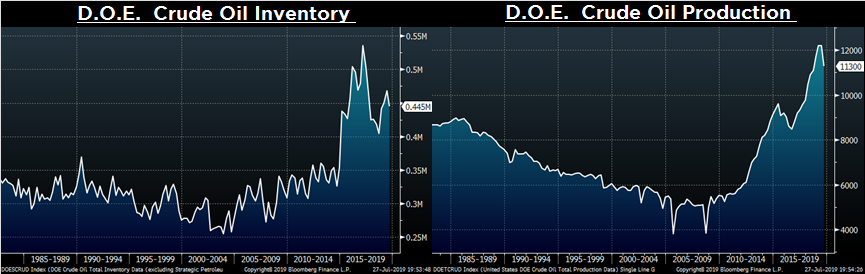

Last week, the Aug WTI crude oil future lost $4.47 or 7.4% to $55.74/bbl. The aggregate inventory level was up 0.8%, and crude oil production fell to 12.0m bbl/day. The Baker Hughes North American rig count gained one rig and the U.S. count lost another eight rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: