Content

-

Weekly Highlights

- Market Commentary

- Risks

For consistent readers of this report, you have probably noticed that over the past two months the first sentence of this report has been relatively consistent: “Nothing in the physical market changed last week and the spot price continued to push higher.” Without flashy headlines there is a possibility of becoming complacent or numb to what is happening within the market. While this week is filed in the same “Nothing significantly changed” category, it is important to take a step back and evaluate what that means for prices. Since the beginning of June, the TSI Platts Midwest HRC price has increased by $237. On top of that, the price officially doubled its 2018 peak of $920. With that context in mind, it should be clear that when we say nothing has changed, we mean the market remains in a demand driven shortage and the rally continues.

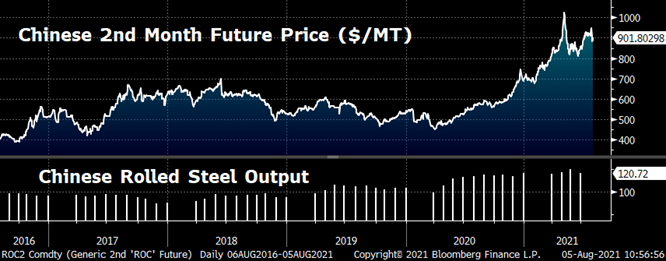

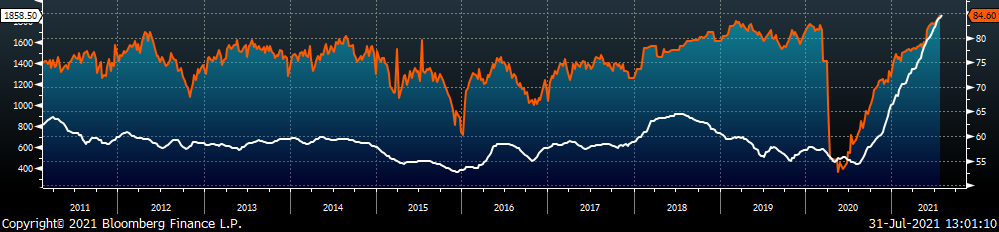

Outside of the U.S., the major news of the week came from China, as the 13% export rebate was removed for most remaining steel products which were not included in the May 1st policy change. The driving principle behind these decisions continues to be the expressed effort to reduce pollution by removing incentives to produce and export steel. So far, they have not been as successful as the market initially expected. The chart below shows Chinese HRC 2nd month Future price and rolled steel output in millions of tons.

While this recent decision did not come as a surprise, it should be noted that the products effected are more value-added products (i.e., cold-rolled & galvanized). The data shows that production out of China remains elevated, due to the fact exports are still very profitable, even without the rebate, reflecting the elevated levels of demand globally. At the same time, there is a seasonal nature to Chinese steel production and current levels are expected to begin decreasing shortly. The overriding factor of the global market is that there is not enough material to satisfy demand. Until equilibrium is reached, there will be sustained upward pressure on steel prices and any restrictions on supply could extend the timeline. As the world’s largest producer and exporter, China will have an outsized impact on these dynamics. If they continue down this path, the question of “Will you be able to get the material you need over the next 12 months?” becomes more difficult to answer with a yes.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

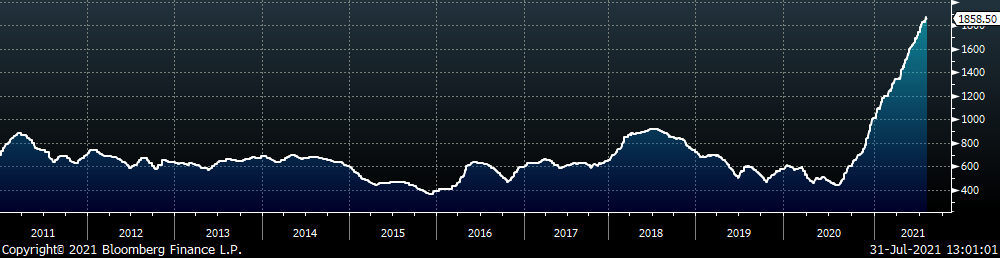

The Platts TSI Daily Midwest HRC Index increased by $25 to $1,858.50.

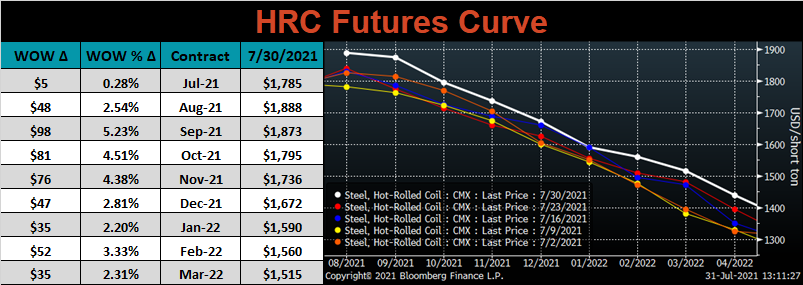

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. Last week, the entire curve shifted higher, most significantly in the front months, as demand and spot prices continue to increase.

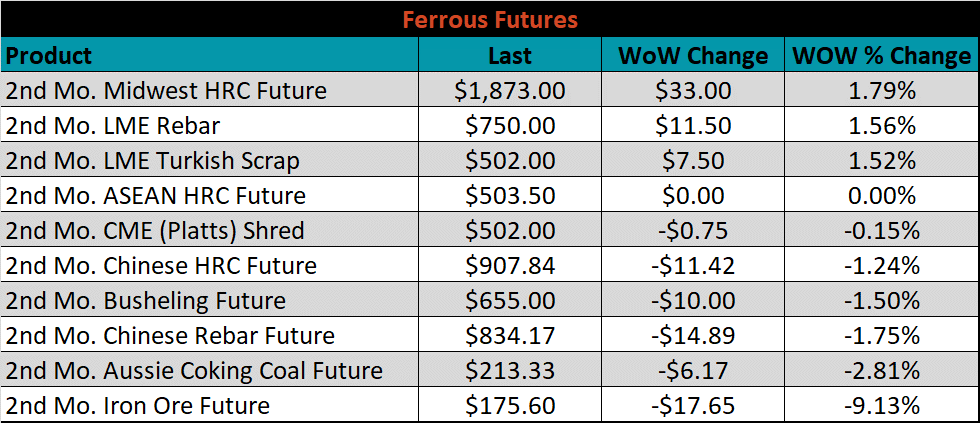

September ferrous futures were mixed. Iron ore lost another 9.1%, while the Midwest HRC future gained 1.8%.

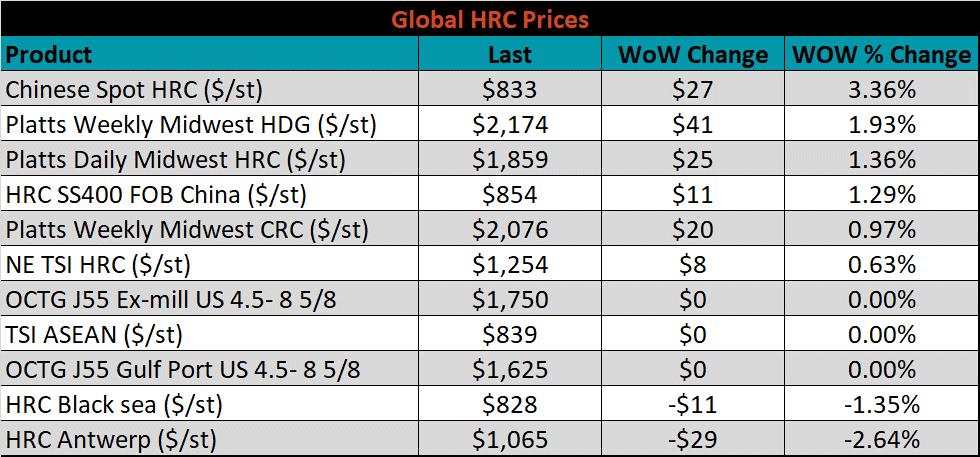

Global flat rolled indexes were mixed. Chinese spot HRC was up 3.4%, while Antwerp HRC was down another 2.6%.

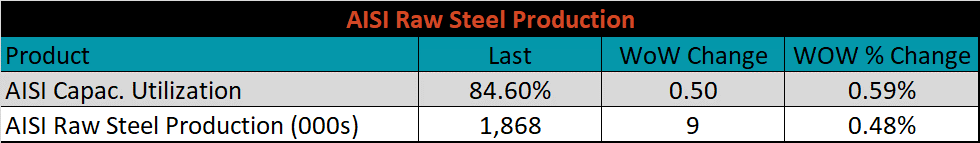

The AISI Capacity Utilization rate increased 0.5% to 84.6%.

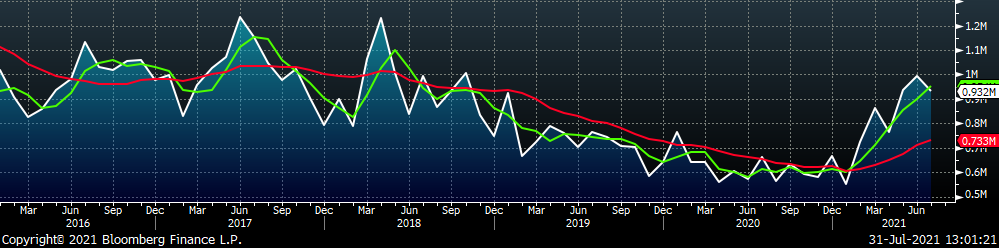

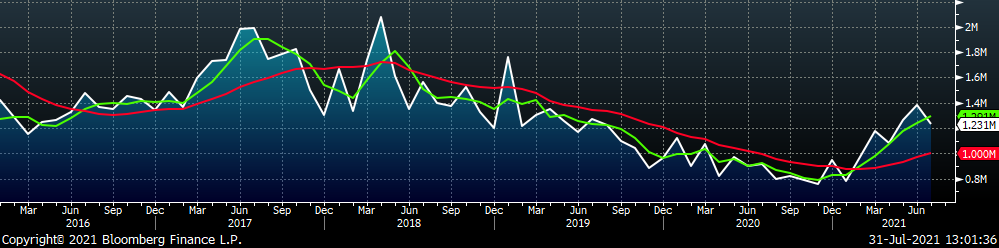

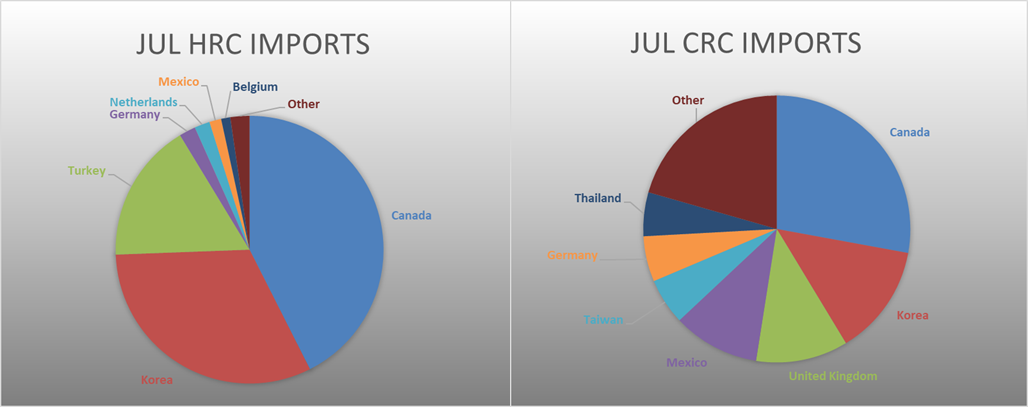

July flat rolled import license data is forecasting a decrease of 61k to 932k MoM.

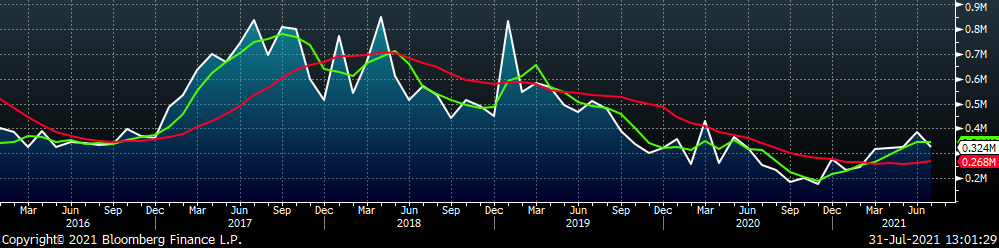

Tube imports license data is forecasting a decrease of 63k to 324k in July.

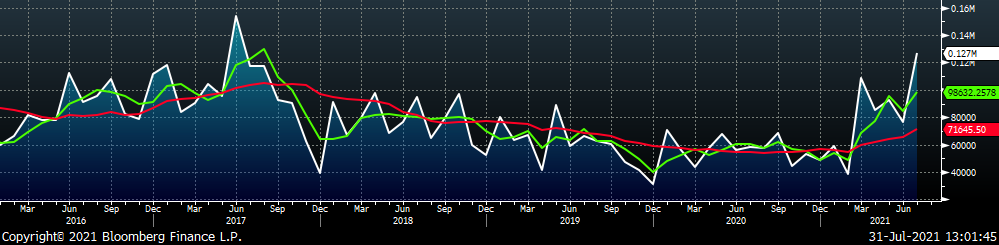

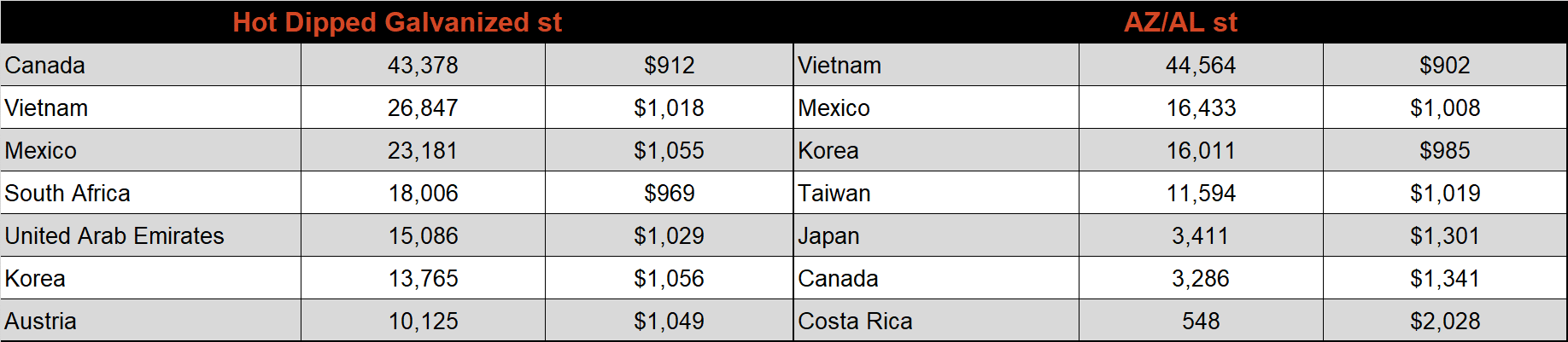

July AZ/AL import license data is forecasting an increase of 51k to 127k.

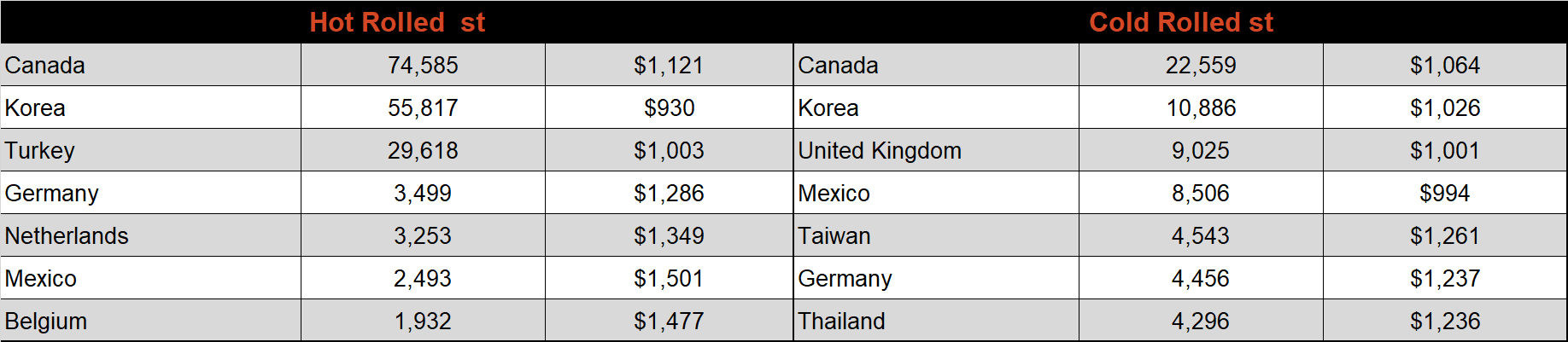

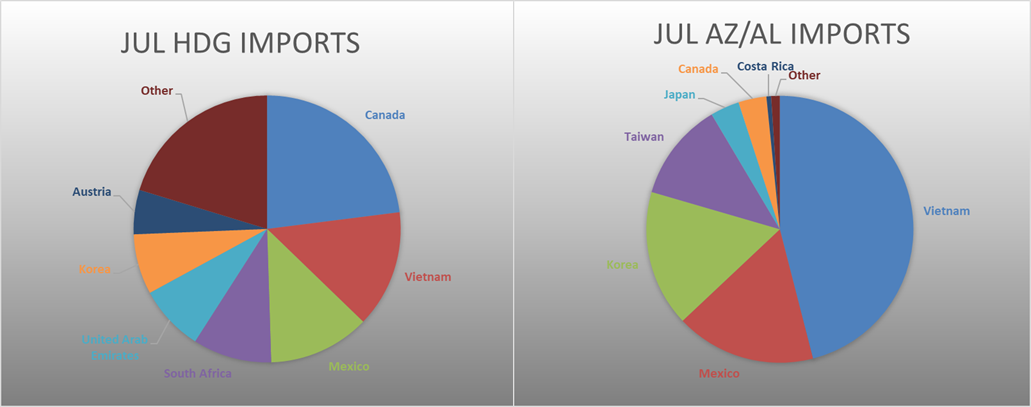

Below is July import license data through July 26th, 2021.

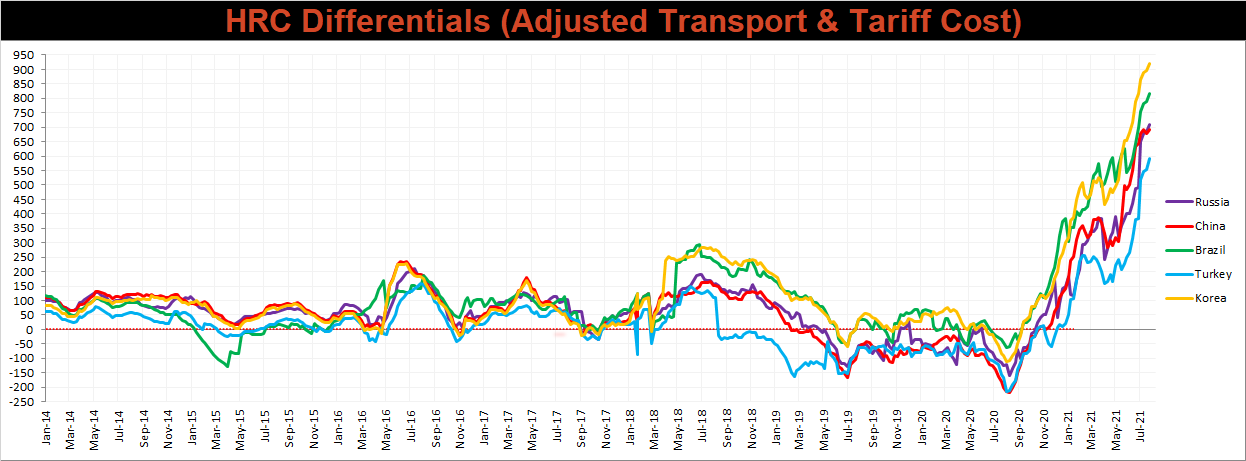

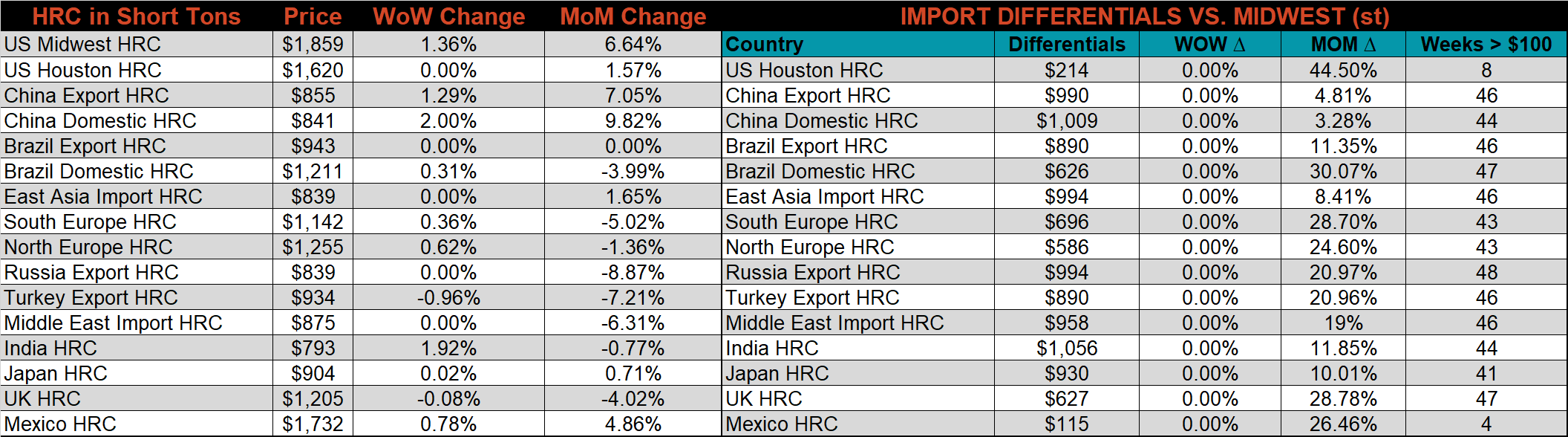

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials for all watched countries increased further.

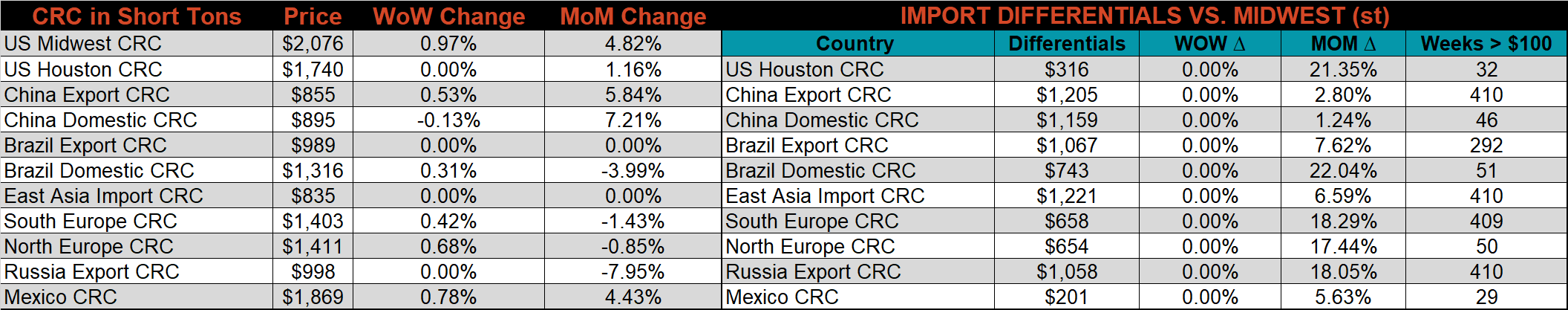

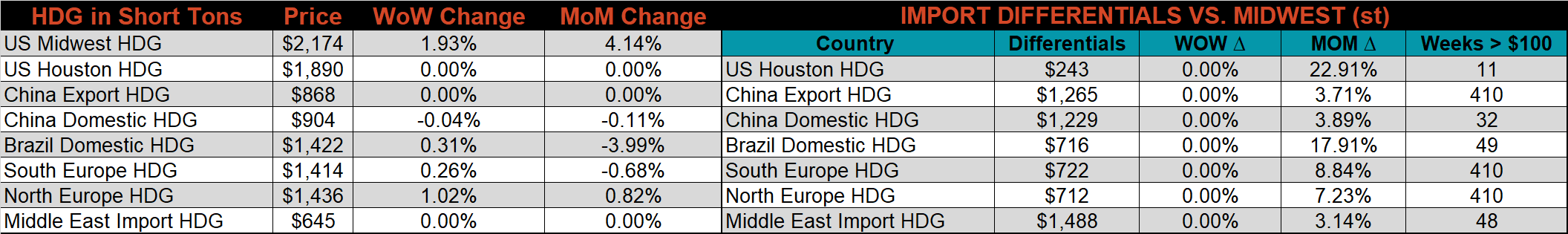

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HDG, HRC, & CRC prices were up, 1.9%, 1.4% and 1%, respectively. Globally, the Chinese domestic HRC price was up 2%.

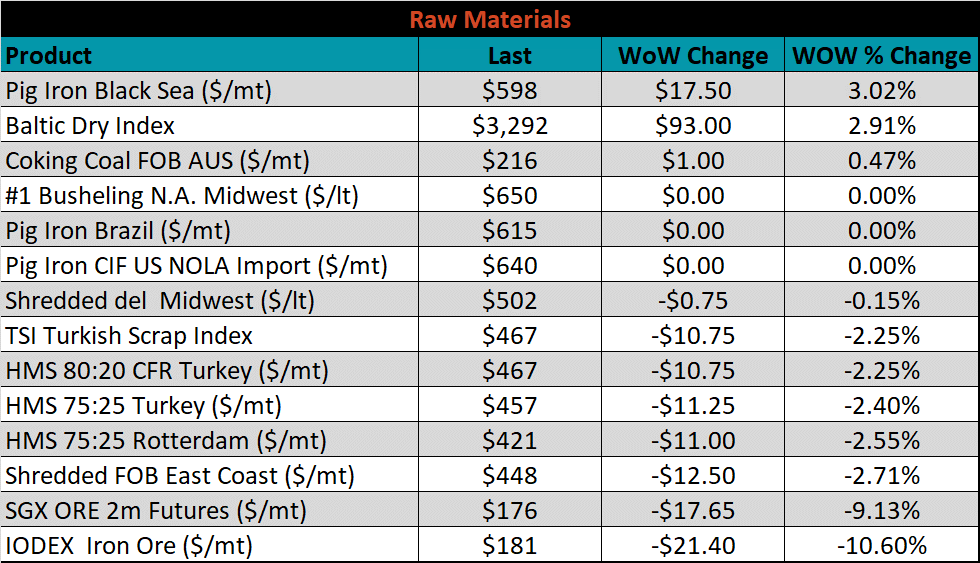

Raw material prices were mixed, Black Sea pig iron was up 3%, while the IODEX iron ore index was down 10.6%.

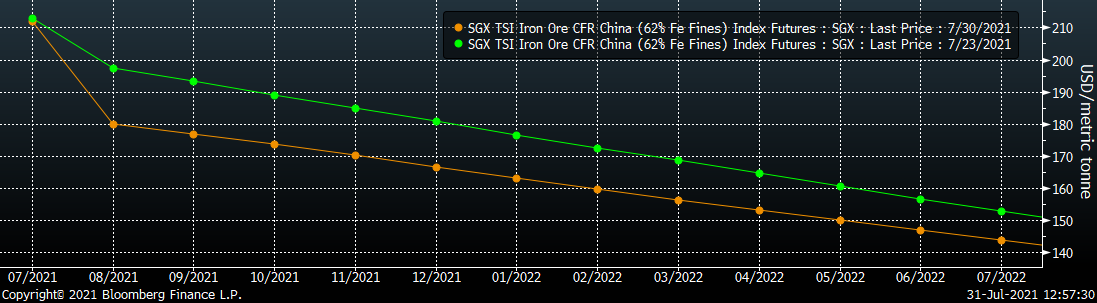

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve shifted dramatically lower most significantly in the front.

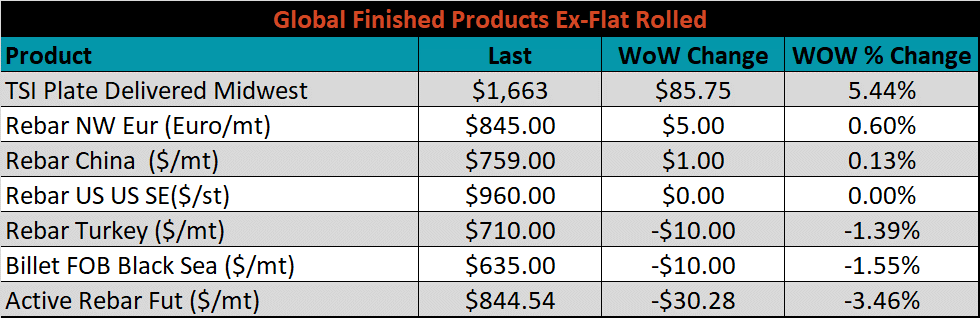

The ex-flat rolled prices are listed below.

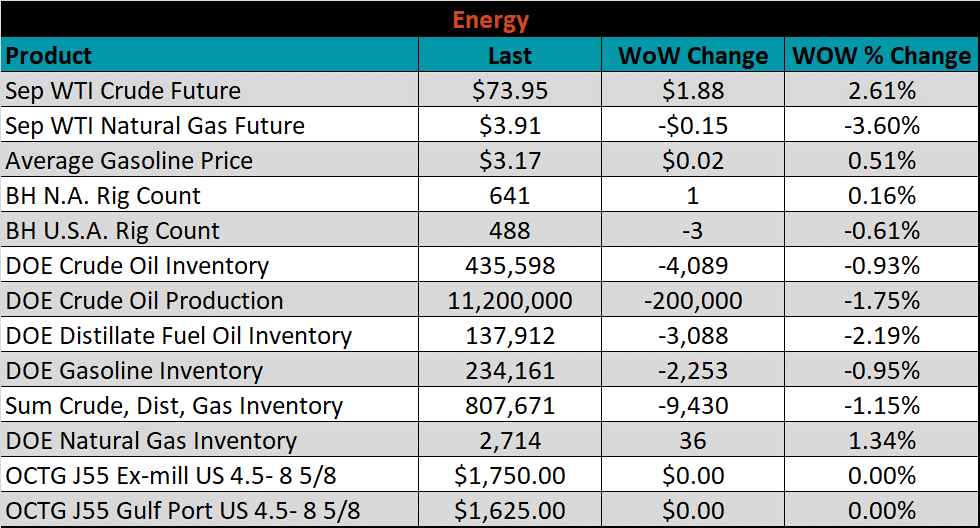

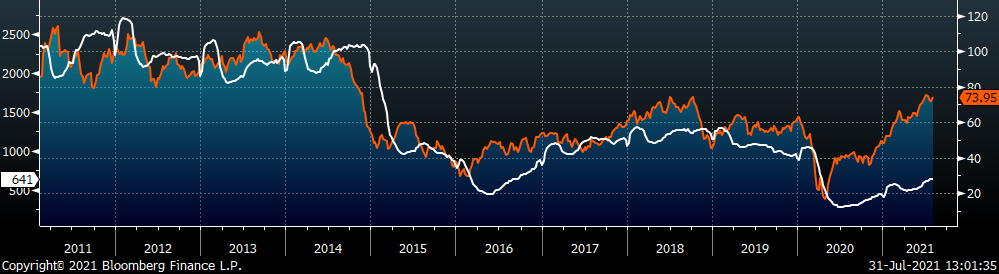

Last week, the September WTI crude oil future was up another $1.88 or 2.6% to $73.95/bbl. The aggregate inventory level was up 1.2%, while crude oil production slipped to 11.2m bbl/day. The Baker Hughes North American rig count was up 1 rig, while the U.S. rig count was down 3 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: