Content

-

Weekly Highlights

- Market Commentary

- Durable Goods

- Risks

Conversations regarding the steel market continue to focus on locating the bottom of the current price cycle. Another way to view this question is what events and circumstances will allow mills to raise prices?

The decline in scrap prices over the past several months allowed mini mills to lower their offers and maintain profitable spot market sales. As we discussed in this report last week, Midwest busheling scrap looks undervalued compared to Turkish scrap, and we expect the busheling pricing to move higher relative to Turkish pricing. However, even a move sideways in the months ahead could give the mills an opportunity to announce a price increase.

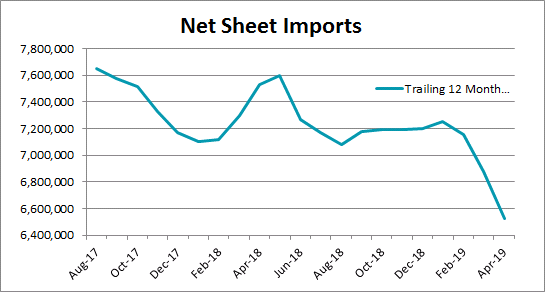

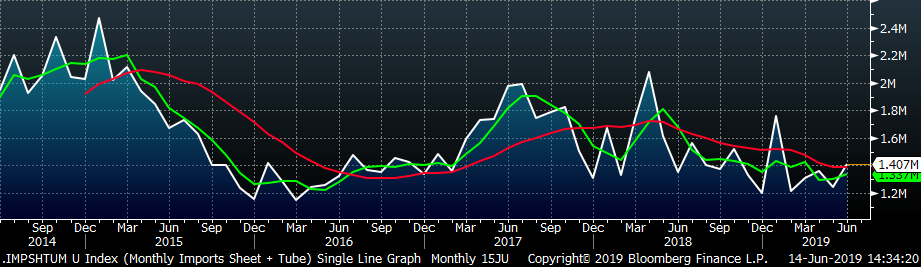

Service center inventories have thinned out from their high levels seen at the beginning of the year, and they have decided to move old, high priced material instead of making speculative purchases at lower prices. The decision to destock has exacerbated the downward domestic price cycle, leading to unattractive import prices. Below is a graph showing the trailing 12 month Net Sheet Imports (imported tons minus exported tons) declining sharply in the second quarter.

These low import levels have contributed to the low inventory levels at service centers, and if they persist, will create a deficit in the market that would support a price increase announcement.

Profitability at mills has continuously been analyzed and discussed in this report, specifically that producing and selling spot tons at current prices is unprofitable. However, taking down a furnace may have political consequences as the administration’s Section 232 tariffs remain in place to increase domestic production. Mills could use already planned maintenance outages as a shield to extend furnace downtime and push out lead times. Lead times have fallen to the lowest levels of the last 3 years, and any ability to push out lead times will support price increases from the mills.

A price increase announcement would have immediate effect on both the physical and futures market, with sellers removing or significantly raising any existing offers. Therefore, a price increase with support and follow through in the market would mark the bottom of the price cycle, and leave many buyers chasing tons and prices higher.

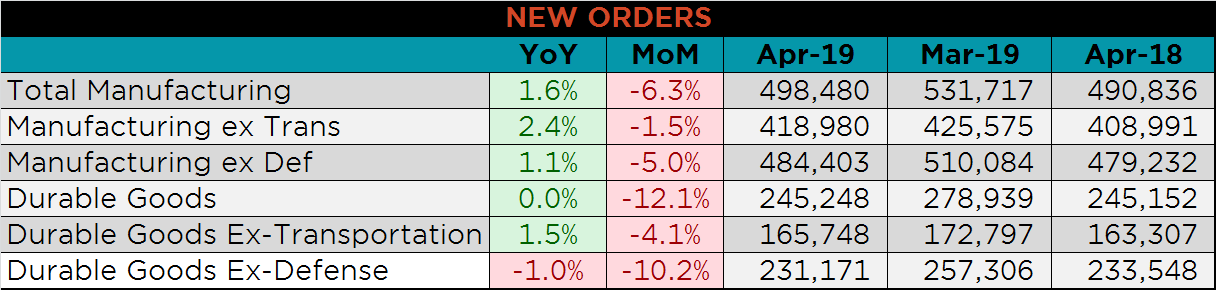

Below are final April new orders from the Durable Goods report. New orders continued to grow YoY, and at a faster YoY pace than they did in March. The below charts show the YoY growth stabilizing in April, however, this is below the high levels of new order YoY growth we saw in 2018.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

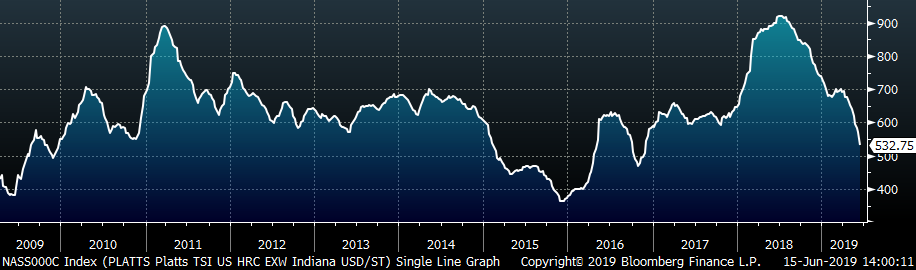

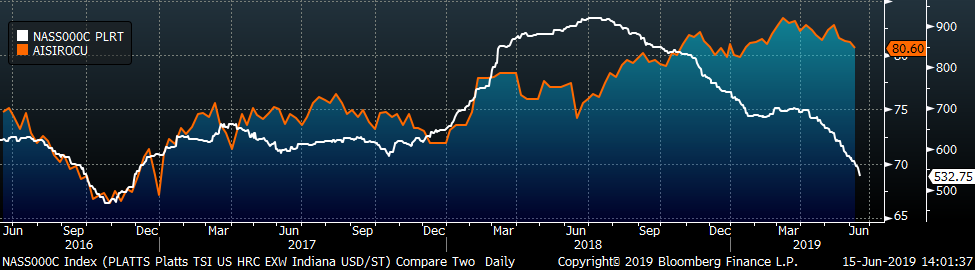

The Platts TSI Daily Midwest HRC Index was down $37.50 to $532.75.

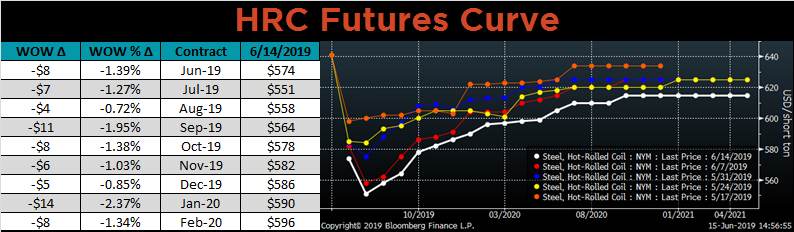

The CME Midwest HRC futures curve is shown below with last Friday’s settlements in white. The curve shifted lower across all expirations last week.

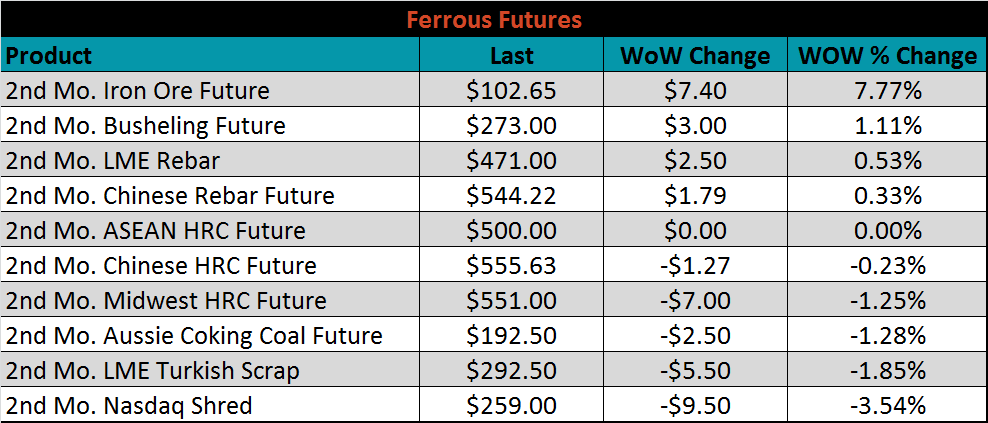

June ferrous futures were mixed. The iron ore future gained 7.77%, while Turkish scrap lost 1.9%.

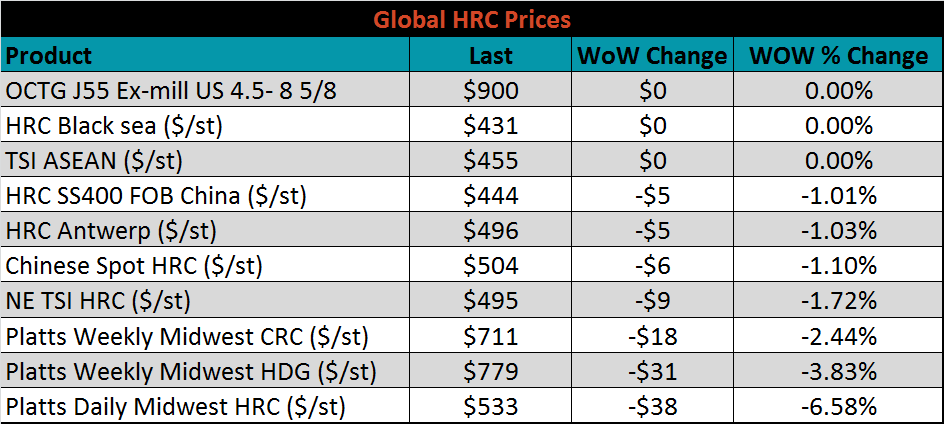

The global flat rolled indexes were mostly lower. Midwest HRC was down the most, 6.6%.

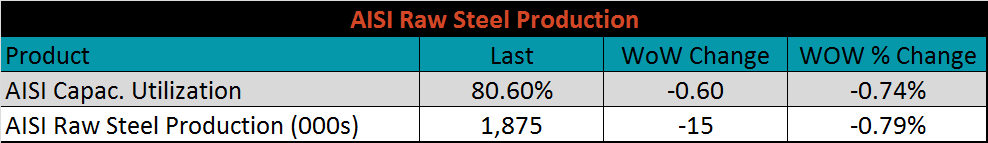

The AISI Capacity Utilization Rate was down 0.6 points to 80.6%. As mentioned in previous weeks, it is hard to imagine mills will produce at these levels while the marginal ton is sold at a loss in the spot market. Reducing production would directly contradict the Trump administration’s goal of 80% Capacity Utilization Rate that has held since October 2018.

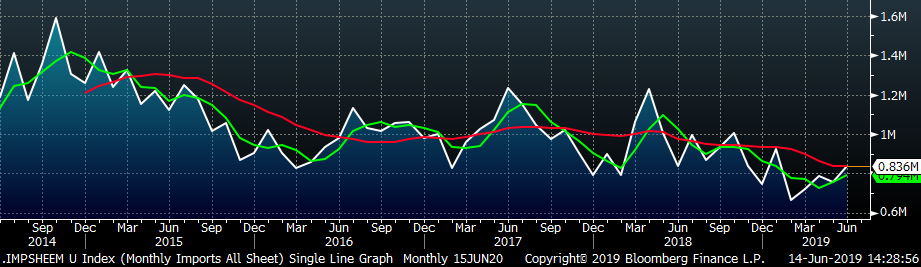

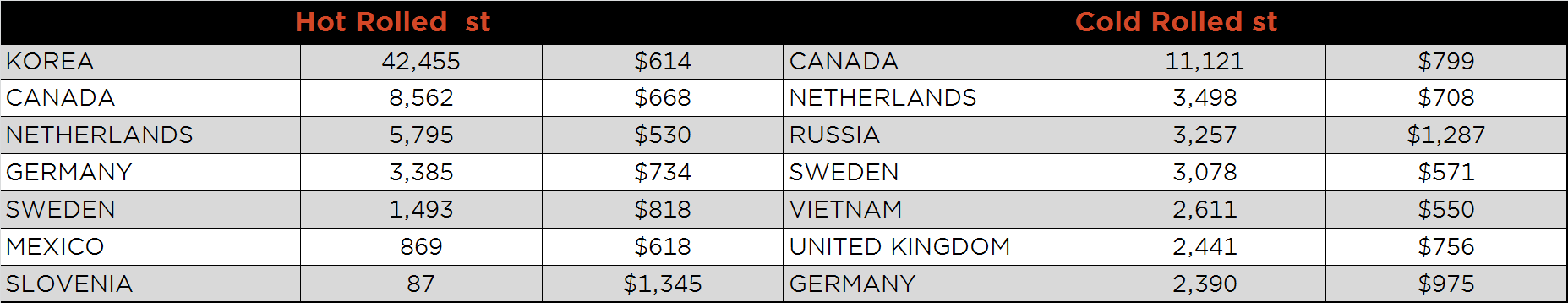

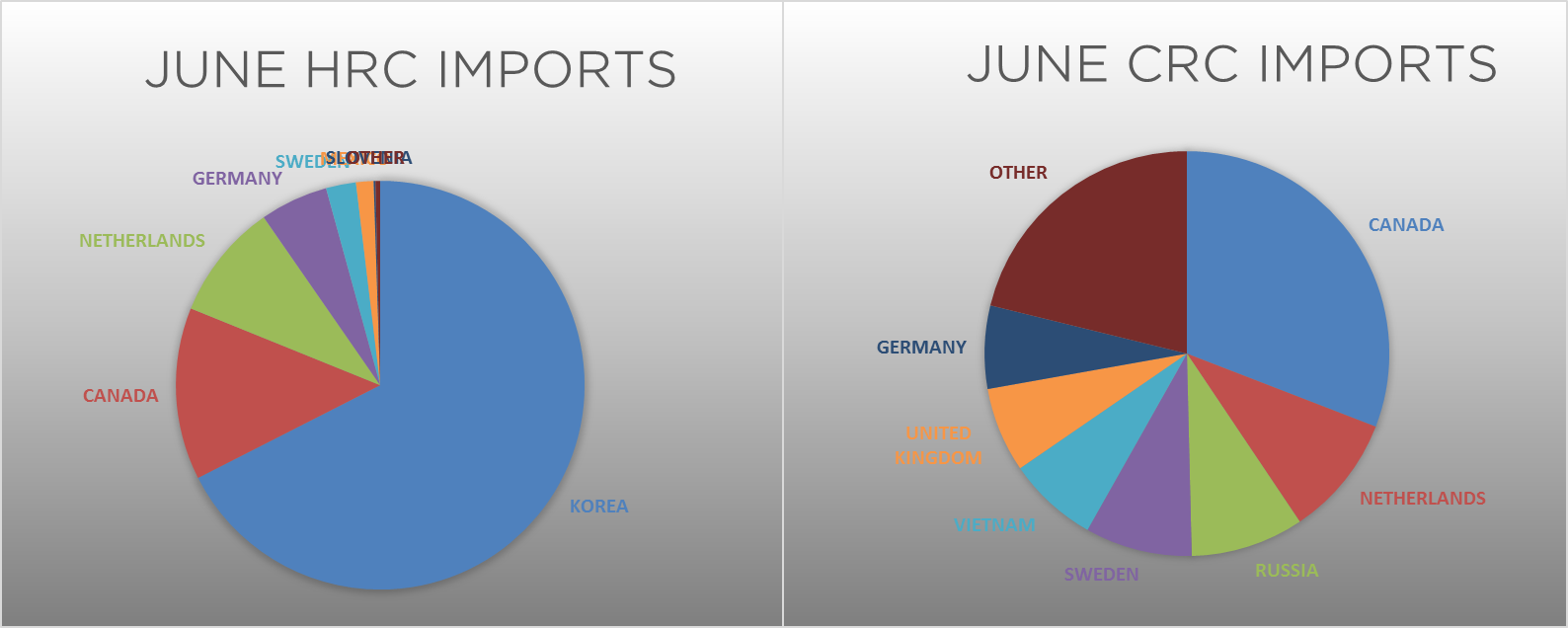

June flat rolled import license data is forecasting an increase to 836k, up 81k MoM.

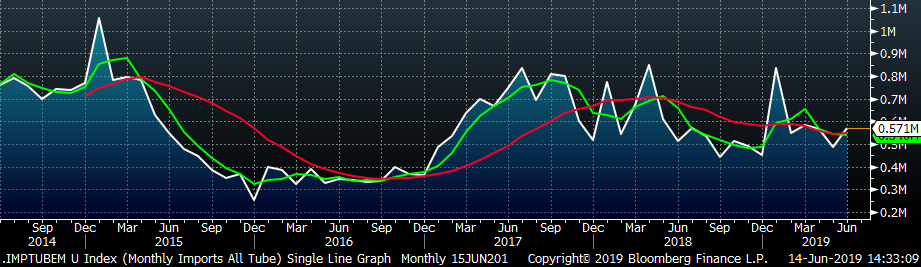

June tube import license data is forecasting a MoM increase of 86k to 571 tons.

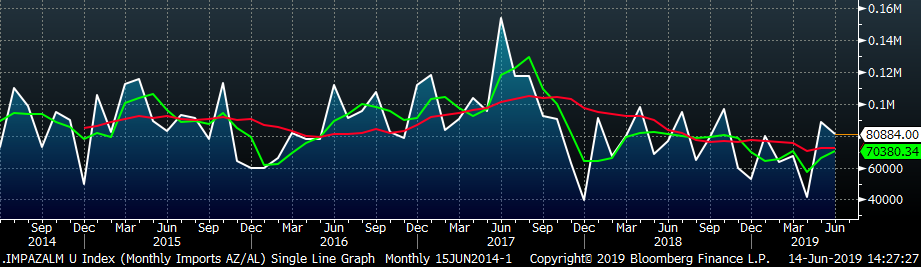

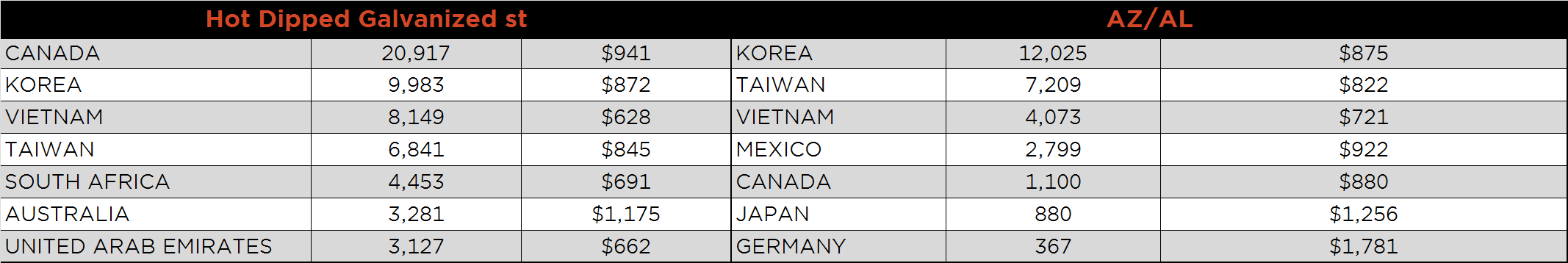

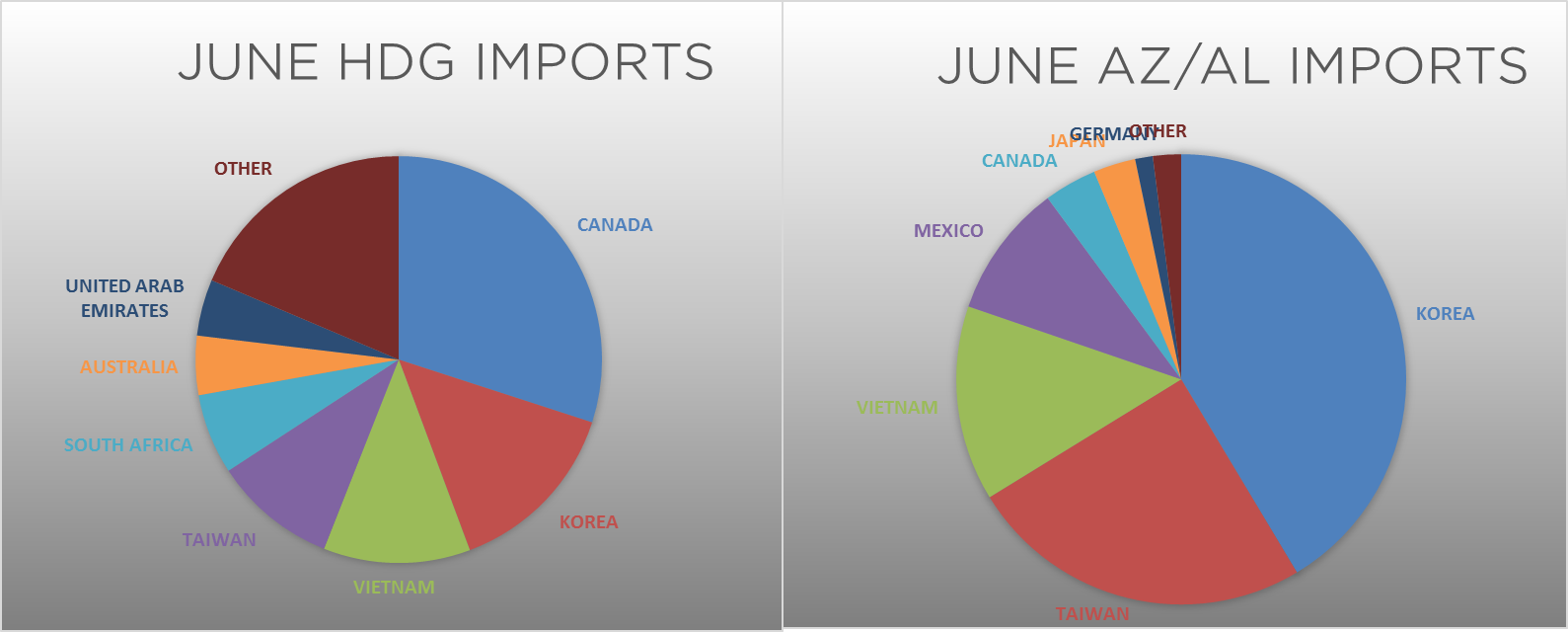

AZ/AL import licenses forecast an decrease of 8k MoM to 81k in June.

Below is May import license data through June 11, 2019.

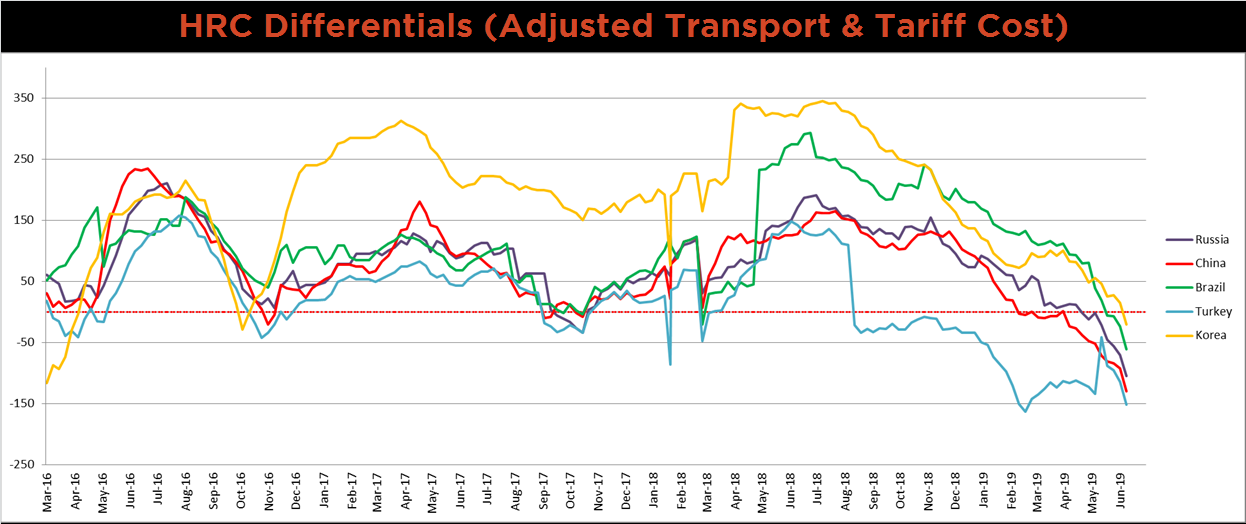

Below is HRC Midwest vs. each listed country’s export price differential using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Since last week, the Midwest price fell nearly $40, this pulled all of the differentials down to the lowest levels in 3 years. Historically, the zero price differential level has acted as a bottoming signal for domestic HRC prices.

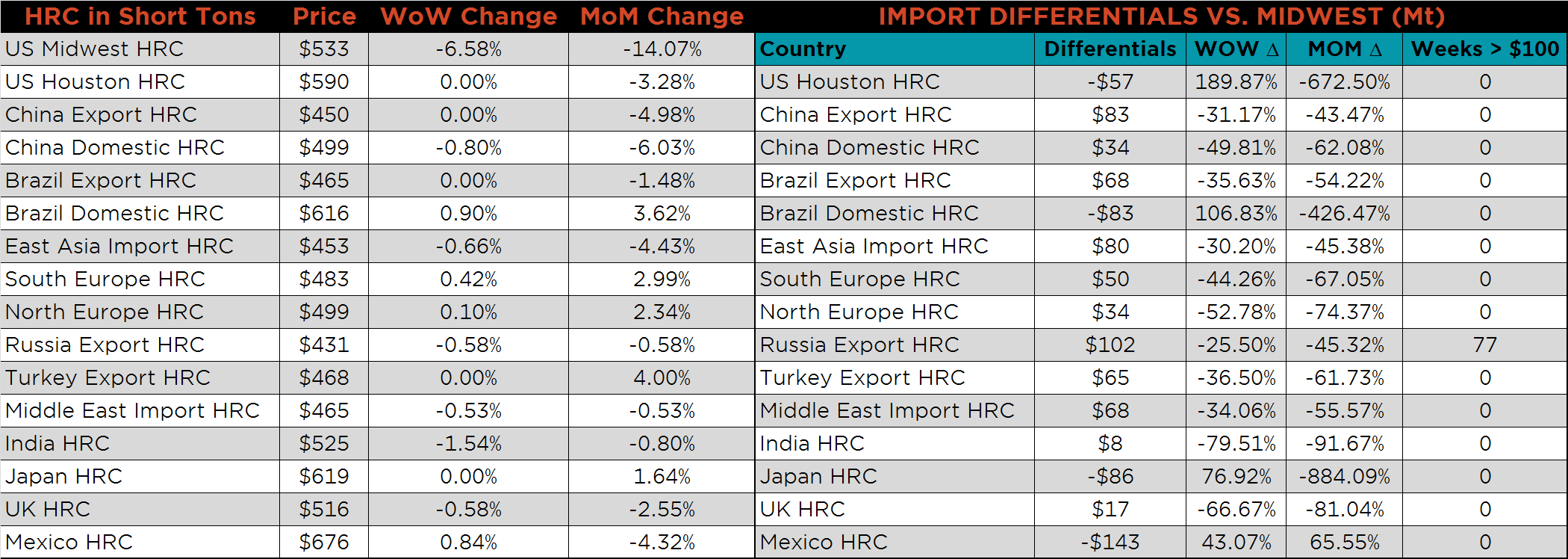

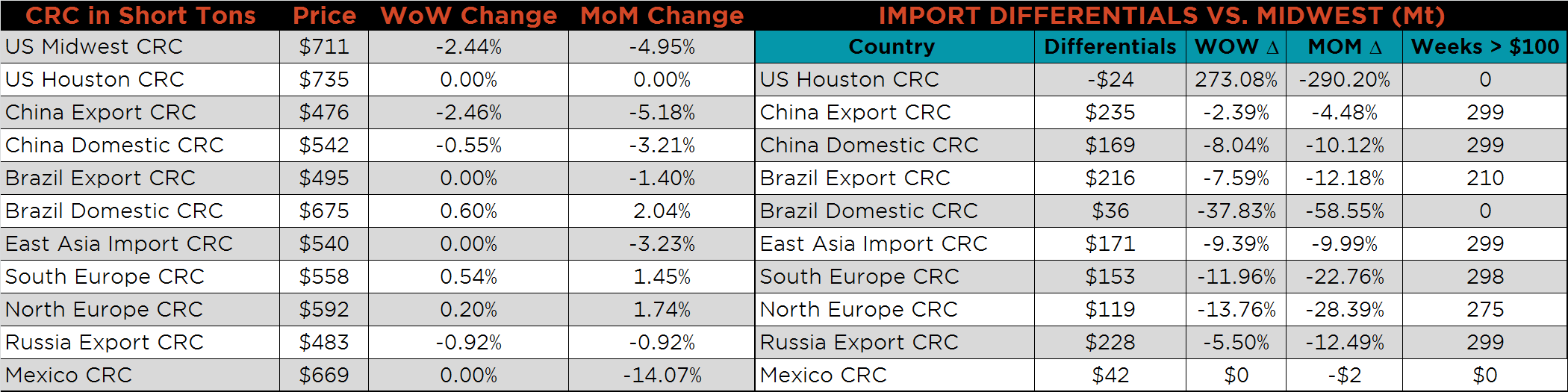

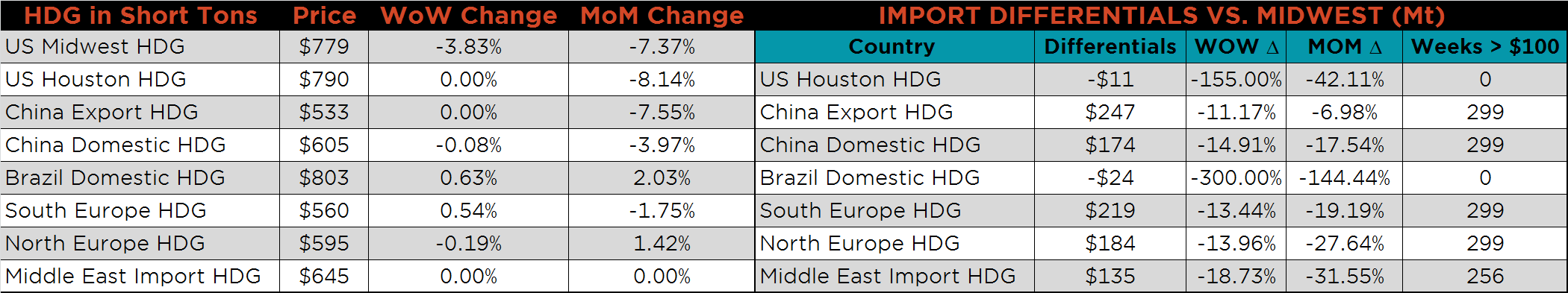

SBB Platt’s HRC, CRC and HDG pricing is below. Midwest HRC, HDG and CRC prices were lower on the week, down 6.6%, 3.8% and 2.4%, respectively. Chinese CRC export prices were down 2.5% as well, while the remainder of the major producers showed little change in prices.

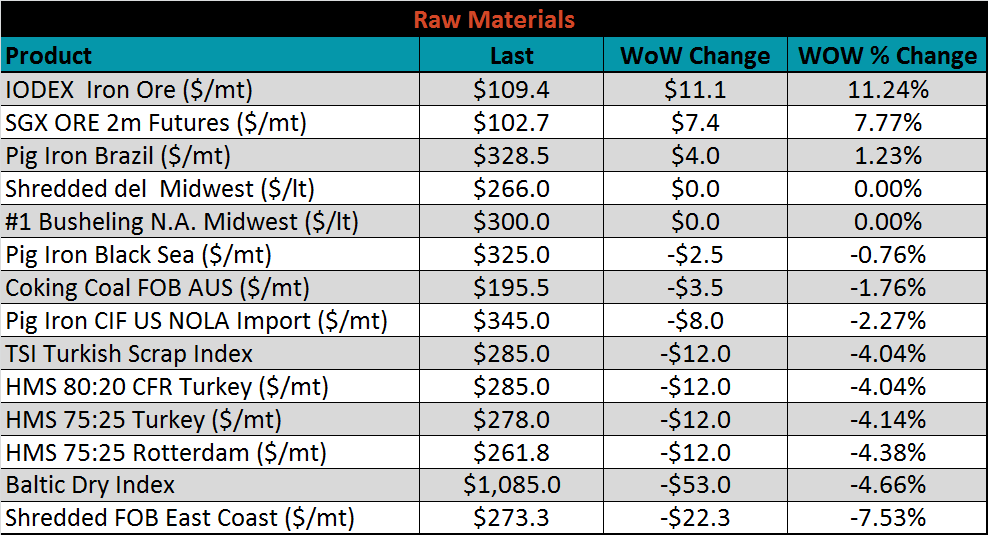

Raw material prices were mixed, SGX iron ore futures gained 7.8%, while East Coast shredded was down 7.5%.

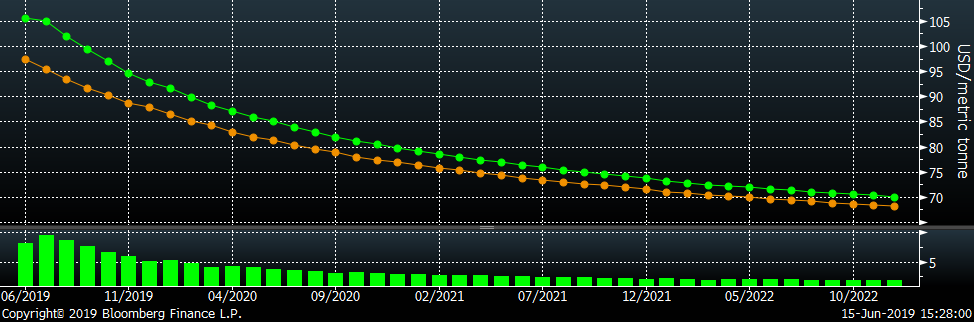

Below is the iron ore future curve with Friday’s settlments in green, and the prior week’s settlements in orange.

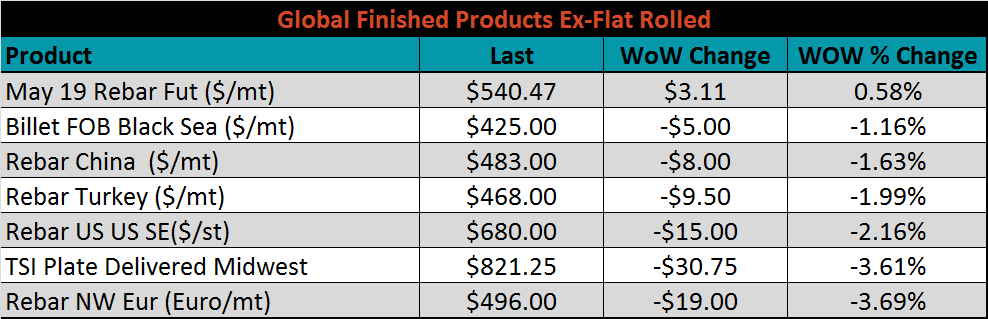

The ex-flat rolled prices are listed below.

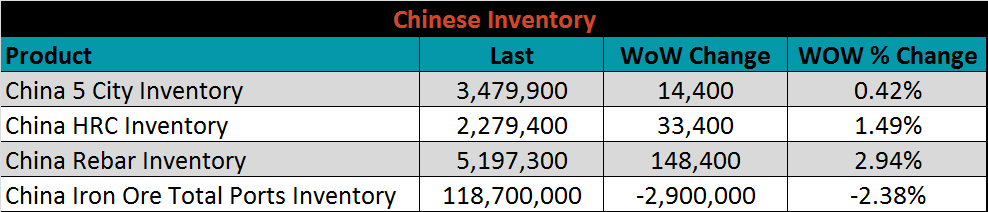

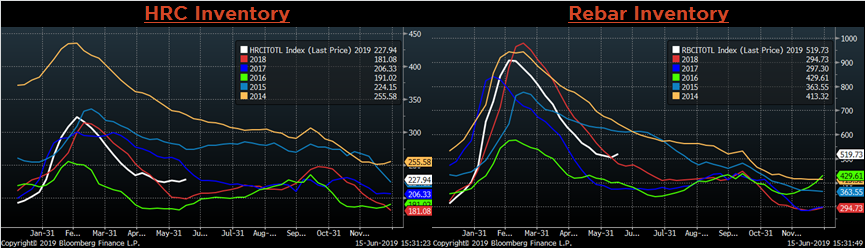

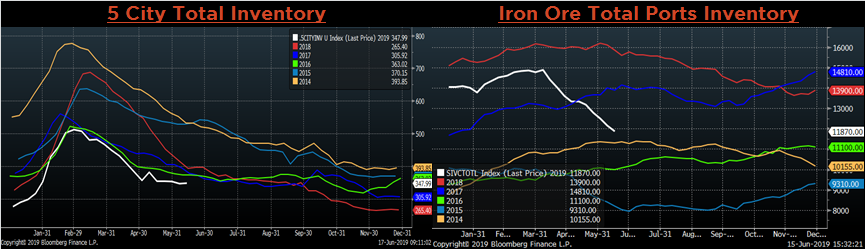

Below are inventory levels for Chinese finished steel products and iron ore. HRC, Rebar and the 5-city Inventory levels all moved higher last week, while iron ore inventory continued to decline. As profit margins at mills shrink due to elevated ore prices and lackluster coil prices, look for the iron ore ports inventory to stabilize as steel production slows.

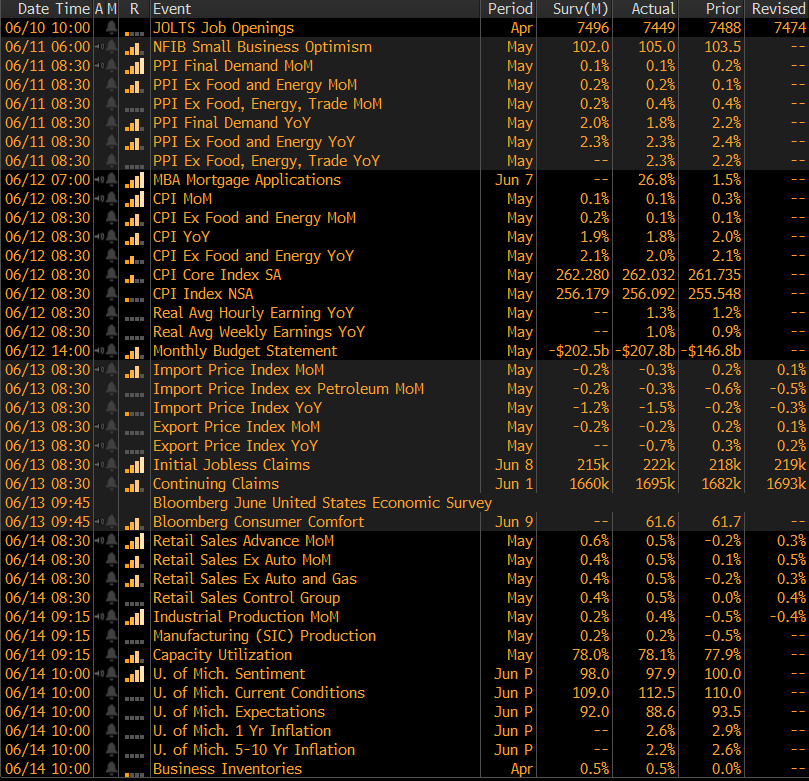

The remainder of the pertinent economic data is to the right. Industrial production and manufacturing production for May were both higher, up 0.4% from -0.5% and 0.2% from -0.5%, respectively. As mentioned in the prior report, next week is the much-anticipated FOMC meeting that will give projections for interest rates going forward. The assumption that there will not be a rate cut until July or September is still the consensus. Finally, markets will be focused on headlines around the upcoming G-20 meeting and whether President Trump and President XI of China will meet to make another attempt at a trade agreement.

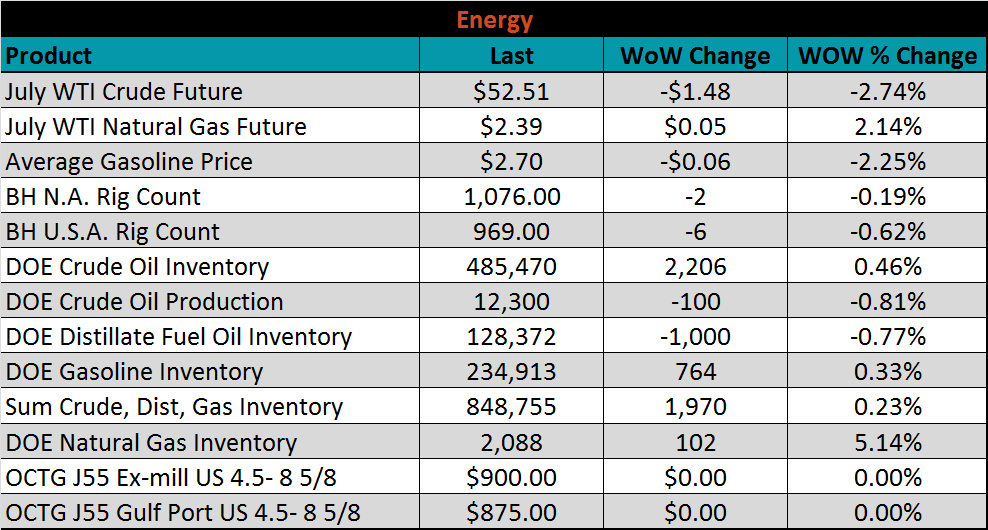

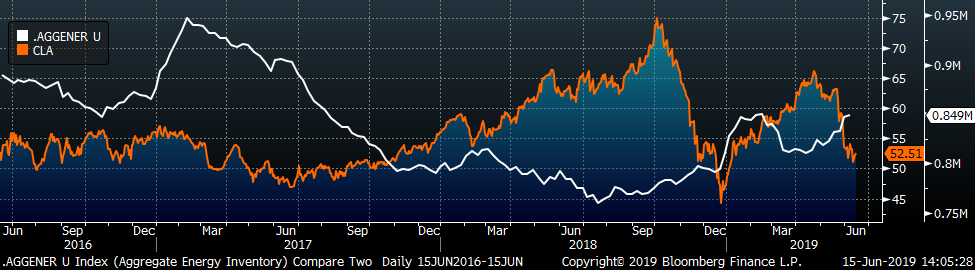

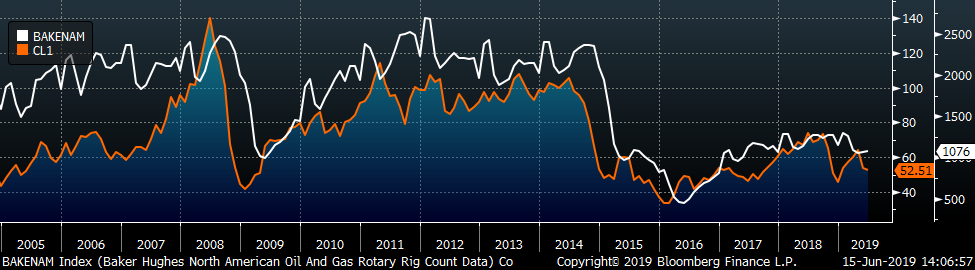

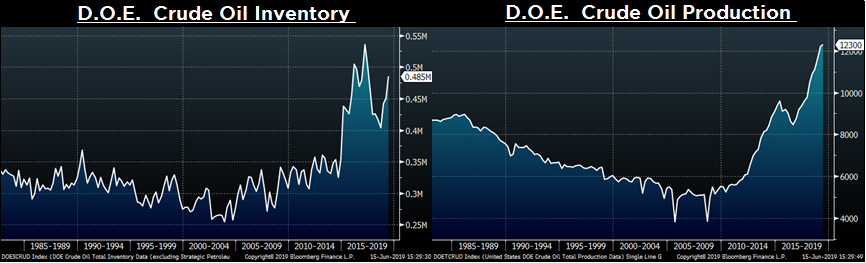

Last week, the July WTI crude oil future LOST $1.48 or 2.7% to $52.51/bbl. The aggregate inventory level was up 0.2%, and crude oil production came down slightly, to 12.3m bbl/day. The Baker Hughes North American rig count lost two rigs while the U.S. lost six.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: