Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

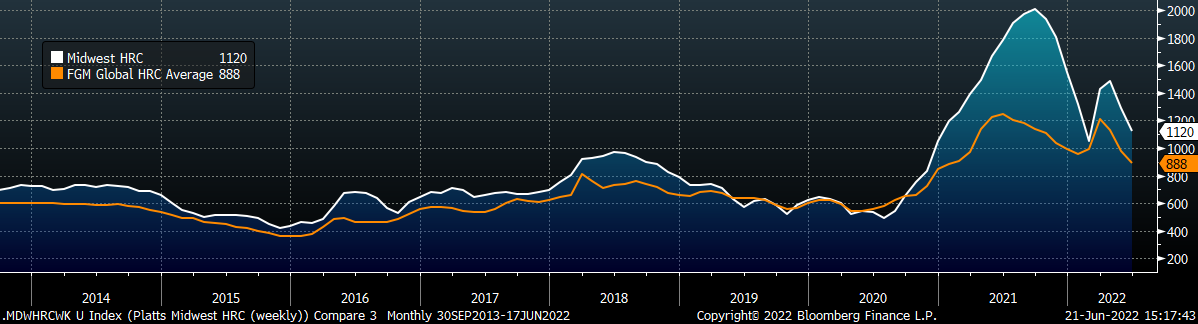

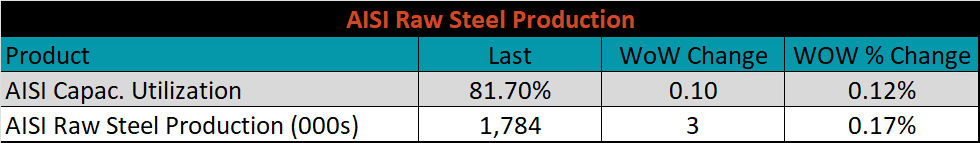

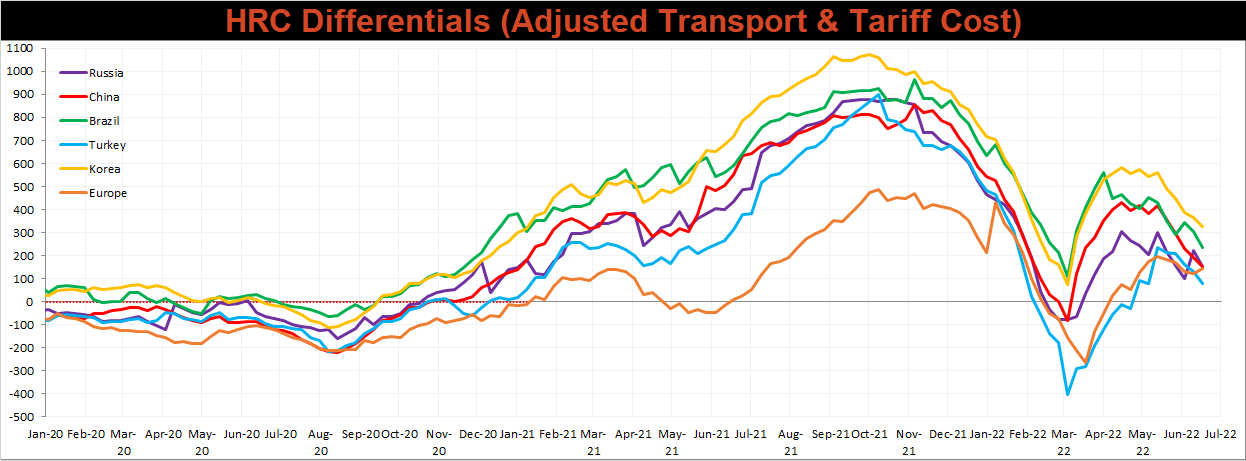

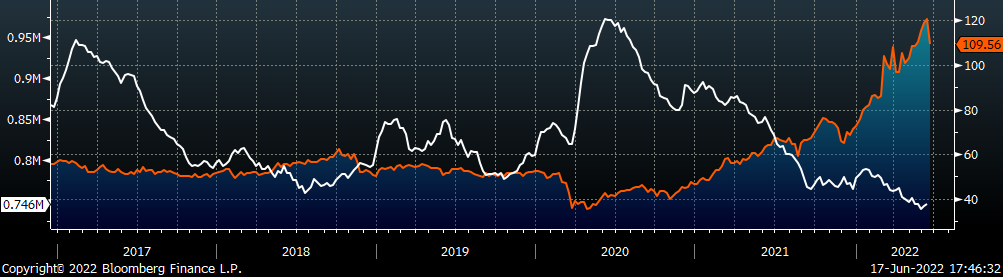

This week was a continuation of downward price pressure in the domestic steel market, as raw materials (all below pre-invasion levels) are still searching for a pricing floor. This should encourage mills to continue reaching for lower prices within the market, as it will not impact their profitability. Additionally, global steel prices fell further last week. The chart below shows the monthly averages for Midwest HRC (white) and a tariff-adjusted global price assessment including transportation (orange).

While short domestic lead times and falling prices reduce the likelihood of a meaningful increase in import arrivals, global prices tend to lead the domestic market and we would look for global prices to stabilize before calling a domestic price floor.

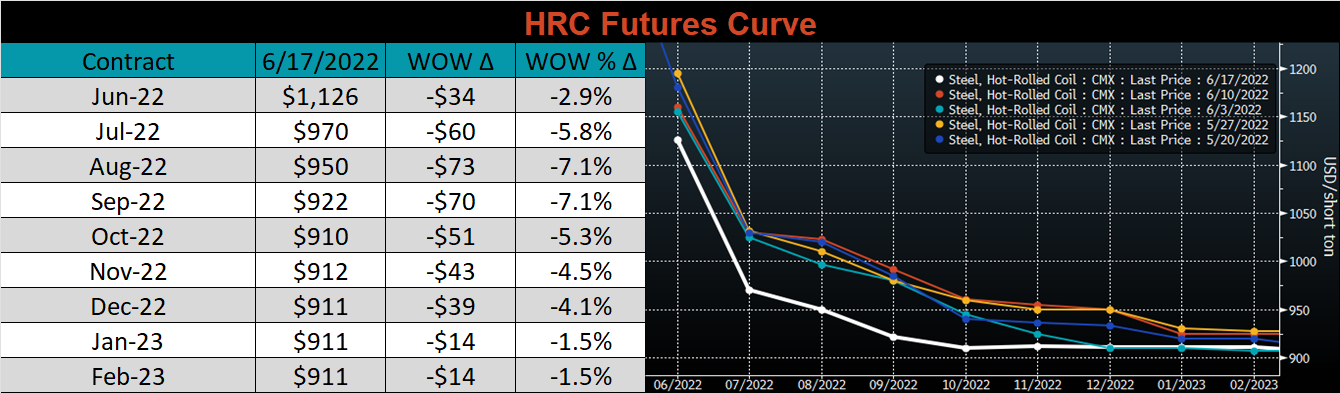

With current spot prices nearly $150 higher than what is available on the futures curve, the most prudent approach is to pause. The next couple of weeks will be an insightful time when making plans for 2023 with the forward curve providing prices below what was expected to be the floor in February. As the spot price and futures prices continue to converge in the coming weeks, we will be closely watching how mills react. Up to this point, there have not been rumors around the idling of any domestic furnaces, but a decrease in production may be the best lever mills have to stabilize prices. As we mentioned earlier, the global market tends to lead the domestic market, and last week we saw announcements that higher-cost mills in the E.U. were going to be idled.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

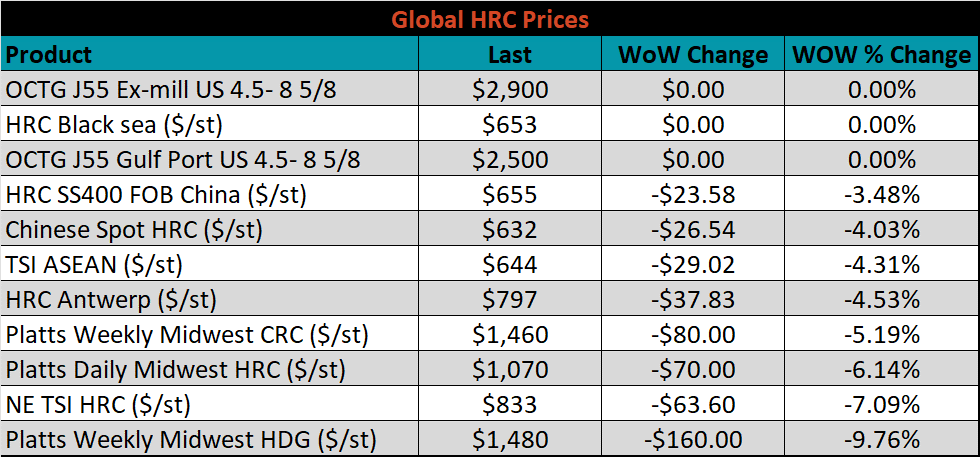

The Platts TSI Daily Midwest HRC Index was down $70 to $1,070.

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The entire curve shifted lower, most significantly in the front, indicating concern around lower demand amid an increasingly hawkish Fed.

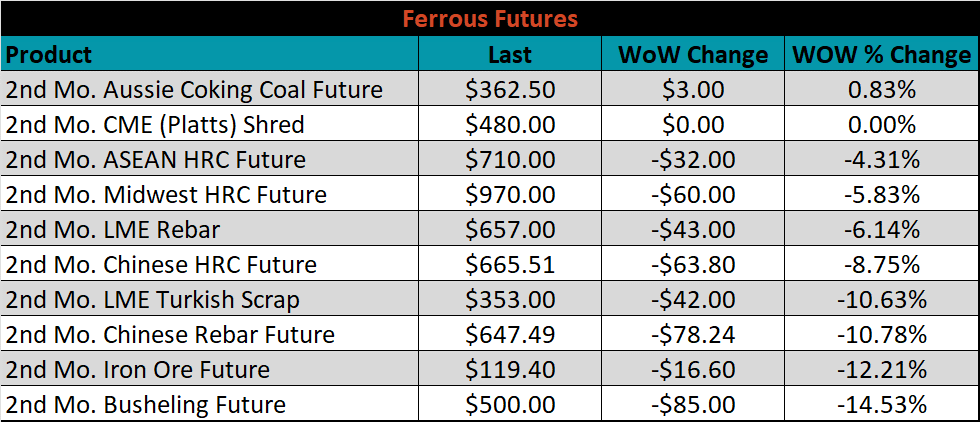

The 2nd month ferrous futures were primarily lower this week. Busheling futures fell steeply, down 14.5%, and Aussie Coking Coal Future was up 0.8%.

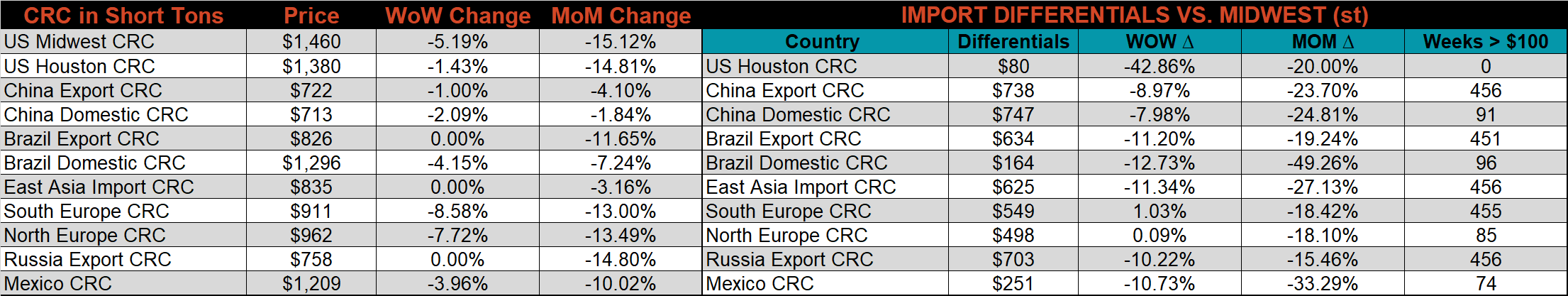

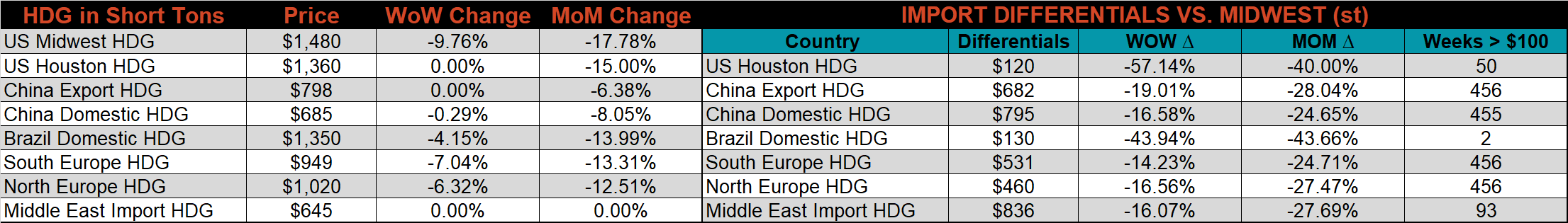

Global flat rolled indexes were mostly lower once again, led by Platts Weekly Midwest HDG, down 9.8%. Since prices peaked last September tandem products have fared much better than HRC, causing historically wide spreads between the products. Even after this week’s decrease, the current spread is more than $125 over its 4-year historical average.

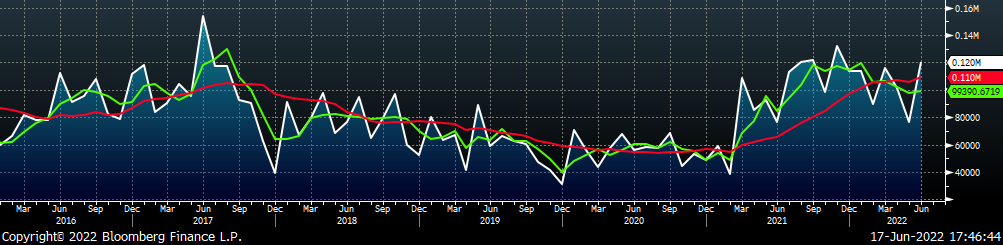

The AISI Capacity Utilization was up 0.1% to 81.7%.

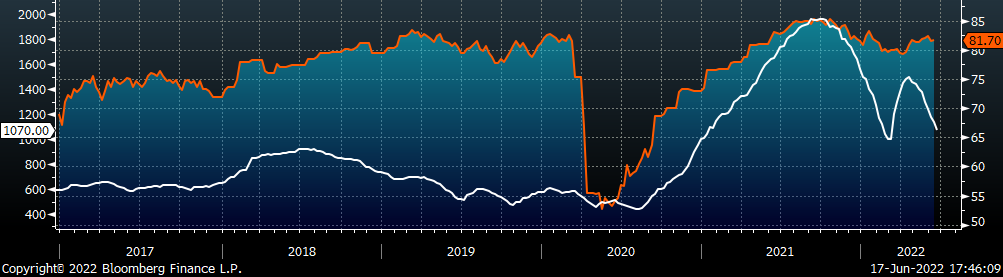

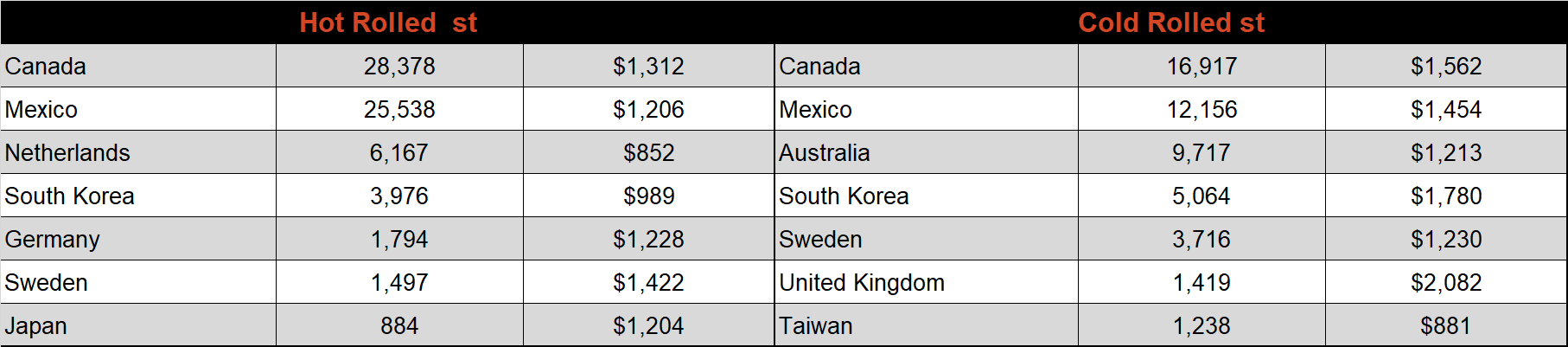

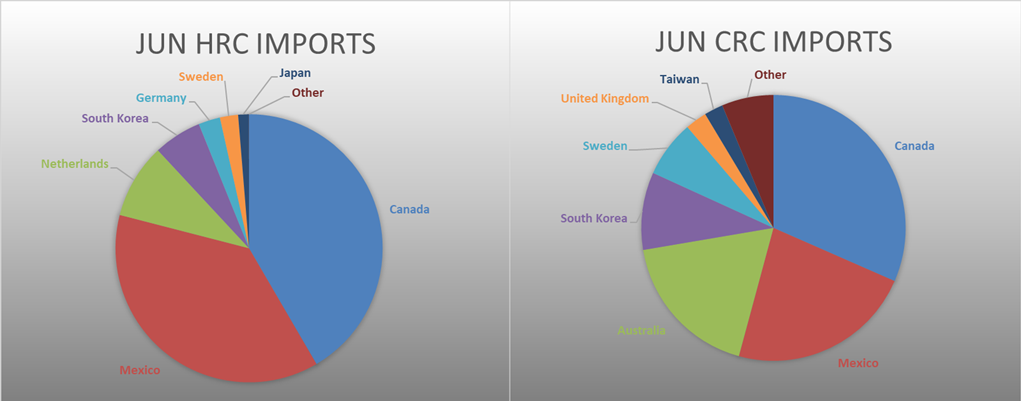

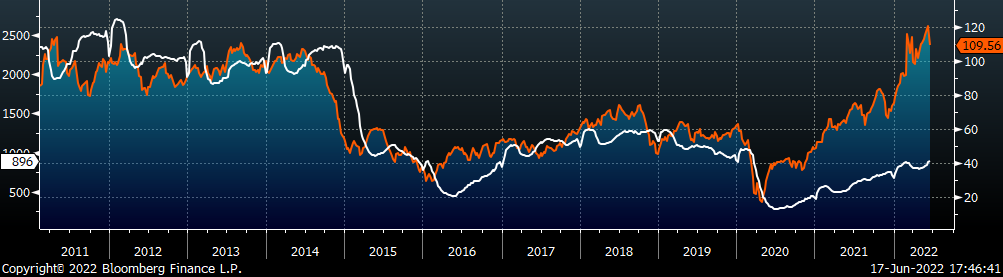

June flat rolled import license data is forecasting a decrease of 58k to 896k MoM.

Tube imports license data is forecasting an increase of 78k to 564k in June.

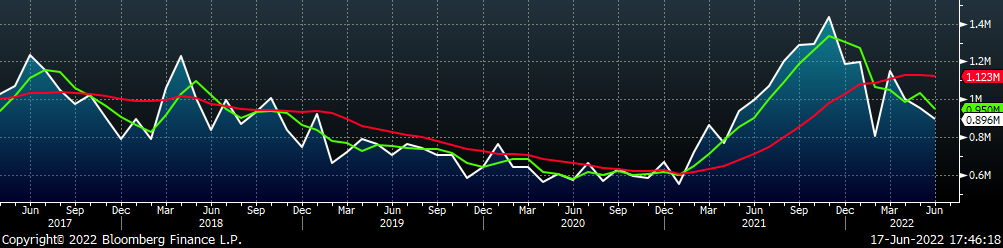

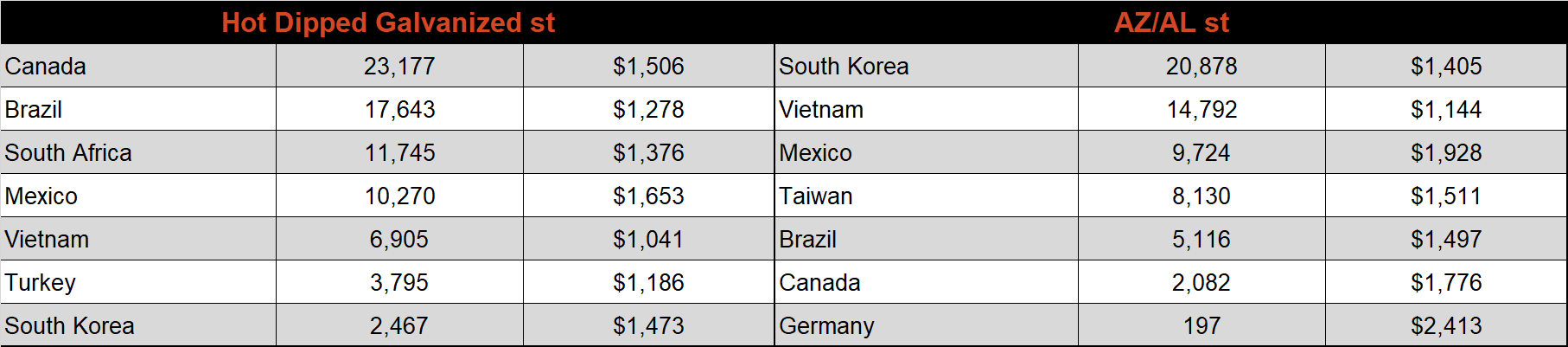

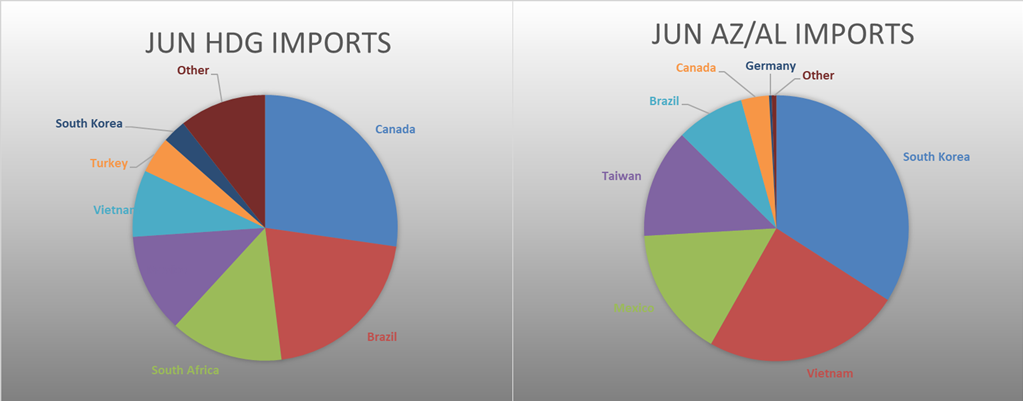

June AZ/AL import license data is forecasting a decrease of 44k to 120k.

Below is June import license data through June 13th, 2022.

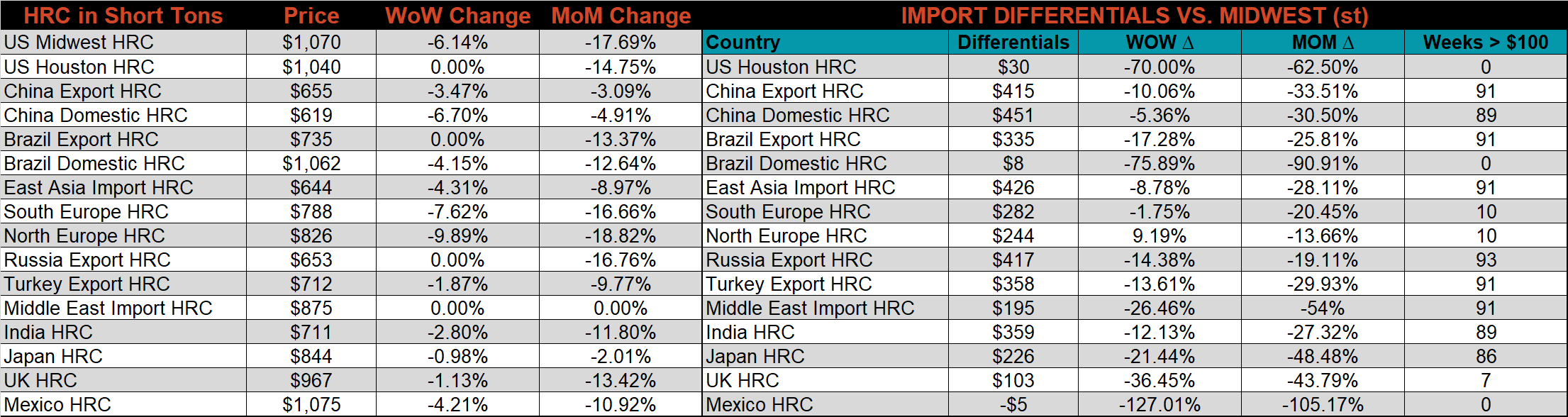

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials decreased across the board less Europe, whose price decreased more than the U.S. price.

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HDG, HRC & CRC prices were down 9.8%, 6.1%, & 5.2% respectively. Northern European HRC price was down the most, down 9.9%.

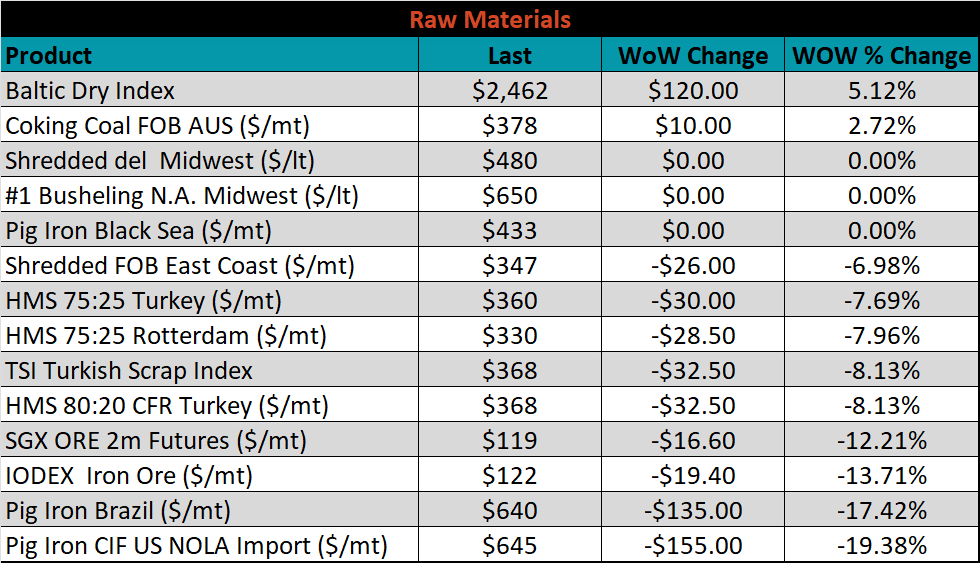

Raw material prices were all lower this week, led by Pig Iron CIF US NOLA Import, down 19.4%.

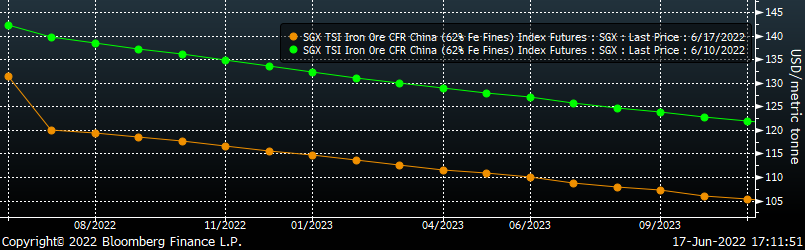

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entre curve shifted slightly lower once again.

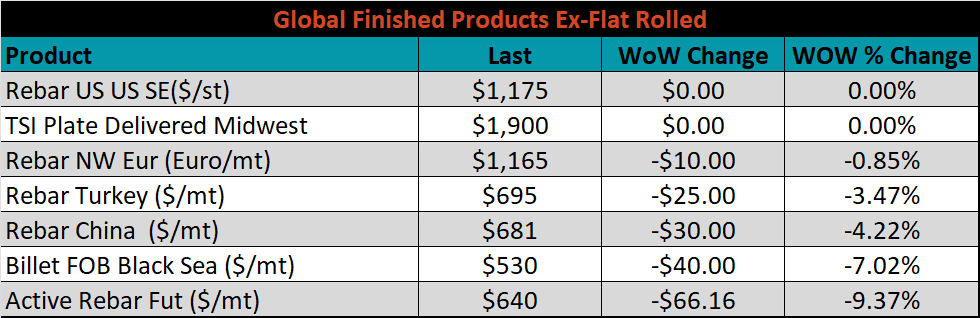

The ex-flat rolled prices are listed below.

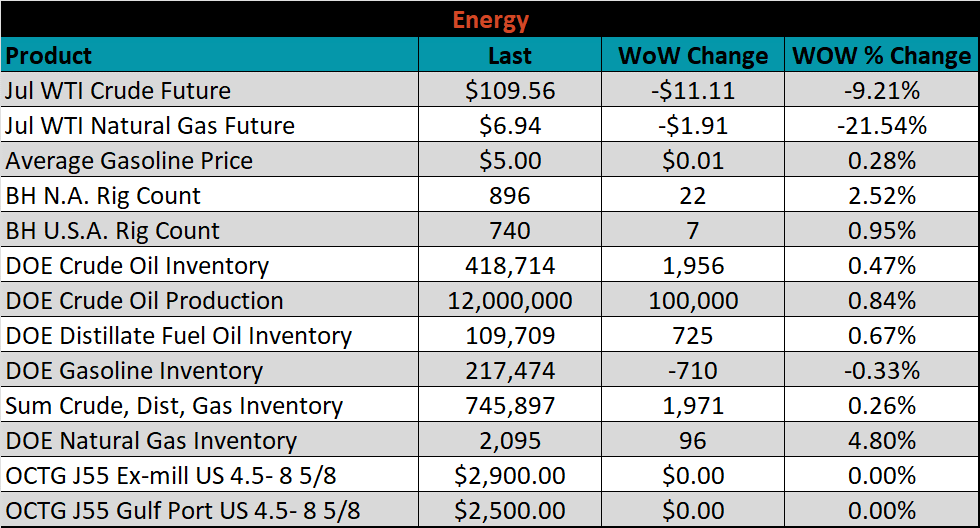

Last week, the July WTI crude oil future lost $11.11 or 9.21% to $109.56/bbl. The aggregate inventory level was up 0.3% and crude oil production was slightly up at 12.0m bbl/day. The Baker Hughes North American rig count was up 22 rigs, and the U.S. rig count was up 7.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: