Content

-

Weekly Highlights

- Market Commentary

- Risks

After the recent price rally stalled in the previous week, last week spot HRC prices slipped lower as more transactions occurred at the bottom of the recent range near $480/st. Additionally, there were rumors of large tonnage deals being done in the low $400s. However, these transactions were described as unrepeatable due to the price and tonnage, thus, they were not included in index price assessments. Before prices bottomed back in the spring, there were also rumors of several similar deals as mills attempted to bolster their deteriorating order books, leading us to believe that there is further weakness in spot pricing ahead.

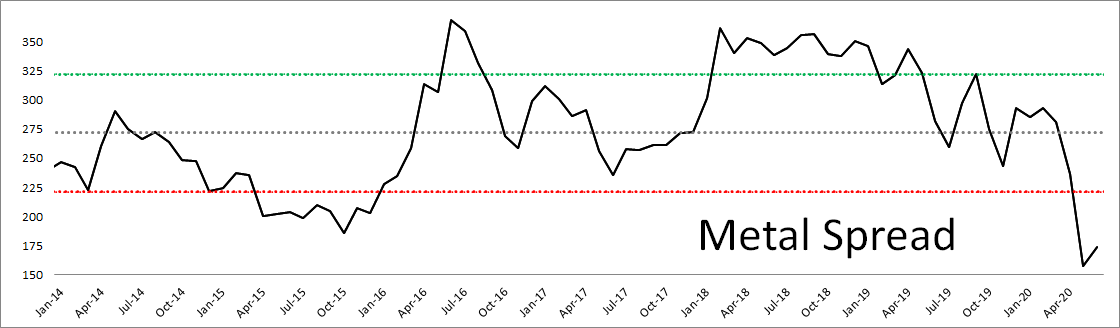

Based on our cost and profitability models, there was very little, if any, profit for the mills in these large tonnage sales last week. Mill profitability is an important indicator in the market bottoming processes, as low levels of profit tend to lead to production cuts necessary to balance the supply with demand in the market. The metal spread, Midwest HRC price minus scrap (busheling), is a proxy for mini mill profitability and is shown in the chart below (Note: the chart was adjusted to remove the 2018 dislocations caused by Section 232 tariffs).

The metal spread collapsed in the spring as scrap was supported by limited supply and HRC prices fell on coronavirus induced economic shutdowns. Mills reacted quickly to pull production from the market, reducing the supply and stabilizing the spot price. The spread started to recover in June with HRC prices grinding higher as the economy restarted, but the current bearish price outlook does not bode well for the already depressed metal spread and profitability. However, instead of limiting production to support spot prices, mills are discussing restarting idled furnaces and ramping up production in July as automotive factories return. Blast furnace restarts are supposed to occur simultaneously as automotive demand, but BOFs must run near full production rates, while auto demand will likely be below pre-virus level. This will lead to more tons in the spot market, weighing on prices. So when normally mills attempt to reduce the spot market supply during a downtrend in price, this time mills may actually be adding to the supply.

Additionally, data from across the metals supply chain, as well as the economy at large, shows high inventory levels relative to the current level of shipments or sales. As discussed above, over the past few months, mills offered large tonnage deals at below spot market prices to several buyers. It will take multiple months or quarters for this material to be produced, processed and consumed, leading to fewer new orders in the months ahead.

The big unknown, as is always the case, is the level of current and future demand in the market. As the economy continues to reopen, demand will improve, helping to offset the discussed supply dynamics. Based on the upward sloping (contango) forward curve, the market is expecting that demand will be more than enough to offset the coming supply, leading to higher prices. For those who believe demand will disappoint relative to the looming supply, the curve provides a great opportunity to protect against lower prices.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

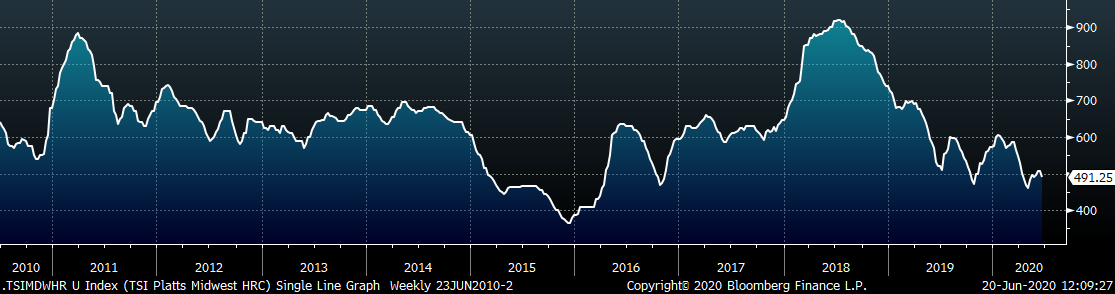

The Platts TSI Daily Midwest HRC Index was down $17 to $491.25.

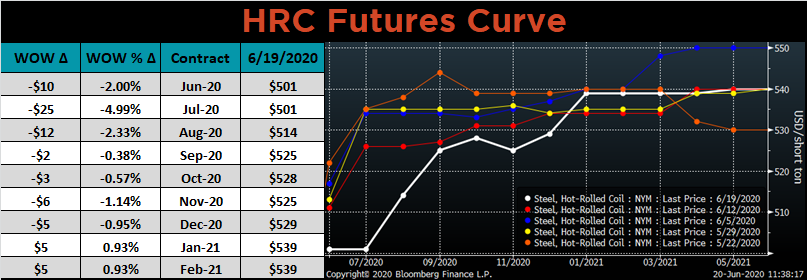

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. Last week the front of the curve shifted dramatically lower.

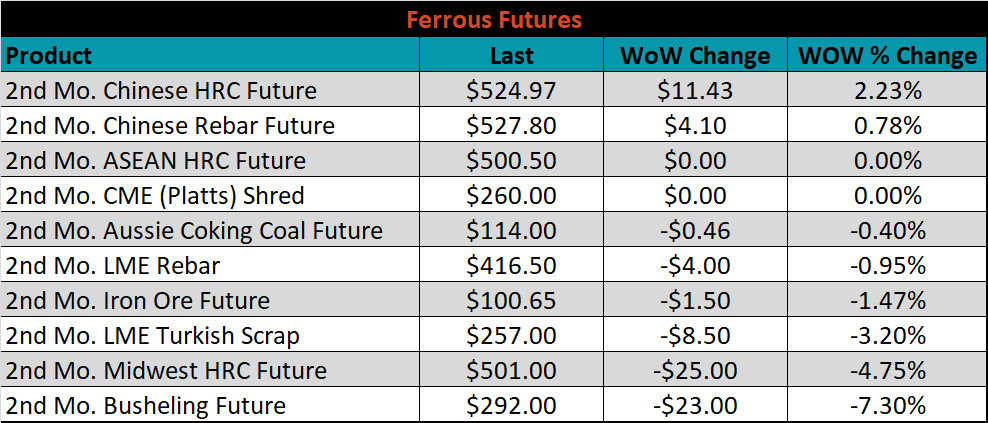

July ferrous futures were mixed. The Chinese HRC future gained 2.2%, while the busheling scrap future lost 7.3%.

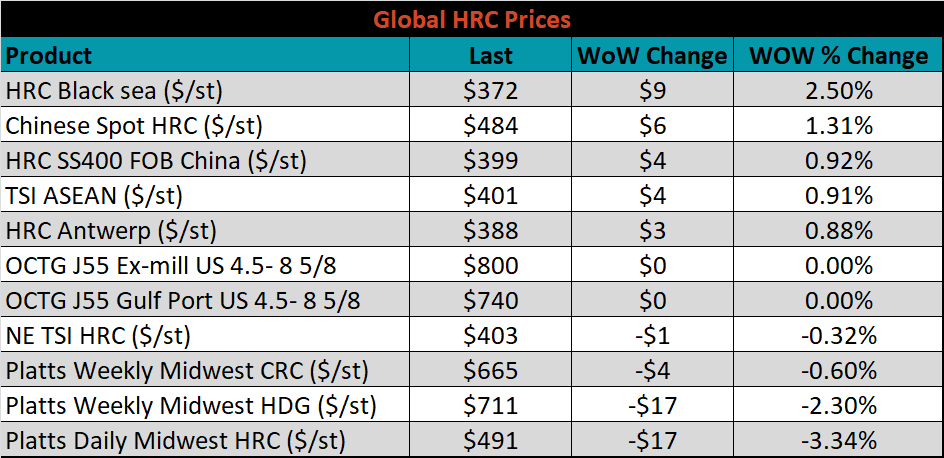

The global flat rolled indexes were mixed. Black Sea HRC was up 2.5%, while TSI Platts Midwest HRC was down 3.3%.

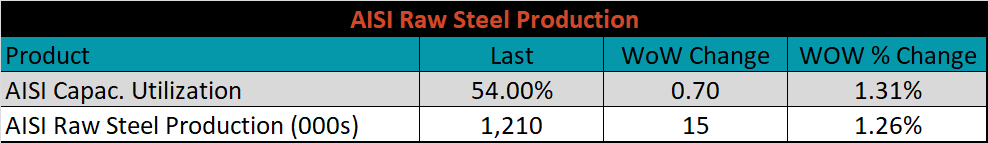

The AISI Capacity Utilization Rate was up 0.7% to 54%.

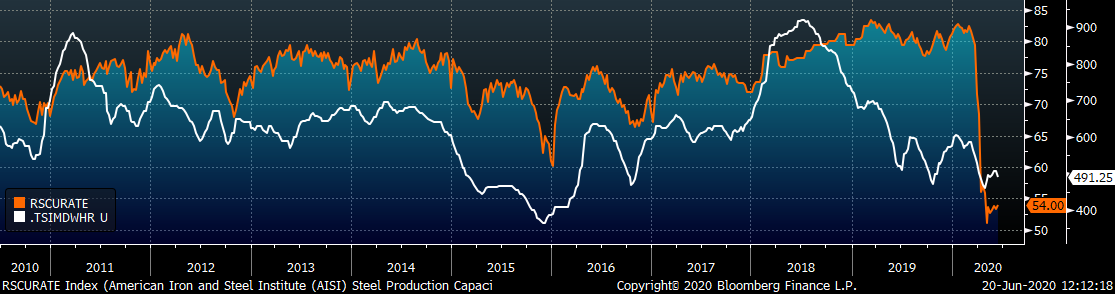

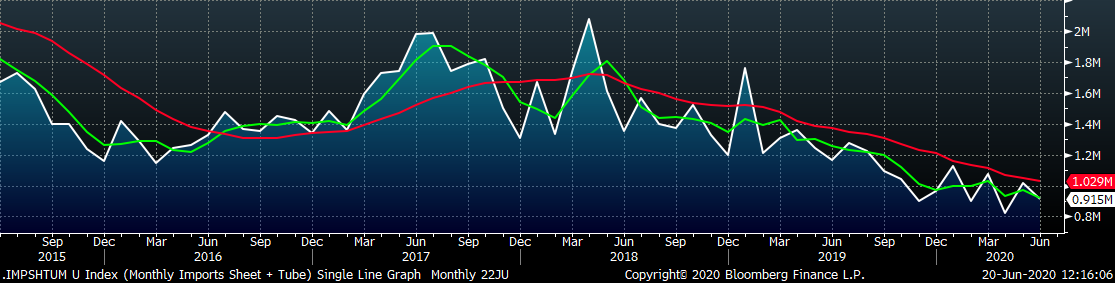

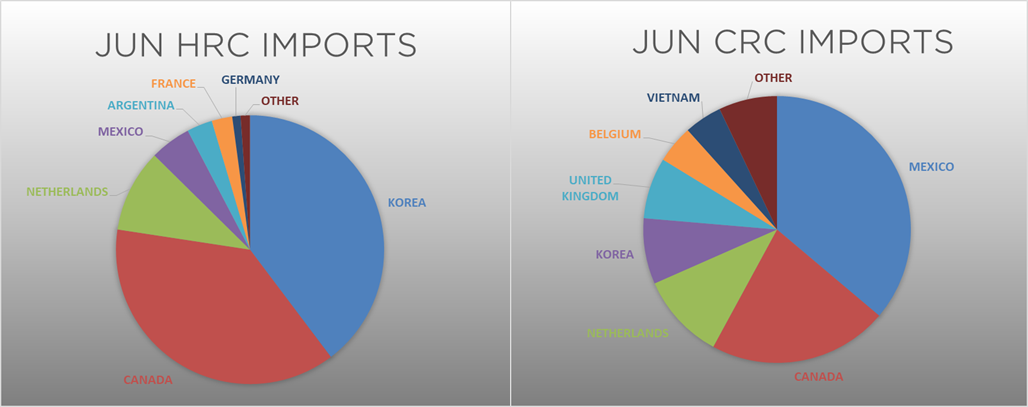

June flat rolled import license data is forecasting a decrease of 3k to 621k MoM.

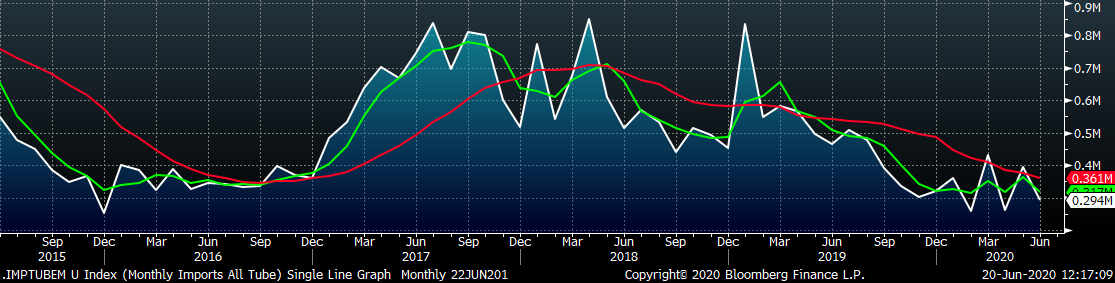

Tube imports license data is forecasting a MoM decrease of 101k to 294k tons in June.

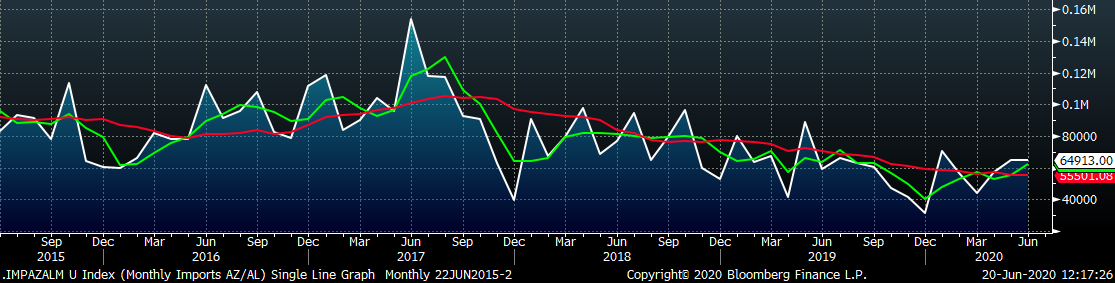

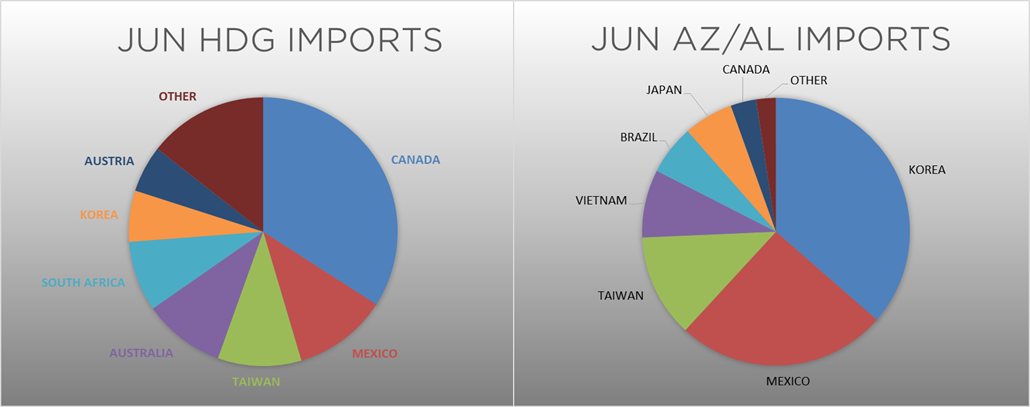

AZ/AL import license data is forecasting a flat June compared to May of 65k.

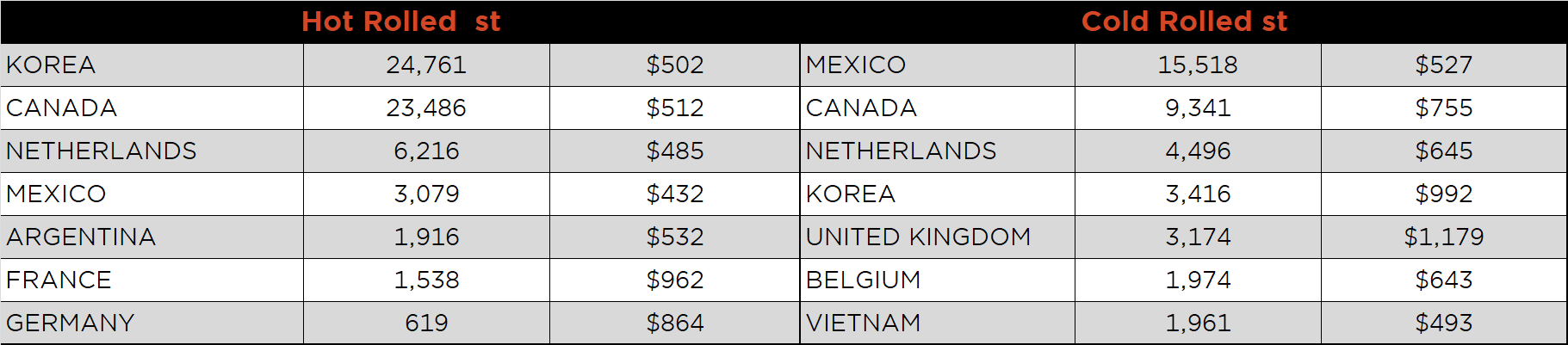

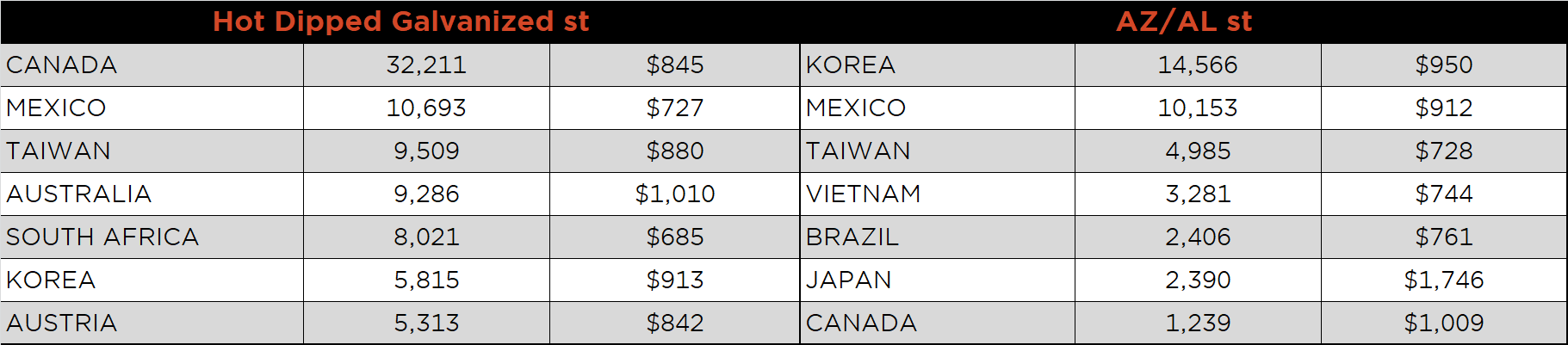

Below is May import license data through June 16, 2020.

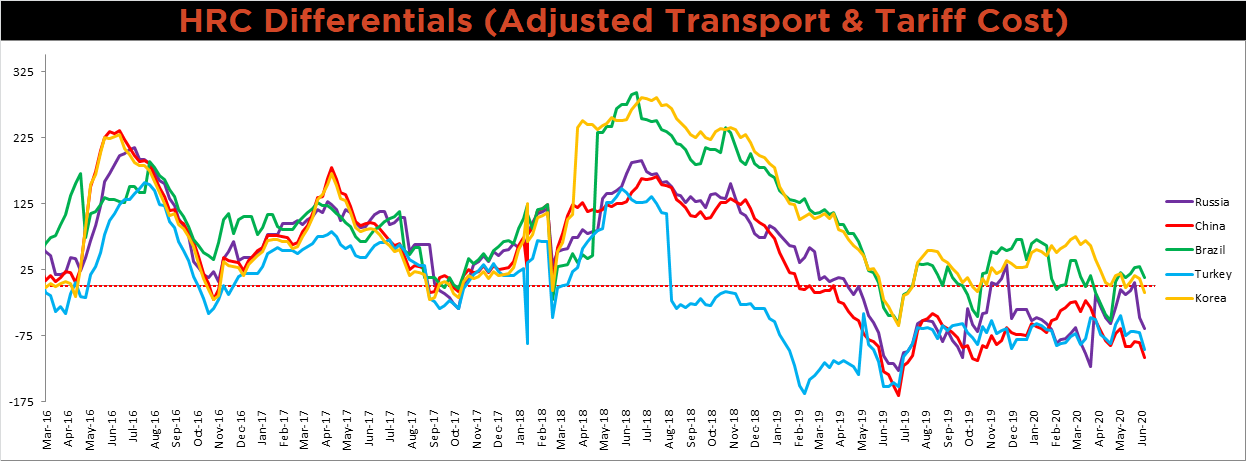

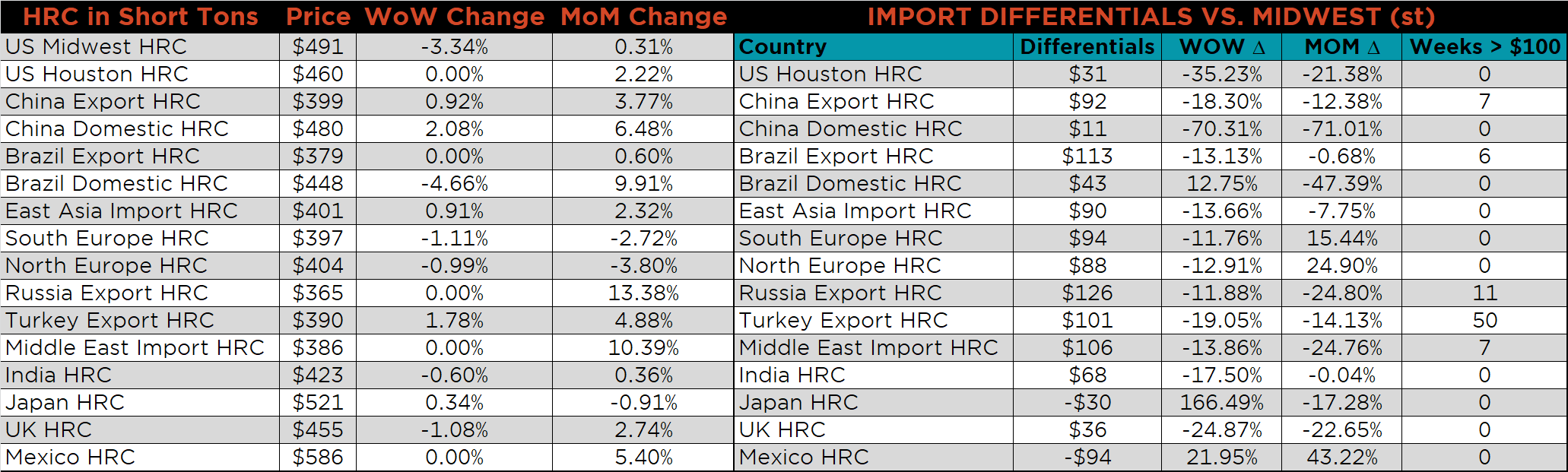

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All the global differentials decreased, as the U.S. price was down over 3% compared to each country’s flat or slightly higher prices.

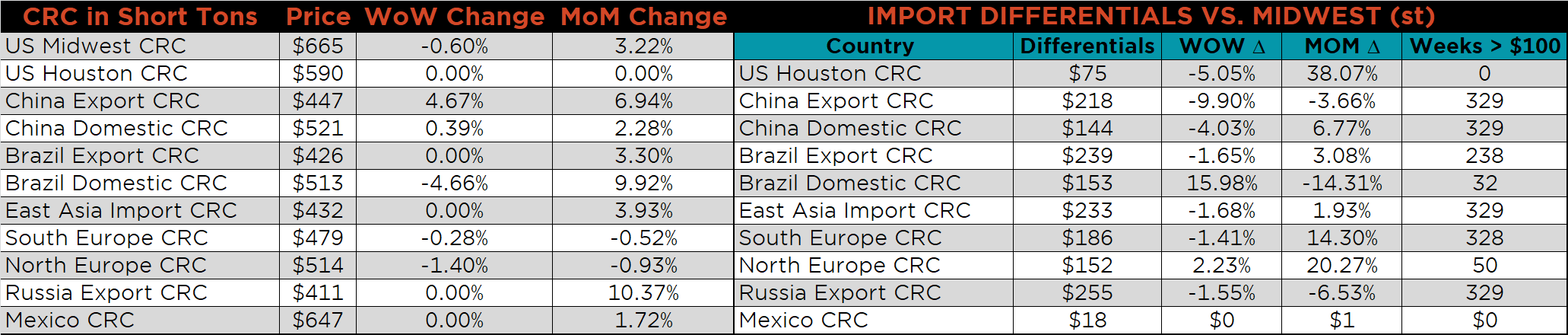

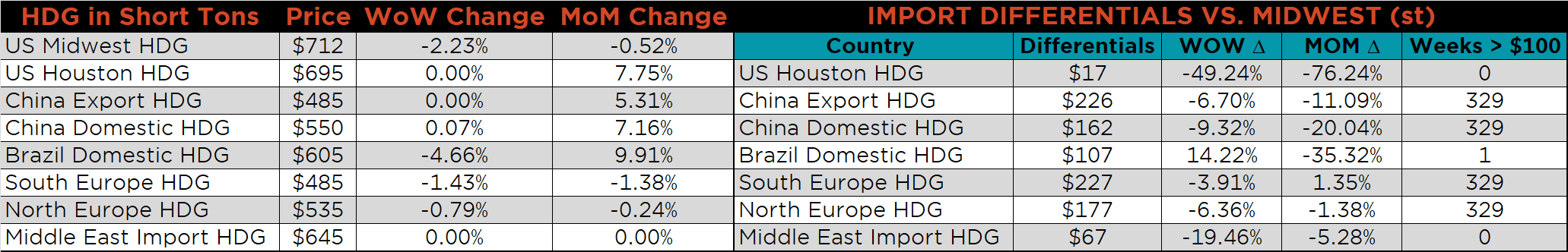

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC, HDG and CRC prices were down 3.3%, 2.2% and 0.6%, respectively. Globally, the Chinese export CRC and HRC prices were up, 4.7% and 0.9%, respectively.

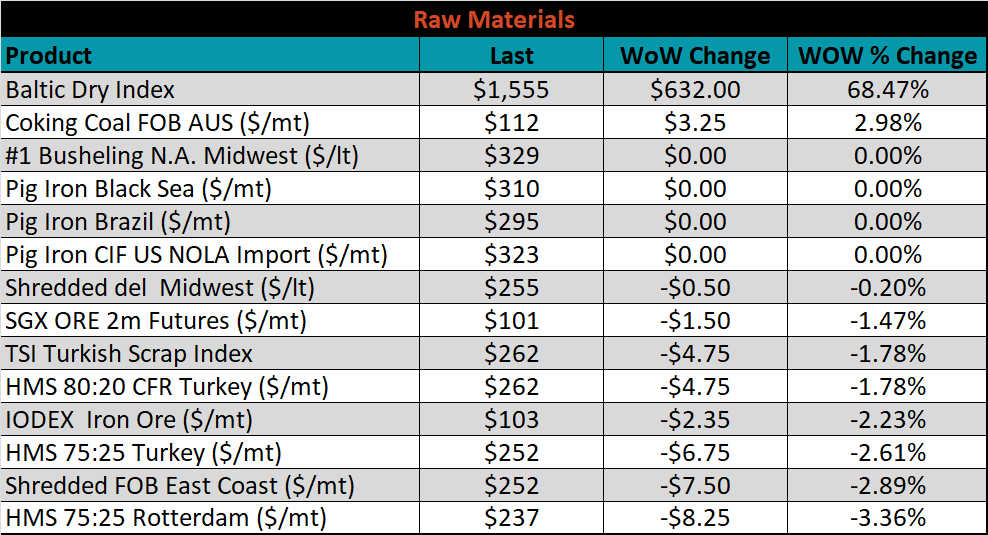

Raw material prices were mixed. Coking coal was up 3%, while Rotterdam HMS was down 3.4%. Additionally, the Baltic Dry Index jumped dramatically, up 68.5%, as global trade continues to tighten.

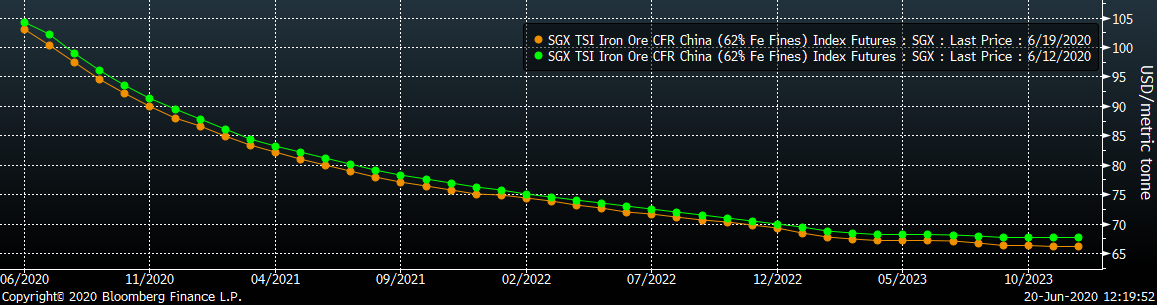

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. The entire curve moved slightly lower over all expirations.

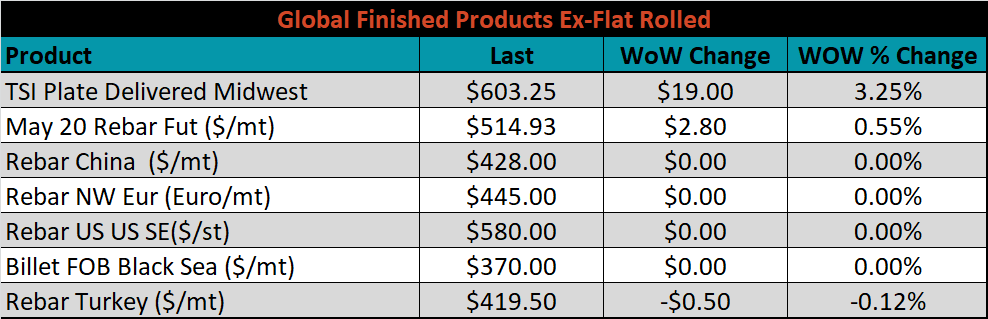

The ex-flat rolled prices are listed below.

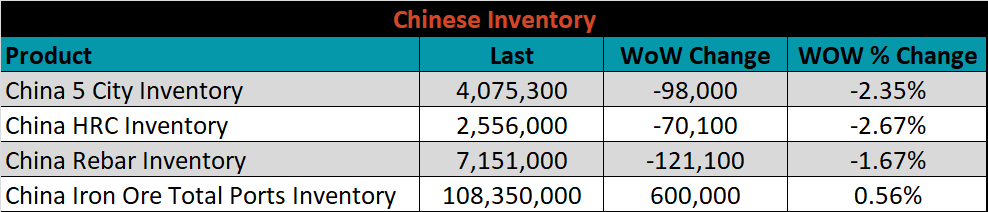

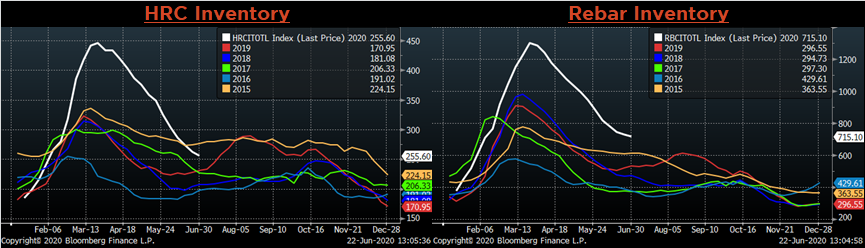

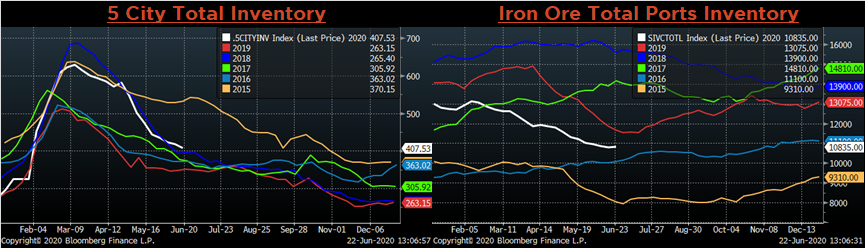

Below are inventory levels for Chinese finished steel products and iron ore. HRC, Rebar and the 5-City inventory levels continue to decline, while iron ore inventory ticked higher. The decline in inventory appears to be losing momentum as rebar remains well above is seasonal level and HRC is below only the 2015 level. At this point, prices remain stable for both, but if inventory levels continue to plateau, pressure on prices will mount as demand seasonally fades.

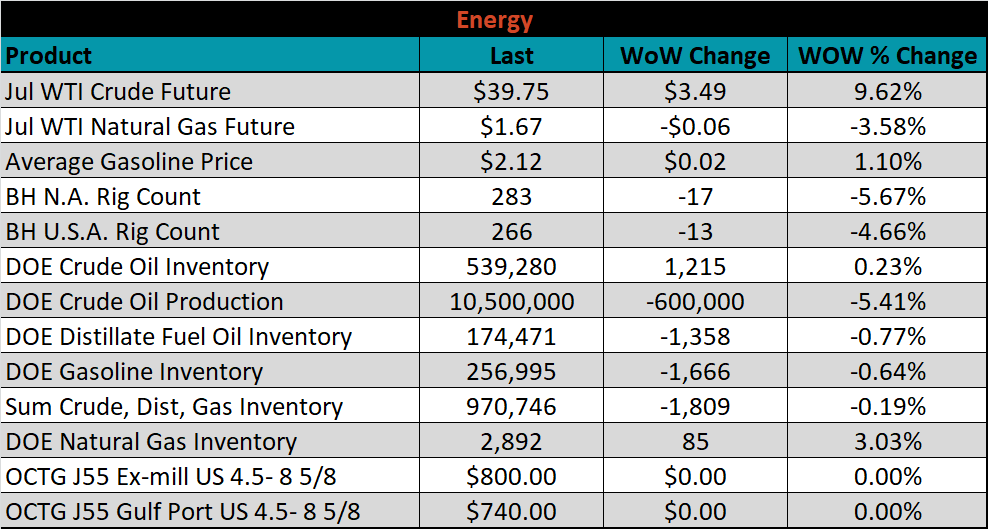

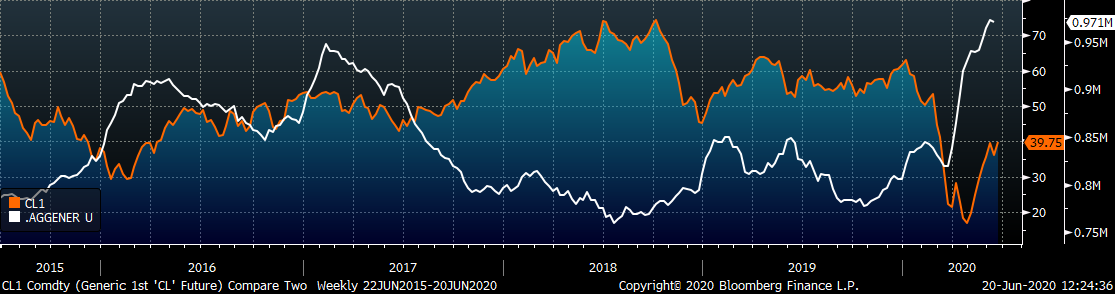

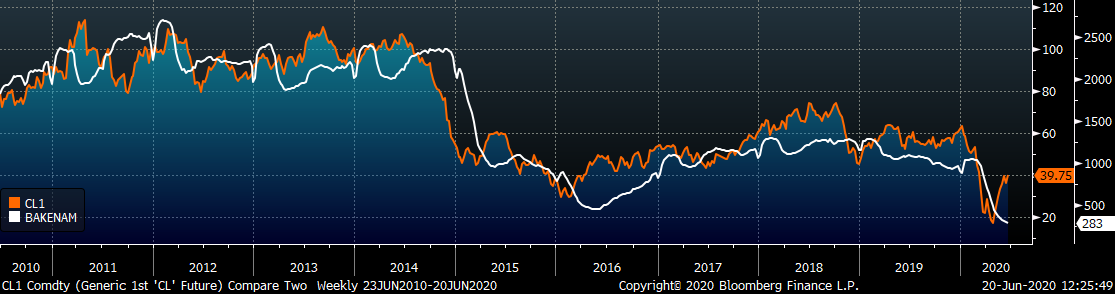

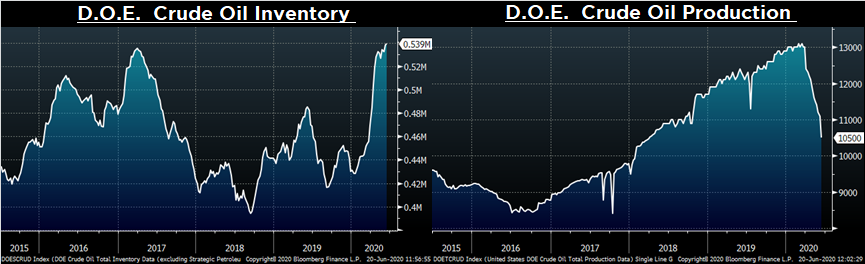

Last week, the July WTI crude oil future gained $3.49 or 9.6% to $39.75/bbl. The aggregate inventory level was down 0.2%, while crude oil production was down 5.4% to 10.5m bbl/day. The Baker Hughes North American rig count was down another 17 rigs and the U.S. rig count was down 13 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: