Content

-

Weekly Highlights

- Market Commentary

- Risks

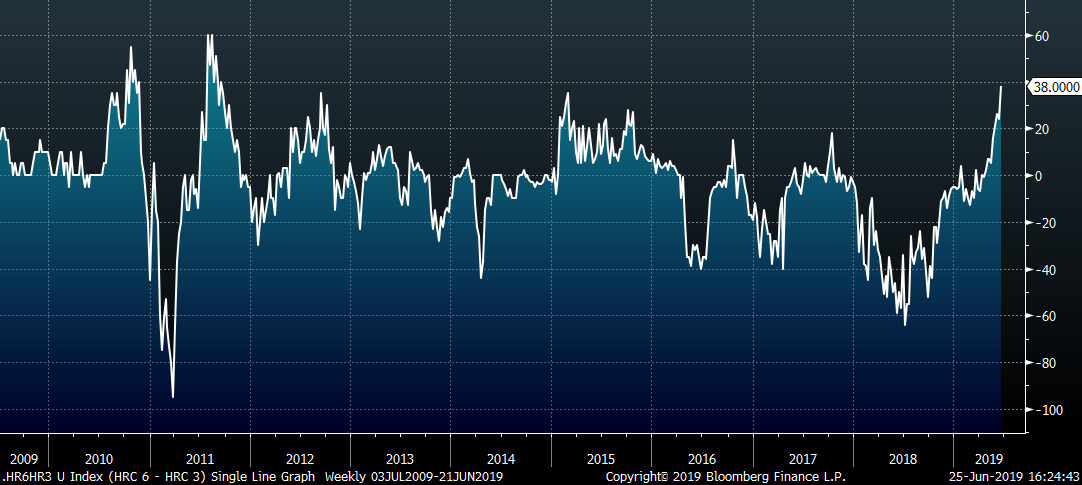

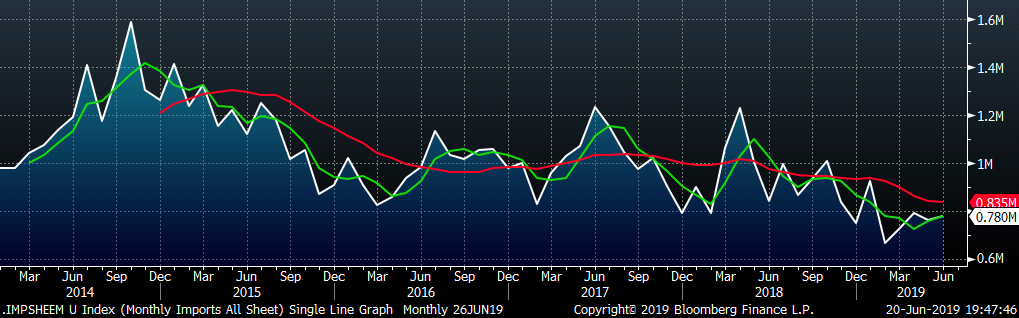

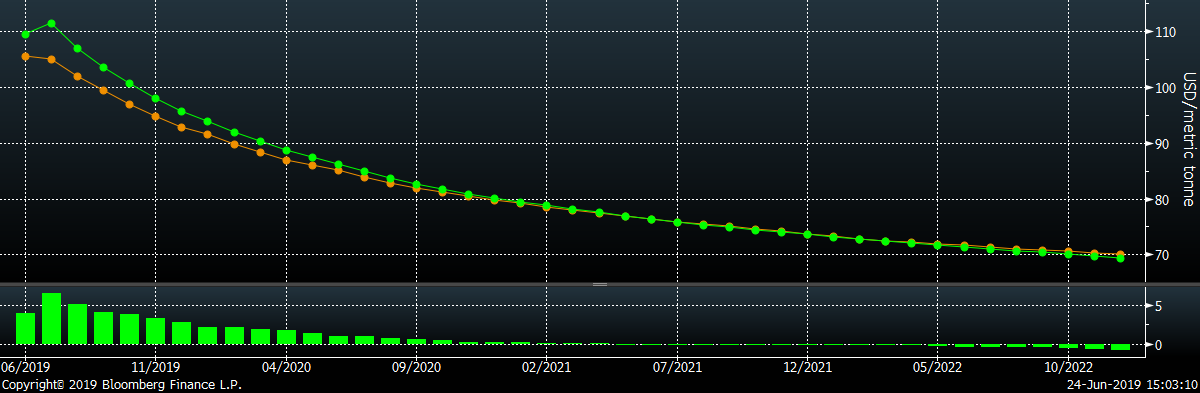

The futures curve has been in contango (upward sloping) for 2 months, meaning that the market expects future spot pricing to be higher. However, during this time the spot price has continued to decline, moving the curve further into contango as the declines in the front were larger than those in the back of the curve. The chart below illustrates this contango by taking the difference of the price of the forward contract 6 months away and the 3-month forward contract price.

The current reading suggests that the market expects a $38/t premium to future pricing, which is the highest level since 2011. The future curve is a notoriously poor predictor of future spot pricing. However, when the future curve moves from contango into backwardation, historically this has been an indicator of the beginning of a price rally.

Last week U.S. Steel announced that it would be idling two furnaces until market pricing improved. Reduced production was one of the conditions that this report has repeatedly discussed as necessary for prices to increase. At the beginning of this week, Nucor led other mills with a $40/t price increase. While the effects will take a few days to materialize (or longer due to the holiday week next week), there are some immediate details that can be deduced from the announcement. First, the announcement implies strength in the mill’s order book. For a price increase announcement to succeed, the mill must be willing to turn away orders, and a full order book makes this possible. Additionally, we would expect this to push out lead times from the current low levels, further supporting the price increase for several weeks. The need to secure spot tons and the risk of higher prices in the future should spur buying in the short term.

However, for the price increase to have longer-term support in the market, other current dynamics must remain, and we believe they are likely to persist. Specifically, low inventory levels, at end users and service centers, should encourage restocking ahead of further price increases and lead times extending. These orders will go to domestic producers as import prices and lead times suggest even less incoming foreign material as we move into the third quarter. The domestic market remains short steel, and depressed imports over multiple quarters empowers domestic mills, and their desire for higher spot prices.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

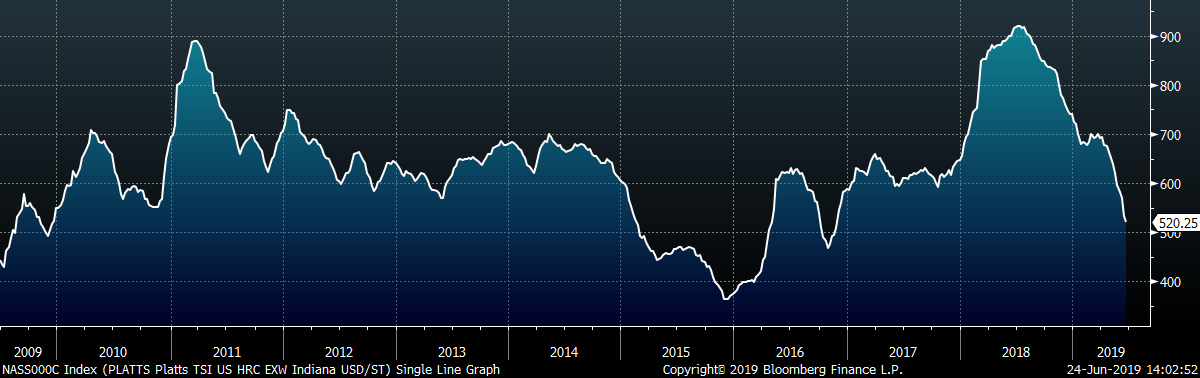

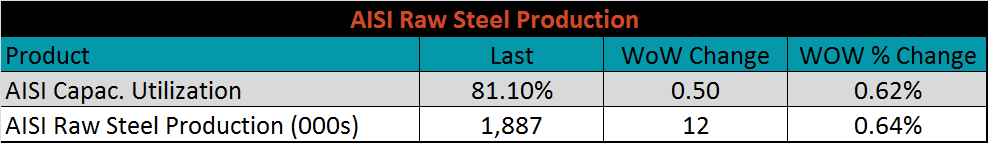

The Platts TSI Daily Midwest HRC Index was down $12.50 to $520.25.

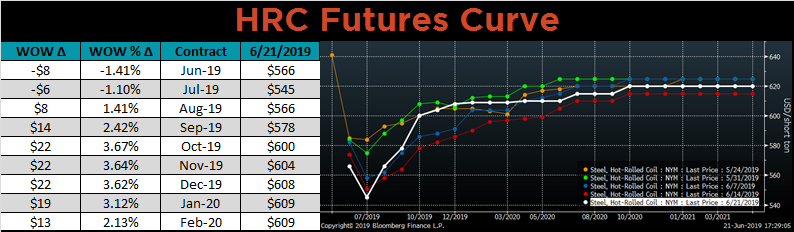

The CME Midwest HRC futures curve is shown below with last Friday’s settlements in white. The back of the curve shifted higher, while the front was little changed.

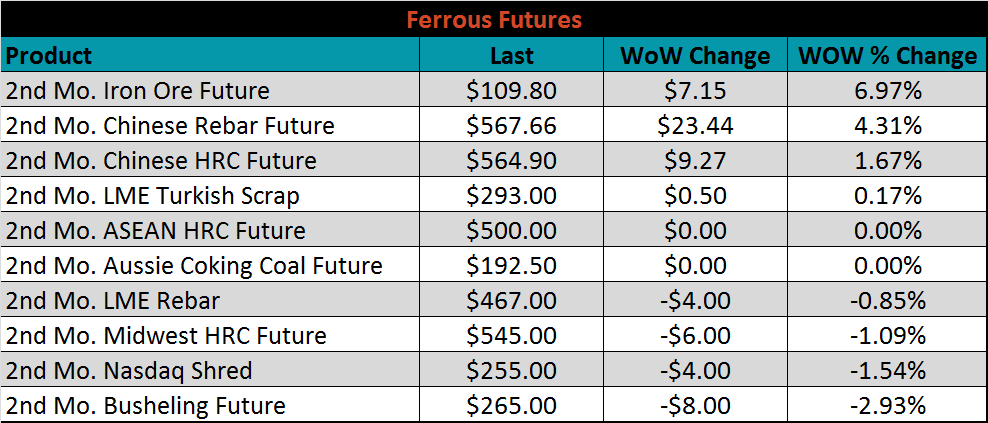

July ferrous futures were mixed. The iron ore future gained 6.97%, while busheling fell 2.93%.

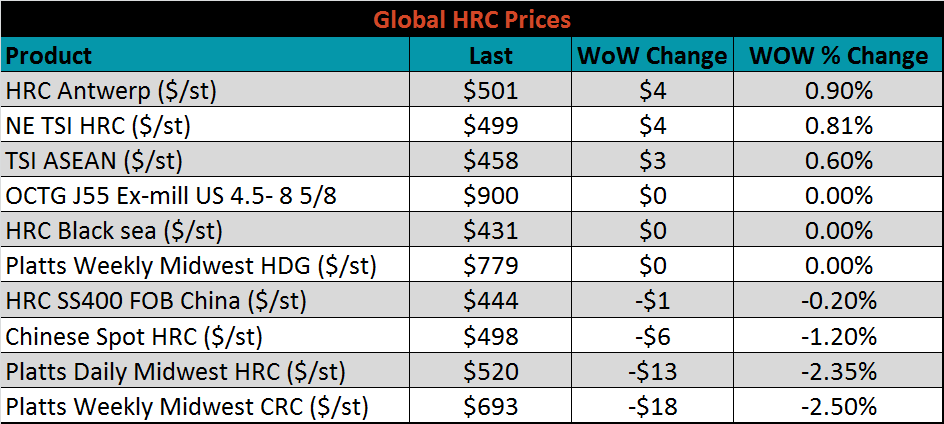

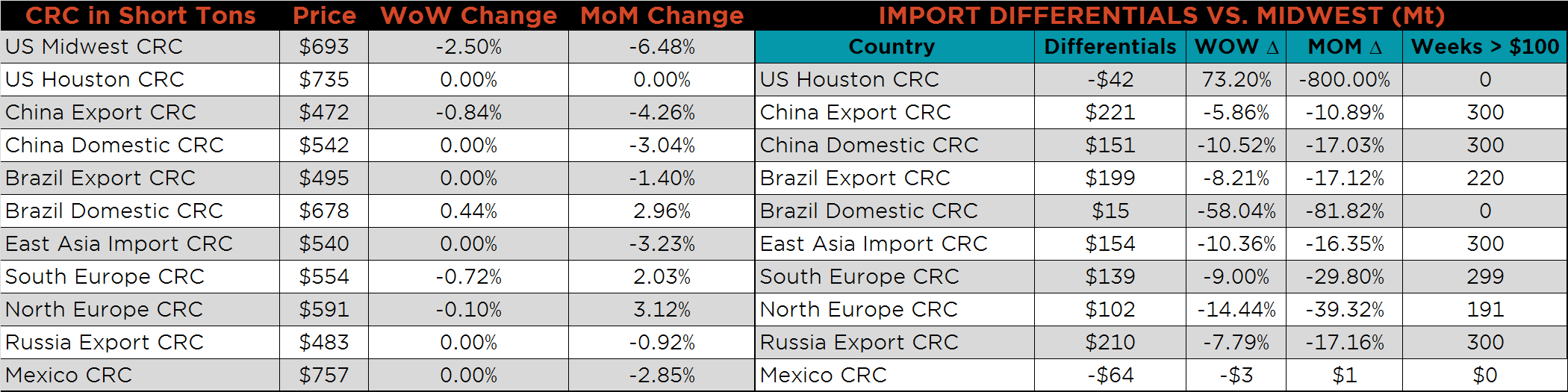

The global flat rolled indexes were mostly lower. Platts Midwest CRC index was down 2.5%.

The AISI Capacity Utilization Rate was up 0.5 points to 81.1%. Last week, US Steel announced extended outages beginning in July until market conditions improve. There have also been rumors of more production coming offline, which appears necessary given current profitability but would contradict the Trump administration’s goal of 80% Capacity Utilization Rate that has held since October 2018.

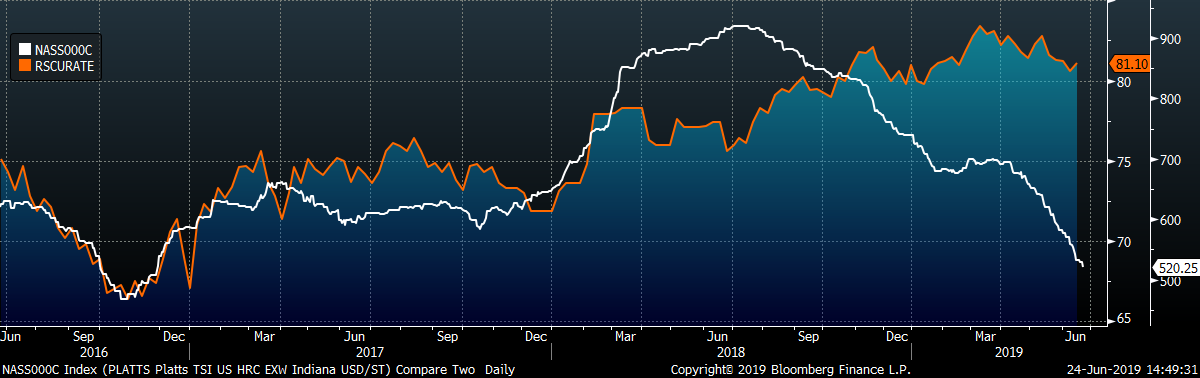

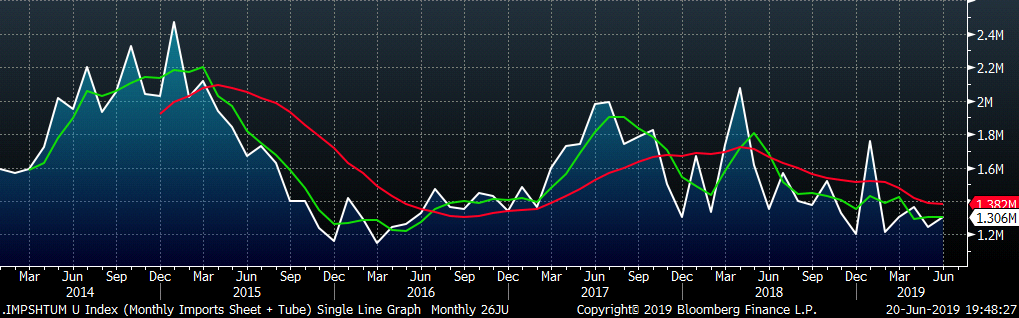

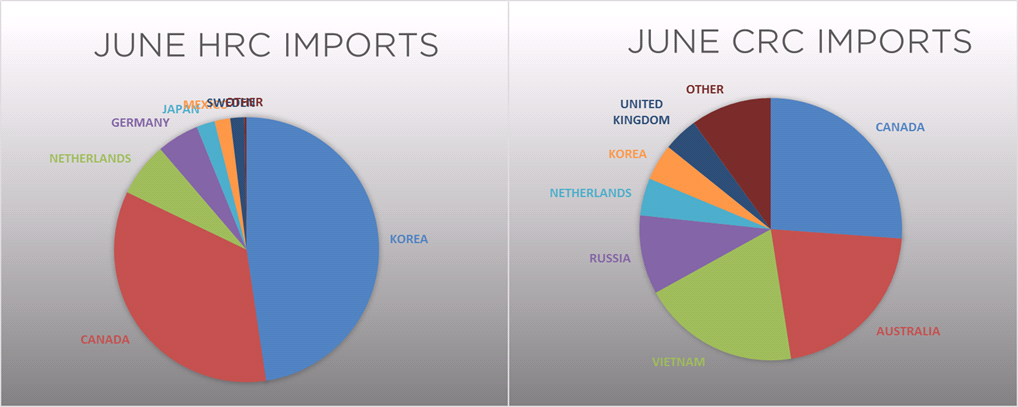

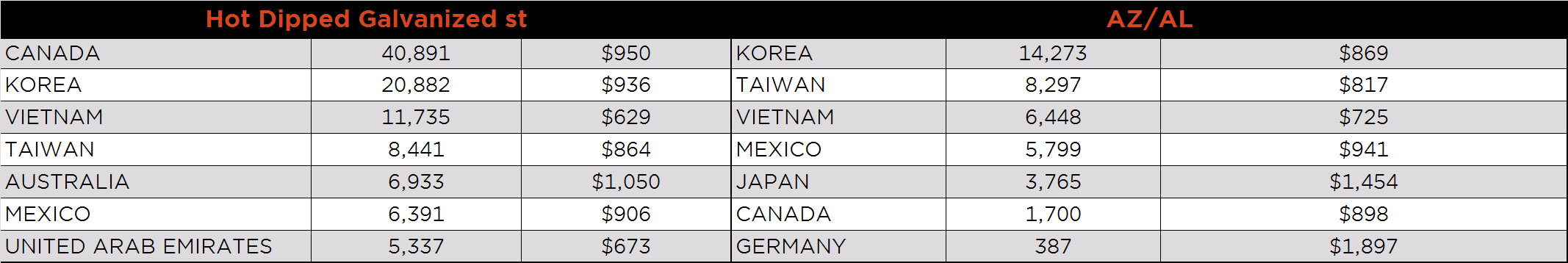

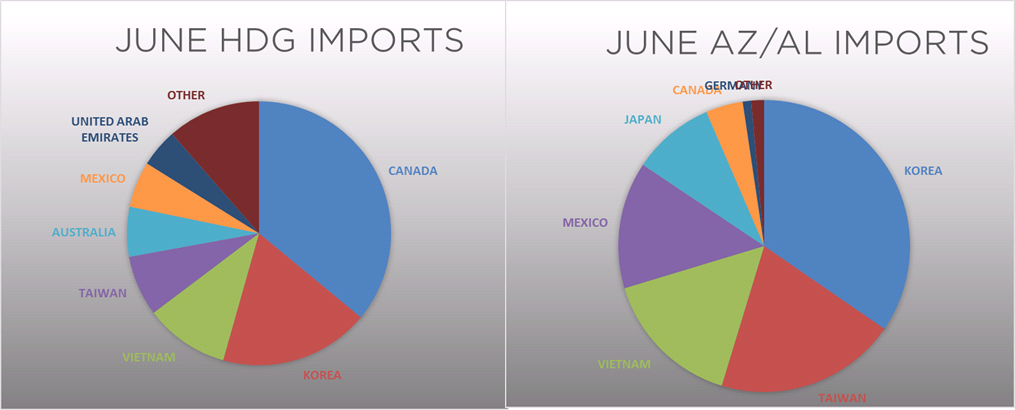

June flat rolled import license data is forecasting an increase to 780k, up 19k MoM.

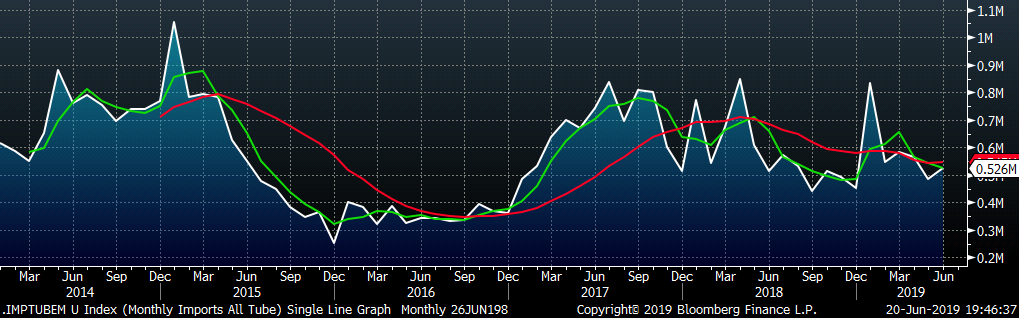

June tube import license data is forecasting a MoM increase of 41k to 526k tons.

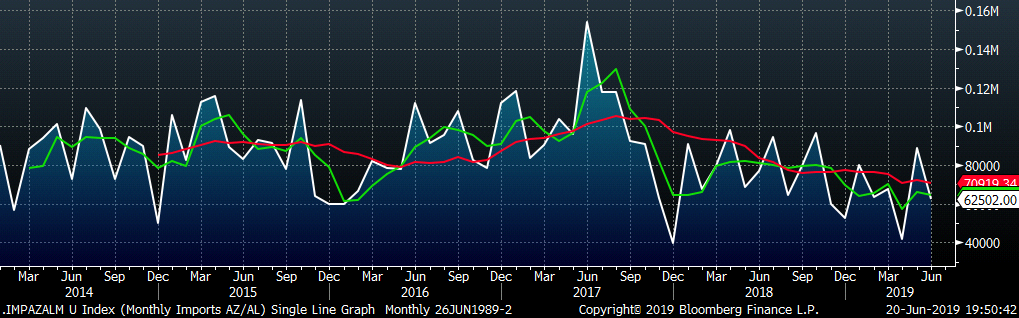

AZ/AL import licenses forecast a decrease of 26k MoM to 62k in June.

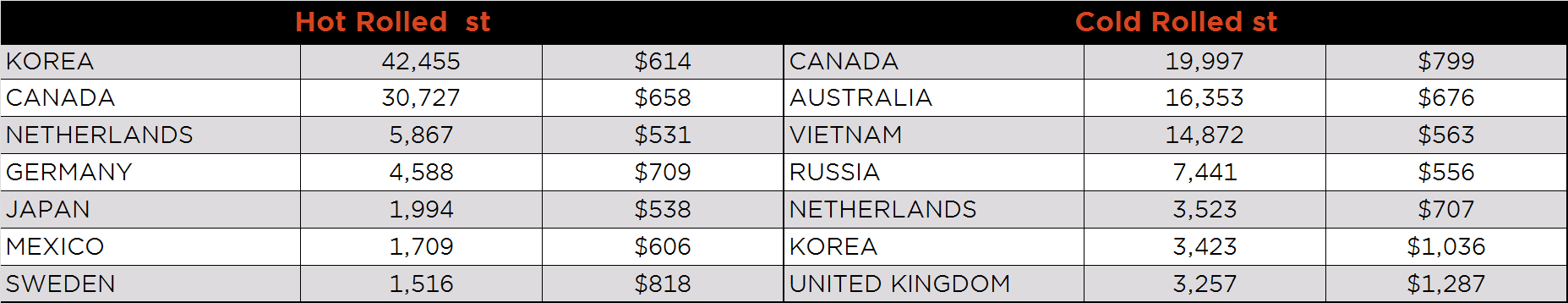

Below is June import license data through June 18, 2019.

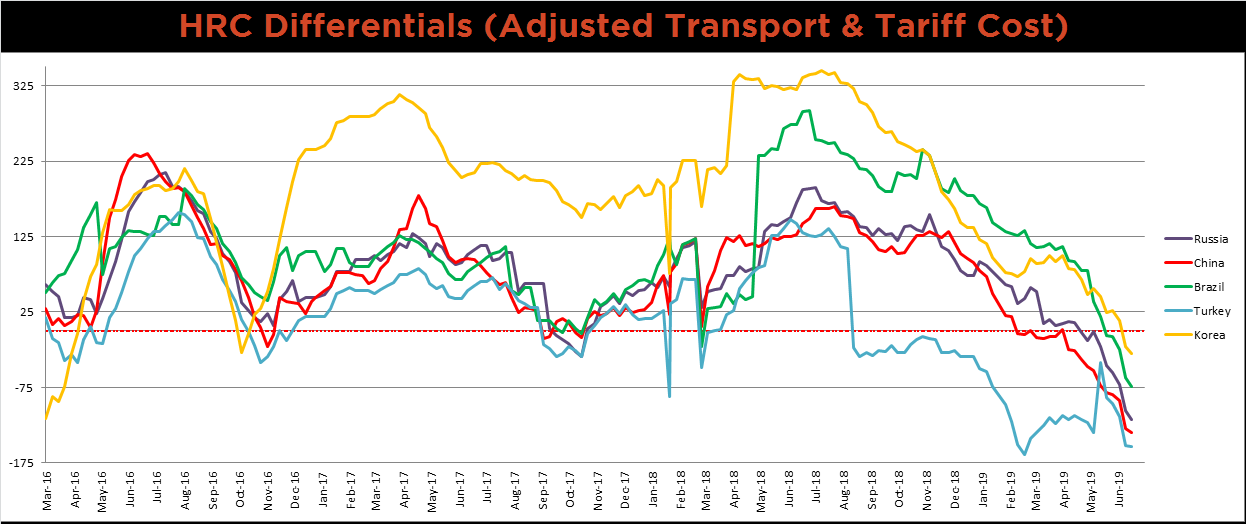

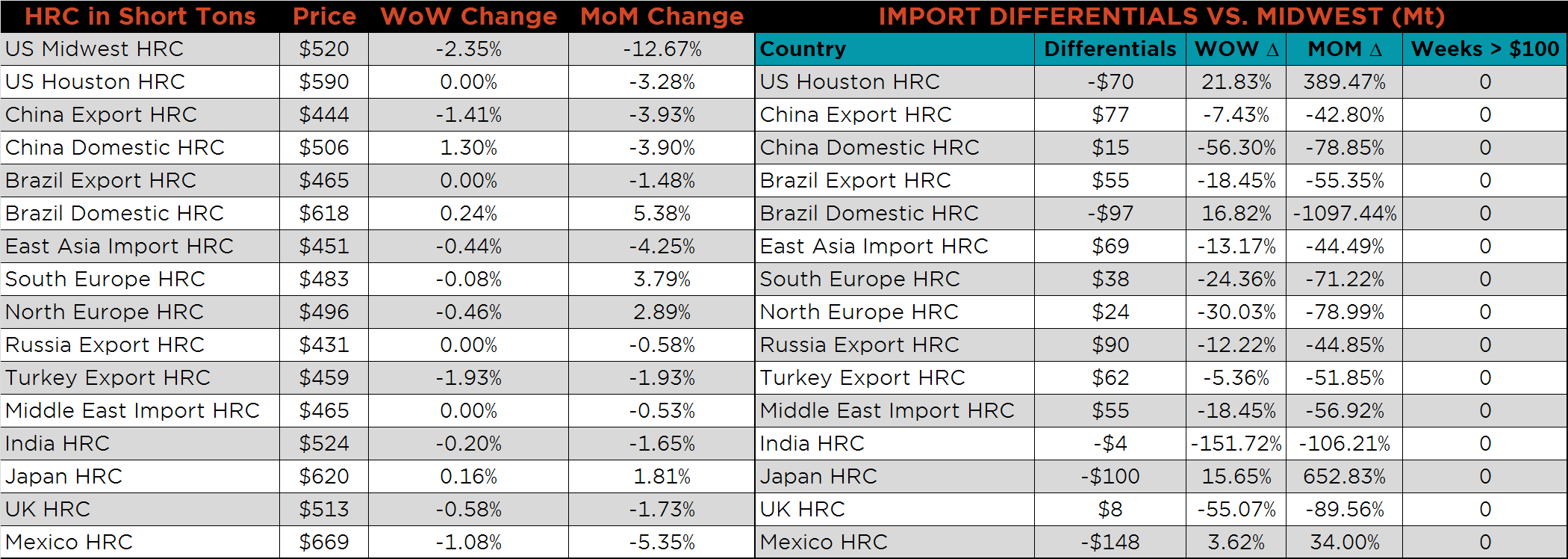

Below is HRC Midwest vs. each listed country’s export price differential using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Since last week, the Midwest price fell $12.50, moving all the differentials further below zero and to the lowest levels in 3 years. Historically, the zero price differential level has acted as a bottoming signal for domestic steel prices.

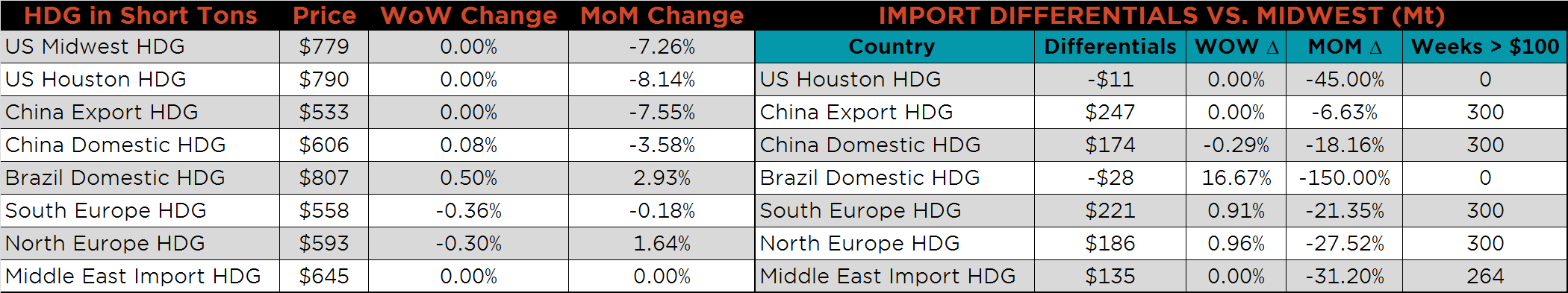

SBB Platt’s HRC, CRC and HDG pricing is below. Midwest HRC and CRC prices were lower on the week, down 2.35% and 2.5%, respectively. Turkey and Chinese HRC export prices were down 1.93% and 1.4%, while the remainder of the major producers showed little change in prices.

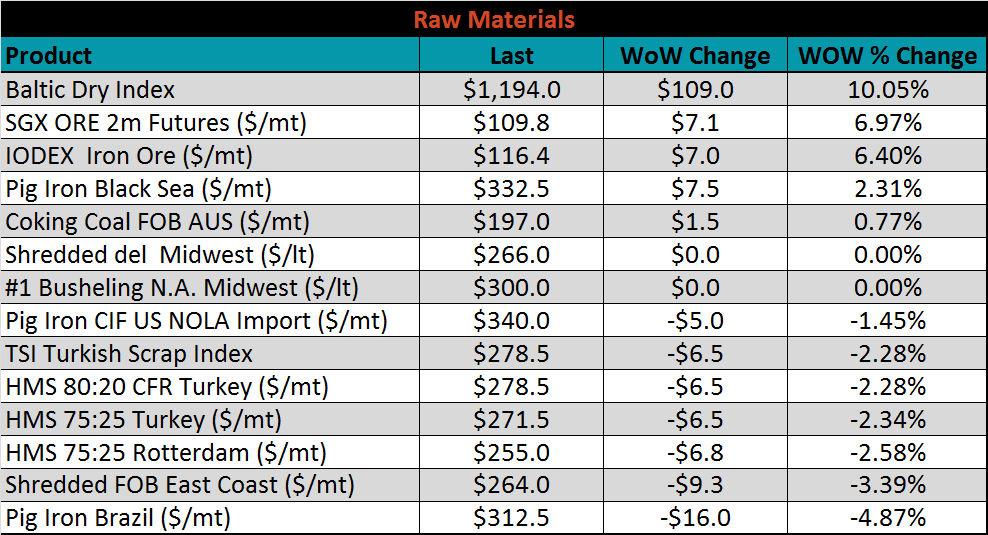

Raw material prices were mixed with SGX iron ore futures gaining 6.97%, while Brazil pig iron fell 4.87%.

Below is the iron ore future curve with Friday’s settlments in green, and the prior week’s settlements in orange.

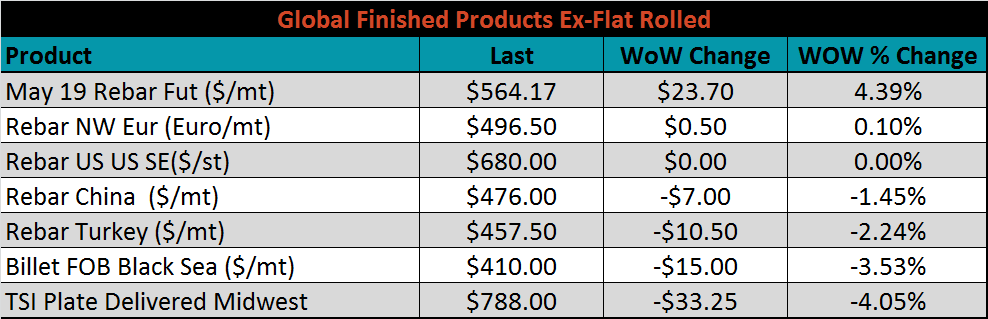

The ex-flat rolled prices are listed below.

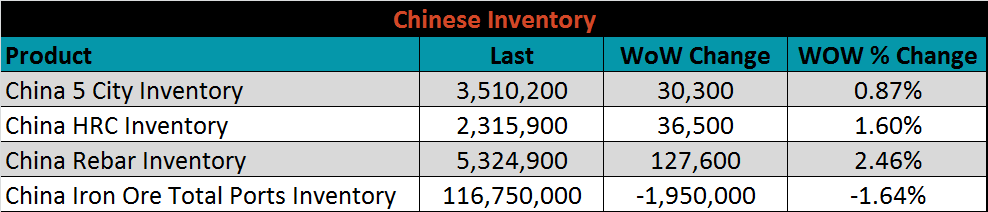

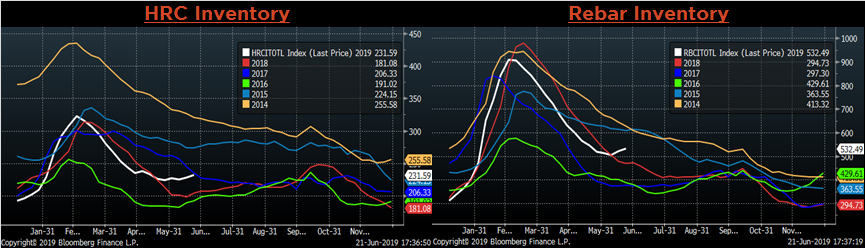

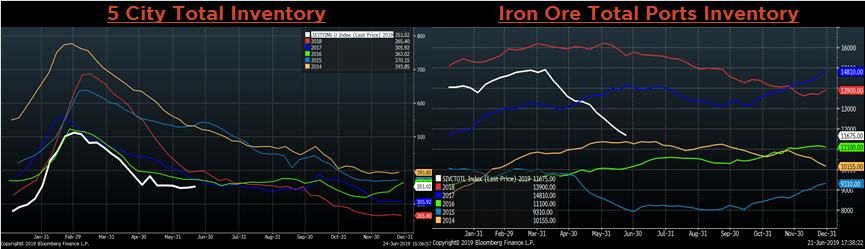

Below are inventory levels for Chinese finished steel products and iron ore. HRC, rebar and the 5-city inventory levels all moved higher again last week, while iron ore inventory continued to decline. As profit margins at mills shrink due to elevated ore prices and foundering coil prices, look for the iron ore ports inventory to stabilize as steel production decreases.

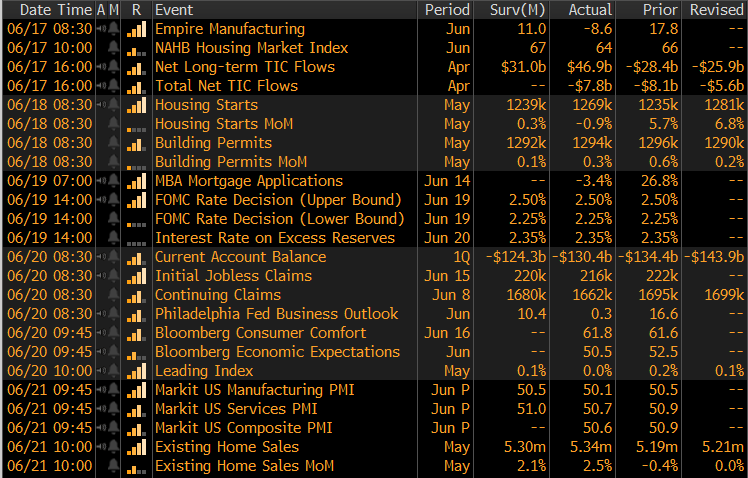

The remainder of the pertinent economic data is to the right. The FOMC left rates unchanged at their monetary policy meeting last week, but signaled that a rate decrease is likely at their meeting taking place at the end of July. The manufacturing data released last week was disappointing, with the Empire State, Philadelphia Fed and Markit manufacturing reports all down MoM and missing expectations.

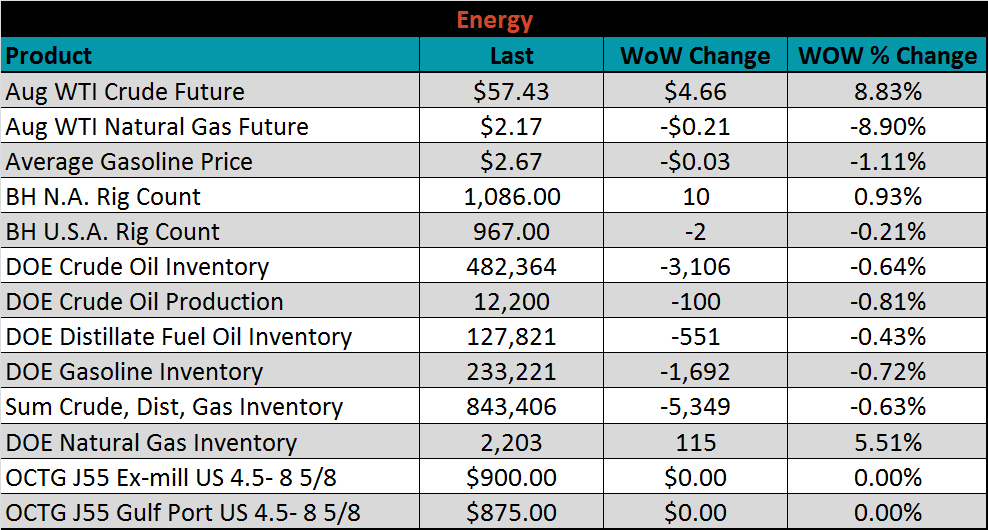

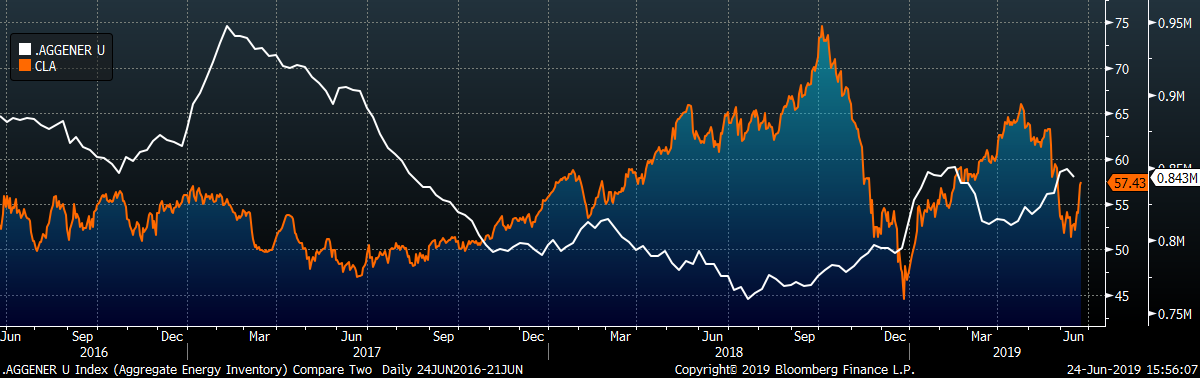

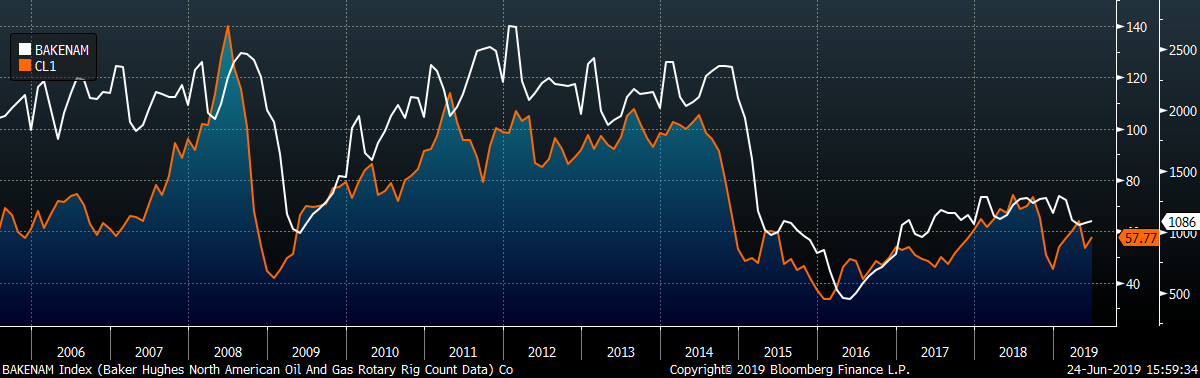

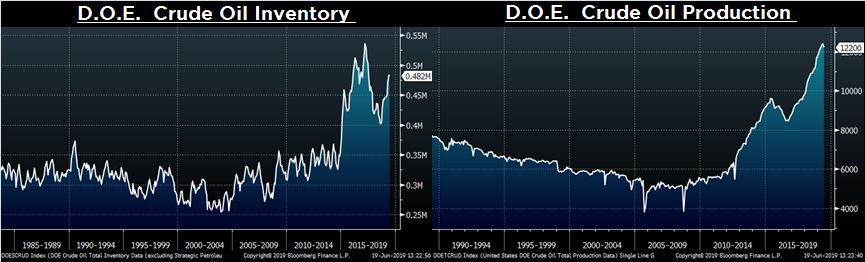

Last week, the Aug WTI crude oil future gained $4.66 or 8.83% to $57.43/bbl. The aggregate inventory level was down 0.6%, and crude oil production fell to 12.2m bbl/day. The Baker Hughes North American rig count gained ten rigs while the U.S. lost two.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: