Content

-

Weekly Highlights

- Market Commentary

- Risks

Over the last week, we have seen a noticeable change from the mills in terms of their attitude and prices offered in the market. After weeks of holding spot offers much higher than the expected transaction price, mills have begun negotiating for orders at significantly lower prices. Buyers will have an upper hand in these negotiations in the near term due to collapsing lead times. It was only a few weeks ago when mills refused to take orders at low prices, pointing to the strength in their order books. However, without booking new orders, and several cancelations on the back of shutdowns at automotive plants, collapsing energy prices and economic uncertainty, large holes have appeared in mill order books. Moreover, the lead-time for this material is extremely short, with some mills still offering April tons. Buyers will be able to set the price on this material, because it is sure to be produced and mills cannot sit on finished inventory for long. Additionally, with scrap prices expected to fall approximately $50 in April, mills will be able protect some profitability even at lower HRC prices.

However, there is a limit to how low mills will offer and how long they will be willing to negotiate. Many buyers have complete left the market, refusing to buy at any price. With this demand outlook and no bottom in sight for prices, profitability at mills will deteriorate. As they look at their order books for the summer months, they will choose to remove production capacity rather than book unprofitable tons. We have already seen some announced production cuts, as well as mills producing at reduced rates. With the current demand outlook, further production cuts will be needed for prices to find support.

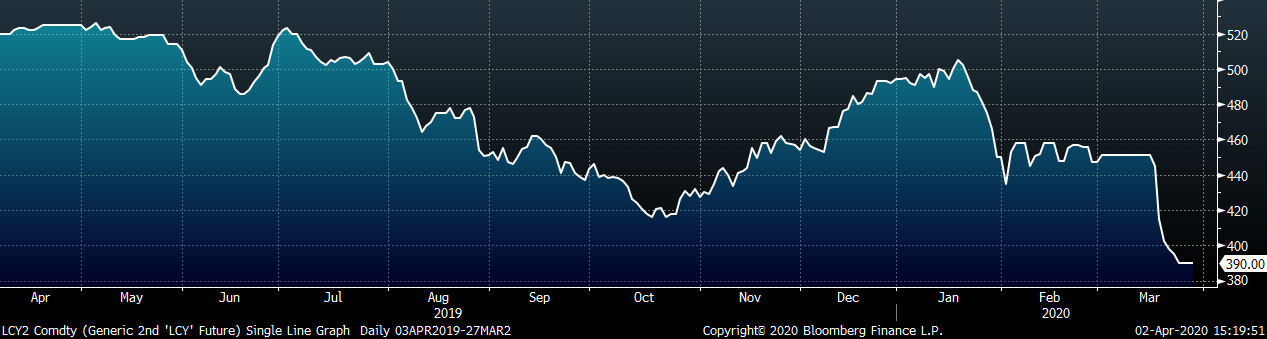

Another dynamic to pay attention to on the supply side in the months ahead is the level of imports. Currently, import activity is at a standstill as supply chains are in limbo and buyers wait for more clarity. Very few offers for foreign steel have surfaced, and current import levels remain low. Due to the longer lead times associated with imported material, these low levels are likely to persist. However, the world price continues to decline due to weak demand and high inventory levels. We can see this through the weakness in the China export price, which is a significant driver of the world price. Below is a chart of the 2nd month LME FOB China HRC future.

After trying to recover from the initial drop in late January, the China price collapsed in March below the previous low from October. As the price in China fell, we also saw the forward curve in the domestic market come under pressure. This continued weakness in HRC prices across the globe leads us to believe that a recovery will take much longer than previously thought, and it is less likely that we will see pre-crisis prices or economic activity any time soon. While many factories shut down overnight, it will take them much longer to ramp up production, and even longer for economic demand to support that production. Future stimulus is likely to be geared to helping restore demand once the crisis is past. However, it is impossible to know when the crisis is peaking, and even tougher to predict what the economy will look like on the other side.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

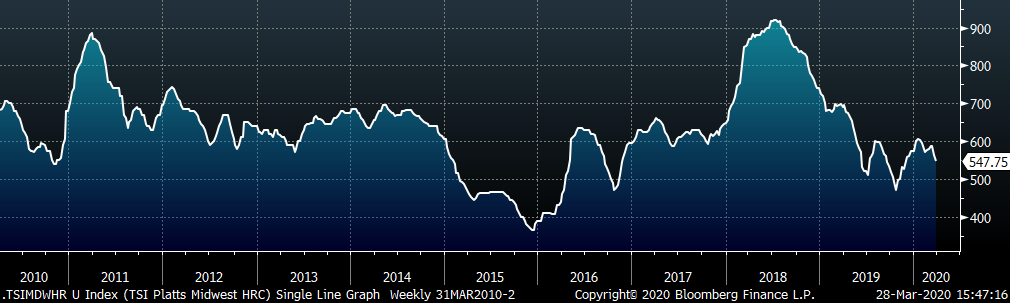

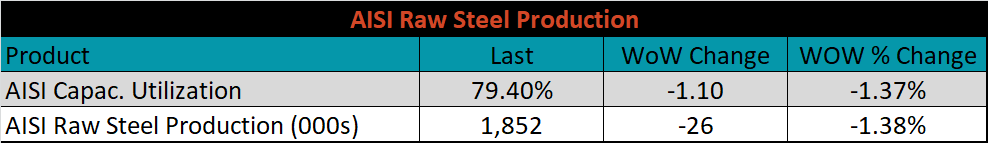

The Platts TSI Daily Midwest HRC Index was down $16 to $547.75.

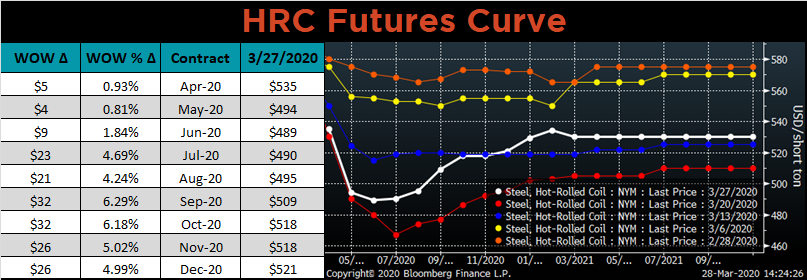

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The entire curve moved higher, most significantly in the back.

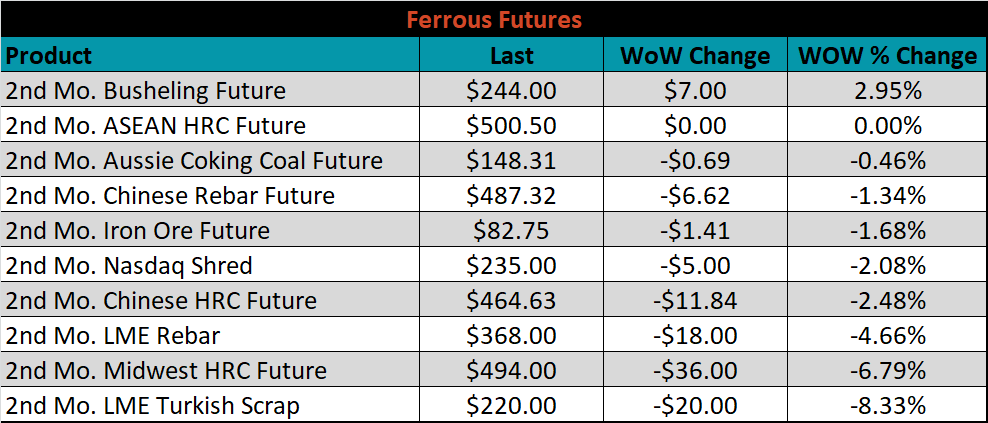

April ferrous futures were mixed. The busheling future gained 3%, while Turkish Scrap lost 8.3%.

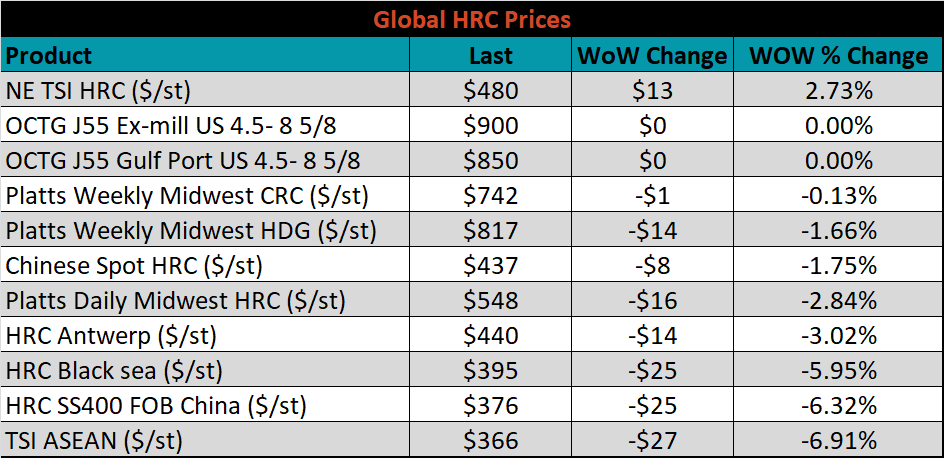

The global flat rolled indexes were mostly lower, led by ASEAN HRC, down 6.9%. Northern European HRC was the exception, up 2.7%.

The AISI Capacity Utilization Rate was down another 1.1% to 79.4%, falling below 80% for the first time this year.

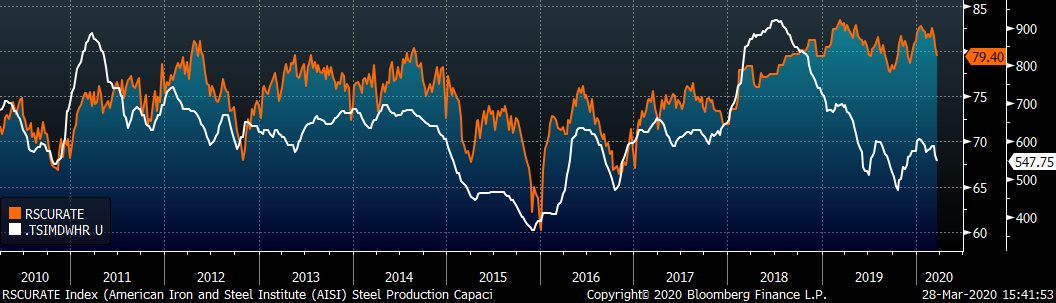

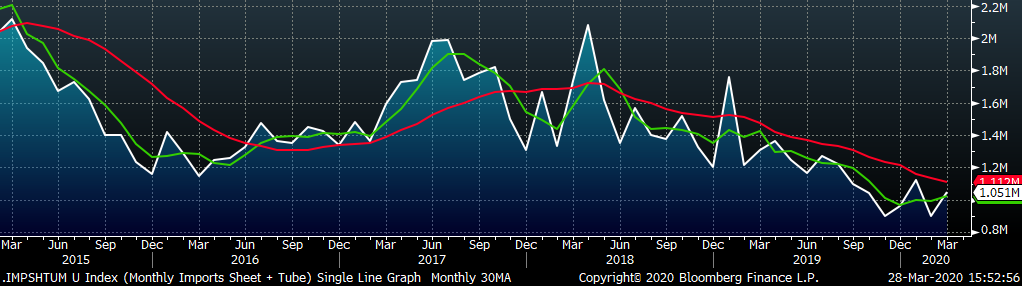

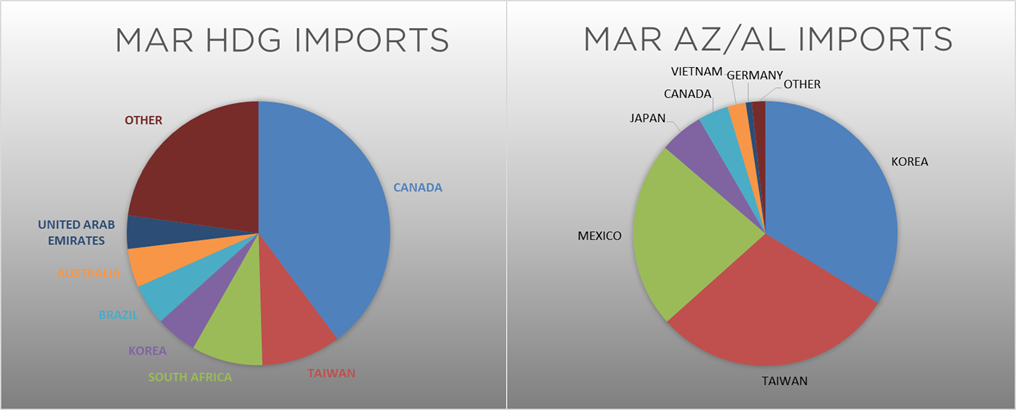

March flat rolled import license data is forecasting an increase of 25k to 667k MoM.

Tube imports license data is forecasting a MoM increase of 126k to 383k tons in March.

AZ/AL import license data is forecasting an increase of 5k in March to 61k.

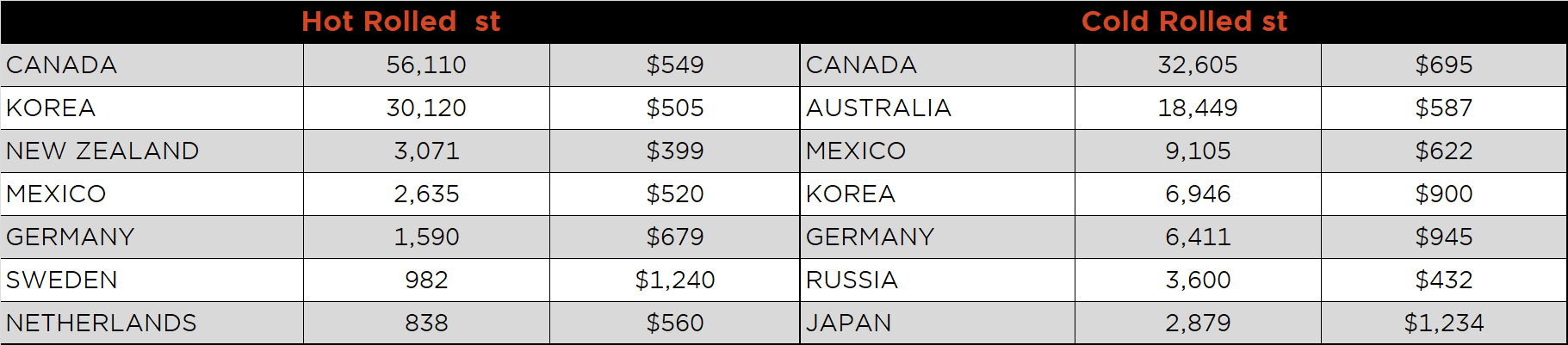

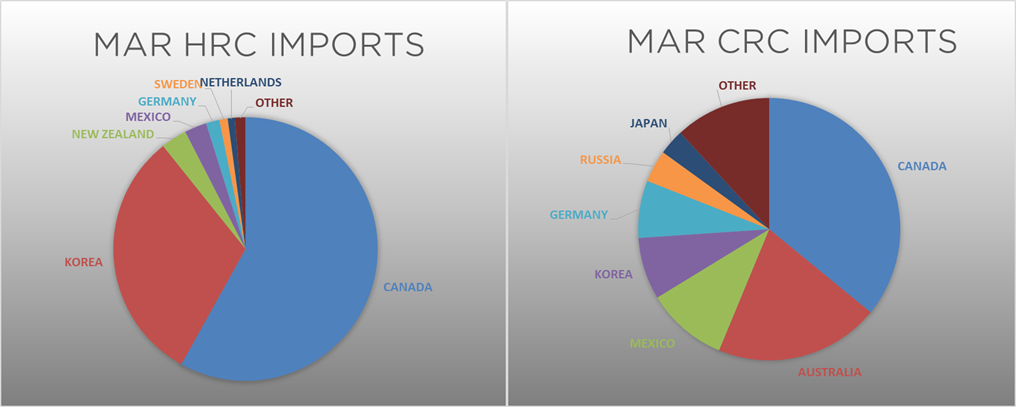

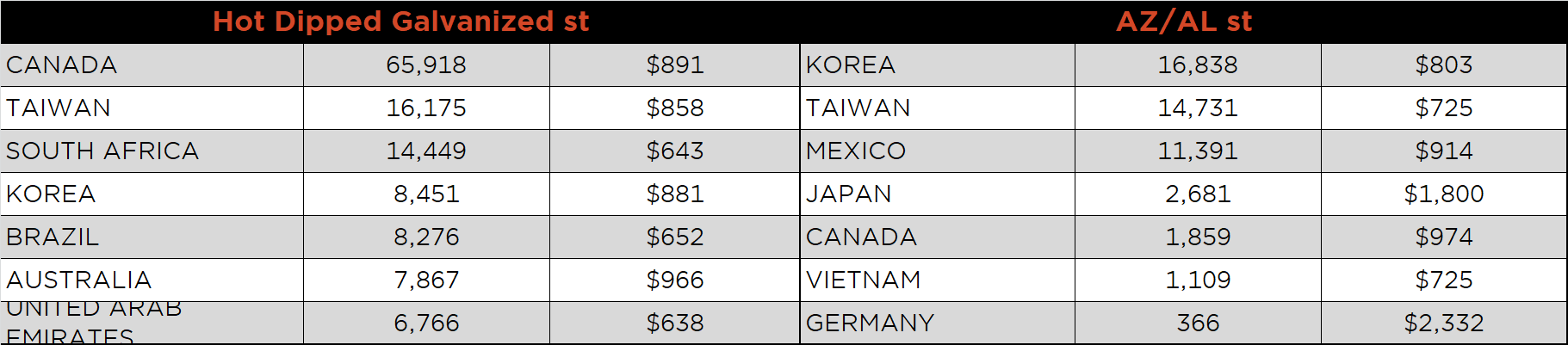

Below is February import license data through March 24, 2020.

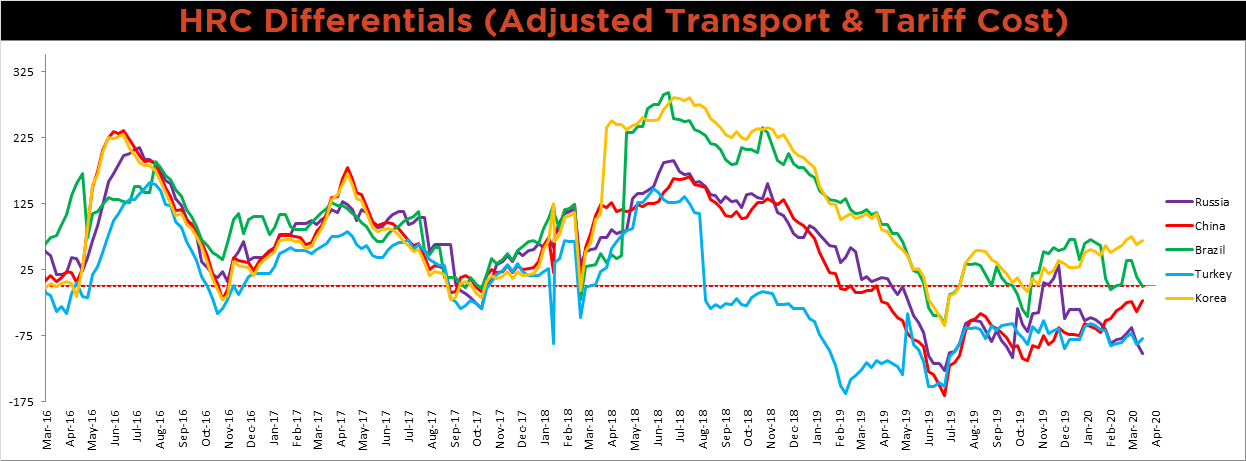

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The Turkish, Korean and Chinese differentials increased, as their respective prices fell further than U.S. Midwest HRC prices, while the Russian and Brazilian differentials decreased.

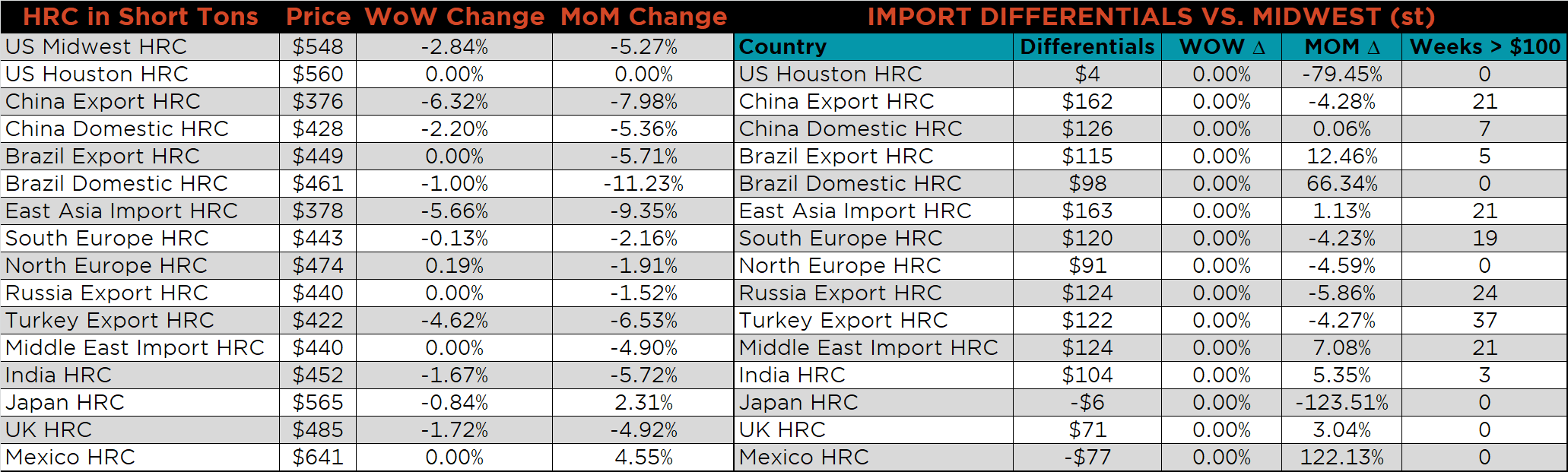

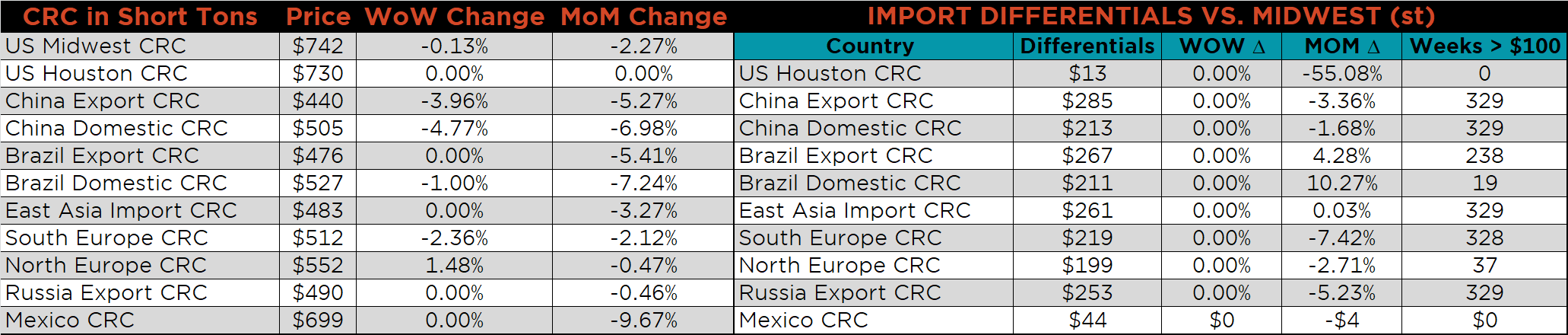

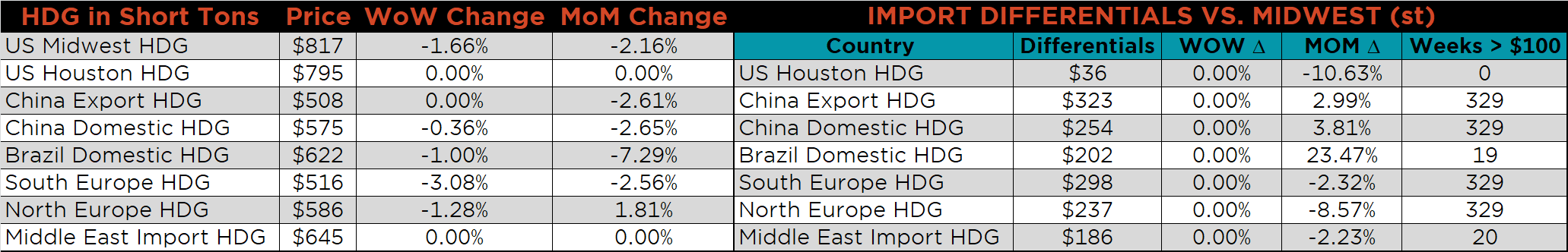

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC, HDG and CRC prices were down 2.8%, 1.7% and 0.1%, respectively. The Chinese Export HRC and CRC prices were down 6.3% and 4%, respectively.

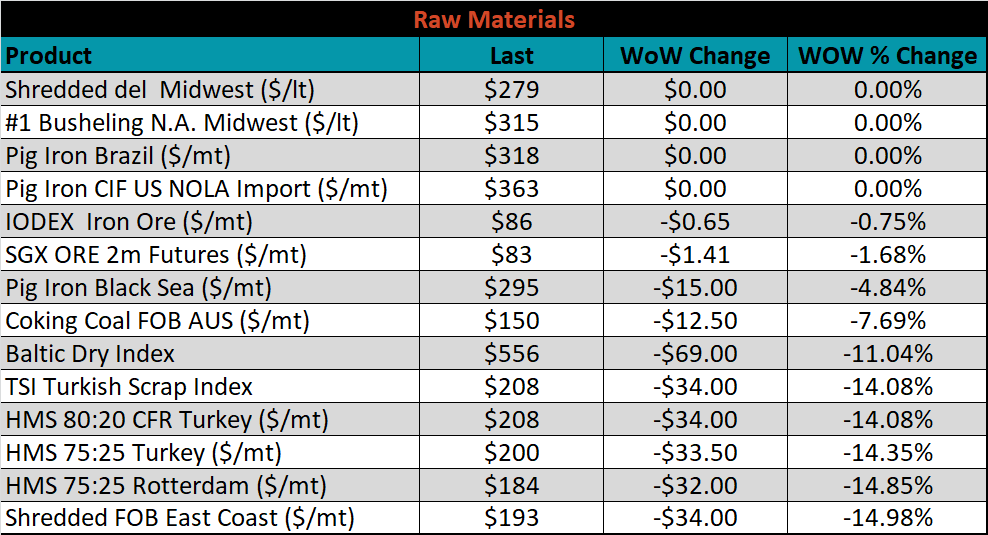

Raw material prices were unchanged or lower. Midwest shredded was flat, while East Coast shredded was down 15% and Rotterdam HMS was down another 14.9%.

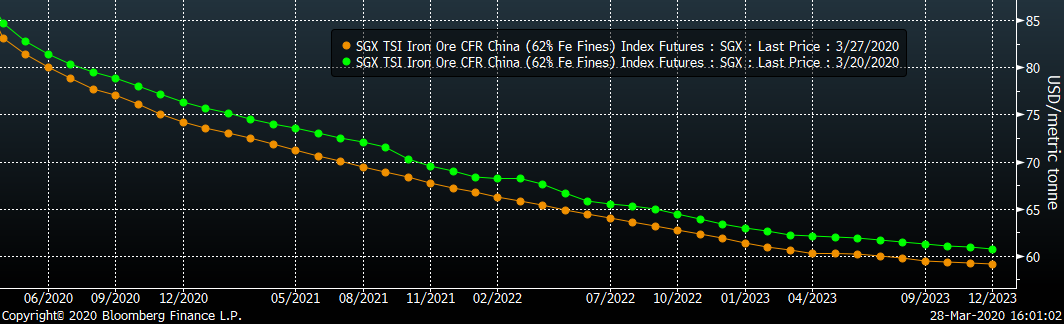

Below is the iron ore future curve with Friday’s settlments in orange, and the prior week’s settlements in green. The entire curve shifted slightly lower.

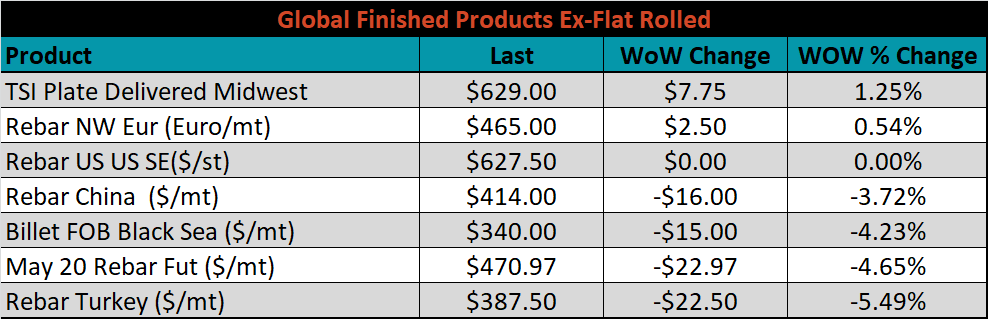

The ex-flat rolled prices are listed below.

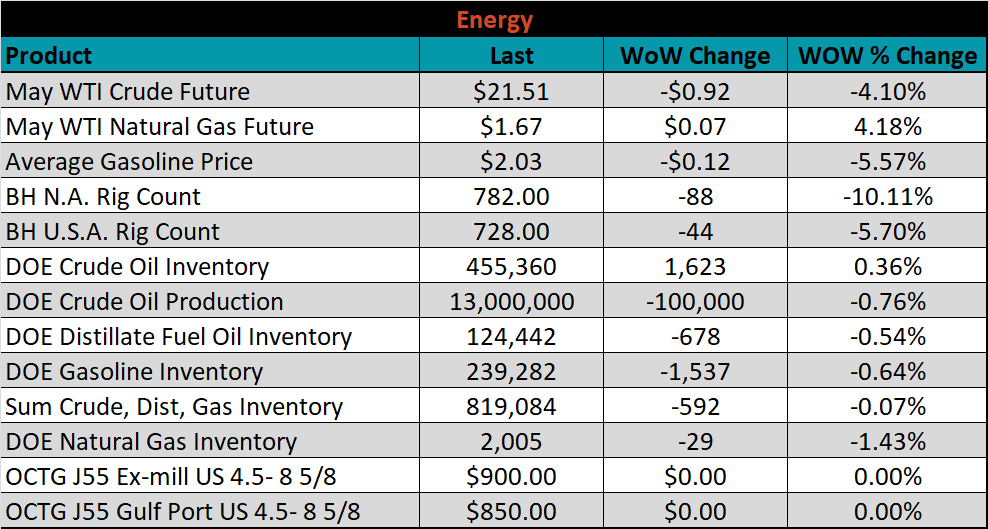

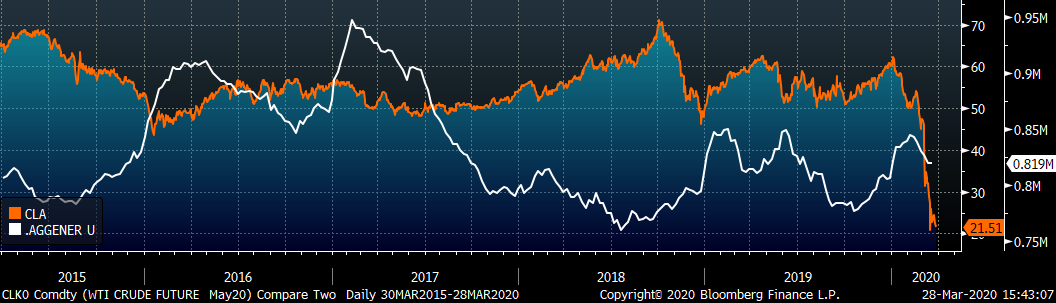

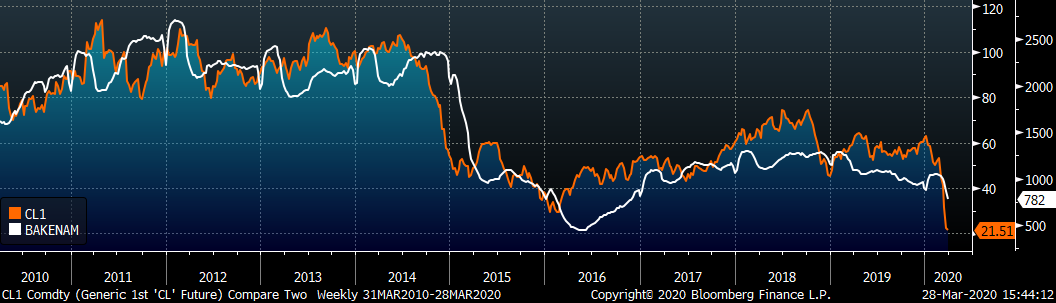

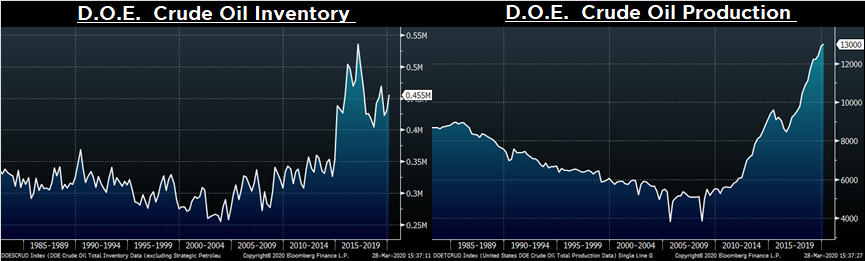

Last week, the May WTI crude oil future lost another $0.92 or 4.1% to $21.51/bbl. The aggregate inventory level was down 0.1% and crude oil production fell to 13m bbl/day. The Baker Hughes North American rig count was down 88 rigs, while the U.S. rig count was down 44 rigs. It is likely we will see production decline over the coming weeks as storage capacity shrinks.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: