Content

-

Weekly Highlights

- Market Commentary

- Risks

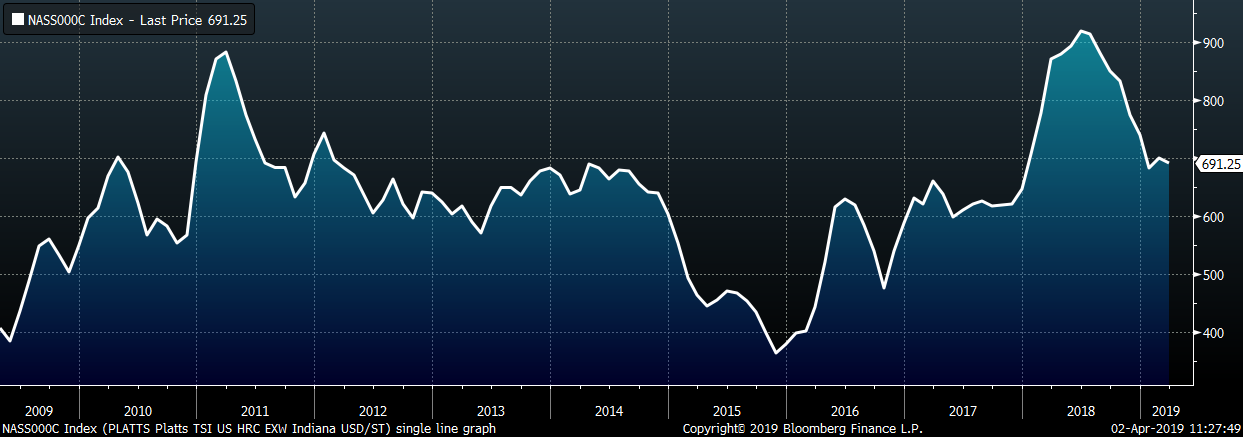

The tariff induced price rally of 2018 ended last summer with the Platts TSI Daily Midwest HRC Index peaking at $920/st. From there, prices and lead times collapsed, and the index bottomed in February of this year at $677/st. However, prices have remained in a tight range between 680 and 700 since then.

During the quarter, mills pushed price increases, which successfully stabilized prices. The world price moved higher, reducing the attractiveness of importing material. The total forecasted sheet imports for the first quarter is 2.3 million tons, the lowest level we have seen in at least the last 5 years. However, prices failed to gain any upside momentum.

Several factors have kept buyers on the sidelines in 2019 including:

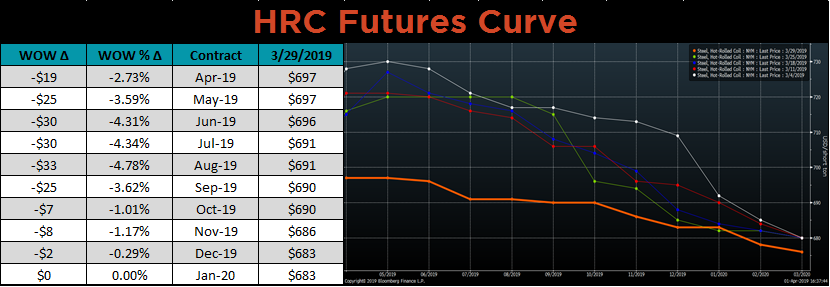

In early March, the HRC future curve moved higher, pricing in expectations of a price rally during the second quarter. However, inactivity in both the physical and the futures market caused the future curve to flatten, with the front falling $25-30 over the last week.

After a sideways pricing environment for much of the first quarter, the question is “Where do we go from here?”

We believe that that the factors weighing on steel prices have largely abated, setting a base for prices to move higher in the second quarter. Inventory levels decreased during the first quarter, and service centers worked through older, high cost material. Lead times have stabilized and even pushed out slightly, removing any incentive to delay material purchases. As the government shutdown ended and economic data became available, it was clear that a recession was not eminent. The Atlanta Fed’s Q1 GDP Forecast moved from near 0% to its current reading of 2.07%. This is an annualized, year over year growth reading, meaning the U.S. economy is continuing to grow from the elevated levels of 2018. Additionally, after raising rates at the December FOMC meeting, the Federal Reserve signaled that they would not be tightening monetary policy in the near future. This supports asset prices and facilitates liquidity in the economy. Importing material will remain unattractive, as the world price continues to move higher, and imports should remain at these low levels.

The HRC future curve looks attractive at the current levels for buyers. There are still risk to this outlook, the most pertinent being the removal of tariffs. Specifically, tariff resolution with Mexico and Canada, as both countries have stated Section 232 tariff removal is needed to approve the USMCA trade deal, would weigh on prices.

Upside Risks:

Downside Risks:

The Platts TSI Daily Midwest HRC Index was down $8 to $691.25.

The CME Midwest HRC futures curve shown below with last Friday’s settlements in orange. The curve dramatically flattened compared to last week, and looks undervalued based on current market dynamics.

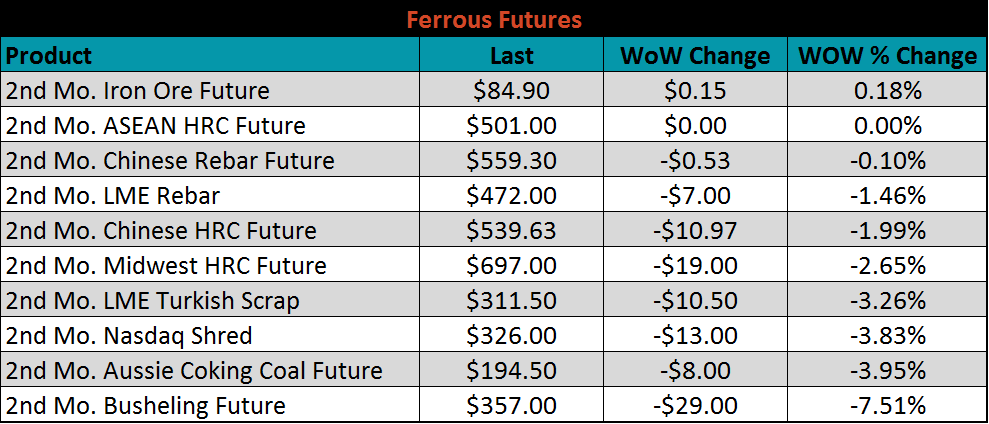

May ferrous futures were mostly down. Led by the busheling future, down 7.5 %.

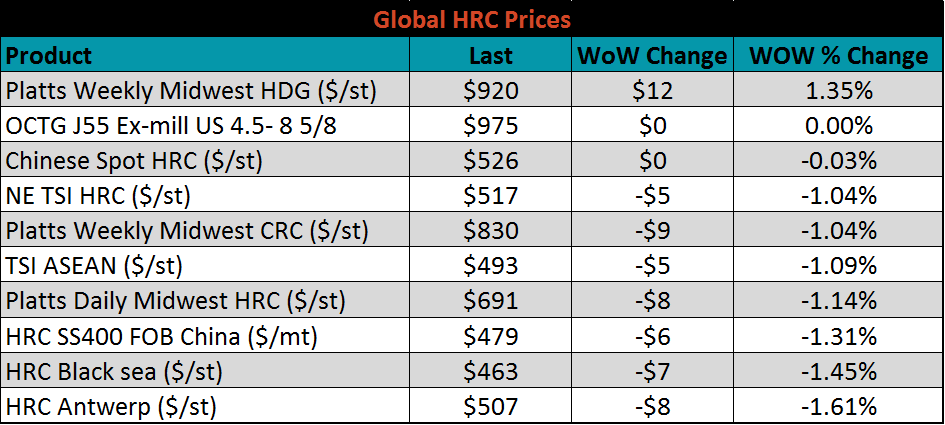

Flat rolled indexes were mostly lower, but saw little change overall.

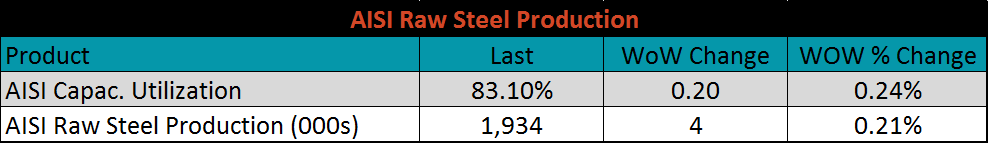

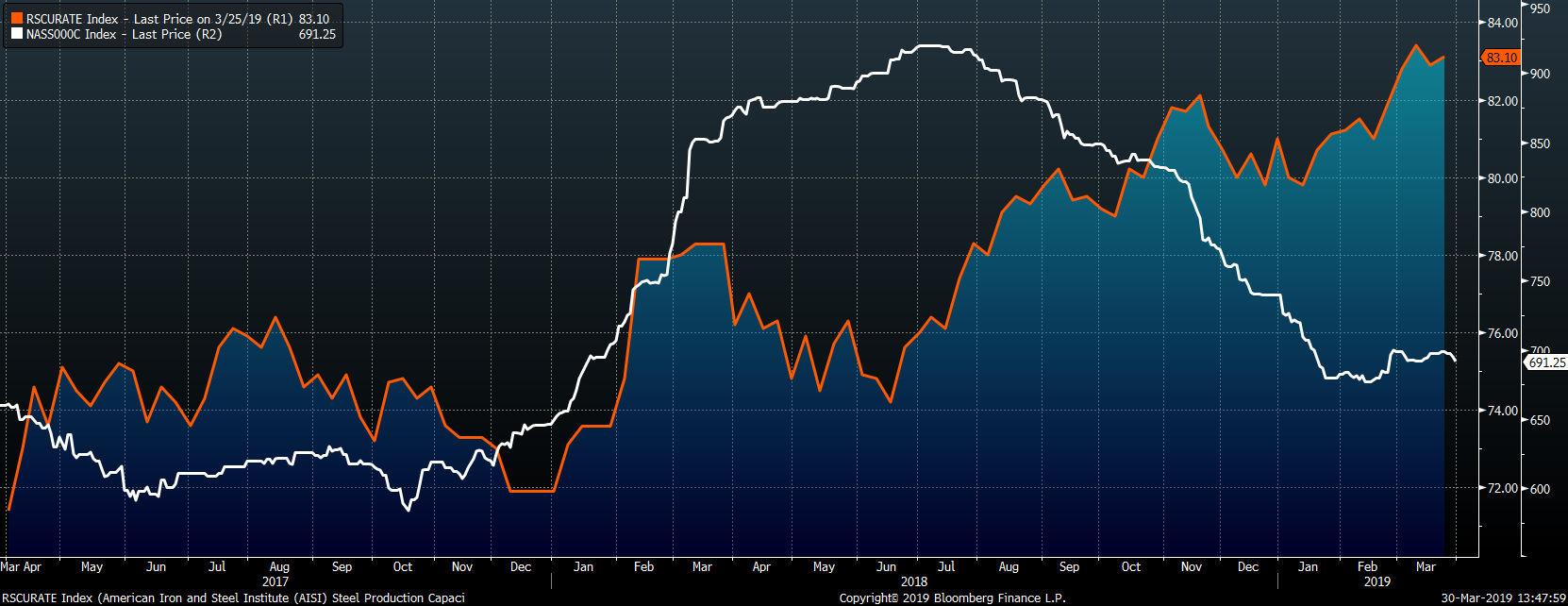

The AISI Capacity Utilization Rate remains elevated at 83.1%. The Trump administration’s goal of 80% Capacity Utilization Rate has held since October 2018, one factor contributing to the price moving lower over that timeframe.

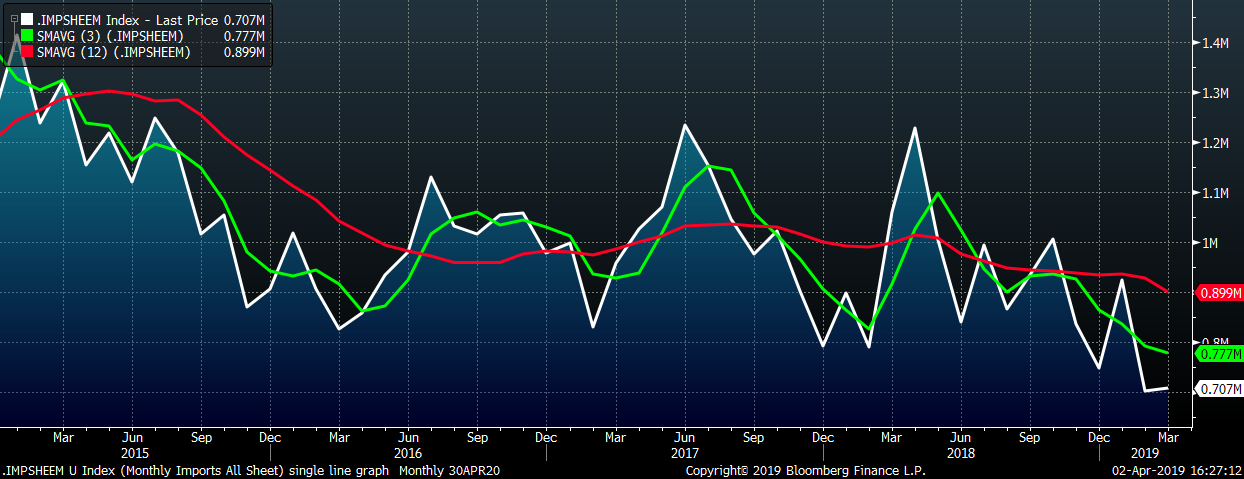

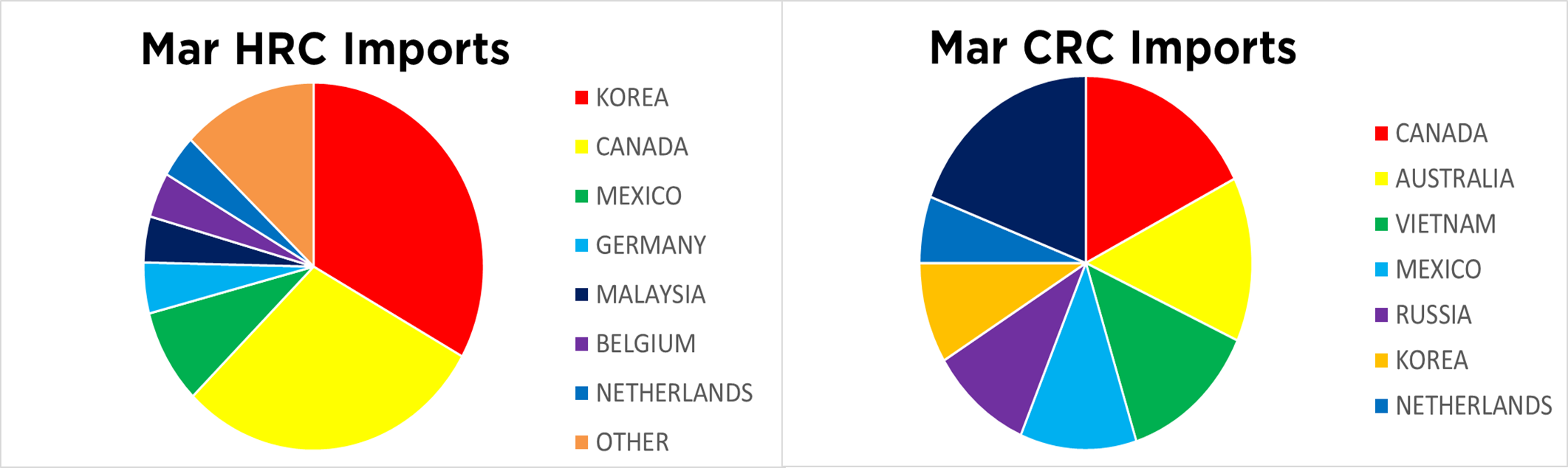

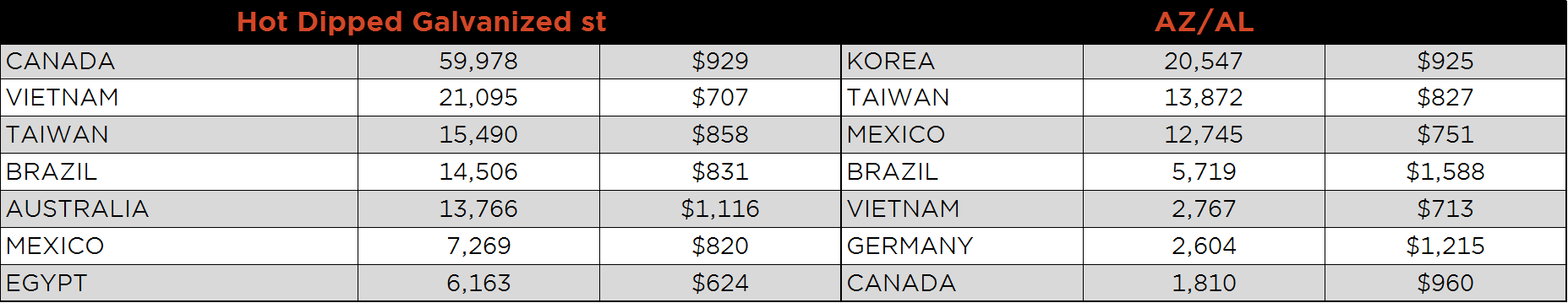

March flat rolled import licenses are forecast to increase slightly to 707k MoM while February flat rolled import licenses are forecasted to fall 221k tons MoM to 702k.

March tube import license data is forecasted to decrease 60k to 520k tons MoM after another steep drop in February.

The combined flat and tube import license forecast looks to fall 56k tons in March after a 477k decrease in February.

AZ/AL import licenses forecast an increase of 8k to 67k in March.

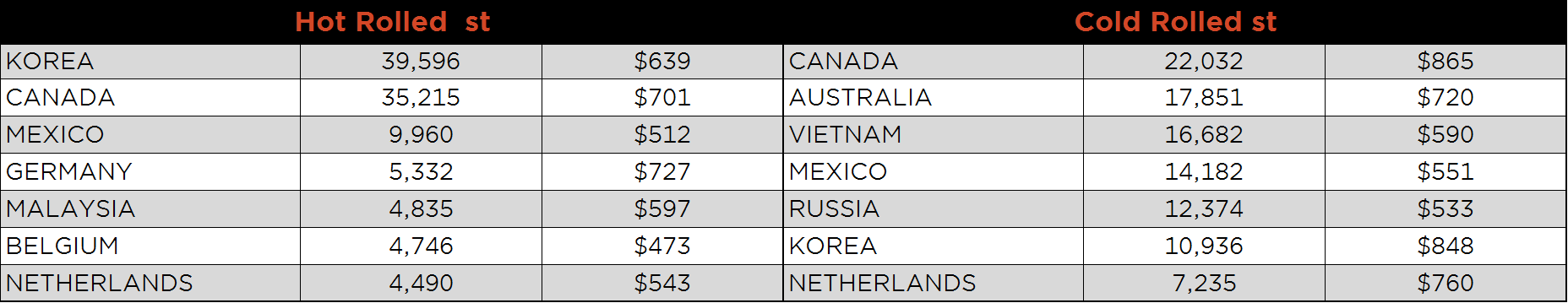

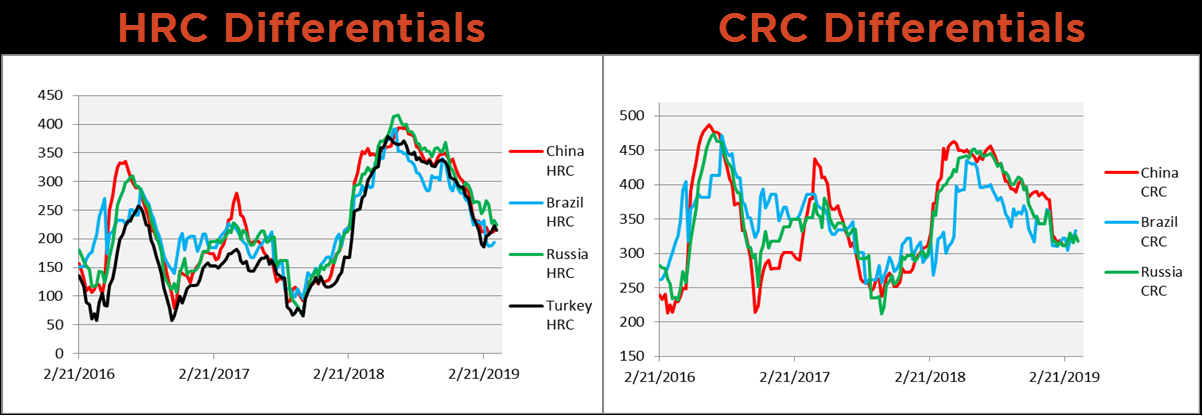

Below is March import license data through March 27, 2019.

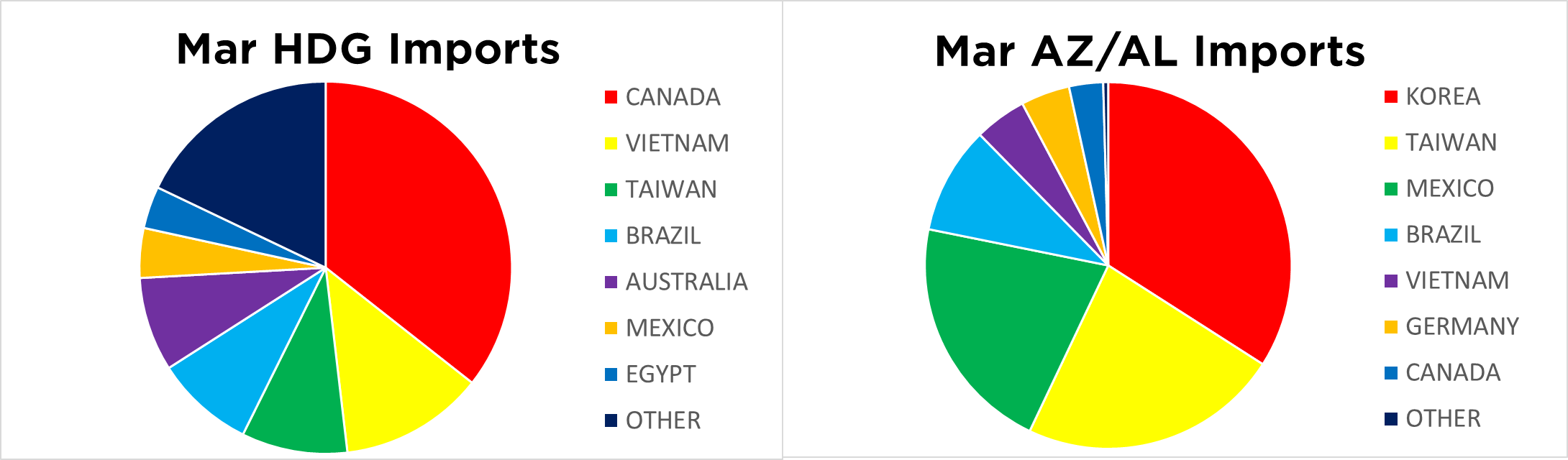

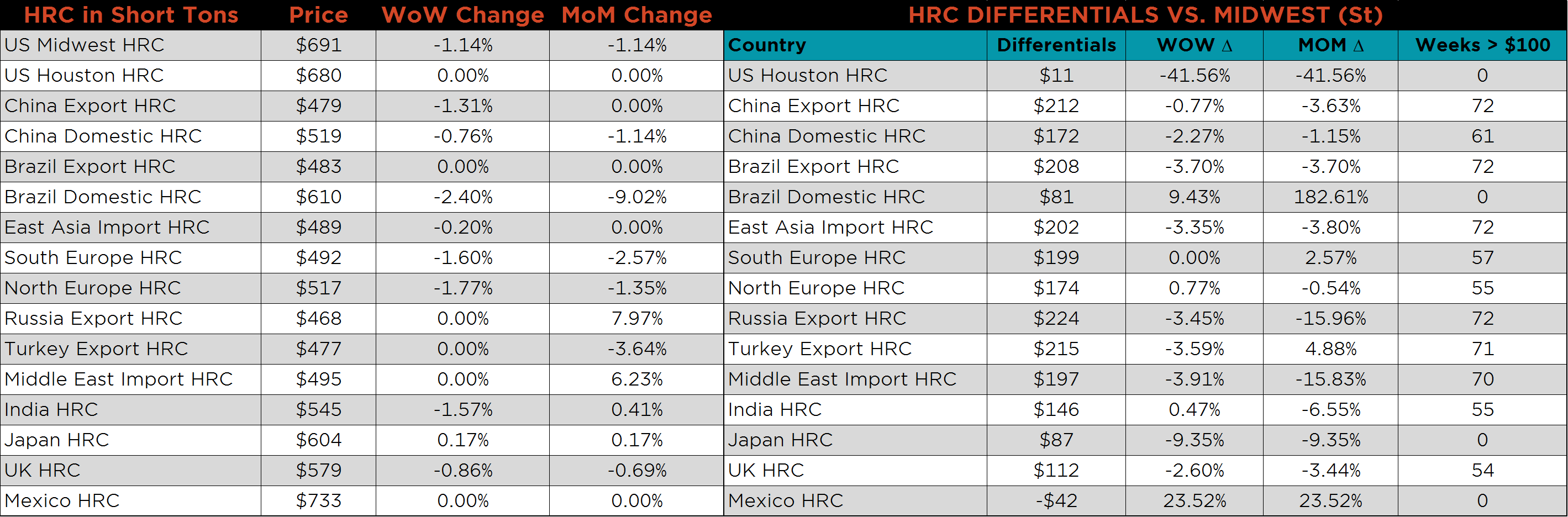

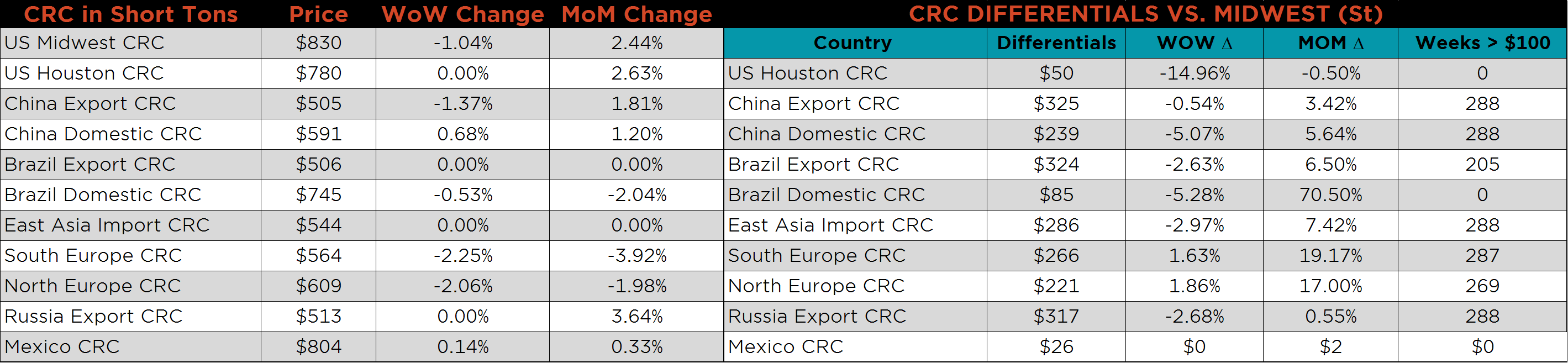

Below are HRC and CRC Midwest vs. each country’s export price differentials using pricing from SBB Platts. Each of the Turkish, Chinese, and Russian HRC differentials decreased last week, while Brazilian increased. All three CRC differentials appear to be range bound.

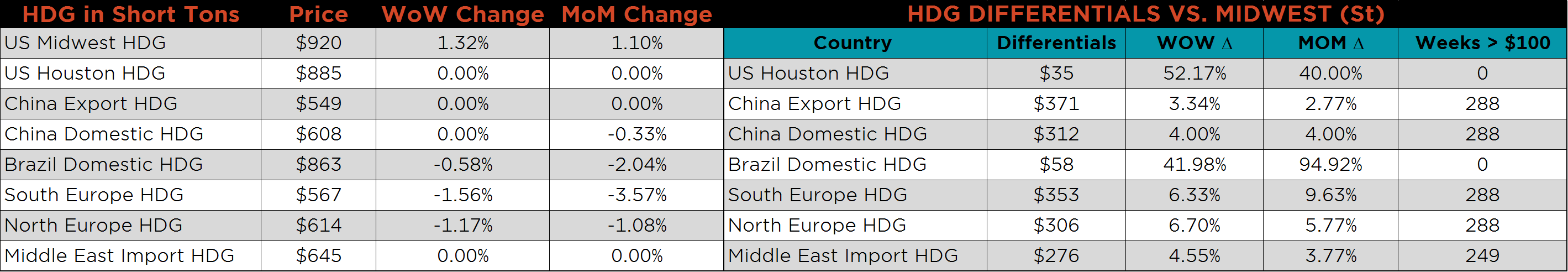

SBB Platt’s HRC, CRC and HDG WoW pricing is below. Midwest HDG gained, while HRC and CRC fell. Brazilian Domestic HRC fell 2.4% while Southern and Northern European CRC fell 2.2% and 2.1%, respectively.

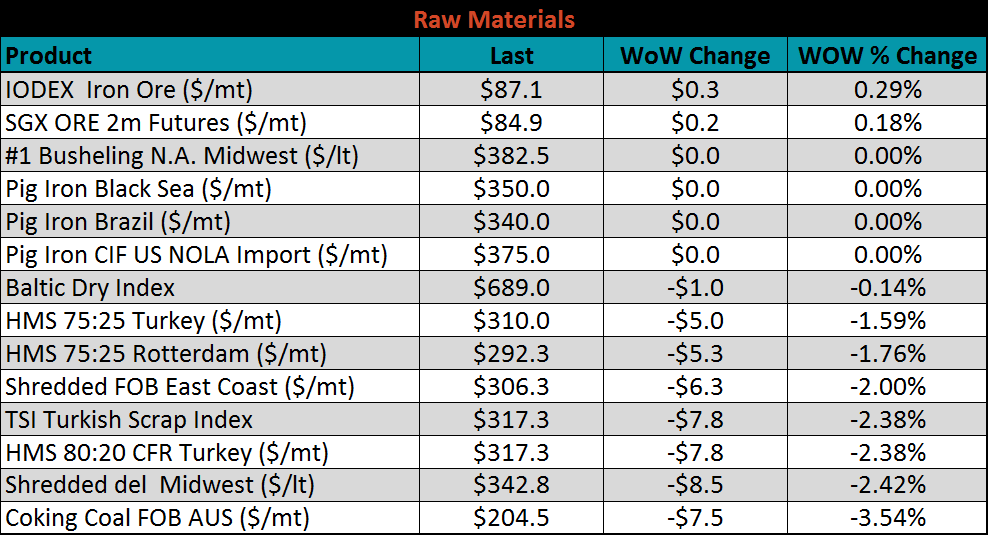

Scrap prices were mostly lower. Australian coking coal was down 3.5%.

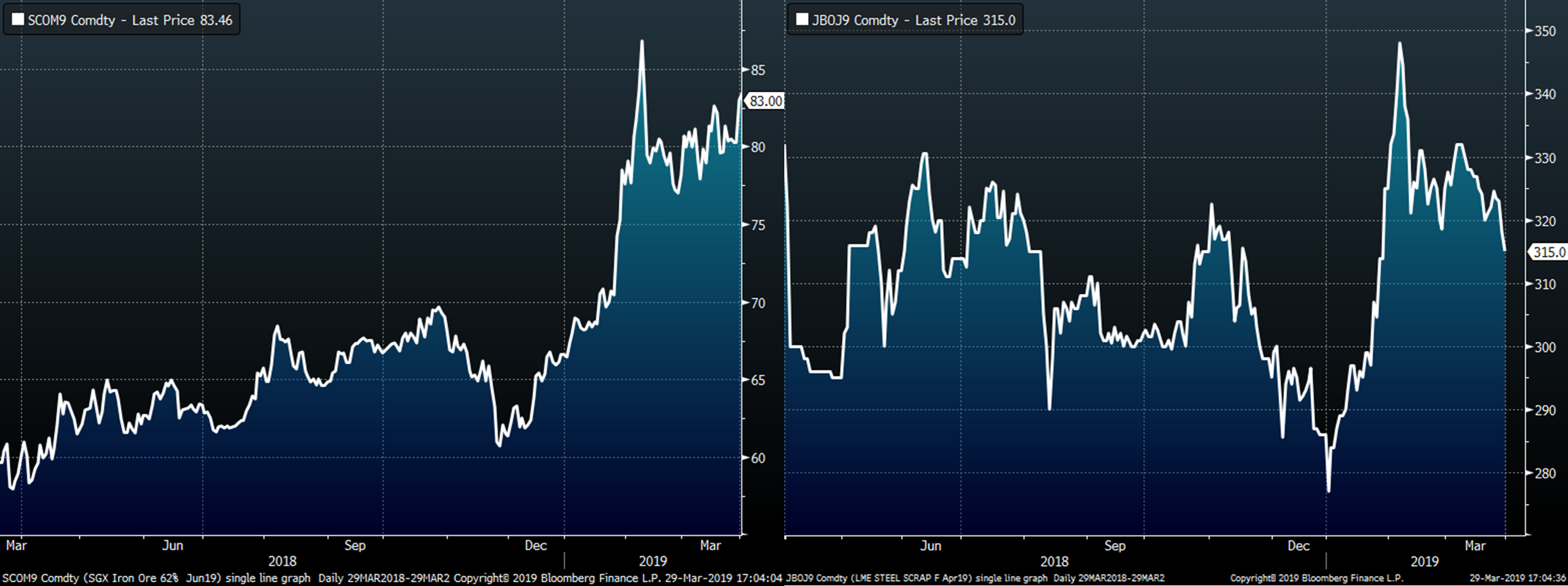

The June SGX iron ore future gained $3.52 to $83 and the April Turkish scrap future lost $7 to $315.

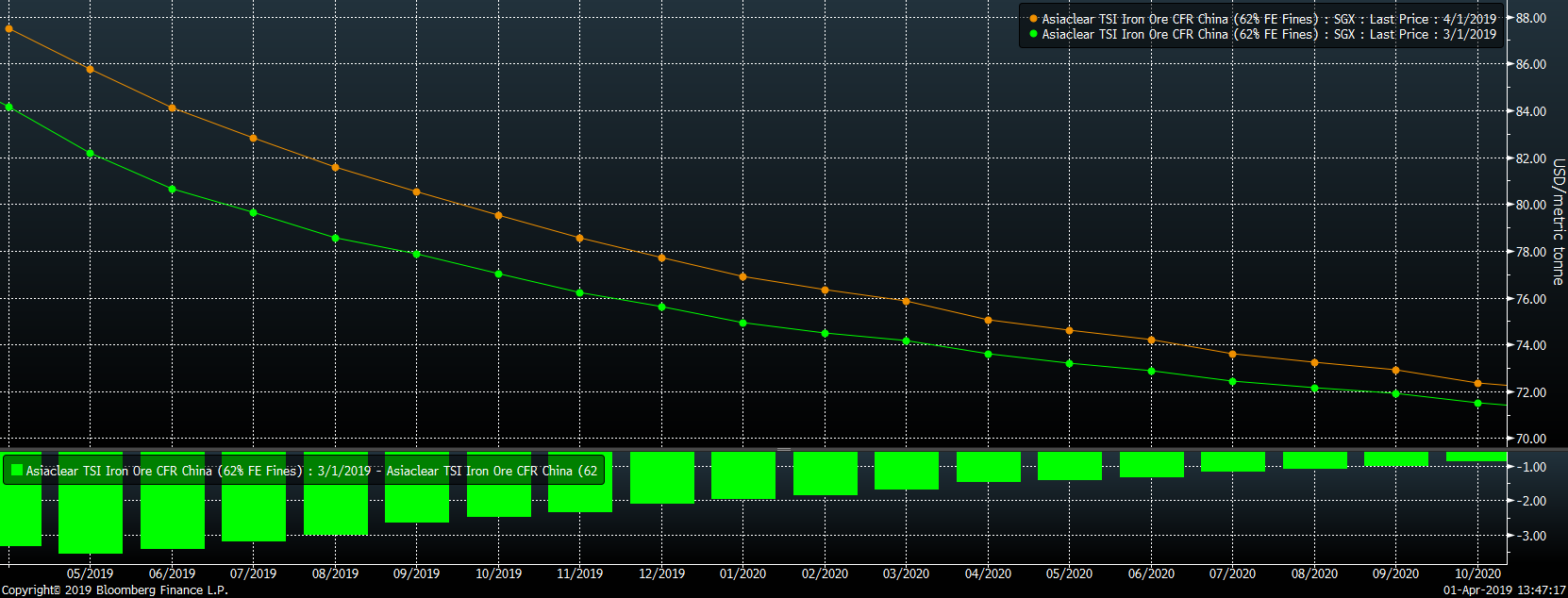

The SGX iron ore futures curve has held most of the gains made following the Vale dam disaster.

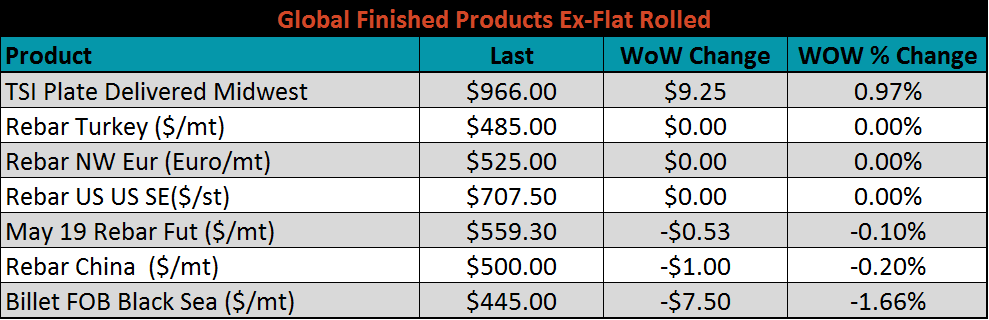

Ex-flat rolled prices saw little movement.

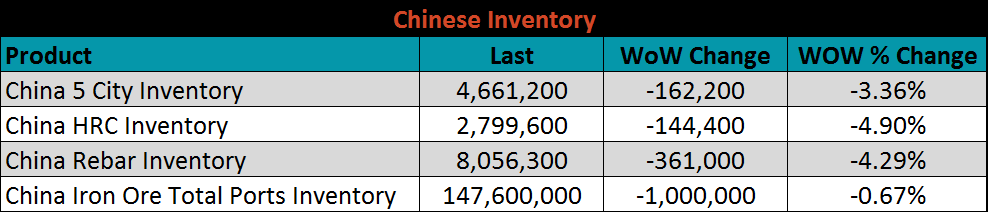

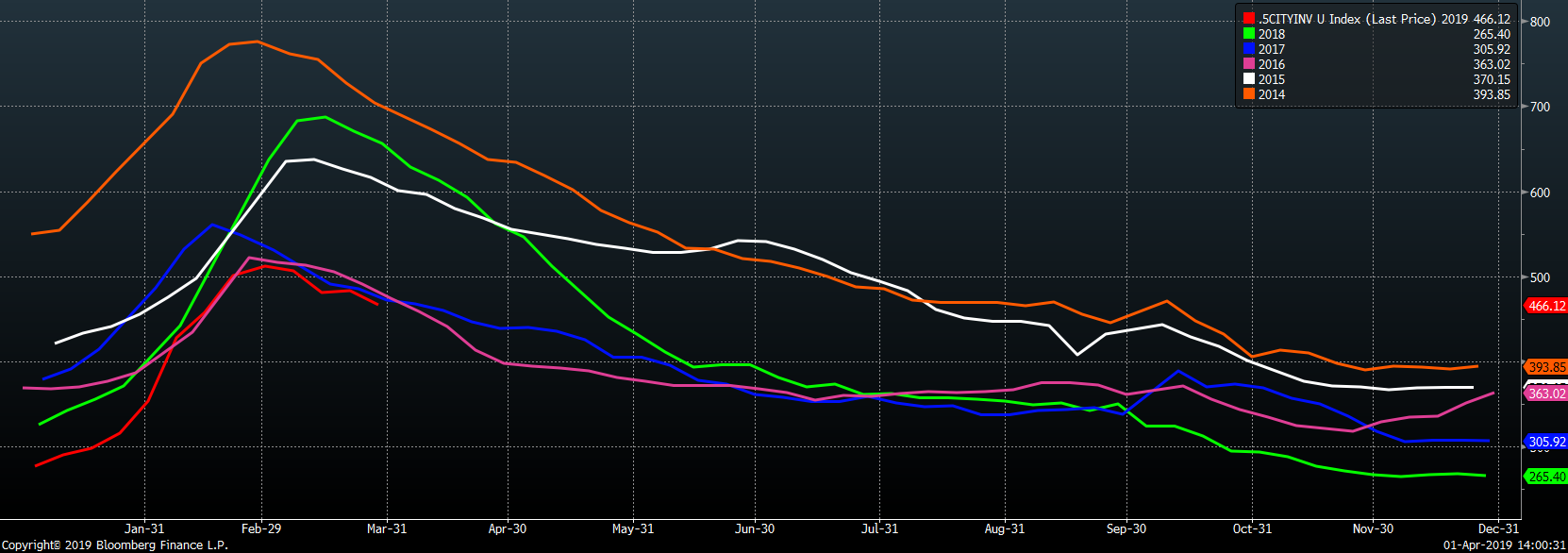

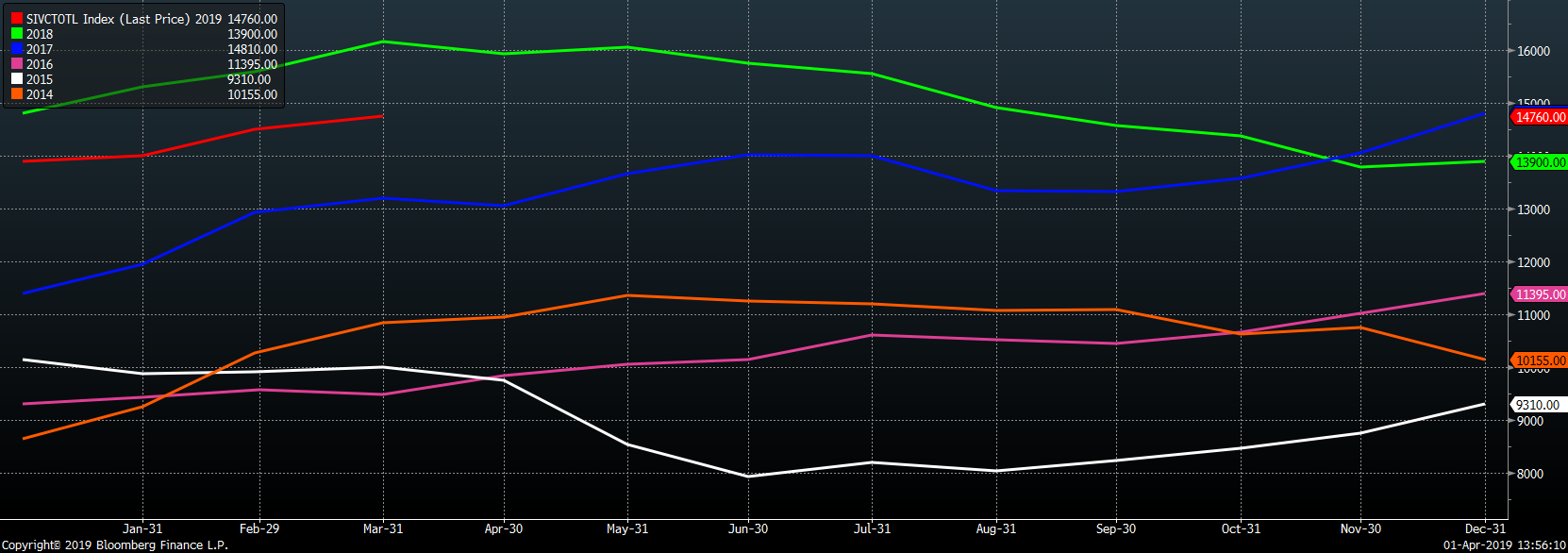

Below are inventory levels for Chinese finished steel products and iron ore. Inventories were lower across the board. HRC and Rebar were each down 4.9% and 4.3%, respectively. The Five City Inventory is down 3.4%, and remains lower compared to levels seen at this point in previous years (red line in the charts below). As economic activity and demand continue to recover, this will be supportive for metals prices in China and the global price. Iron Ore port inventories remain elevated vs prior years. However, this is due to the expected supply disruptions from Vale and Rio and won’t necessarily prevent prices from remaining elevated.

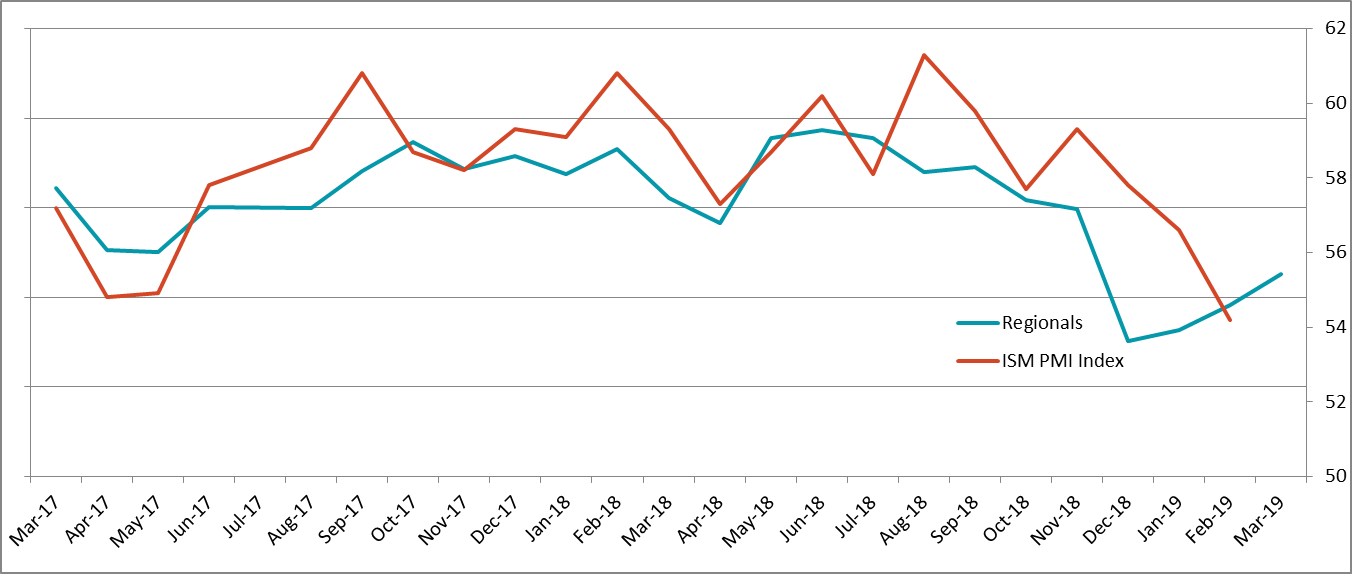

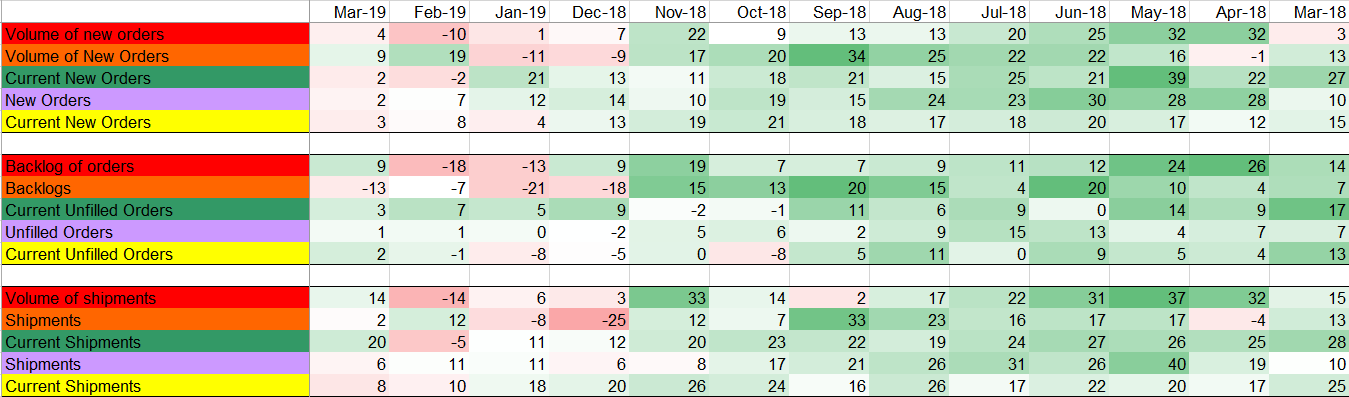

On the economic data front last week, the remaining regional manufacturing surveys were released ahead of the ISM PMI. The chart of the regional surveys vs the ISM PMI below shows the expected stabilization of manufacturing activity in March. With readings above 50, the manufacturing sector continues to expand. The heat map of regional report’s demand related indexes (New Orders, Backlog, and Shipments) shows the strength of 2018. While the indexes have moved away from these high levels, they have recovered from the low levels of December through February.

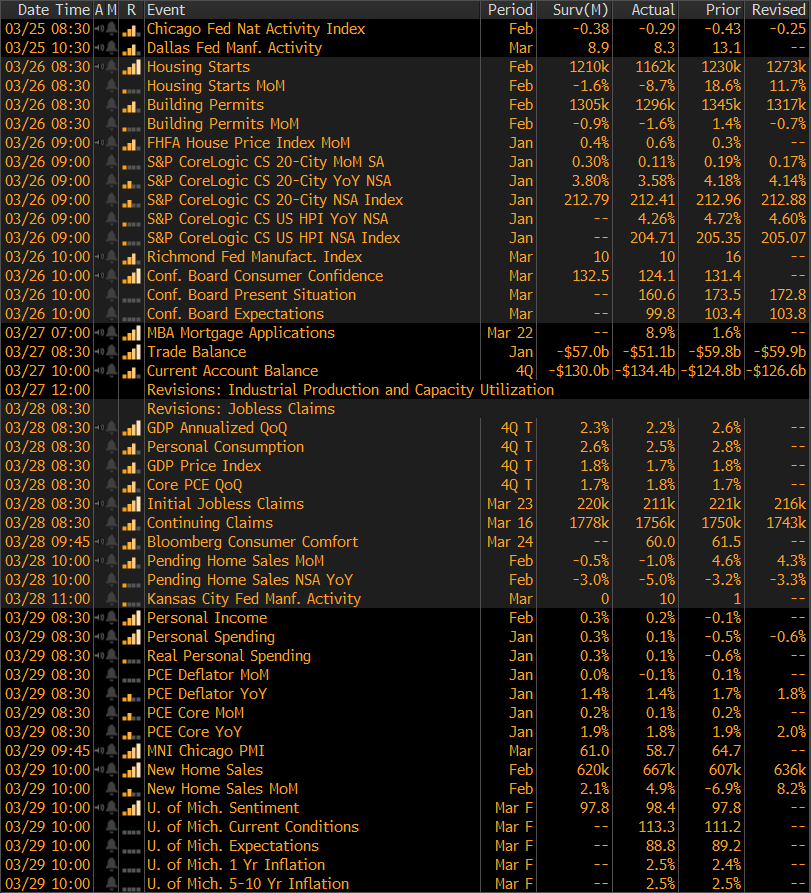

The rest of last week’s economic releases are to the right.

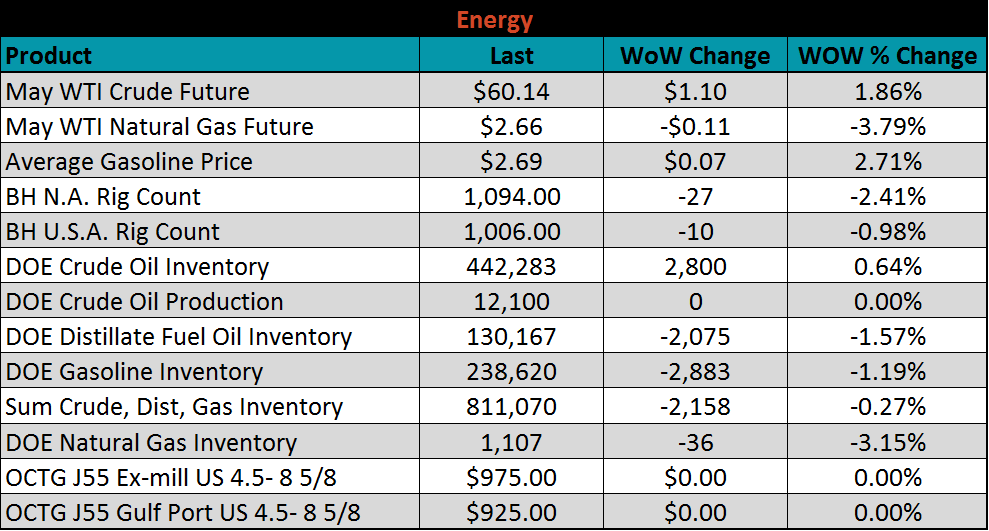

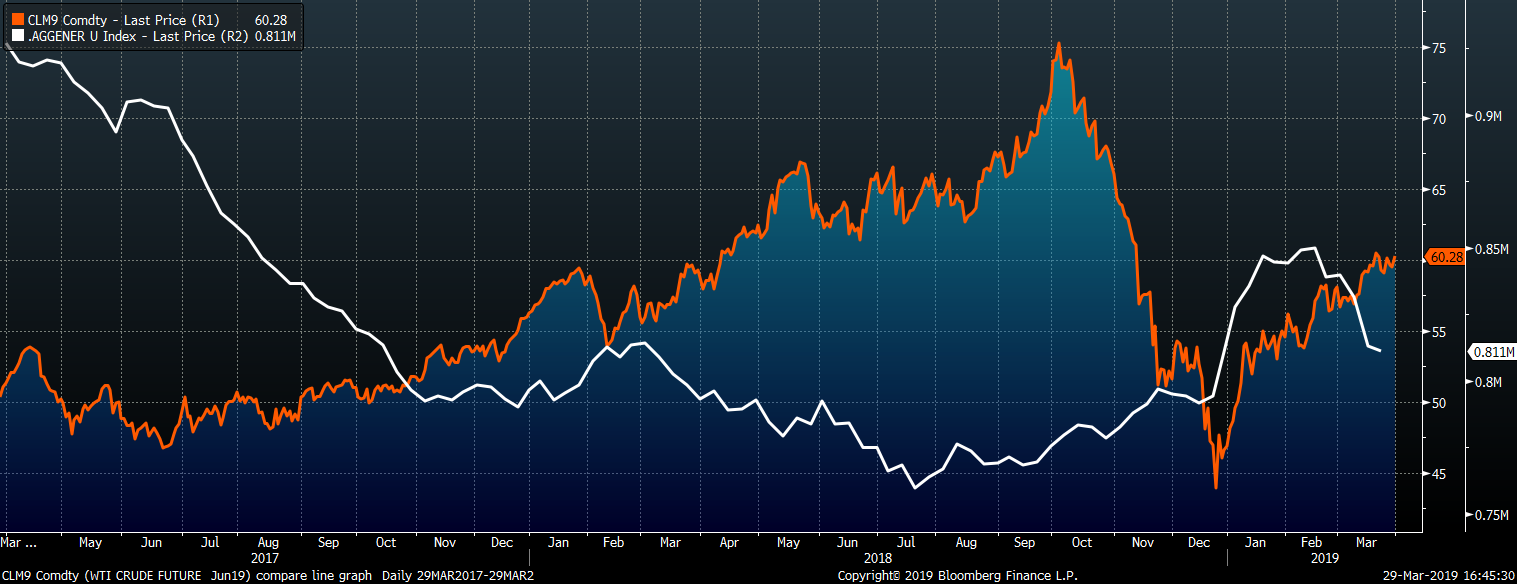

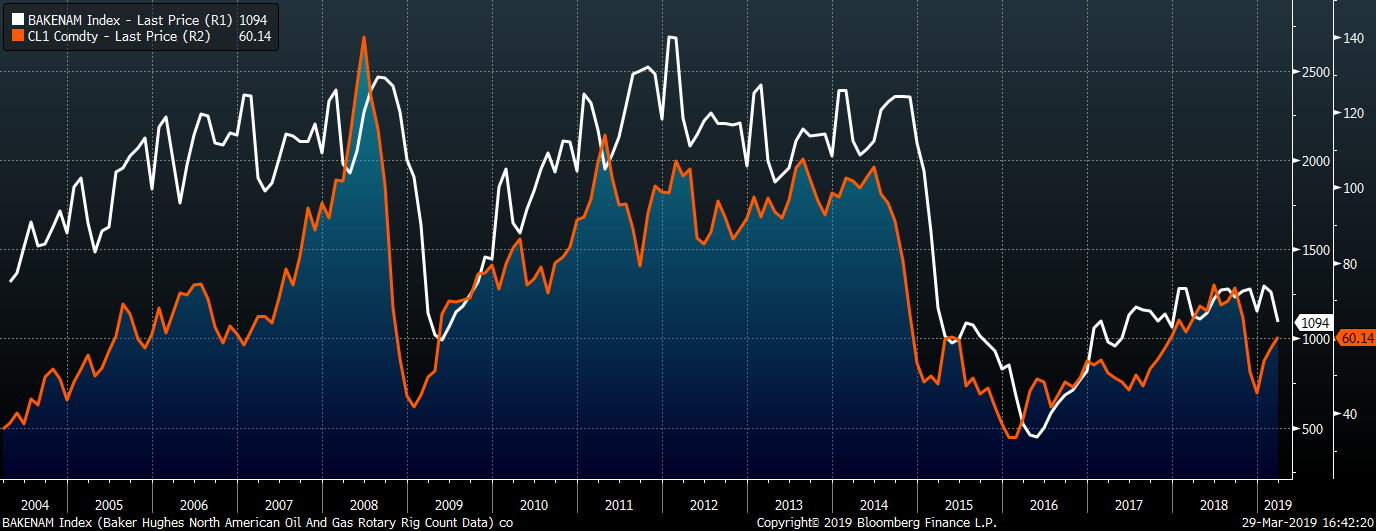

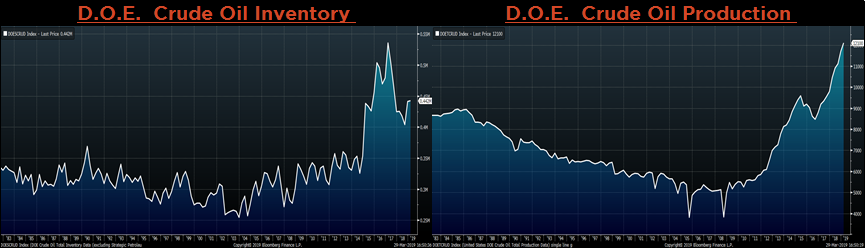

Last week, the May WTI crude oil future gained $1.10 or 1.9% to $60.14/bbl. The aggregate inventory level was slightly down 0.3%. Crude oil production remains at 12.1m bbl/day. The U.S. rig count lost ten rigs while the North American rig count lost 27 rigs. After prices declined sharply in November, rig counts were expected to decline with a multiple month lag. However, the rebound in prices this year may allow oil companies to keep rigs online because they had forward hedges several months into the future.

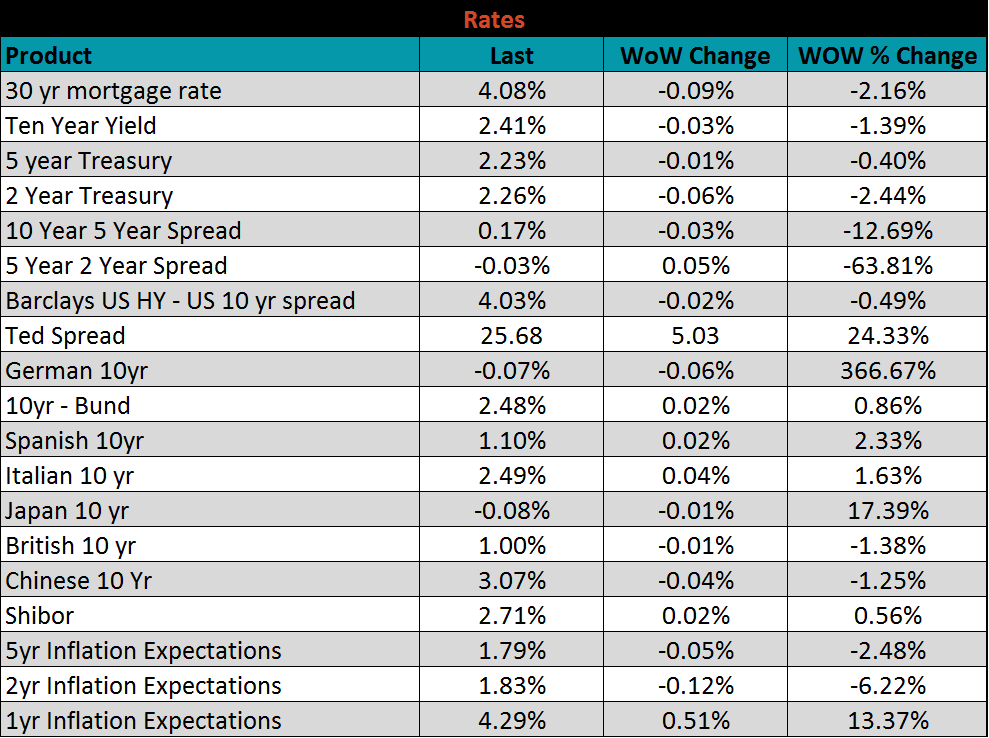

The U.S. 10-year treasury yield was down three basis points closing the week at 2.41%. The German 10-year yield fell another six basis points to -0.07% while the Japanese 10-year yield was down one basis points to -0.08%.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely.

Upside Risks:

Downside Risks: