Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

In March, steel prices significantly overshot the increases to raw material prices as fear around raw material availability was at its highest level. Since then, the input costs for mills have receded along with the risk of prolonged shortages. At the same time, steel prices have held up much better. Each ton sold at the current assessed prices still has $200-300 dollars of “excess” profits, compared to peak profitability in 2018. Clearly, there is plenty of room for buyers to negotiate lower prices, while mills have not shown signs of full capitulation.

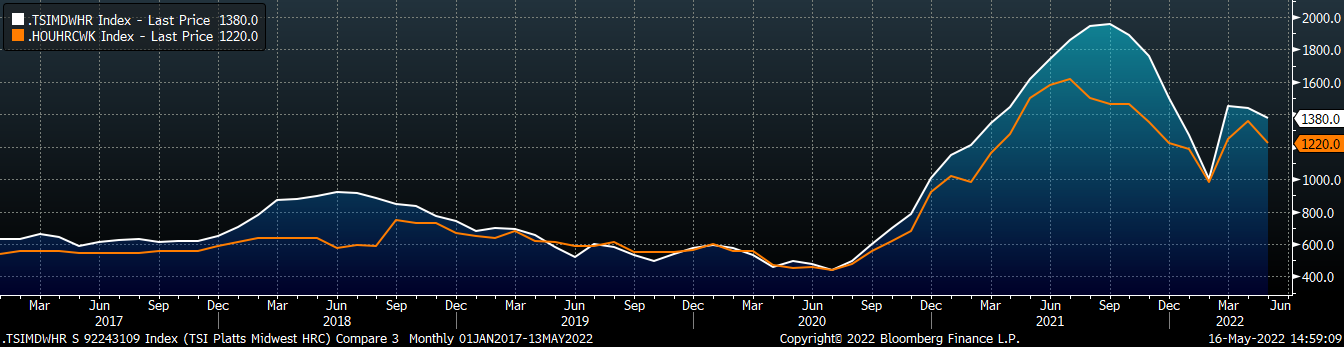

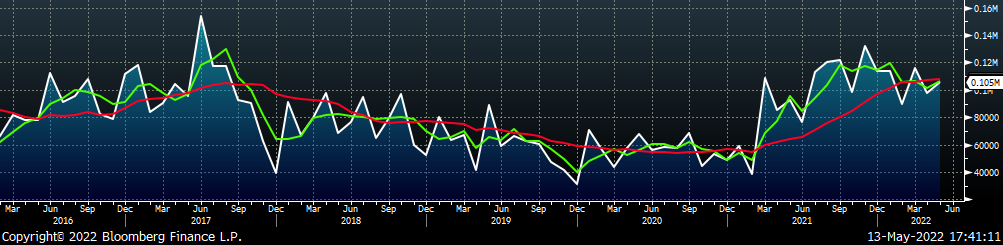

Turning to global markets, we have a seen a deterioration in HRC prices over the last four weeks, and the impact on the U.S. domestic market is already visible in the falling Houston price, down 6.1%, last week. As imports continue to arrive at a steady pace, the impact of the Houston price will be more pronounced on the domestic market. The chart below shows both the Midwest and Houston prices over the last 5 years.

The faster pace lower in Houston’s price is not necessarily a forecast for Midwest prices, however, this widening gap is a signal that the domestic market will likely be under sustained pressure until the two converge. At the same time, it is important to remember that the global market has been operating ex-China for much of this year. Since the lockdowns, we have had a taste of a global market without its biggest player and the eventual impact of China coming online cannot be overstated, their demand could easily absorb all the low-cost material to offset this years’ reduced production. Lower cost imports are making their way around the world, and they will keep pressure on domestic prices in the coming weeks. At the same time, this is a going to be delicate trend, and the benefits of waiting for lower prices are reduced by the increasing freight cost, port congestion, and the serious risk around availability once China is back in the market.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

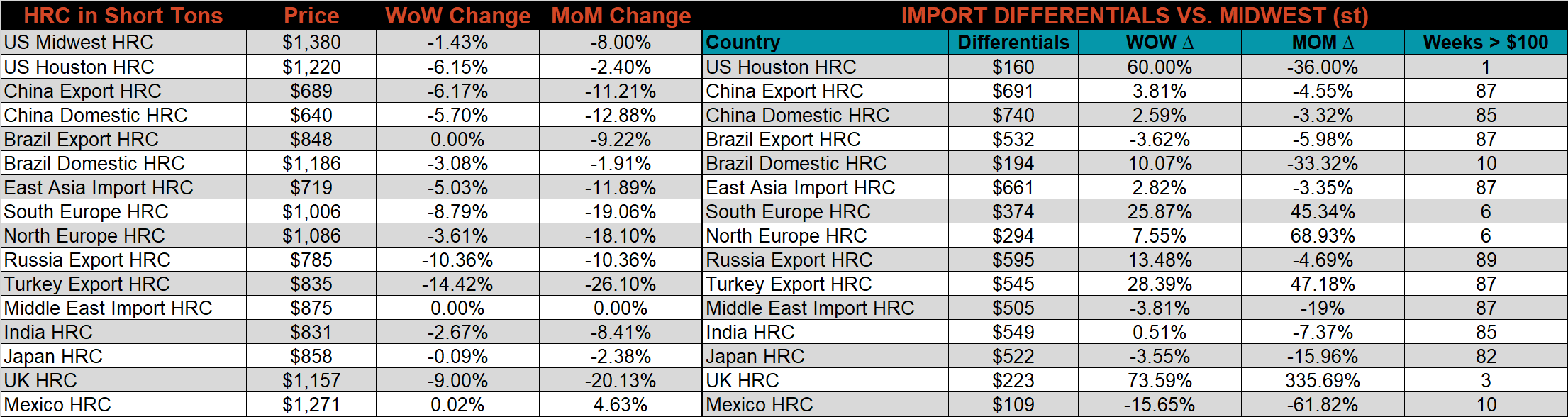

The Platts TSI Daily Midwest HRC Index was down another 20 to $1,380.

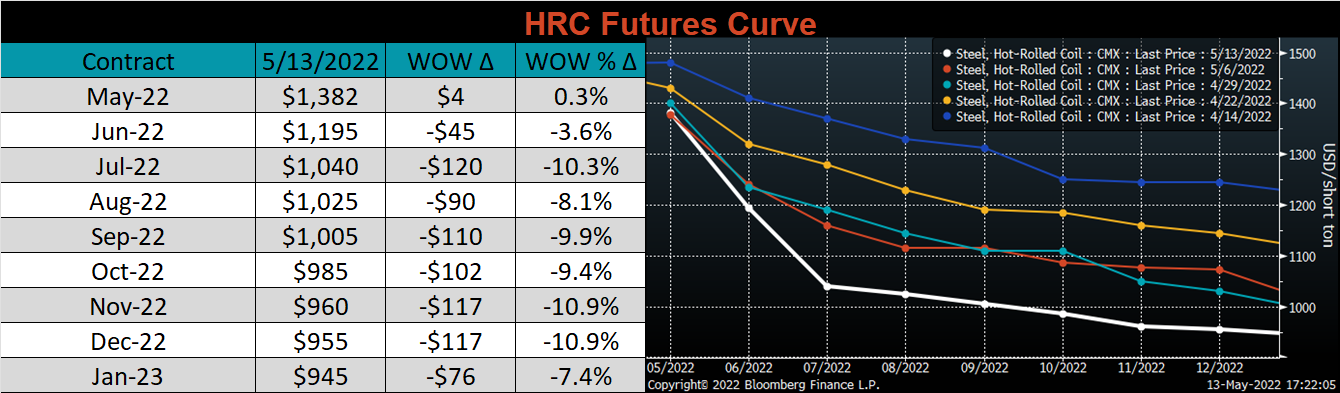

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The entire curve shifted lower again, this week, most significantly in the back.

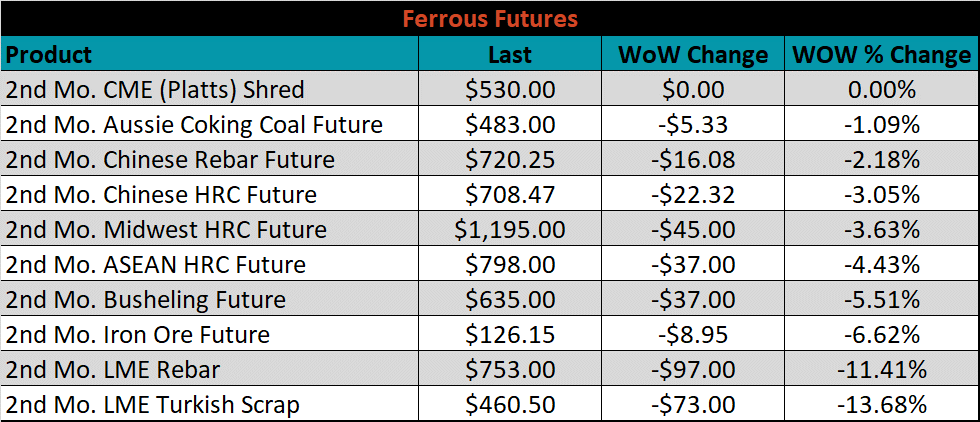

June ferrous futures were all lower, led by Turkish scrap, which lost 13.7%.

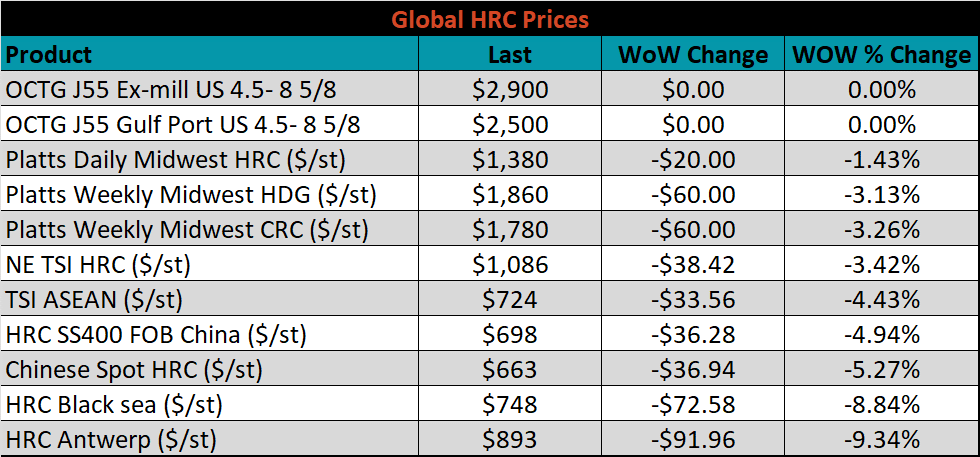

Global flat rolled indexes were lower again, led by Antwerp HRC, down another 9.3%.

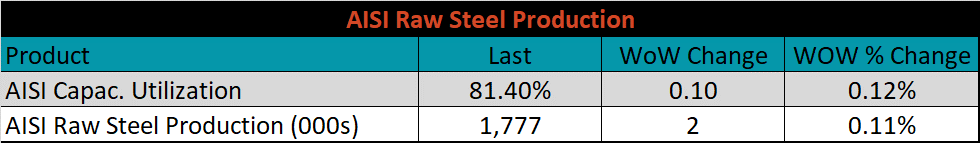

The AISI Capacity Utilization was up 0.1% to 81.4%.

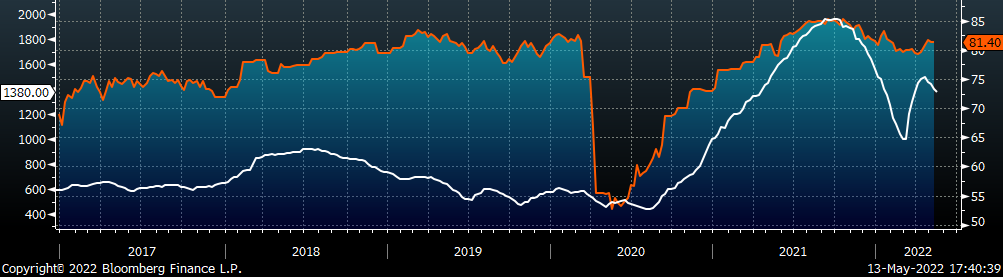

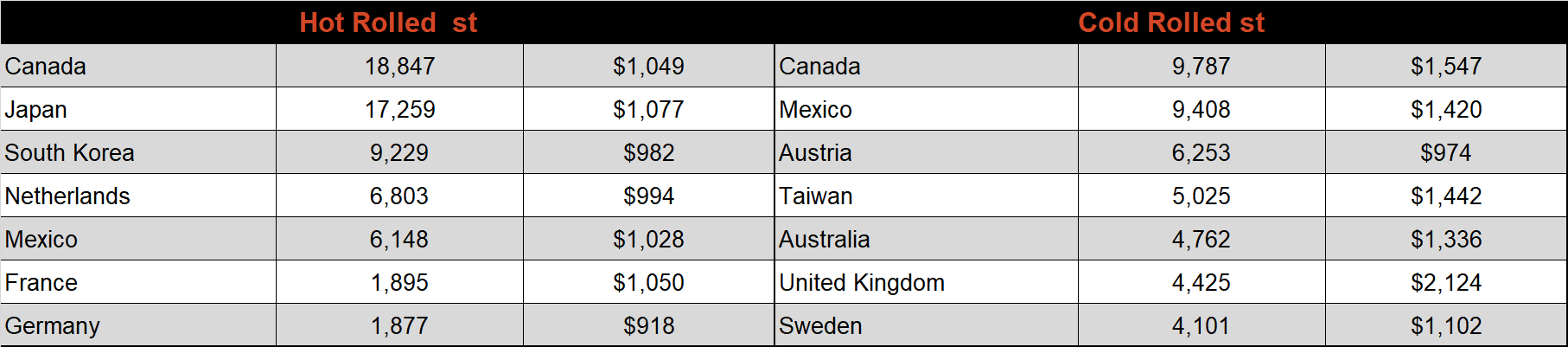

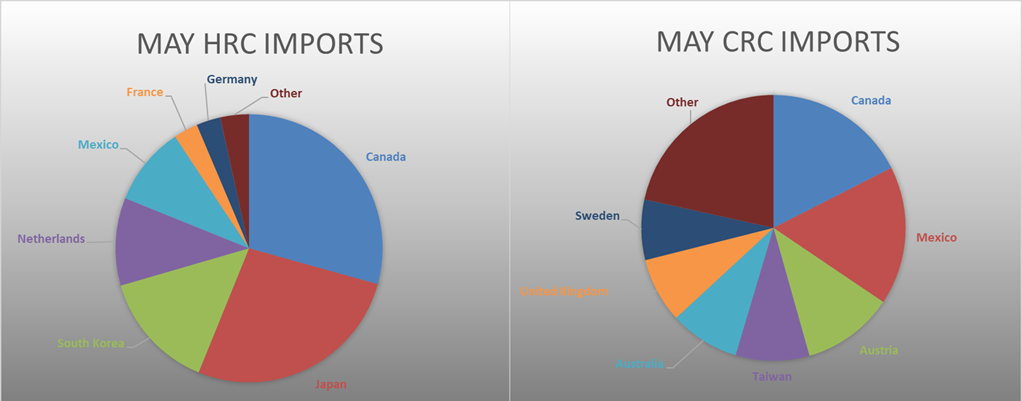

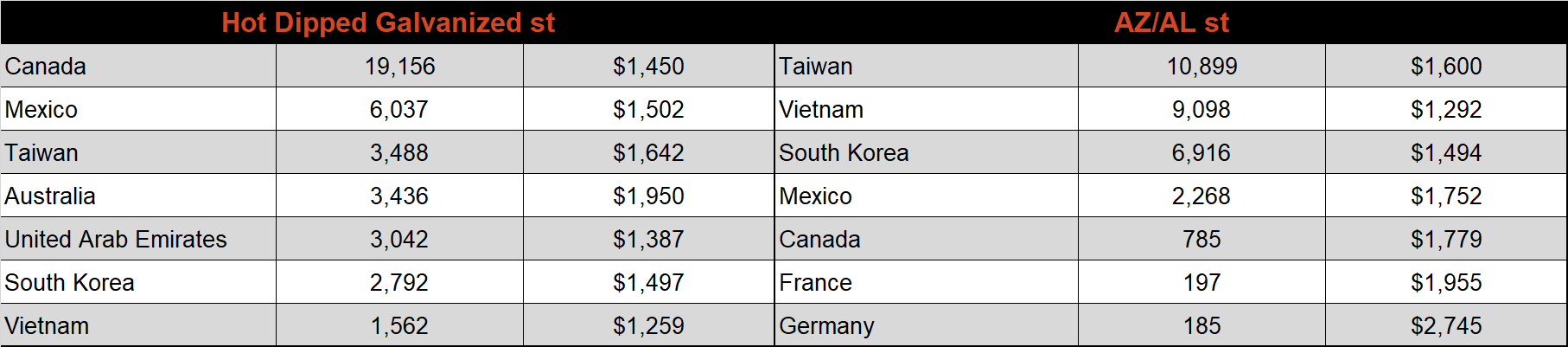

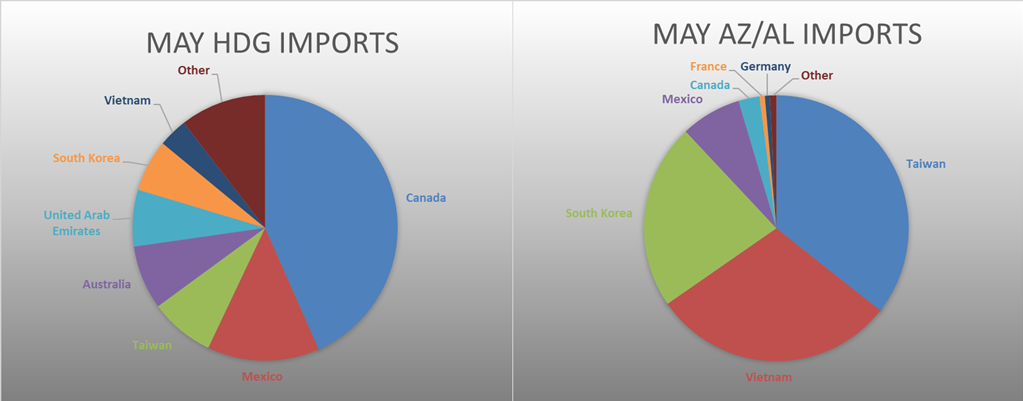

May flat rolled import license data is forecasting an increase of 81k to 1.12M MoM.

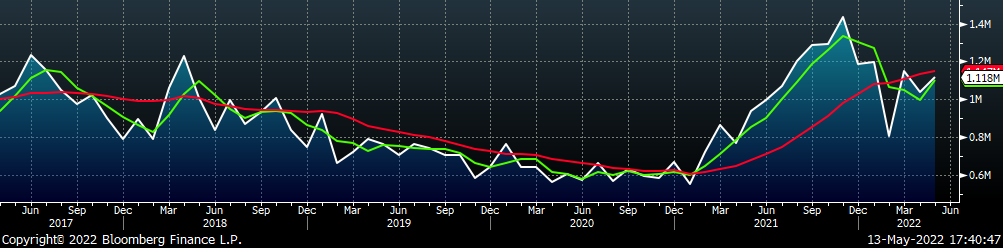

Tube imports license data is forecasting an increase of 101k to 531k in May.

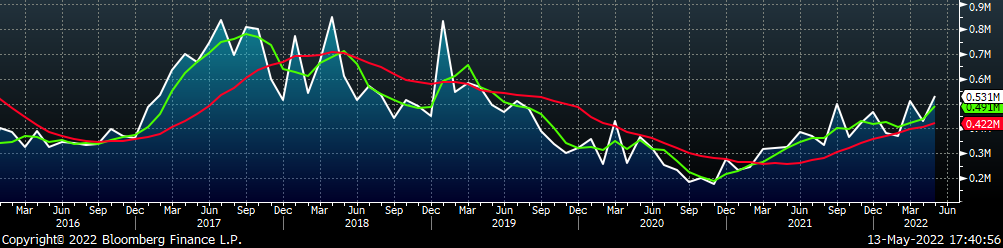

May AZ/AL import license data is forecasting an increase of 7k to 105k.

Below is May import license data through May 9th, 2022.

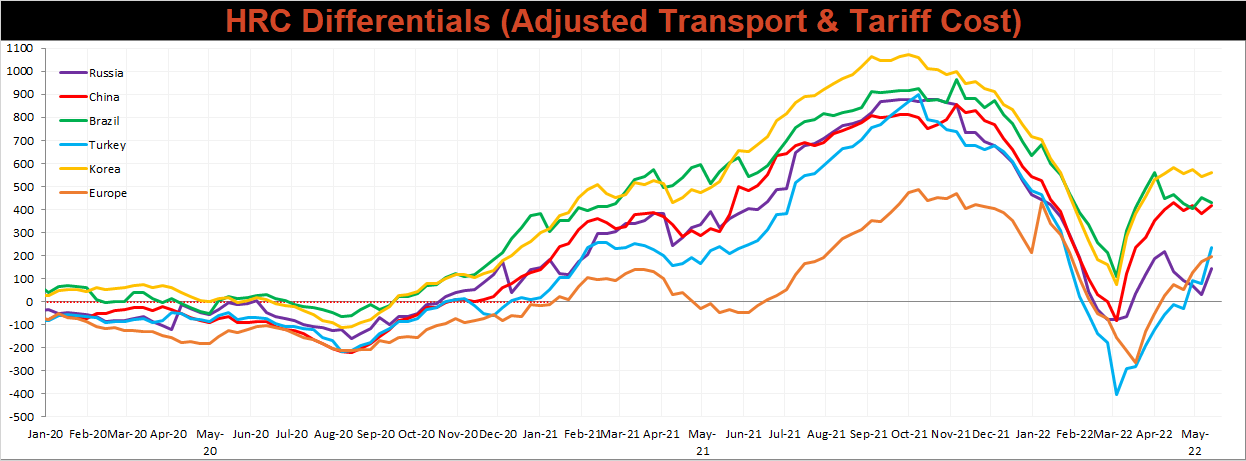

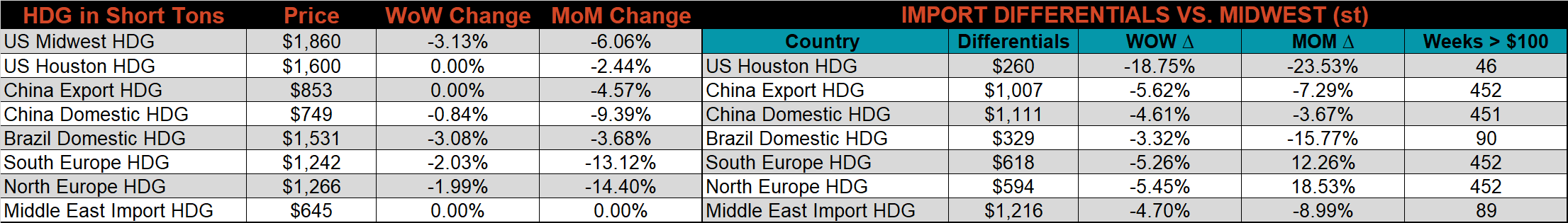

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials increased for all the watched countries except for Brazil, as global prices fell more sharply than in the U.S.

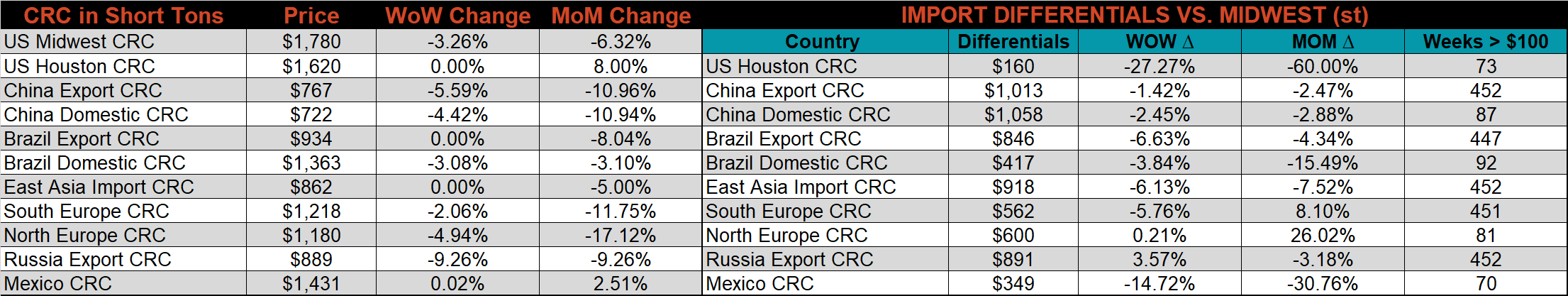

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest CRC, HDG, & HRC prices were down 3.3%, 3.2%, & 1.4%, respectively. Outside of the U.S., the Turkish HRC export price was down the most, -14.4%.

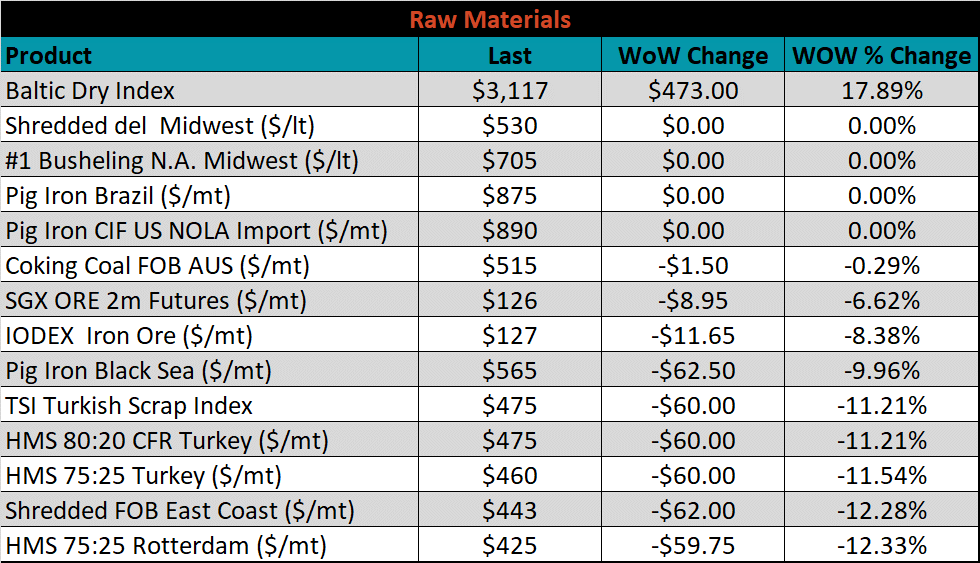

Raw material prices were all lower, led by Rotterdam HMS, down 12.3%.

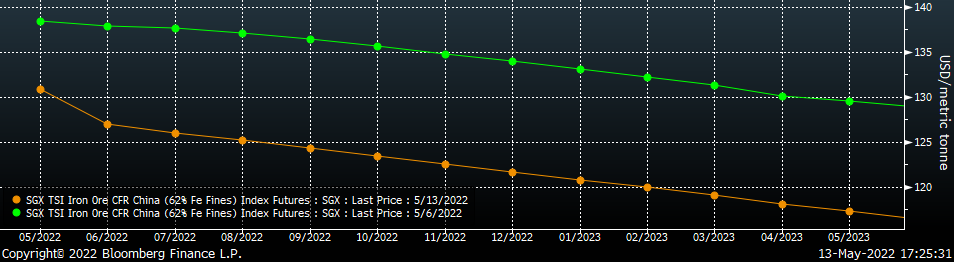

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve shifted sharply lower at all expirations, again.

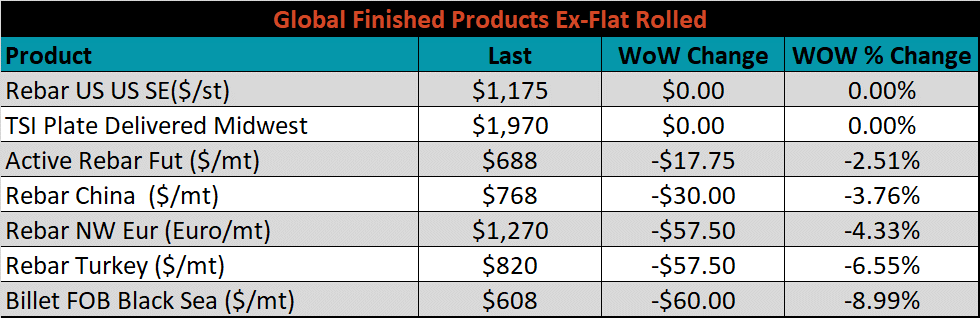

The ex-flat rolled prices are listed below.

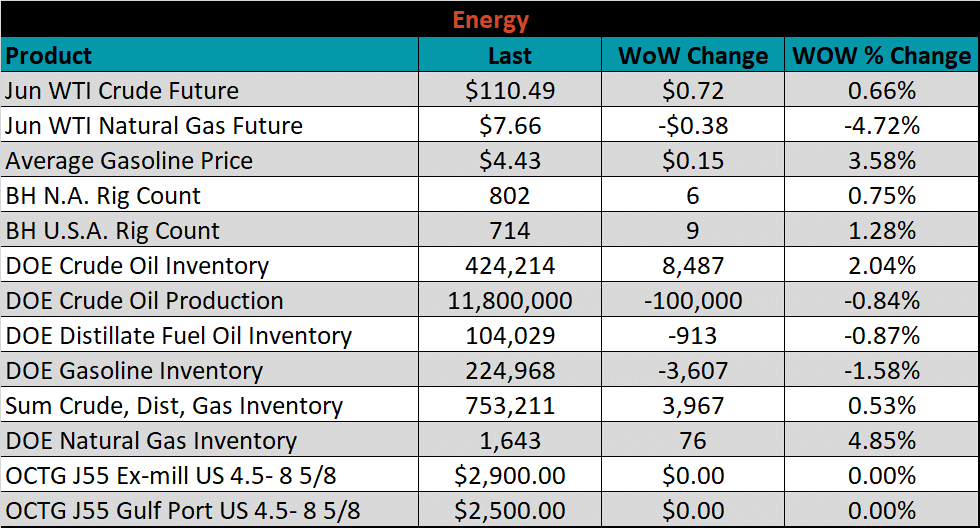

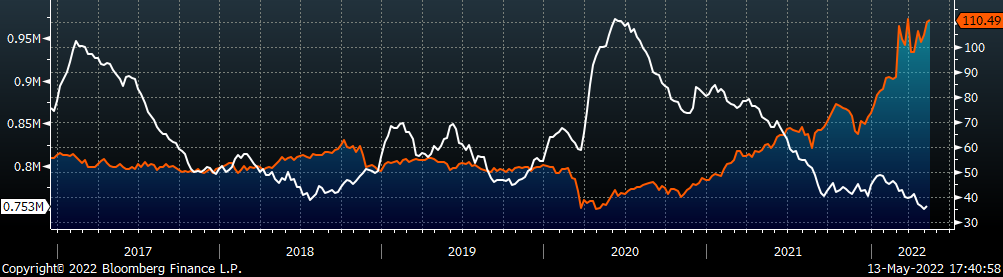

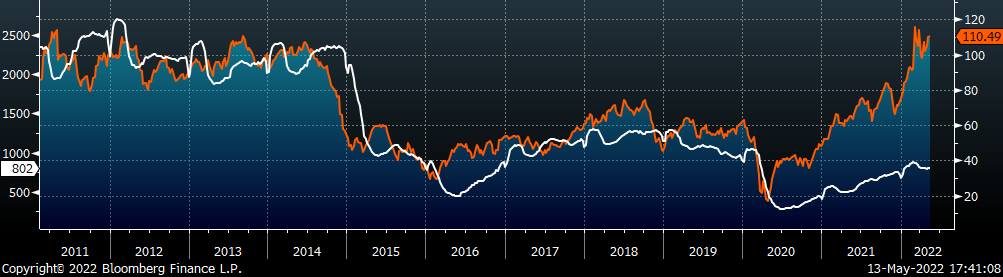

Last week, the June WTI crude oil future gained another $0.72 or 0.7% to $110.49/bbl. The aggregate inventory level was up 0.5% and crude oil production is down to 11.8m bbl/day. The Baker Hughes North American rig count was up 6 rigs, while the U.S. rig count was up another 9.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: