Content

-

Weekly Highlights

- Market Commentary

- Risks

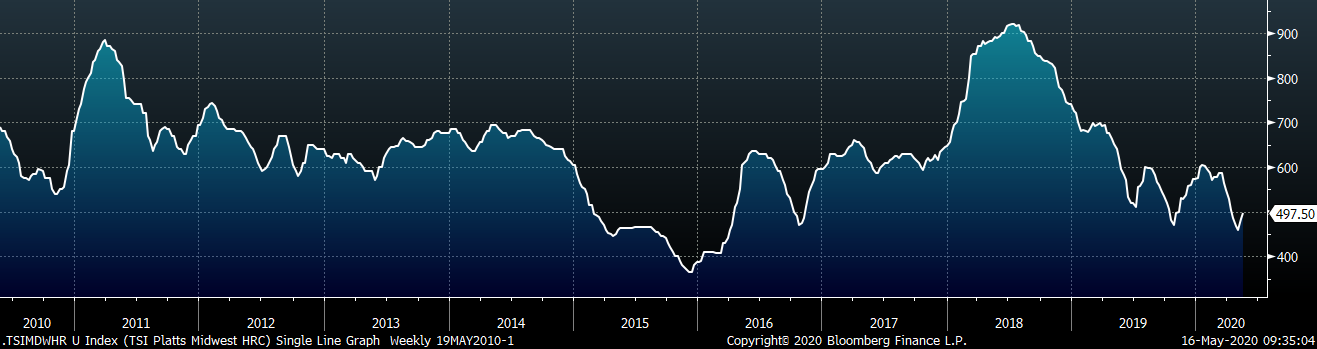

After another week of Covid-19 driving the headlines, we are beginning to see some encouraging signs from an economic activity standpoint. We still do not know how this economic restart will play out concerning new cases, health effects or a “second wave” later in the year. However, we do know that people are starting to go back to work in certain parts of the country, automobile factories are starting back up, WTI crude oil prices are back above $30/barrel and the height of the economic shutdown is behind us. This encouraging outlook reflects in the spot HRC price grinding higher over the past two weeks. The Platts TSI Midwest HRC index settled higher last week at $497.50/st, just below the $500 level that most mills are offering for new inquiries. While mills have been successful at capturing their initial price increase from several weeks ago, they have refrained from restarting any furnaces that have been idled. If economic activity continues to ramp up and production remains limited, prices will continue to strengthen.

While the spot price has moved higher, it is difficult to know if mills have been able to fill their order books at these prices. Much of the steel demand remains either shutdown or skeptical and uncertain of the current price rally. Additionally, high scrap prices continue to eat into mill profitability, even after prices have moved higher. This reduces the mill’s incentive to book business at current prices. Rather than raising prices from current levels, mills may have to drive profitability through securing scrap at lower prices in the next several months. This could be easily achievable as automotive factories, and the economy, ramp up and ease the tightness in the scrap supply.

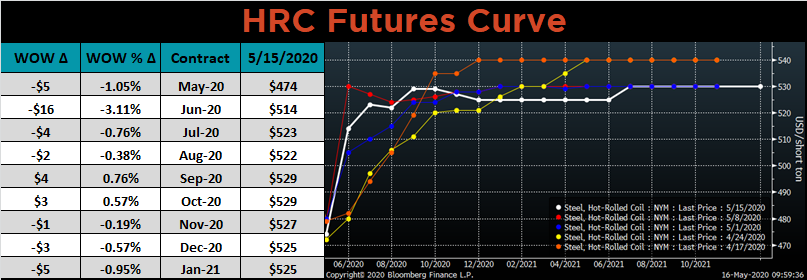

The forward curve continues to be flat starting in the summer months and into 2021. However, the very front of the curve is still in contango, with the spot price lower than June future, indicating that the market expects further strengthening in the spot price over the next four weeks. For this to occur, the economy will have to continue to reopen, and mills will have to keep idled production on the sidelines. Restarting furnaces due to the recent price increase may stop the rally’s momentum if it occurs before demand reemerges. This would add to supply at a time when inventory levels across the supply chain are elevated. We will likely need to see inventory levels right size and lead times push out for the current rally to be sustained into the fall.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

The Platts TSI Daily Midwest HRC Index was up $14 to $497.50.

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The June expiration moved lower, while the remainder of the curve was essentially flat.

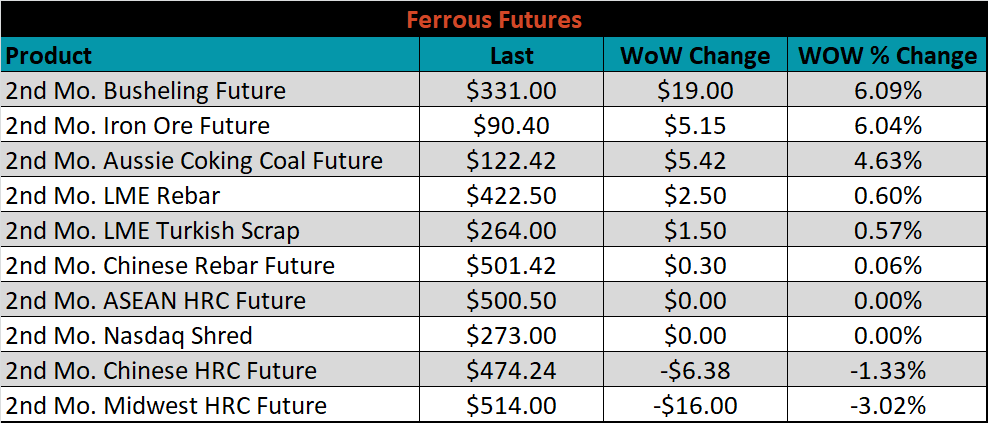

June ferrous futures were mixed. The busheling and iron ore futures gained 6.1% and 6% respectively, while the HRC future lost 3%.

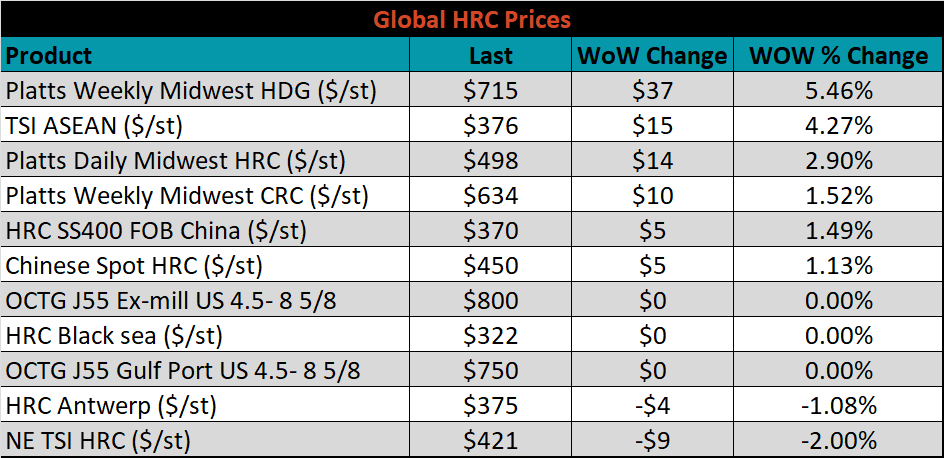

The global flat rolled indexes were mixed. Platts Midwest HDG was up 5.5%, while Platts Northern European HRC was down 2%.

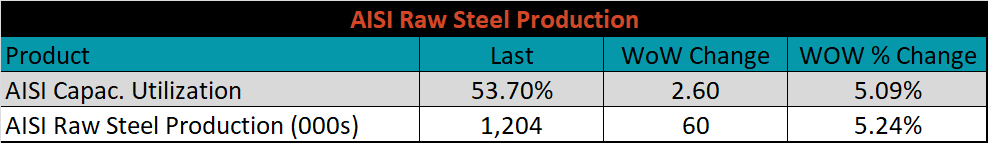

The AISI Capacity Utilization Rate was up 2.6% to 53.7%.

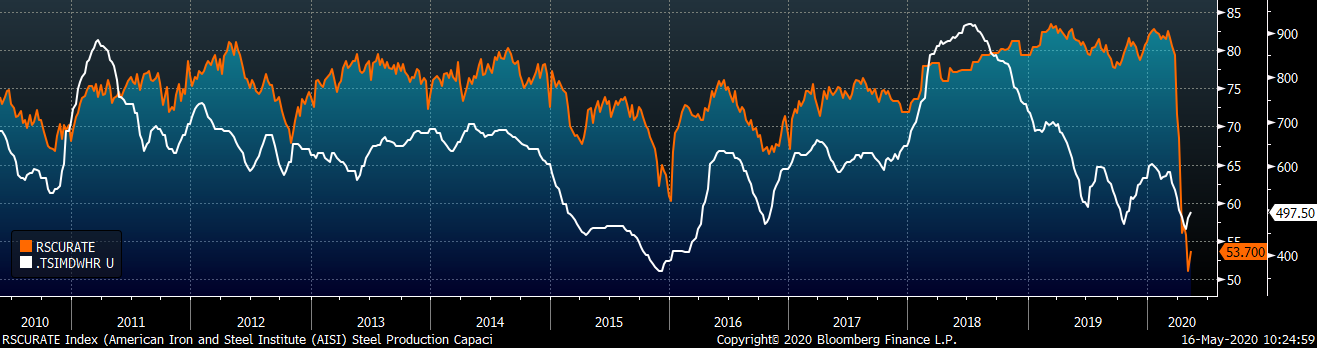

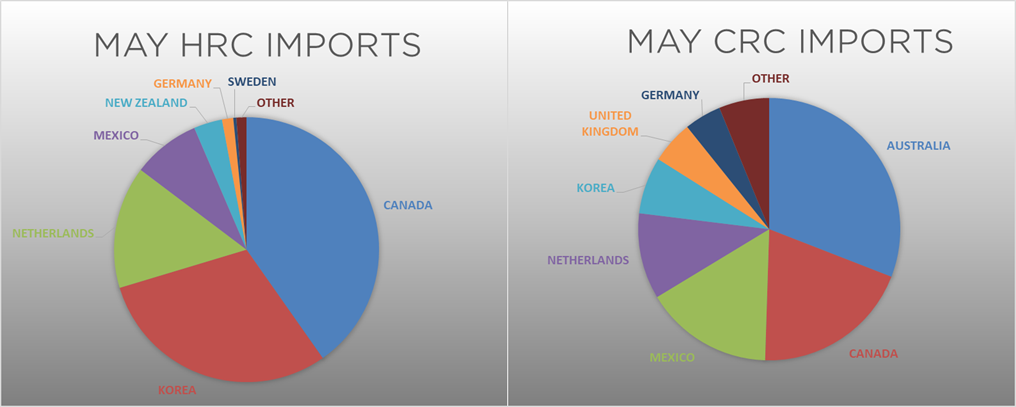

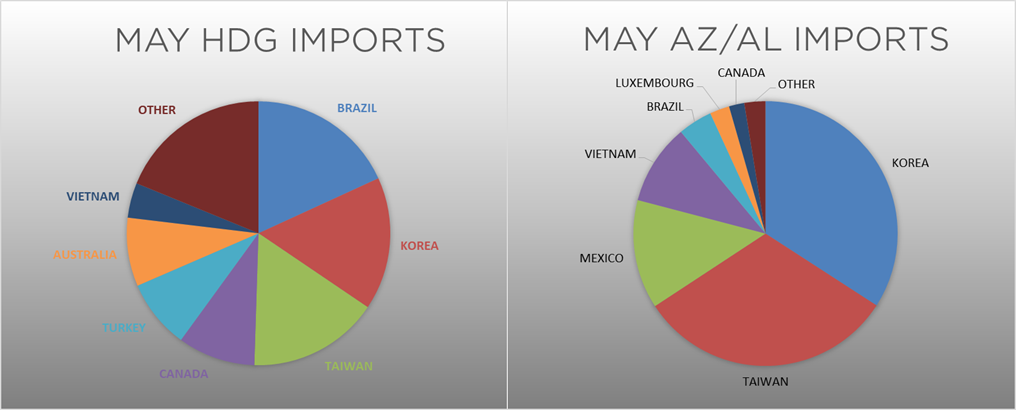

May flat rolled import license data is forecasting an increase of 11k to 581k MoM.

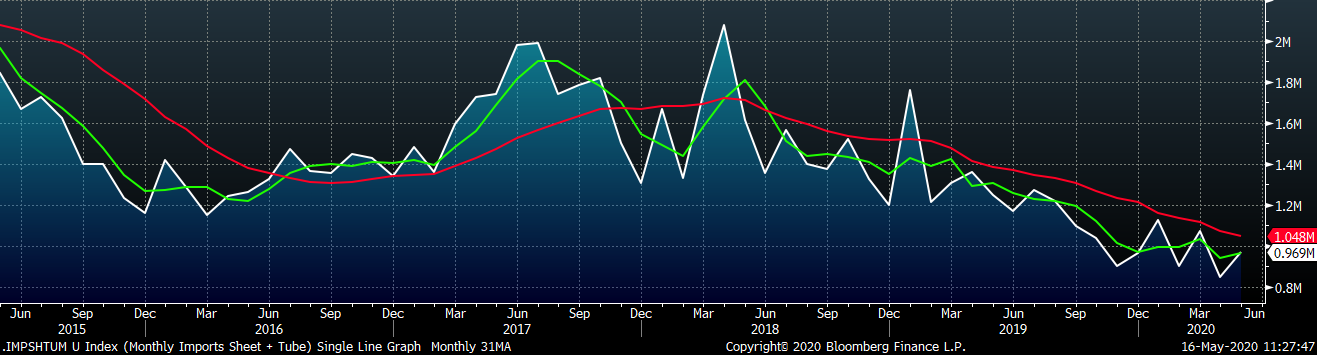

Tube imports license data is forecasting a MoM increase of 111k to 388k tons in May.

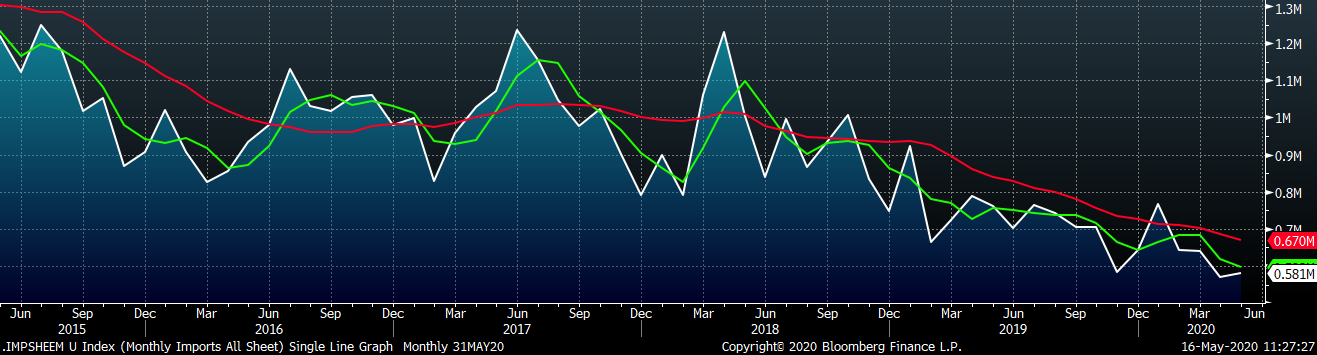

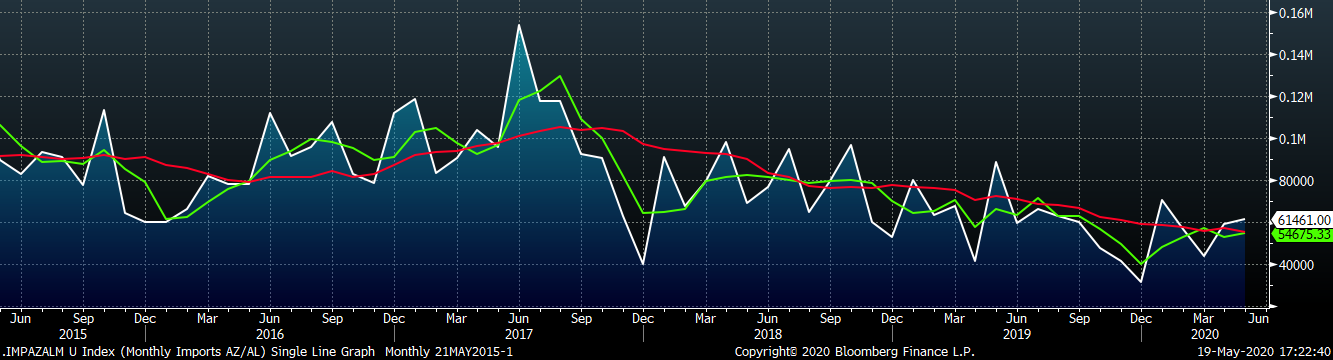

AZ/AL import license data is forecasting an increase of 3k in May to 61k.

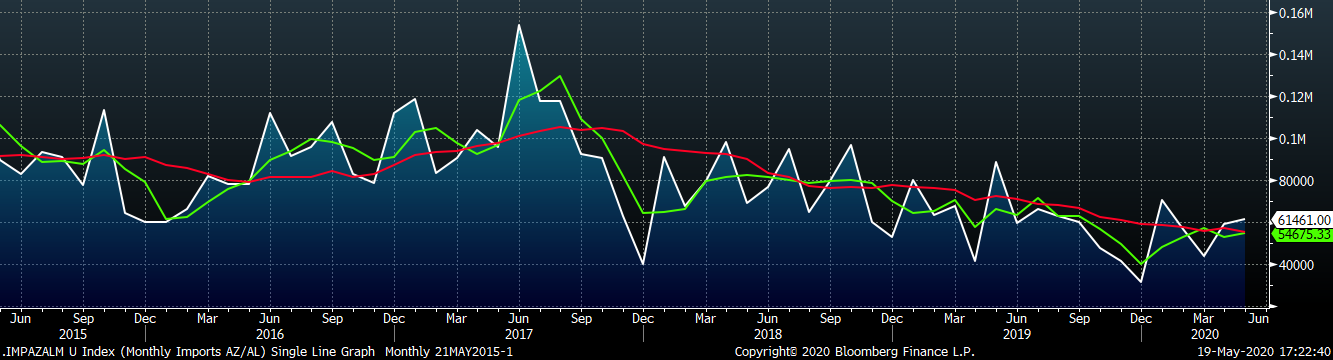

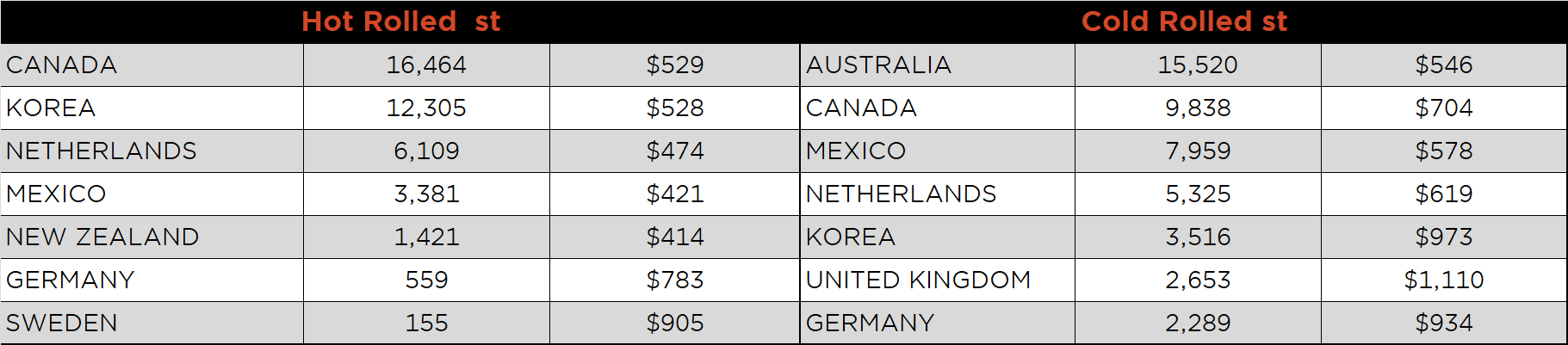

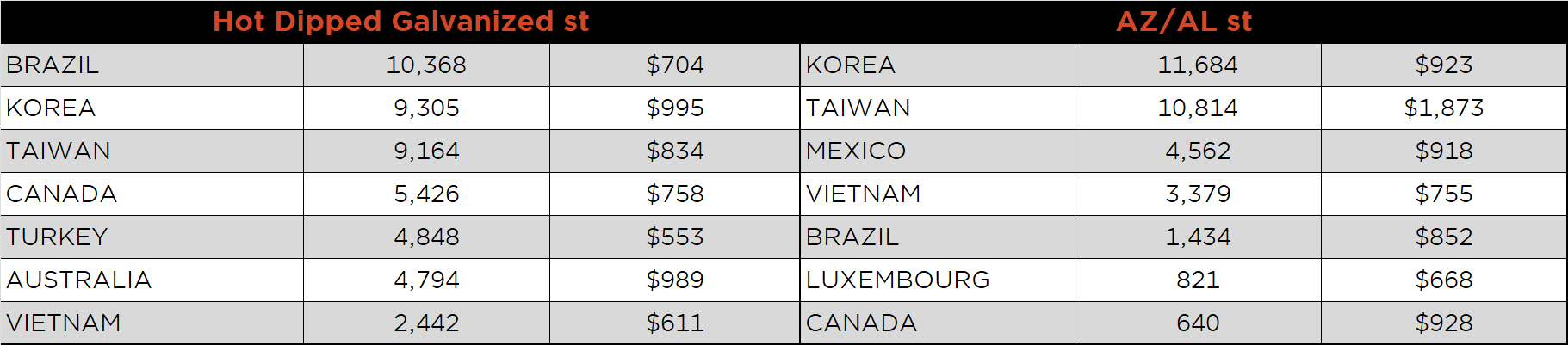

Below is May import license data through May 12, 2020.

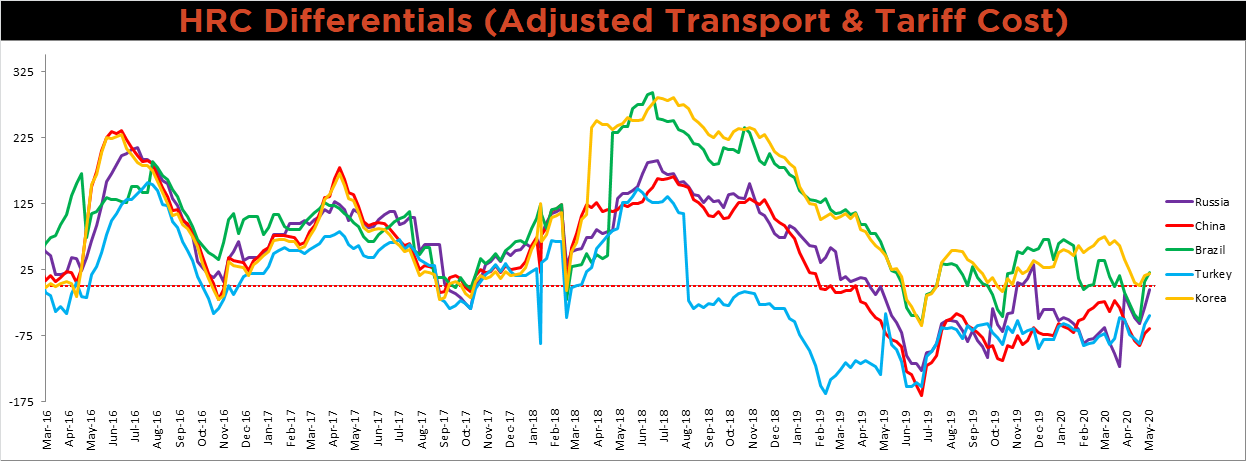

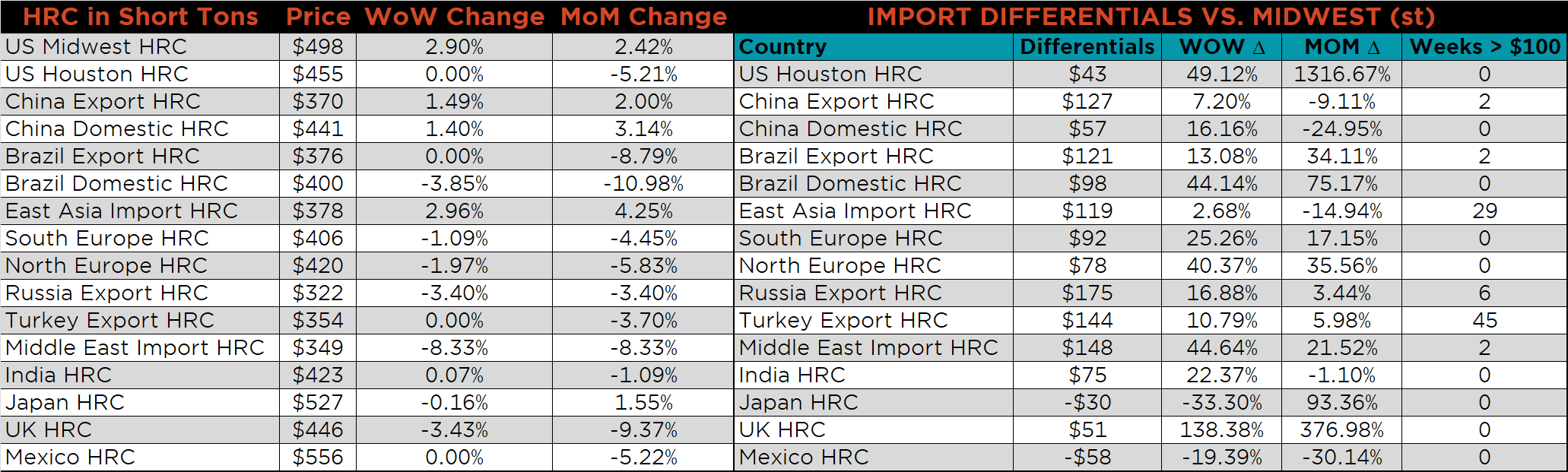

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All five countries differentials increased again this week, as the U.S. domestic price continues to rise.

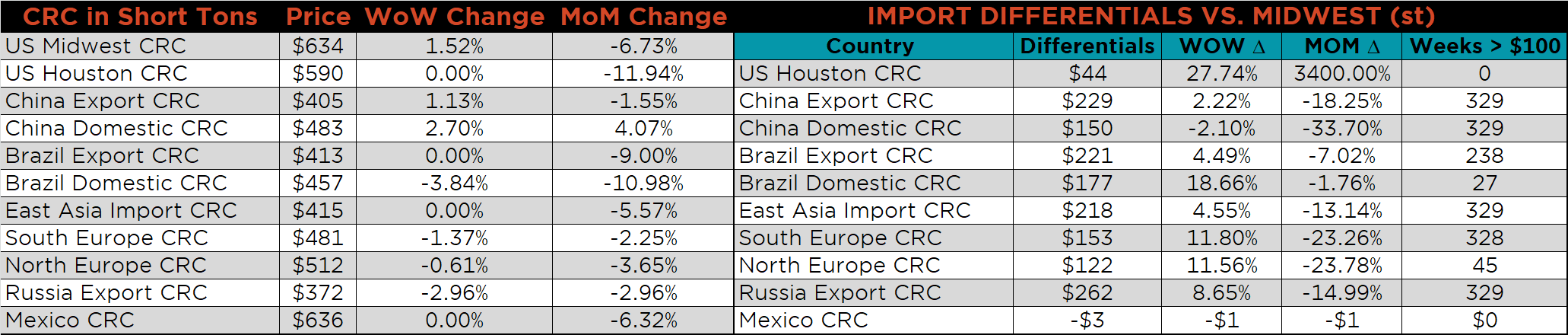

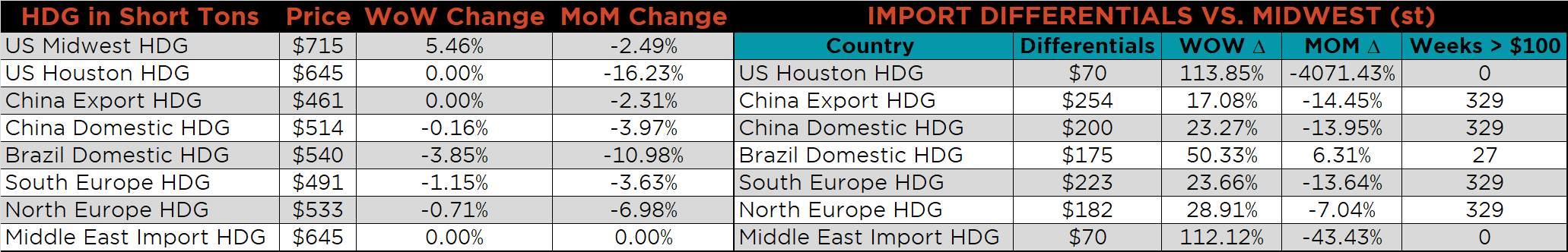

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HDG, HRC and CRC prices were up 5.5%, 2.9% and 1.5%, respectively. Globally, the Russian export HRC and CRC prices were down, 3.4% and 3%, respectively.

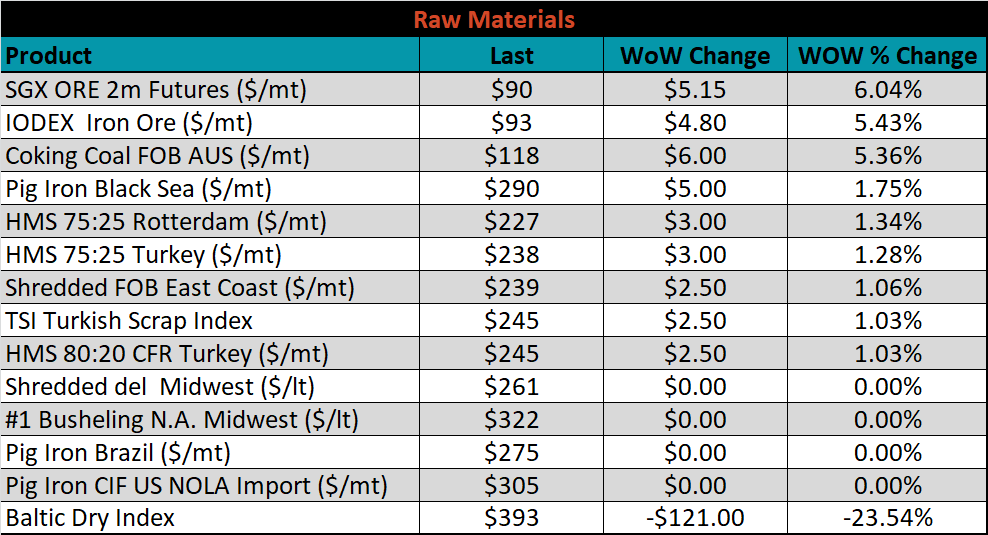

Raw material prices were mostly higher. Iron ore futures gained 6%, while the Baltic Dry Index was down another 23.5%.

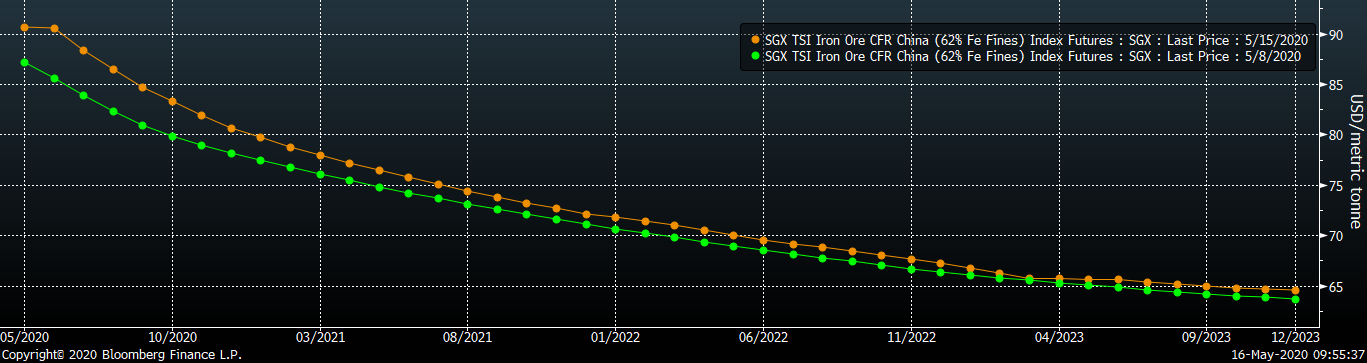

Below is the iron ore future curve with Friday’s settlments in orange, and the prior week’s settlements in green. The front of the curve shifted higher.

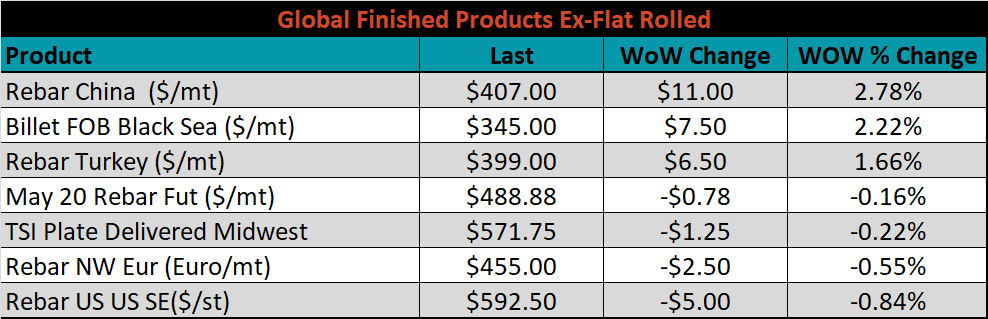

The ex-flat rolled prices are listed below.

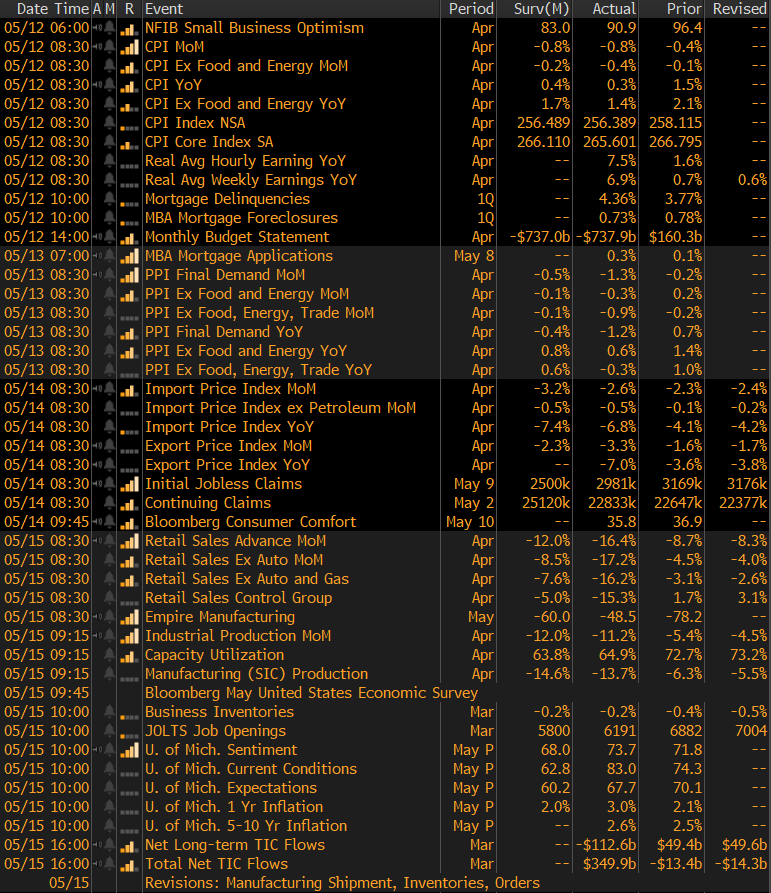

The remaining significant economic data is below. CPI data came in below expectations, with the CPI up 0.3% YoY versus expectations of 0.4%, and CPI (excluding Food and Energy) up 1.4% YoY versus expectations of 1.7%. The University of Michigan Survey came in above expectations with Sentiment at 73.7, versus 68 and Current conditions at 83 versus 62.8. Finally, the May Empire Manufacturing Index printed at -48.5, above Aprils -78.2, and expectations of -60.

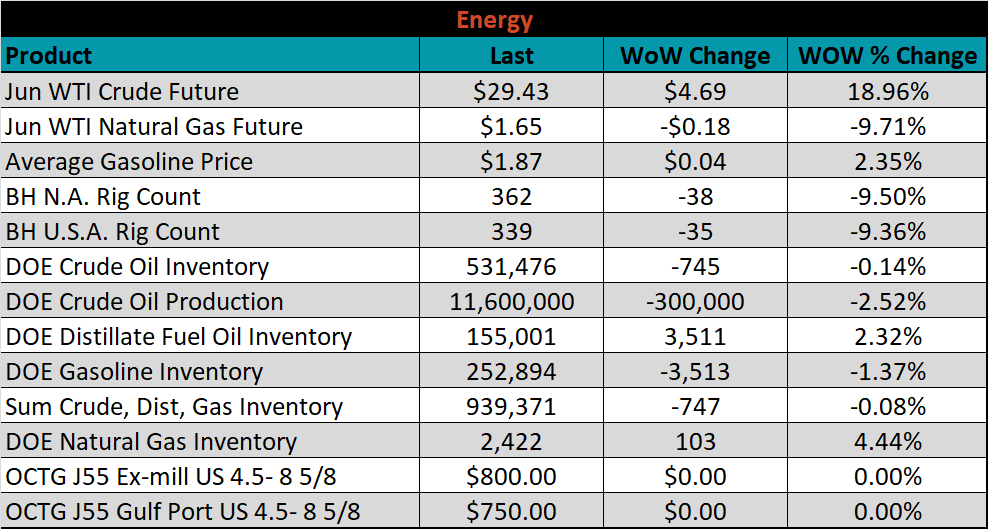

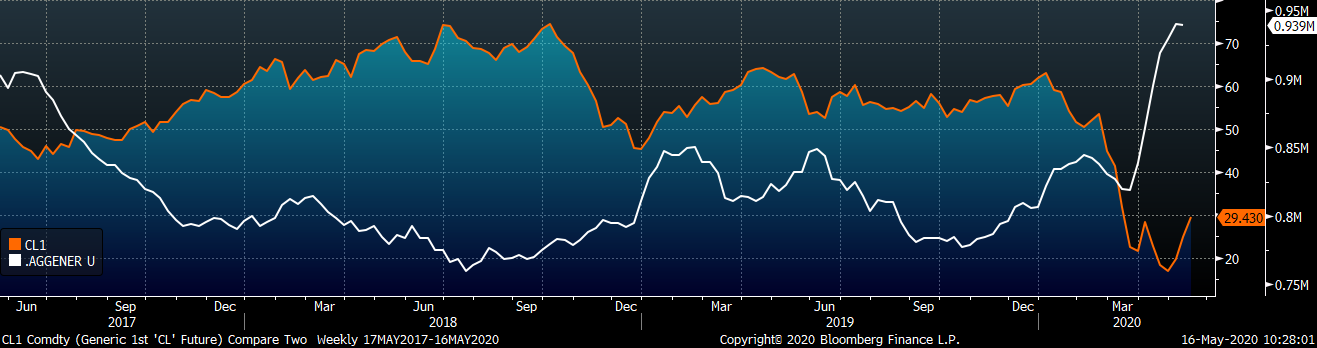

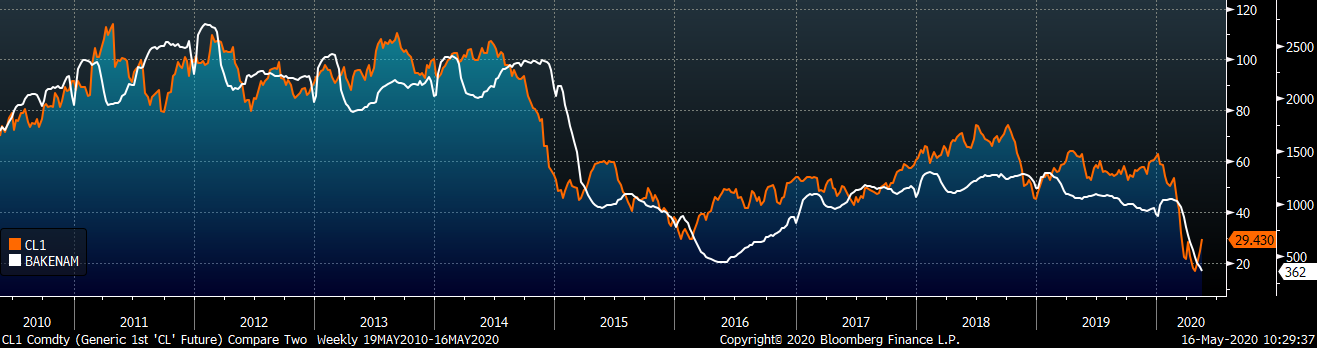

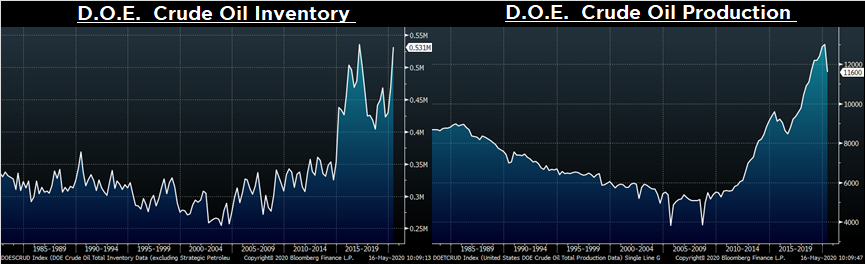

Last week, the June WTI crude oil future gained $4.69 or 19% to $29.43/bbl. The aggregate inventory level was down slightly, and crude oil production was down to 11.6m bbl/day. The Baker Hughes North American rig count was down another 38 rigs, and the U.S. rig count was down 35 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: