Content

-

Weekly Highlights

- Market Commentary

- Risks

The big news in the steel market last week was the removal of the Section 232 tariffs on Canada and Mexico, as well as the reduction of the tariff on Turkey from 50% to 25%. Future markets reacted, with Midwest HRC prices declining and LME Turkish scrap futures rising, with the assumption that Turkey will be able to produce more steel to send to the U.S. market. “Tariff resolution and/or 232 exclusions” is identified below on the list of downside risks. While tariffs remain in effect for most countries and imported material, last week’s resolutions give some insight and clarity regarding pricing going forward. Additionally, the effect of the downside risk is now minimized, as a portion of the risk is already reflected in the current prices. Foreign pricing remains at unattractive levels, even with this reduction in tariffs, due to the decline in domestic prices. Last week this report analyzed current and projected domestic pricing relative to the delivered China export price. This relationship continued to narrow last week, reaching the lowest level since January 12th, 2018.

Flat rolled inventories at service centers remained steady over the last month, suggesting that the inventory hangover of 2018 and early 2019 persists. With the spot price continuing to fall into the second quarter, the effect of this inventory overhang gets worse. Shipments have remained steady, implying that high cost material sold at losses is being replaced at current market prices. However, service centers have not restocked amid an uncertain outlook, declining lead times and prices. Assuming no change in these current market dynamics, it will take reduced production at the mills, through planned or unplanned outages, to stop the prices from declining. Profitability and earnings expectations at domestic producers continue to decline, nearing levels that the marginal ton produced must be sold at a loss. How low will mills allow prices to go before they take off production?

With continued domestic price declines, we see the upside risks intensifying significantly, specifically from producer outages due to profitability and abnormally high delivered foreign prices. Now is a great time to consider locking in forward tons.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

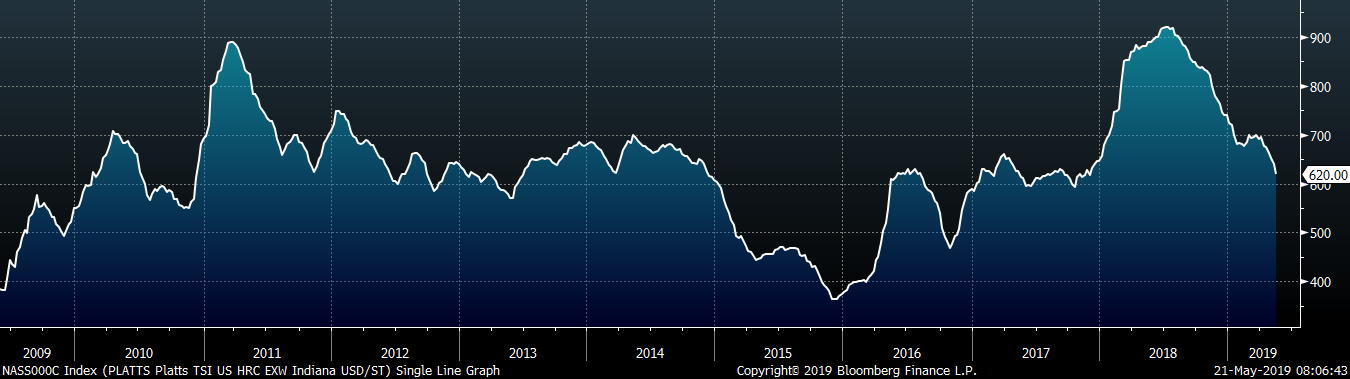

The Platts TSI Daily Midwest HRC Index was down $18.75 to $621.

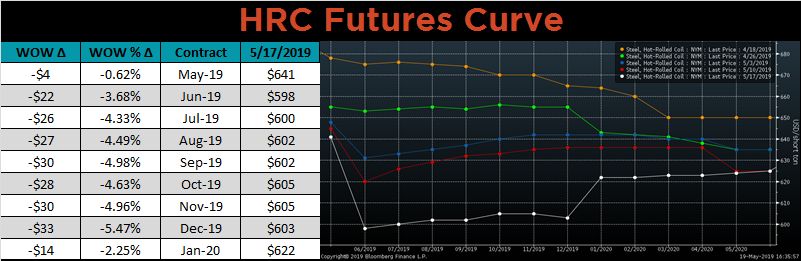

The CME Midwest HRC futures curve is shown below with last Friday’s settlements in white. The curve shifted lower again last week, and it remains in contango.

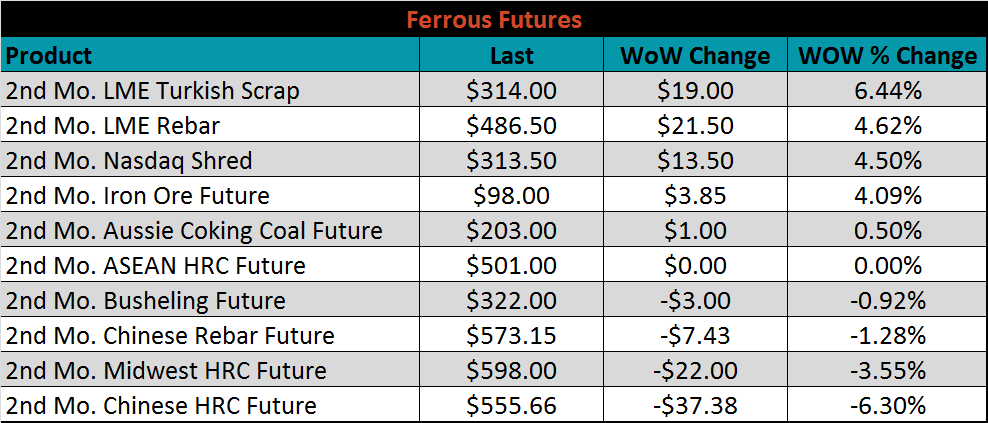

June ferrous futures were mixed. The Turkish scrap future gained 6.4%, while the Chinese HRC future lost 6.3%.

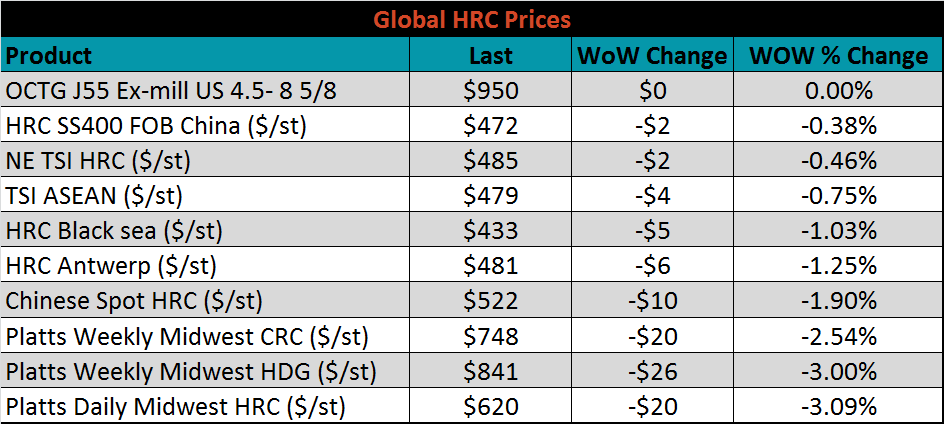

The global flat rolled indexes were mostly lower. Platts Midwest HRC and HDG led the group, down 3.1% and 3%, respectively.

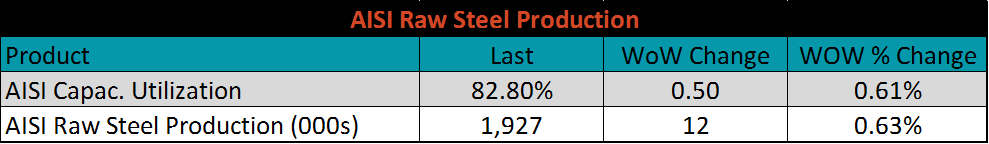

The AISI Capacity Utilization Rate was up 0.5 points to 82.8%. The Trump administration’s goal of 80% Capacity Utilization Rate has held since October 2018, but could be in jeopardy if mills cut production due to low prices.

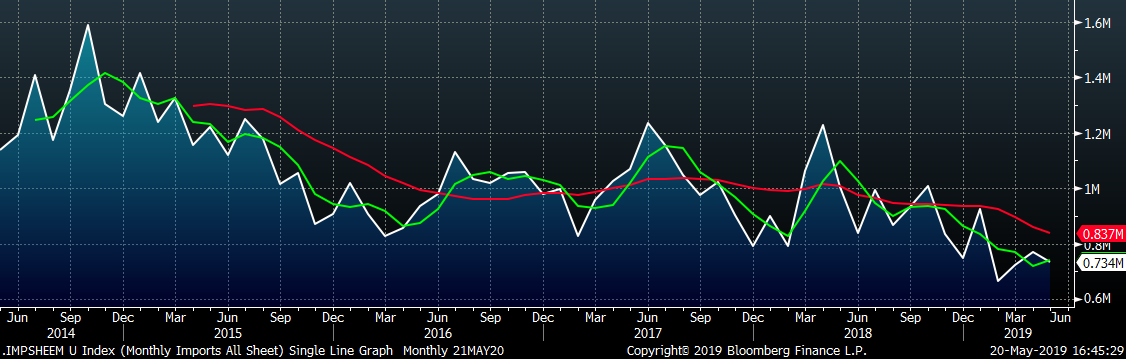

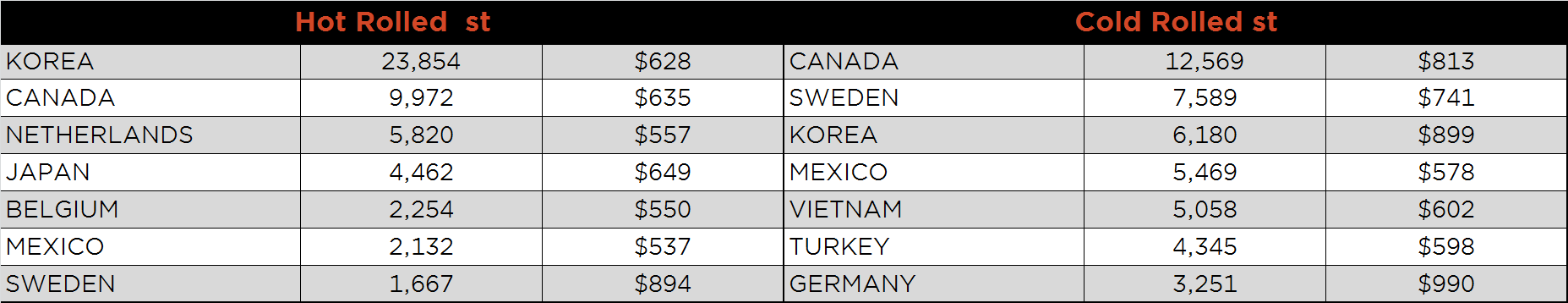

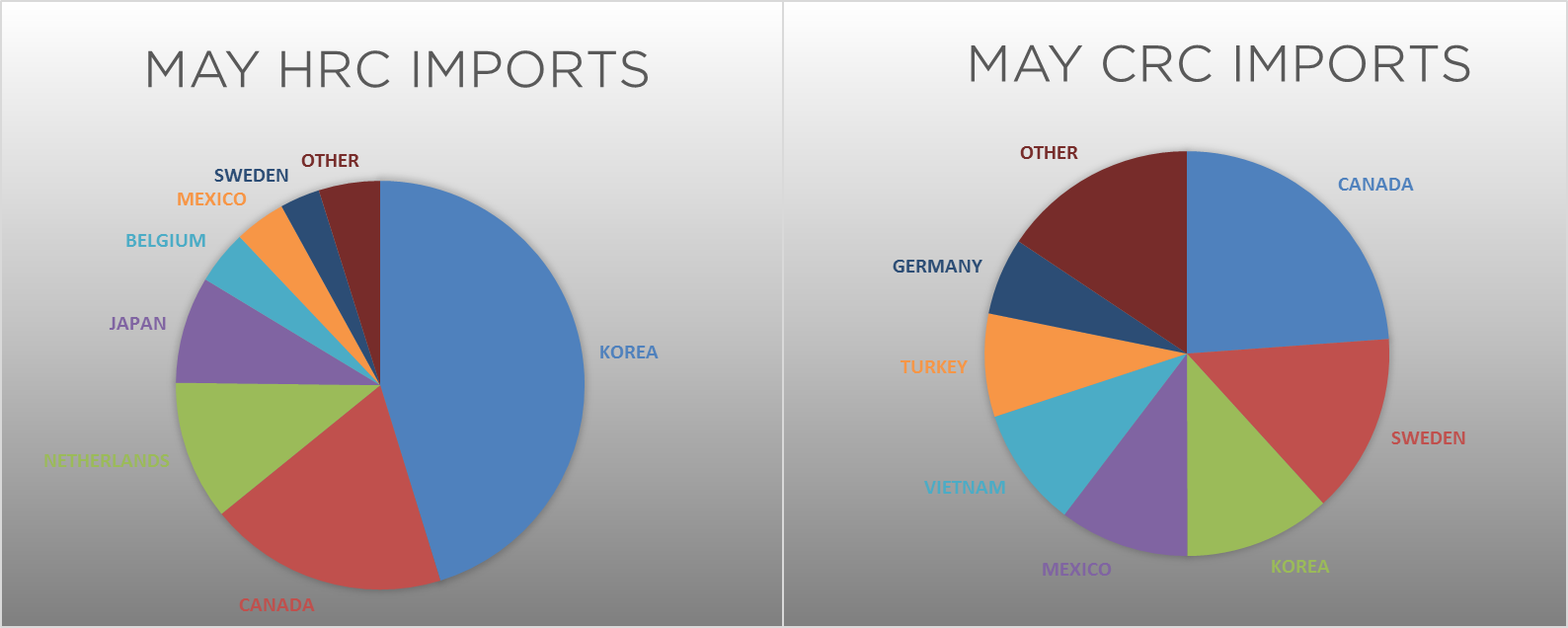

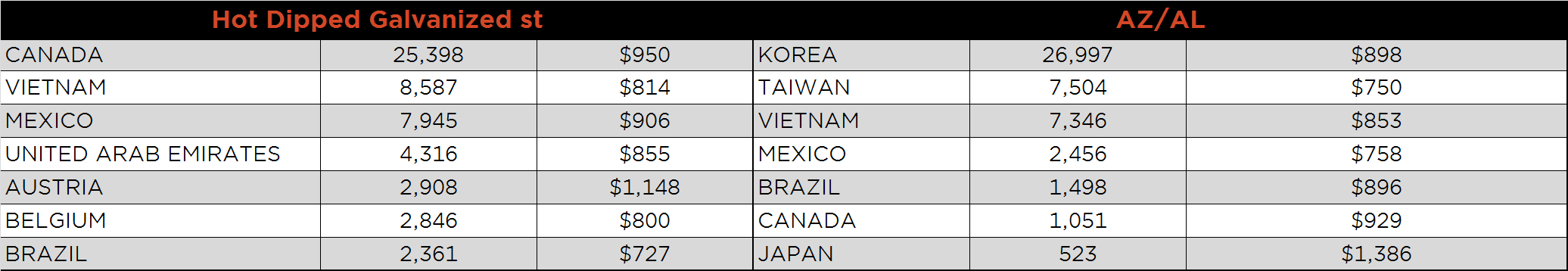

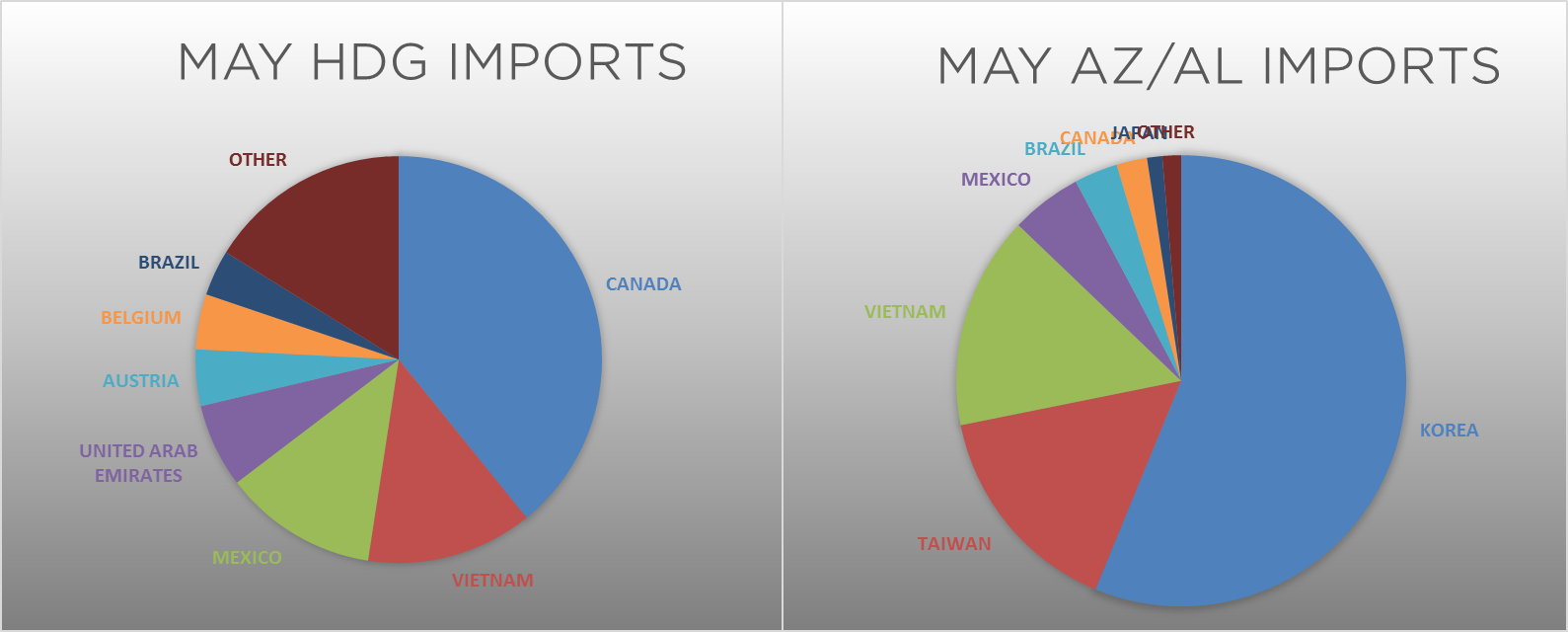

May flat rolled import license data is forecasting a decrease to 734k, down 35k MoM.

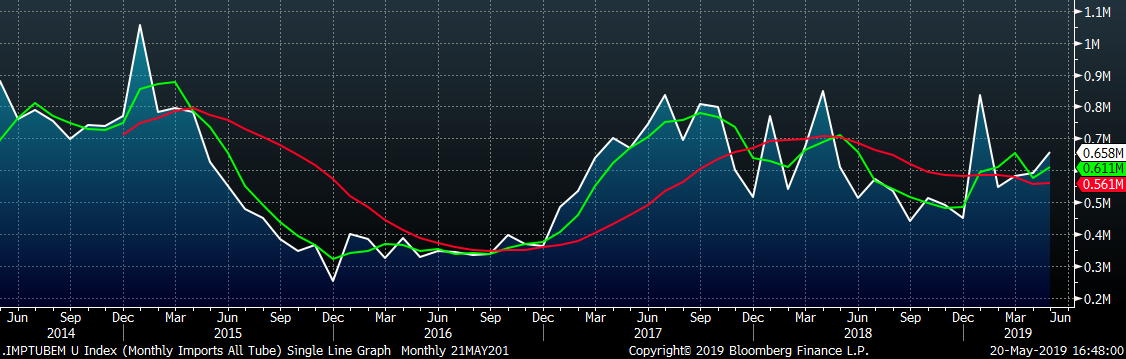

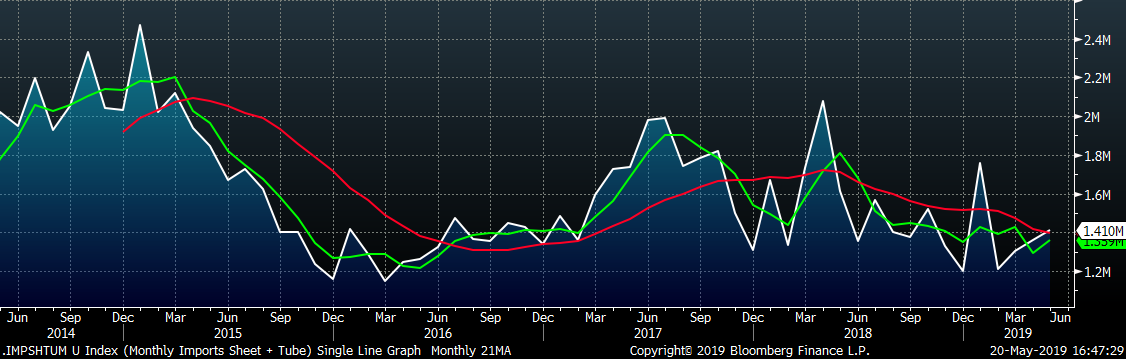

May tube import license data is forecasting a MoM increase of 65k to 657k tons.

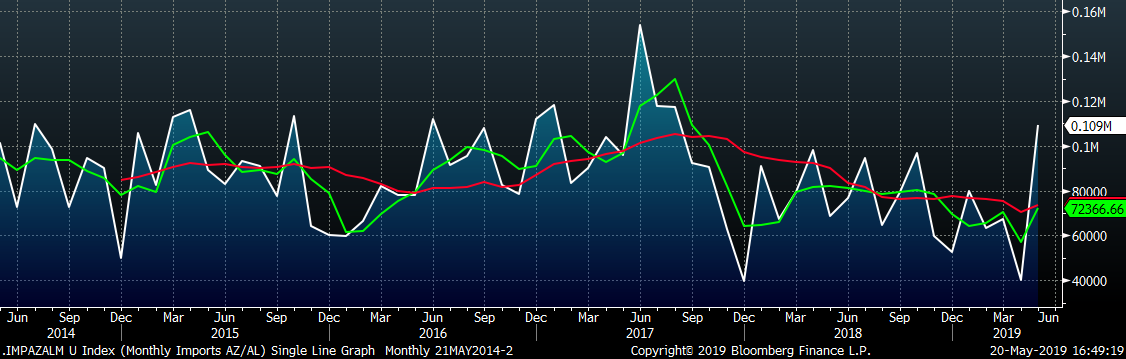

AZ/AL import licenses forecast an increase of 69k MoM to 109k in May.

Below is April import license data through May 14, 2019.

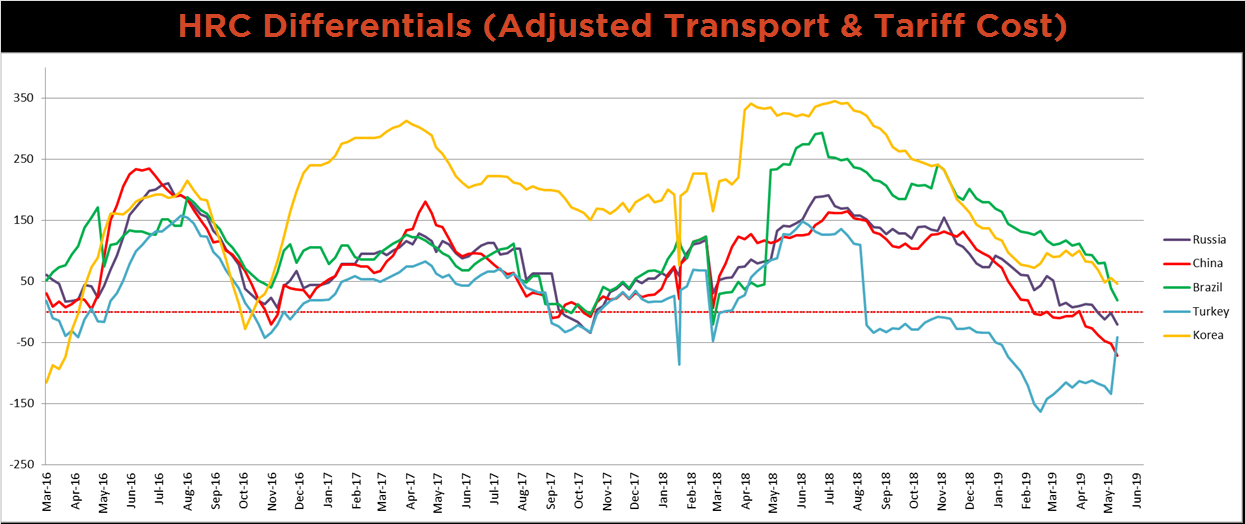

Below is HRC Midwest vs. each listed country’s export price differential using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. This week Turkey’s tariffs went from 50% to 25%, moving it’s tariff and transport adjusted differential in line with the other differentials near the zero level. Historically, the zero price differential level has acted as a bottom for the differentials, as well as a signal for bottoming domestic HRC prices.

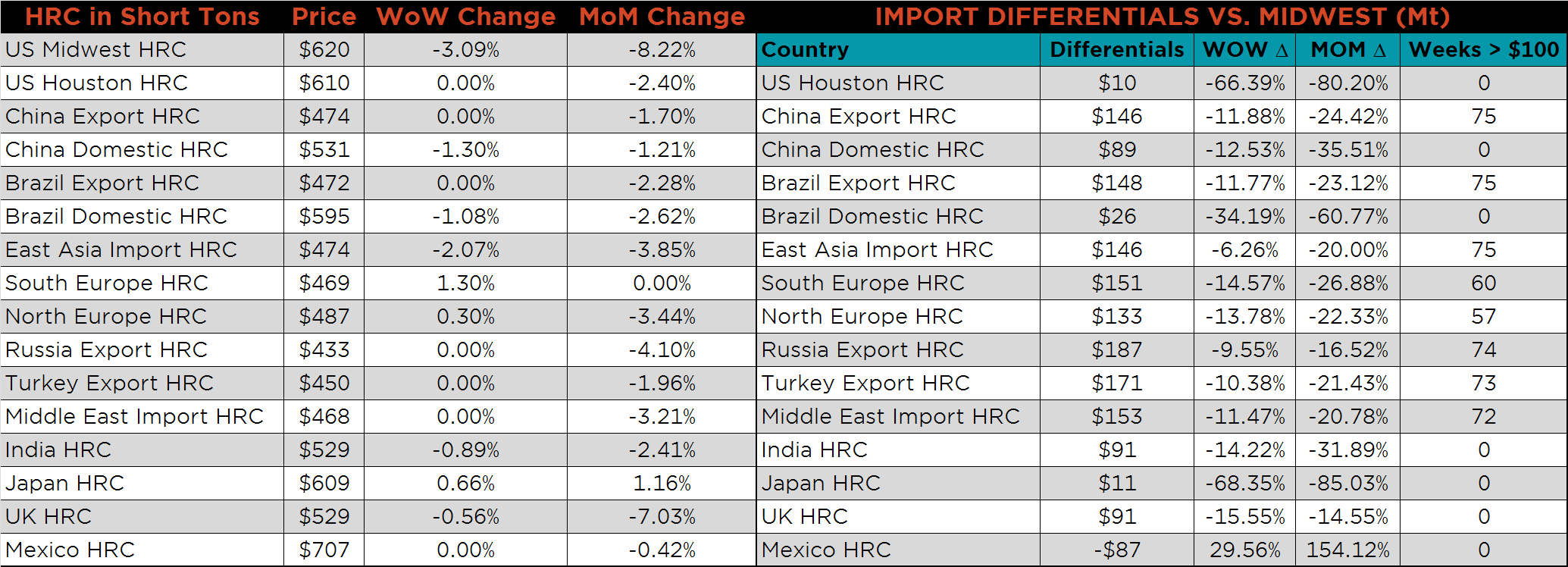

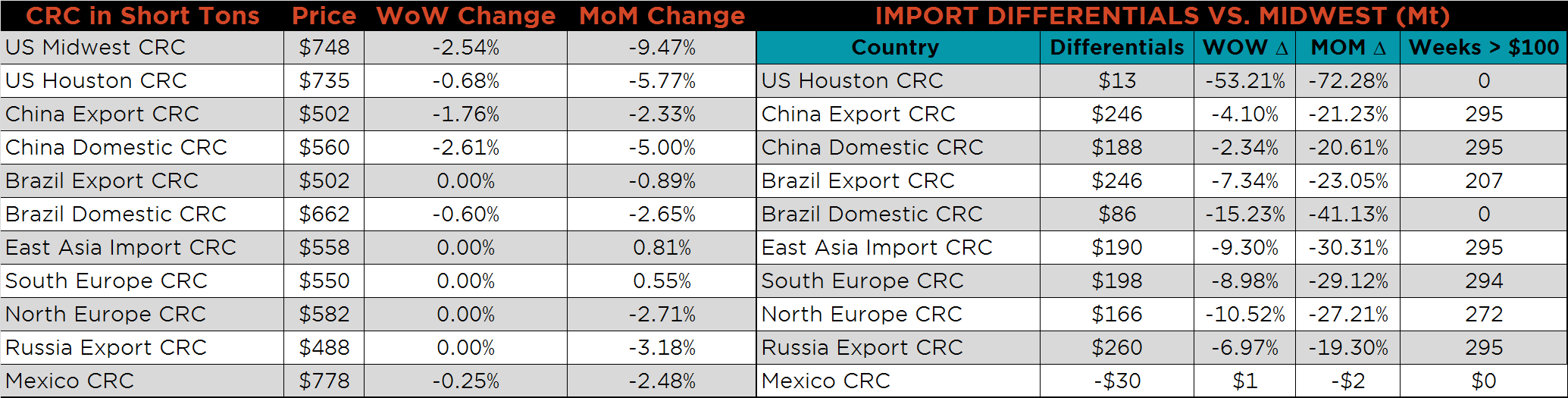

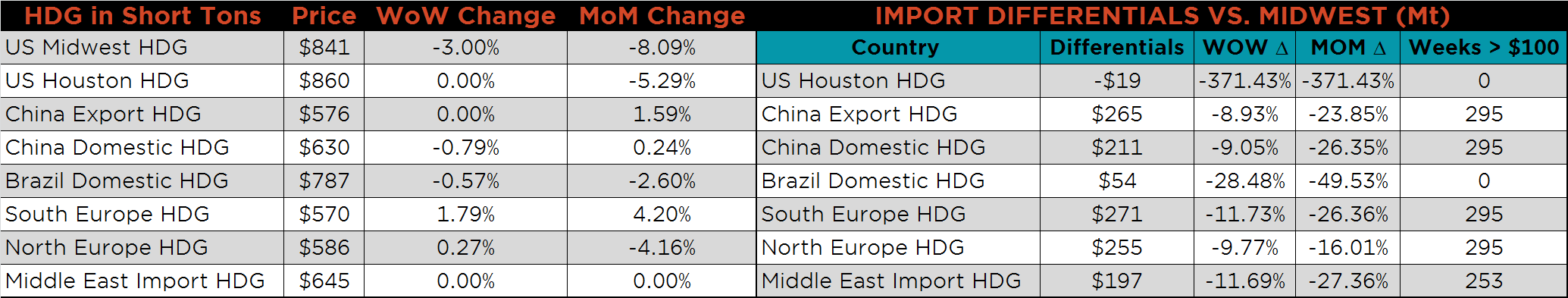

SBB Platt’s HRC, CRC and HDG pricing is below. Midwest HRC, HDG and CRC prices were lower on the week, 3.1%, 3% and 2.5%, respectively. The Chinese Domestic CRC price was down 2.6%, while the South Europe HDG price rose 1.8%.

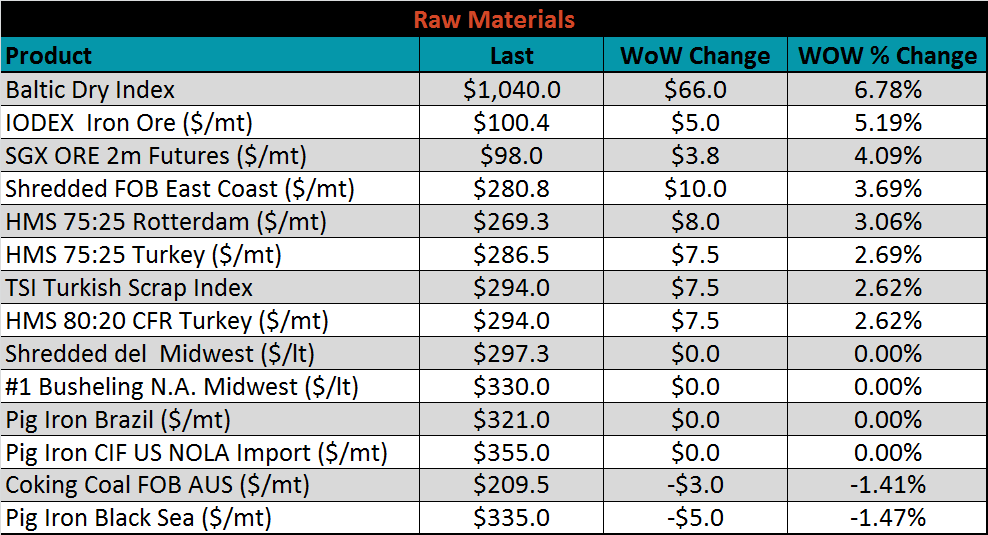

Raw material prices were mostly higher. The IODEX was up 5.2%, while coking coal and pig iron were each down 1.5% and 1.4%, respectively.

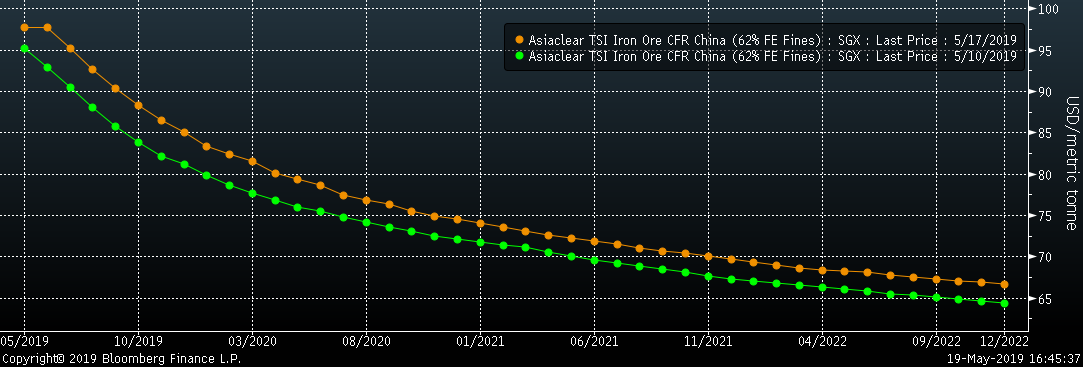

Below is the Iron Ore future curve with Friday’s settlments in orange, and one week prior’s settlements in green.

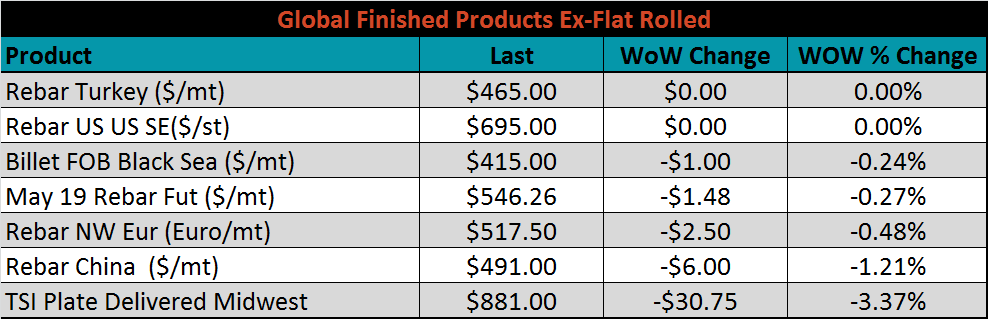

The ex-flat rolled prices listed below were mostly lower.

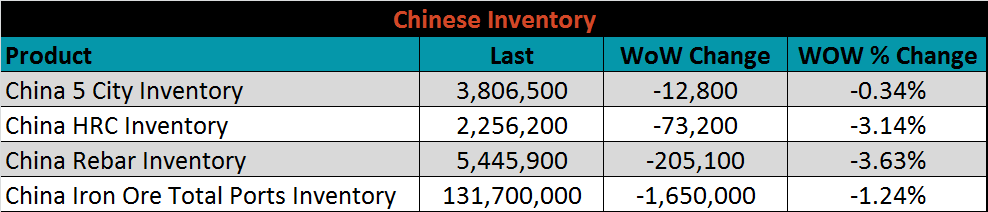

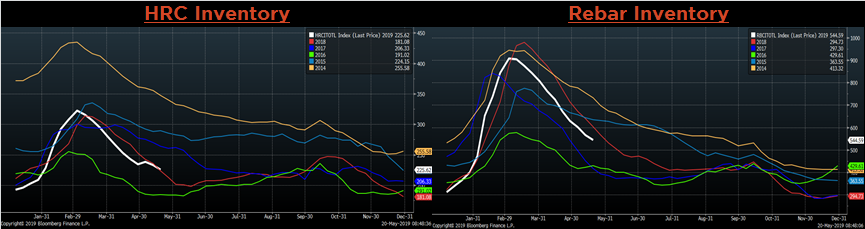

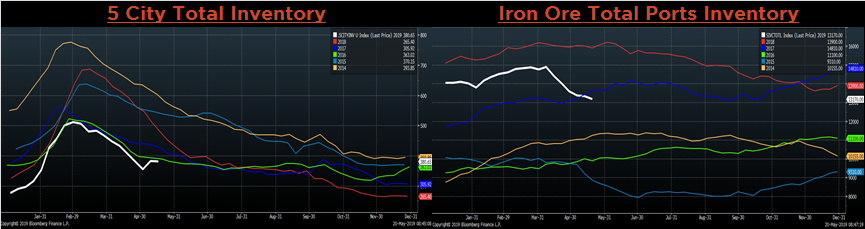

Below are inventory levels for Chinese finished steel products and iron ore, which all moved lower on the week. 5 City inventory remains at the lowest level of the previous five years. Iron ore continues to fall as elevated prices have clearly led to a depletion of existing inventory. The white line in the charts shows how 2019 is tracking so far compared to the previous 5 years.

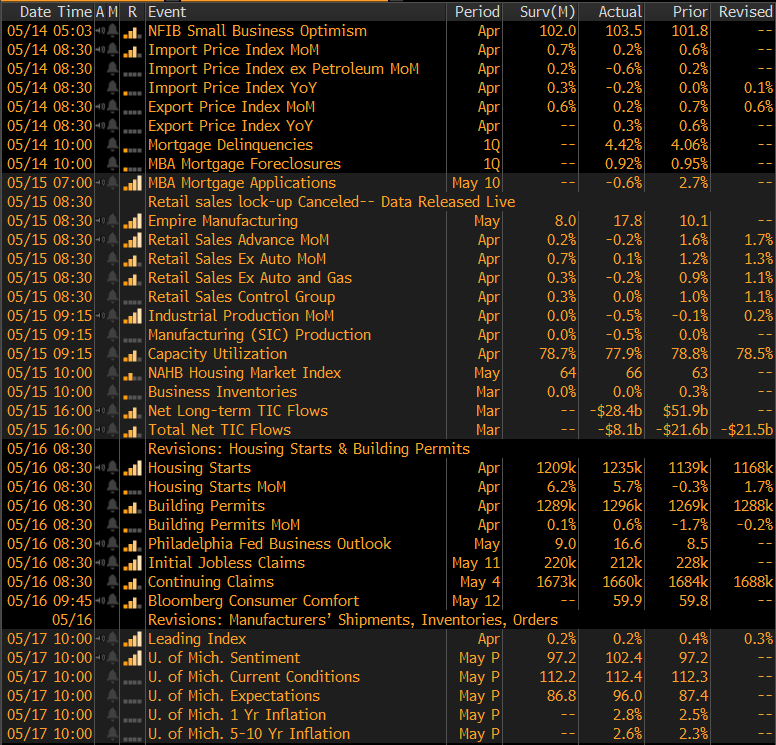

To the right is the remainder of this week’s economic data. The Empire Manufacturing index rose 7.7 points to 17.8. This is above the expectations of 8.0 and suggests strength in the northeast behind new orders (2.2 higher), shipments (7.7 higher) and unfilled orders (2.8 higher). Additionally, Housing starts came in above expectations 1,235k versus 1,209k, and the University of Michigan Consumer Sentiment Survey printed at 102.4, the highest printing since January 2004.

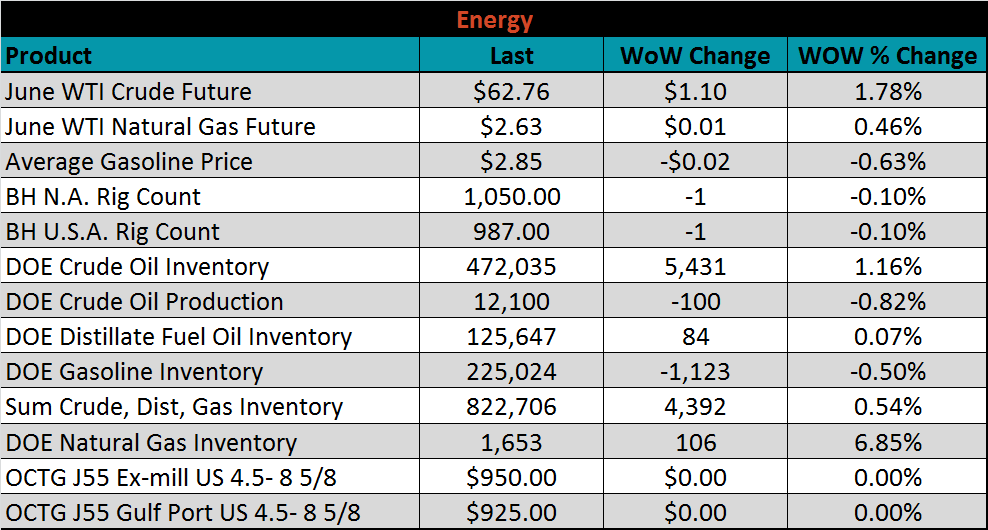

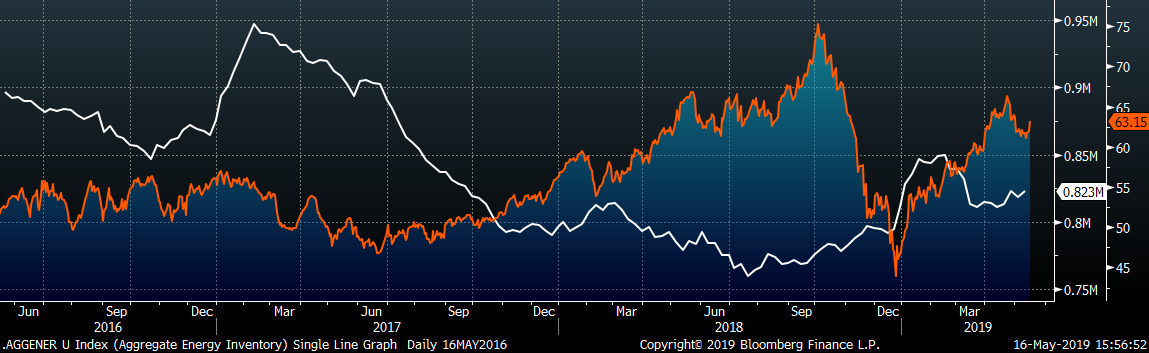

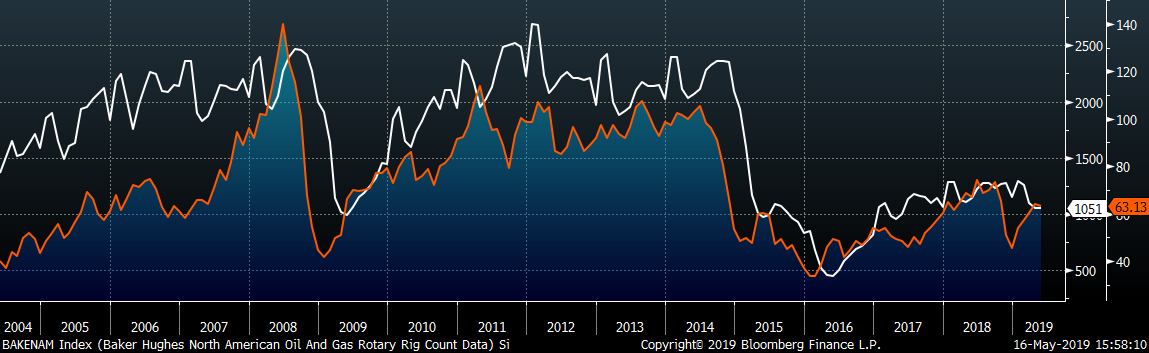

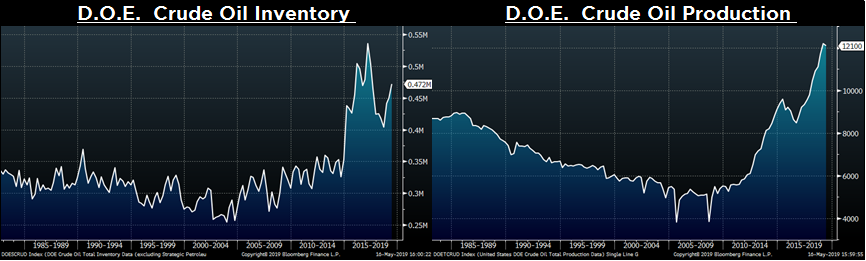

Last week, the June WTI crude oil future gained $1.10 or 1.8% to $62.76/bbl. The aggregate inventory level was up 0.5%, and crude oil production fell back down to 12.1m bbl/day. The U.S. and North American rig count lost one rig each. Geopolitical tensions have supported oil prices among increased production and inventory.

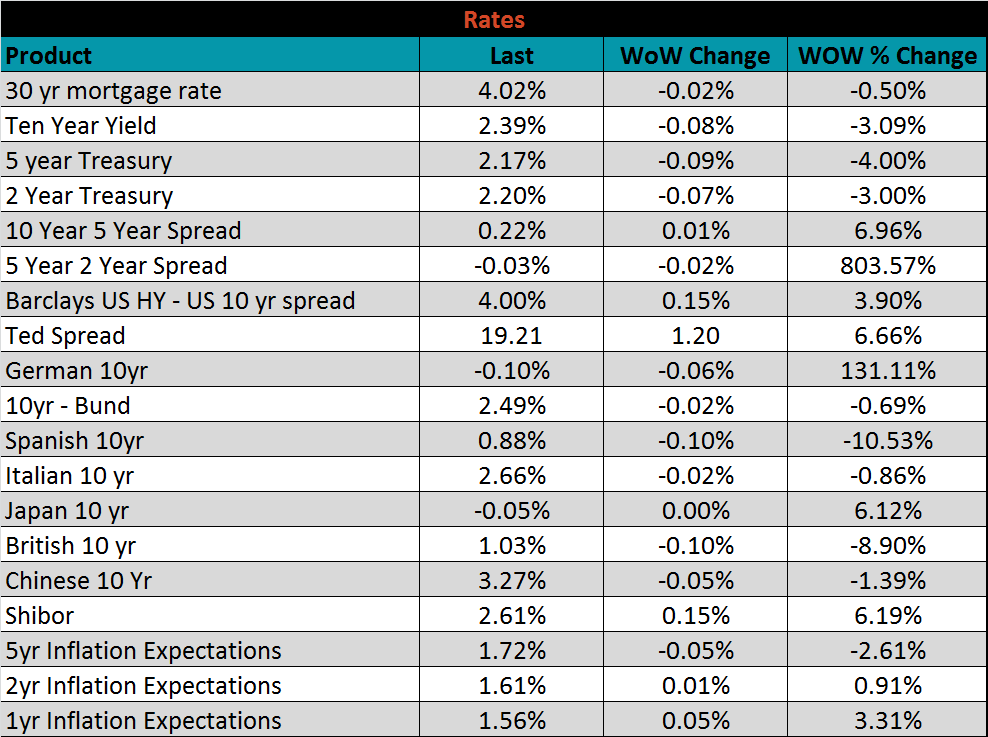

The U.S. 10-year treasury yield was down eight basis points, closing the week at 2.39%. The Japanese 10-year yield was unchanged and remains at -0.05%. The German 10-year yield was down another six basis points to -0.10%, another indication of weakness in the German economy.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: