Content

-

Weekly Highlights

- Market Commentary

- Risks

Last week, the HRC spot price continued to firm around the $1,600 level, as mill offers grind higher. Mills maintain significant negotiating power in the current market with extended lead times, and customer inventories remain too low. From the physical market outlook perspective, current inventory levels continue to be the most significant upside risk in the current demand environment, establishing an elevated floor for the price as restocking becomes unavoidable. In the coming weeks and months, this risk will likely increase as mills have already begun contacting some customers about reinstating contract minimums to catch up on their current orderbook. With the severity of the structural shortage worsening domestically, the traditional playbook is to turn to the global markets for import opportunities.

Over the past year, the Chinese HRC and iron ore prices have led global prices higher, including our domestic price, as they were the first to be hit by and recover from the pandemic. Last week, the China spot price was down 12.9% and the iron ore price has been under significant pressure for the last two weeks. In a normal market, we would view this as a serious crack to the domestic rally that needed to be immediately accounted for. However, the move lower and additional downward pressure comes from government actions to reduce speculation and pollution. The likely result of these events in China is reduced production, which has been a stated goal for months. Supply and demand are not the forces driving their market lower; therefore, we believe they are disconnected from what has fueled the historic rise in global pricing. On a global level, China’s reduced production, in the face of strengthening demand and global steel shortages should only make the problems worse.

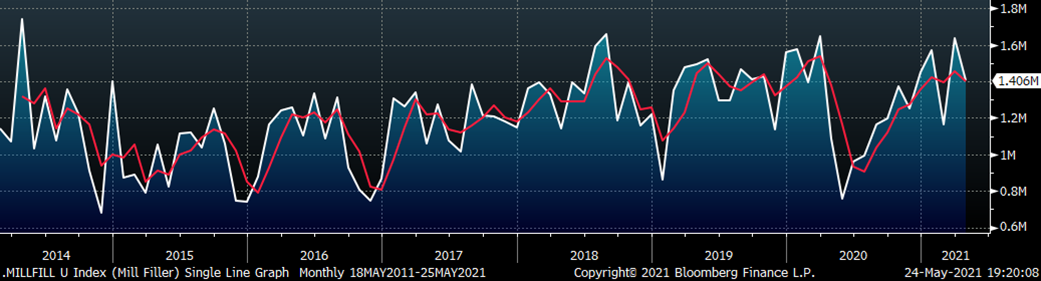

On top of the lack of global availability, global freight costs are extremely prohibitive and make importing these limited tons even more difficult. Below is the Baltic Exchange Dry Index over the last 10 years, a shorthand indicator for global freight within the metals complex.

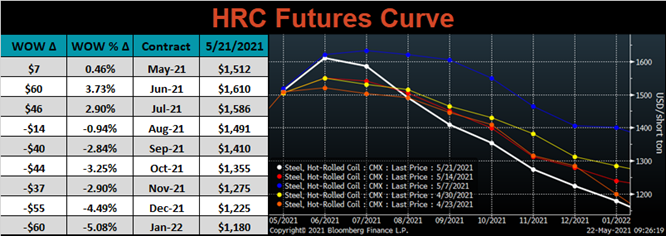

Here we see that, although the index recently declined off its peak, these levels are the highest of the last decade, and are only surpassed by the outlandish prices of the mid 2000’s. As a final point, the 232 tariffs remain firmly in place, and they likely loom large for steel exporting countries both on and off the list. Because of this, we believe that the current threat of lower Chinese prices will not result in enough imported tons necessary to right-size the shortage and has the potential to make it worse. Given all the information available in the current physical market here and abroad, it is difficult to come up with the scenario that would result in a more than $400 decrease in HRC prices from June 2021 to January 2022. And yet, that is exactly what the current futures curve is pricing in.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

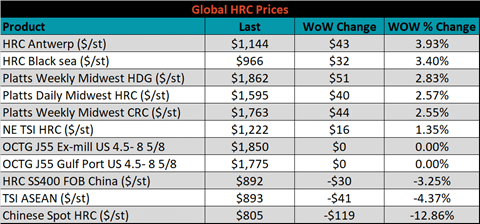

The Platts TSI Daily Midwest HRC Index increased by $40 to $1,594.75.

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The selloff that started at the end of the week two weeks ago continued early into last week. This dynamic changed midweek, as near-term expirations started to rally, and June settled just below its all-time high.

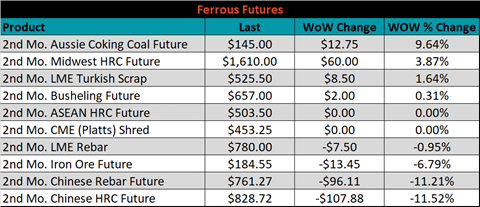

June ferrous futures were mixed, with the Chinese HRC future down 11.5%, while Aussie coking coal future gained another 9.6%.

Global flat rolled indexes were mostly higher, led by Antwerp HRC, up 3.9%, while Chinese spot HRC was down 12.9%.

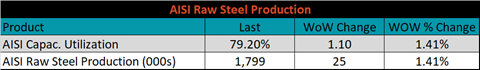

The AISI Capacity Utilization rate increased 1.1% to 79.2%.

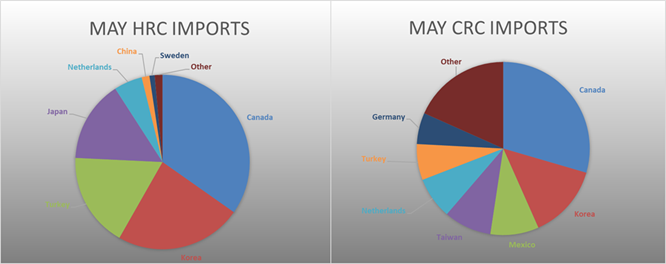

May flat rolled import license data is forecasting an increase of 129k to 909k MoM.

Tube imports license data is forecasting an increase of 28k to 328k in May.

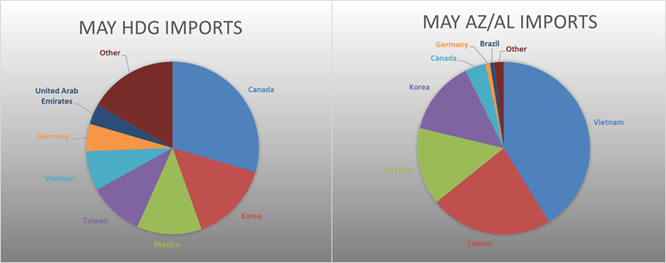

May AZ/AL import license data is forecasting an increase of 8k to 99k.

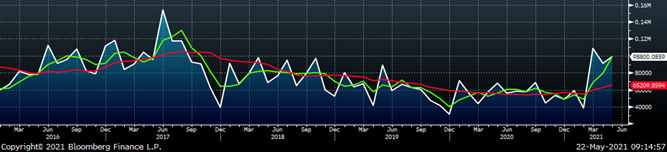

Below is May import license data through May 17, 2021.

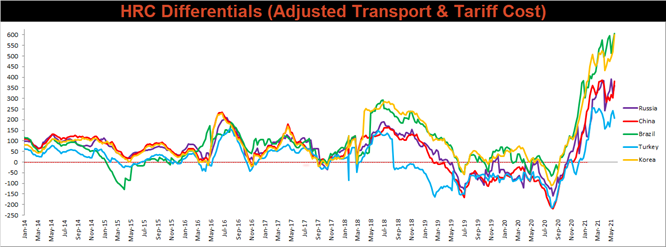

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The differentials increased for all the watched countries except for Turkey, as the U.S. domestic price continues to outpace the rest of the world.

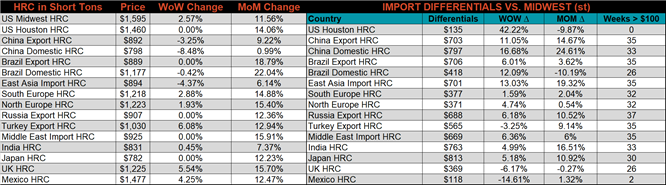

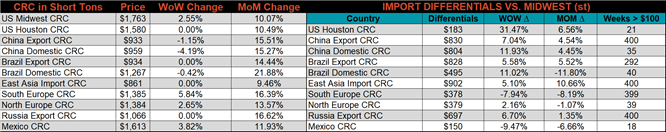

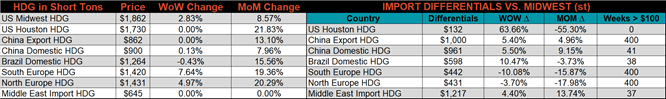

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HDG, HRC & CRC prices were up, 2.8%, 2.6% and 2.6%, respectively. Globally, the Turkish export HRC price was up 6.1%.

Raw material prices were mostly higher, led by Aussie coking coal, up 18.3%.

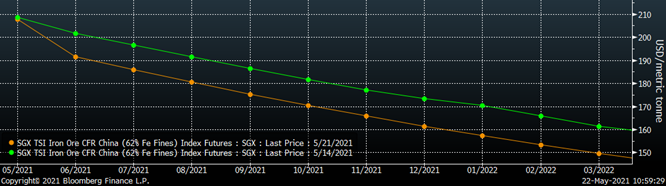

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve shifted another step lower.

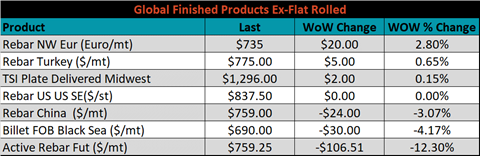

The ex-flat rolled prices are listed below.

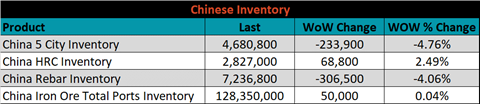

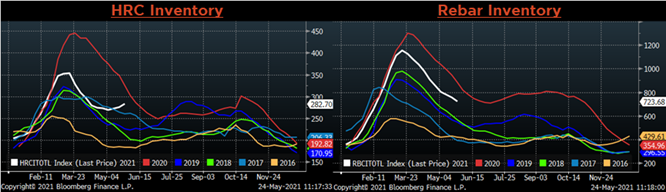

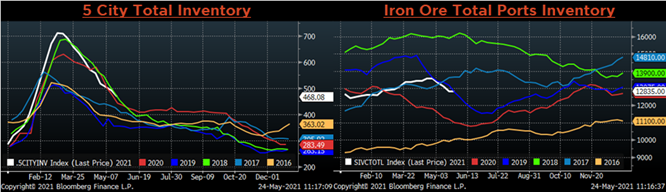

Below are inventory levels for Chinese finished steel products and iron ore. The rebar and 5-city inventory levels were down, while iron ore was essentially flat. Since the end of April, HRC inventory levels have started to grind higher and could be an additional factor in why the Chinese export price has been under pressure.

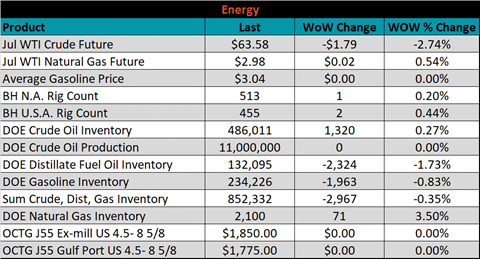

Last week, the July WTI crude oil future was down $1.79 or 2.7% to $63.58/bbl. The aggregate inventory level was down another 0.4%, while crude oil production remains at 11m bbl/day. The Baker Hughes North American rig count was up 1 rig, and the U.S. rig count was up 2 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: