Content

-

Weekly Highlights

- Market Commentary

- Risks

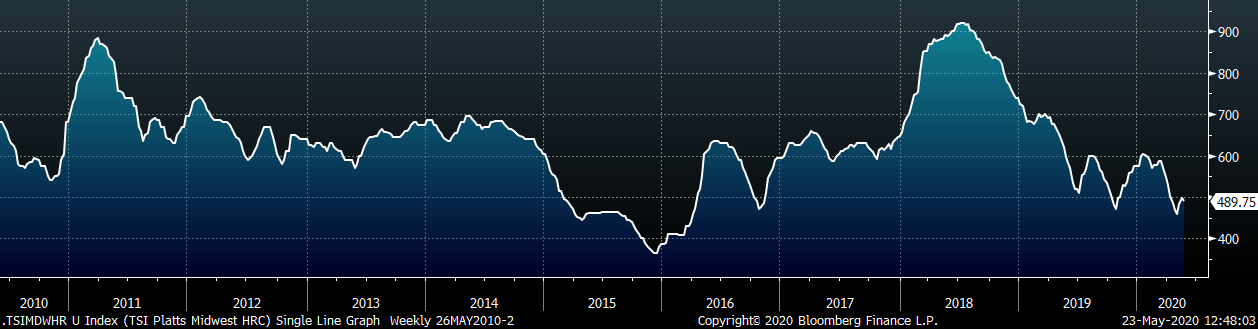

Last Thursday morning, US Steel lead the way in announcing a second round of price increases for flat rolled steel, with the new target of $540/st for HRC. However, the spot price rally over the previous 3 weeks stalled out slightly below the $500 level, and the Platts TSI Midwest HRC index finished the week at $489.75. With the Memorial Day holiday weekend and the price increase announcement, physical transactions have been limited with many buyers in a “waiting and see” mode. While it will likely take a few weeks to determine if the market accepts these increases, mills pushed this price hike because they believe that the economic restart and demand resurgence will provide enough support. The risk to that scenario is mills, with costly, idled furnaces, bring back too much production too fast.

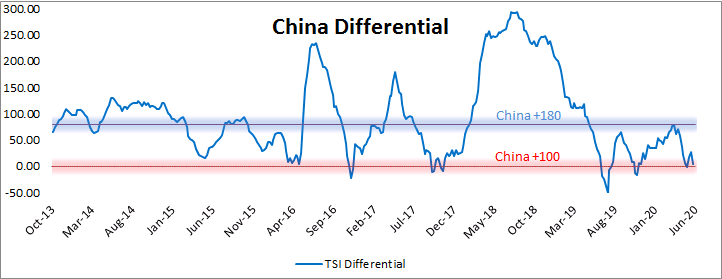

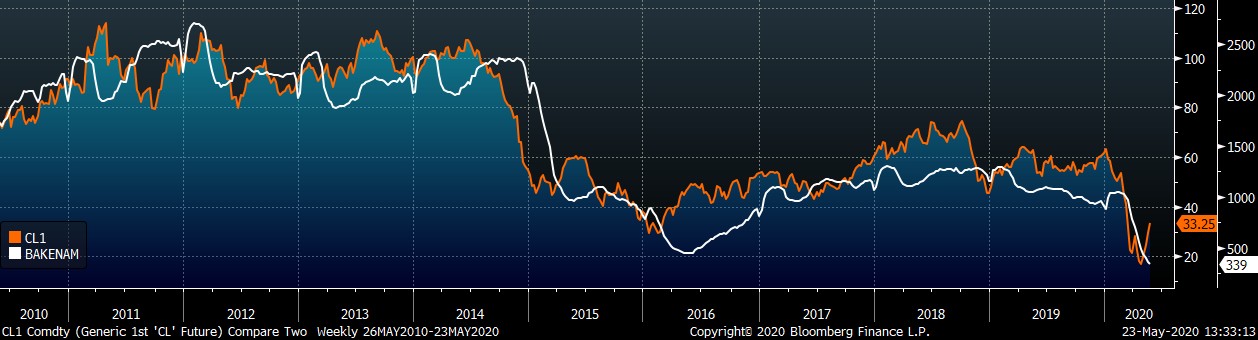

Since the beginning of the coronavirus global outbreak, many have speculated on the shape of the recovery, trying to understand the economic impact. Regardless of how the economic data settles, market prices are telling us that the recovery is underway and will be swift. Crude oil is up a whopping 170% in the last month, with copper up 6.5%, iron ore up 10.5%, and Chinese HRC up 7% as well. Focusing specifically on the Chinese steel market, inventory levels have been declining rapidly after the initial build during their virus outbreak. Last week, inventory levels fell at the fastest pace in recent history for this time of year. This destocking, signaling strong exports and domestic demand, helped drive the price higher. Looking at the China Differential, a staple in this report, the strength in the Chinese market has capped the increase in this differential (Midwest HRC price minus China export price, including transportation costs), despite the domestic price rally.

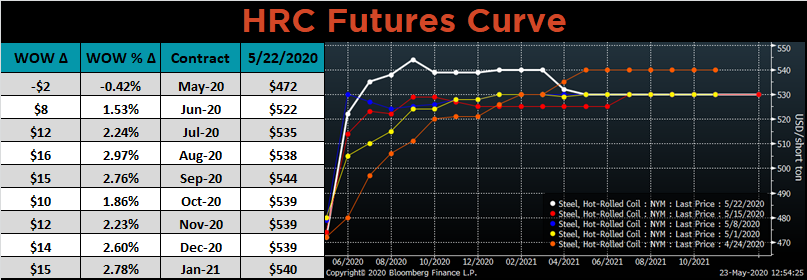

The domestic forward curve shows the market’s expectations for the price rally to continue, which would lift this differential further above the zero level that has historically been a low point on the chart. However, the differential can also rise if prices in China perform worse than the domestic price. Several new risks to the price recovery have recently arisen, which will likely hit the Chinese steel market should they come to fruition. Tensions with Hong Kong are increasing as the government in Beijing is pushing through legislation that questions the autonomy of Hong Kong. This would jeopardize Hong Kong’s preferential status in global trade. Additionally, there have been concerns of China’s ability and willingness to follow through with commitments in the Phase One trade deal with the US. With the upcoming presidential election, there are heightened risks involving rhetoric and policy from the administration against China for political gain. Disputes in negotiating the next phase of a trade deal also pose risks to steel prices in China, which could also affect the domestic market as it did during the previous trade war. With the domestic forward curve expecting the price to recover further, these emerging risks should be factored into business specific outlooks. The forward curve in contango provides an opportunity to hedge these downside risks at prices above the current spot price.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

The Platts TSI Daily Midwest HRC Index was down $7.75 to $489.75.

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The entire curve shifted higher.

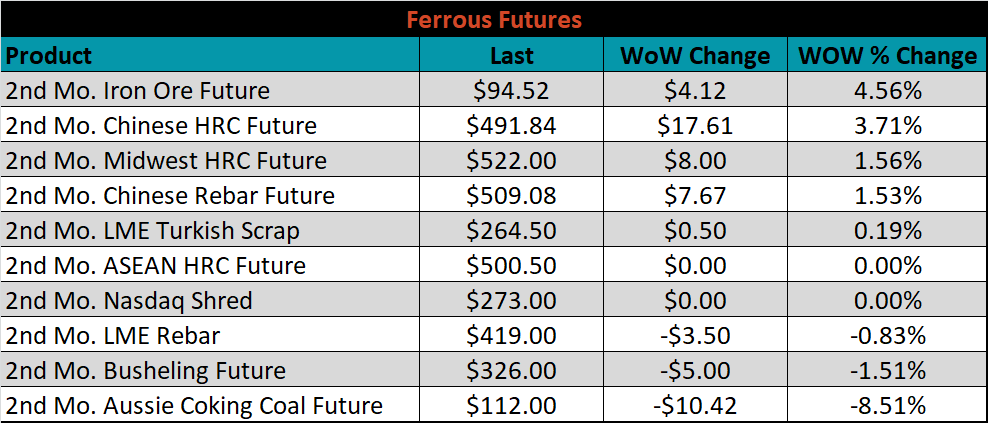

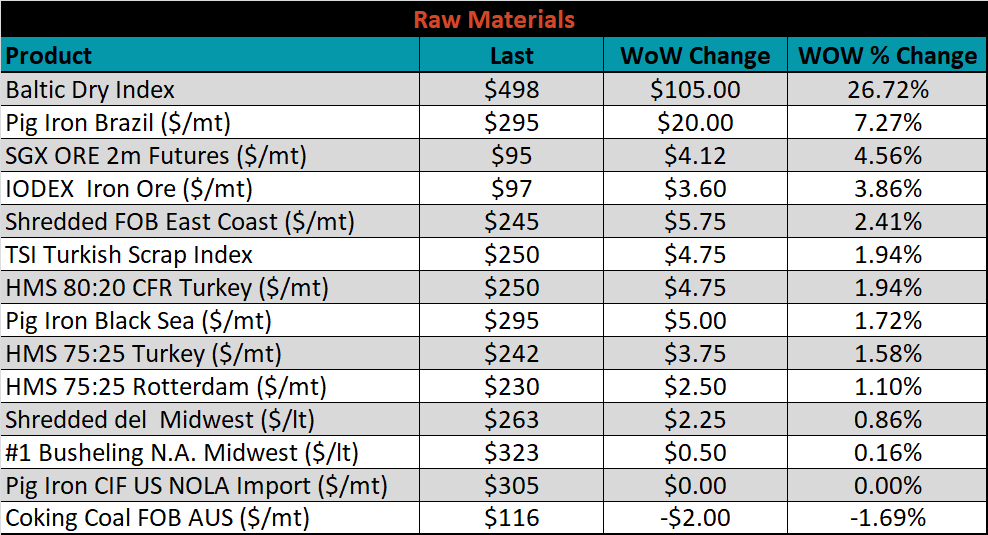

June ferrous futures were mixed. The iron ore future gained 4.6%, while the coking coal future lost 8.5%.

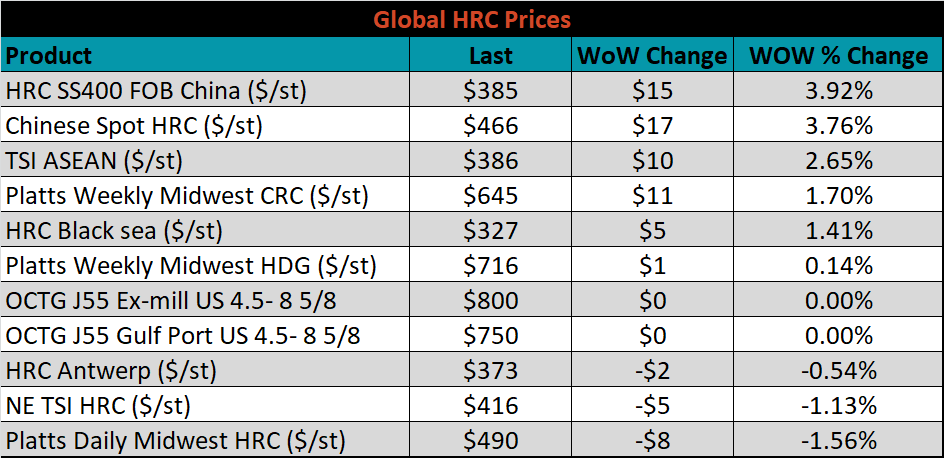

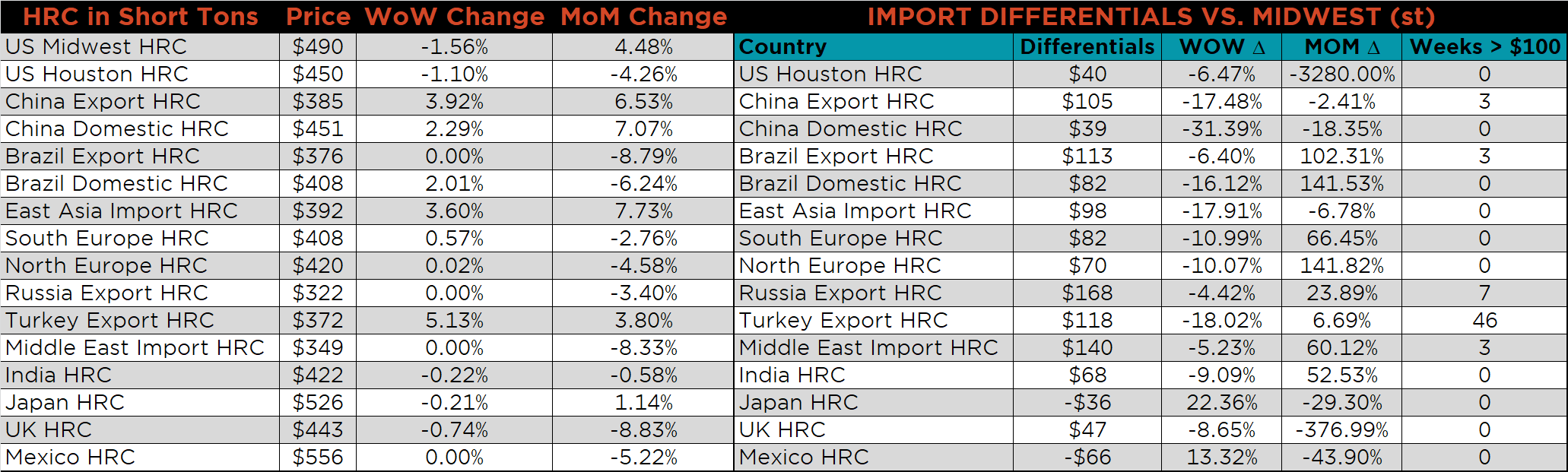

The global flat rolled indexes were mixed. Chinses export HRC was up 3.9%, while Platts Midwest HRC was down 1.6%.

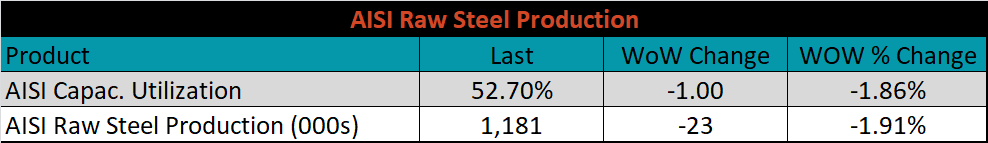

The AISI Capacity Utilization Rate was down 1% to 52.7%.

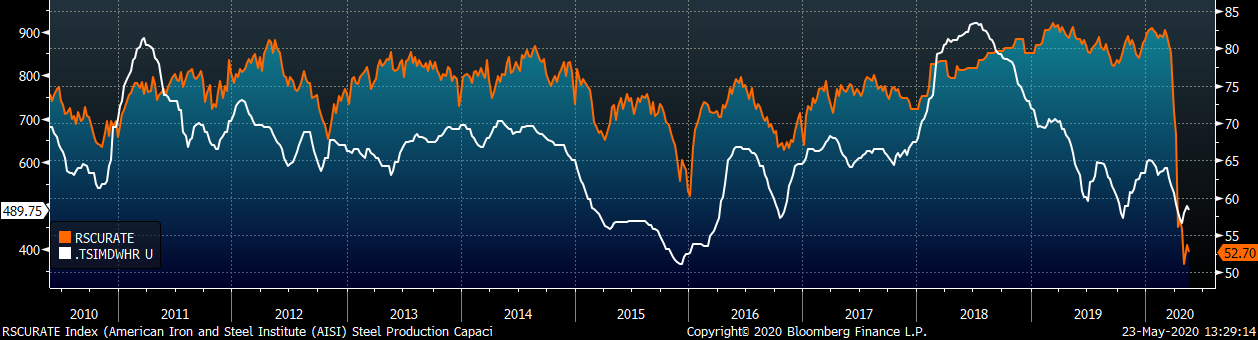

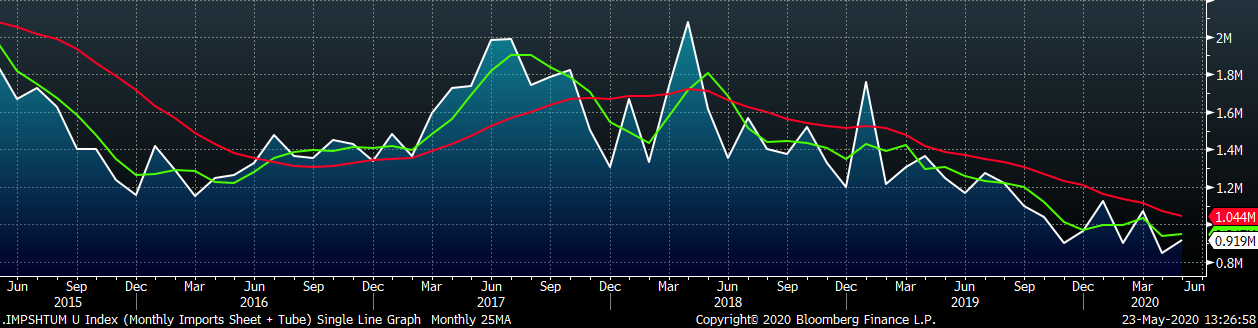

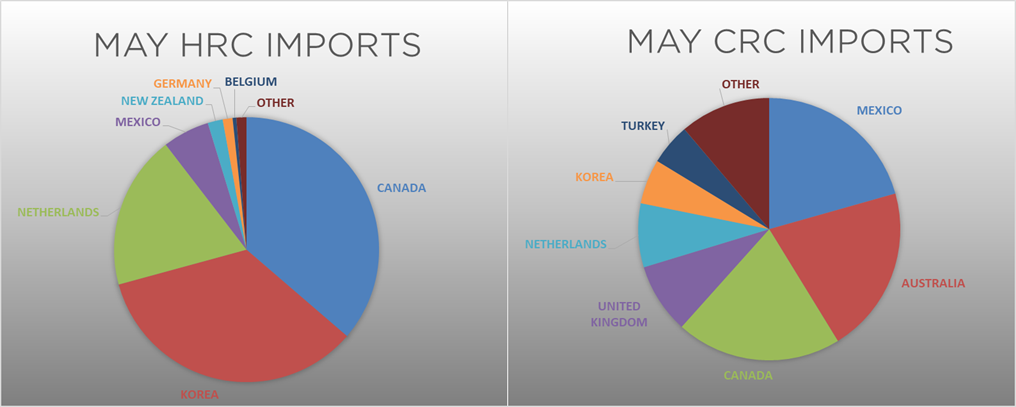

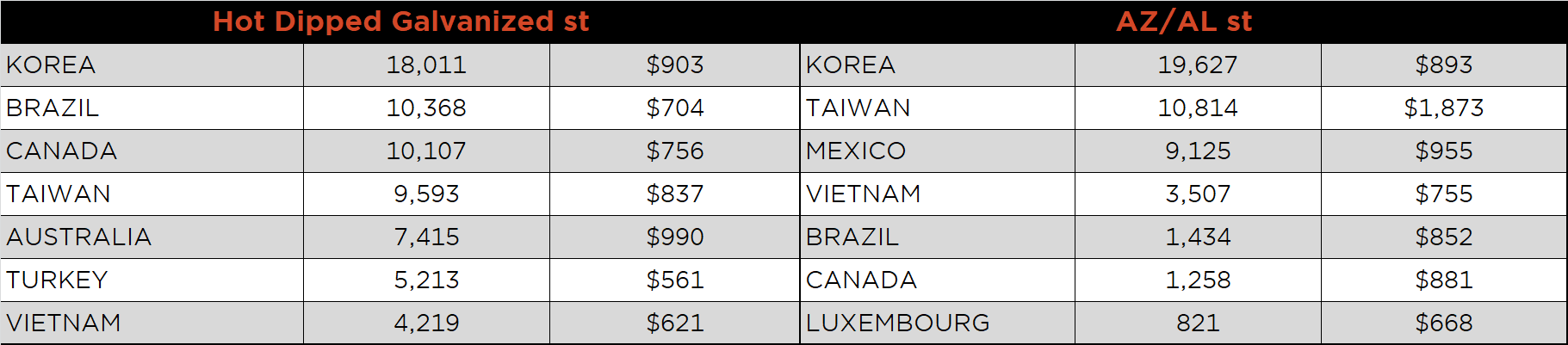

May flat rolled import license data is forecasting an increase of 29k to 599k MoM.

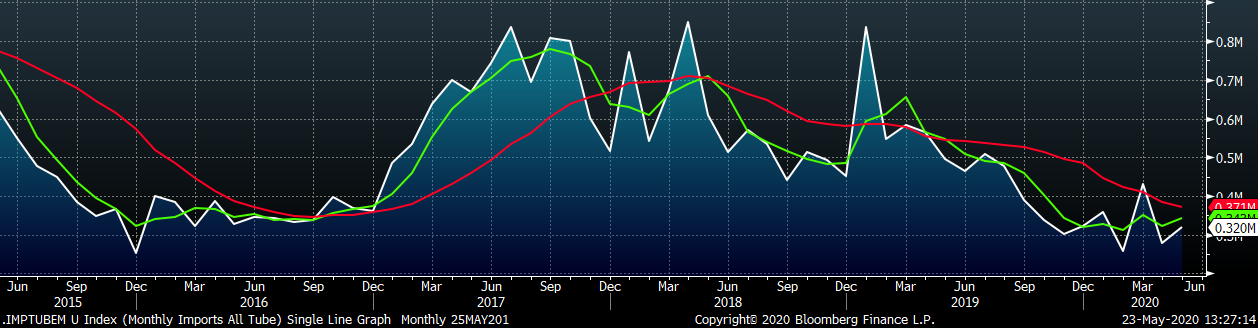

Tube imports license data is forecasting a MoM increase of 43k to 320k tons in May.

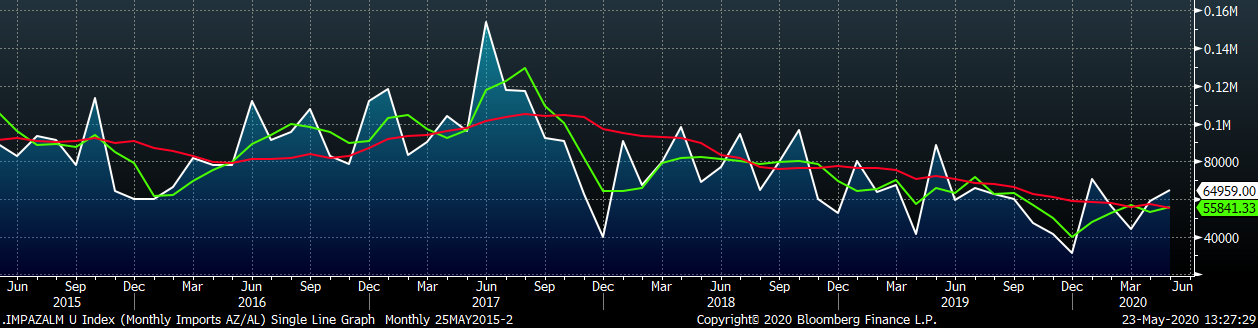

AZ/AL import license data is forecasting an increase of 3k in May to 61k.

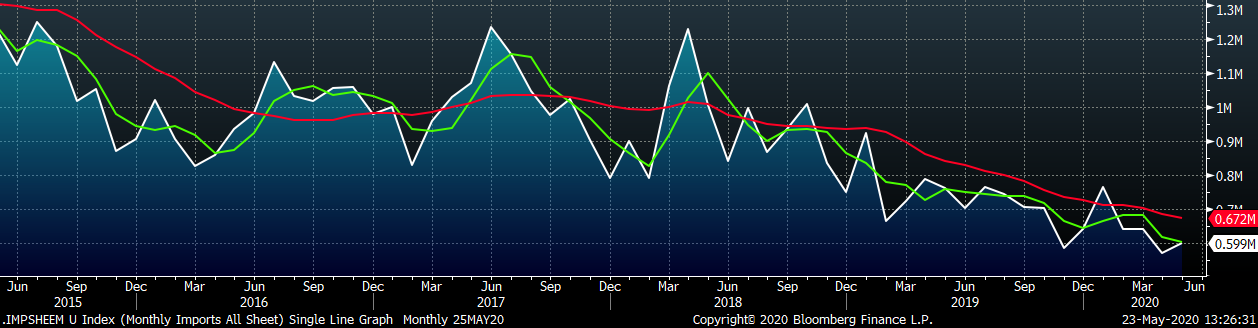

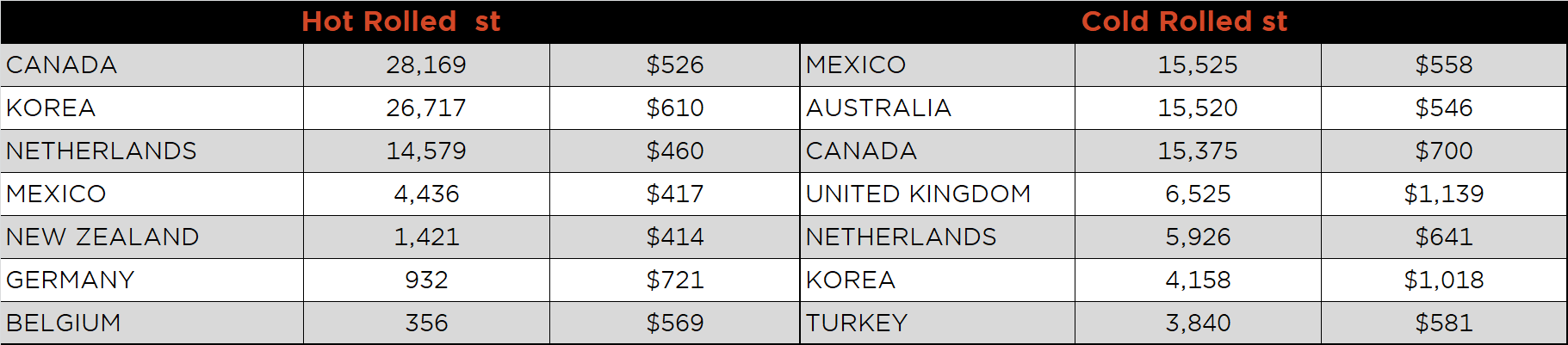

Below is May import license data through May 19, 2020.

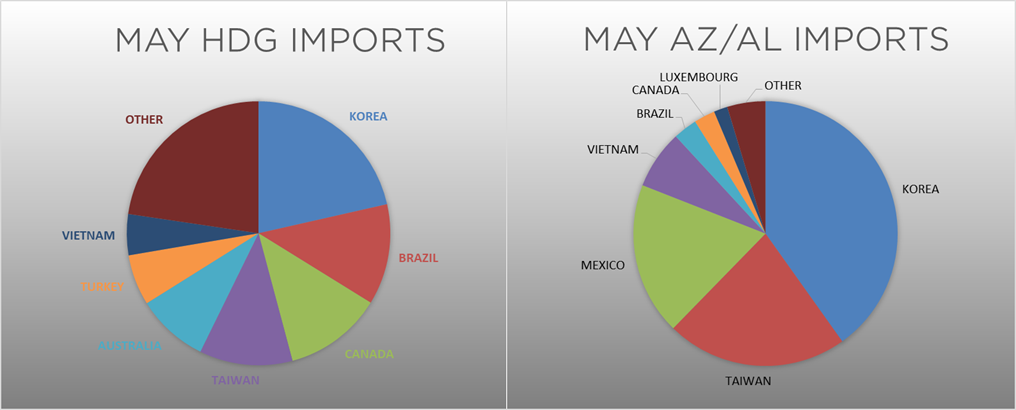

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All five countries differentials decreased this week, as global export prices were largely flat to higher and the U.S. domestic price decreased.

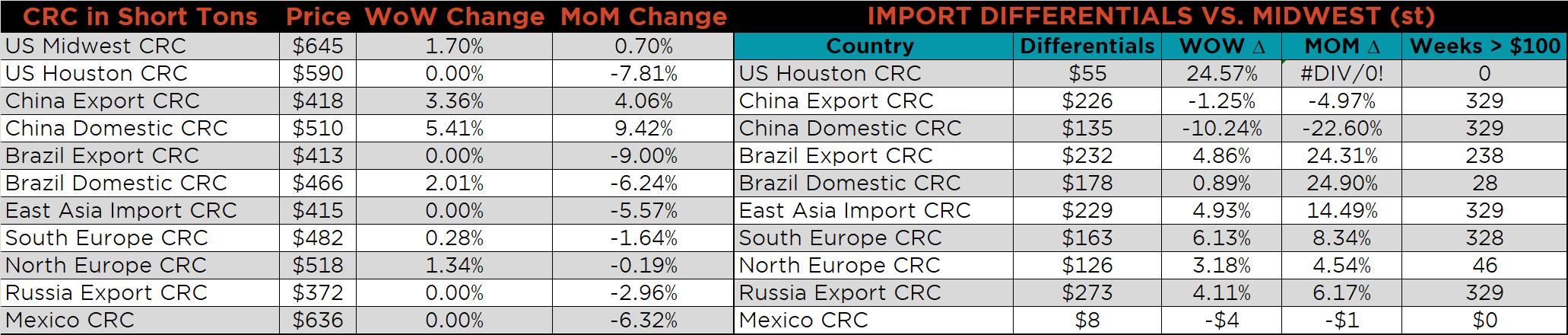

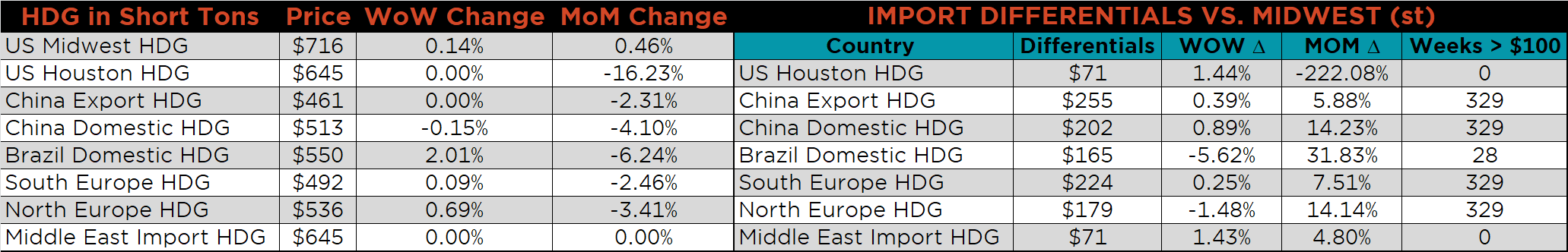

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest CRC and HDG prices were up 1.7% and 0.1%, respectively, while the HRC price was down 1.6%. Globally, the Turkish and Chinese export HRC prices were up, 5.1% and 3.9%, respectively.

Raw material prices were mostly higher. Brazilian pig iron was up 7.3%, while Australian coking coal was down 1.7%.

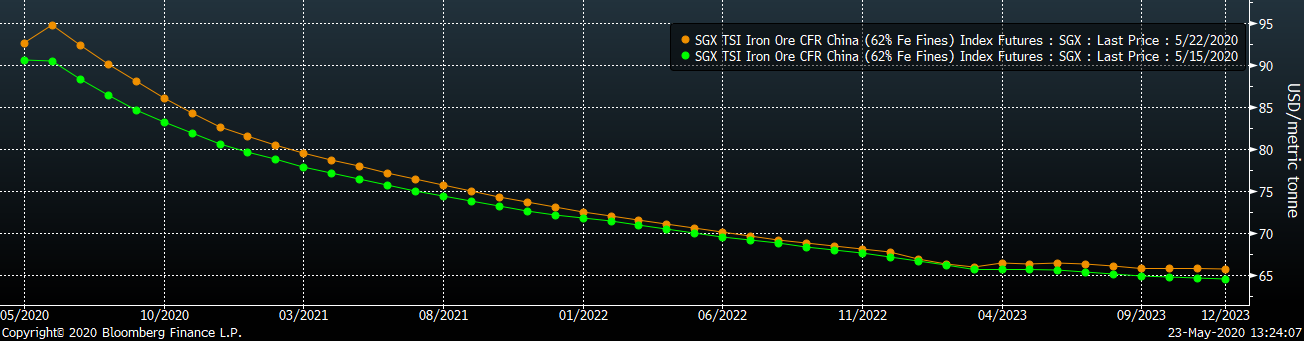

Below is the iron ore future curve with Friday’s settlments in orange, and the prior week’s settlements in green. The front of the curve shifted higher for the third week in a row.

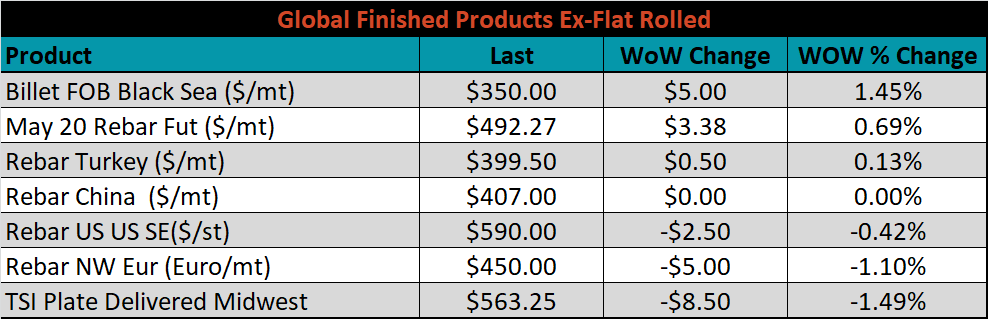

The ex-flat rolled prices are listed below.

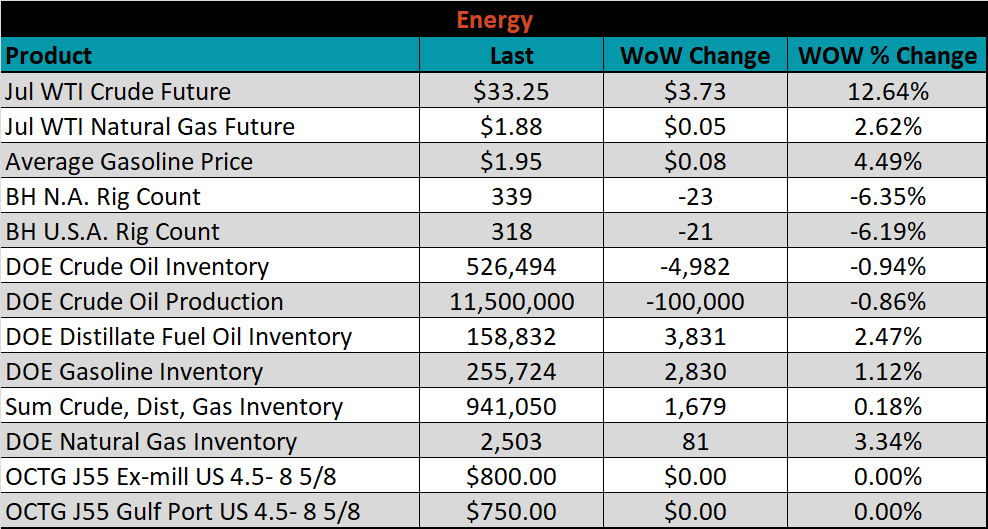

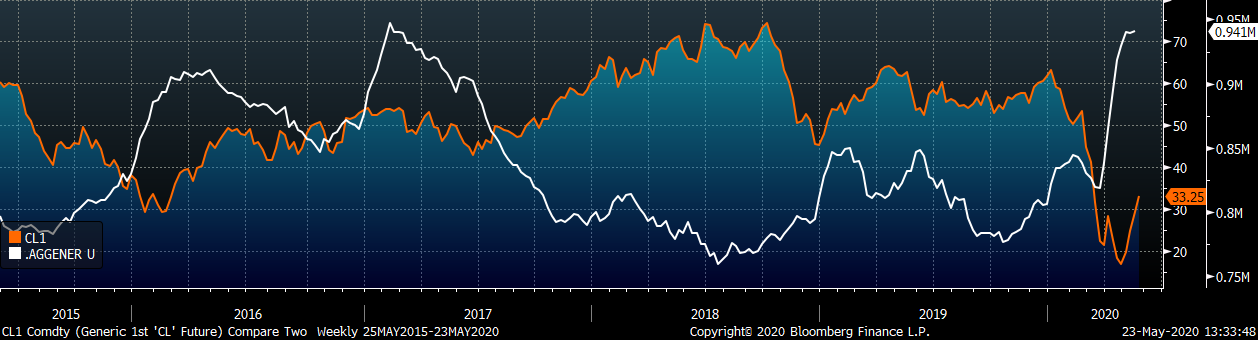

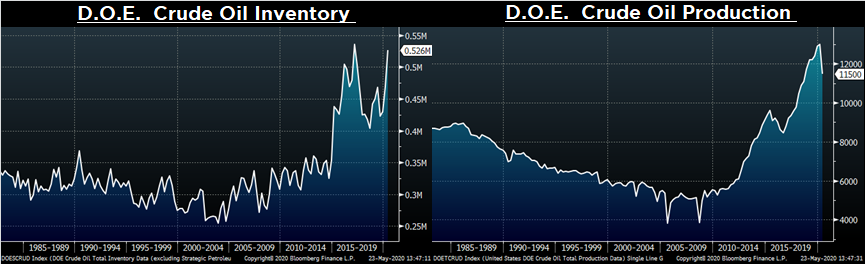

Last week, the July WTI crude oil future gained $3.73 or 12.6% to $33.25/bbl. The aggregate inventory level was up slightly, while crude oil production was down to 11.5m bbl/day. The Baker Hughes North American rig count was down another 23 rigs, and the U.S. rig count was down 21 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: