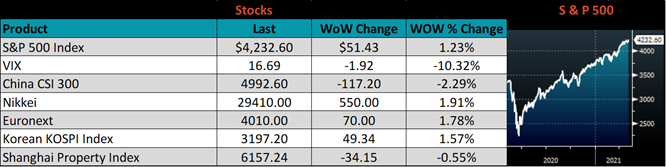

Market Commentary

As the spot market continues to grind higher and mill offers well above $1,500, very little has changed regarding the outlook in the domestic market this week. With lead times creeping into July, inventories remaining too low and not enough import, little progress is being made in addressing the current supply shortage. At the same time, analysts continue to pepper readers on the inevitability of a peak and subsequent price crash. The constant drumbeat of impending doom makes it perfectly understandable why many buyers continue to question the longevity of the current rally. However, as broad strength in demand remains the driving force of the rally, relief from current pressure does not appear in sight. This week we will discuss the economic data released early last week and what it says about the current market.

Before 2020, a steel buyer had a good idea of who their competition was and what the competition was willing to pay for steel, because it mirrored their own business. Short lead times and a global surplus provided enough ammunition for buyers to use this knowledge in negotiations with sellers. However, what has been uncovered over the last couple of months is that there is significant portion of the market that has relatively inelastic demand for steel – higher prices do not reduce the amount of material they want to buy. This reality directly contradicts the belief that there will be widespread demand destruction as prices rise. We believe that any demand destruction in certain segments of the steel consuming community is vastly overshadowed in the current steel deficit by other sectors where demand is elevated and growing. This seamless demand replacement was exhibited when a “rally breaking” event took place over the last couple of weeks. The well reported chip shortage and subsequent auto manufacturing slowdown was supposed to offer relief to spot buyers and signal a peak to the rally. However, all the “available” tons were soaked up by construction and yellow goods before the average spot buyer saw an offer.

As this report moves through specific economic data points, you may find the urge to jump over a sector that does not specifically apply to your business. More than ever, we recommend you widen your scope of analysis. With a supply shortage this severe, you are no longer competing within your segment. Now you are competing with the largest auto manufacturers, OEMs, construction companies, appliance manufacturers and energy producers, and all the financial strength and influence they possess. This type of competition is something we at Flack Global Metals are very familiar with. We have been punching with the biggest in the industry since our inception, and the only reason we are still in the fight is because we have taken a wholistic market view and used all the tools at our disposal, especially hedging.

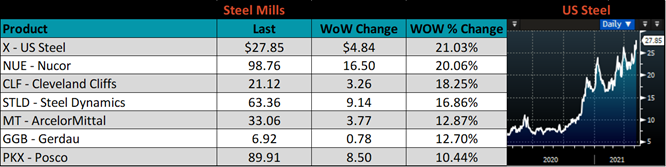

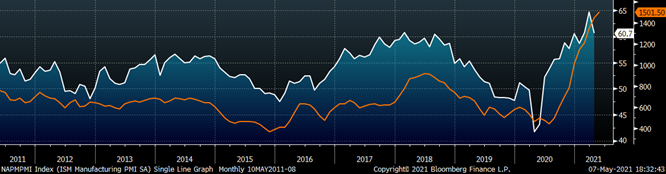

The chart below is the Platts Midwest HRC index (white) and the ISM Manufacturing PMI (orange).

After March’s record month it is possible to look at the move lower on charts and red on the tables and think that demand is weakening. This would be a mistake. The subindexes represent survey responses from purchasing managers in the manufacturing sector, and readings above 50 indicate expanding categories. As far as the topline number is concerned, it has printed in expansionary territory for eleven straight months, with three straight prints above 60.

ISM PMI

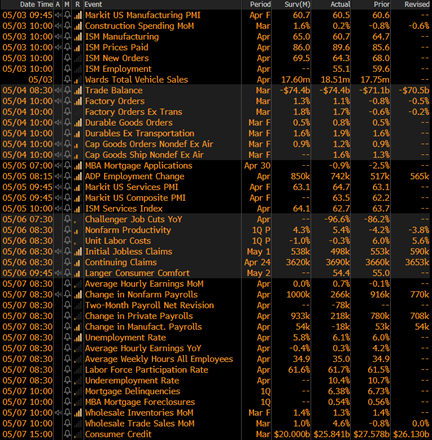

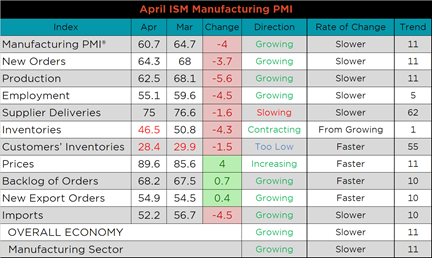

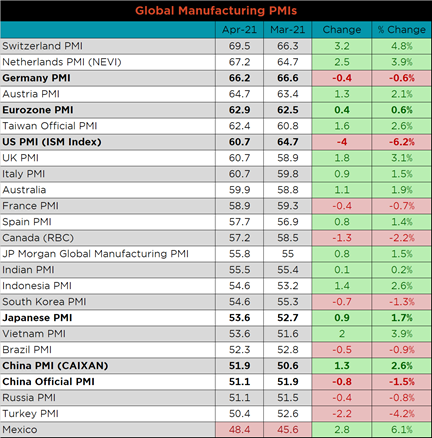

The April ISM Manufacturing PMI and subindexes are below.

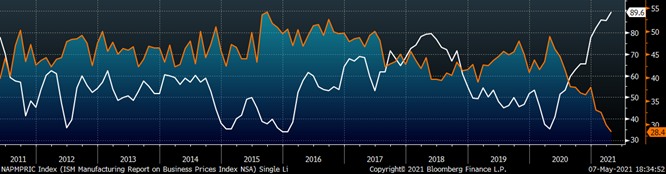

The chart below compares the ISM prices subindex with the ISM customer inventories subindex. The prices subindex reached its highest print on record, while customer inventories continued to print lower. The second chart shows the new orders plus backlog subindexes. New orders were down from their record high print last month, but continue to grow, while the backlog expanded further. The final chart shows supplier deliveries moving slightly lower after March’s record high. The overall trend remains clear, record prices are having a minimal impact as demand continues to grow stronger, while low inventories and supply chain constraints present headwinds for manufacturers.

ISM Manufacturing PMI Customer Inventories Subindex (orange) & Prices Subindex (white)

ISM Manufacturing PMI New Orders plus Backlog Subindexes

ISM Manufacturing Prices Subindex

Year over year readings are representative of the most restrictive time of the pandemic (April 2020), when manufacturing demand was at record low levels. Interestingly, customer and producer inventories remain well below levels from that time, and supplier deliveries were only slightly tighter then, than they are now.

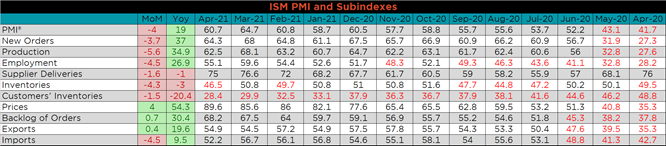

Global PMI

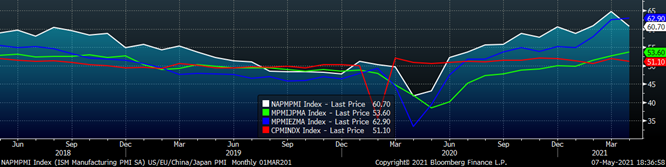

The April global PMI printings continue to show broad global strength with only one country, Mexico, currently in contraction. Of the most significant countries (bold), the German, U.S. and Official Chinese PMI’s were lower, but all continue to expand.

J.P. Morgan Global Manufacturing

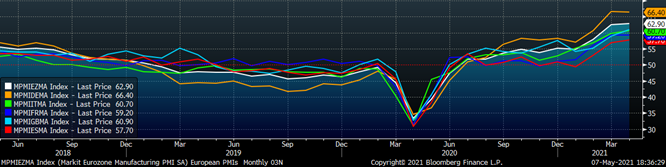

Eurozone (white), German (orange), Italian (green), Spanish (red), and French (blue), U.K. (teal) Manufacturing PMIs

US (white), Euro (blue), Chinese (red) and Japanese (green) Manufacturing PMIs

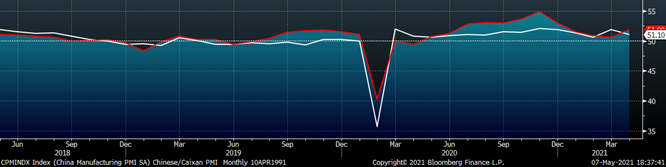

China’s official manufacturing PMI decreased, while the Caixan PMI increased. Both remain in expansion territory.

China Official (white) and Caixan (red) Manufacturing PMIs

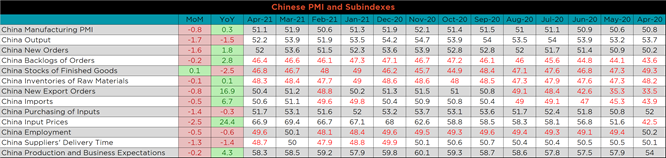

The table below breaks down China’s official manufacturing PMI subindexes. The stock of finished goods was the only subindex to increase, while input prices show the most significant move lower, both compared to March levels.

Construction Spending

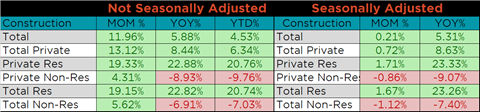

March seasonally adjusted U.S. construction spending was up slightly, 0.1% compared to January, and 5.3% higher than a year ago.

March U.S. Construction Spending

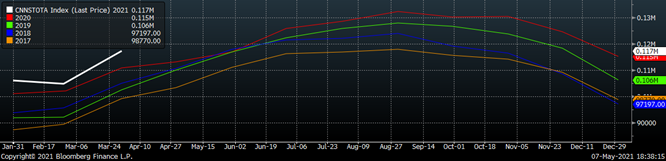

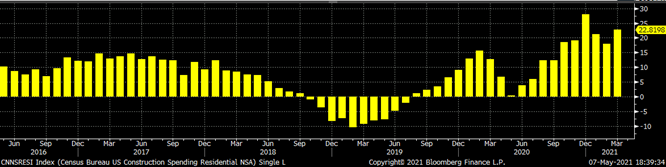

The white line in the chart below represents not seasonally adjusted construction spending in 2021 and compares it to the spending of the previous 4 years. The rate of the increase was obviously more significant than what is seasonally typical but could have been partly due to last month’s unseasonal decrease. The last two charts show the YoY changes in construction spending. Private non-residential spending decreased further in February, for the eleventh month in a row, while at an improving rate. Residential spending remains significantly elevated compared to last year, and at a higher rate than the recent trend.

U.S. Construction Spending

U.S. Private Nonresidential Construction Spending NSA YoY % Change

U.S. Residential Construction Spending NSA YoY % Change

Auto Sales

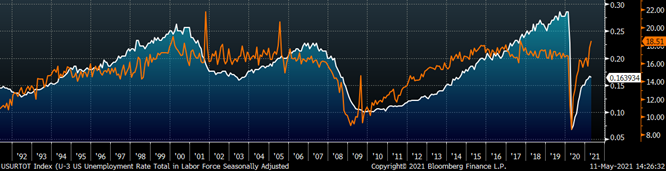

April U.S. light vehicle sales jumped to an 18.5m seasonally adjusted annualized rate (S.A.A.R), the highest level in the last 10 years. The second chart shows the relationship between the unemployment rate and auto sales. The unemployment rate is inverted to show that declining unemployment typically leads to increasing auto sales. The labor market recovery slowed with a jobs number that came in well below expectations, while demand for autos is red hot.

April U.S. Auto Sales (S.A.A.R.)

April U.S. Auto Sales (orange) and the Inverted Unemployment Rate (white)

Risks

Below are the most pertinent upside and downside price risks:

Upside Risks:

- Higher share of discretionary income allocated to goods from steel intensive industries

- Strengthening global flat rolled and raw material prices

- Unplanned & extended planned outages

- Low current import levels

- Declining/low inventory levels at end users and service centers

- Broad increases in commodity prices due to a weakening US Dollar

- Limited spot transactions skewing market indexes to extreme levels

Downside Risks:

- Increased domestic production capacity

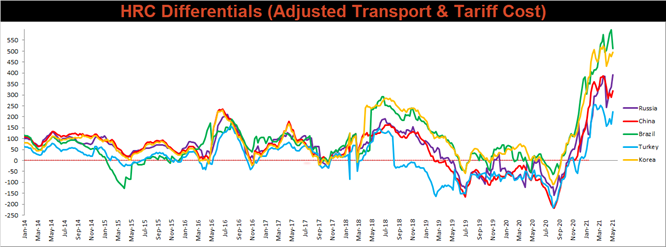

- Increasing price differentials and hedging opportunities leading to higher imports

- Steel consumers substitute to lower cost alternatives

- Steel buyers and consumers “double ordering” to more than cover steel needs

- Weak labor and construction markets

- Tightening credit markets, as elevated prices push total costs to credit caps

- Reduction and/or removal of domestic trade barriers

- Supply chain disruptions allowing producers to catch up on orders

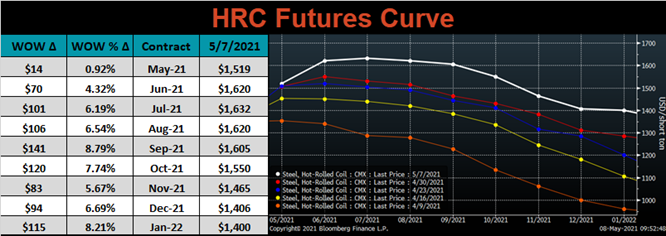

HRC Futures

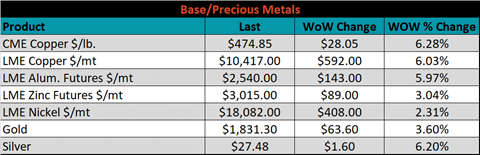

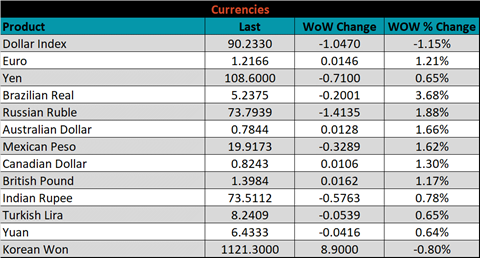

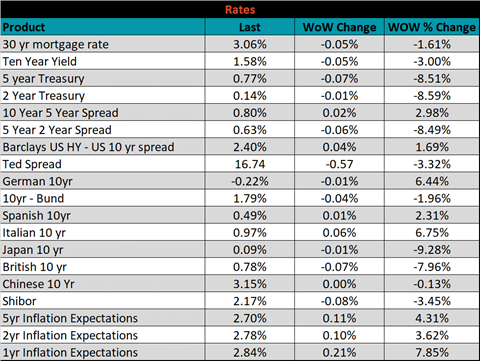

All of the below data points are as of May 7, 2021.

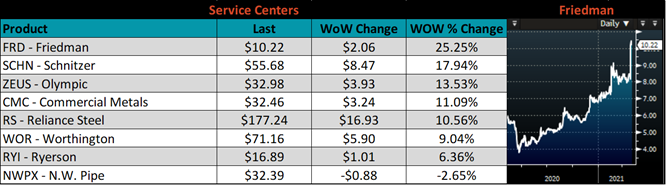

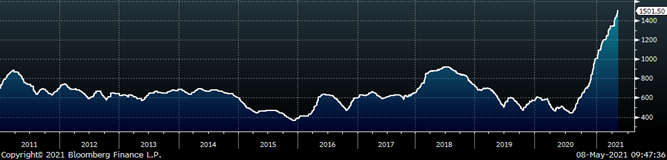

The Platts TSI Daily Midwest HRC Index increased by $56.50 to $1,501.50.

Platts TSI Daily Midwest HRC Index

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. Last week, the entire curve shifted significantly higher, as June through September all jumped above the $1,600 level.

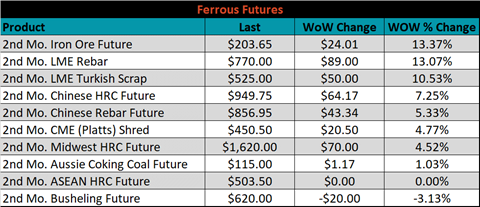

June ferrous futures were mostly higher. The iron ore future gained 13.4%, while busheling lost 3.1%.

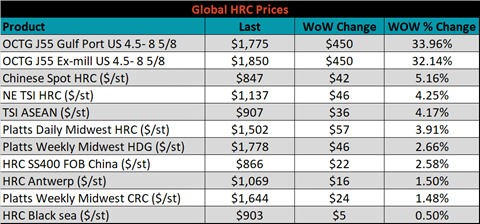

Global flat rolled indexes were all higher, led by Chinese spot HRC up 5.2% and both monthly tube prices were 32% higher than April.

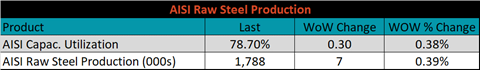

The AISI Capacity Utilization rate increased 0.3% to 78.7%.

AISI Steel Capacity Utilization Rate (orange) and TSI Daily HRC Price (white)

Imports & Differentials

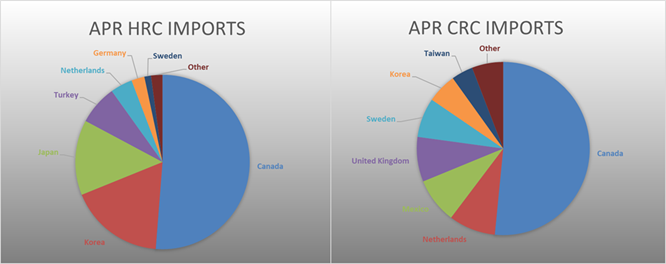

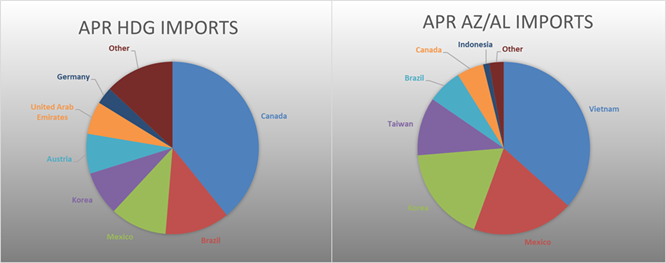

April flat rolled import license data is forecasting a decrease of 2k to 861k MoM.

All Sheet Imports (white) w/ 3-Mo. (green) & 12-Mo. Moving Average (red)

Tube imports license data is forecasting an increase of 18k to 335k in April.

All Tube Imports (white) w/ 3-Mo. (green) & 12-Mo. Moving Average (red)

All Sheet plus Tube (white) w/ 3-Mo. (green) & 12-Mo. Moving Average (red)

April AZ/AL import license data is forecasting a decrease of 2k to 106k.

Galvalume Imports (white) w/ 3 Mo. (green) & 12 Mo. Moving Average (red)

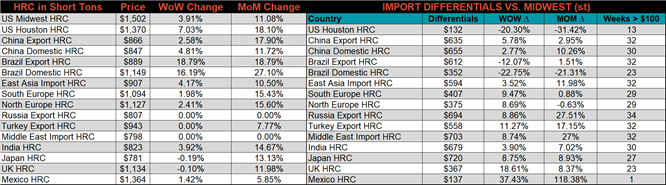

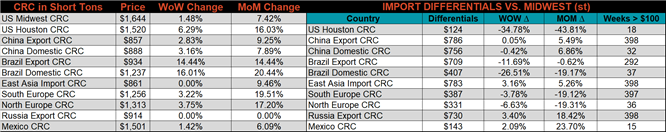

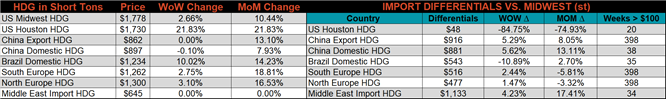

Below is April import license data through April 27, 2021.

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The differentials increased for all watched countries, as the U.S. domestic price rose more significantly that theirs.

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC, HDG & CRC prices were up, 3.9%, 2.7% and 1.5%, respectively. Globally, the Brazilian export HRC price was up 18.8%.

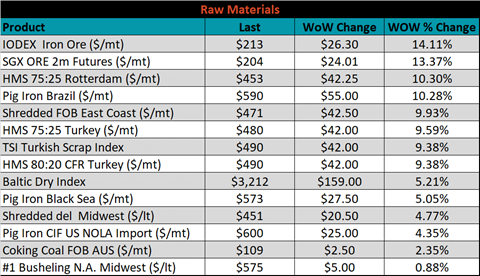

Raw Materials

Raw material prices were all higher, led by the IODEX, up 14.1%.

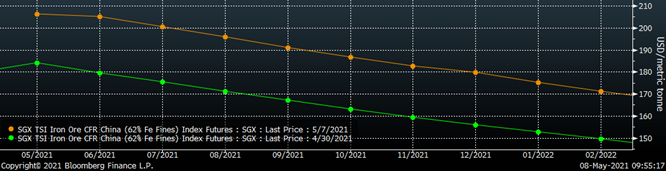

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week the curve exploded higher across the board.

SGX Iron Ore Futures Curve

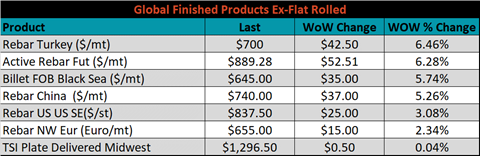

The ex-flat rolled prices are listed below.

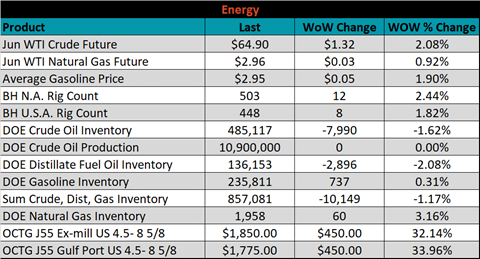

Energy

Last week, the June WTI crude oil future was up $1.32 or 2.1% to $64.90/bbl. The aggregate inventory level was down another 1.2% and crude oil production was unchanged at 10.9m bbl/day. The Baker Hughes North American rig count was up 12 rigs, and the U.S. rig count was up 8 rigs.

June WTI Crude Oil Futures (orange) vs. Aggregate Energy Inventory (white)

Front Month WTI Crude Oil Future (orange) and Baker Hughes N.A. Rig Count (white)

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

- Higher share of discretionary income allocated to goods from steel intensive industries

- Changes in China’s policies regarding ferrous markets, including production cuts and imports

- Strengthening global flat rolled and raw material prices

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Declining/low inventory levels at end users and service centers

- Broad increases in commodity prices due to a weakening US Dollar

- Limited spot transactions skewing market indexes to extreme levels

- Chinese economic stimulus measures

- Fiscal policy measures including a new stimulus and/or infrastructure package

- Low interest rates

- China strict steel capacity cuts

- Energy industry rebound

- Unexpected inflation

- Further section 232 tariffs and quotas restricting supply

Downside Risks:

- Increased domestic production capacity

- Increasing price differentials and hedging opportunities leading to higher imports

- Steel consumers substitute to lower cost alternatives

- Steel buyers and consumers “double ordering” to more than cover steel needs

- Weak labor and construction markets

- Tightening credit markets, as elevated prices push total costs to credit caps

- Reduction and/or removal of domestic trade barriers

- Supply chain disruptions allowing producers to catch up on orders

- Political & geopolitical uncertainty

- Weak global economics/PMIs

- Trade slowdown in China due to tensions with US, Hong Kong, and others

- Domestic automotive industry under pressure

- Chinese restrictions in property market

- The Chinese Financial Crisis

- Unexpected sharp China RMB devaluation