Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

There will not be a new report next week. The next report will be published the week of Monday, November 29th, 2021.

The gap between mill offers and what buyers are willing to pay continued to expand, this week, as neither side appears eager to bridge the gap going into the end of the year. Bargaining power today is clearly on the side of buyers and we anticipate that this will cause prices to continue their decline. The only question that remains is what the pace of the decline is going into next year. In the remainder of this week’s report, we will take a step back and look at how recent trade negotiations and the global push towards greener steel is going to impact prices in our market going forward.

Two weeks ago, the WoW report focused on the E.U. and U.S. trade agreement. Since then, further developments between the U.S. and Japan clearly show that a new regime is taking hold, where protection of domestic industry is prioritized, while restrictions on trade ease. Time after time, language in every news release specifically references overcapacity as the most serious threat to the global steel market. While this is an obvious gesture towards China, the world’s largest producer, there is another layer to it as well. The E.U. has also proposed carbon border adjustment taxes on imports of iron, steel, aluminum, and other products (starting in 2026). While there is not currently enough political appetite for that type of legislation in the U.S., each of the major domestic mills are proactively using significant portions of their record earnings to reinvest in ensuring that U.S. domestic production is the greenest, globally. Policy shifts, and private investments at this scale are not done on a whim, and there will be seen and unforeseen consequences.

The most obvious result is a global move towards EAF production, this is an area where the U.S. has been ahead of the rest of the world, but everyone else is working to catch up. Outside of lower emissions, the most valuable benefit from EAF production has been the lower average input cost. This is because EAF’s costs are based primarily off a blend of steel scrap which are highly correlated to steel prices, compared to BOF’s, which are largely fixed, this had allowed EAF’s to offer lower prices and capture increased market share. However, as the world transitions towards EAF production and requires more scrap to do so, scrap prices will increase, causing the gap between BOF and EAF profitability to shrink.

China is a wild card in this arena. Early in the year the party announced that it would also be transitioning away from BOF production to dramatically curb its pollution output. Additionally, they have consistently placed roadblocks in front of exporters this year, starting with the removal subsidies and then going as far as imposing taxes on steel leaving the country. Both moves on the surface appear to be responses to the global concerns around overcapacity and emissions, but neither the U.S. nor E.U. have signaled any willingness to reopen free-trade agreements with China. No matter how global dynamics with China play out, if they follow through with a large scale move towards EAF production, there will not be enough global scrap supply available to satisfy the projected global demand for it. This is another example of China’s impact on the steel market. Even with safeguards in place and their steel never landing on the shore, fluctuations in the Chinese demand for inputs on the global market will reverberate around the globe.

Over the coming months, fundamental drivers of the physical market, which were overridden by the need for steel, will once again require monitoring. One of the most important relationships, historically, are global price differentials. Because of this, we anticipate the continued convergence of global prices, well into the first half of next year as supply chain tightness eases. However, the developments in trade and the global push for greener steel, highlighted above, will create a higher global floor for HRC prices in the future. This will be even more so the case as the E.U. moves forward on carbon border adjustment taxes and the world follows suit. Additionally, as a larger portion of global steel is produced by EAF’s the relative ease at which these mills can slow down and speed up production according to changes in supply and demand should lead to less overproduction and exports. To be clear, as more of these changes are enacted, the steel market will irreversibly change, which suggests that a full reversion to historical norms is increasingly unlikely. The dynamics highlighted in this report were always going to occur, however, fallout from pandemic and the subsequent rally in prices accelerated the timeline.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

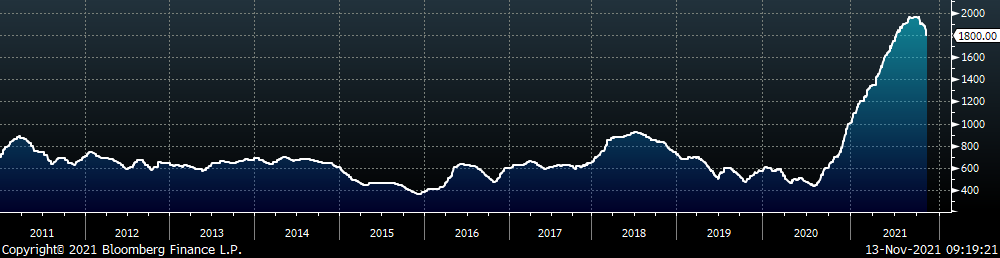

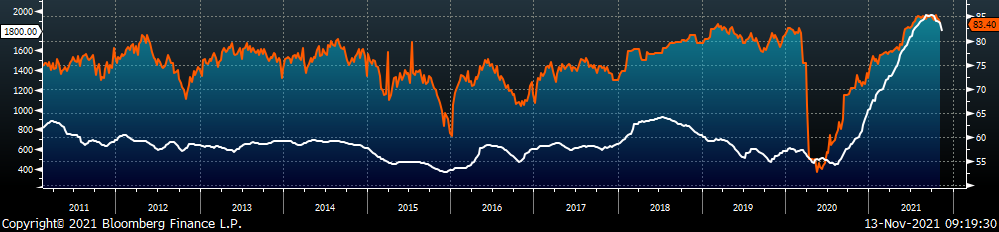

The Platts TSI Daily Midwest HRC Index decreased by $80 to $1,800.

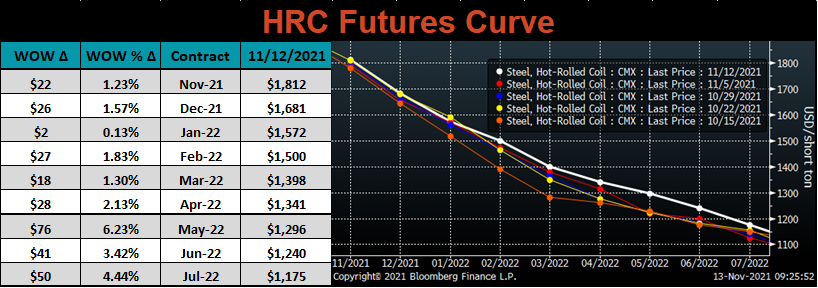

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. Last week, the entire curve was higher, most significantly 2Q22 and beyond.

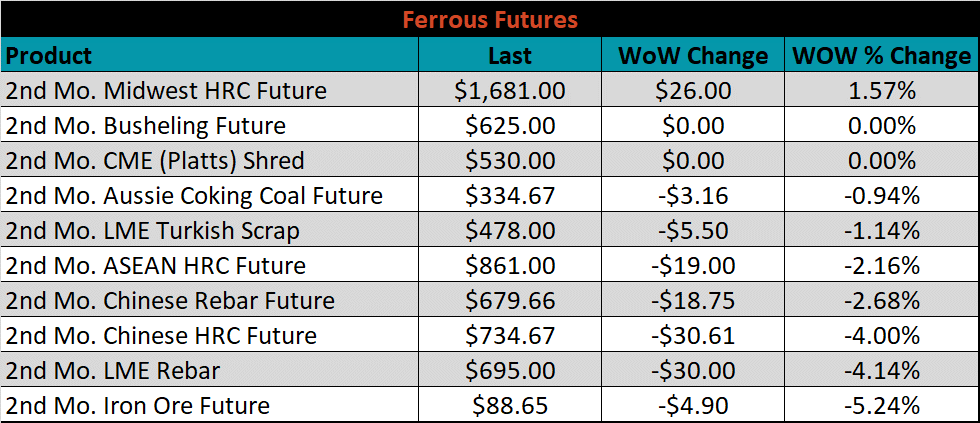

December ferrous futures were mostly lower, led by iron ore which lost another 5.2%. Midwest HRC was the only future to increase, it gained 1.6%.

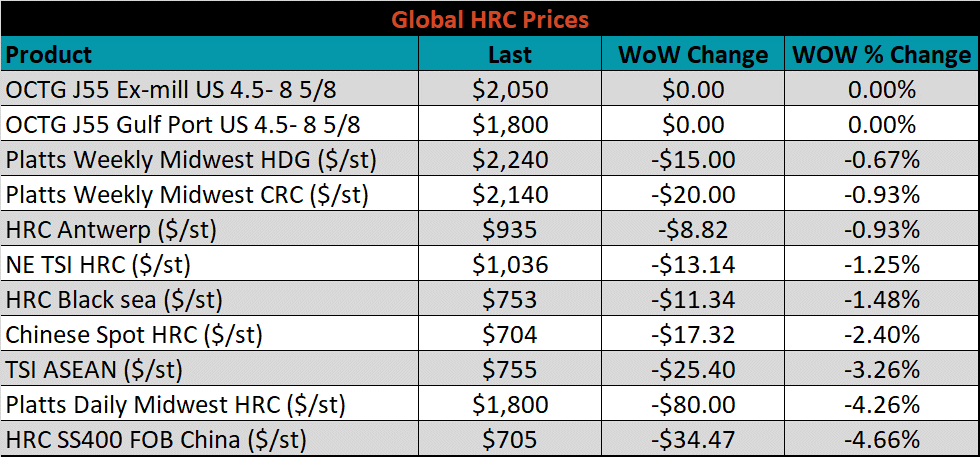

Global flat rolled indexes were all lower, led by the Chinese HRC export price, down another 4.7%.

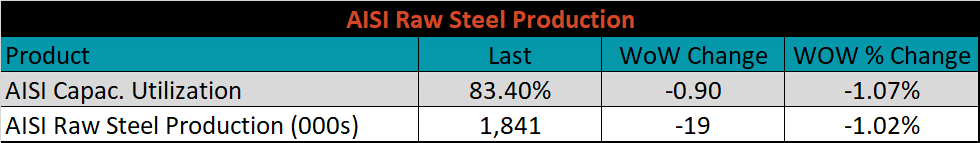

The AISI Capacity Utilization was down another 0.9% to 83.4%.

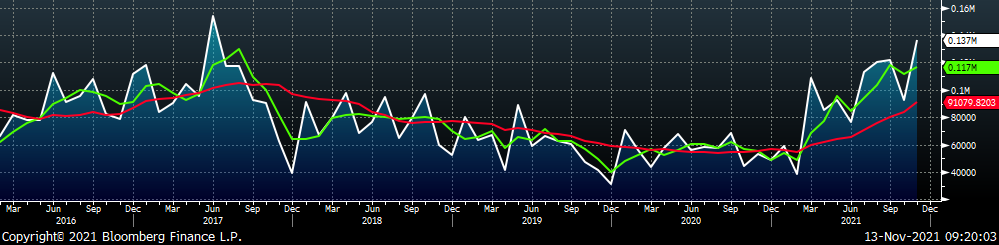

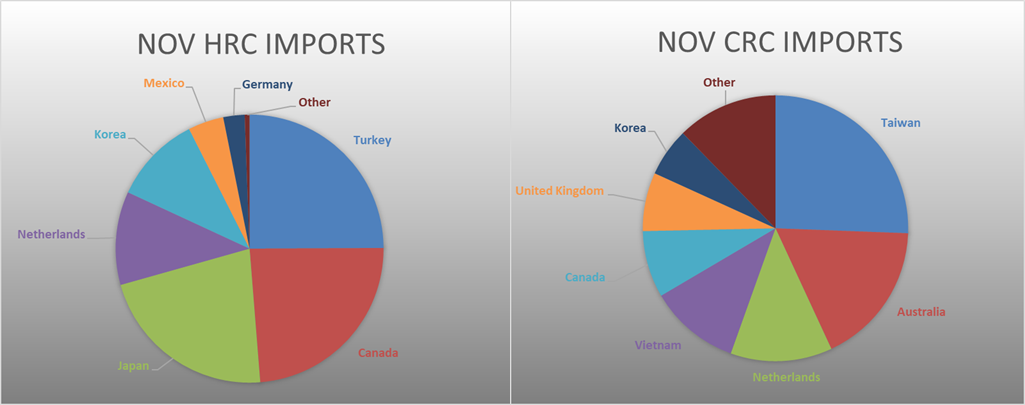

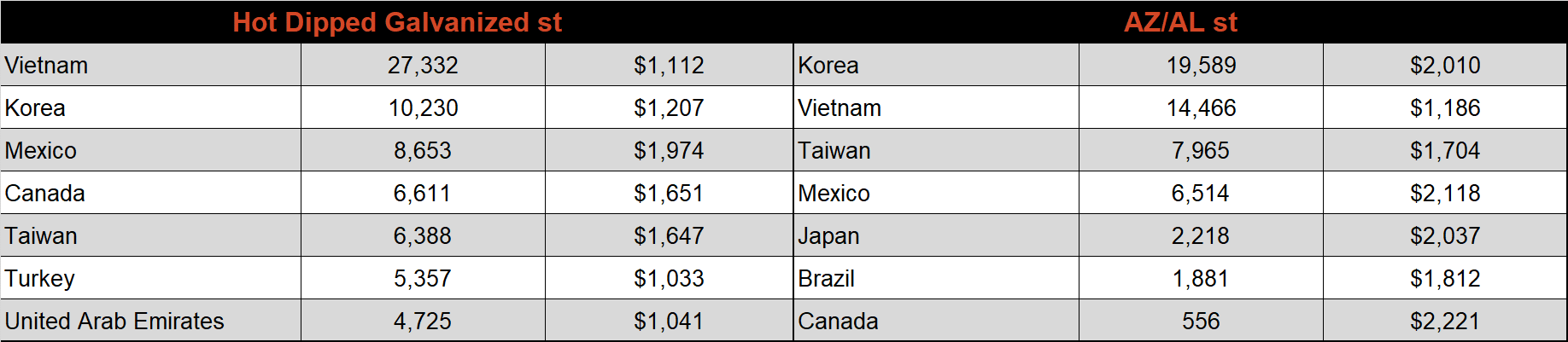

November flat rolled import license data is forecasting a decrease of 93k to 1,011k MoM.

Tube imports license data is forecasting an increase of 128k to 451k in November.

November AZ/AL import license data is forecasting an increase of 44k to 137k.

Below is October import license data through November 8th, 2021.

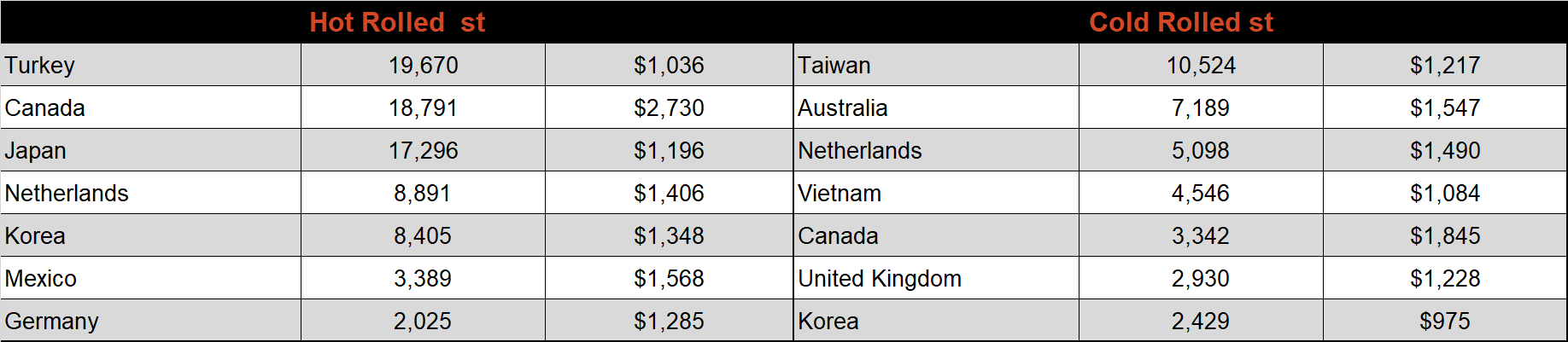

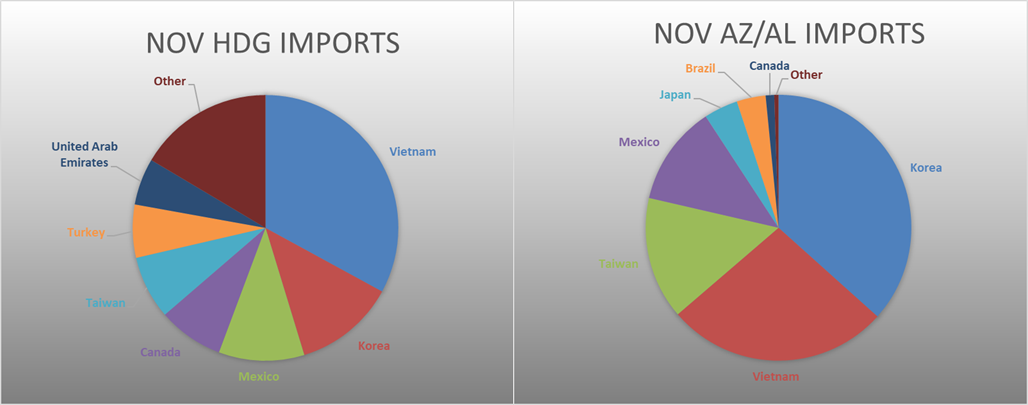

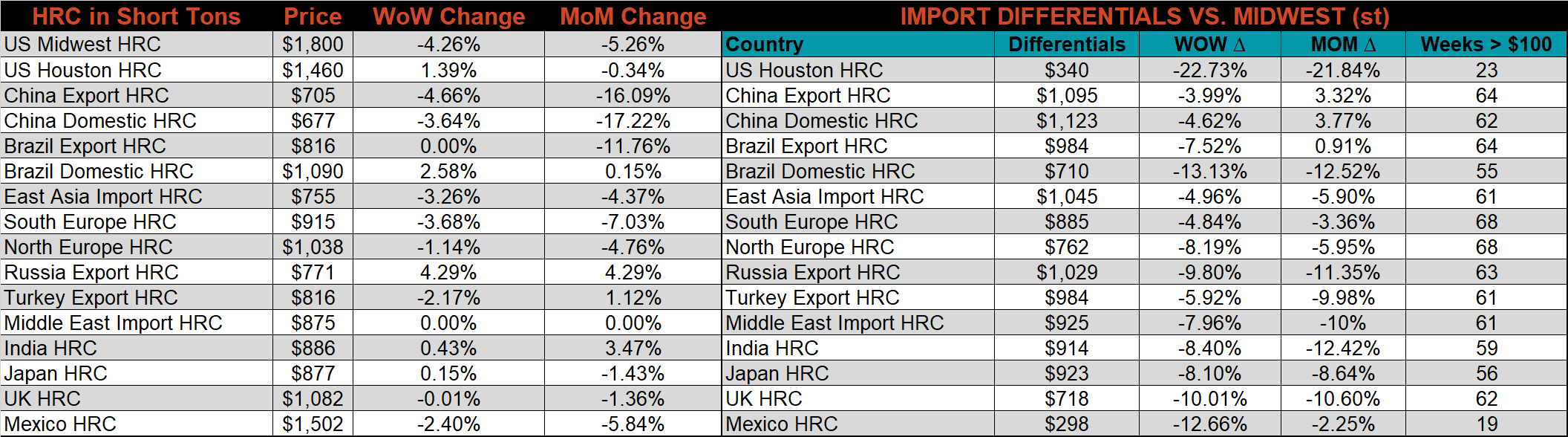

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. All the differentials moved sharply lower this week as the Midwest HRC price fell more significantly than any other global prices.

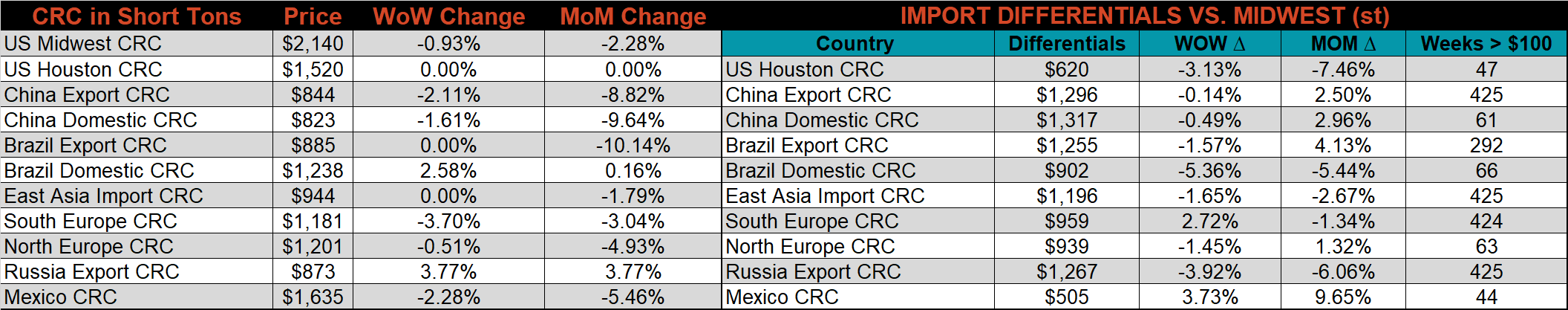

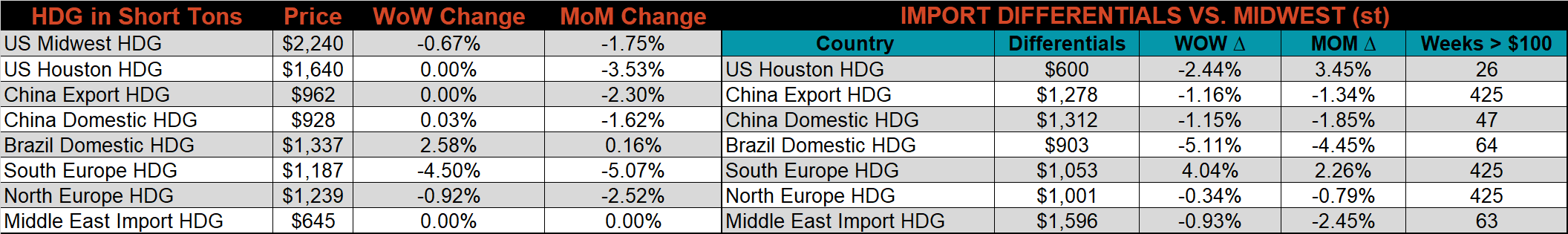

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC, CRC and HDG prices were all lower this week, down 4.3%, 0.9% and 0.7%, respectively. Outside of the U.S., the Chinese and Russian HRC export prices were down 4.7% and 4.3%, respectively.

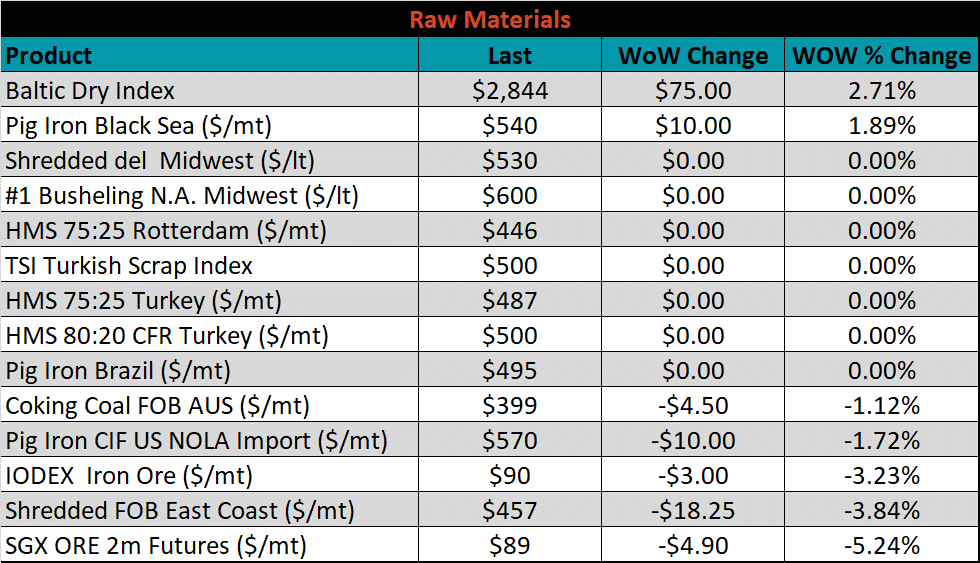

Raw material prices were mixed. The December iron ore future was down another 5.2%, while Black Sea pig iron was up 1.9%.

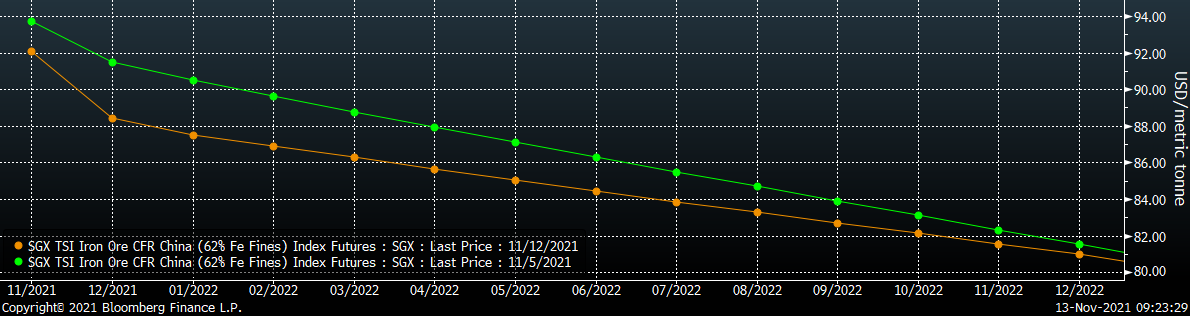

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve was shifted lower, most significantly in the front month expirations.

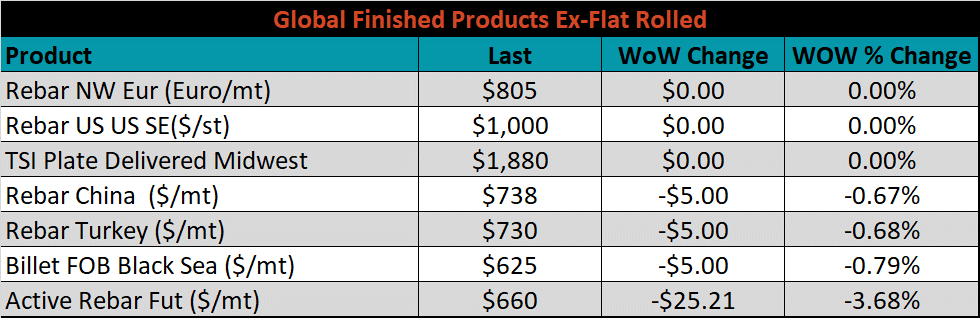

The ex-flat rolled prices are listed below.

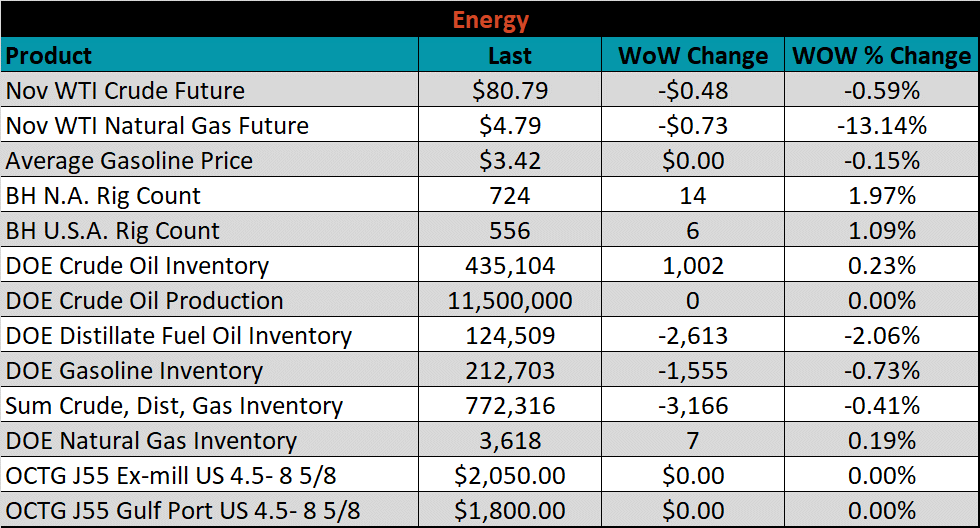

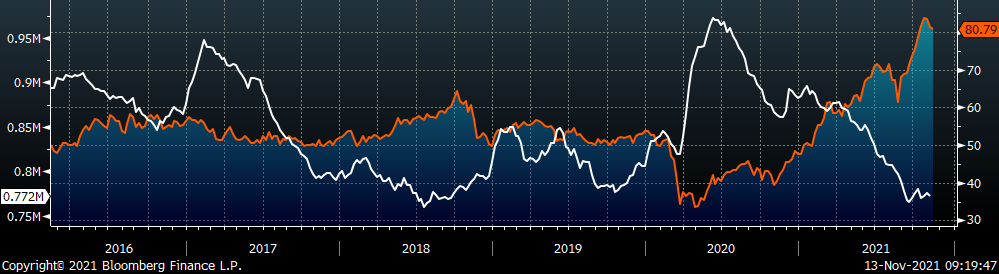

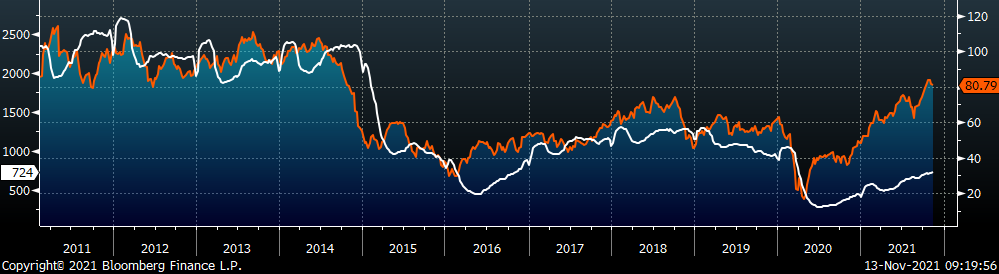

Last week, the November WTI crude oil future was down another $0.48 or 0.6% to $80.79/bbl. The aggregate inventory level was down 0.4%, while crude oil production remains at 11.5m bbl/day. The Baker Hughes North American rig count was up 14 rigs, while the U.S. rig count was up another 6 rigs.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: