Content

-

Weekly Highlights

- Market Commentary

- Risks

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

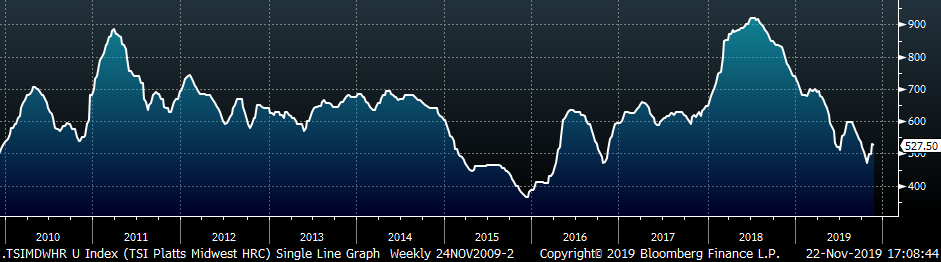

The Platts TSI Daily Midwest HRC Index was down $2.75 to $527.50.

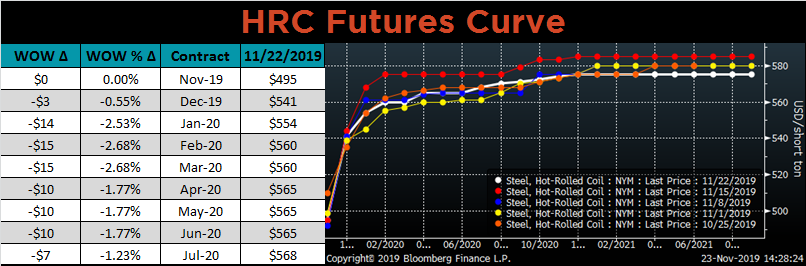

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The curve shifted lower across all expirations and remains flat in 2020 near $570.

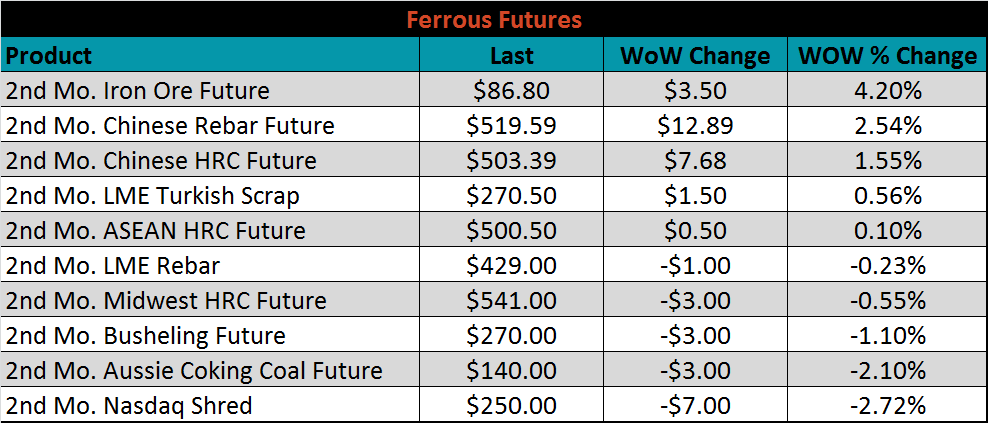

December ferrous futures were mixed. The iron ore future gained 4.2%, while the Nasdaq shred future lost 2.7%.

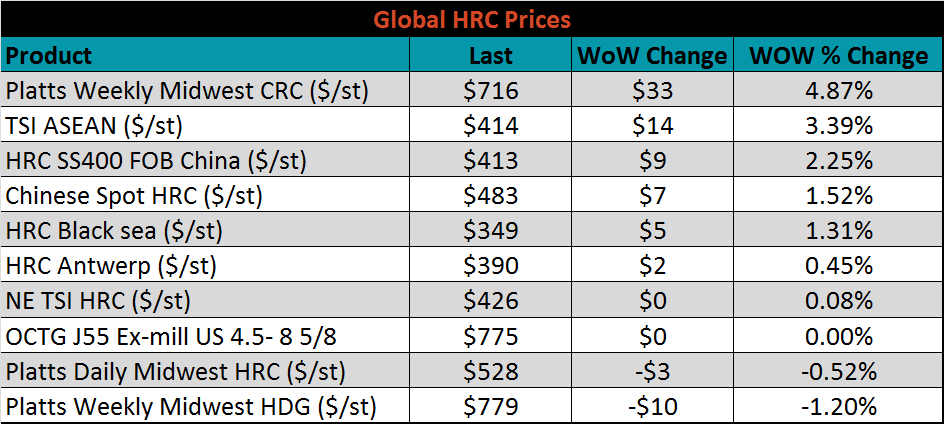

The global flat rolled indexes were mostly higher. Midwest TSI CRC was up 4.9%, while Midwest TSI HDG was down 1.2%.

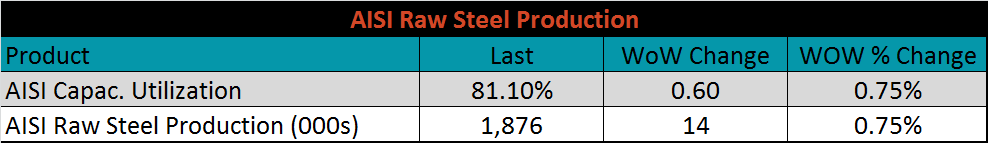

The AISI Capacity Utilization Rate was up 0.6% to 81.1%.

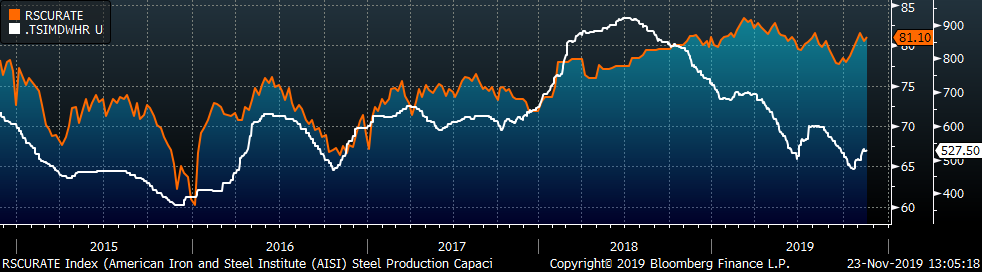

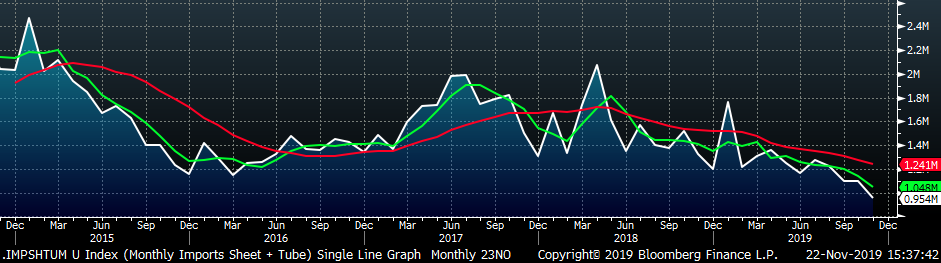

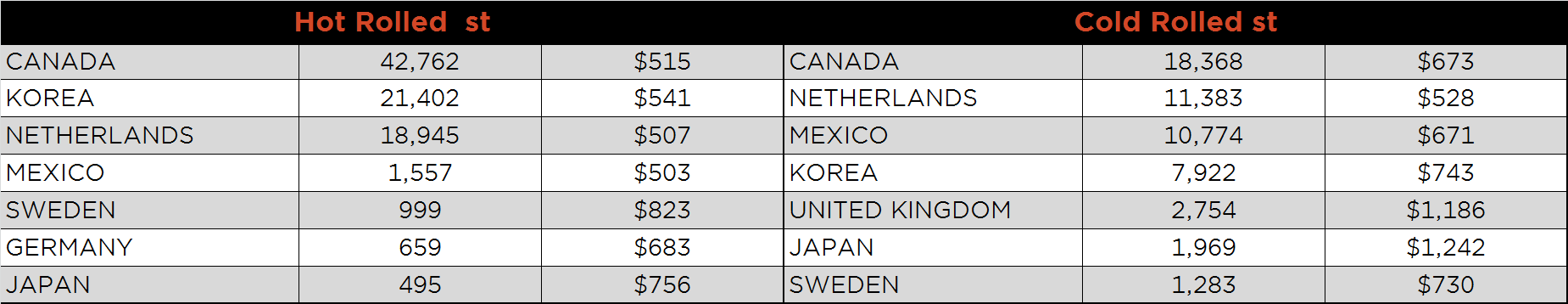

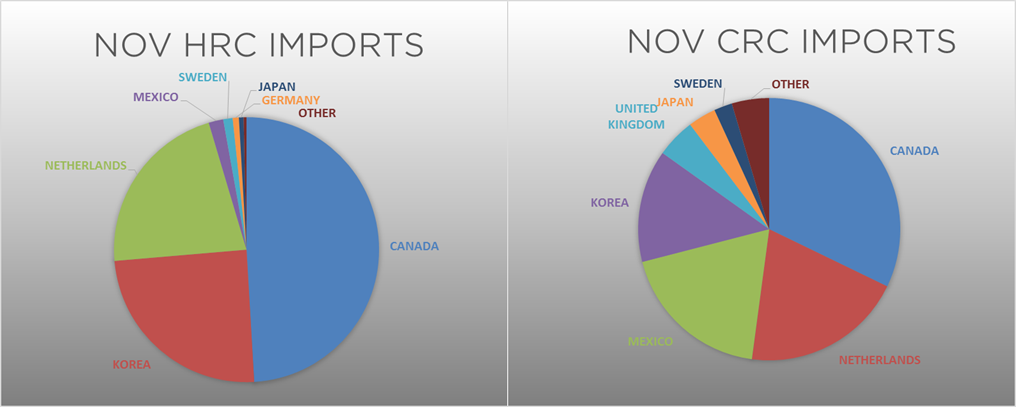

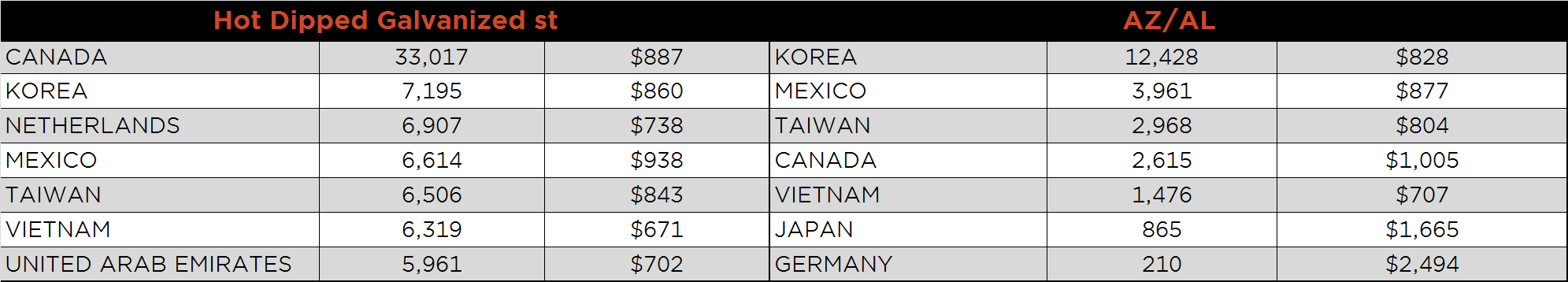

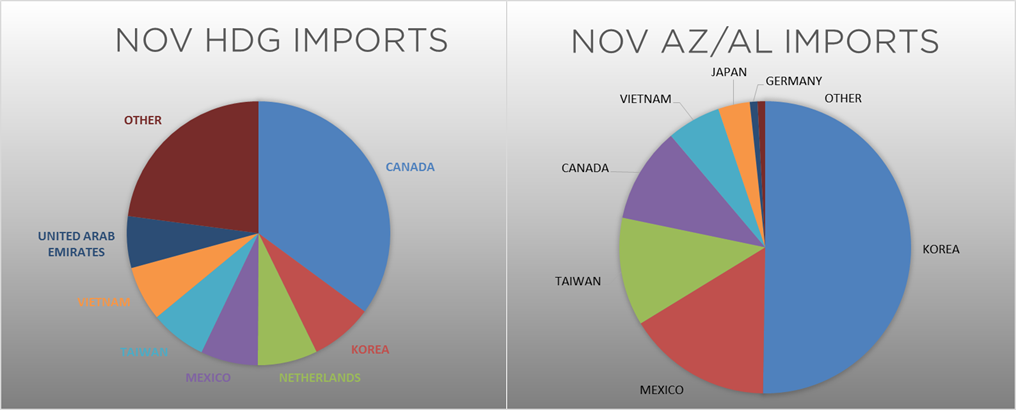

November flat rolled import license data is forecasting a decrease of 160k to 584k MoM.

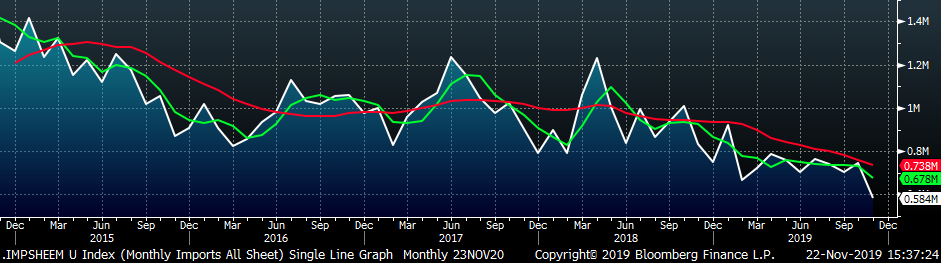

Tube imports license data is forecasting a MoM increase of 19k to 370k tons in November.

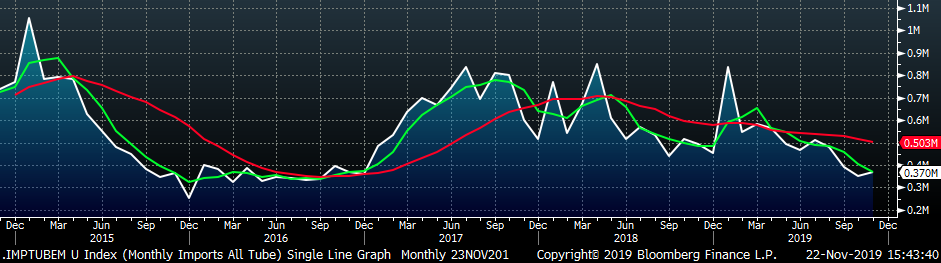

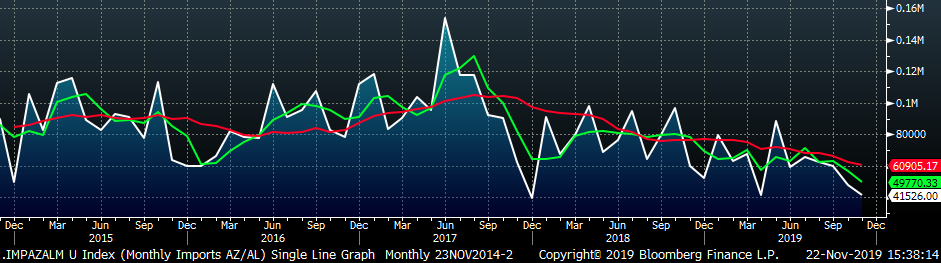

AZ/AL import license data is forecasting a decrease of 6k in October to 56k.

Below is October import license data through November 19, 2019.

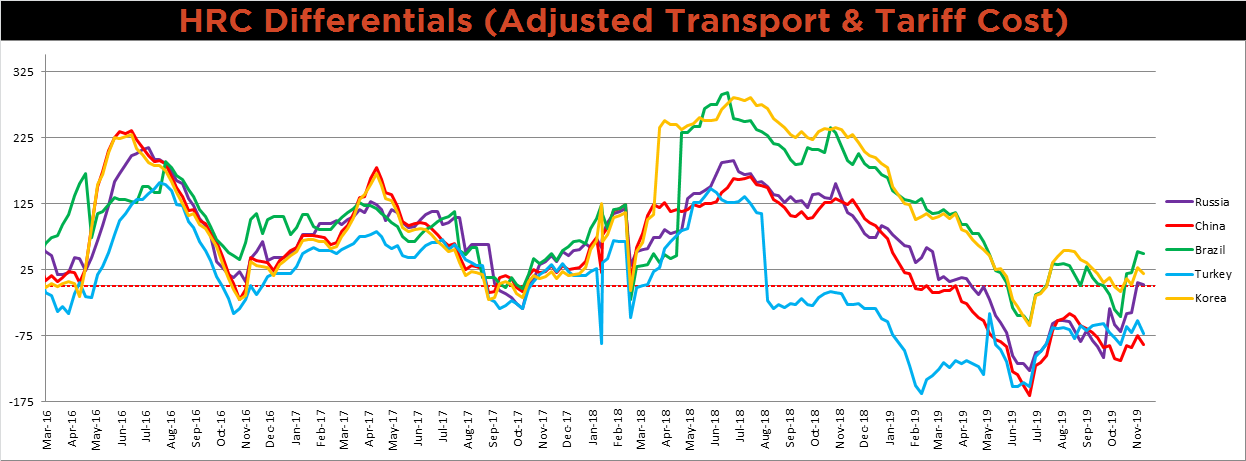

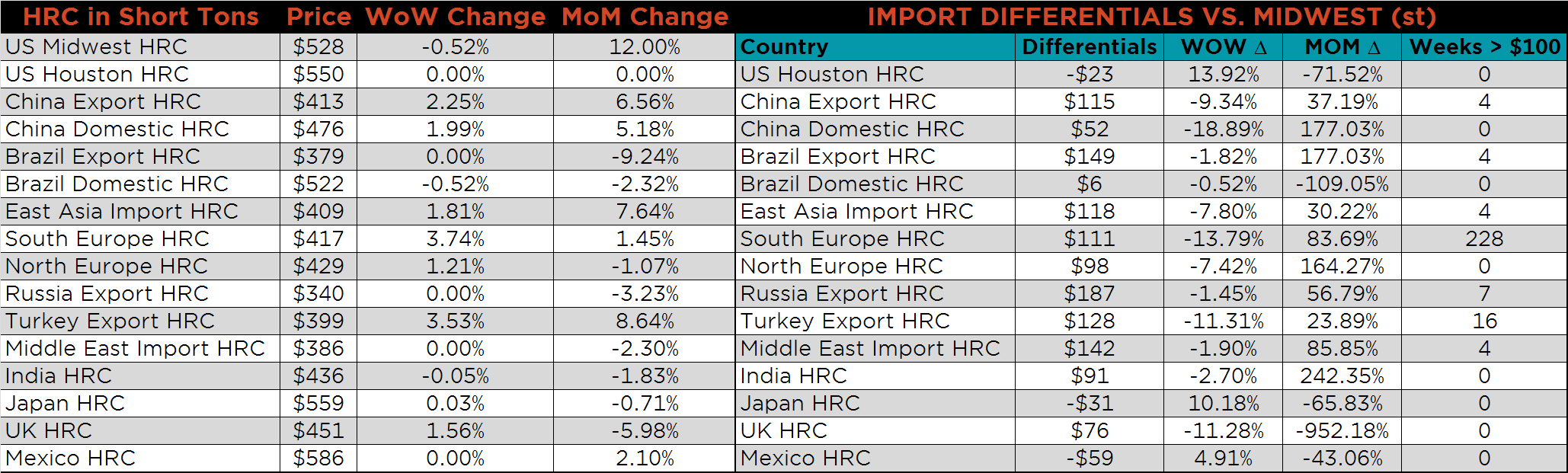

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The Midwest HRC price moved slightly lower, pulling all the global differentials slightly lower.

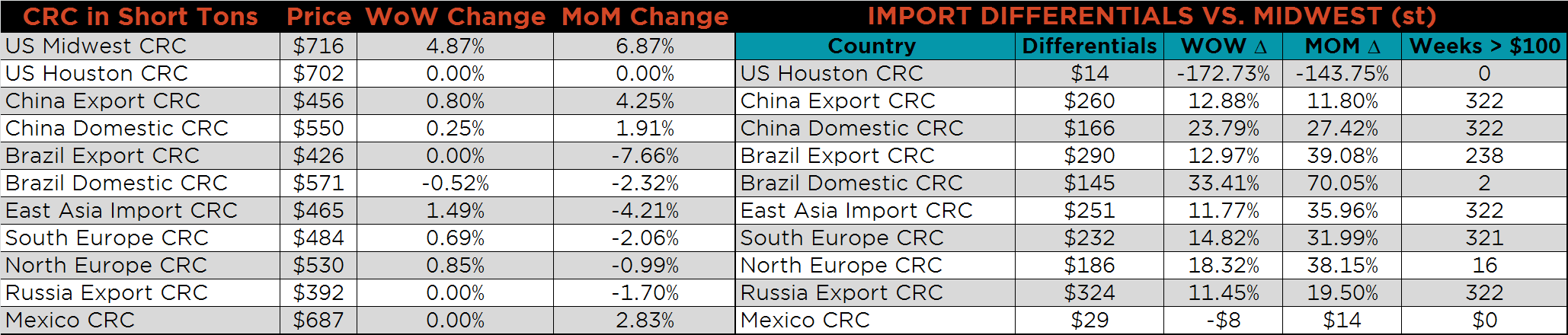

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest CRC price was up 4.9%, while the HDG and HRC prices were down 1.2% and 0.5%, respectively. Globally, the Turkish and Chinese HRC export prices were up, 3.5% and 2%, respectively.

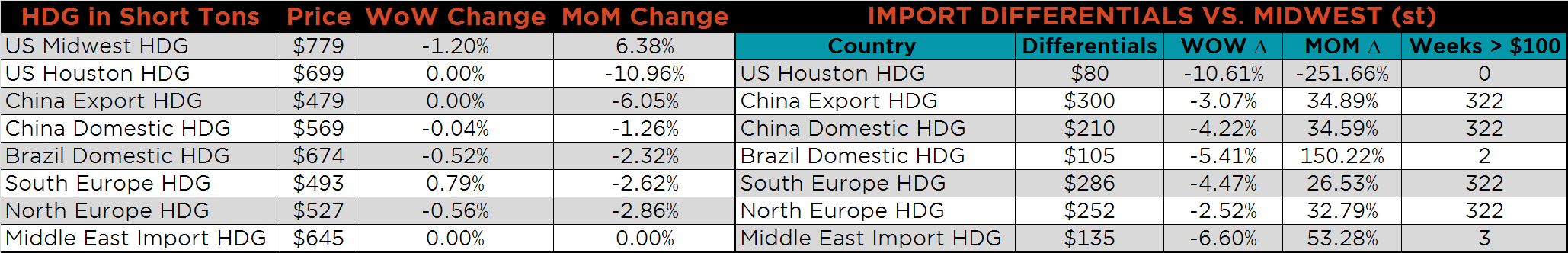

Raw material prices were mostly higher, led by the SGX ore futures, which gained another 4.2%, while Australian coking coal was down 1.7%.

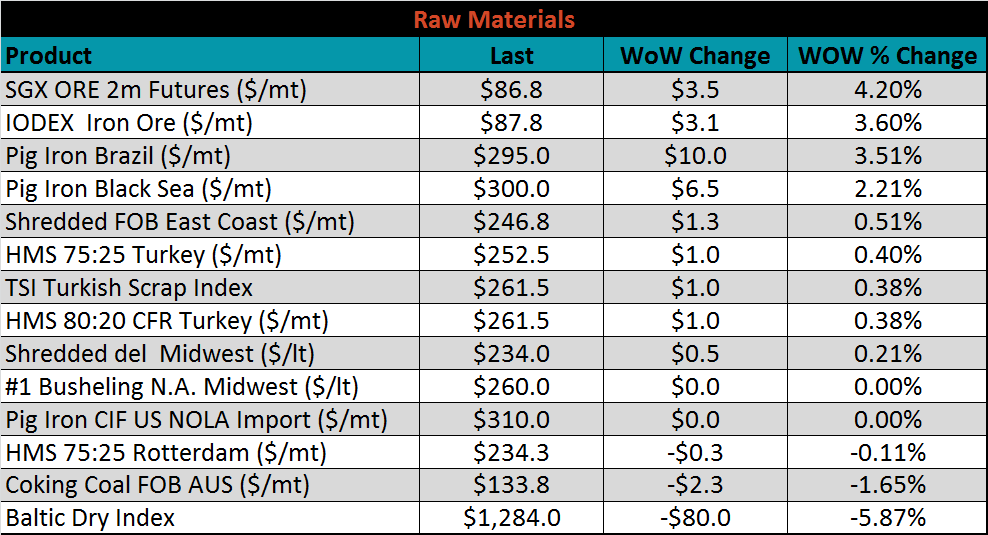

Below is the iron ore future curve with Friday’s settlments in orange, and the prior week’s settlements in green. The curve shifted higher across all expirations again this week, most significantly in the front.

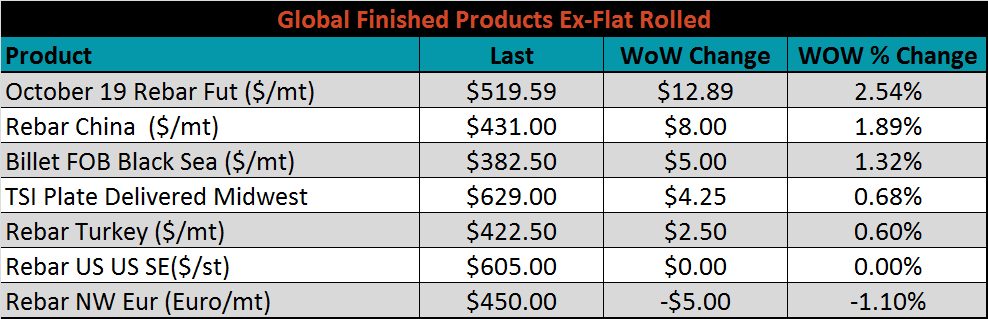

The ex-flat rolled prices are listed below.

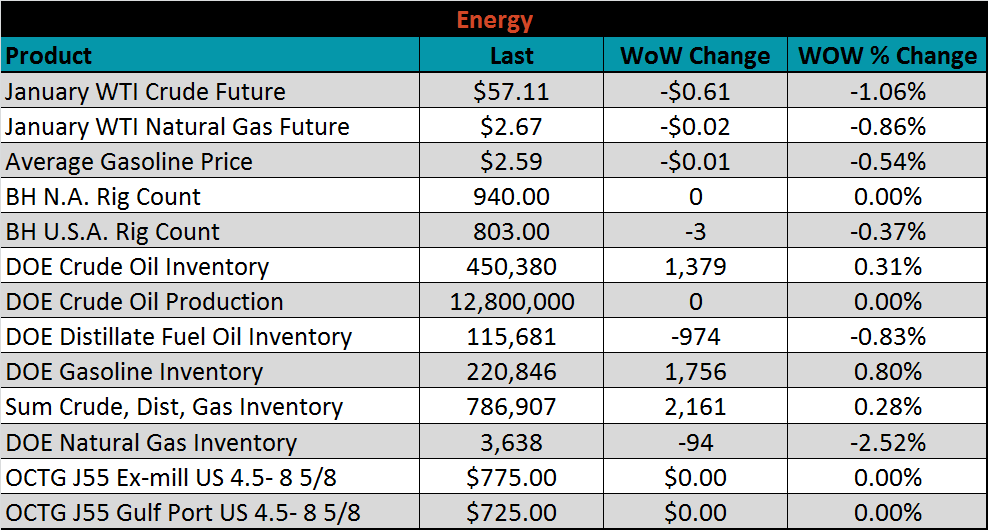

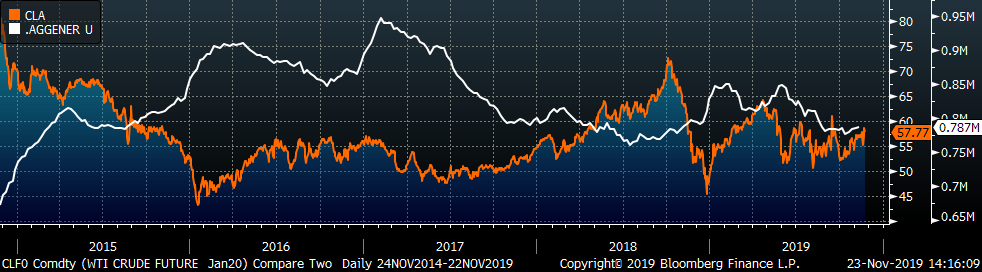

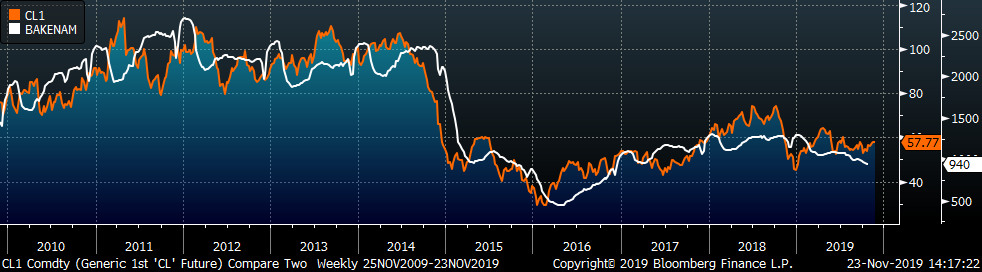

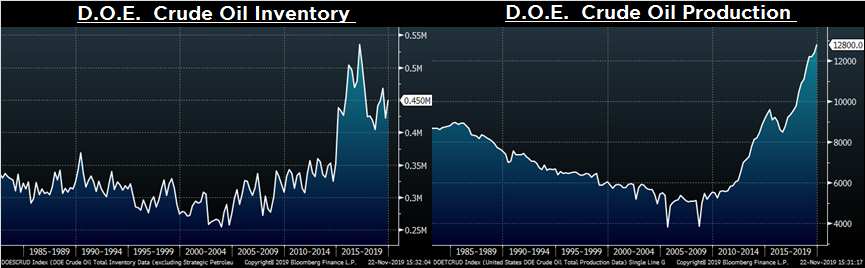

Last week, the January WTI crude oil future lost $0.61 or 1.1% to $57.11/bbl. The aggregate inventory level was up 0.3% and crude oil production remains at 12.8m bbl/day. The Baker Hughes North American rig count was flat, while the U.S. count lost three rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: