Content

-

Weekly Highlights

- Market Commentary

- Risks

Over the last two weeks, there have been several news stories hitting the headlines, all resulting in strengthening bullish sentiment in ferrous markets. Domestic mills pushed a third price increase announcement, led by US Steel’s $30 increase on the Friday before Thanksgiving. Over the holiday weekend, US Steel’s Gary Works facility suffered flooding from a water pipe leak, causing an unplanned outage. Finally, President Trump tweeted that steel and aluminum tariffs would once again be placed on Brazil and Argentina because of the depreciation of their currencies. These stories should remind us that accurately predicting the market price is impossible, and uncontrollable events, such as weather, equipment malfunctions, geo-politics and even tweets, pose significant price risk, especially to the upside. It ADDS risk to your business if you are not hedging against them.

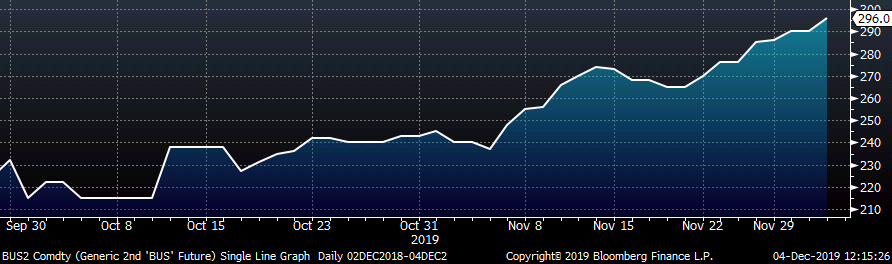

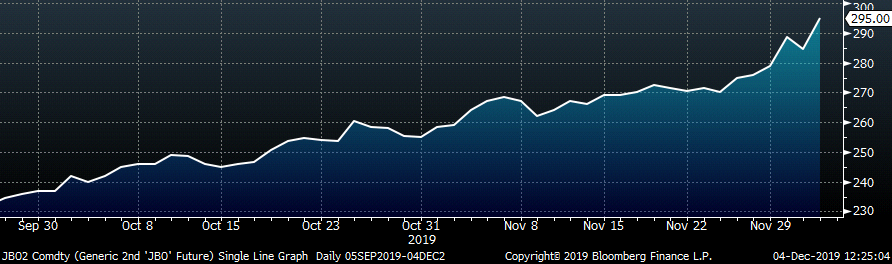

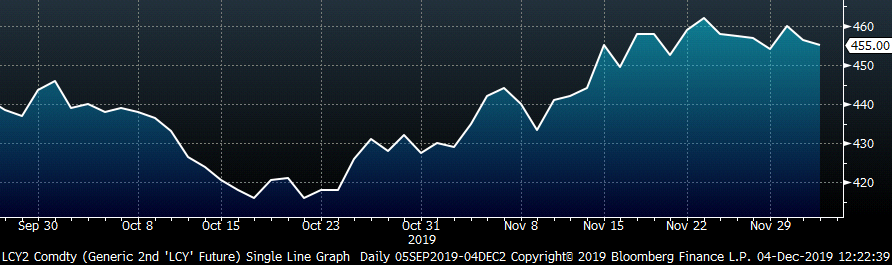

The immediate price reaction to the above headlines was subdued as the price increase announcement was expected, the outage duration is expected to be short and minimal in terms of tonnage, and annual quotas have reduced Brazilian slab imports through year-end. However, spot prices continue to grind higher, and mills are now asking for $600/st for HRC, over $150 increase from the spot price in October. A driver of the recent domestic price rally is the strength in raw material and global ferrous prices. Below are charts of busheling scrap, Turkish scrap and China HRC showing similar price rallies over the last two months.

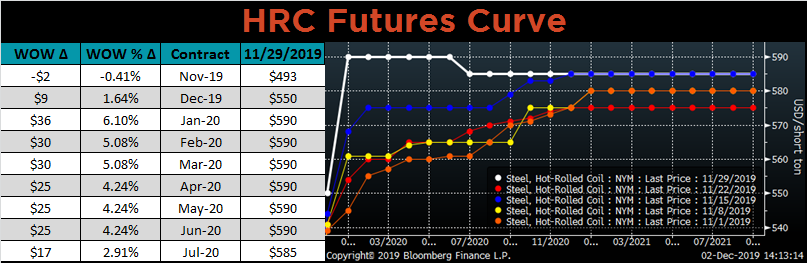

The strength in these prices, as well as prices in Europe and CIS, supports the move higher in domestic flat rolled prices, and encourages further price increases. The HRC futures curve (below) is currently displaying these optimistic expectations, with all of 2020 priced just below $600. With spot and future prices at similar levels, the curve presents a great opportunity for buyers looking into 2020 to hedge against prices increasing again from the current levels.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

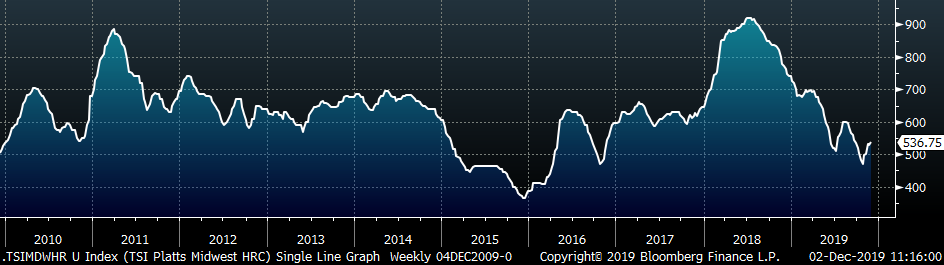

The Platts TSI Daily Midwest HRC Index was up $9.50 to $536.75.

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The curve shifted significantly higher in the front, but remained relatively flat in the back, shifting into slight backwardation in the second half of 2020.

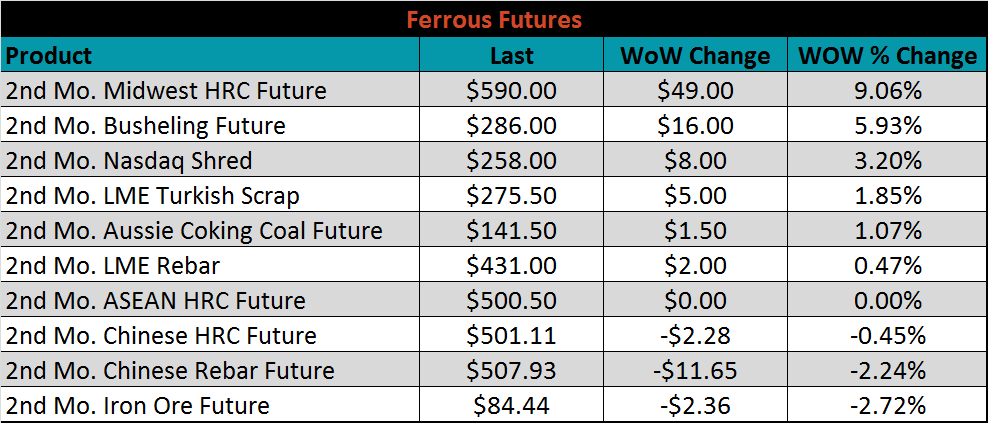

January ferrous futures were mixed. The Midwest HRC future gained 9.1%, while the iron ore future lost 2.7%.

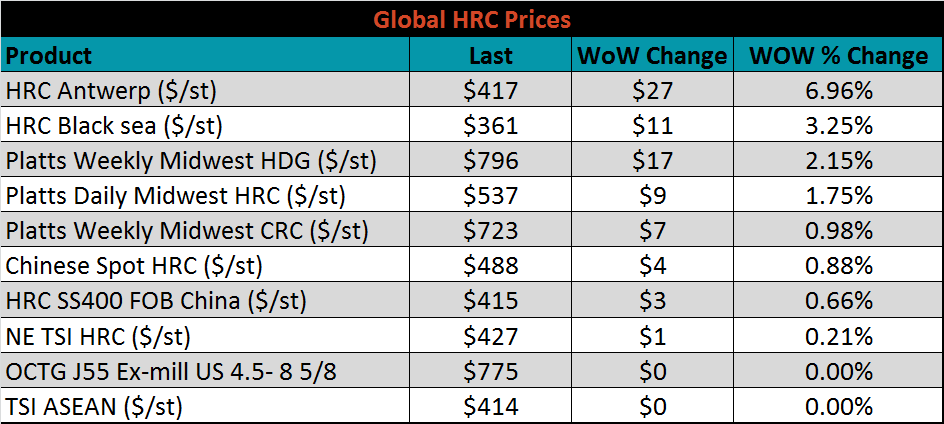

The global flat rolled indexes were mostly higher, led by Antwerp HRC was up 7%.

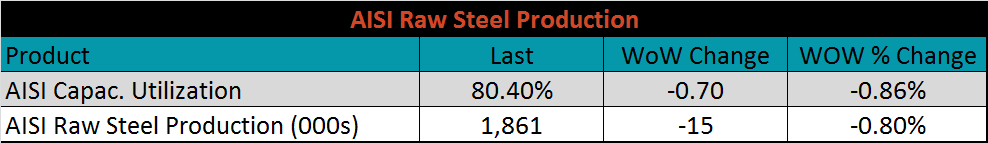

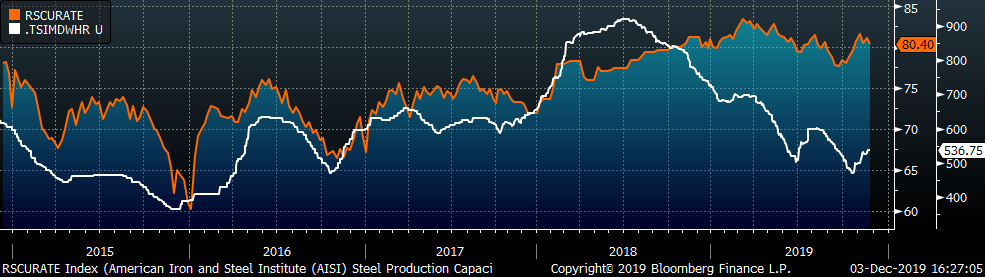

The AISI Capacity Utilization Rate was down 0.7% to 80.4%. The 80% goal set by the Trump administration continues to hold, with a year-to-date average of 80.8%.

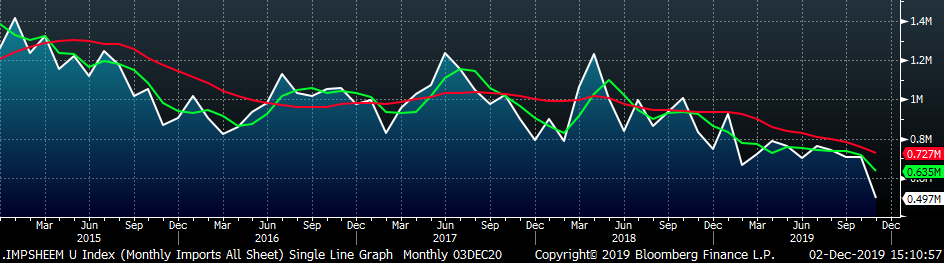

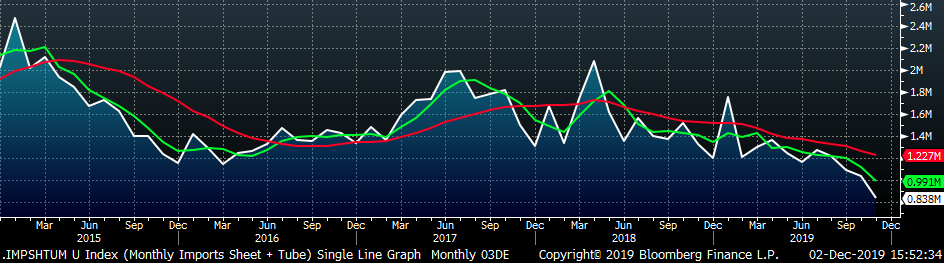

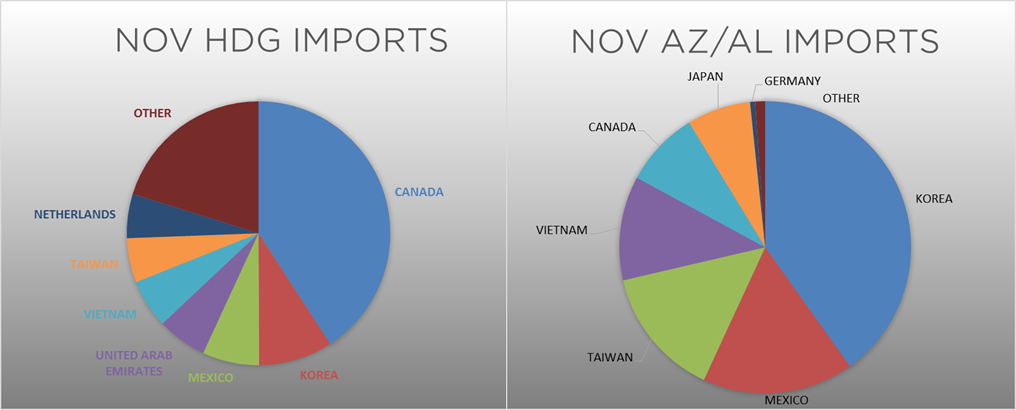

November flat rolled import license data is forecasting a decrease of 206k to 497k MoM.

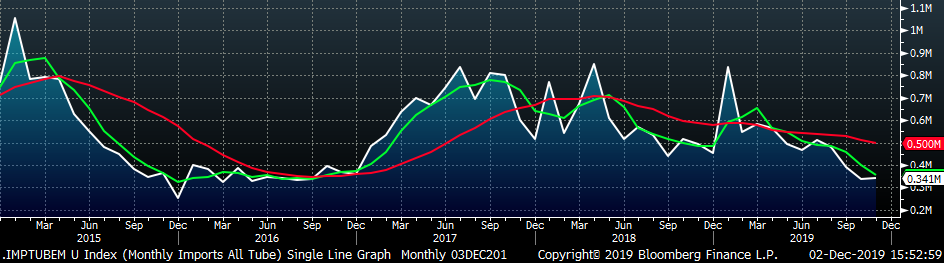

Tube imports license data is forecasting a MoM increase of 4k to 341k tons in November.

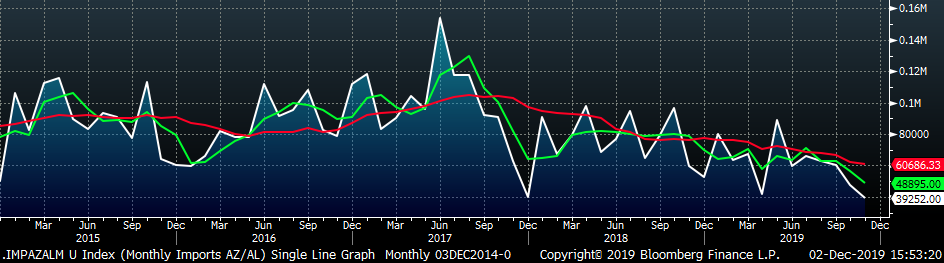

AZ/AL import license data is forecasting a decrease of 8k in October to 39k.

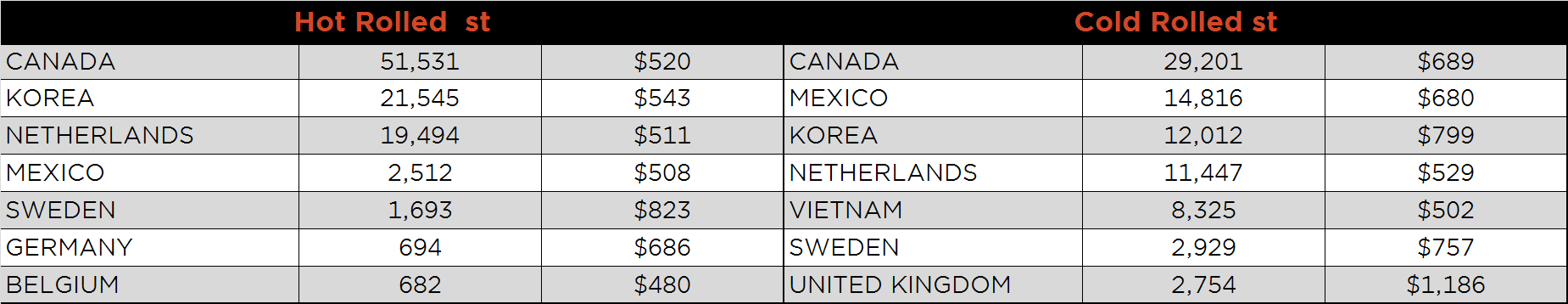

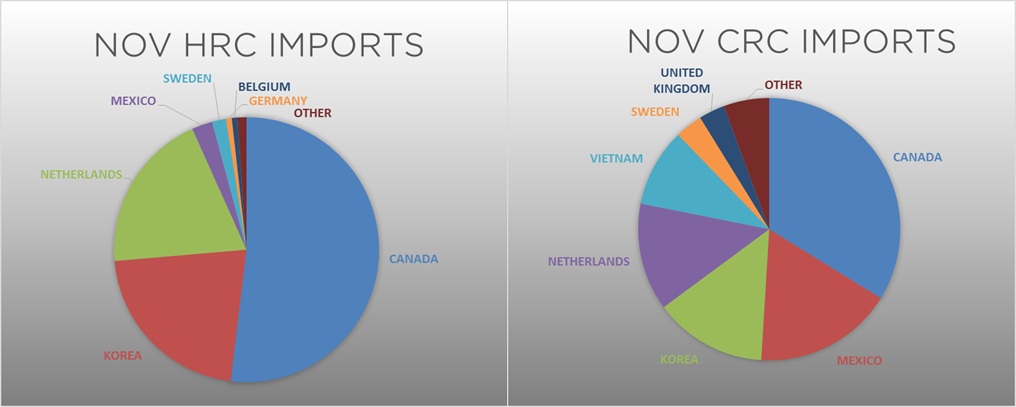

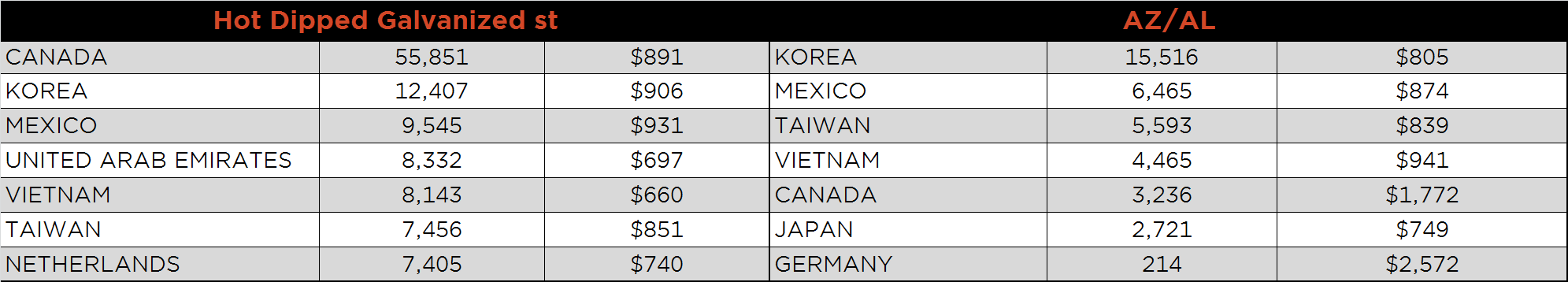

Below is October import license data through November 27, 2019.

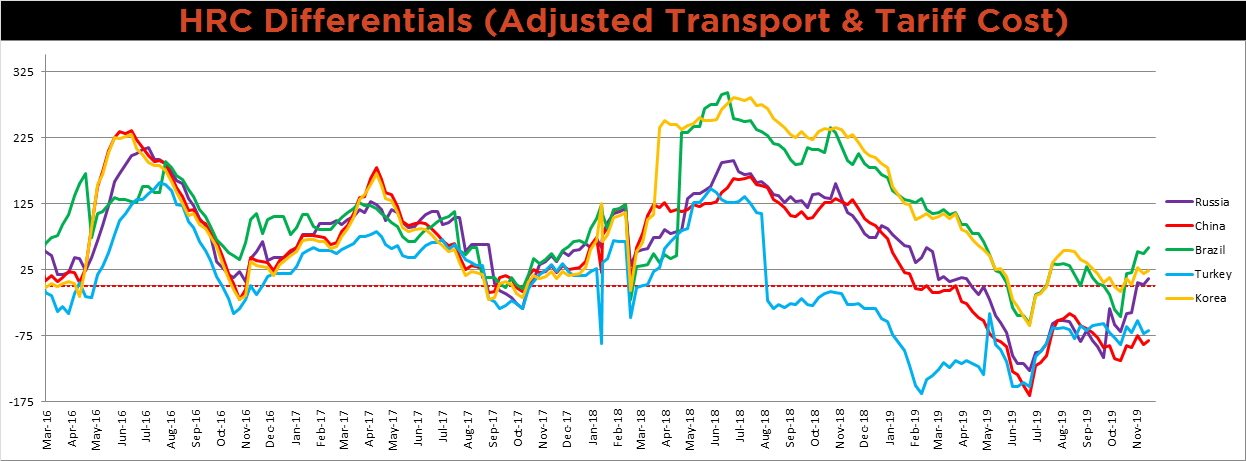

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The Midwest HRC price was up, increasing all the global differentials.

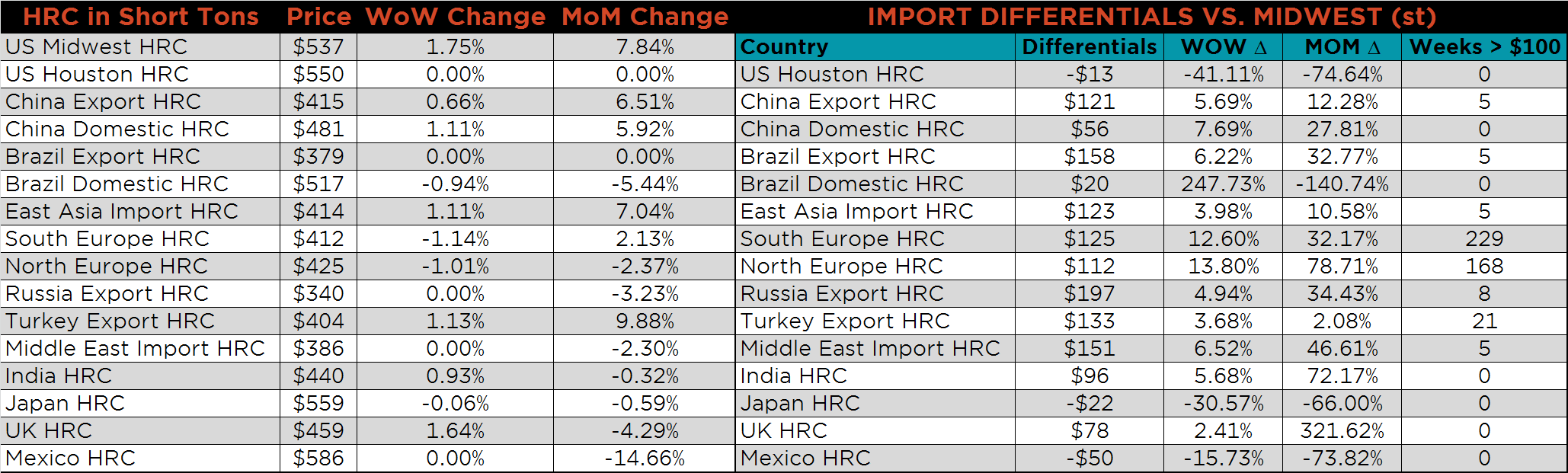

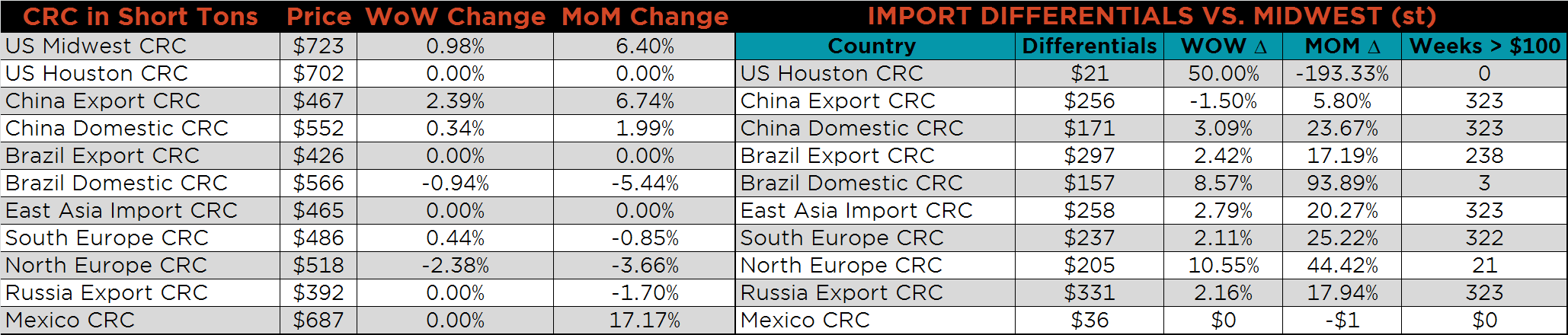

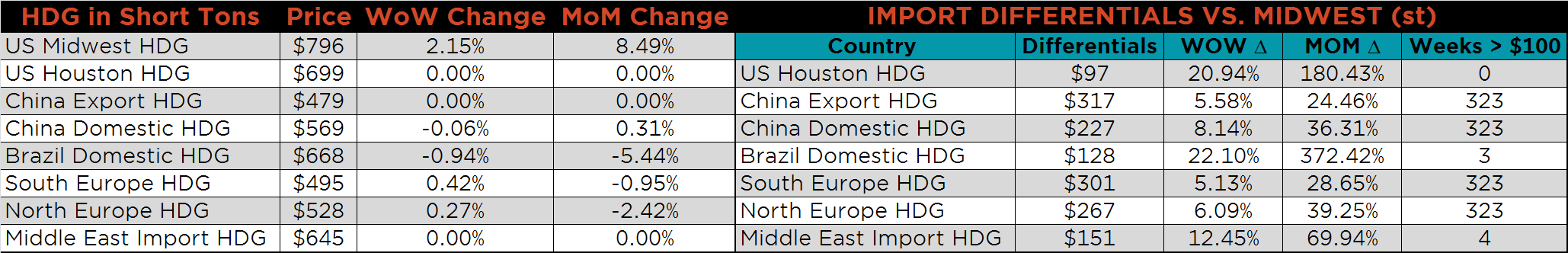

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HDG, HRC and CRC prices were all up, 2.2%, 1.8% and 1% higher, respectively. Globally, the Chinese HRC and Turkish HRC export prices were up, 2.4% and 1.1%, respectively.

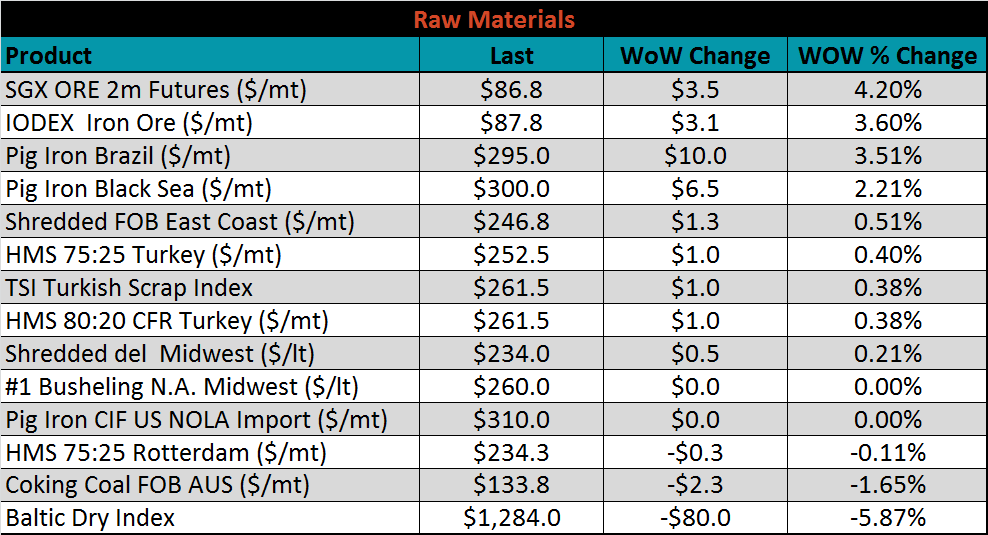

Raw material prices were mostly higher. Rotterdam HMS was up 3.8%, while January SGX iron ore futures lost 2.7%.

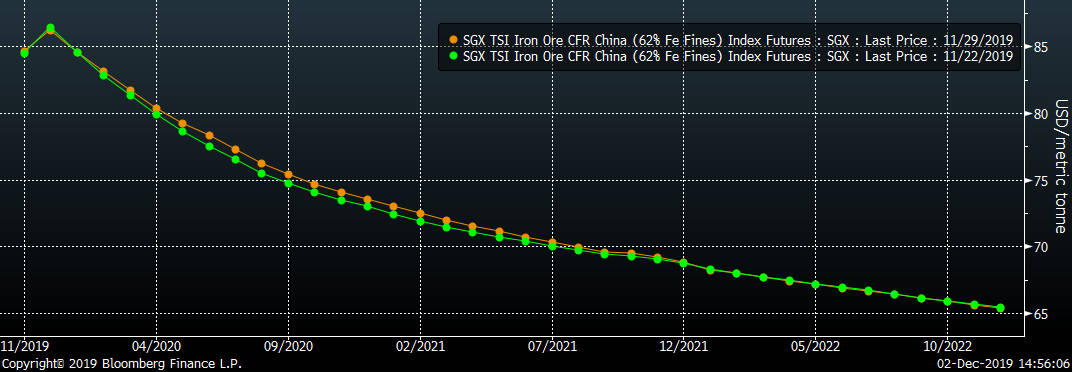

Below is the iron ore future curve with Friday’s settlments in orange, and the prior week’s settlements in green. The curve shifted slightly higher.

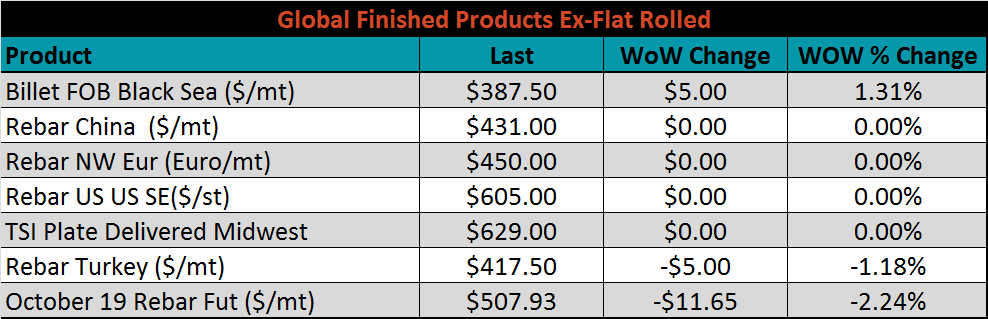

The ex-flat rolled prices are listed below.

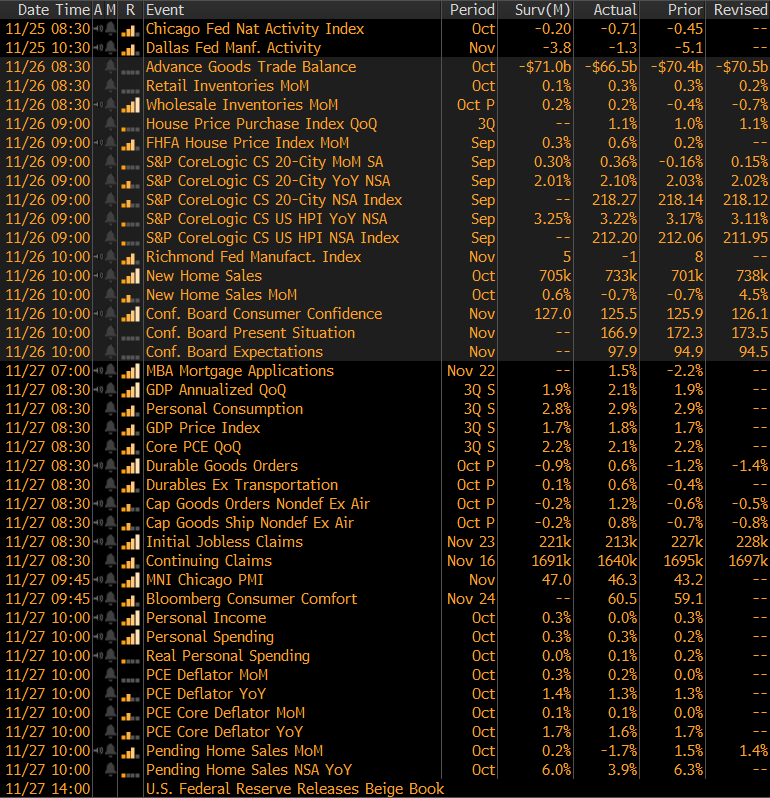

The remaining significant economic data is to the right. This week, the preliminary Durable Goods report for October came in above expectations of -0.9% at 0.6%. Additionally, we had two regional manufacturing indexes print their November reading. Dallas was above the expectations of -3.8, while still printing negative at -1.3; Richmond was below expectations of 5, at -1.

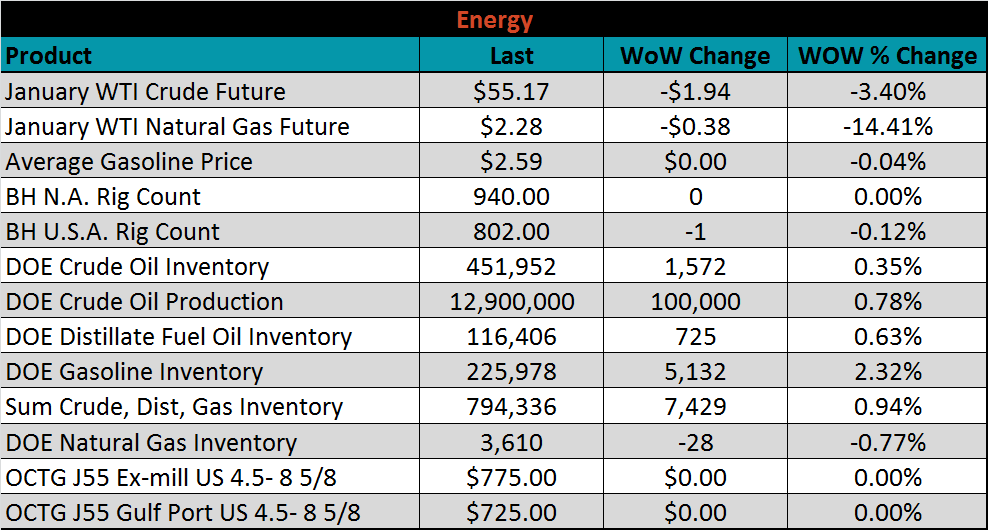

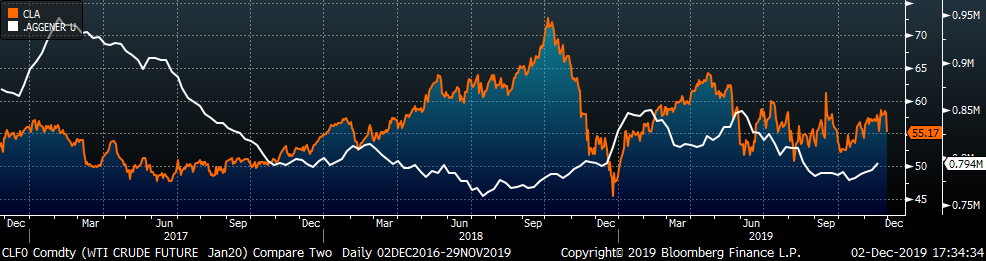

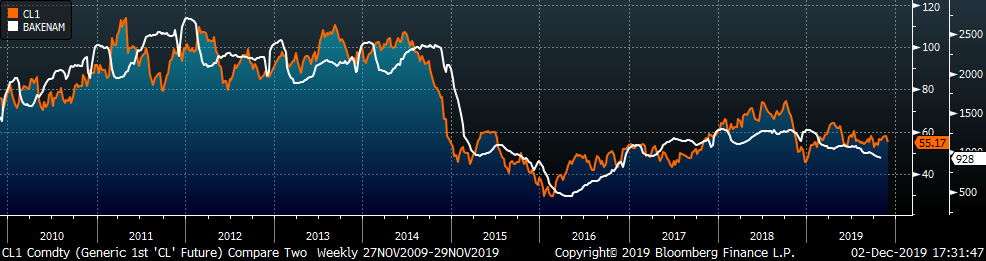

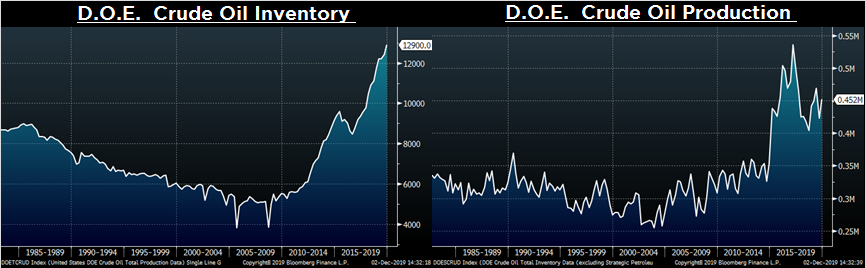

Last week, the January WTI crude oil future lost $1.94 or 3.4% to $55.17/bbl. The aggregate inventory level was up 1% and crude oil production rose to 12.9m bbl/day. The Baker Hughes North American rig count was flat, while the U.S. count lost one rig.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: