Market Commentary

Over the last 3 weeks, long awaited 2022 mill contracts have increasingly come to light. While negotiations for many will continue well into October, a few trends are becoming clear which provide vital information for 2022. First and foremost, mills are clearly lightening their contract books and attempting to push more customers into the spot market. As far as pricing goes, discounts to index have been limited and long-standing conversion prices and extras are increasing. Mills clearly looked at everything on their contract books, which they’ve begrudgingly agreed to over the years and used the fallout from 2021 as leverage to fundamentally change how their contract business is organized. A key takeaway from this should be to expect more volatility in prices going forward. With EAF’s producing approximately 70% of all the steel in the domestic market, and a larger portion of tons moving to spot purchases, increased buyer competition and tighter supplier control suggests that “guaranteed spot availability” for certain products may be less likely than ever before.

Turning to today’s physical market, the standoff continues another week with a static spot price around $1,950. Mills are keeping offers for new inquiries elevated, while extended lead times steadily decline. From the buy side, a sense of ease is starting to take hold as more and more participants appear to be operating under the impression that the recent trend of spot availability implies the end of the shortage and eminent lower pricing.

As we begin a new month, we also receive a slew of new steel intensive economic datapoints and we will dive deeper in the sections below. Before we do that, given the current steel price in the physical market and further clarity in 2022 contracts, it would be borderline negligent for us to not urge 2022 steel buyers to start locking in their prices for next year on the HRC forward curve. Long term availability is shaping up to be the primary concern looking into next year. Demand across sectors remains surprisingly stable in the face of logistics delays unlike anything the global market has ever experienced, and next year’s contracts are shaping up to leave an increased number of buyers competing for spot tons at uncertain prices.

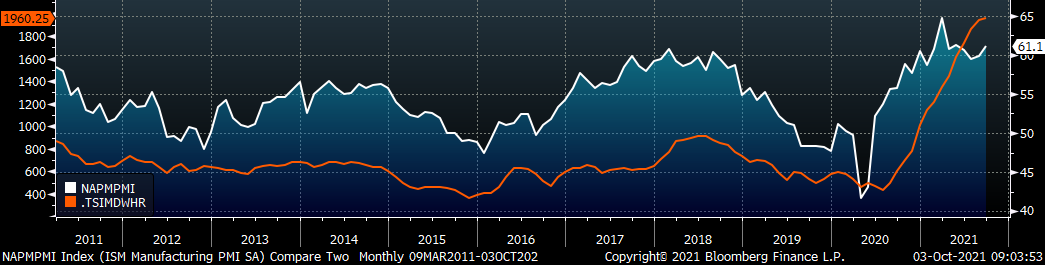

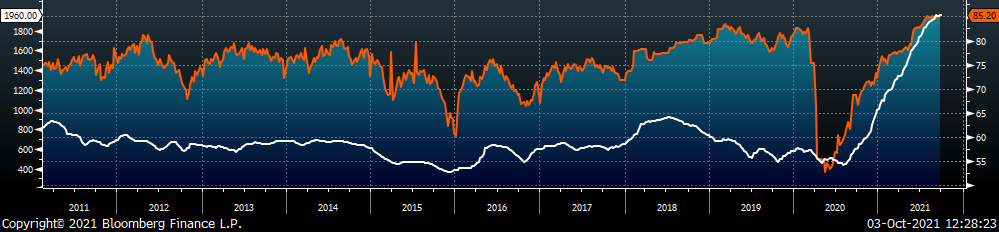

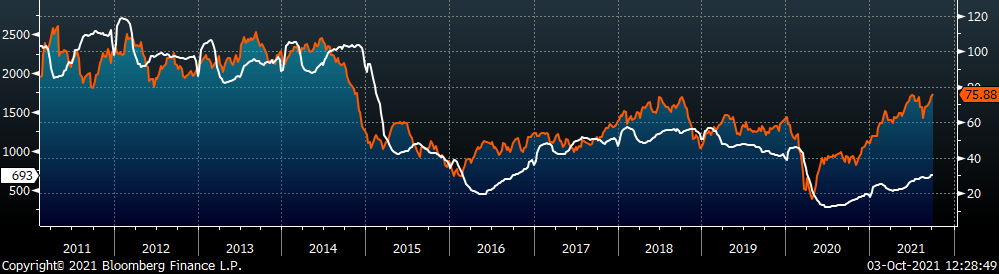

The chart below is the Platts Midwest HRC index (white) and the ISM Manufacturing PMI (orange). Sustained expansion (prints above 50) in the manufacturing sector continues to support elevated HRC prices. This is the first time an expansionary period in the manufacturing sector has seen 7 prints above 60. The only comparable scenario is at the end of 2003 into 2004 when there were 6 out of 7.

ISM PMI

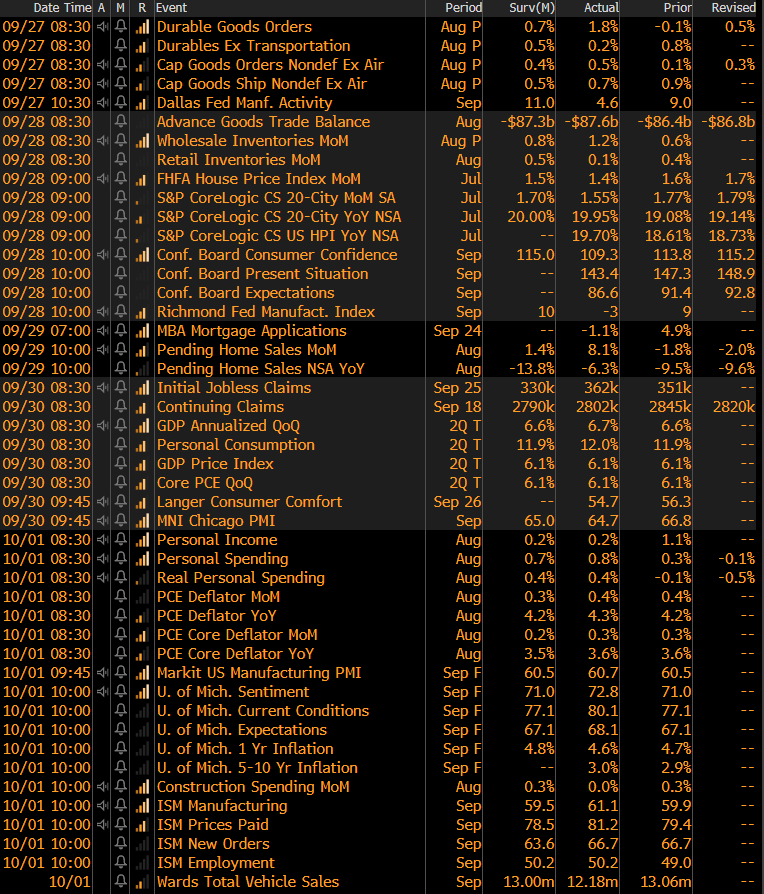

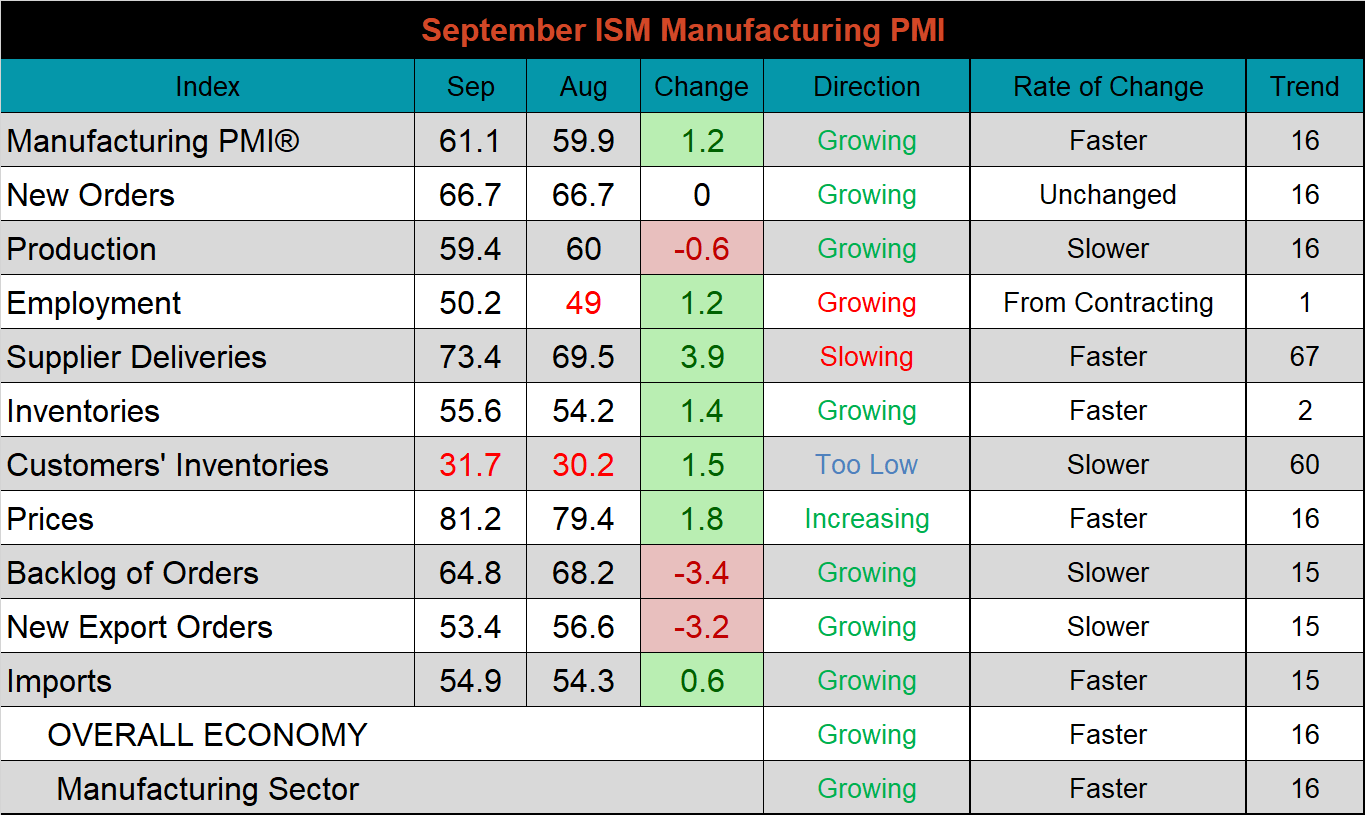

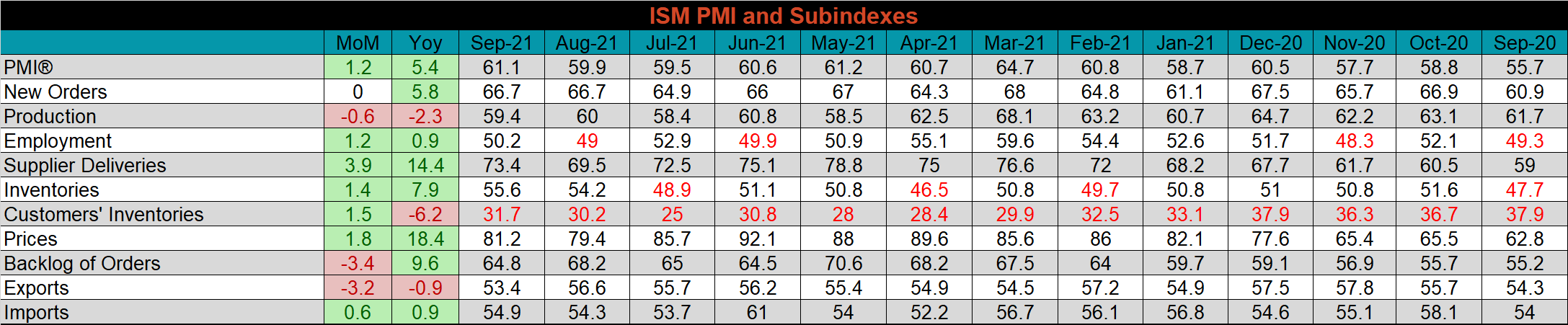

The September ISM Manufacturing PMI and subindexes are below.

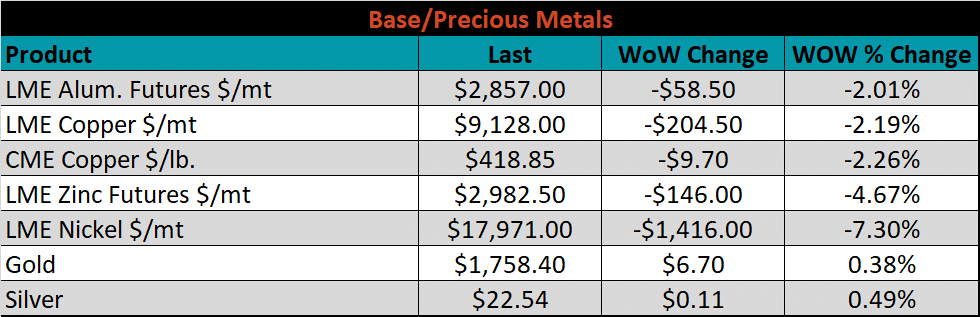

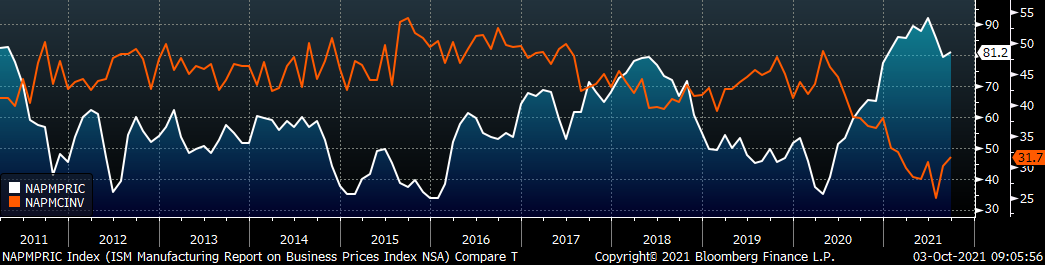

The chart below compares the ISM prices subindex with the ISM customer inventories subindex. This month, the customer inventories subindex continued to increase, but remain far below normal operating levels. The prices subindex increased as well and remains well in expansion territory for the 16th month in a row. The second chart shows the new orders plus backlog subindexes which printed lower but remains well in expansion territory. Taking a closer look, new orders held steady, while the backlog decreased. The final chart shows the supplier deliveries subindexes, which pushed higher, ending a 3-month streak of easing at elevated levels, further showing that logistics and supply chains remain under significant pressure going into the end of the year.

ISM Manufacturing PMI Customer Inventories Subindex (orange) & Prices Subindex (white)

ISM Manufacturing PMI New Orders plus Backlog sub-indexes

ISM Manufacturing Supplier Deliveries

The table below shows the historical values of each subindex over the last year.

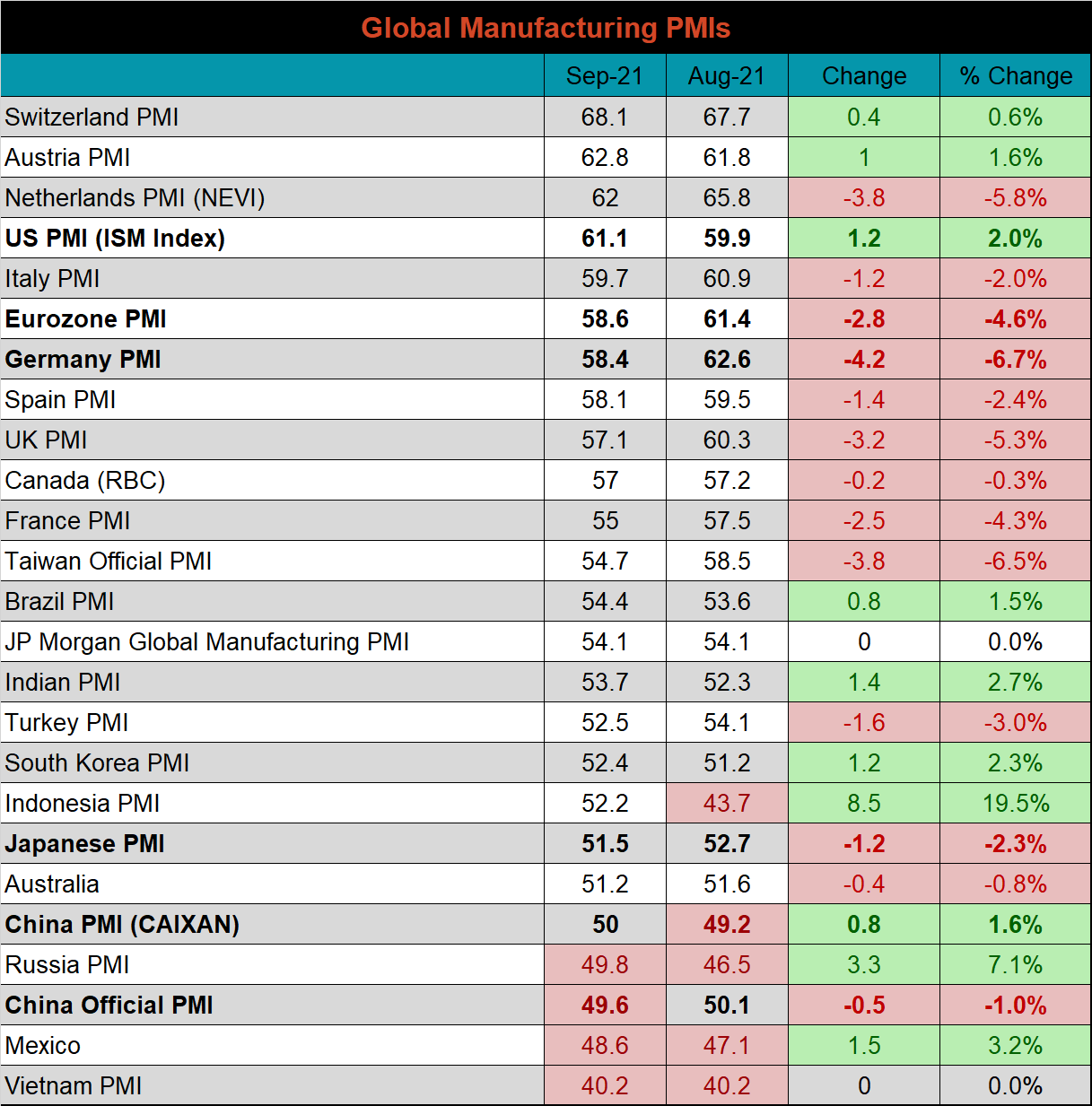

Global PMI

The September global PMI printings were mixed; however, most remain in expansion territory with 19 of the 23 watched countries saw growth from their respective manufacturing industries. The five most significant countries (bold) continue to expand, albeit at a slower pace.

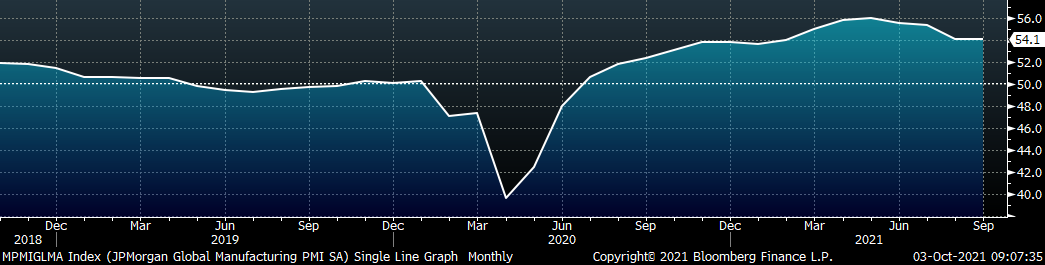

J.P. Morgan Global Manufacturing

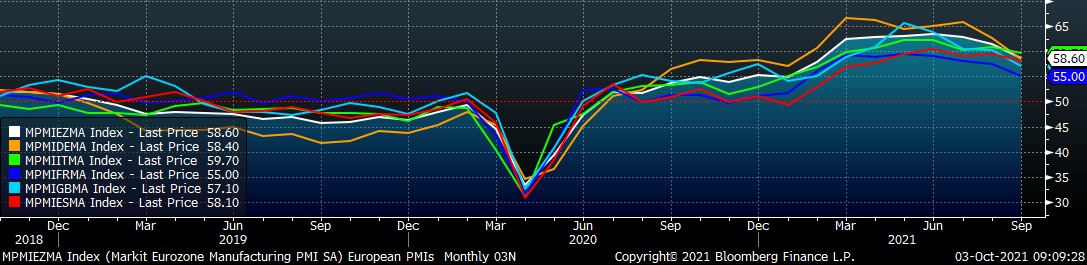

Eurozone (white), German (orange), Italian (green), Spanish (red), and French (blue), U.K. (teal) Manufacturing PMIs

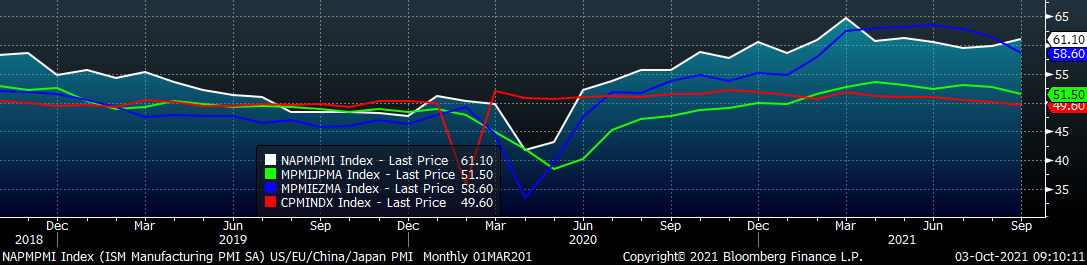

US (white), Euro (blue), Chinese (red) and Japanese (green) Manufacturing PMIs

China’s official manufacturing PMI dipped into contraction, while the Caixan PMI increased and moved into expansion. Over the last two months, both indexes have printed just above and just below the expansion/contraction level, after trending slightly lower each month since March.

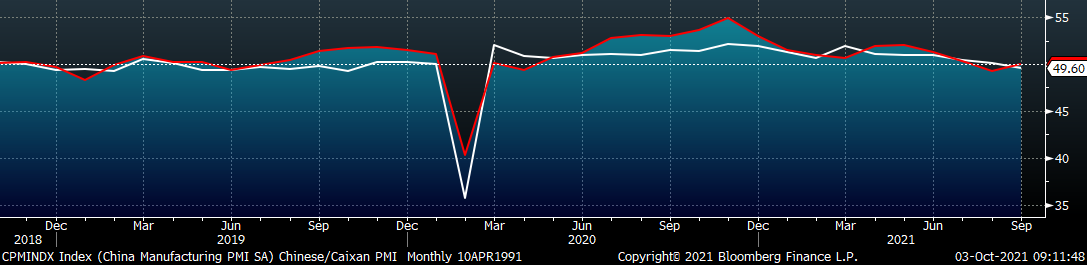

China Official (white) and Caixan (red) Manufacturing PMIs

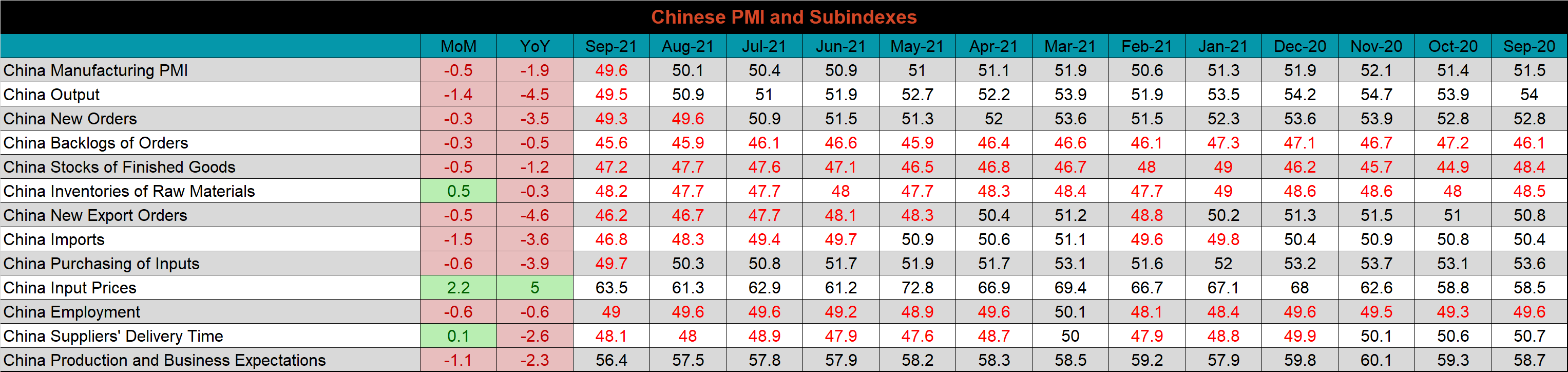

The table below breaks down China’s official manufacturing PMI subindexes. The overall trend clearly shows headwinds for the Chinese manufacturing sector, as increases for the input prices, and supplier delivery times subindexes should drag manufacturing activity going forward.

Construction Spending

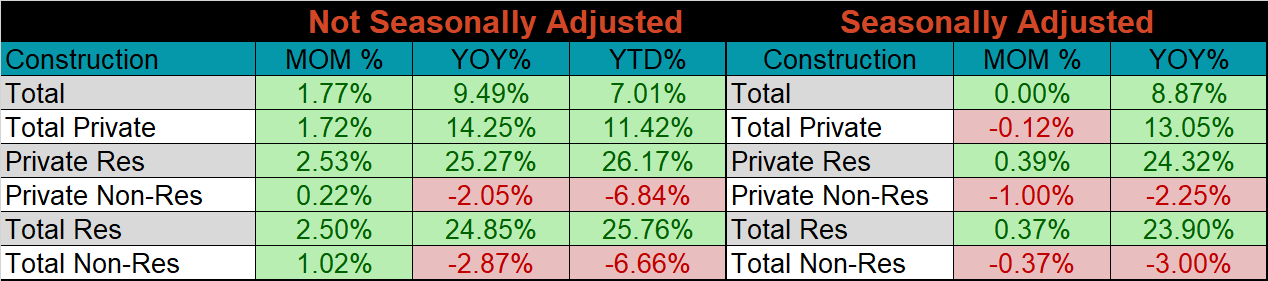

August seasonally adjusted U.S. construction spending was unchanged compared to July, and 8.9% higher than August 2020.

August U.S. Construction Spending

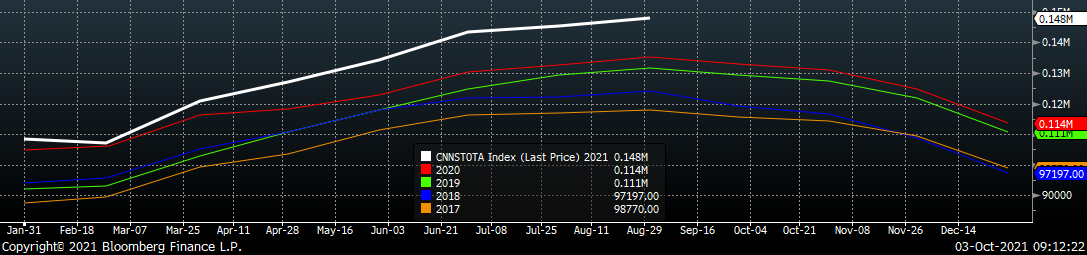

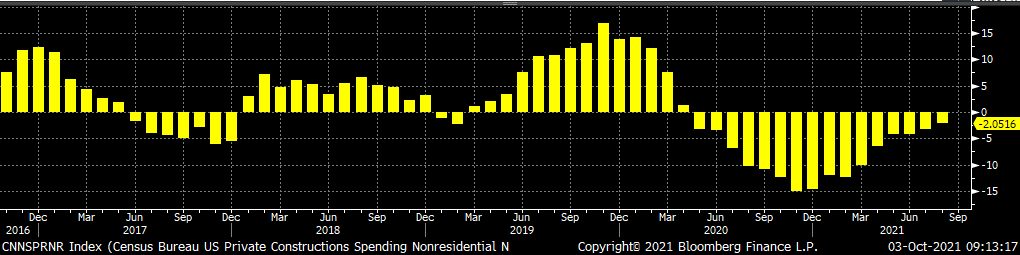

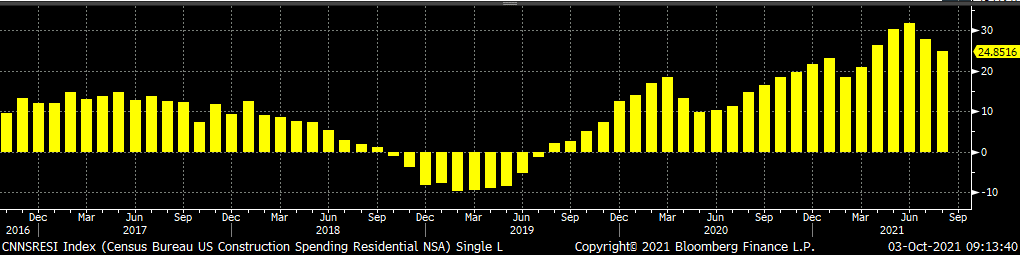

The white line in the chart below represents not seasonally adjusted construction spending in 2021 and compares it to the spending of the previous 4 years. Total spending continues to expand and is at its highest level in the last 4 years. The last two charts show the YoY changes in construction spending. Private non-residential spending decreased further in August, for the sixteenth month in a row. Private non-residential spending continues to trend closer to year-over-year growth, which is in line with expectations from leading indicators. Residential spending remains strong, with 24 straight months of YoY growth.

U.S. Construction Spending

U.S. Private Nonresidential Construction Spending NSA YoY % Change

U.S. Residential Construction Spending NSA YoY % Change

Risks

Below are the most pertinent upside and downside price risks:

Upside Risks:

- Inventory at end users and service centers below normal operational levels

- Higher share of discretionary income allocated to goods from steel intensive industries

- Changes in China’s policies regarding ferrous markets, including production cuts and exports

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Limited spot transactions skewing market indexes to extreme levels

- Energy & construction industry rebound

- Prolonged 2022 contract negotiations creating availability concerns in the short term

- Easing labor and supply chain constraints allowing increased manufacturing activity

- Mills extending outages/taking down capacity to keep prices elevated

Downside Risks:

- Increased domestic production capacity

- Increasing price differentials and hedging opportunities leading to sustained higher imports

- Steel consumers substitute to lower cost alternatives

- Steel buyers and consumers “double ordering” to more than cover steel needs

- Tightening credit markets, as elevated prices push total costs to credit caps

- Supply chain disruptions allowing producers to catch up on orders

- Limited desire to restock at elevated prices, causing a “Buyer’s Strike”

HRC Futures

All of the below data points are as of October 1, 2021.

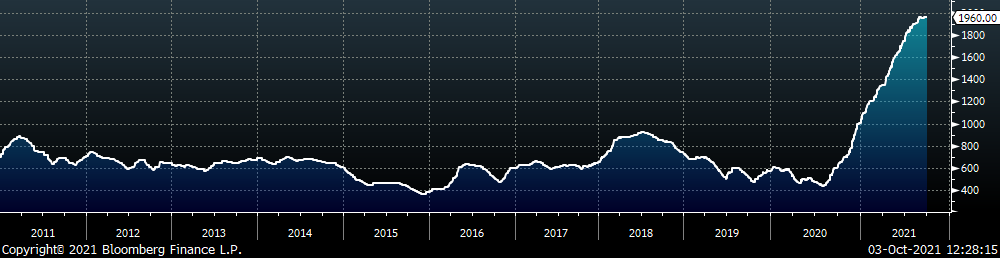

The Platts TSI Daily Midwest HRC Index decreased by $0.25 to $1,960.

Platts TSI Daily Midwest HRC Index

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The entire curve shifted higher last week, most significantly in the front month expirations.

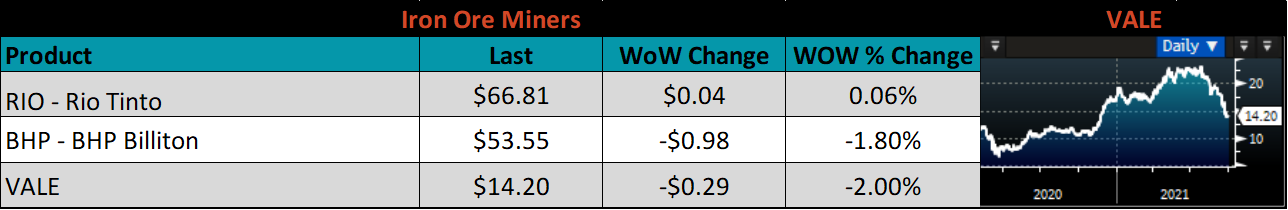

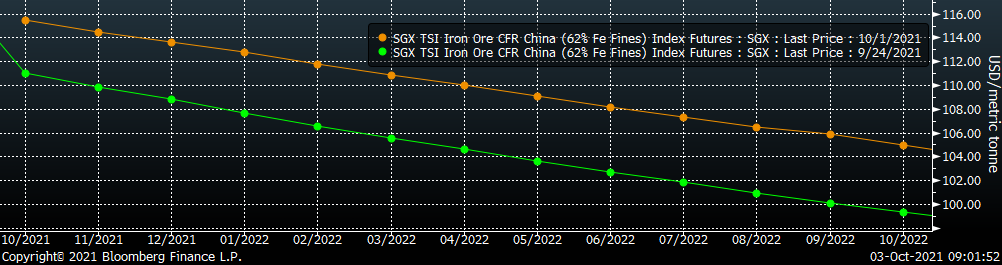

October ferrous futures were mixed, with iron ore up an additional 3.5%, while Aussie coking coal lost another 2.7%.

Global flat rolled indexes were mostly lower, led by Black Sea HRC, down 3.6%, while Chinese spot HRC was up 1.2%.

The AISI Capacity Utilization was up 0.3% to 85.2%.

AISI Steel Capacity Utilization Rate (orange) and Platts TSI Daily Midwest HRC Index (white)

Imports & Differentials

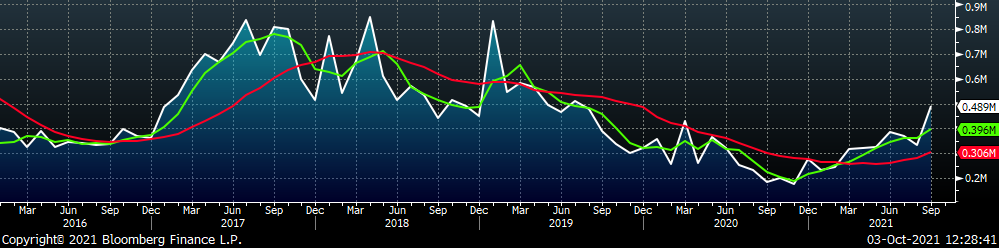

September flat rolled import license data is forecasting a decrease of 226k to 978k MoM.

All Sheet Imports (white) w/ 3-Mo. (green) & 12-Mo. Moving Average (red)

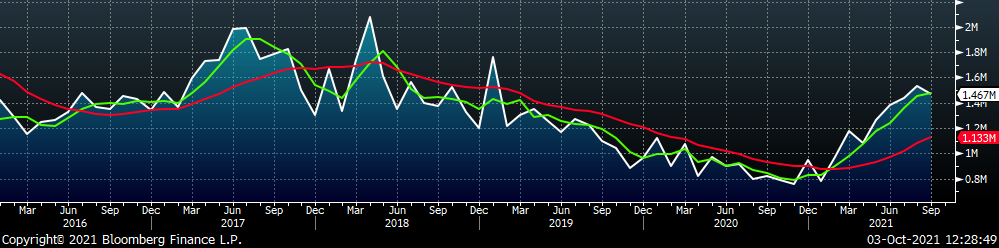

Tube imports license data is forecasting an increase of 157k to 489k in September.

All Tube Imports (white) w/ 3-Mo. (green) & 12-Mo. Moving Average (red)

All Sheet plus Tube (white) w/ 3-Mo. (green) & 12-Mo. Moving Average (red)

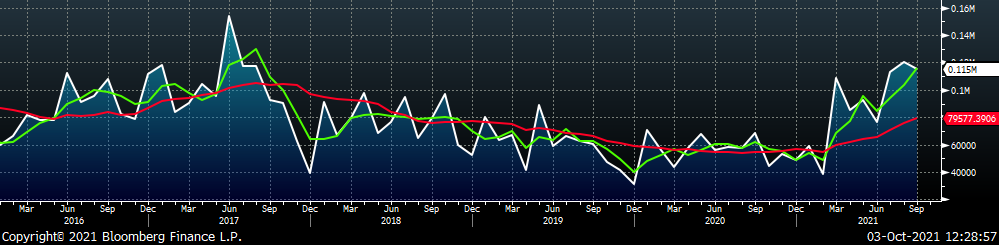

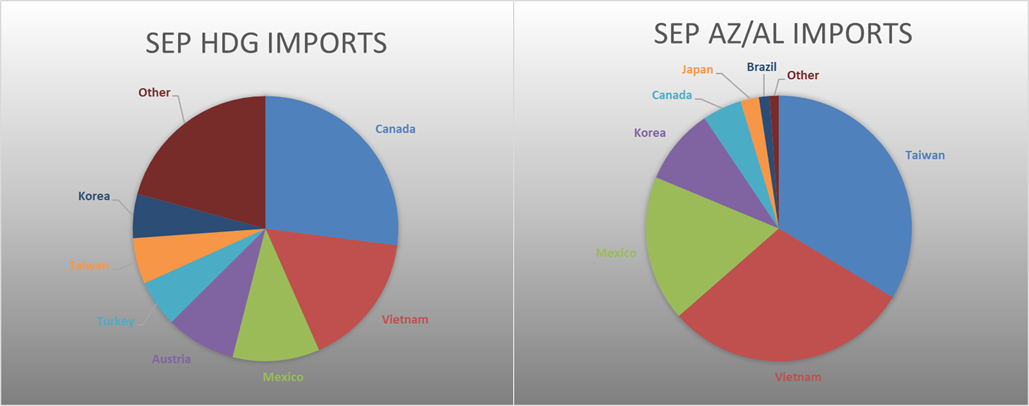

September AZ/AL import license data is forecasting a decrease of 5k to 115k.

Galvalume Imports (white) w/ 3 Mo. (green) & 12 Mo. Moving Average (red)

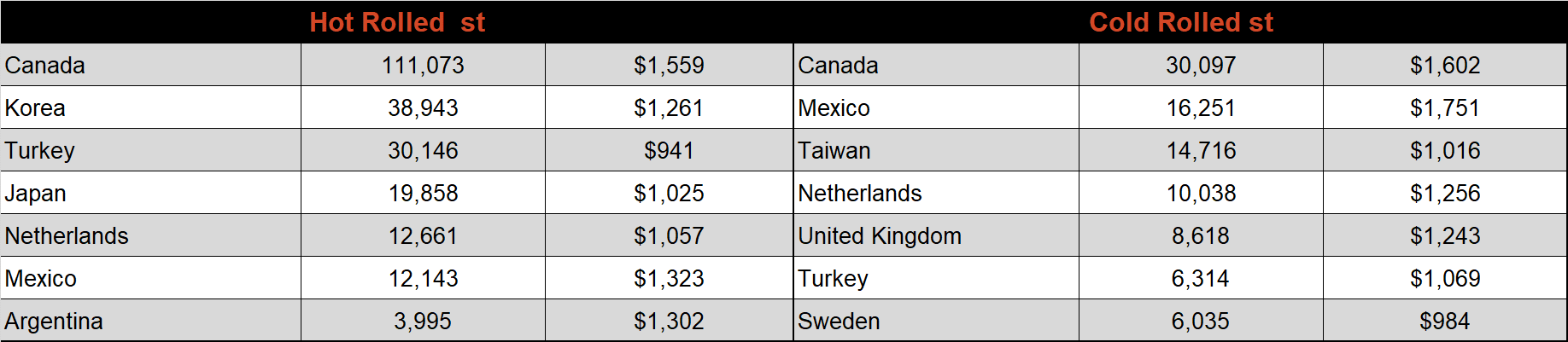

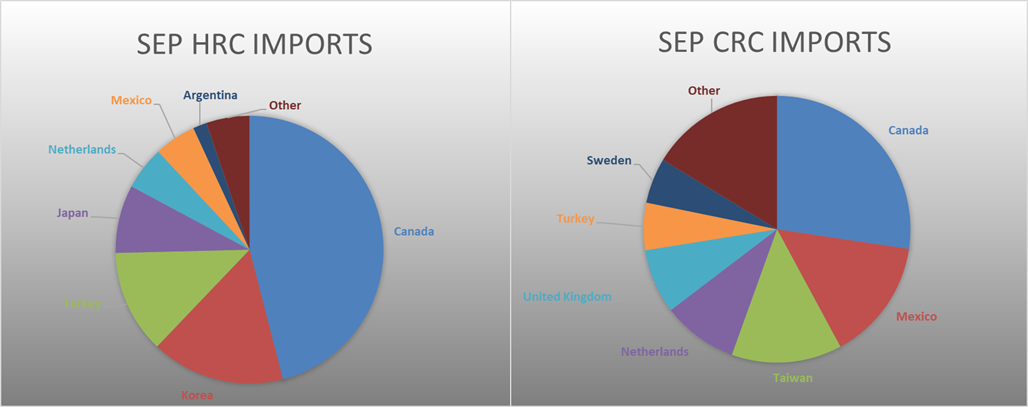

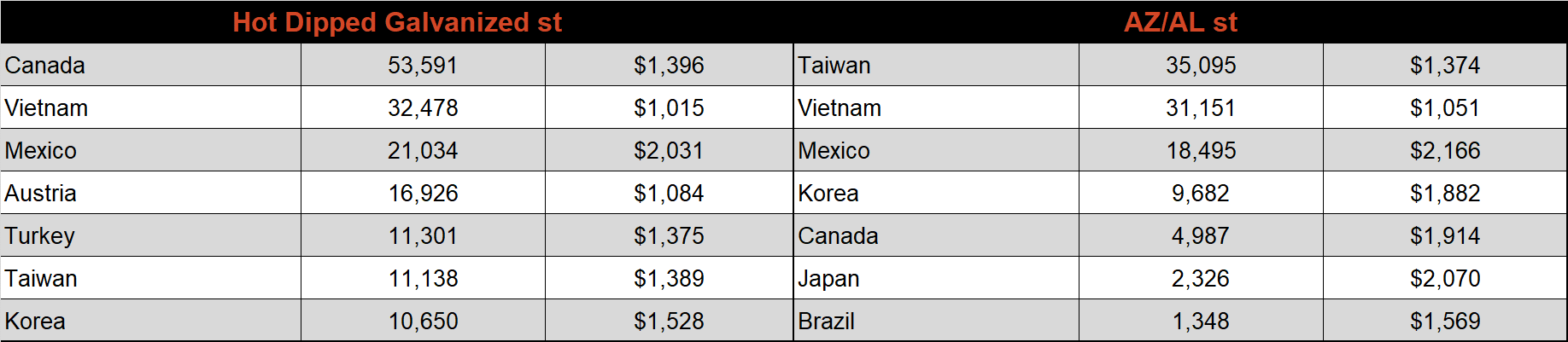

Below is September import license data through September 27th, 2021.

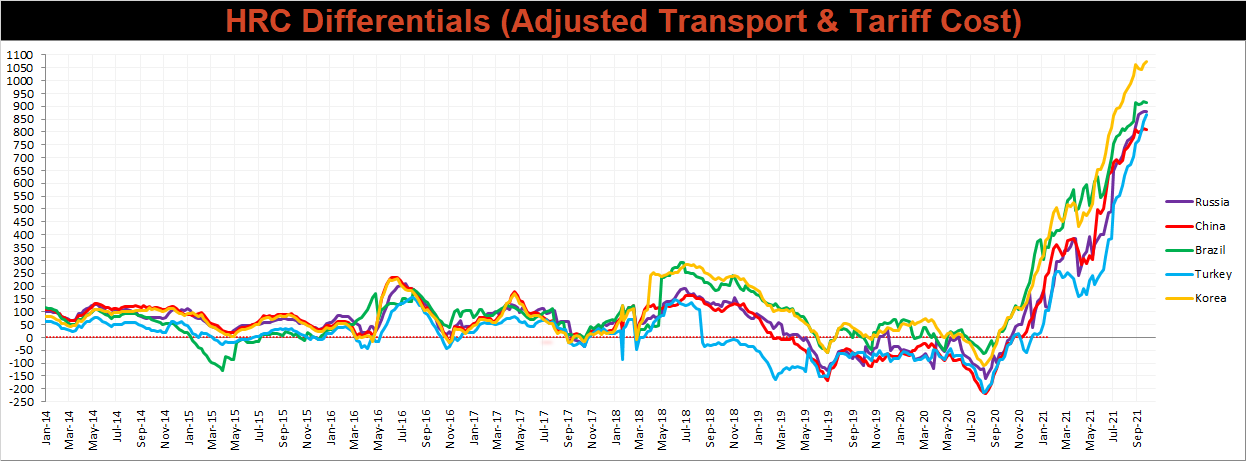

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials increased further for all the watched countries with an unchanged U.S. domestic price in the face of declining global prices.

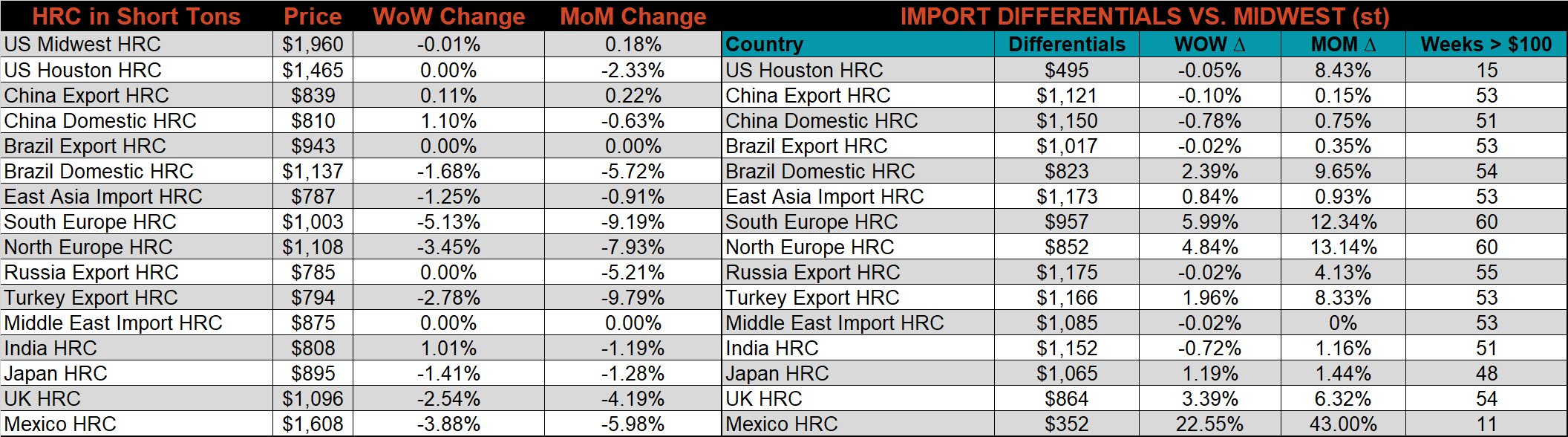

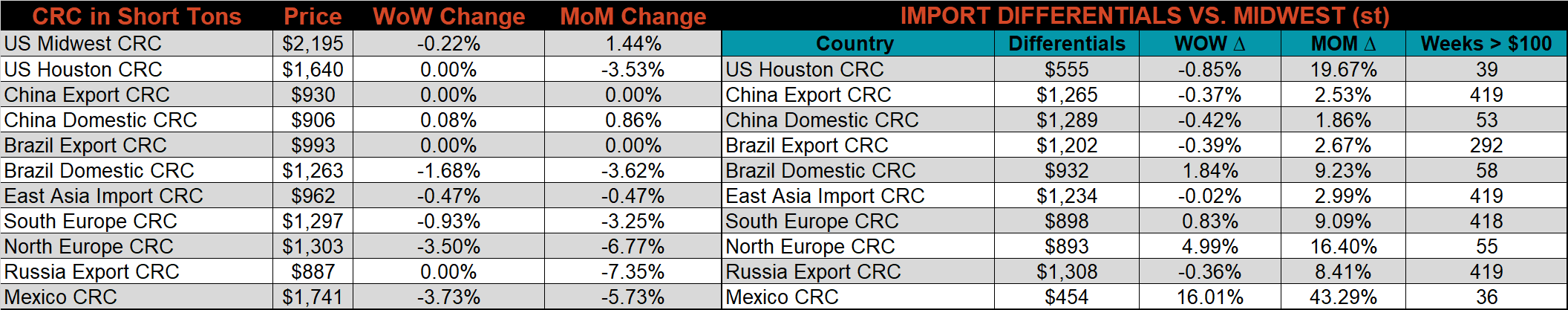

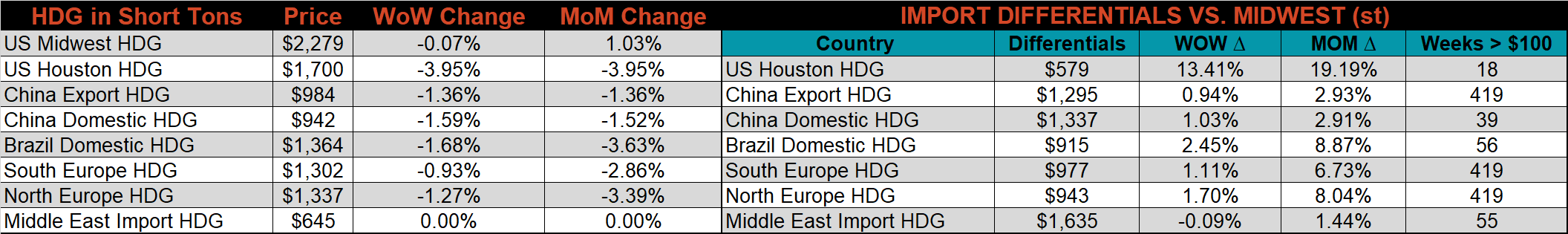

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest CRC, HDG, & HRC prices were down slightly, 0.2%, 0.1%, and 0.01%, respectively. Outside of the U.S., the Southern European HRC price was down another 5.1%.

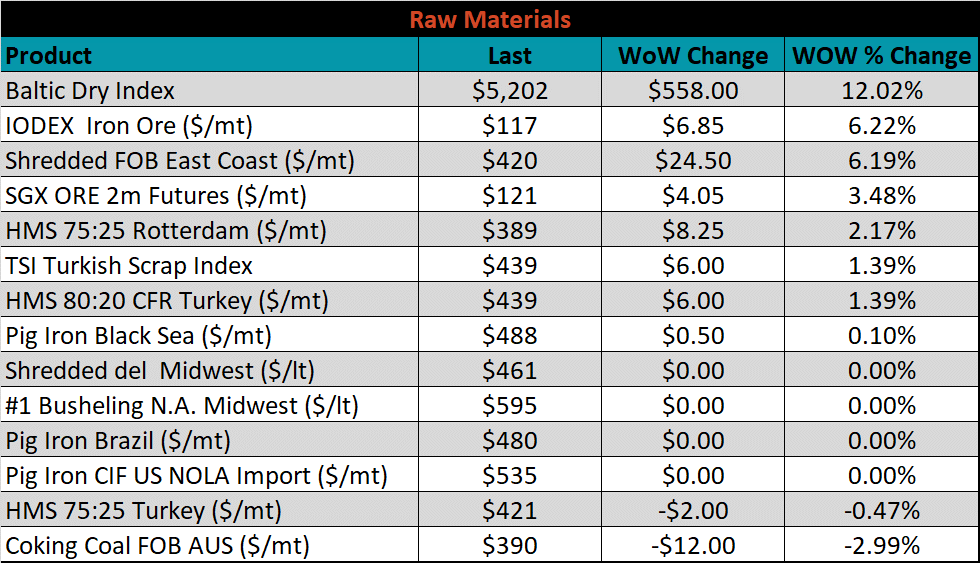

Raw Materials

Raw material prices were mixed. The IODEX iron ore index was up another 6.2%, while Aussie coking coal lost 3%.

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve shifted higher, more significantly in the back, causing additional flattening at later expirations.

SGX Iron Ore Futures Curve

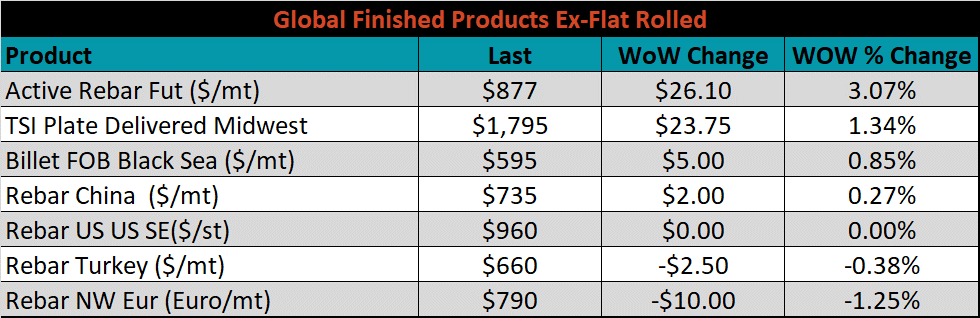

The ex-flat rolled prices are listed below.

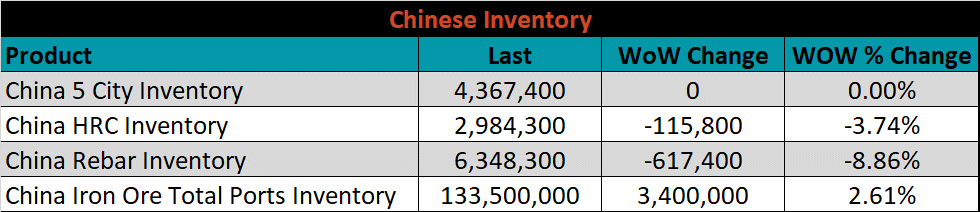

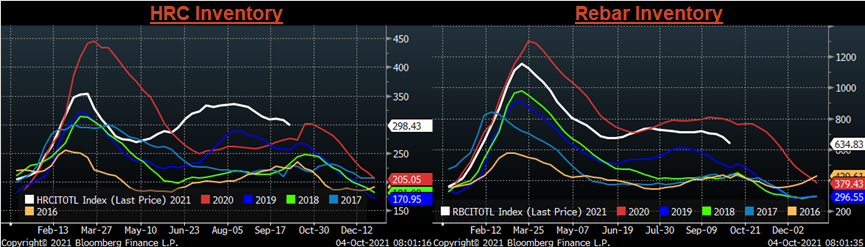

Chinese Inventory

Below are inventory levels for Chinese finished steel products and iron ore. The iron ore inventory level jumped higher, after a 2-month trend of most decreasing iron ore prices appears to have ended. The 5-city inventory level was not updated, due to the national holiday. However, rebar and HRC inventories continued their decline.

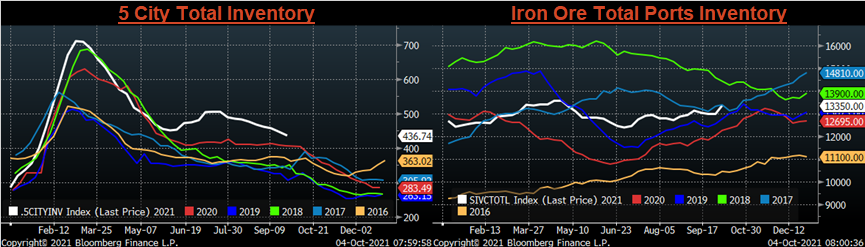

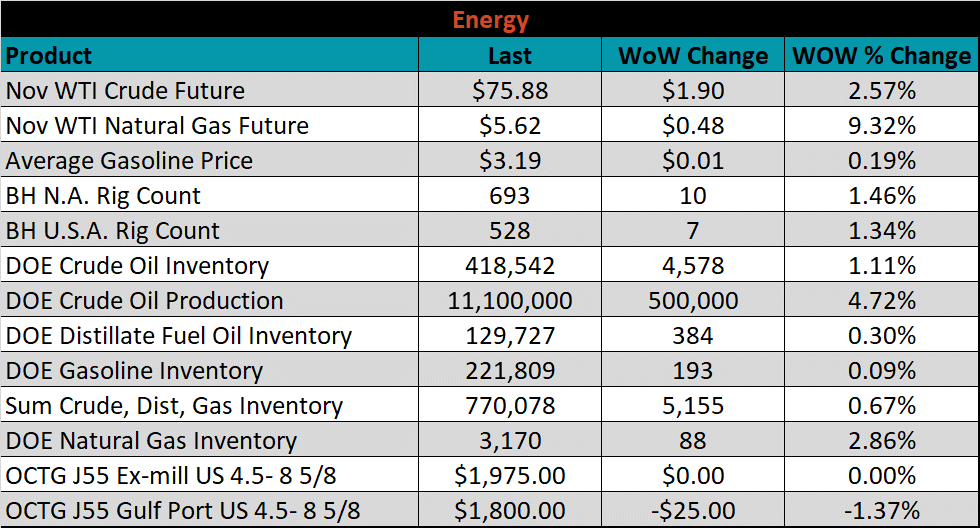

Energy

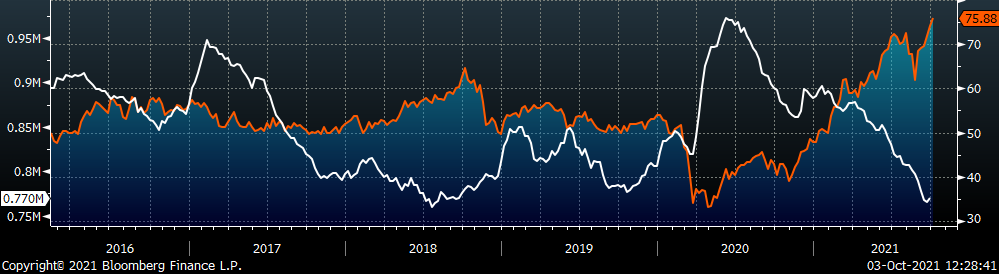

Last week, the November WTI crude oil future was up another $1.90 or 2.6% to $75.88/bbl. The aggregate inventory level was up 0.7%, while crude oil production increased to 11.1m bbl/day. The Baker Hughes North American rig count was up 10 rigs, and the U.S. rig count was up another 7 rigs.

November WTI Crude Oil Futures (orange) vs. Aggregate Energy Inventory (white)

Front Month WTI Crude Oil Future (orange) and Baker Hughes N.A. Rig Count (white)

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

- Inventory at end users and service centers below normal operational levels

- Higher share of discretionary income allocated to goods from steel intensive industries

- Changes in China’s policies regarding ferrous markets, including production cuts and exports

- Unplanned & extended planned outages, including operational issues leaving mills behind

- Limited spot transactions skewing market indexes to extreme levels

- Energy & construction industry rebound

- Prolonged 2022 contract negotiations creating availability concerns in the short term

- Easing labor and supply chain constraints allowing increased manufacturing activity

- Mills extending outages/taking down capacity to keep prices elevated

- A weakening US Dollar

- Fiscal policy measures including a new stimulus and/or infrastructure package

- Fluctuating auto production, pushing steel demand out into the future

- Low interest rates

- Threat of further protectionist trade policies muting imports

- Unexpected and sustained inflation

Downside Risks:

- Increased domestic production capacity

- Increasing price differentials and hedging opportunities leading to sustained higher imports

- Steel consumers substitute to lower cost alternatives

- Steel buyers and consumers “double ordering” to more than cover steel needs

- Tightening credit markets, as elevated prices push total costs to credit caps

- Supply chain disruptions allowing producers to catch up on orders

- Limited desire to restock at elevated prices, causing a “Buyer’s Strike”

- Reduction and/or removal of domestic trade barriers

- Political & geopolitical uncertainty

- Chinese restrictions in property market

- Unexpected sharp China RMB devaluation