Content

-

Weekly Highlights

- Market Commentary

- Durable Goods

- Risks

In domestic ferrous markets, many of the prevailing trends and sentiments still appear to be intact. Physical transactions remain sparse and occur over a wide range of prices. Spot prices continue to slide lower amid tight inventory management, weak manufacturing demand and declining global prices. There have been some notable changes in the market over the last week that are supportive of prices, but they seem unlikely to stop the current downtrend.

First, the Trump administration increased tariffs on Turkey’s steel imports from 25% to 50% after Turkey’s forces moved into Syria. While current price differentials between the U.S. and Turkey are not conducive to bringing in material, this action will prevent any future imports that may have been in discussion. Additionally, it display’s the administration’s intention to maintain current tariffs, removing the possibility of a reversal of the Section 232. However, the lack of imports this year from Turkey as well as the harm to the country’s economy and the global ferrous metals market should prevent any significant influence on domestic prices.

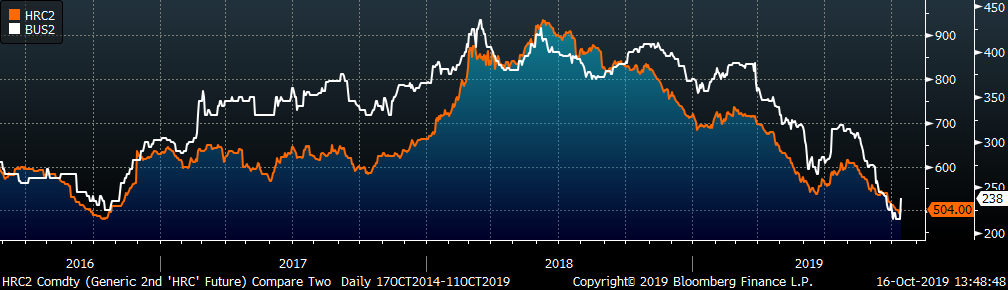

The current downtrend in HRC prices has corresponded with a similar downtrend in scrap prices. Mills have accepted negotiations at lower prices because their raw material costs have also slid throughout the year, allowing them to achieve profitable sales at low prices. Below is a graph of the 2nd month HRC future (orange) and the 2nd month #1 Busheling future (white).

After a large decline in scrap prices in October, the market has stabilized. Current expectations are for scrap prices to rise from current levels into yearend, which will support the domestic HRC price. Clarity on the November scrap market will provide insight into the outlook for the HRC market.

Finally, this week we saw lead times stabilize and push out slightly as upcoming planned outages tighten select markets. Removing production is fundamentally supportive of prices, as we saw in June with US Steel idling 2 furnaces ahead of multiple price increase announcements. However, for the mills to be able to successfully push a price increase, they have to be ready to turn away orders at lower prices. We have seen no indication of this as mini-mill profitably remains strong.

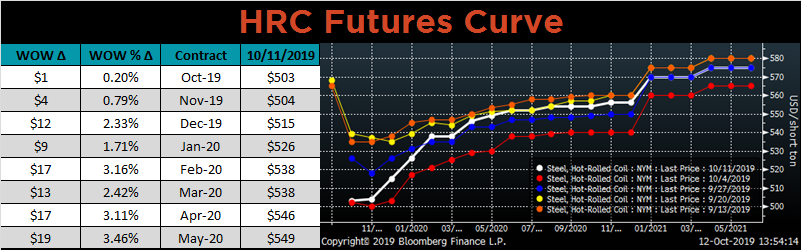

Looking at the futures market, this week saw buying interest in 2020 expirations for the first time in several weeks. This seems logical as we are in the mist of contract season, and many end users are trying to lock up tonnage for next year in order to understand costs and forecast performance. If you are not taking this opportunity to lock in prices and tonnage for next year, you are likely missing out because your competitors are.

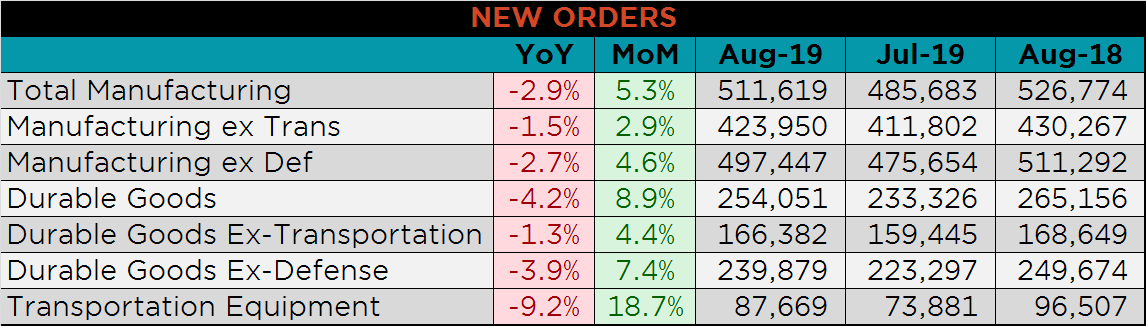

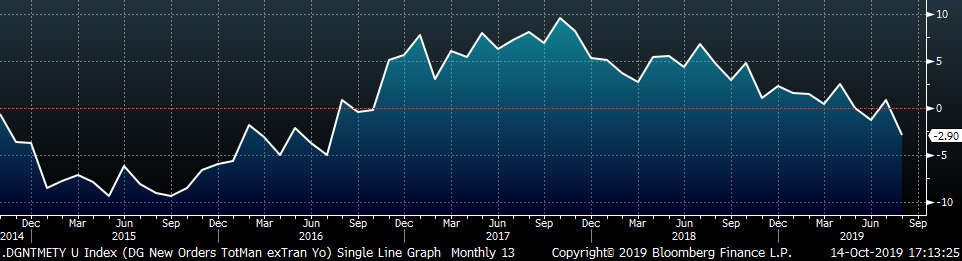

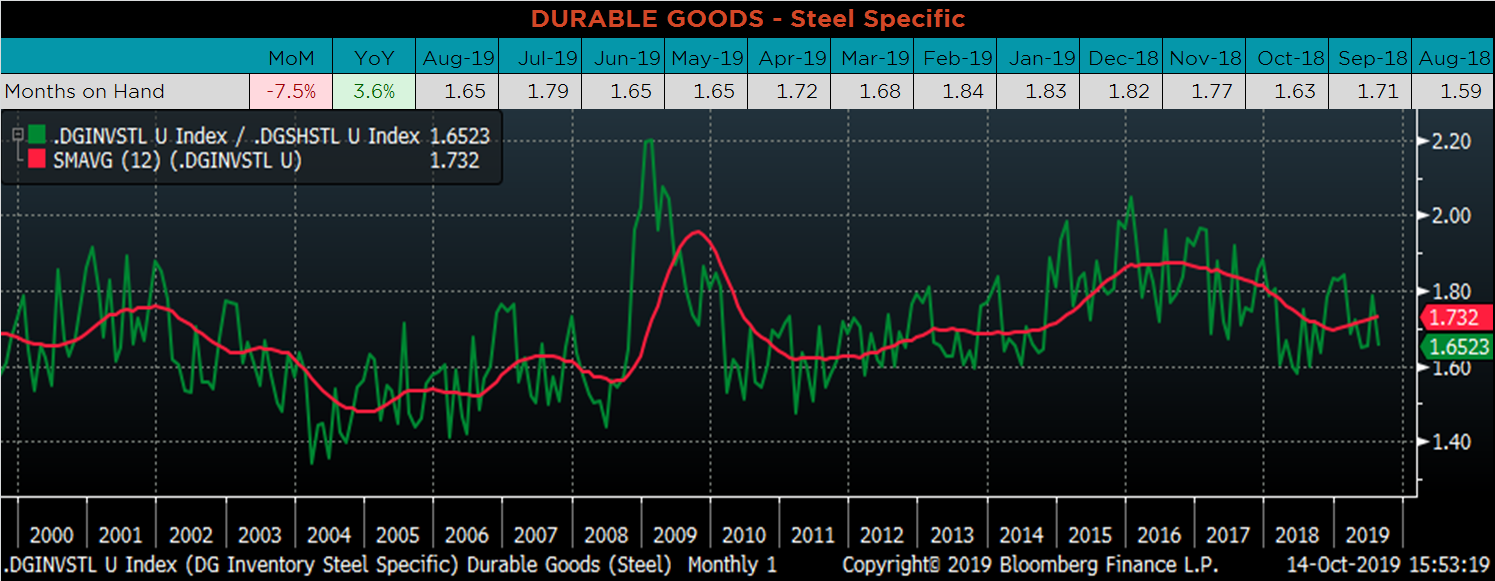

Below are final August new orders from the Durable Goods report. Overall, new orders were lower YoY, but up compared to last month. Manufacturing new orders ex-transportation continue to show weakness compared to a year ago. The final chart looks at the months on hand (inventory divided by shipments) for durable goods categories that are steel intensive. MOH moved lower as rising steel prices in July led to increased shipments while many firms continue to hold thin inventories.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

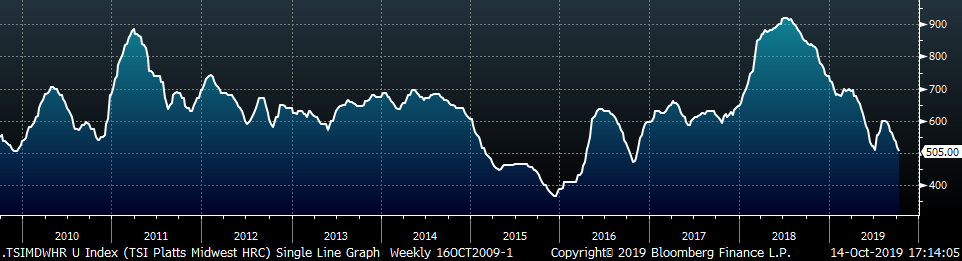

The Platts TSI Daily Midwest HRC Index was down $13.75 to $505.

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. For the first time in over a month, the curve moved higher across all expirations. This move higher was most significant in the back half of 2020.

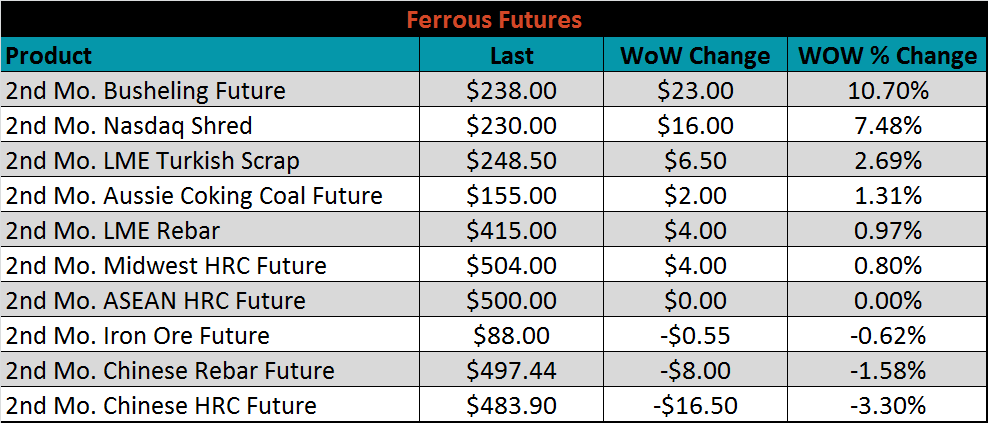

November ferrous futures were mixed. The Busheling future was up 10.7%, while Chinese HRC future lost 3.3%.

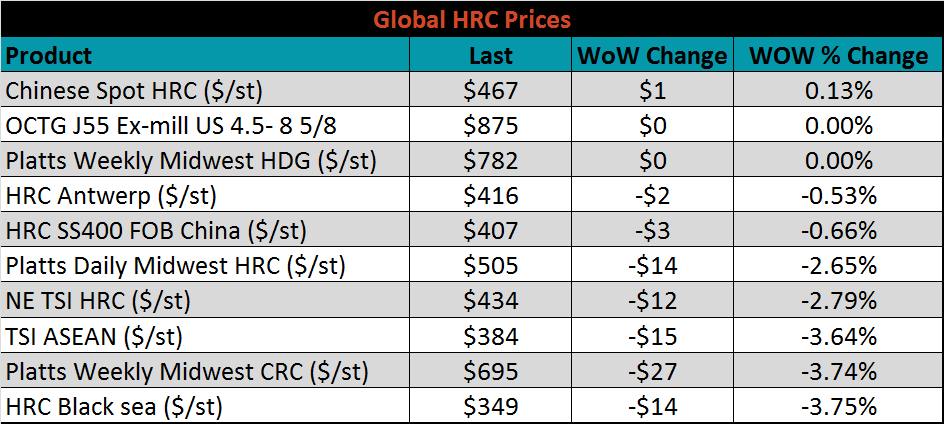

The global flat rolled indexes were mostly lower. Northern European TSI HRC was up slightly, while HRC Black Sea was down 3.6%.

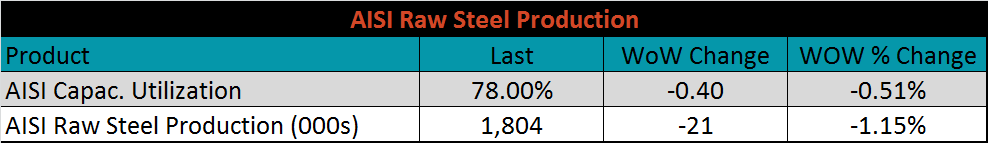

The AISI Capacity Utilization Rate was up 0.7% to 78.4%, and remains below the 80% goal set by the Trump administration.

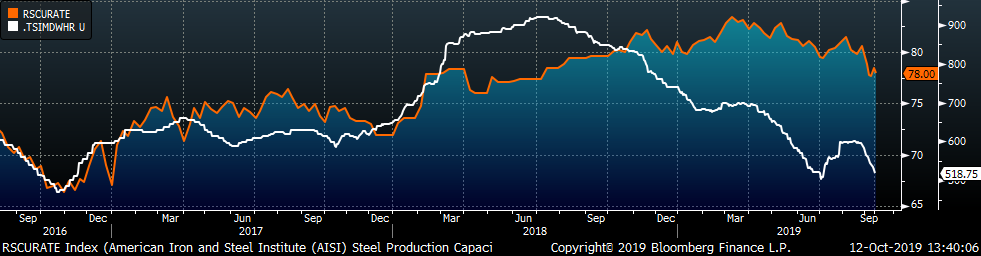

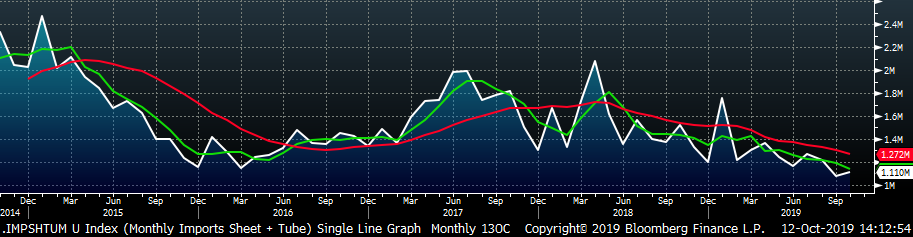

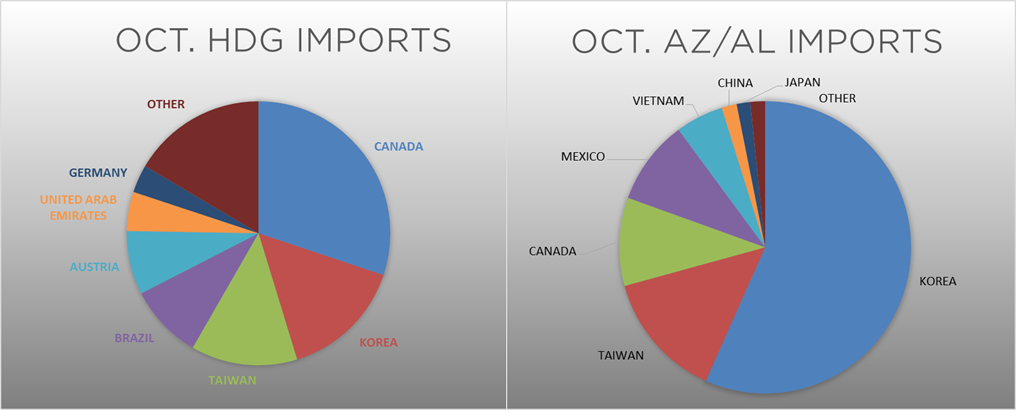

October flat rolled import license data is forecasting an increase of 9k to 699k MoM.

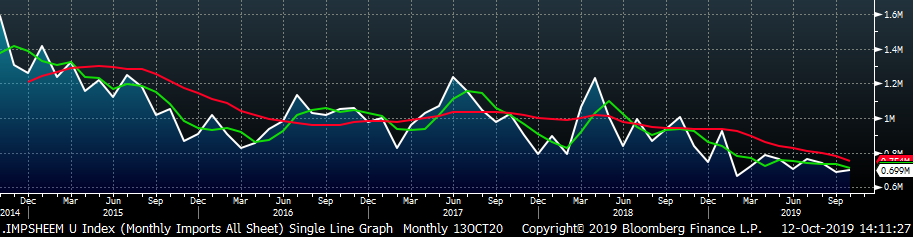

Tube imports license data is forecasting a MoM increase of 23k to 411k tons in October.

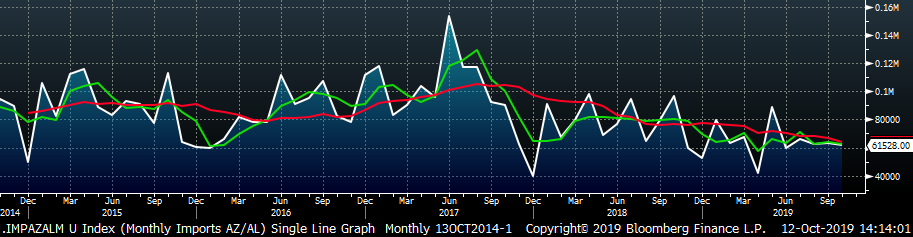

AZ/AL import license data is forecasting a decrease of 2k in October to 61k.

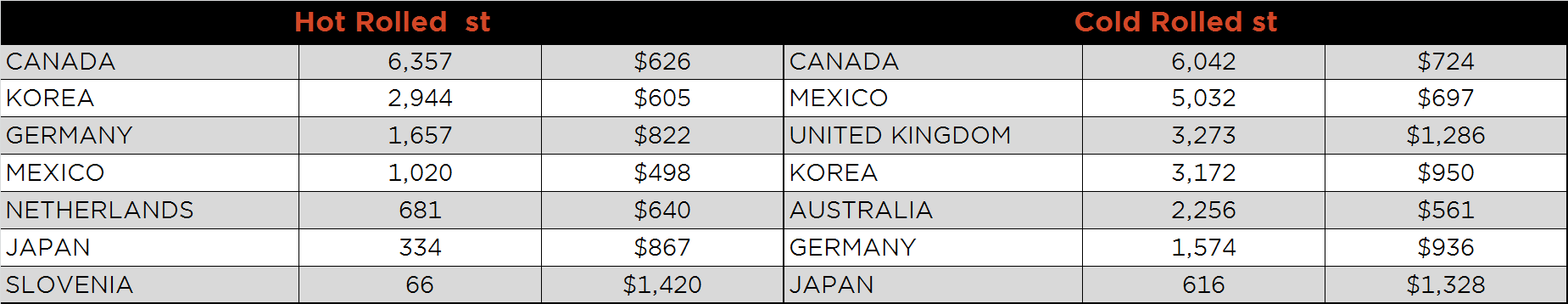

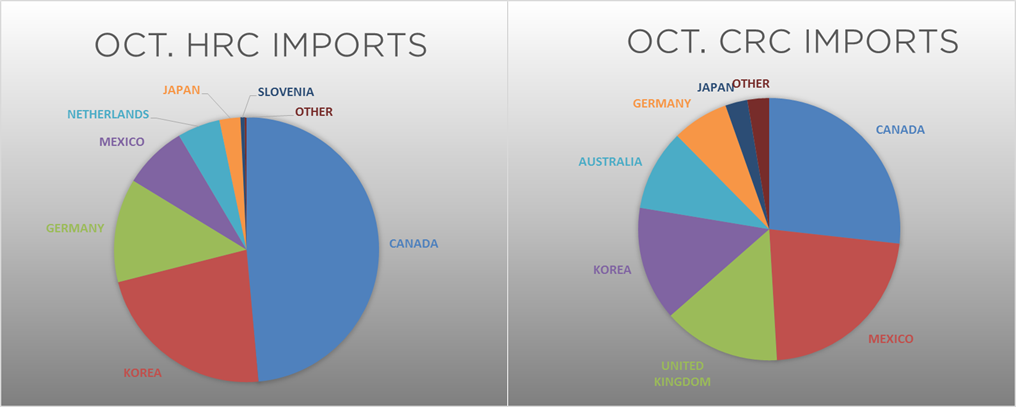

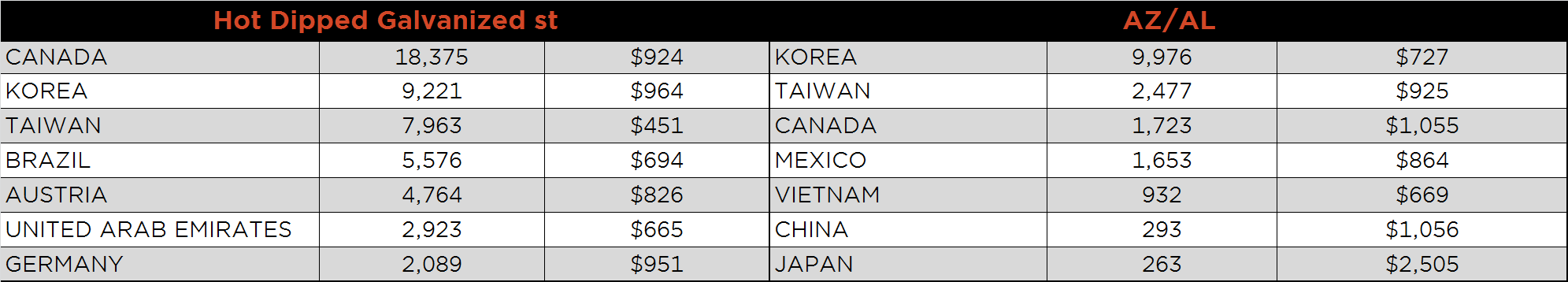

Below is September import license data through October 8, 2019.

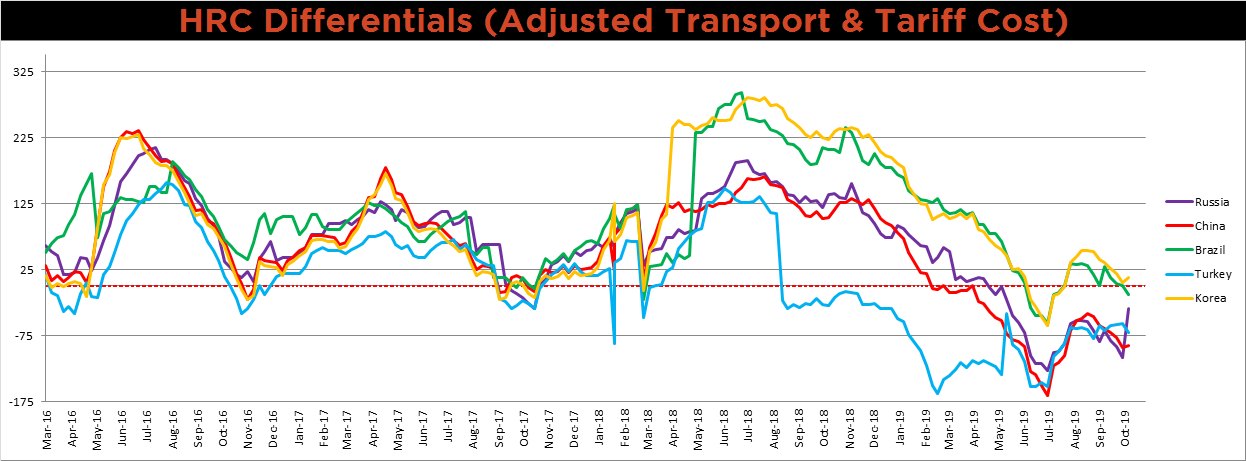

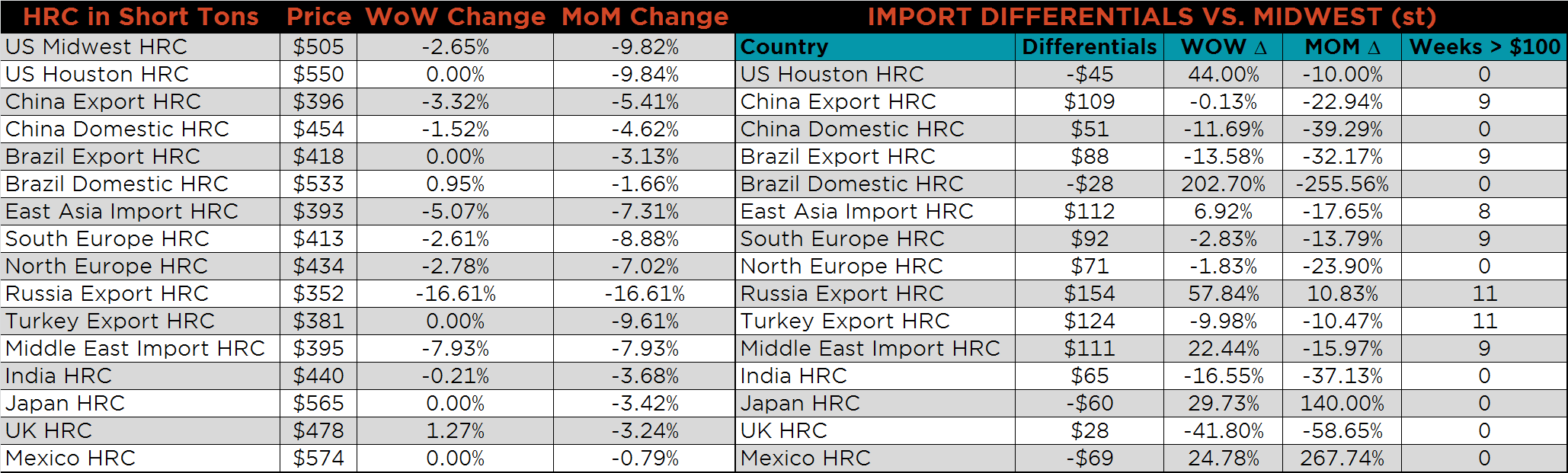

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The Russian HRC export price fell by 16.6%, leading to a sharp increase in the U.S. vs Russian price differential.

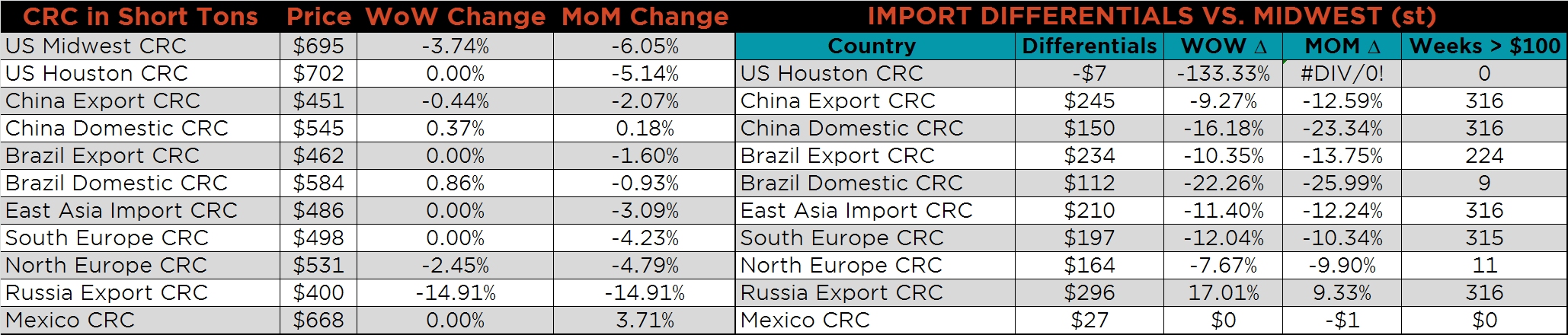

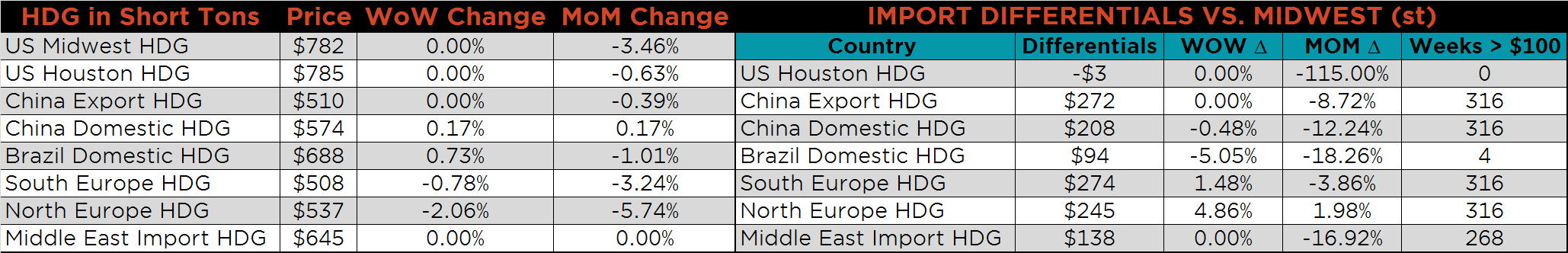

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest CRC and HRC prices were down 3.7 and 2.7%, respectively, while the HDG price was flat. As mentioned before, the Russian export HRC price was down 16.6%, and the CRC export price was down significantly as well, 14.9%.

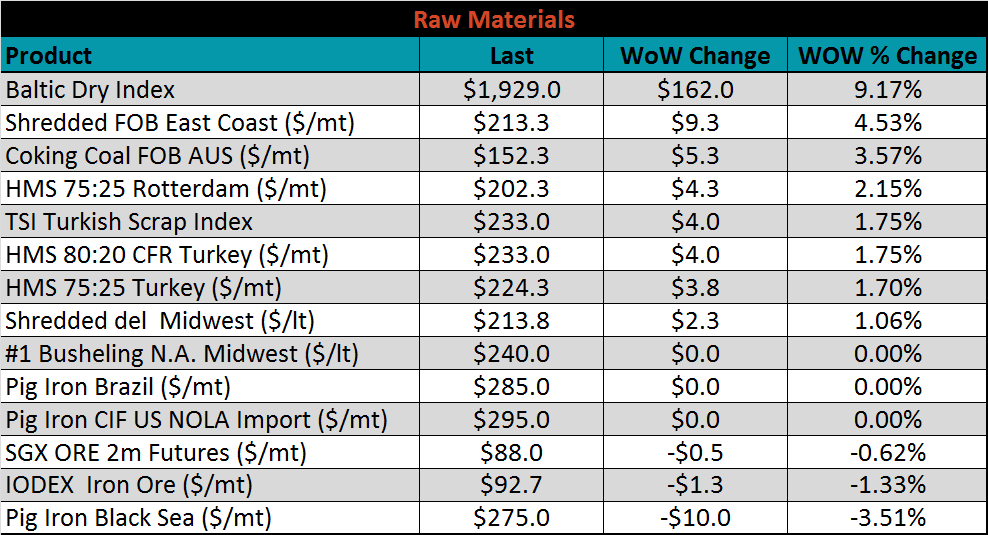

Raw material prices were mixed. Black Sea pig iron was down 3.5%, while East Coast shredded was up 4.5%.

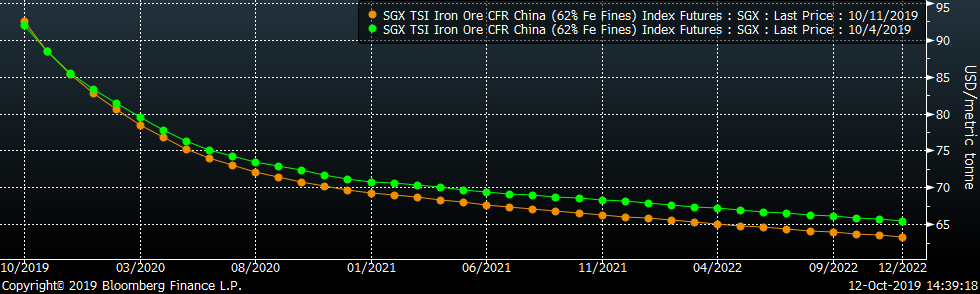

Below is the iron ore future curve with Friday’s settlments in orange, and the prior week’s settlements in green. The entire curve shifted lower across all expirations last week, but more so in the back expirations.

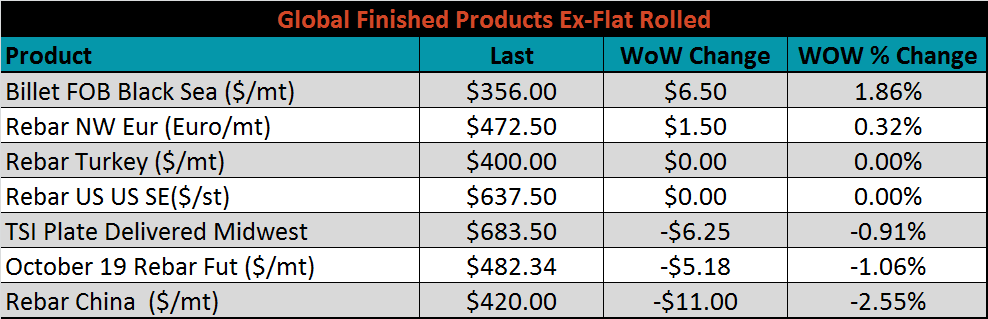

The ex-flat rolled prices are listed below.

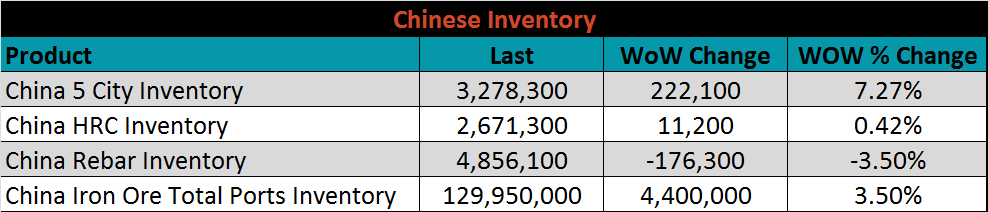

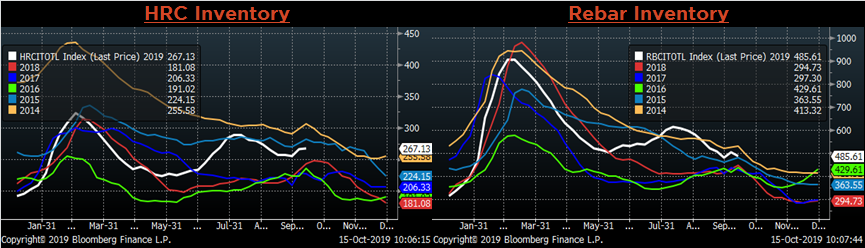

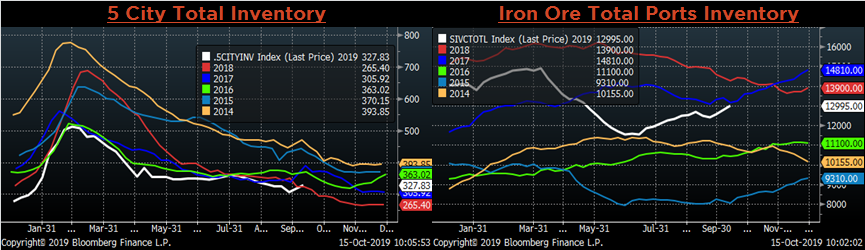

Below are inventory levels for Chinese finished steel products and iron ore. After a week of limited reporting, Chinese Rebar inventory lost 3.5%, while HRC was relatively flat. On the other hand, 5-city inventory rose off its lowest September level in five years while iron ore continued to build.

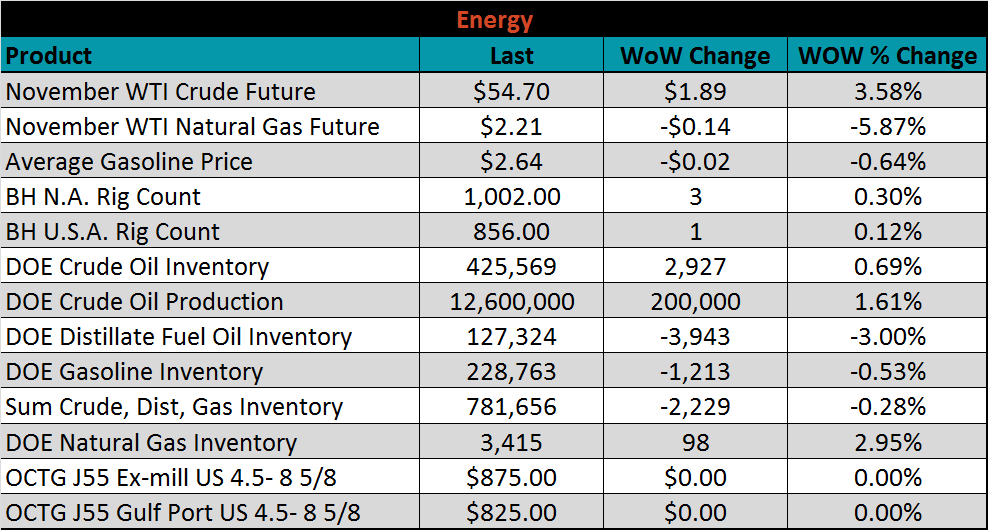

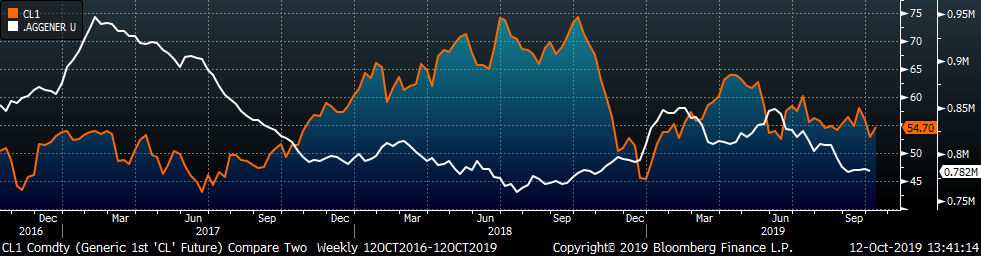

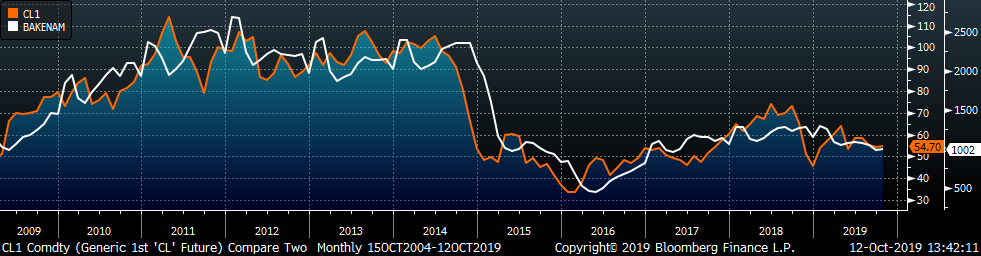

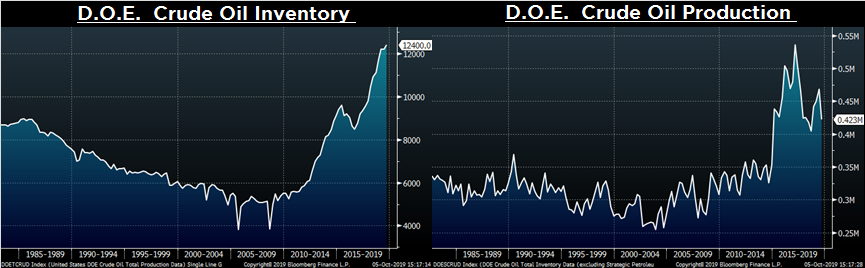

Last week, the November WTI crude oil future gained $1.89 or 3.6% to $54.70/bbl. The aggregate inventory level was down 0.3%, while crude oil production rose to 12.6m bbl/day. The Baker Hughes North American rig count gained three, while the U.S. count gained one.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: