Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

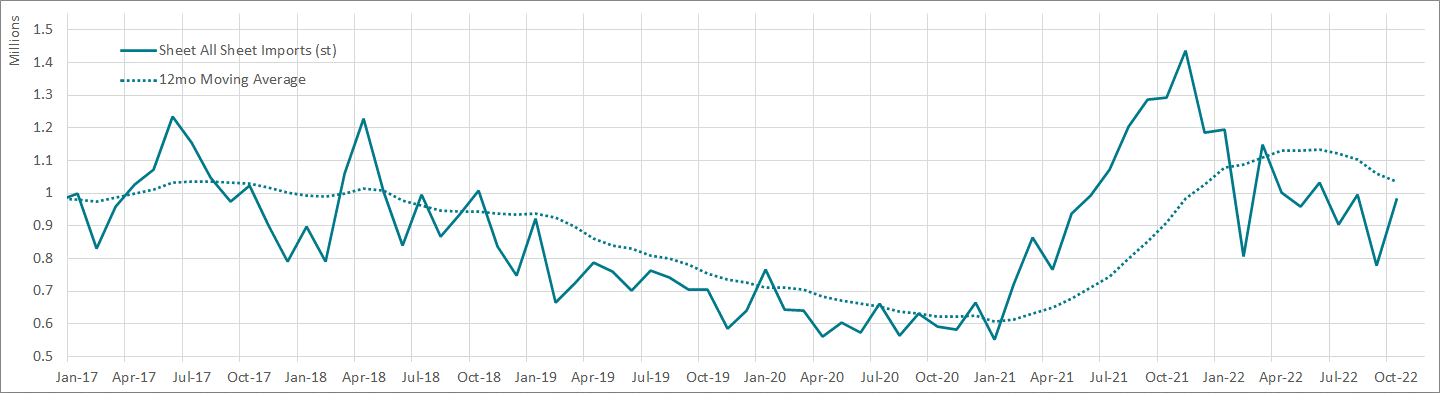

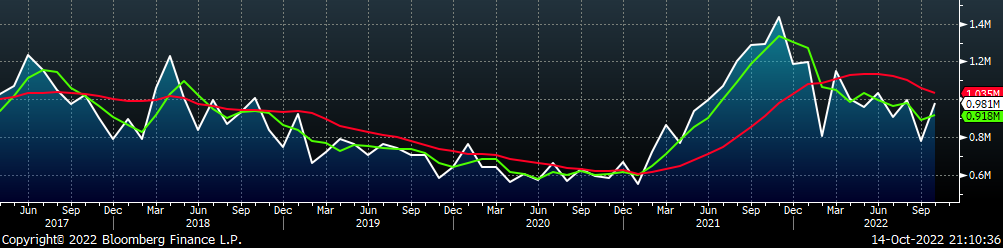

Since mid-August, the Midwest assessed price has been stable around $800. That price was supported by a Houston price above $700 and the trend of lower import arrivals, which restricted options for already reluctant buyers. However, this dynamic changed last week, and it will put pressure on the mills to further reduce production or quickly compete with significantly lower prices from abroad. The chart below shows all sheet import data, beginning in January 2017 with the dotted line representing the 12-month moving average.

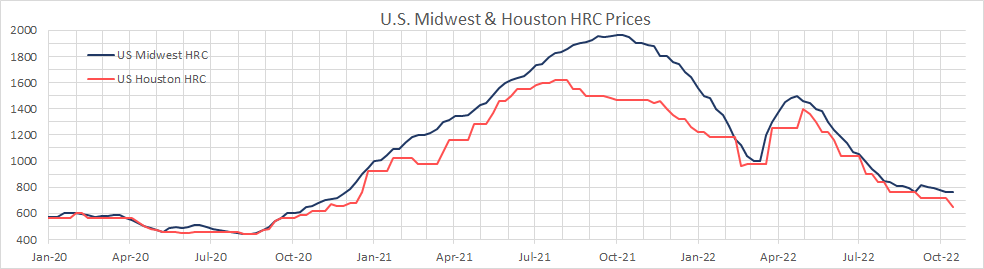

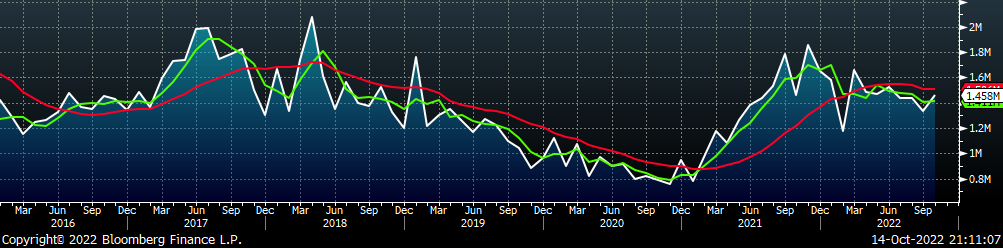

After September import arrivals briefly fell to the lowest level since April 2021, the preliminary data suggests a sharp rebound back up to 1M tons-per-month and just below the moving average. On its own, this more than replaces the gap created by the recent domestic production cuts and furnace idling, but it is even more of a significant signal when considering the price of these arrivals. The chart below shows the Midwest domestic HRC price in dark blue and the Houston delivered HRC price in orange.

As the chart shows, the Houston price does not update as frequently as Midwest assessed pricing, but last week the price fell 9.7%, down to $650. This is important because the Houston price is a good representation of the import delivered price. While there are exceptions, the Midwest price tends to converge with the Houston delivered price. If there are no further shocks to the supply and demand dynamic, we anticipate the two prices to converge closer to the current Houston price.

Upside Risks:

Downside Risks:

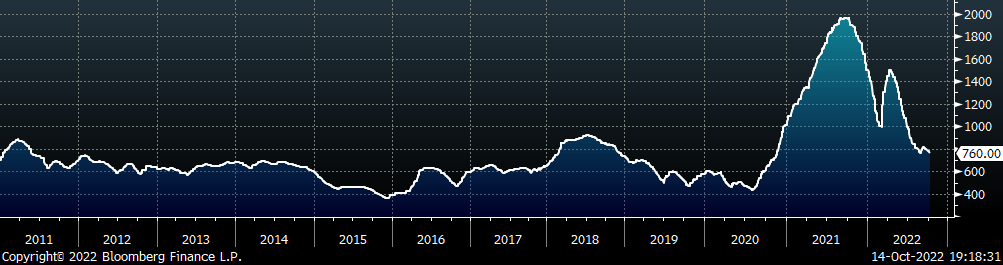

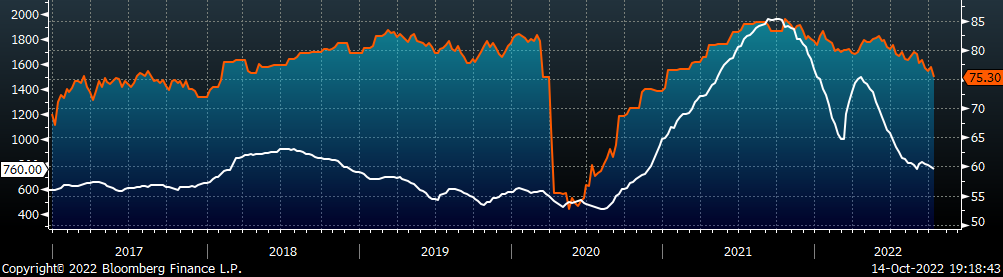

The Platts TSI Daily Midwest HRC Index was unchanged at $760.

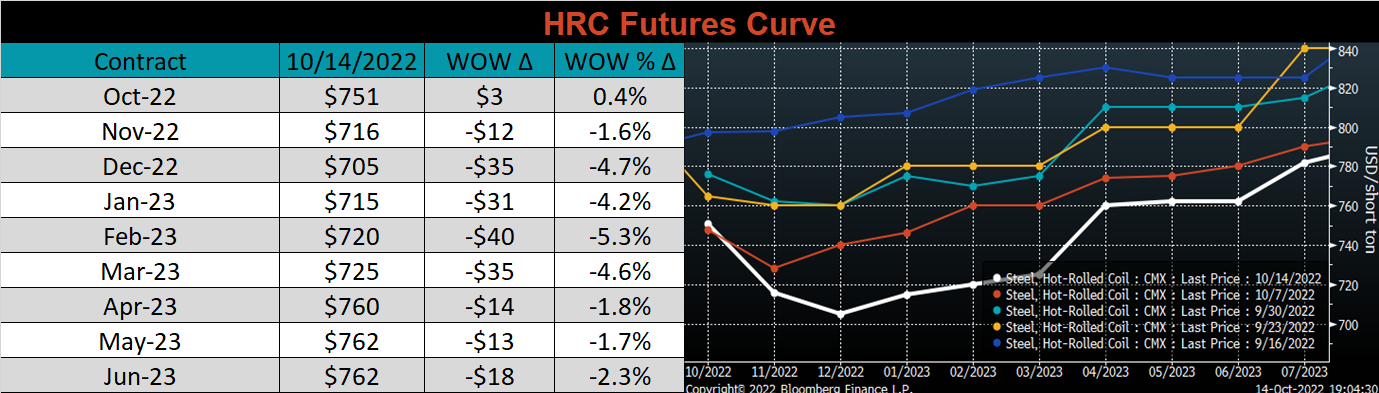

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The curve continues to be under significant pressure with the 4Q22 and 1Q23 both trading below current spot prices.

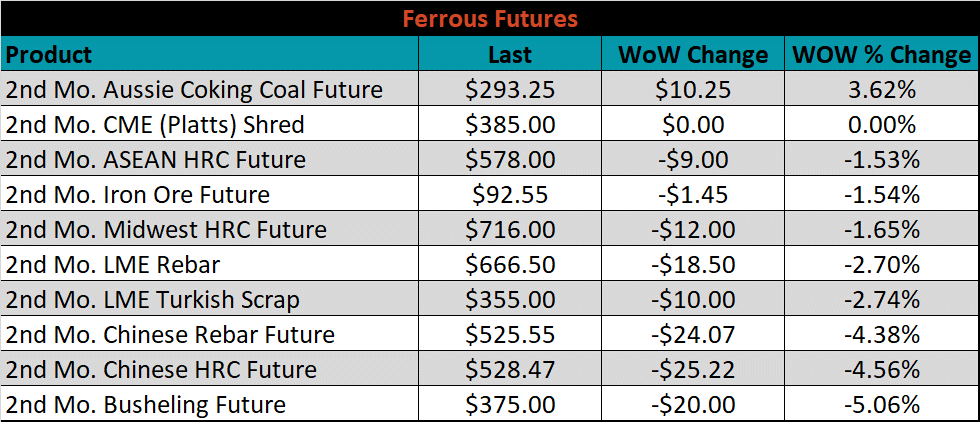

The 2nd month ferrous futures were mostly lower, with Midwest busheling down 5.1%, while Aussie coking coal continues to buck this trend, up another 3.6%.

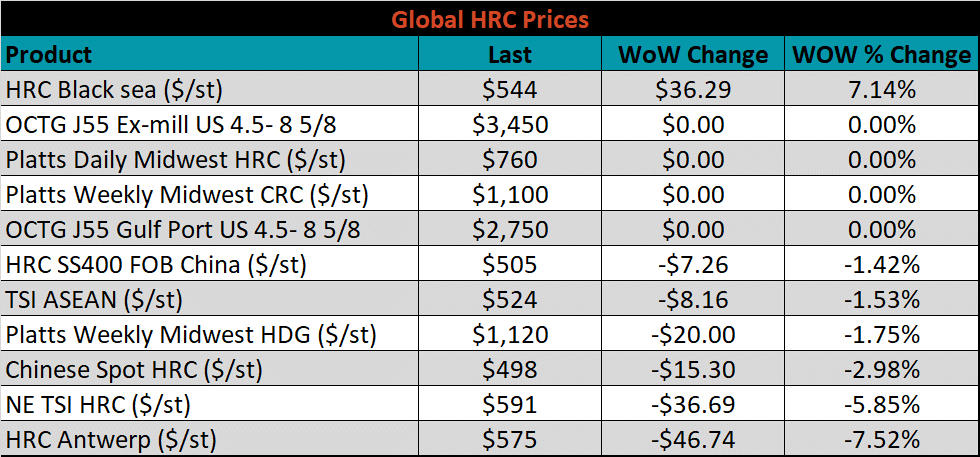

Global flat rolled indexes were mostly lower again, led by Antwerp HRC, down 7.5%, while Black Sea HRC was up 7.1%.

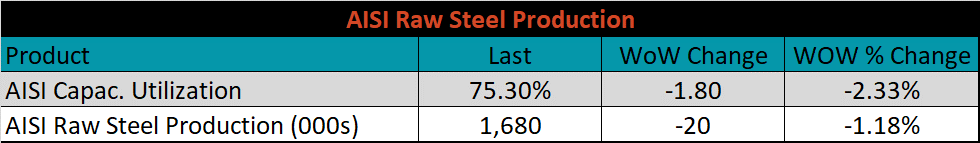

The AISI Capacity Utilization was down sharply, 1.8% to 75.3%.

October flat rolled import license data is forecasting an increase of 204k to 981k MoM.

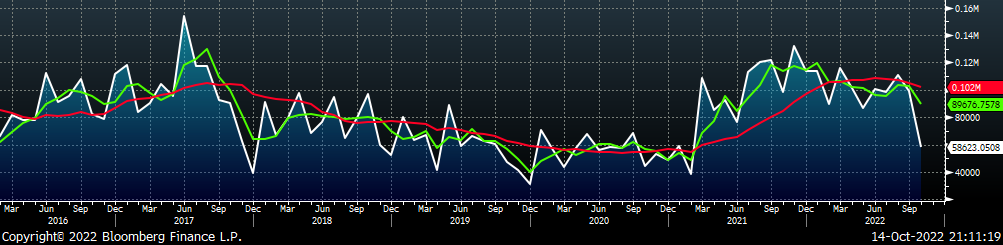

Tube imports license data is forecasting a decrease of 83k to 476k in October.

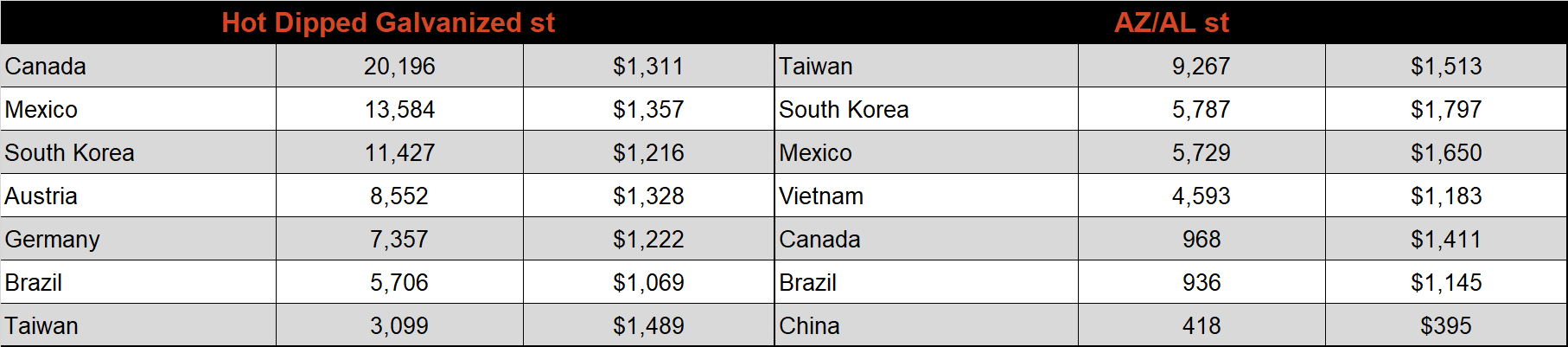

October AZ/AL import license data is forecasting a decrease of 41k to 59k.

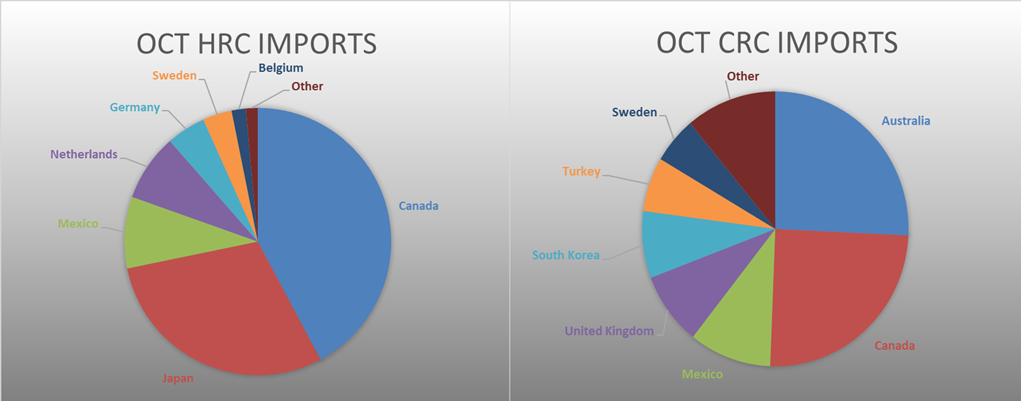

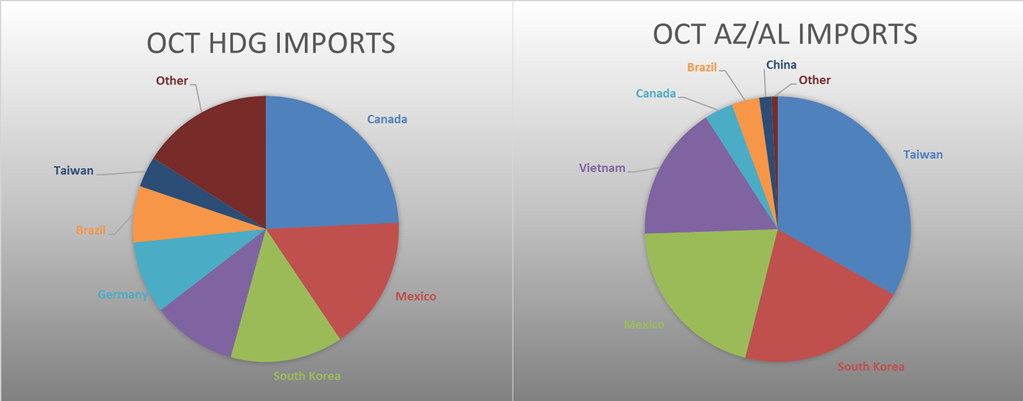

Below is October import license data through October 10th, 2022.

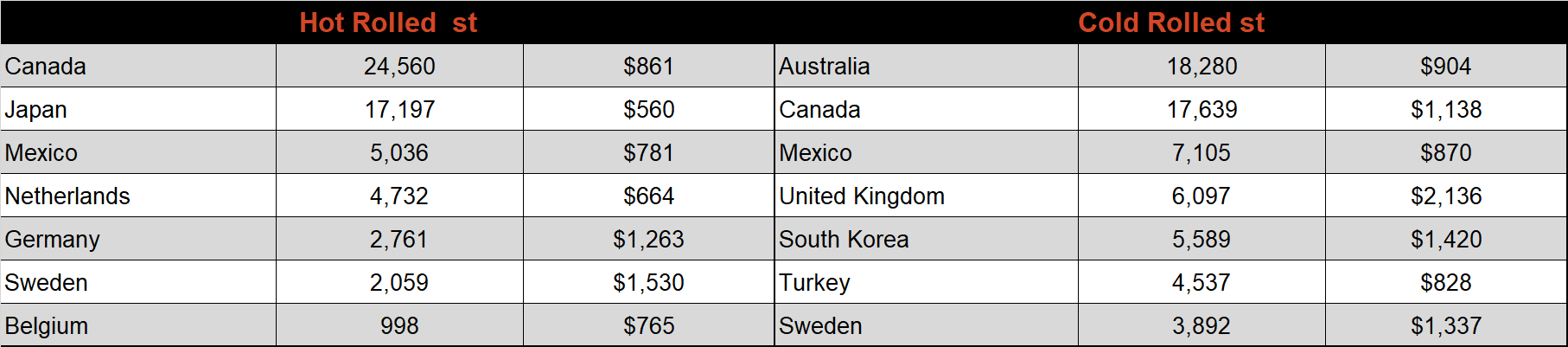

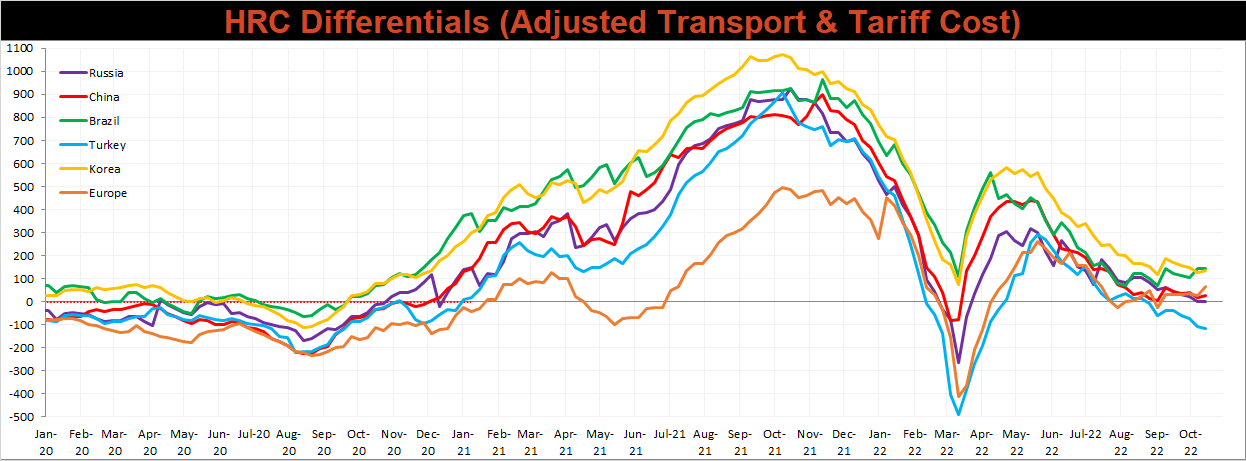

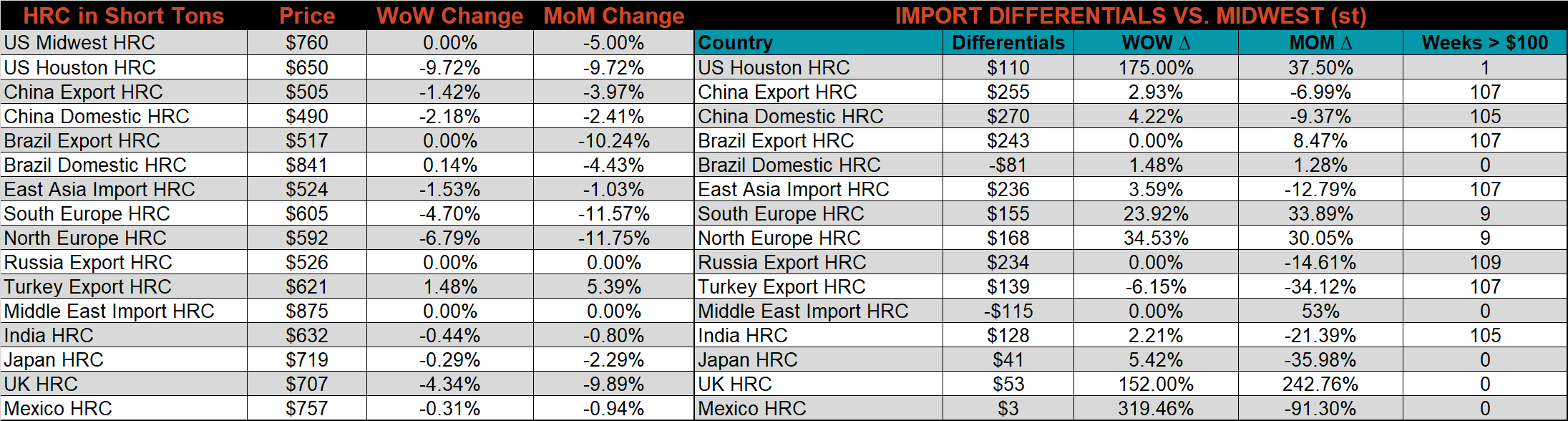

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials increased for China, Korea and Europe but fell for Turkey.

Global prices were mostly lower this week, led by Northern European HRC, down 6.8%.

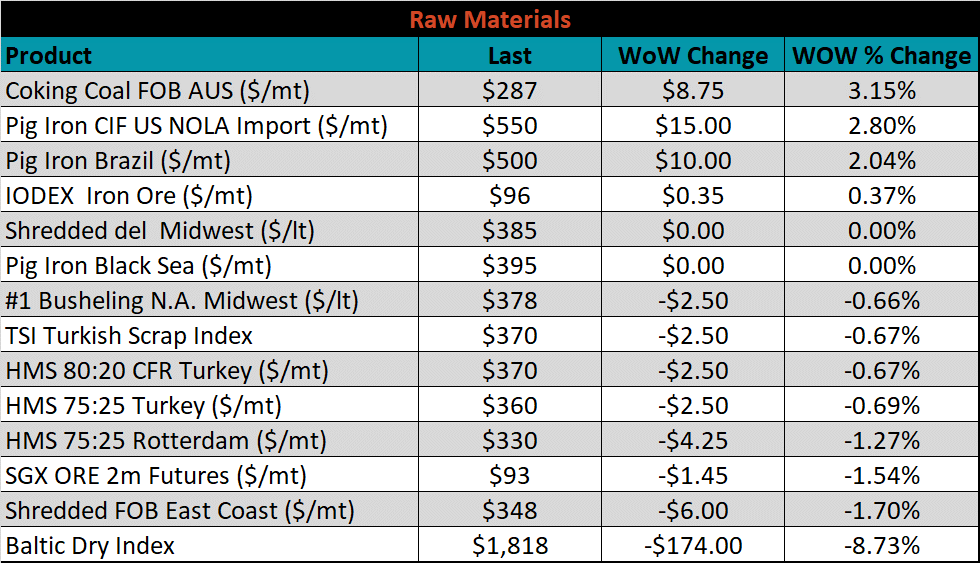

Raw material prices were mixed this week, with Aussie coking coal up 3.2%, while East Coast shredded was down 1.7%.

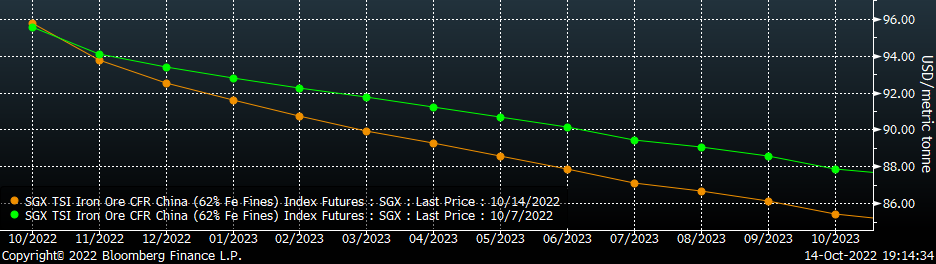

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve was lower, much more significantly in the back.

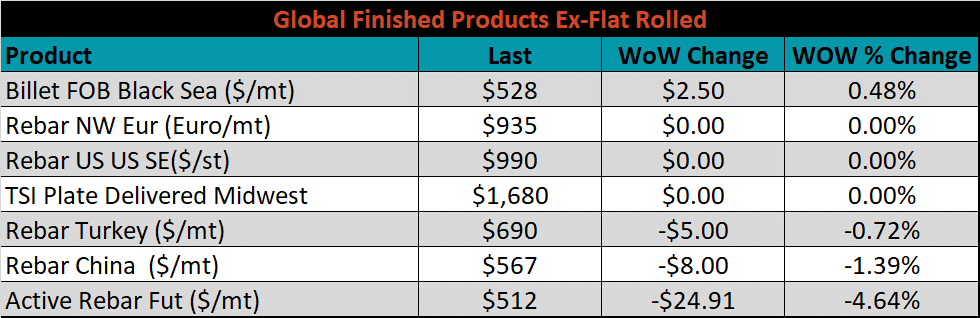

The ex-flat rolled prices are listed below.

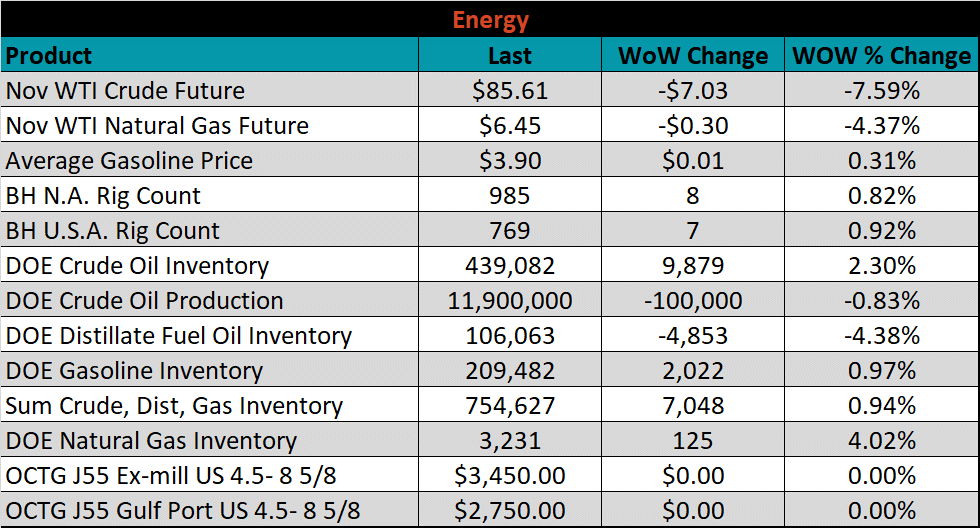

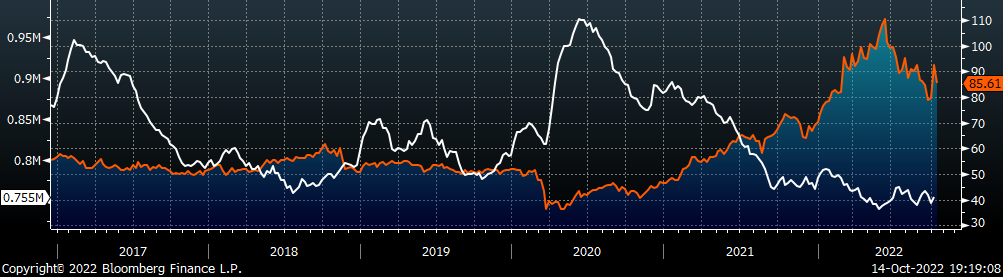

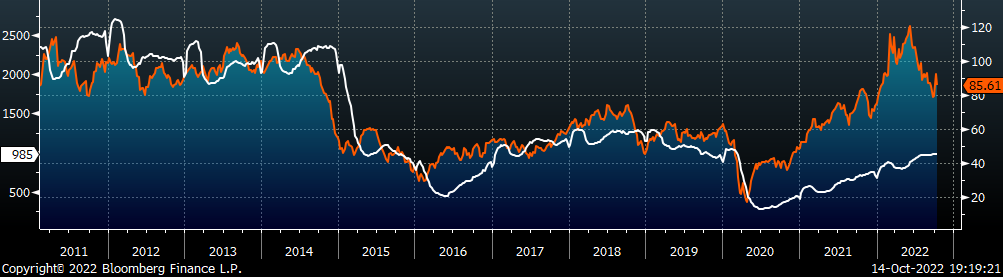

Last week, the November WTI crude oil future lost $7.03 or 7.6% to $85.61/bbl. The aggregate inventory level rose 0.9%. The Baker Hughes North American rig count increased by 8 rigs, and the U.S. rig count increased by 7 rigs.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: