Content

-

Weekly Highlights

- Market Commentary

- Risks

While the spot market continues to move higher, the pace has slowed slightly as buyers digest the recent shock of this historic price rally. Spot transactions are occurring near $660/st for HRC, with mills targeting $680 for the next leg up. The general market consensus is that prices will increase without a formal announcement, at least for the next few weeks, as lead times remain extended and mills are concerned with overselling their still limited capacity. Buyers remain hesitant to commit to tons at these prices unless the material is immediately needed because they believe there will be a better restocking opportunity early next year. We caution against this outlook because if this view takes hold across the entire buying community, inventories will remain thin, adding to the tightness in supply and propelling prices even higher into next year. Moreover, our short-term outlook concerning the spot market tightness does not contain any relief from imports or domestic production. This week we will analyze the recent market trends from the perspective of the domestic producers, as well as the dynamics influencing their decisions.

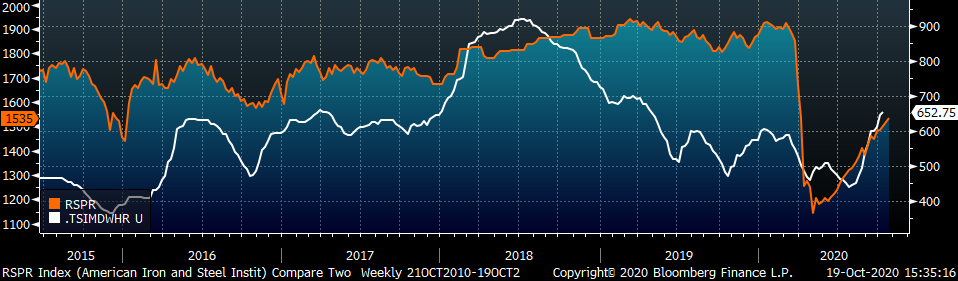

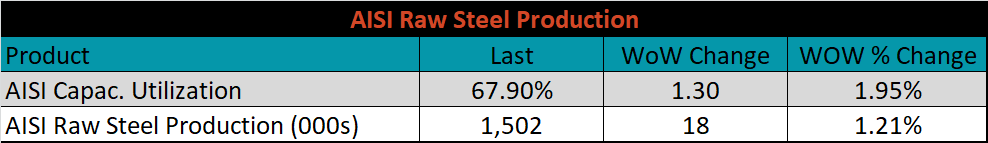

Two significant factors for the current historic rally in HRC prices are how quickly steel mills cut production at the beginning of the pandemic and, more importantly, how disciplined they have remained in increasing supply as demand recovered. The chart below tracks raw steel production and compares it to domestic HRC prices.

By early May, production was cut over 40% and only about half of that has been brought back online since. The recent price rally has accelerated in part because production did not return as many expected late in the summer amid higher prices. Furnace idle/restart cycles in the past informed these expectations as mills historically brought back production once prices recovered in order to sell more tons at higher prices, allowing companies to meet revenue and profit guidance. However, by keeping production offline for longer, mills were able to sell at even higher prices, offsetting a portion of the profitability shortfalls.

Relatedly, there were several planned maintenance outages scheduled for this fall, and companies had already budgeted for and disclosed these capital expenditures. Therefore, some of the costs associated with idling furnaces and reducing production were already expected, and as production remained sidelined for longer, these costs were covered by the budgeted maintenance cost in the fall. Most companies stopped providing quantitative guidance for analysts and the investment community when the pandemic hit, reducing short-term profit or capital expenditure incentives that historically may have caused production to restart quicker.

Finally, capital markets have remained supportive through the recovery, allowing mills access to capital for pandemic related cash flow shortages or investments in future projects that otherwise would be in jeopardy. The stock market recovered from its spring collapse, and the Federal Reserve’s swift action to provide liquidity through bond buying (including corporate bonds, indirectly) and low interest rates allowed corporations to borrow at historically low rates. Some domestic producers took advantage – since May, Steel Dynamics borrowed a total of $900 million, US Steel $1.05 billion and Nucor $1 billion. This access to capital, along with fewer short-term financial incentives, allowed mills to maintain strategic goals while operating at lower production levels.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

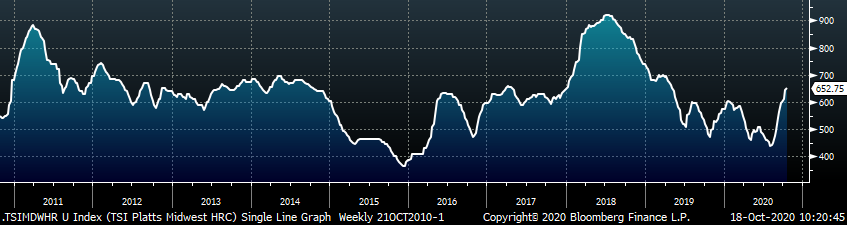

The Platts TSI Daily Midwest HRC Index increased by $7.25 to $652.75.

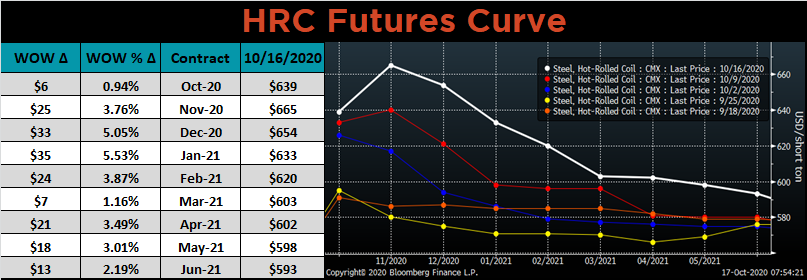

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The entire curve rose significantly again last week. A futures curve in this shape is a clear signal of a market that is short on steel and getting worse. This is exemplified by a growing willingness to pay a significant premium for any steel available in near expirations as lead times remain firm and even push out.

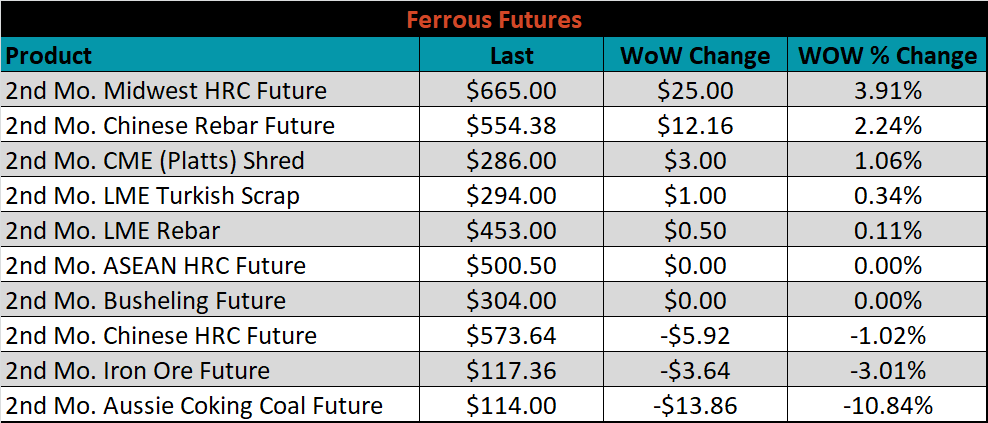

November ferrous futures were mixed. Midwest HRC gained 3.9%, while Aussie coking coal fell another 10.8%.

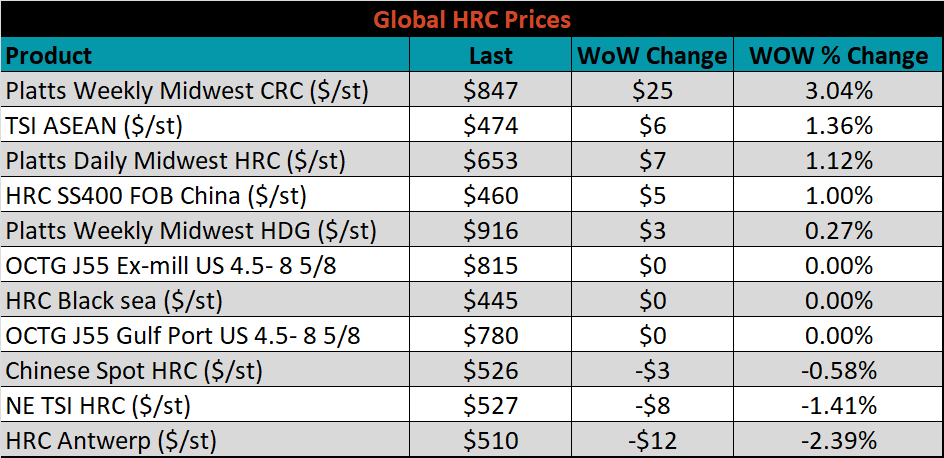

The global flat rolled indexes were mostly higher. TSI Platts Midwest CRC was up 3%, while Antwerp HRC was down 2.4%.

The AISI Capacity Utilization rate increased 1.3% to 67.9%.

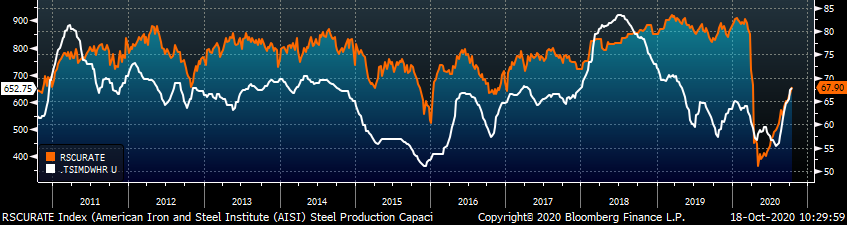

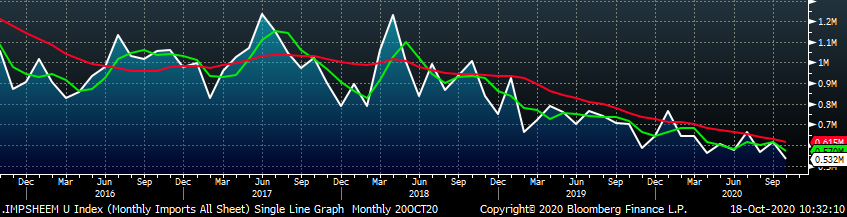

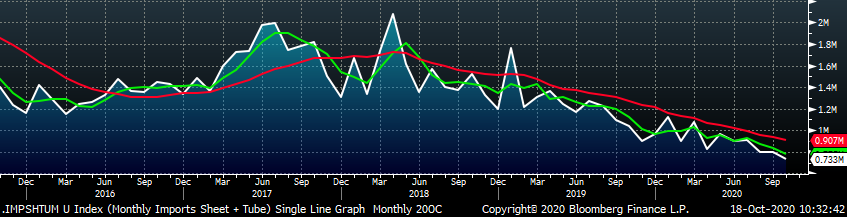

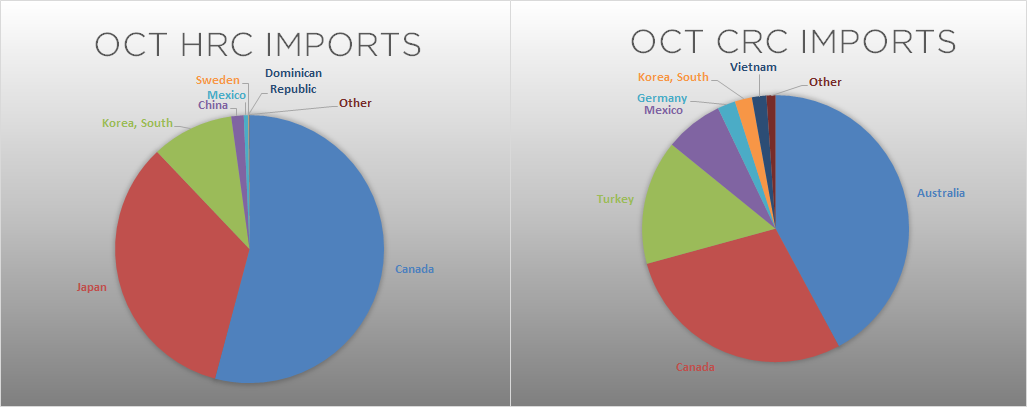

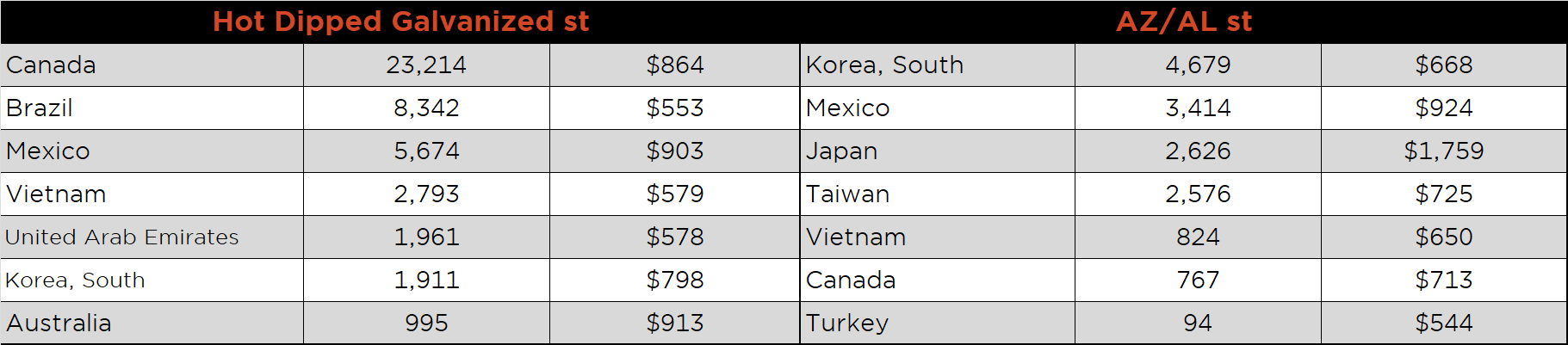

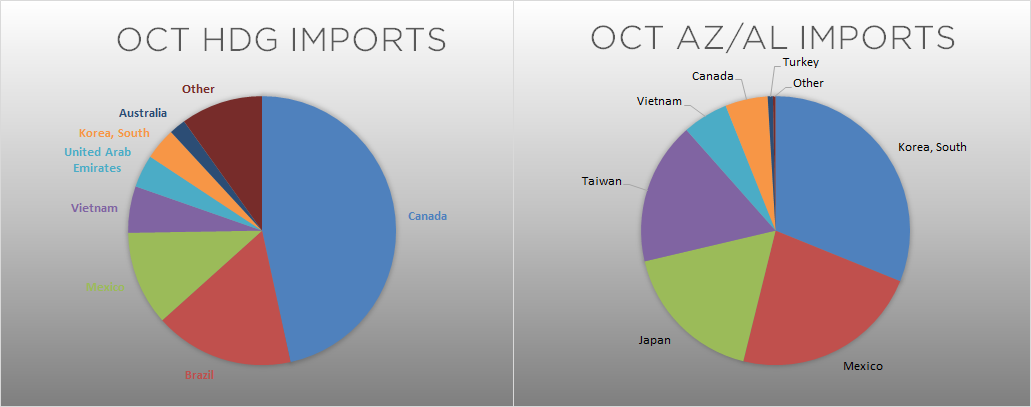

October flat rolled import license data is forecasting a decrease of 81k to 532k MoM.

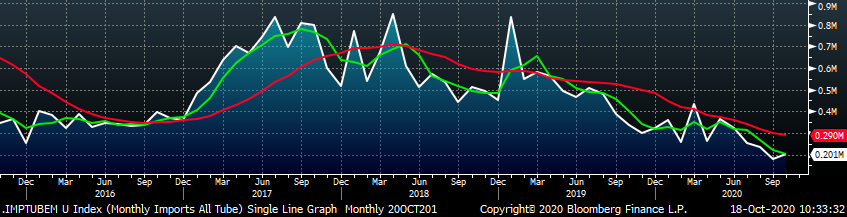

Tube imports license data is forecasting a decrease of 20k to 201k in October.

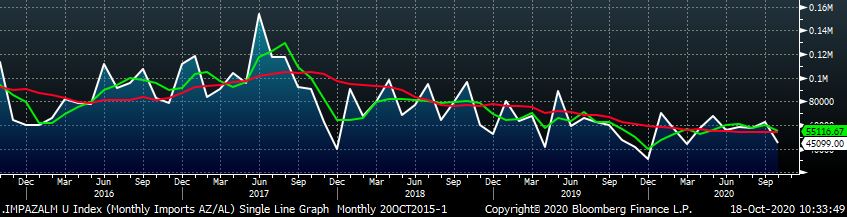

October AZ/AL import license data is forecasting an 18k decrease to 45k.

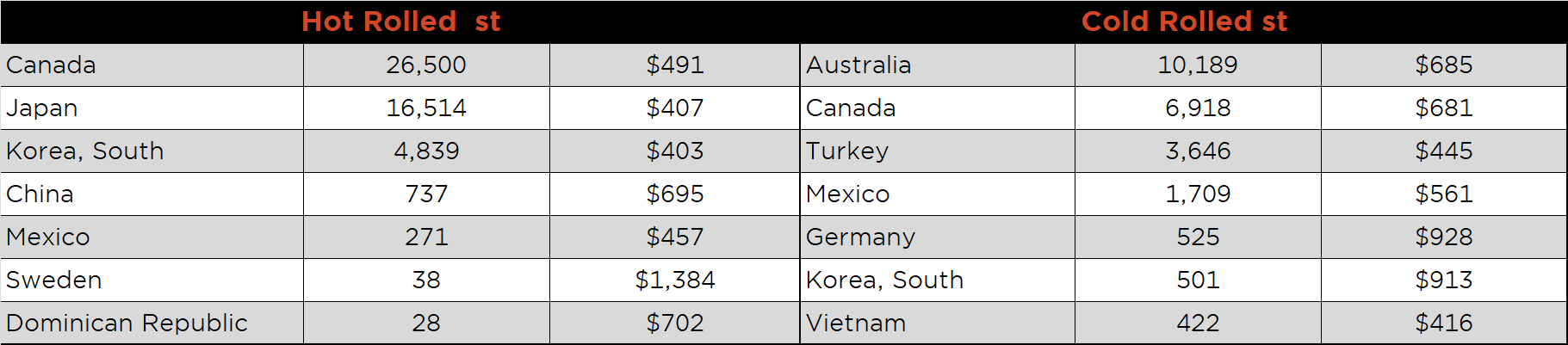

Below is October import license data through October 9, 2020.

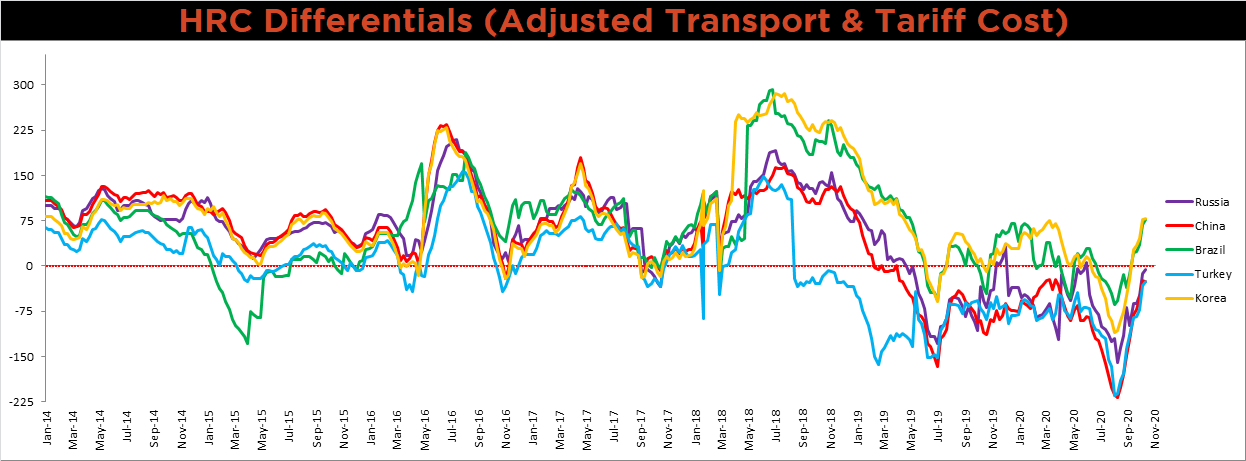

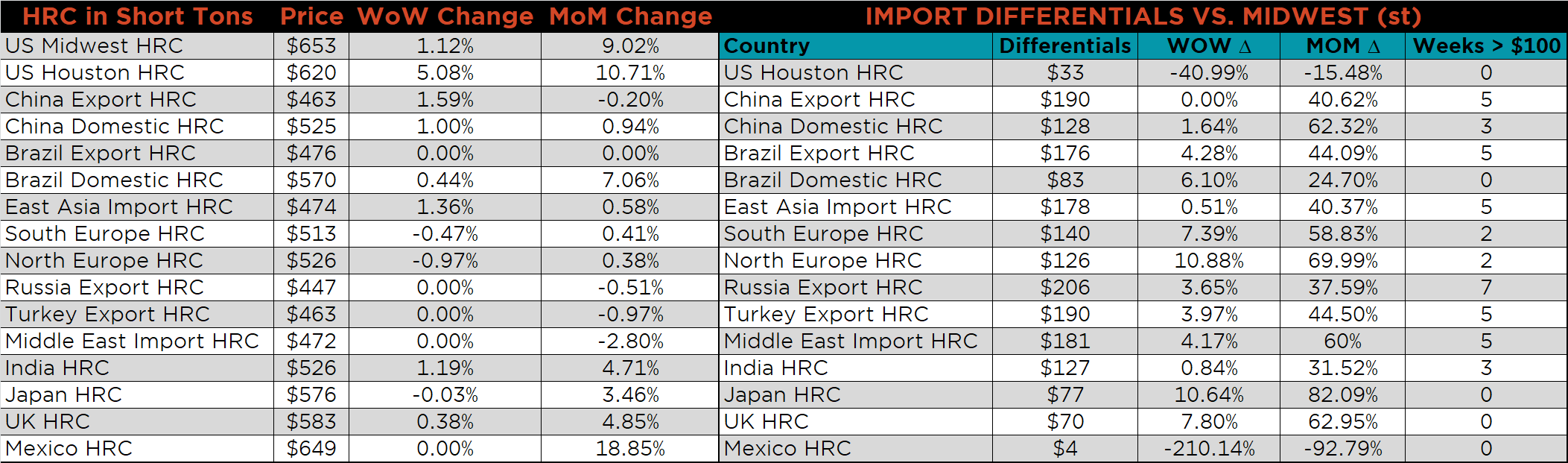

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The differentials for all watched countries increased again last week, as the U.S. price rose and global prices were unchanged or just slightly higher.

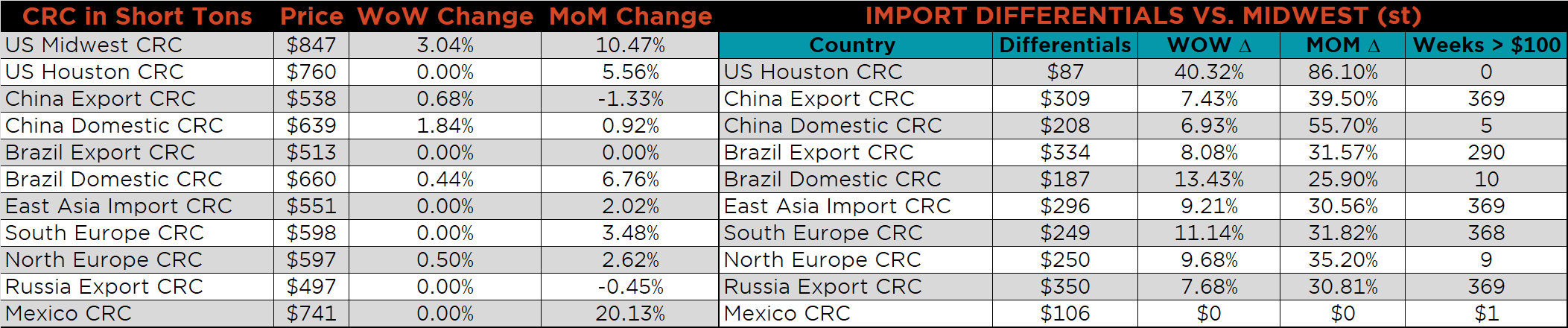

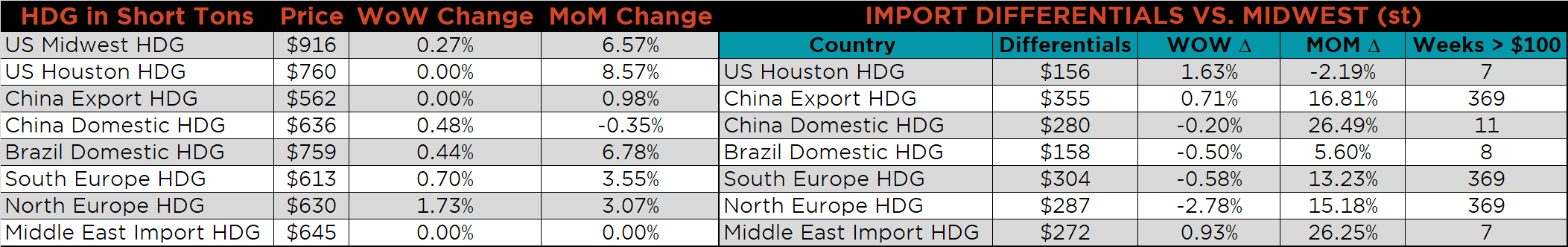

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest CRC, HRC and HDG prices were up, 3%, 1.1% and 0.3%, respectively. Globally, the Chinese export HRC price was up 1.6%.

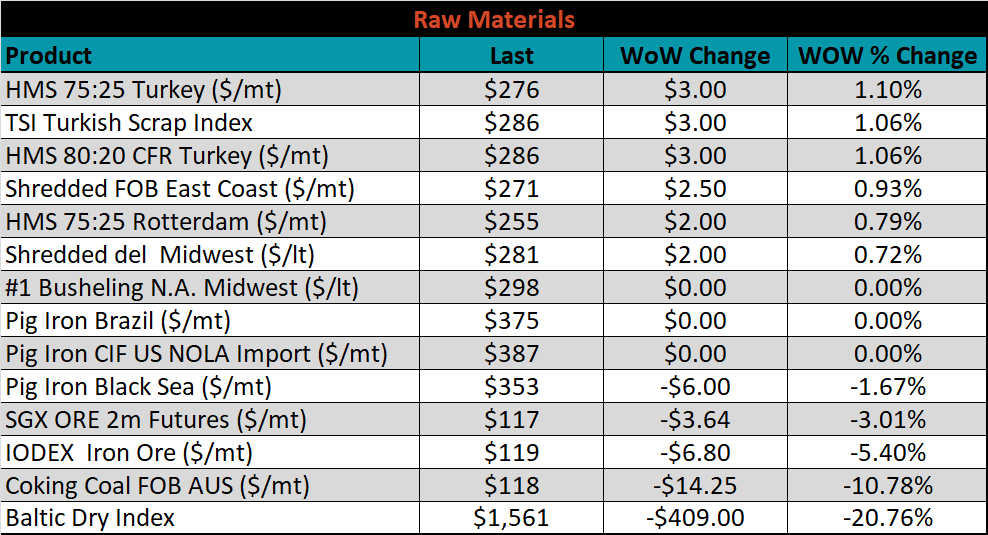

Raw material prices were mixed. Turkish HMS was up 1.1%, while Aussie coking coal was down 10.8%.

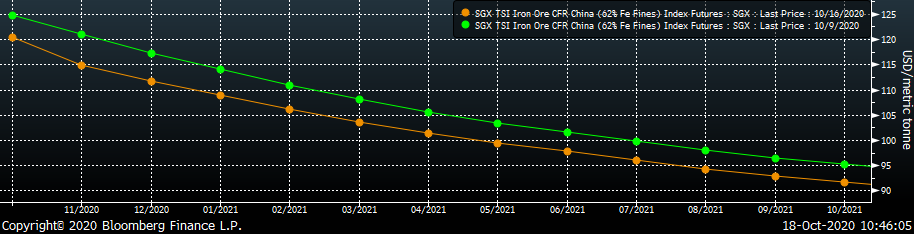

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the curve decreased equally along all expirations.

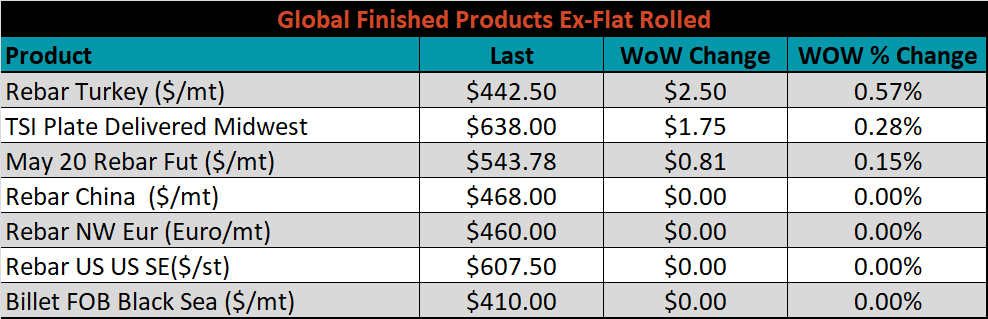

The ex-flat rolled prices are listed below.

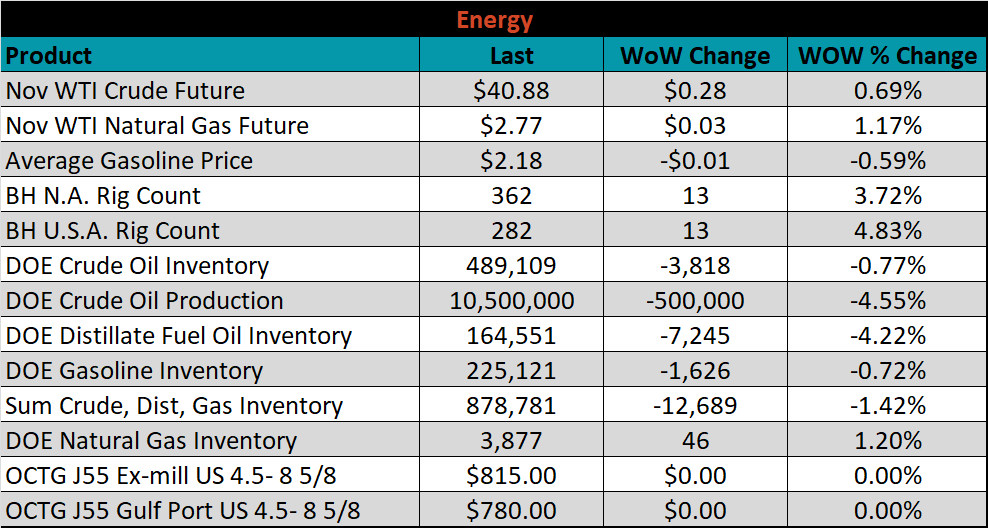

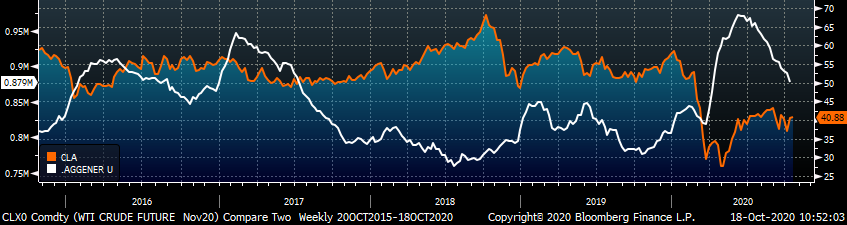

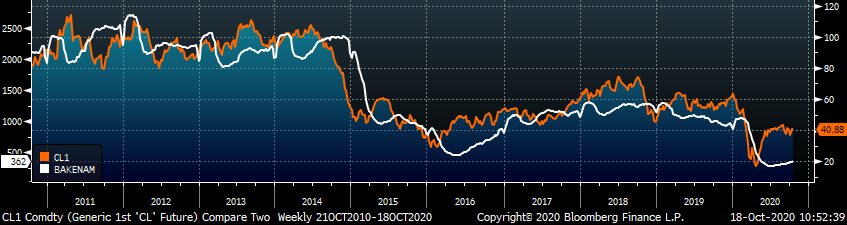

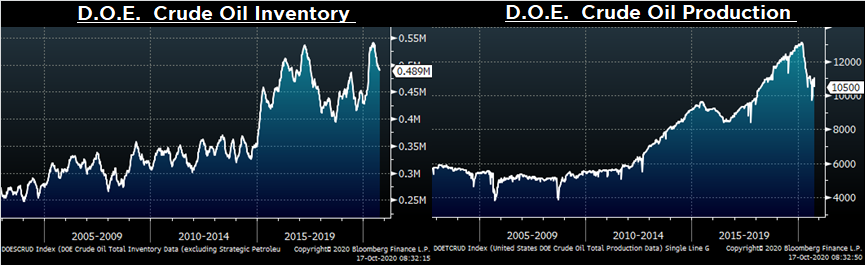

Last week, the November WTI crude oil future gained $0.28 or 0.7% to $40.88/bbl. The aggregate inventory level was down another 1.4%, while crude oil production fell to 10.5m bbl/day. The Baker Hughes North American and U.S. rig counts were each up 13 rigs. Since recovering from a historic decline in the spring, the energy sector continues to face headwinds. Below we see the WTI Crude price in orange, range bound since June while the market continues to work through excess supply.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: