Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

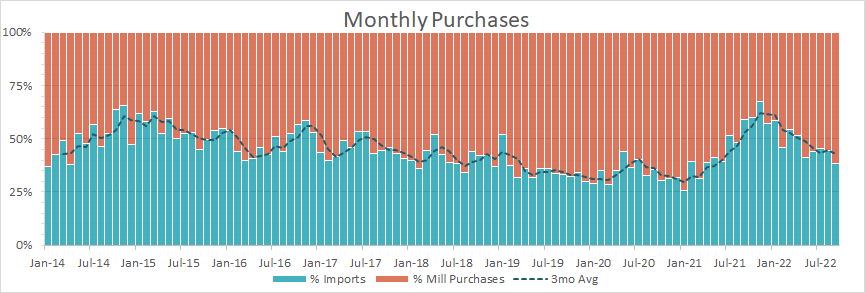

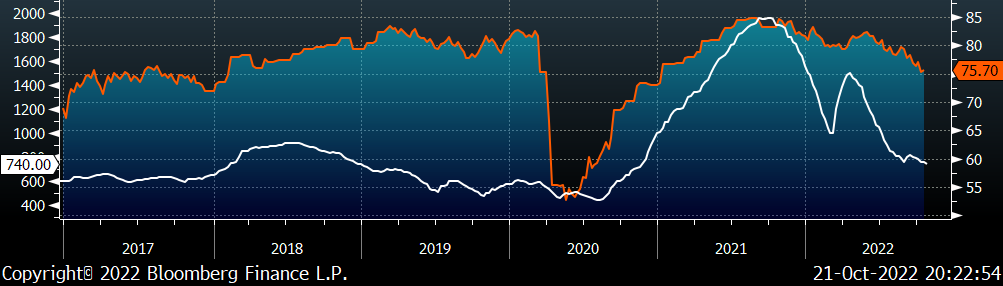

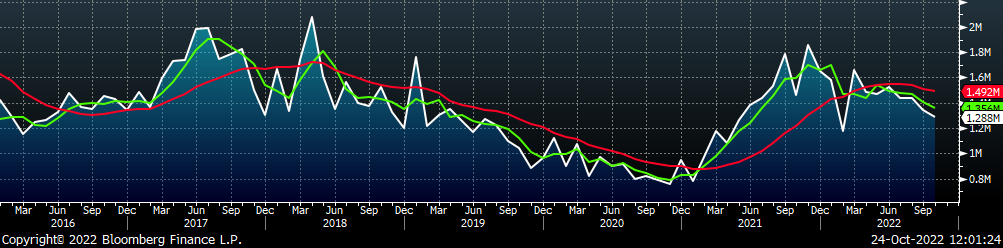

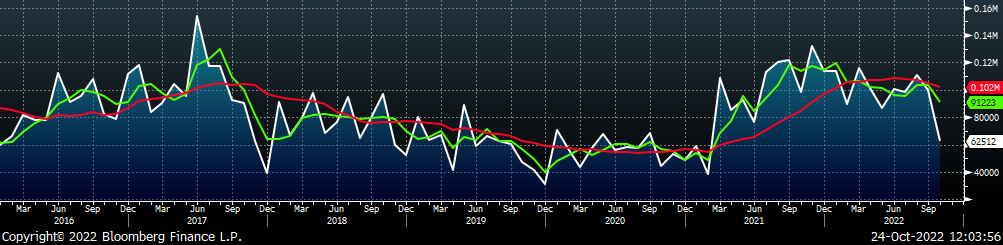

The chart below shows that buyers have steadily become more reliant on domestic supply than on imported material since May of this year. This has been the case while both imports and domestic production have started trending lower to match the slowing growth rates of demand, compared to last year.

If this trend persists while domestic production and import arrivals simultaneously decline, the physical market would be at increased risk of a temporary shortage causing support for falling domestic prices. Furthermore, mills appear to be doubling down on last year’s strategy of reducing their overall contract books to increase spot market activity. Because of this, the longer buyers wait to restock in a more competitive spot market, the more significant a short squeeze would become. At the same time, we do not anticipate an impact from these dynamics until 1Q23 at the earliest, given the normal seasonality of the domestic market, unless unforeseen catalysts in steel demand arise.

Upside Risks:

Downside Risks:

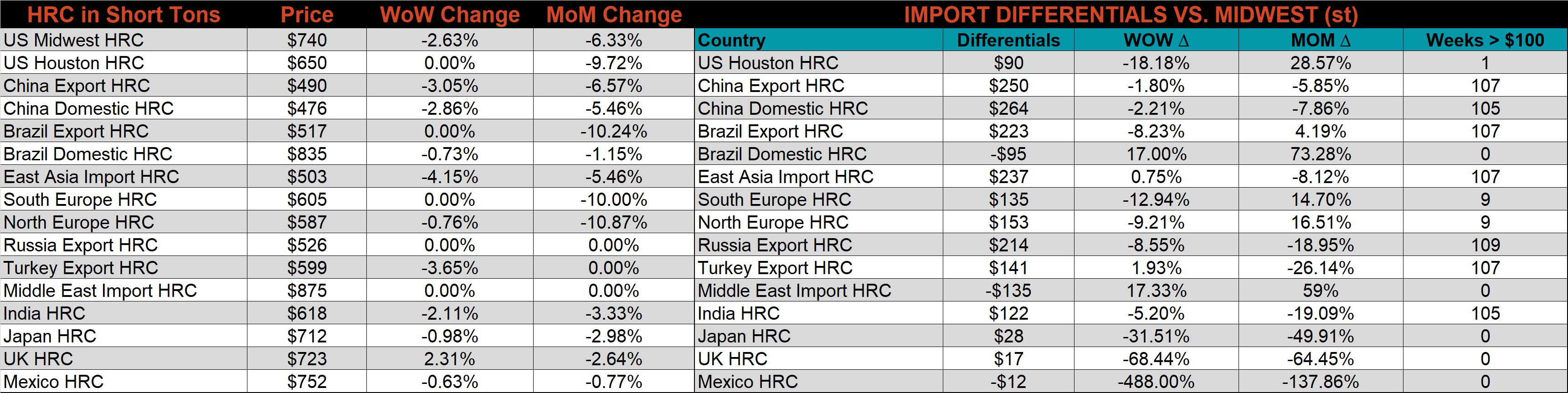

The Platts TSI Daily Midwest HRC Index was down $20 to $740.

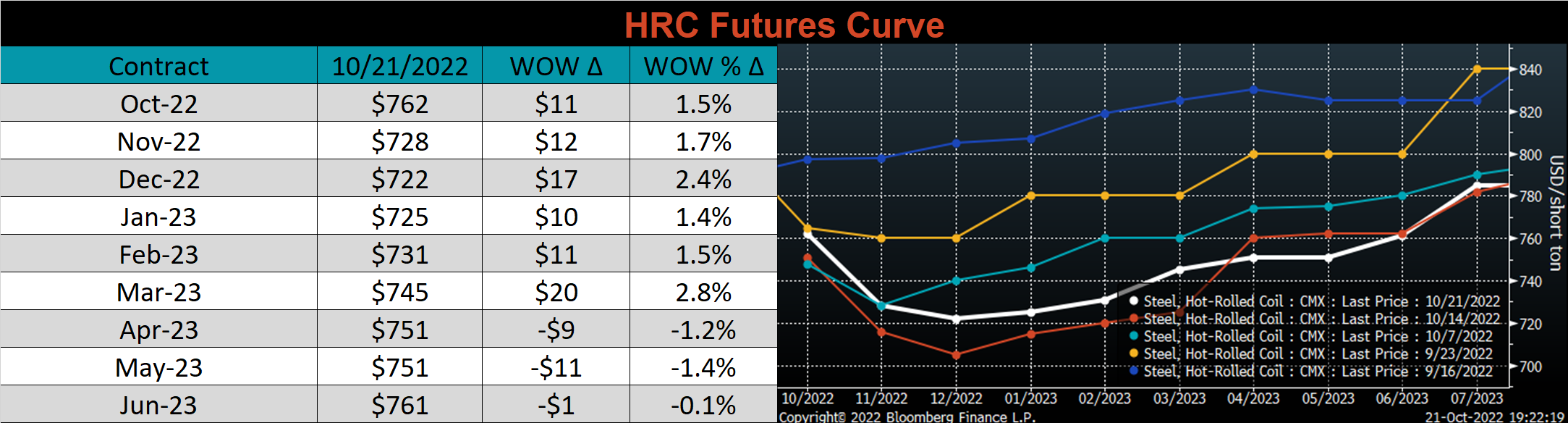

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The curve was slightly higher in the front and lower in the back, leading to an overall flattening at prices just below published spot levels.

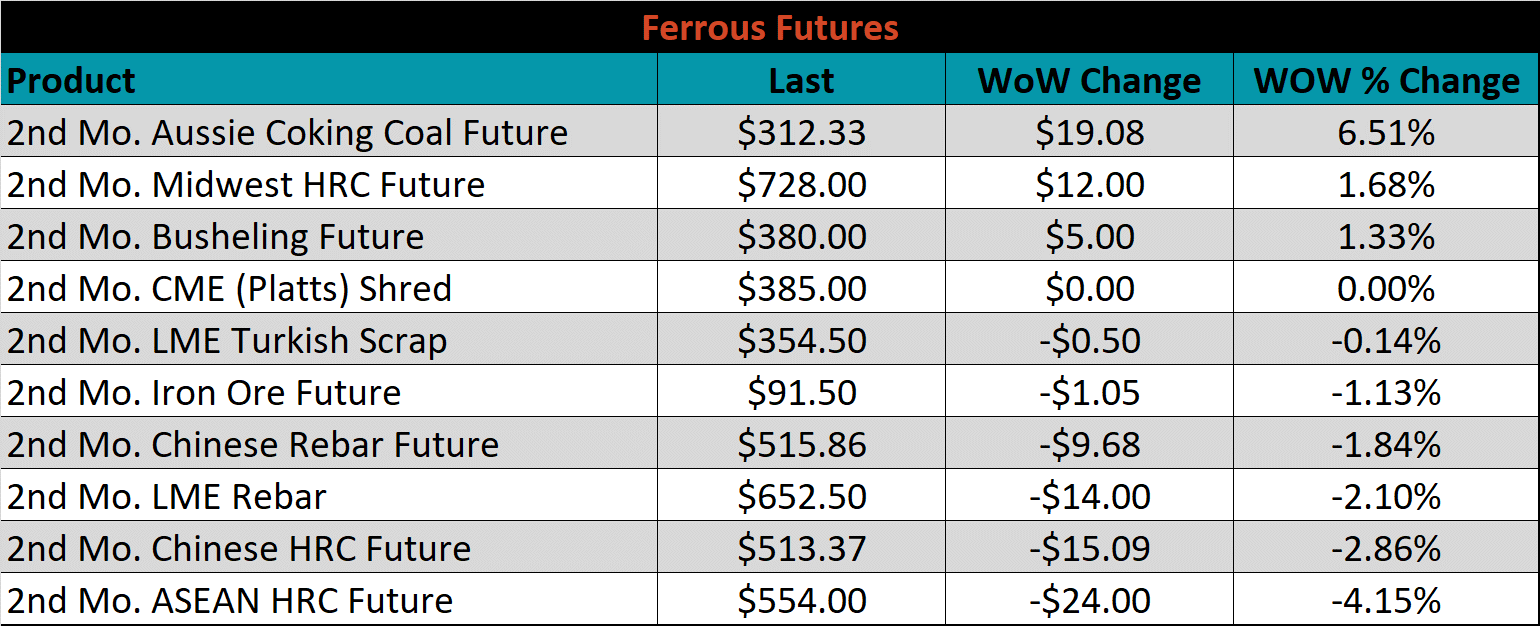

The 2nd month ferrous futures were mostly lower, led by prices in Southeast Asia down 4.2%, while Aussie coking coal continues to rise, up another 6.5%.

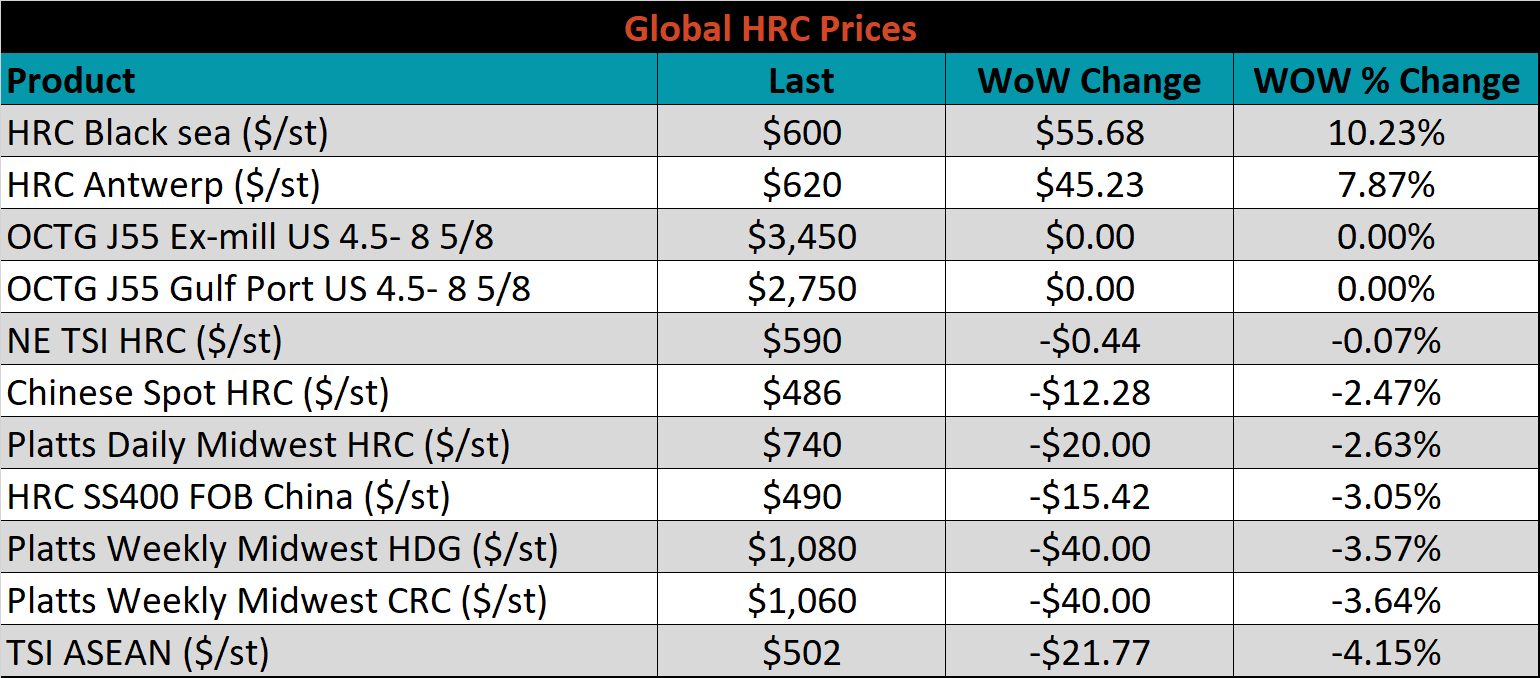

Global flat rolled indexes were mostly lower again, but Black Sea and Antwerp HRC were both up sharply, 10.2% and 7.9%, respectively. U.S. domestic tandem products recorded some of the steepest declines last week as their differential to HRC continues to revert to more historically normal levels.

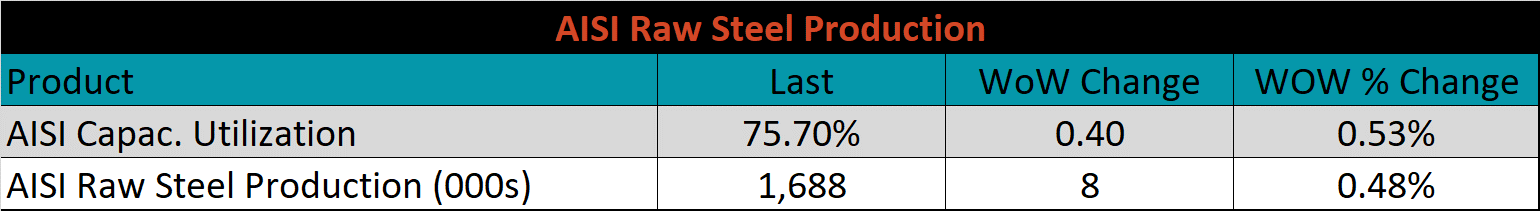

The AISI Capacity Utilization was up, 0.4% to 75.7%.

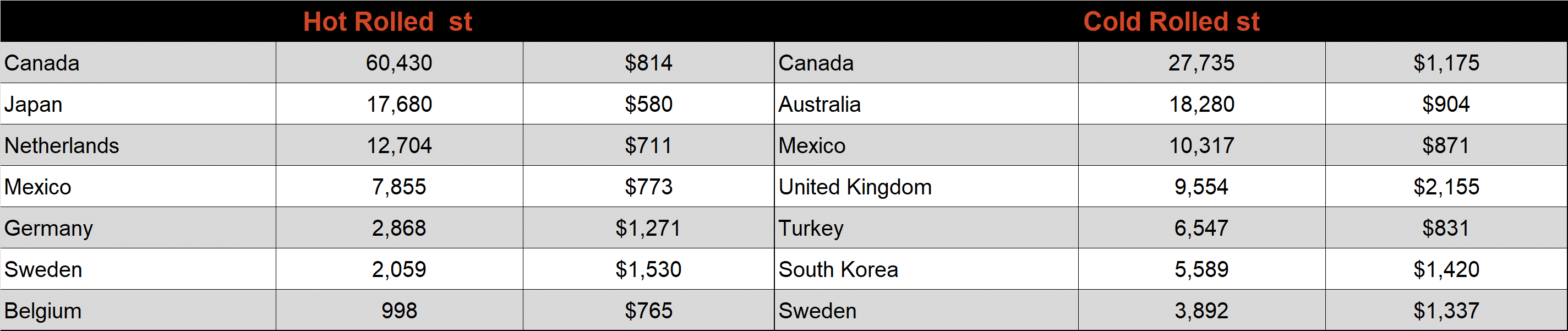

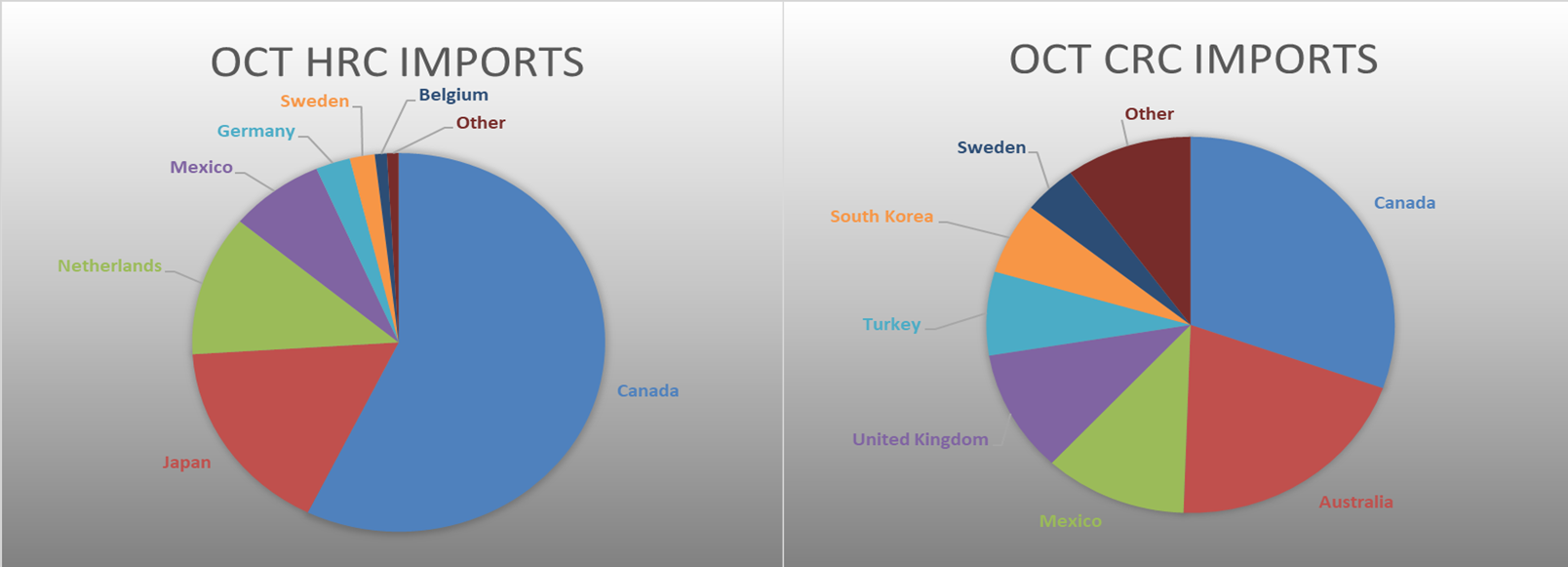

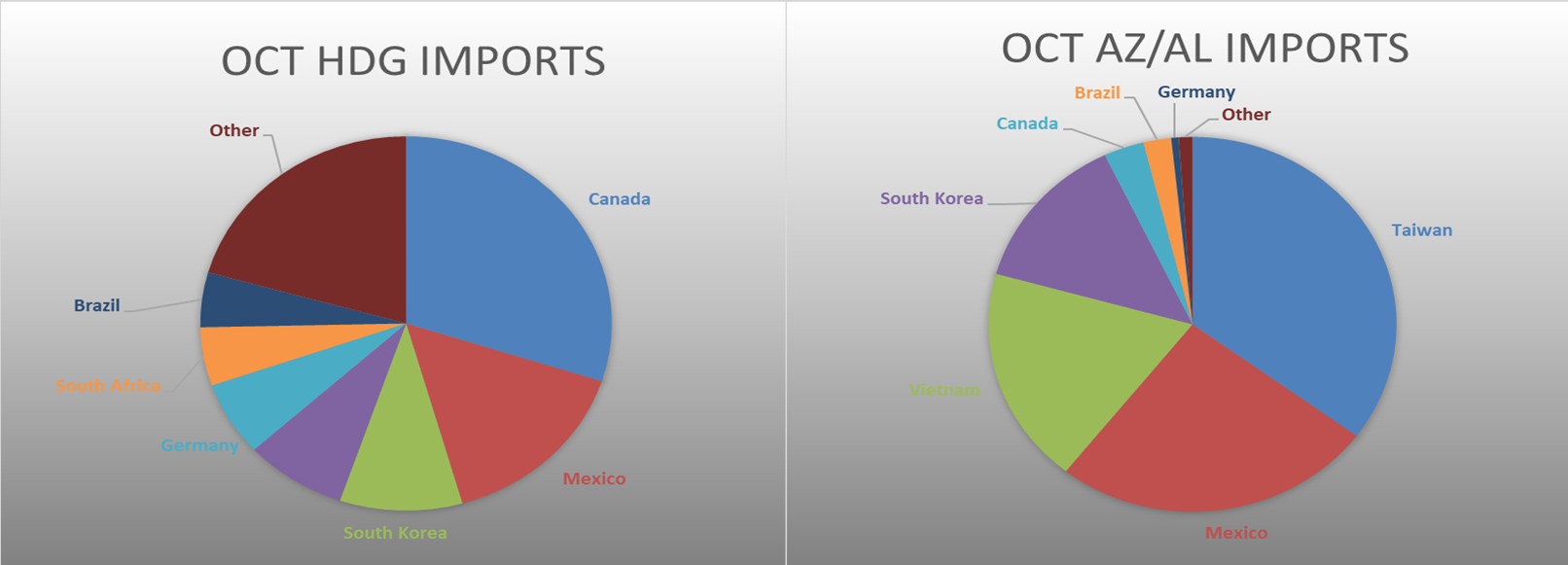

October flat rolled import license data is forecasting an increase of 101k to 879k MoM.

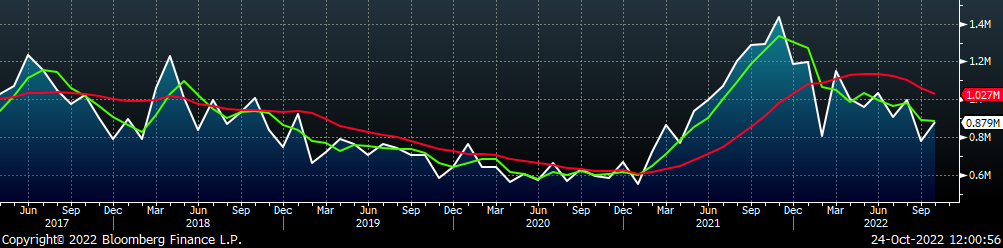

Tube imports license data is forecasting a decrease of 156k to 409k in October.

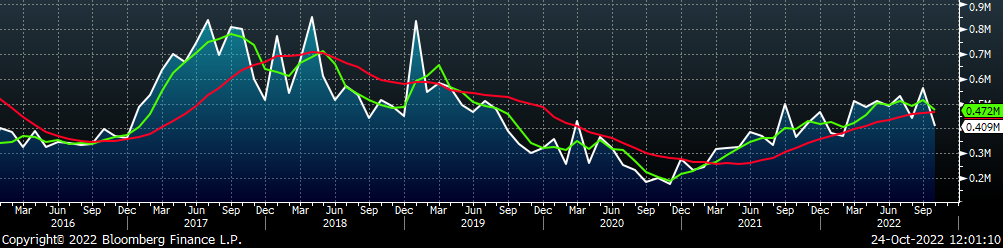

October AZ/AL import license data is forecasting a decrease of 38k to 63k.

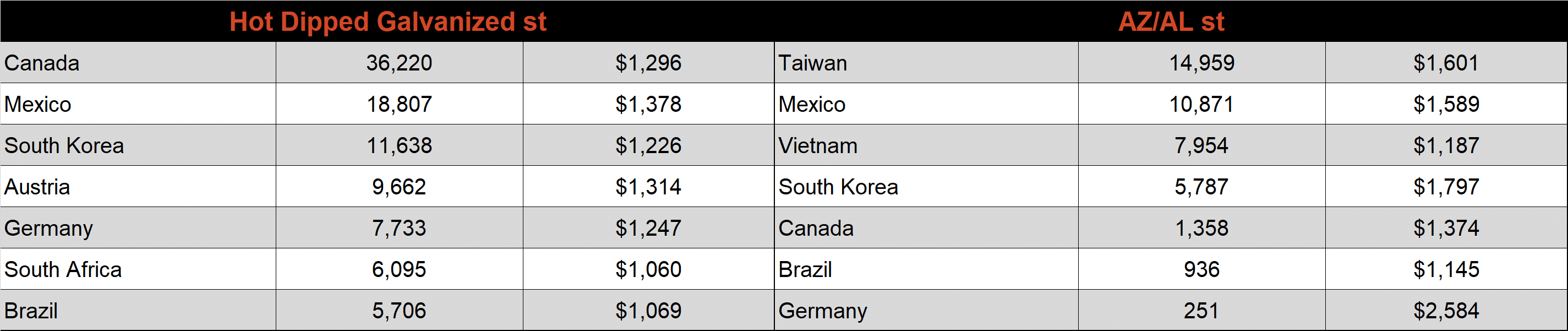

Below is October import license data through October 17th, 2022.

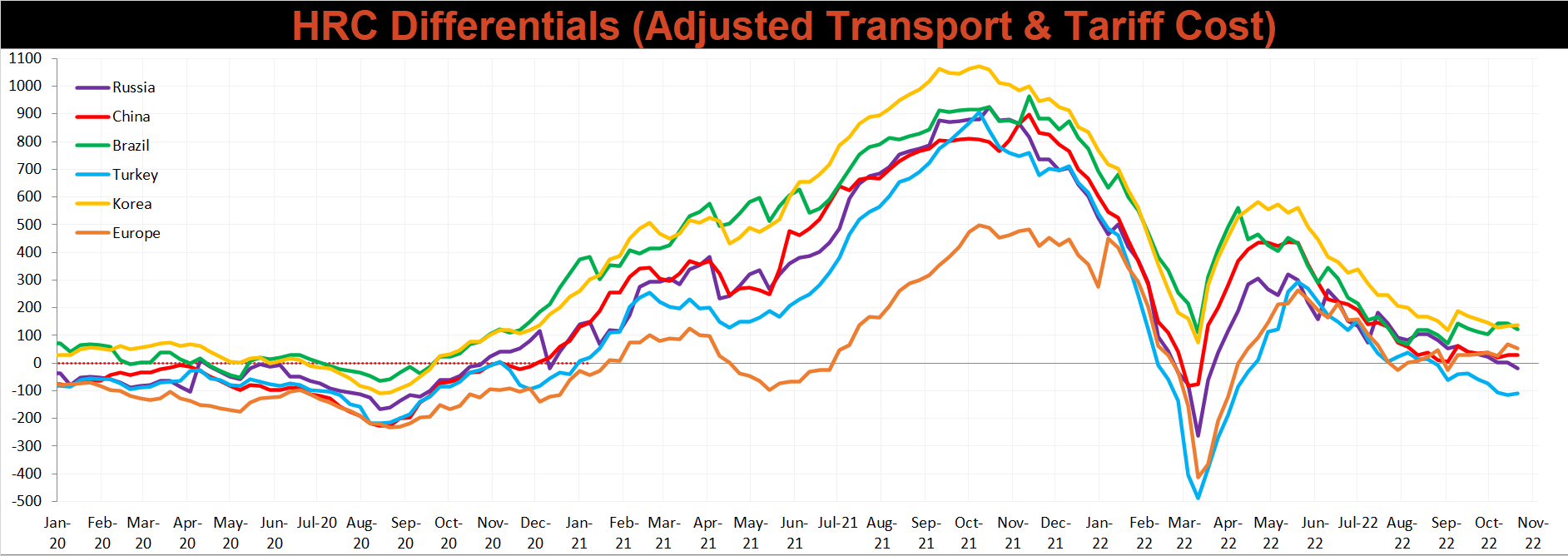

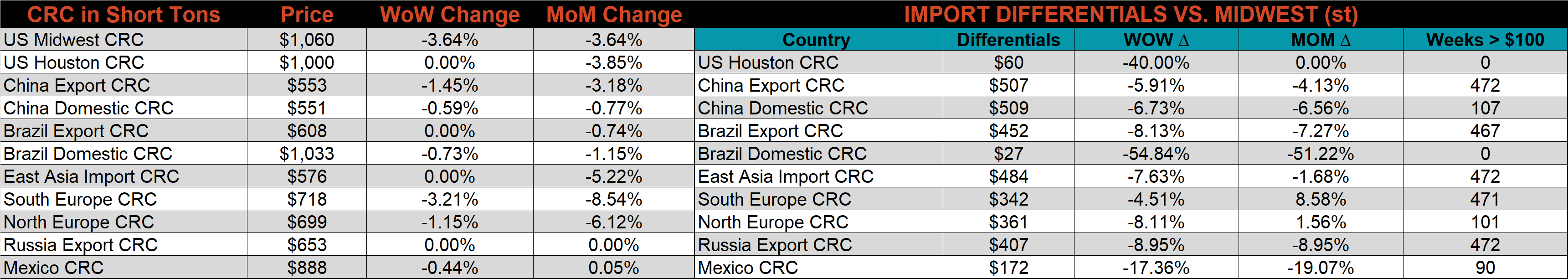

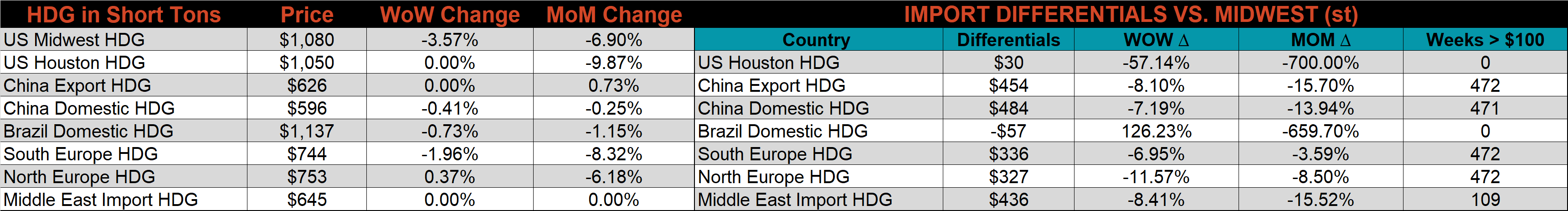

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials increased for China, Korea, and Turkey, suggesting that there is more global downward pressure which the U.S. domestic price has not yet realized.

Global prices were mostly lower this week, led by East Asian HRC, down 4.2%.

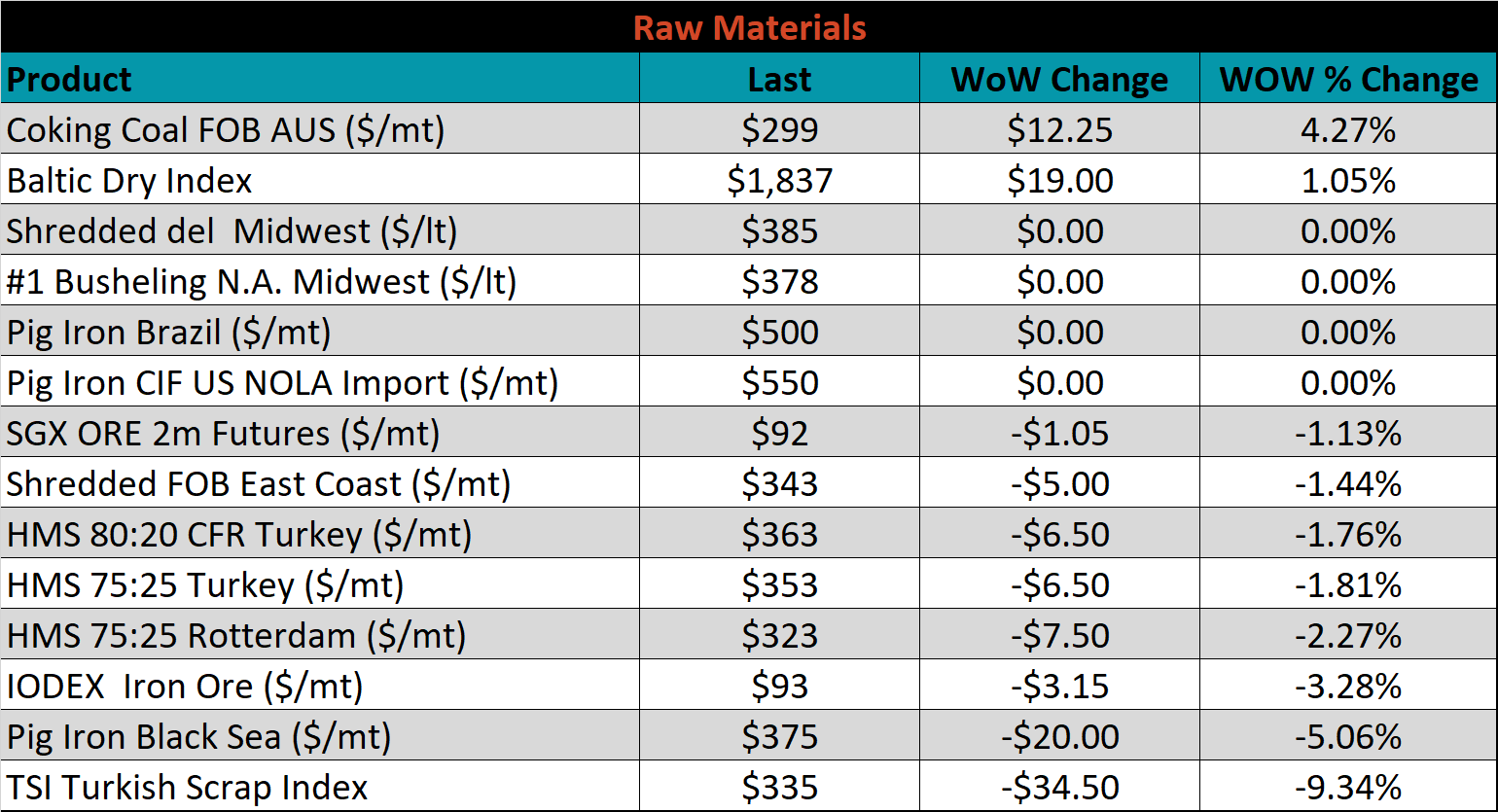

Raw material prices were mixed this week, with Aussie coking coal continue to rise, up another 4.3%, while Turkish scrap was down 9.3%.

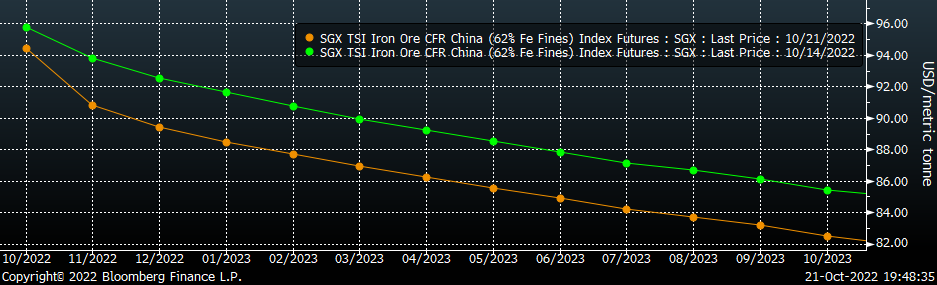

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Iron ore continues to be under significant pressure with the entire curve was lower shifting lower last week, most significantly in the back.

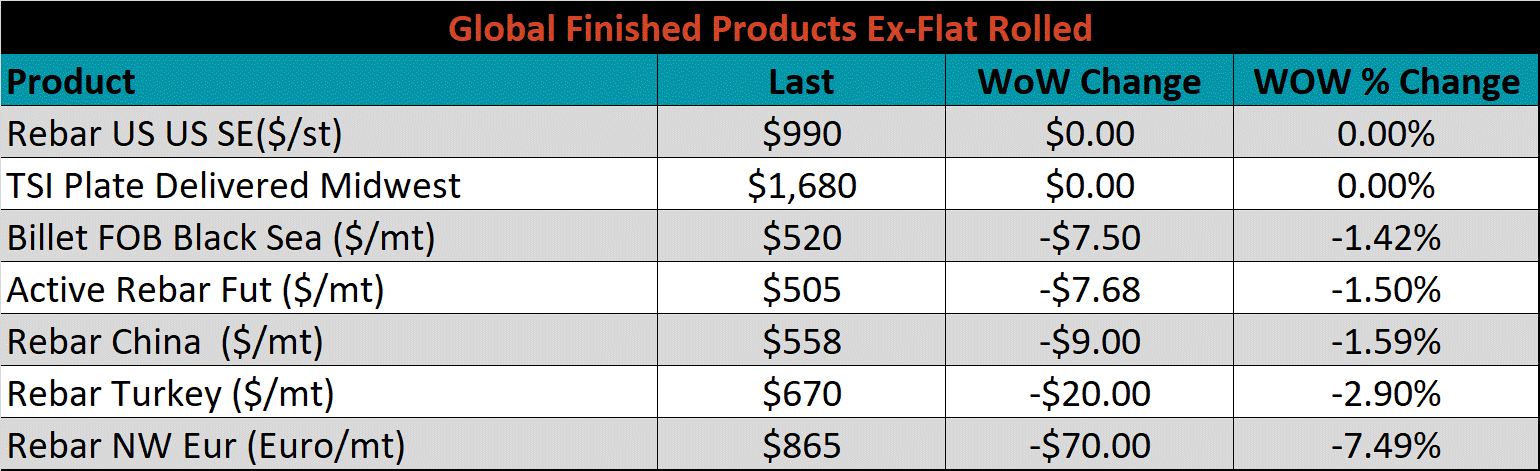

The ex-flat rolled prices are listed below.

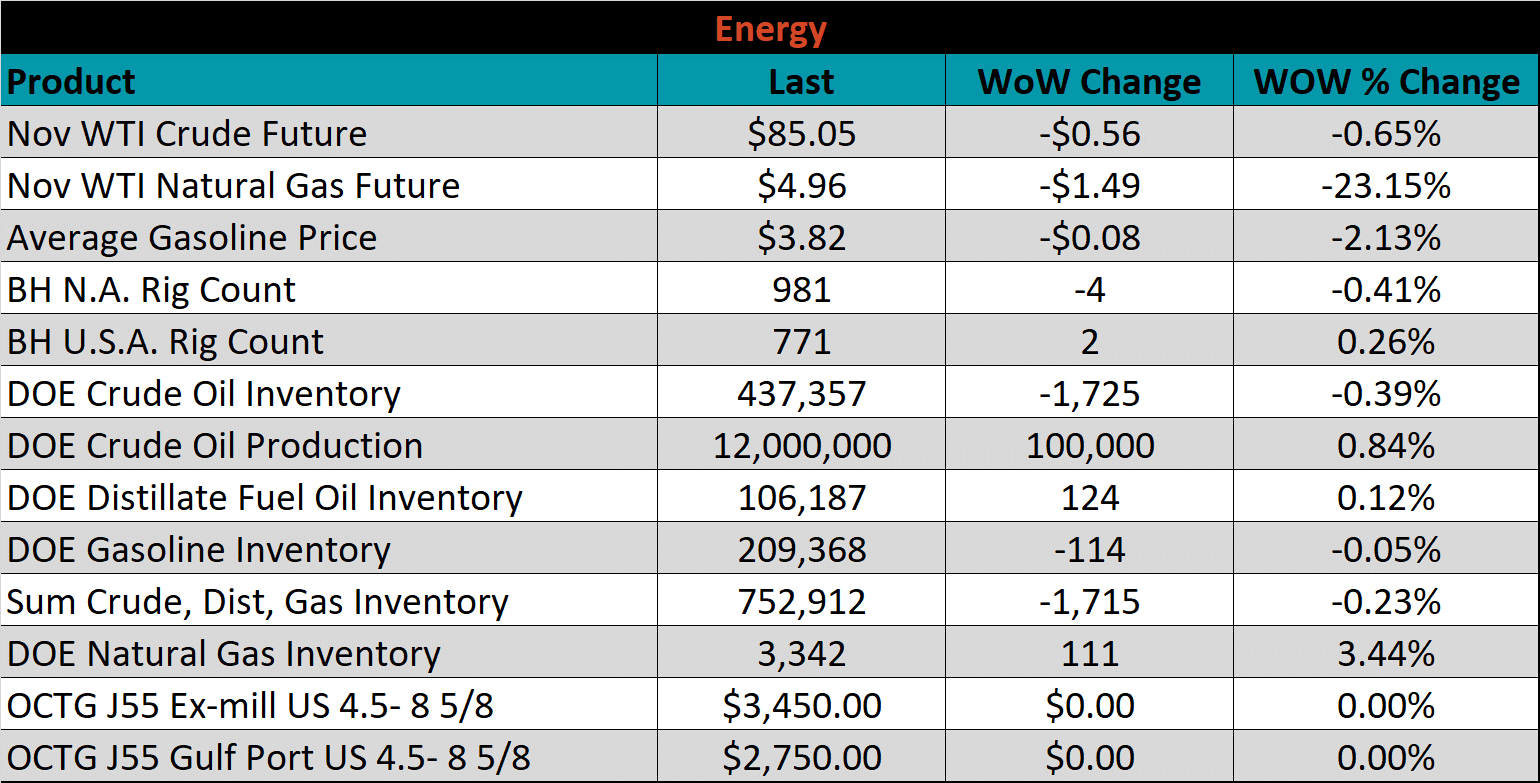

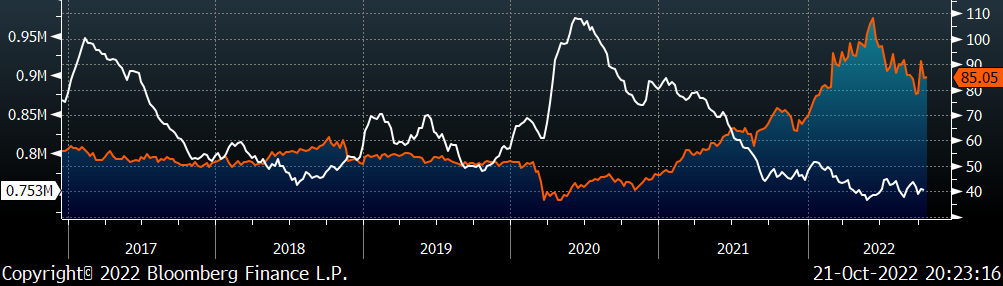

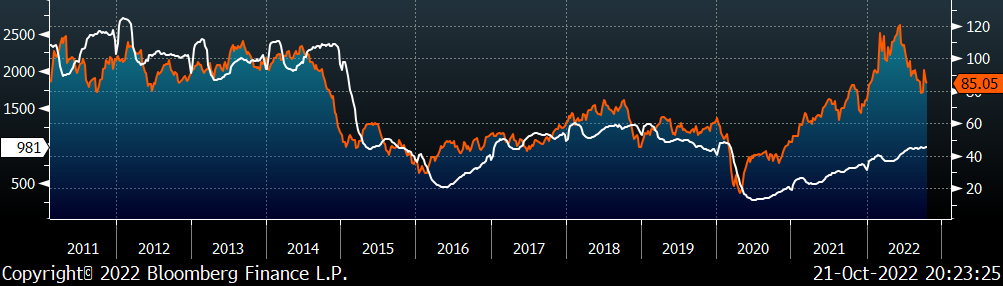

Last week, the November WTI crude oil future lost another $0.56 or 0.7% to $85.05/bbl. The aggregate inventory level fell 0.2%. The Baker Hughes North American rig count decreased by 4 rigs, while the U.S. rig count increased by 2 rigs.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: