Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

Last week ended the much-anticipated 20th Party Congress in China. Outside observers closely watched the event for any signals on how the central government would be shaped over the next 5-years. The most significant question was whether the country would move away from its restrictive COVID-zero policy stance which has resulted in a headwind for steel demand within the country and globally. However, the outcome of the congress was a doubling down on the current restrictive policy. Xi Jinping was confirmed as the party’s leader for a 3rd term and a closer look at political appointments shows that Xi loyalists were installed to replace many of the market-based representatives in leadership positions.

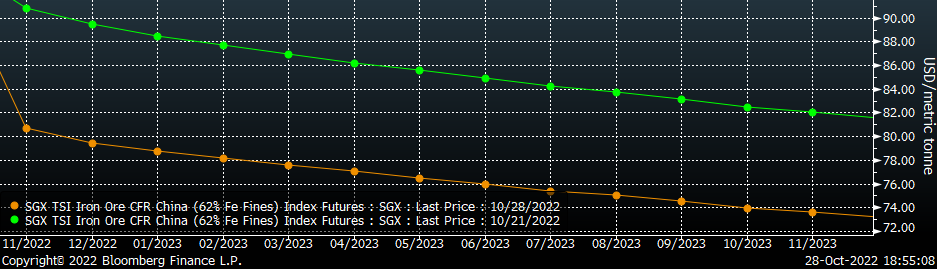

Further, there was no signal that the restrictive policies would be unwound, and the market reacted in kind, with the 2nd Month (December) iron ore futures closing the week at their lowest level since early-May 2020.

This means there will be fewer dissenting voices or checks on Xi’s power over the next five years, which will surely impact global markets across all asset classes. For ferrous markets specifically, it will likely lead to heightened volatility in iron ore and steel products given how vulnerable these markets are to the potentially rash decision making by the world’s largest steel producer and consumer.

Upside Risks:

Downside Risks:

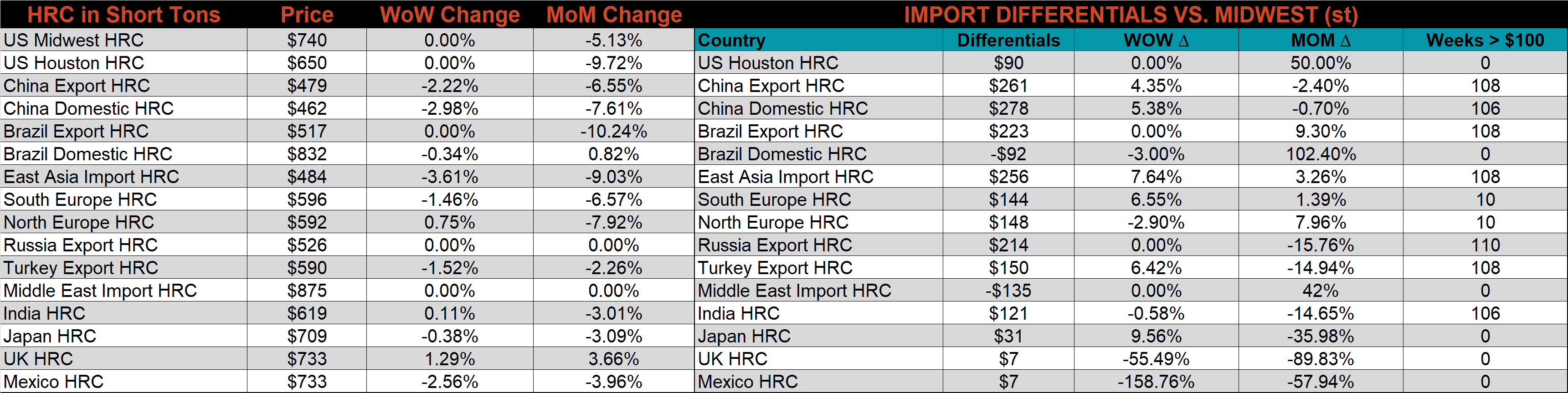

The Platts TSI Daily Midwest HRC Index was unchanged at $740.

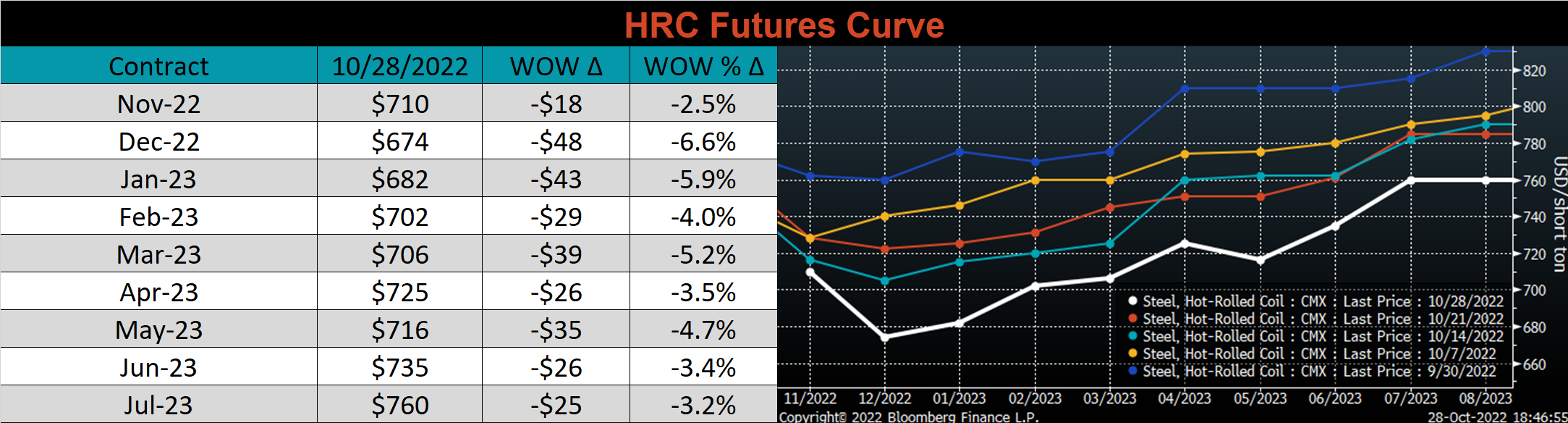

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The entire cure shifted sharply lower last week, most significantly in the front.

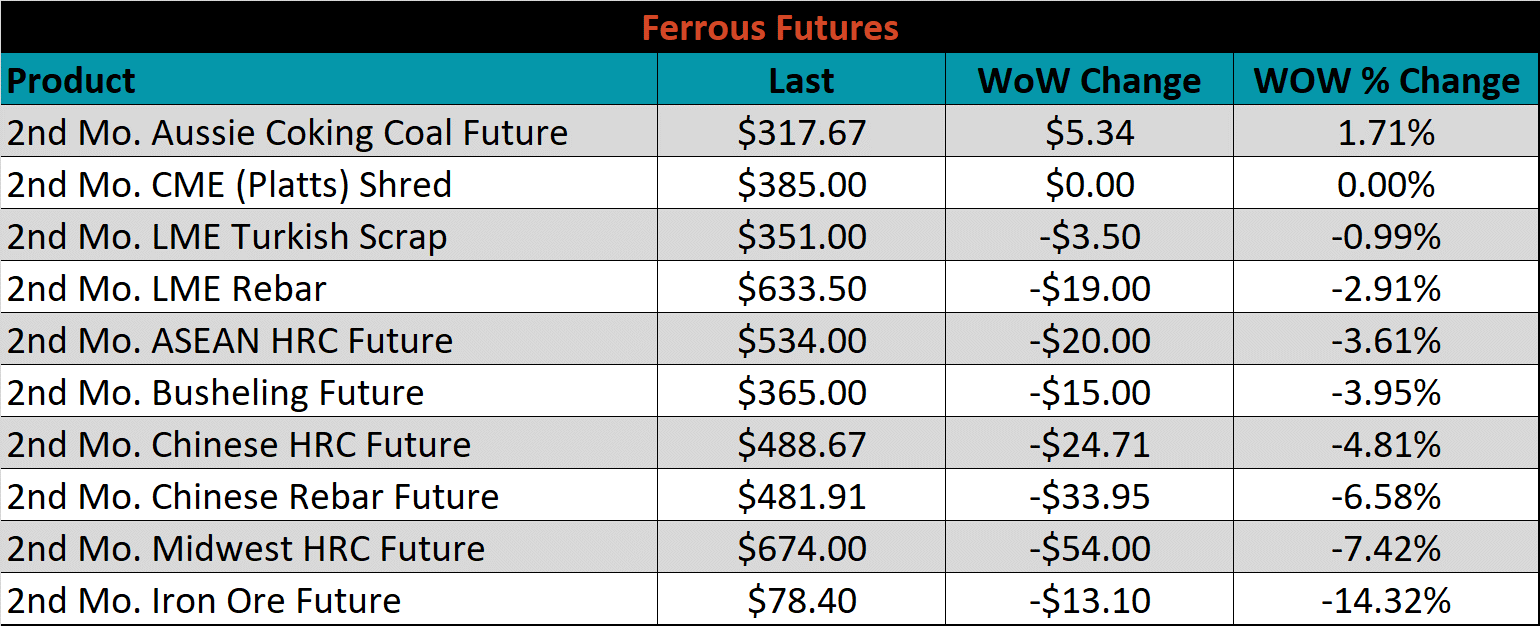

The 2nd month ferrous futures were mostly lower again this week, led by consistent downward movement on iron ore, which lost another 14.3%, while Aussie coking coal continues to rise, up another 1.7%.

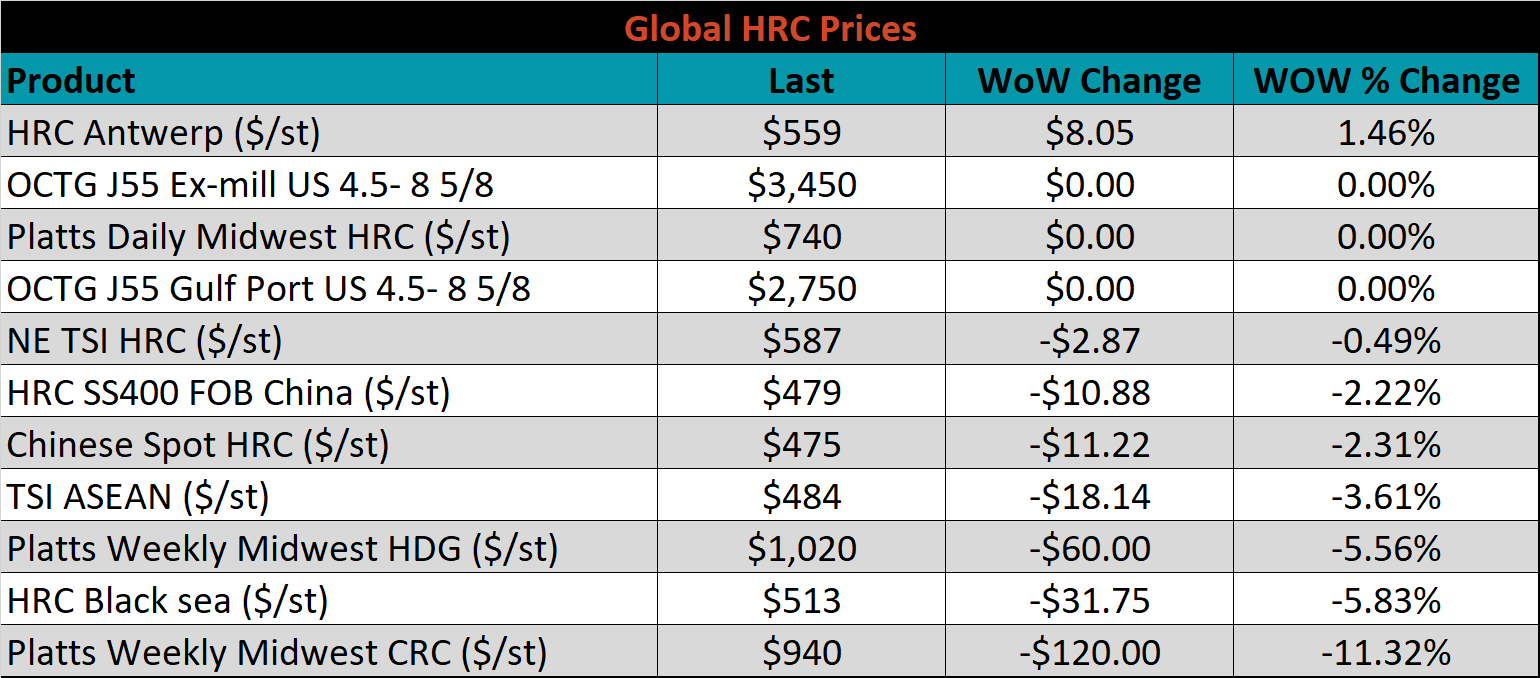

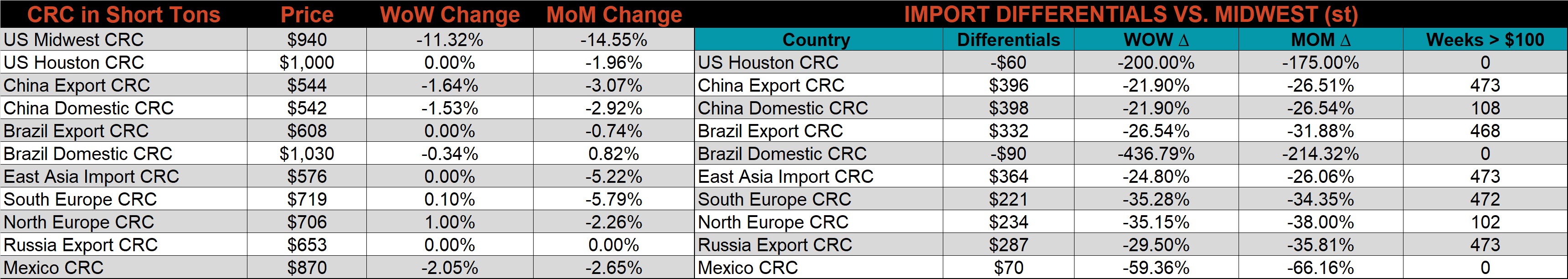

Global flat rolled indexes were mostly lower again last week, led by Midwest CRC, down 11.3%, while Antwerp HRC rose for the second week in a row, up 1.5%.

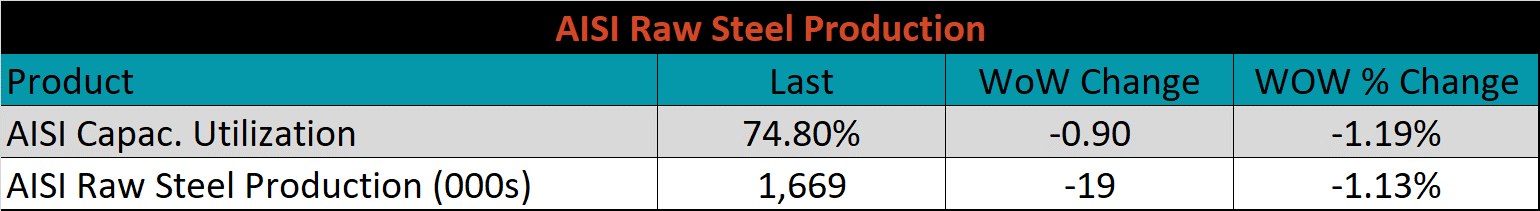

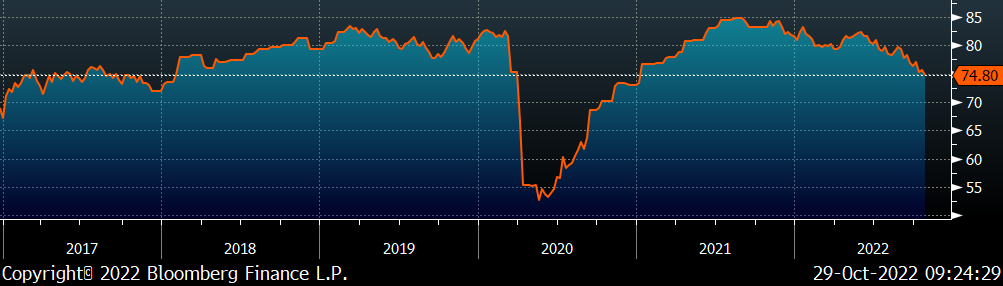

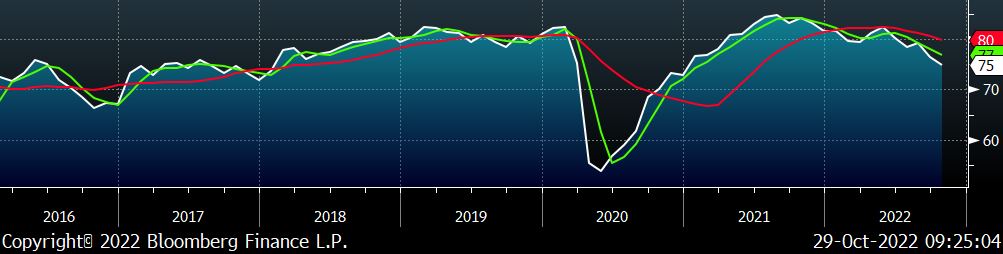

The AISI Capacity Utilization was down, 0.9% to 74.8%.

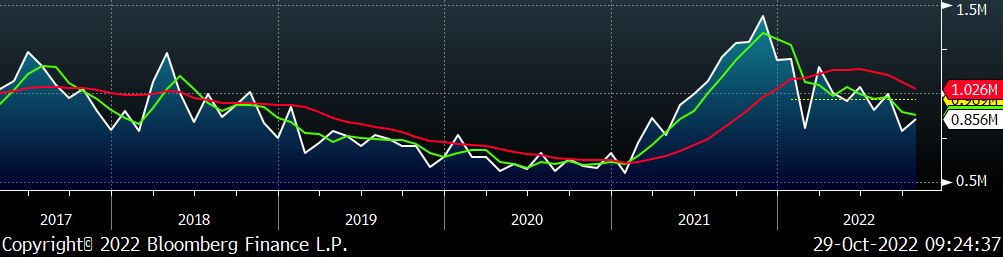

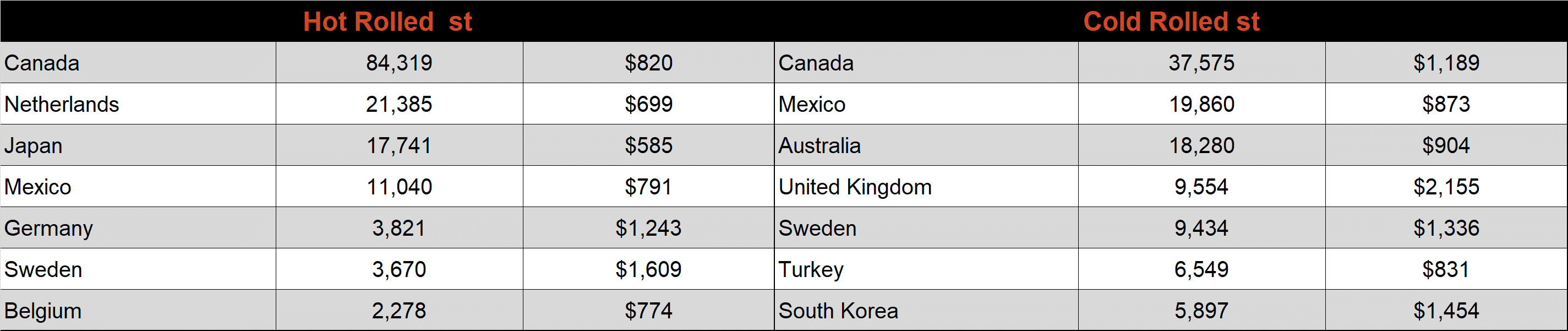

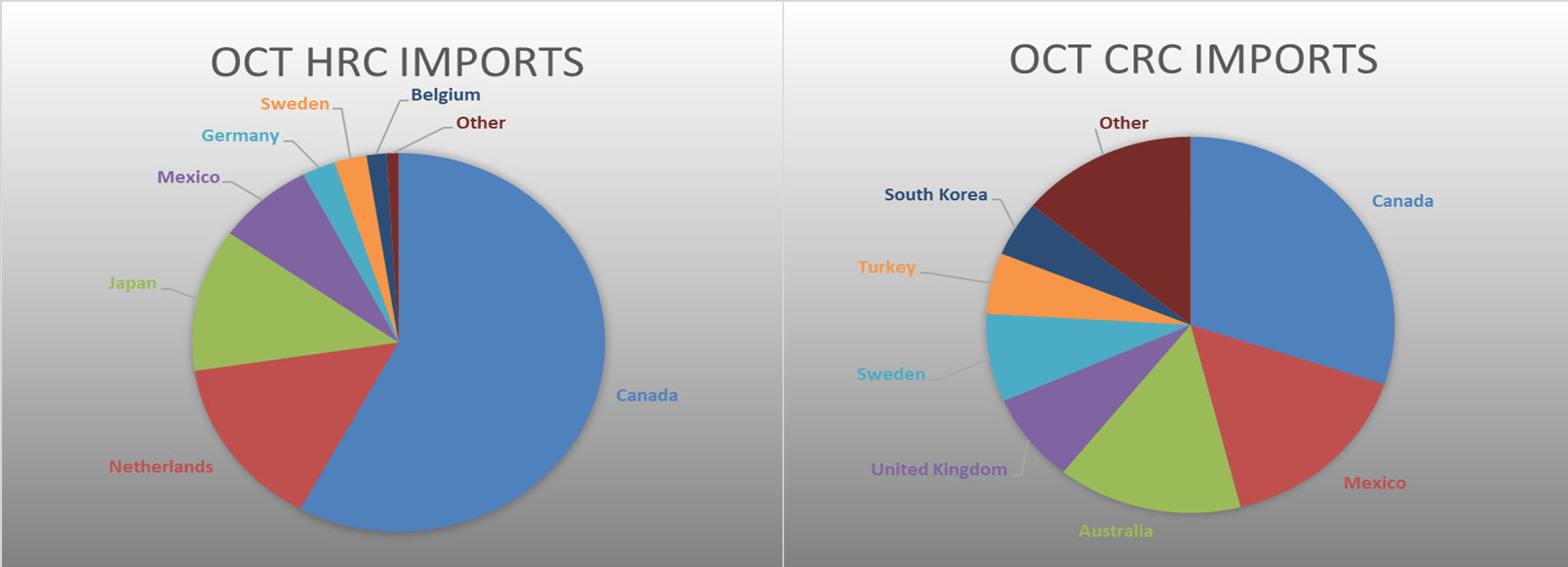

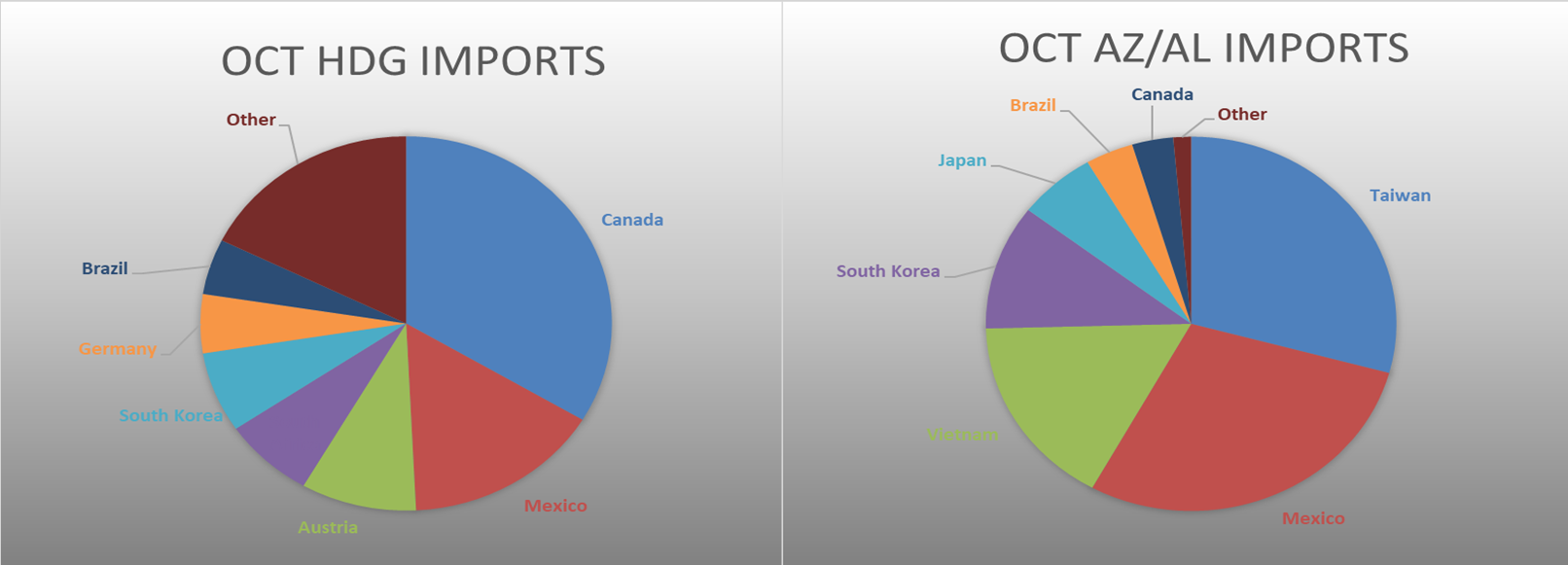

October flat rolled import license data is forecasting an increase of 67k to 856k MoM.

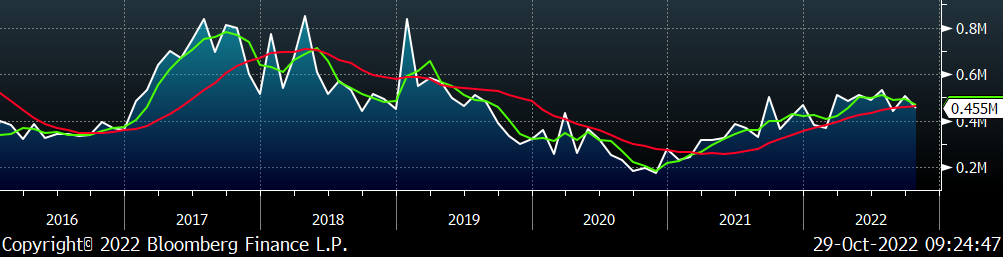

Tube imports license data is forecasting a decrease of 526k to 455k in October.

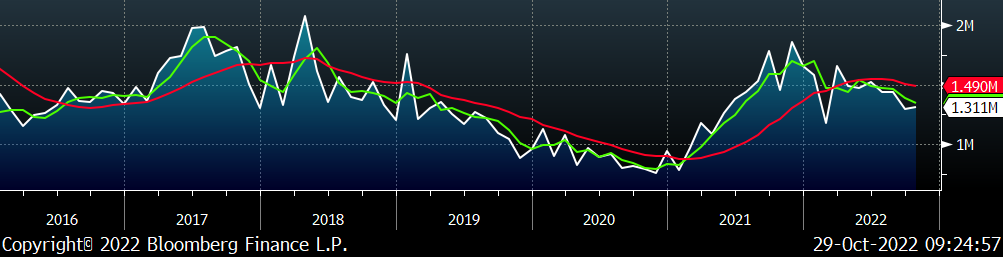

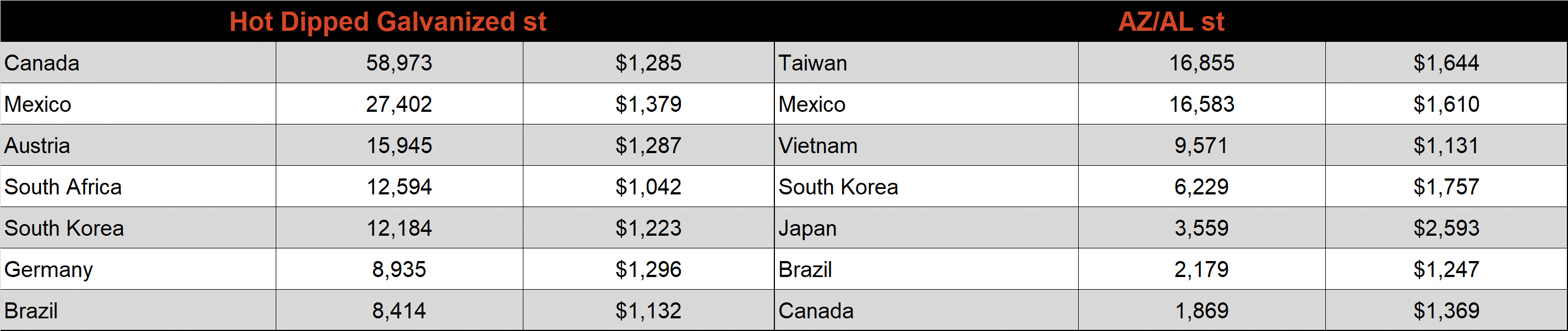

October AZ/AL import license data is forecasting a decrease of 33k to 64k.

Below is October import license data through October 25th, 2022.

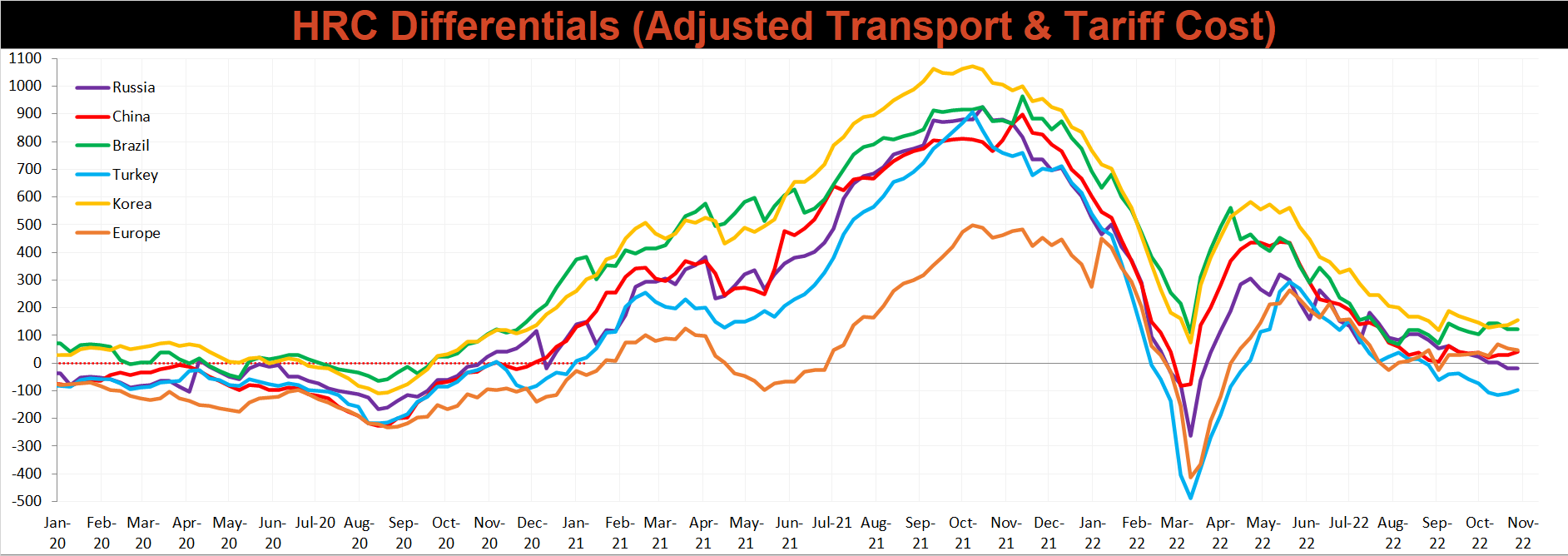

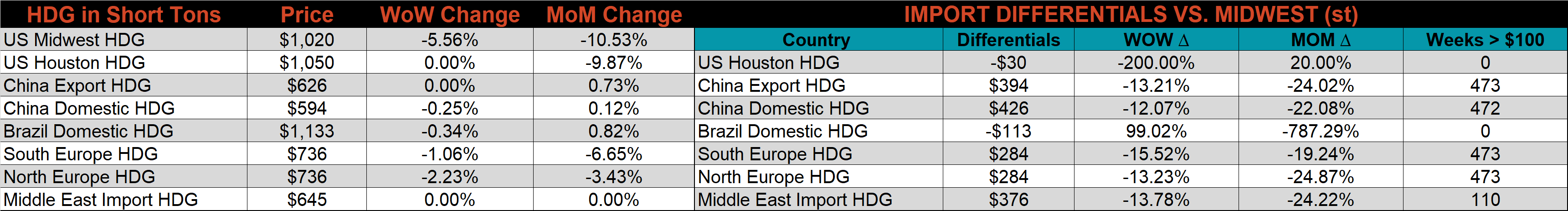

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials increased for all the watched countries expect for Northern Europe and Russia.

Global prices were mostly lower this week, led again by East Asian HRC, down another 3.6%.

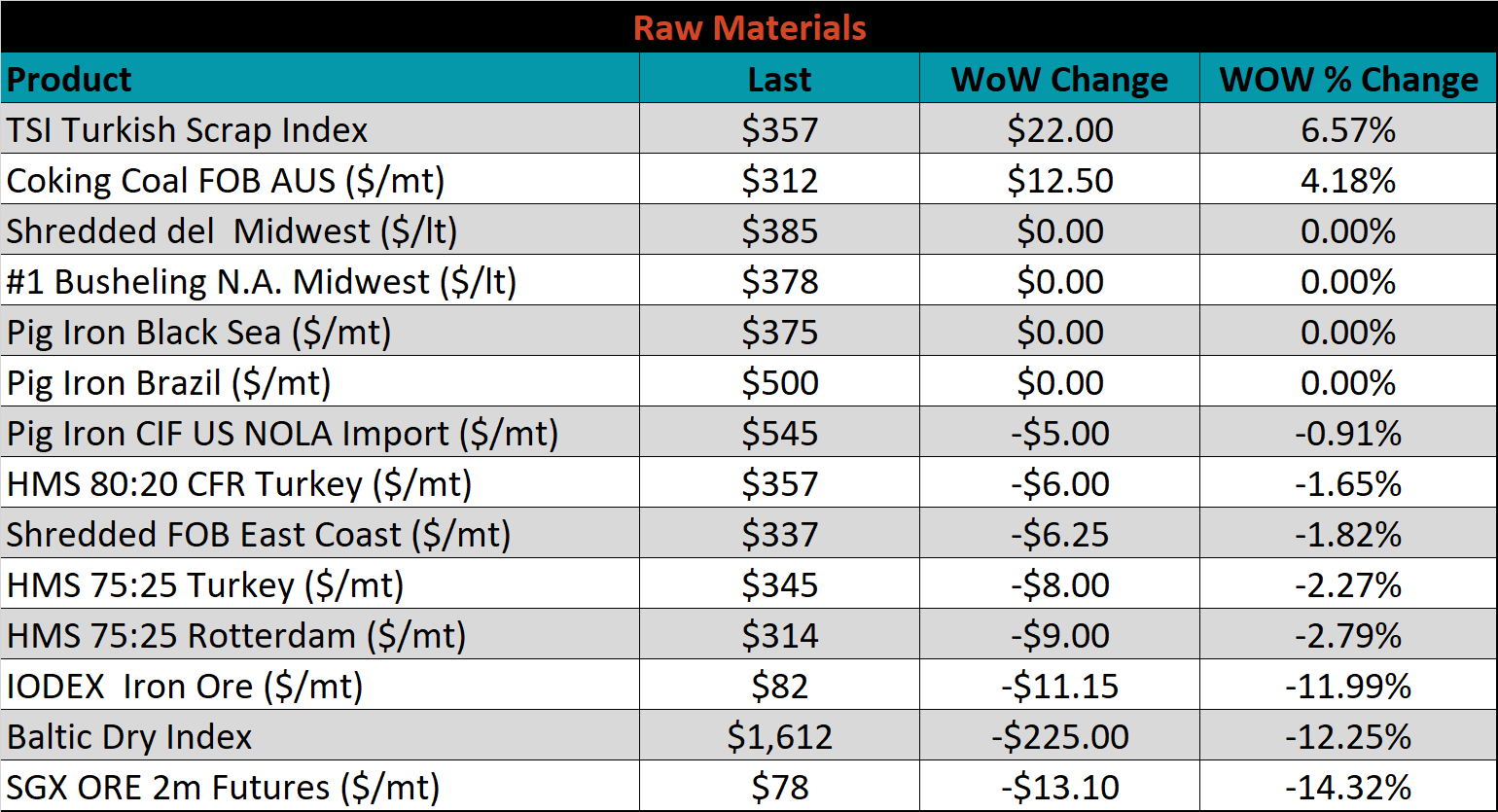

Raw material prices were mixed this week, with Turkish scrap up 6.6%, while the iron ore futures and the IODEX iron ore index both lost, 14.3, and 12%, respectively.

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Iron ore shifted sharply lower at all expirations last week, the current spot price is now trading at its lowest level since November 2019.

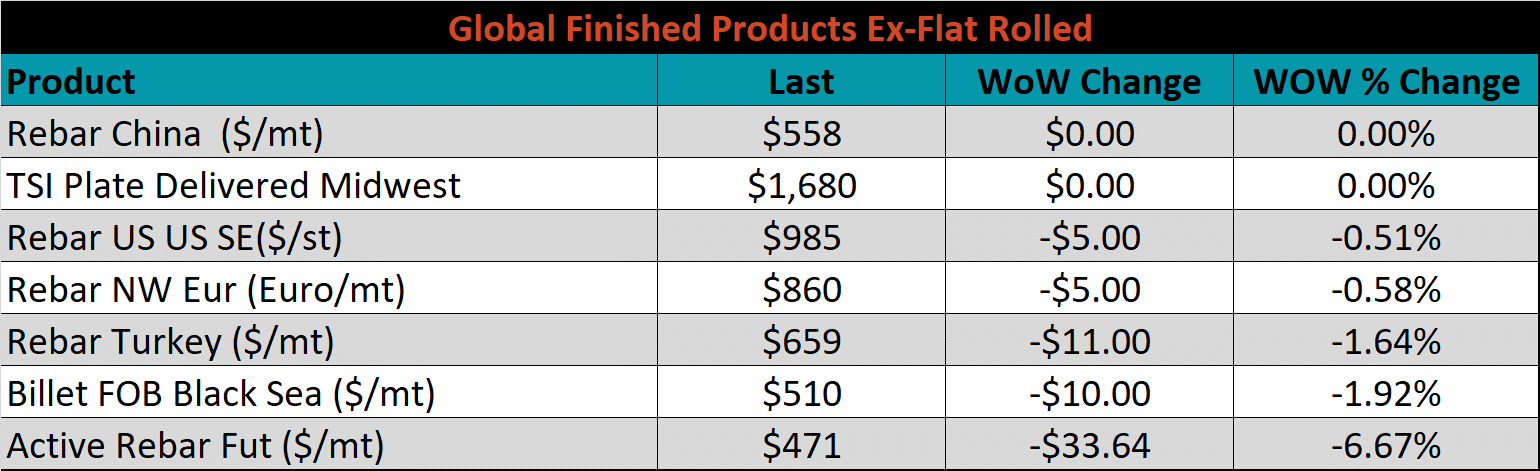

The ex-flat rolled prices are listed below.

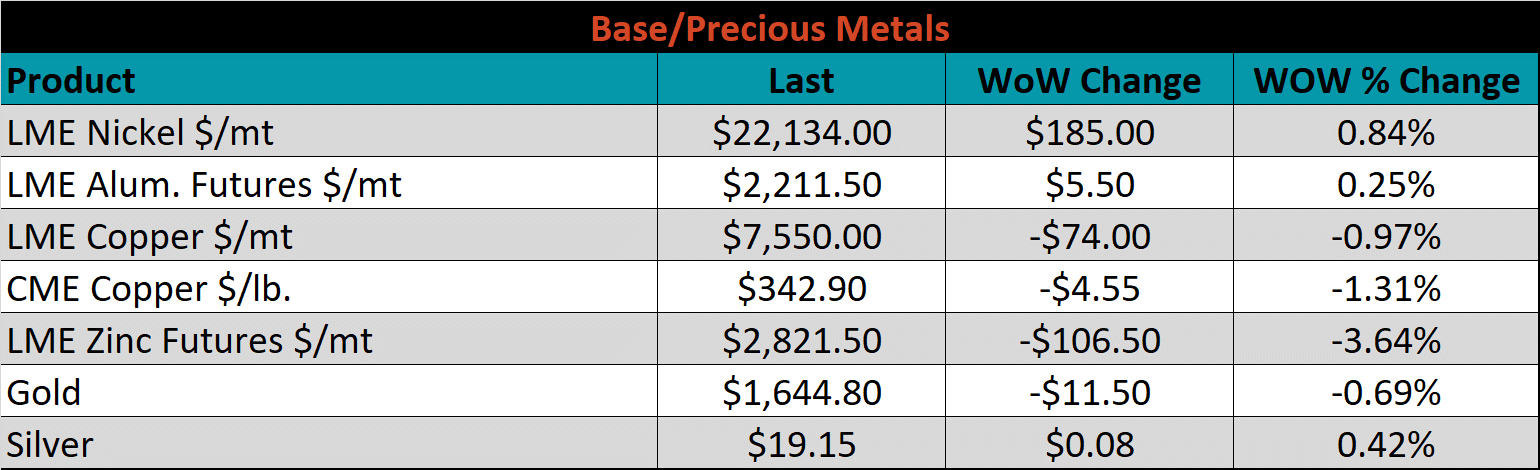

Base and precious metal futures showed very little change on a weekly basis. Zinc was down most significantly, 3.6%, while gold also lost 0.7%. The entire complex continues to be weighed down by dollar strength and uncertainty around how severe hawkishness from the Fed will be on interest rates.

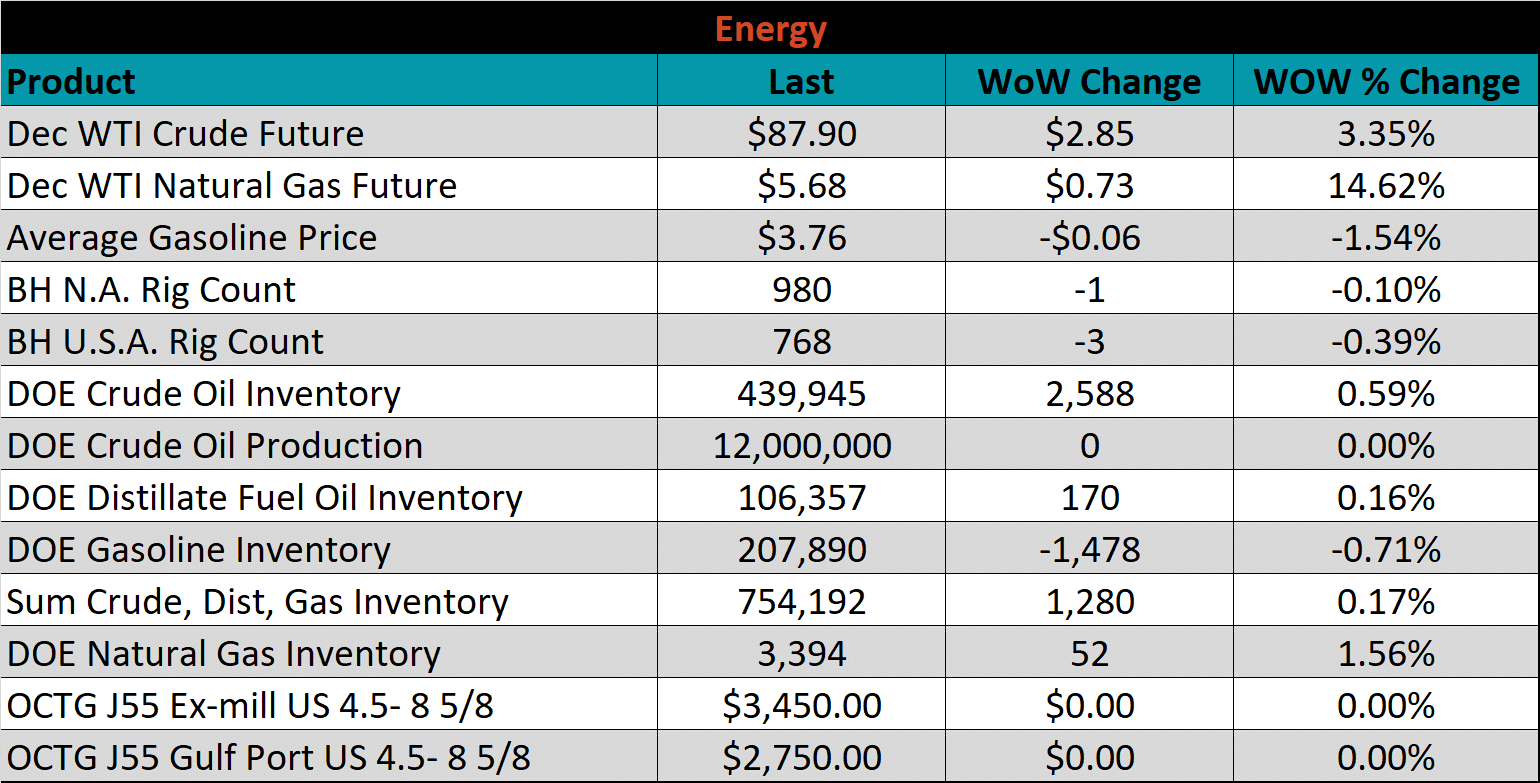

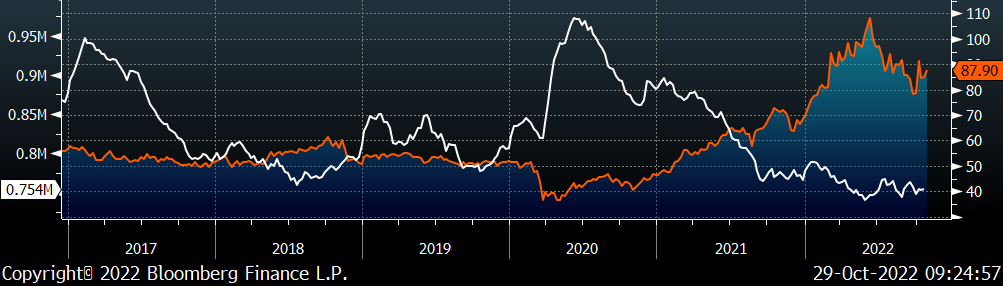

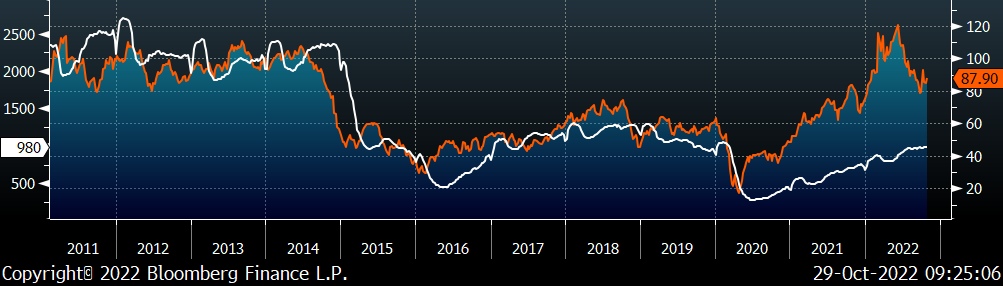

Last week, the December WTI crude oil future gained $2.85 or 3.4% to $87.90/bbl. The aggregate inventory level rose 0.2%. The Baker Hughes North American rig count decreased by 1 rig and the U.S. rig count decreased by 3 rigs.

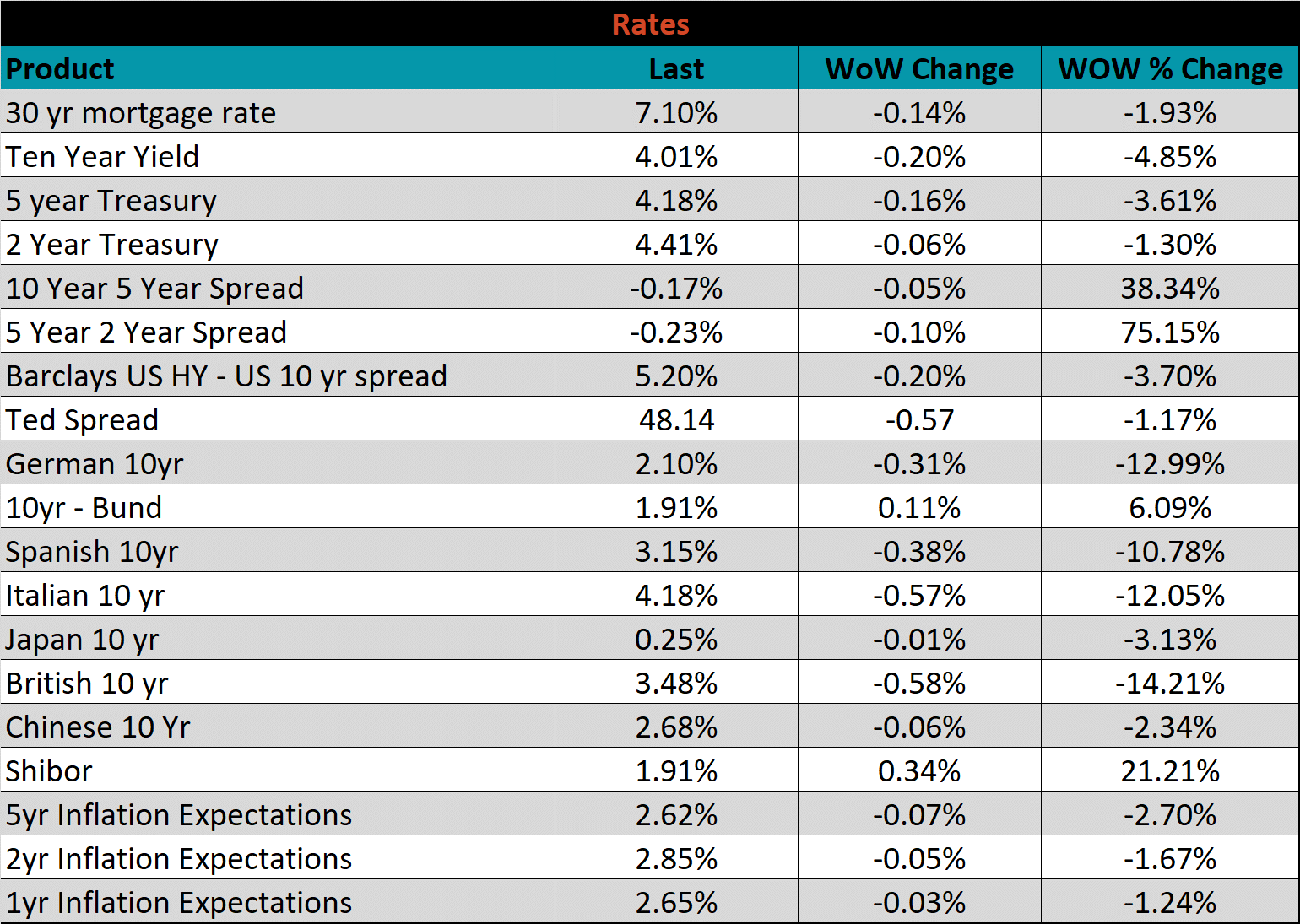

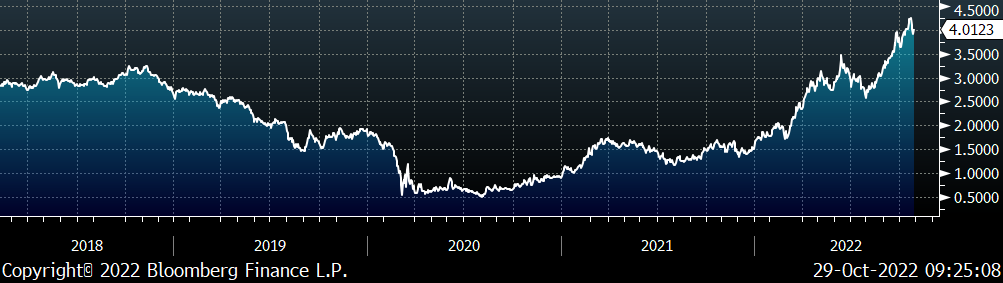

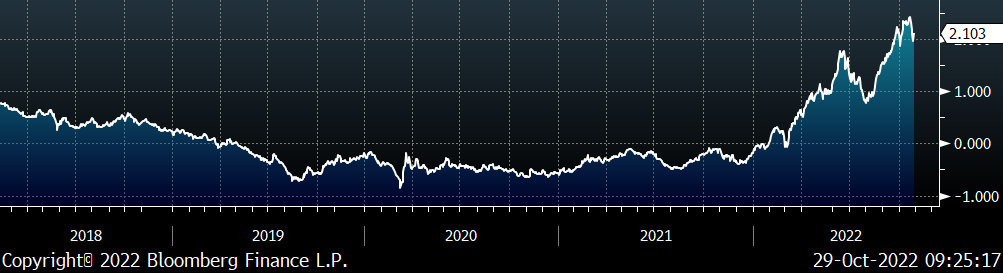

The U.S. 10-year yield was down 20 bps, closing the week at 4.01%. An important recession indicator was also met last week, as the 3-month / 10-year yield spread briefly crossed on Tuesday. The German 10-year yield was down 31 bps to 2.10%, and the Japanese 10-year yield was down 1 bps to 0.25%.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: