Content

-

Weekly Highlights

- Market Commentary

- Risks

The HRC price rally continues unimpeded, as spot indexes are nearing $700/st and mills are hoping to increase prices further in the weeks ahead. Due to limited spot availability and extended lead times, additional price increases will likely be pushed without a formal announcement. Right now, there is no spot price because there are no spot tons available for the rest of this year and January order books are closed as mills wait to finalize contract negotiations. This rally has allowed mills to reduce discounts and maintain a similar proportion of their order book for contract tons compared to last year. This week, we will discuss how historically relevant downside risks relate to the current market dynamics and how the next few months could play out.

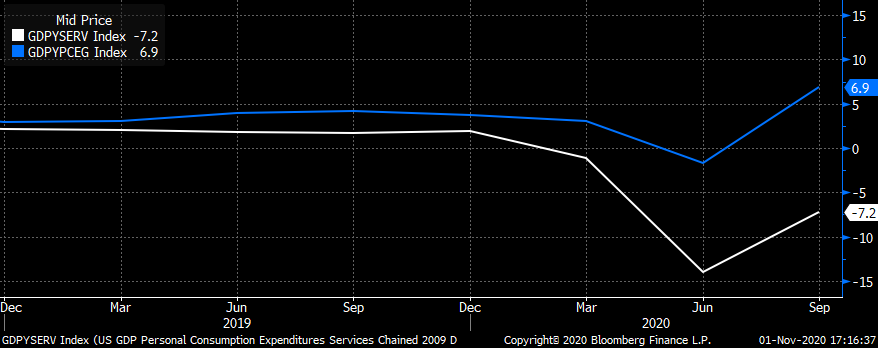

In a normal steel price cycle, a run-up in price usually coincides with downside risks increasing in magnitude and importance. For example, basic economics tells us that demand should decline as buyers are forced to pay higher prices for a good. However, this assumes that buyer’s budget is relatively constant, which is not the case in the current environment. Consumers across the country have reduced their spending on services such as dining, travel, concerts, gym memberships etc. This gives consumers more discretionary income to allocate to goods, which have become much more desirable during the coronavirus pandemic. The below chart shows seasonally adjusted annual rate (in percentage terms) of consumer spending on both goods (blue) and services (white).

Demand for goods held up much better than that of services during the spring and summer, and over the past quarter, has accelerated among changing consumer preferences. So instead of seeing an exhausted steel buying community after a significant price rally, we are witnessing a second wind from buyers as the economy recovers and demand for steel accelerates.

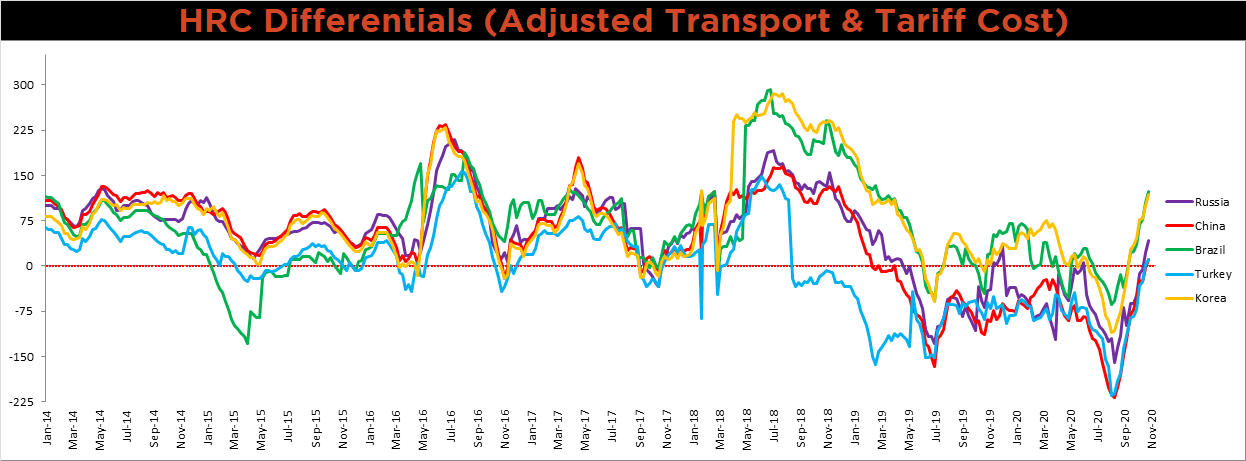

As in other commodity markets, higher prices usually spur increases in supply as producers try to sell larger quantities at elevated prices. This prevents prices from rising to levels that are unsustainable. However, domestic steel producers have maintained reduced production levels for several months, driven by both maintenance outages during the fall and extended furnace idling, which the market did not expect. Similarly, as the domestic price rallies, differentials with global prices grow, increasing the likelihood for imports to alleviate the supply shortage. However, quarterly and annual quotas and the lengthy lead-time for bringing in foreign material will prevent a surge of imports for the remainder of this year. Therefore, we see no fix in the short term the structural steel shortage in the domestic market. Moreover, we might not have seen the worst of this short squeeze yet. The longer these dynamics last, the worse the shortage gets because inventory levels decline across the supply chain. The spot market has dried up, and now the limited spot transactions can significantly influence market indexes, and thus drive this market significantly higher into next year.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

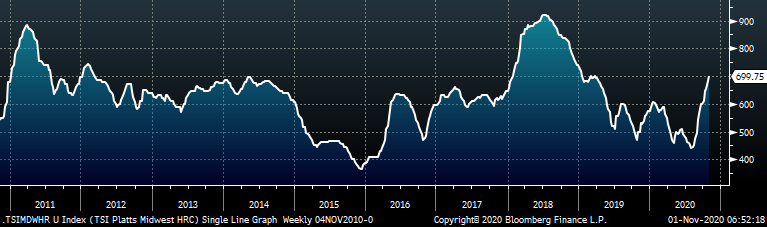

The Platts TSI Daily Midwest HRC Index increased by $19.25 to $699.75.

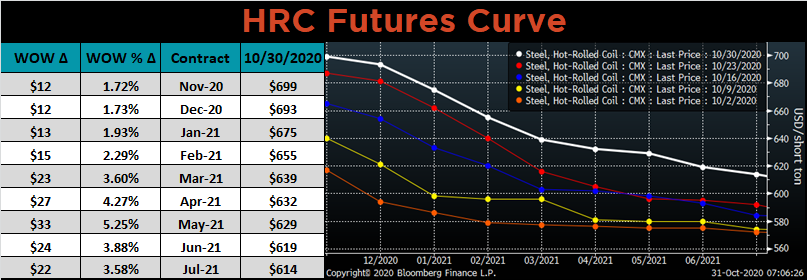

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The curve shifted higher last week, most significantly in the back of the curve. This is the first time that the curve flattened in the past 12 weeks. The May expiration was up $33, or 5.3%, signaling that the market has come to believe that elevated prices can last much longer than previously thought.

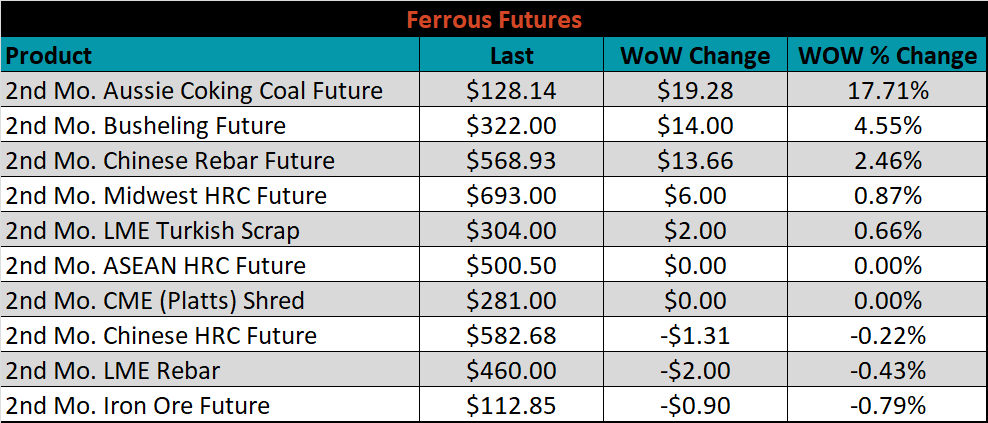

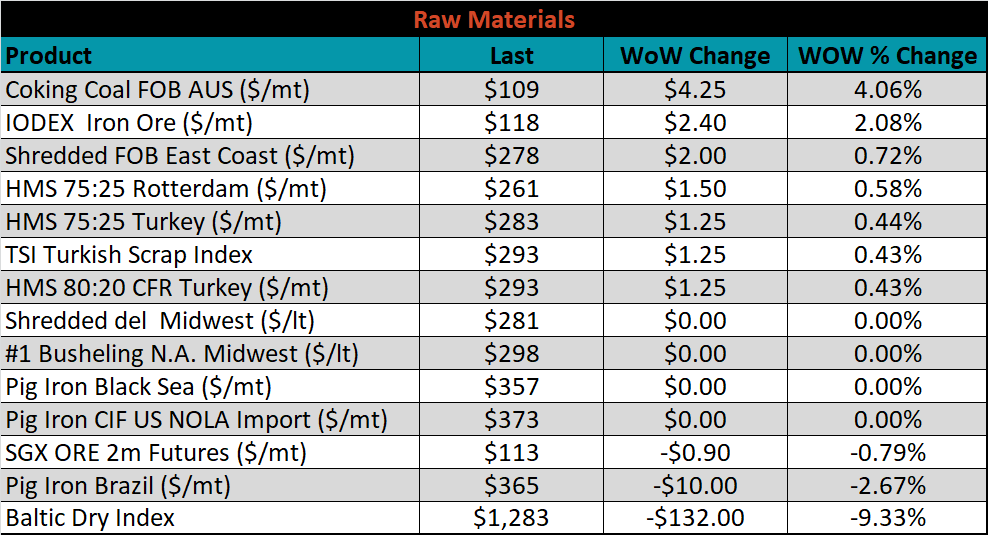

December ferrous futures were mixed. Aussie coking coal jumped 17.7% after a significant decline last month, while iron ore fell 0.8%.

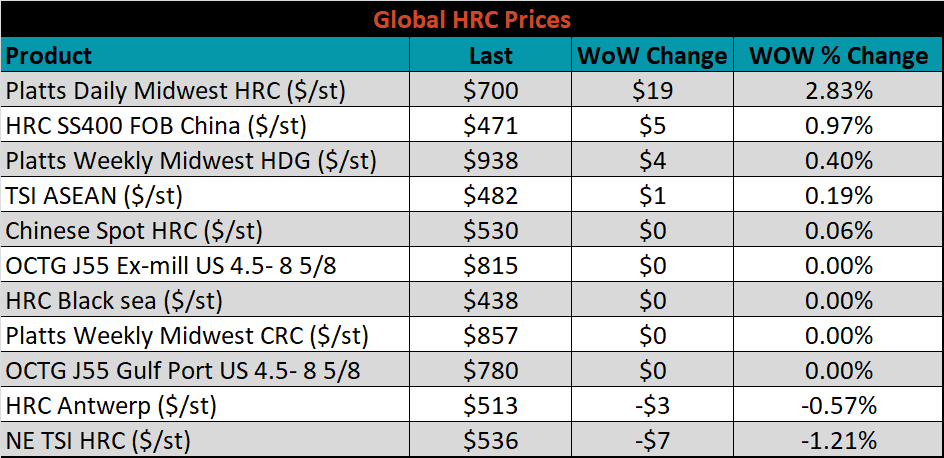

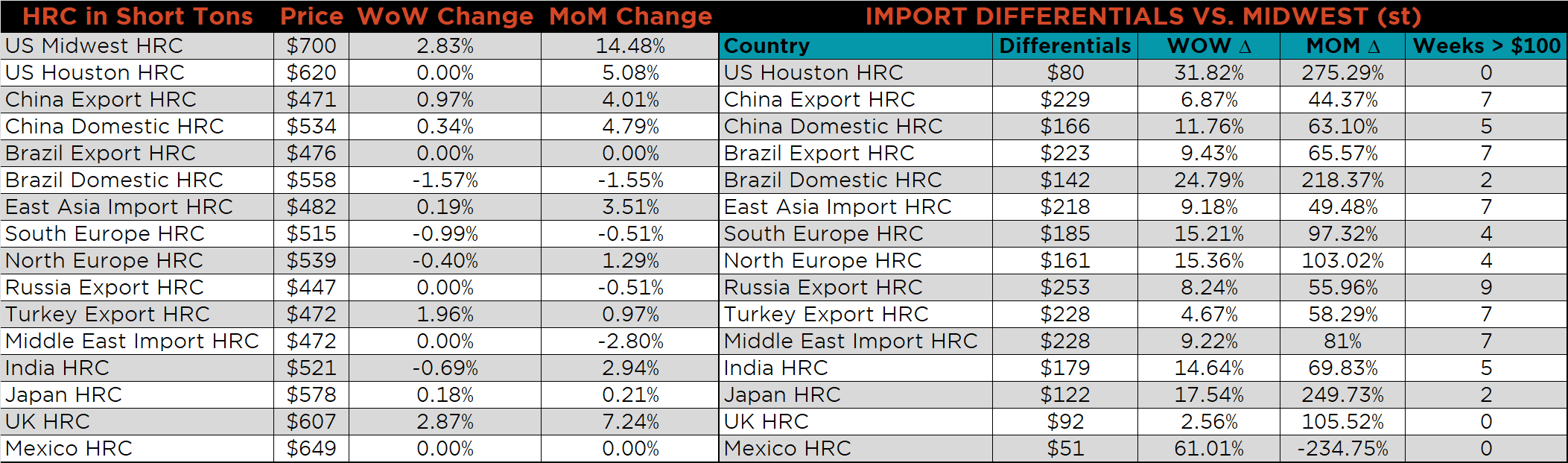

The global flat rolled indexes were mostly higher. TSI Platts Midwest HRC was up another 2.8%, while Northern European HRC was down 1.2%.

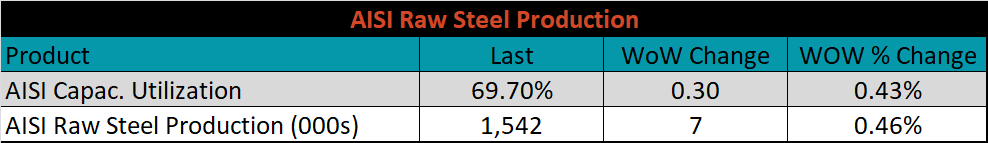

The AISI Capacity Utilization rate increased 0.3% to 69.7%.

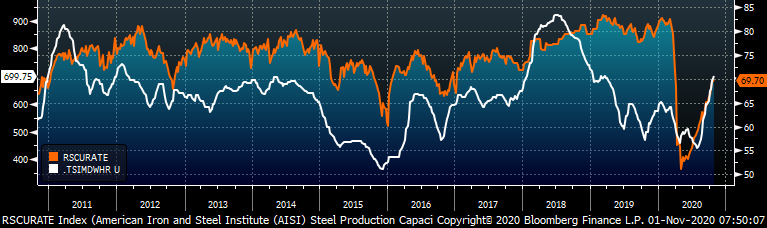

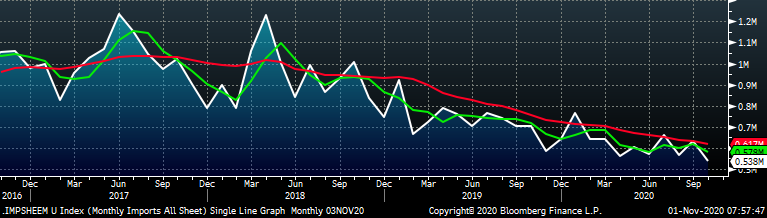

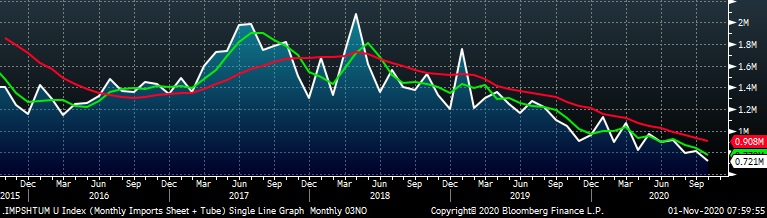

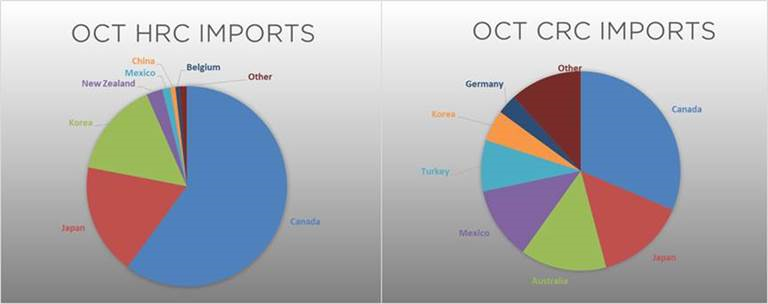

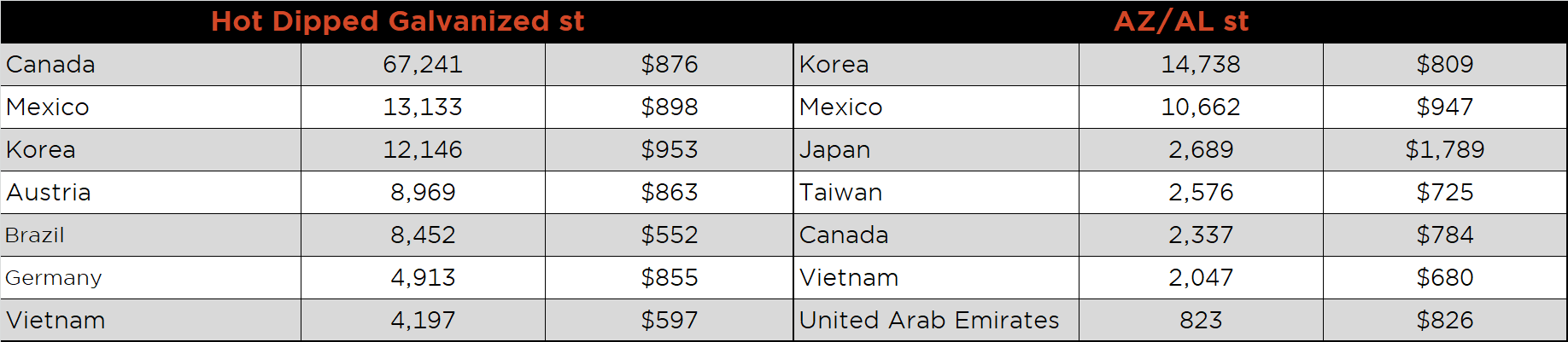

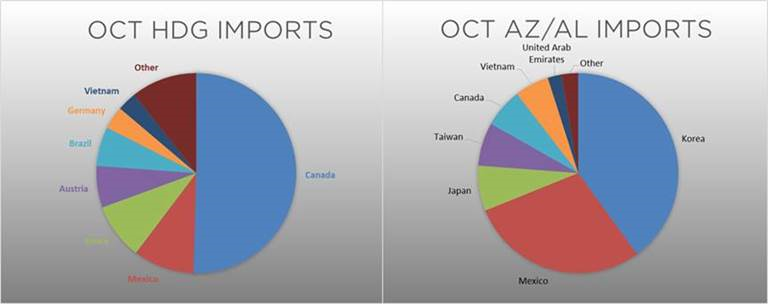

October flat rolled import license data is forecasting a decrease of 94k to 538k MoM.

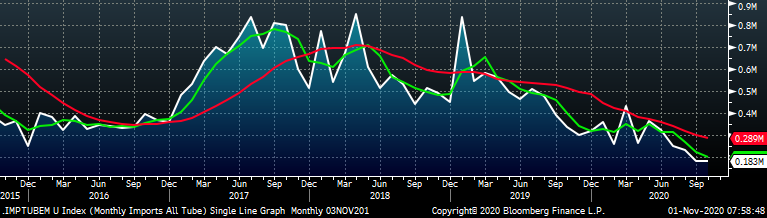

Tube imports license data is forecasting a decrease of 1k to 183k in October.

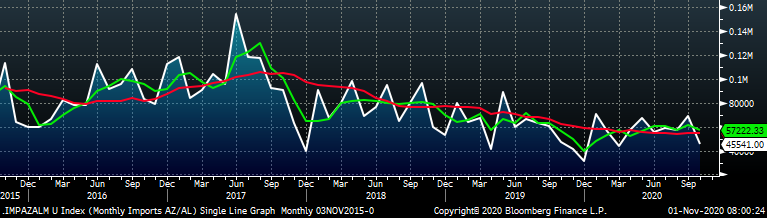

October AZ/AL import license data is forecasting a 23k decrease to 46k.

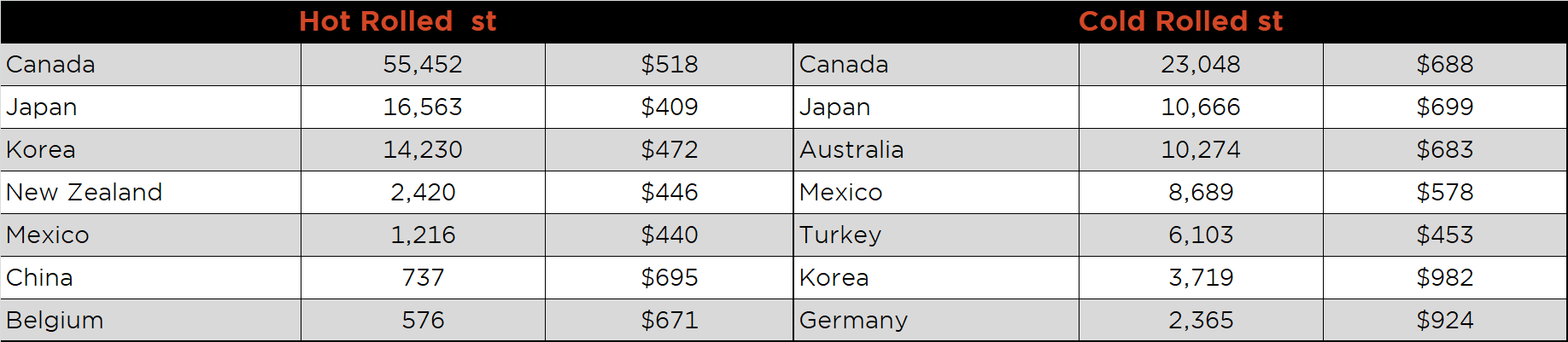

Below is October import license data through October 26, 2020.

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The differentials for all watched countries increased again last week, as the U.S. price outpaced all global prices.

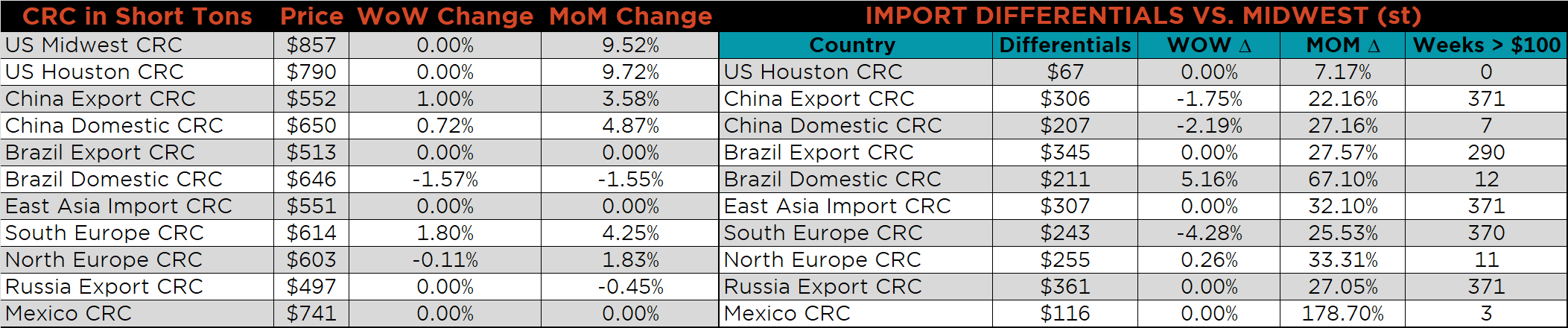

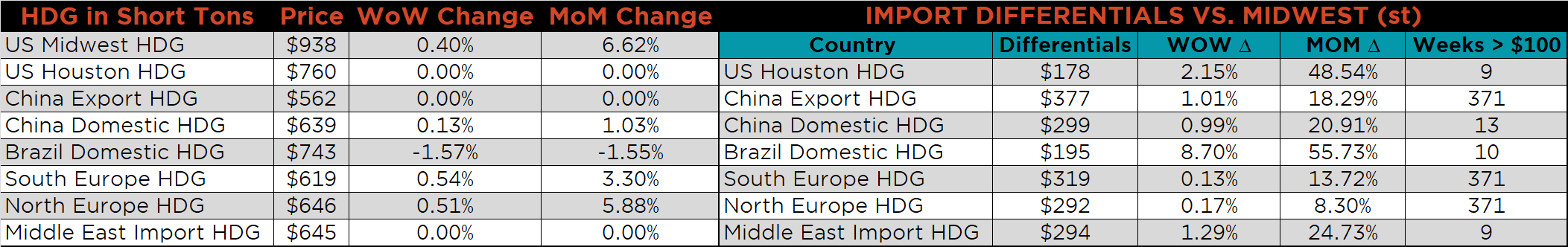

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC and HDG prices were up 2.8% and 0.4%, respectively, while the CRC price was unchanged. Globally, the United Kingdom HRC price was up 2.9%.

Raw material prices were mixed. Aussie coking coal was up 4%, while Brazil pig iron was down 2.7%.

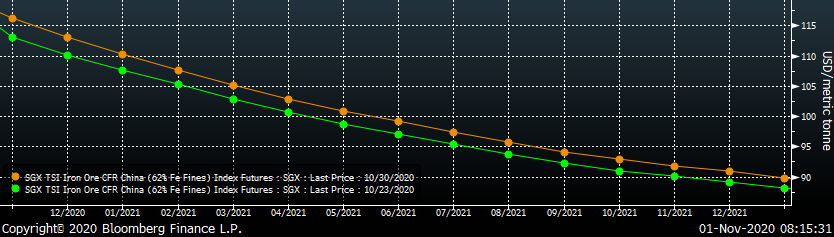

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the curve steadily increased across all expirations.

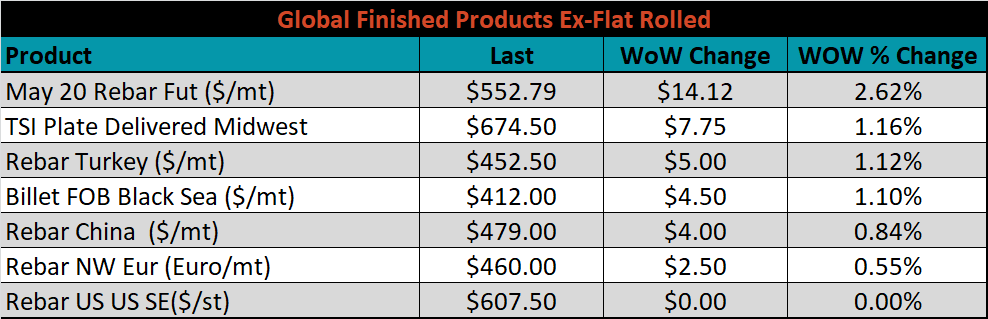

The ex-flat rolled prices are listed below.

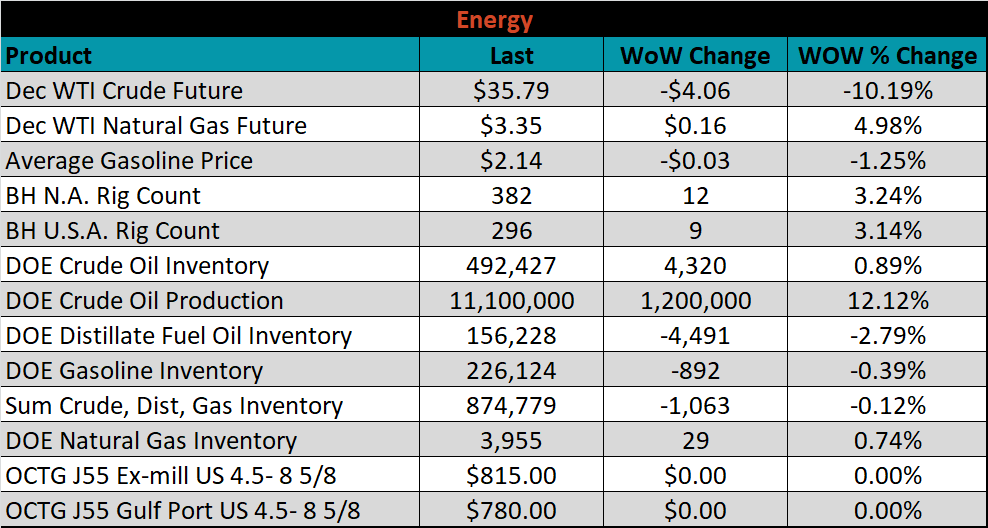

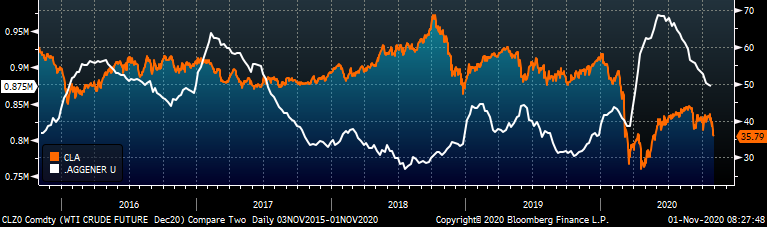

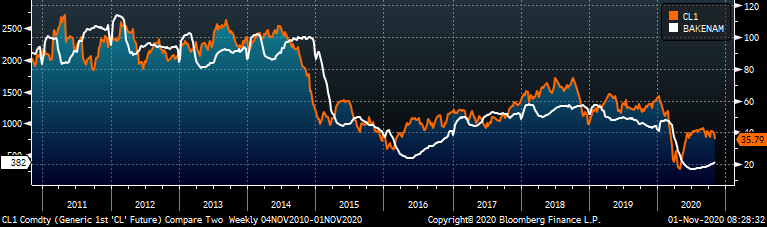

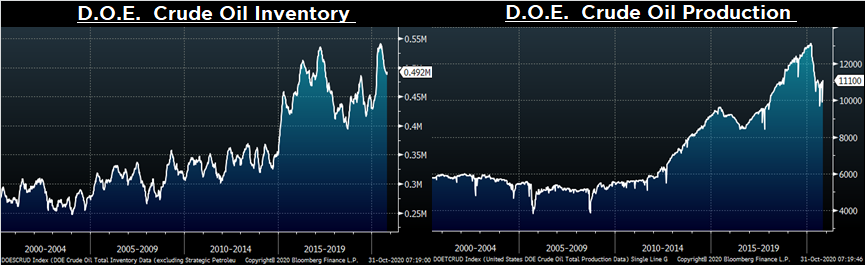

Last week, the December WTI crude oil future lost another $4.06 or 10.2% to $35.79/bbl. The aggregate inventory level was down 0.1%, while crude oil production rose to 11.1m bbl/day. The Baker Hughes North American rig count was up 12 rigs and the U.S. rig count was up 9 rigs.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: