Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

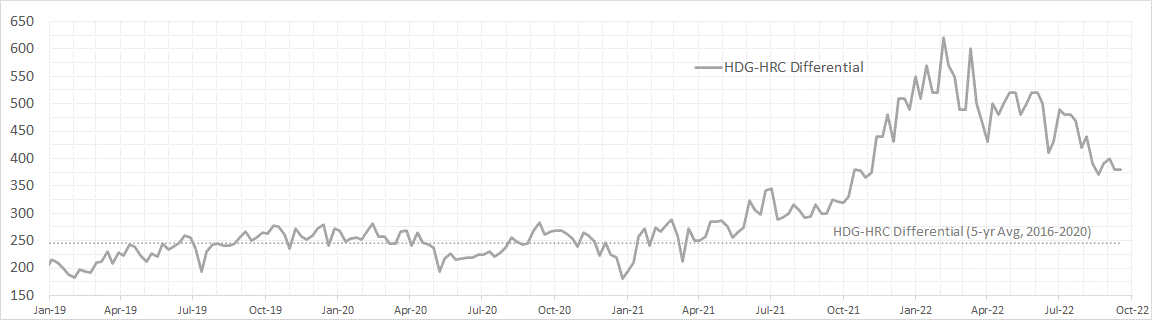

Over the last two months, galvanized (HDG) prices have been weaker than hot-rolled (HRC), causing the historically high HDG-HRC differential to push down below $400 for the first time since early November 2021. The chart below shows the weekly prices for Platts HDG minus HRC, along with the 5-year average (before 2021).

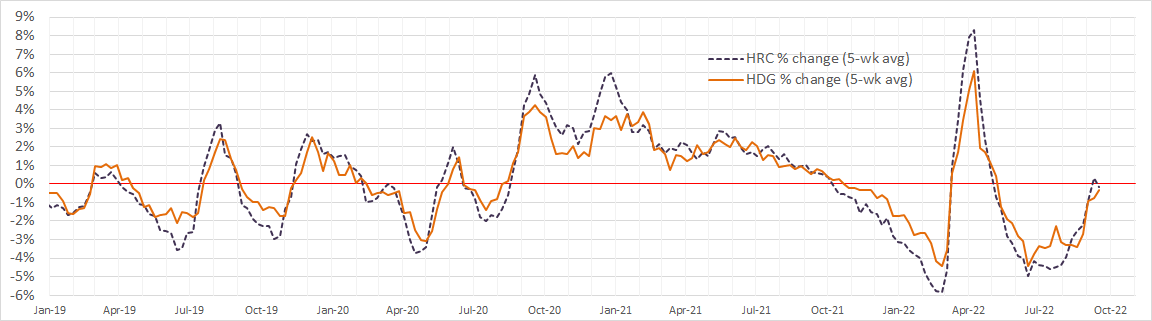

The chart below is the 5-week-moving average of the weekly percentage changes for both HRC (blue dashed) & HDG (orange). This helps visualize pricing momentum between the two products over the same period.

Last week (ending in 9/9), the 5-week-moving average for HRC printed higher for the first time in 18 weeks. This epitomizes the shift in sentiment from the mills, where they are attempting to support spot index pricing for HRC near $800 but are willing to negotiate lower prices on HDG and tandem products because of the increased embedded profits. The chart also provides some perspective on how significant the selloff was for HRC compared to HDG, which led to the historic spreads in the first place. Looking forward, we anticipate the spread between the two to continue to converge, as domestic mills show more willingness to negotiate pricing with tandem tons that still provide higher levels of profitability than HRC.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

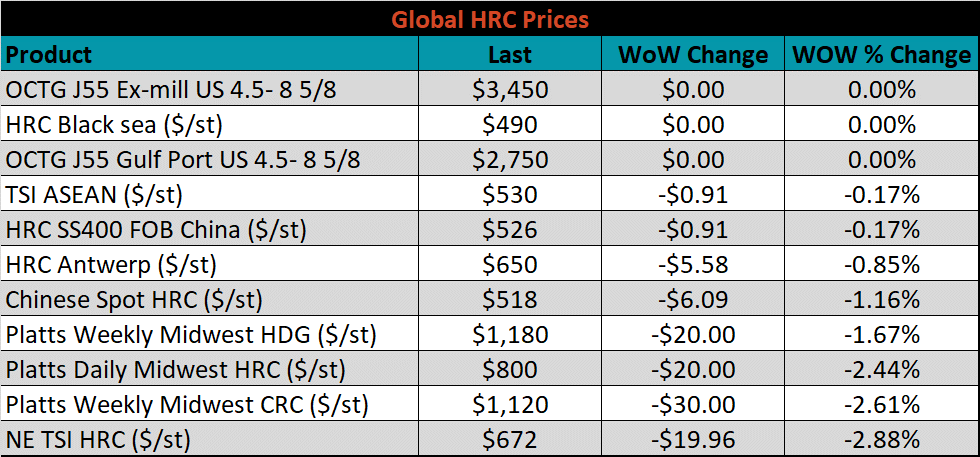

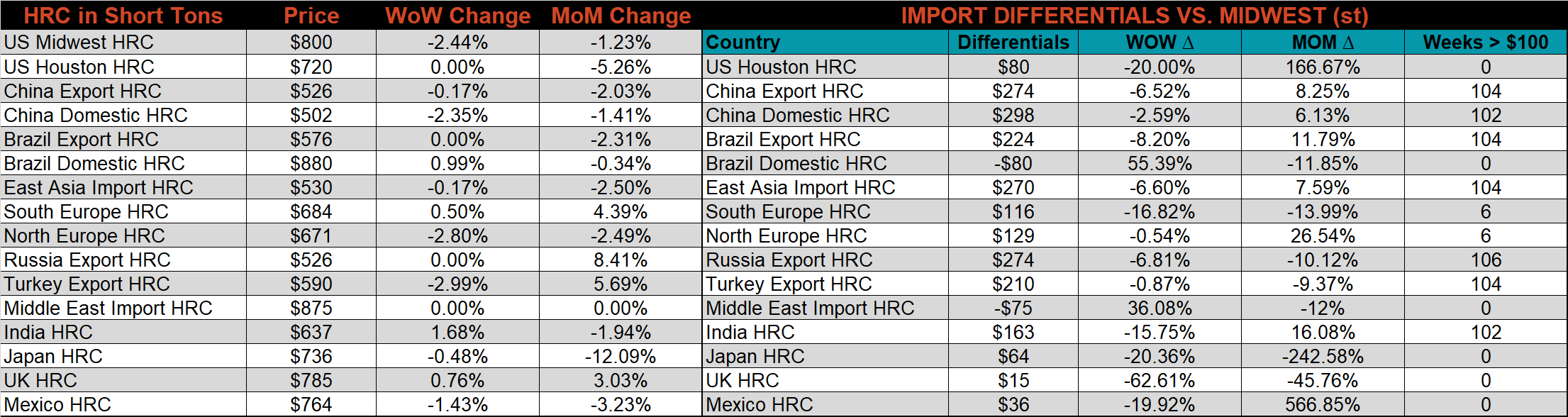

The Platts TSI Daily Midwest HRC Index was down $20 to $800.

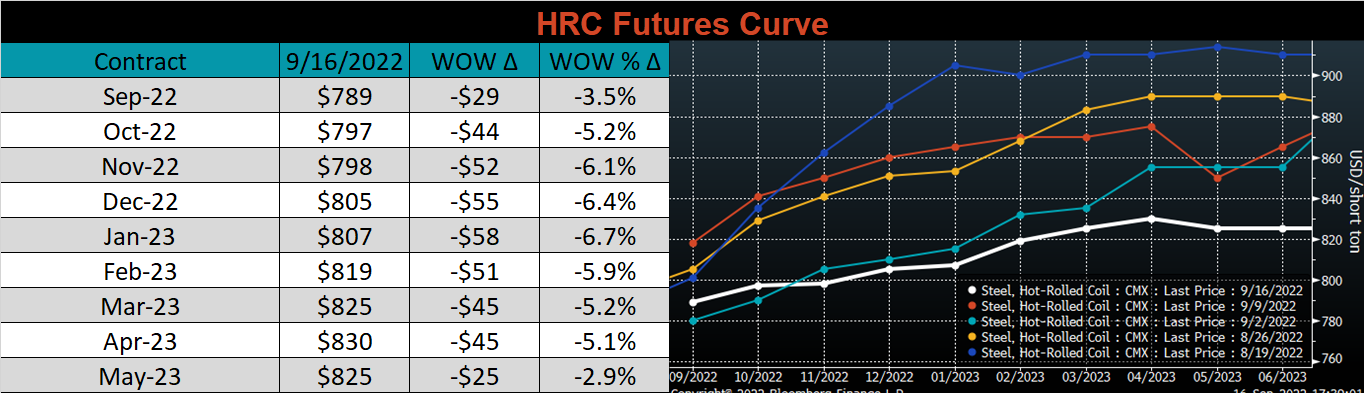

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The entire curve shifted lower last week, with Nov.22-May.23 futures settling at its lowest levels in the last month.

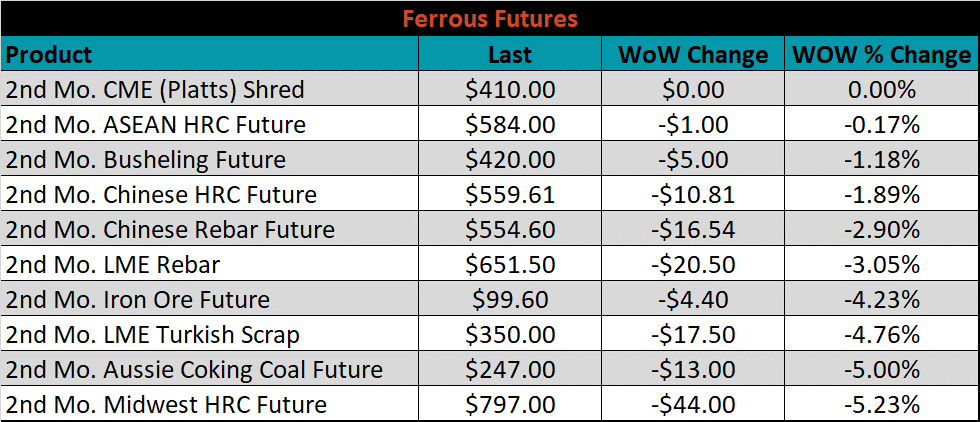

The 2nd month ferrous futures were mostly lower, led by Midwest HRC, which lost 5.2%.

Global flat rolled indexes were all lower last week, led by Northern European HRC down 2.9%.

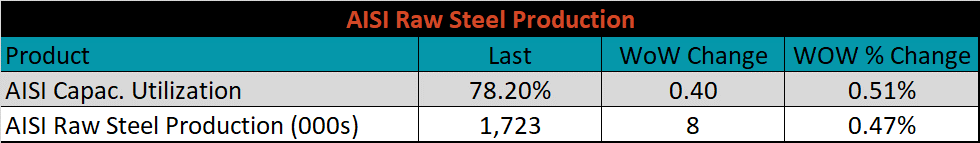

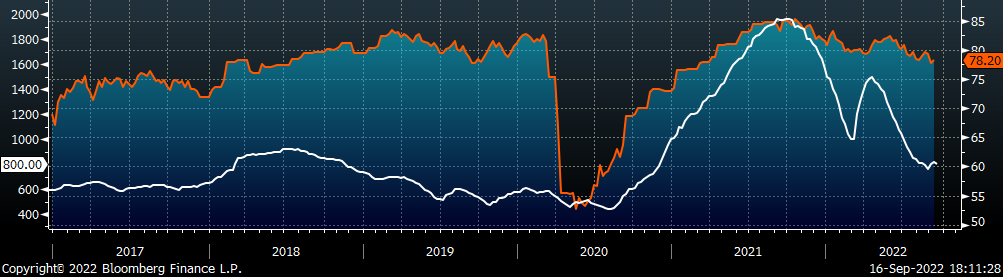

The AISI Capacity Utilization was up 0.4% to 78.2%.

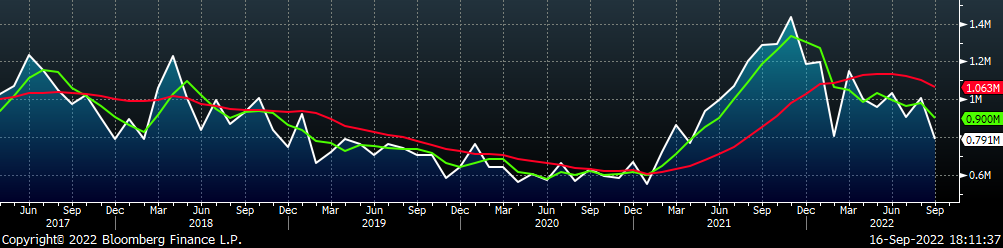

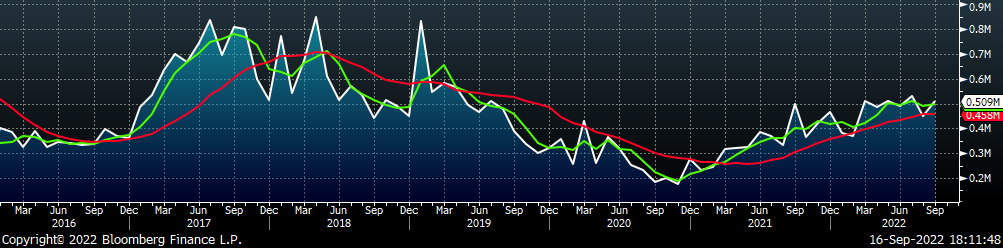

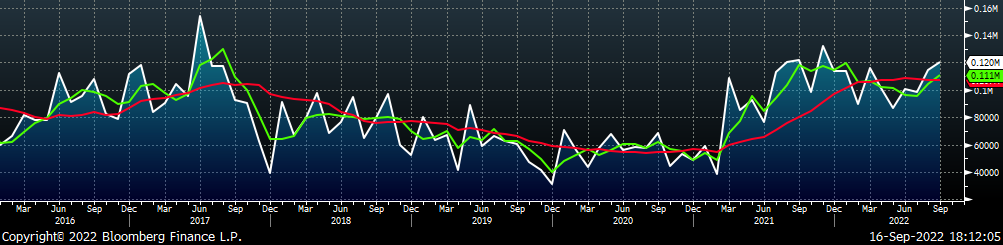

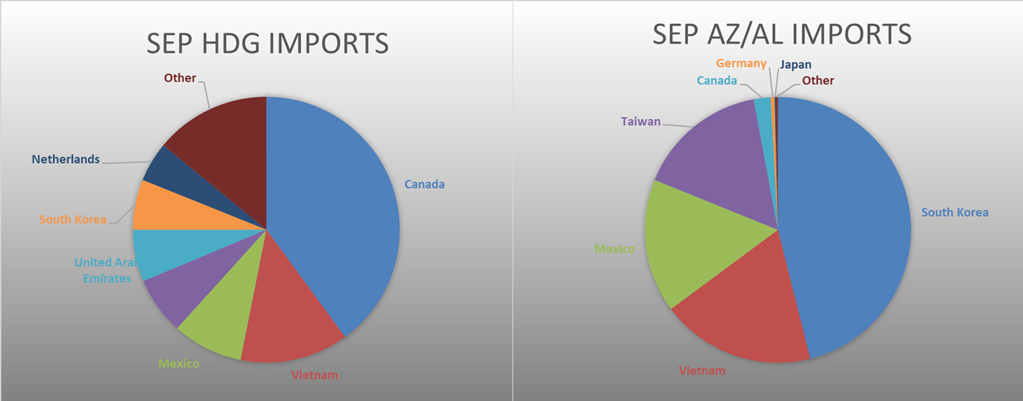

September flat rolled import license data is forecasting a significant decrease of 213k to 791k MoM.

Tube imports license data is forecasting an increase of 60k to 509k in September.

September AZ/AL import license data is forecasting an increase of 6k to 120k.

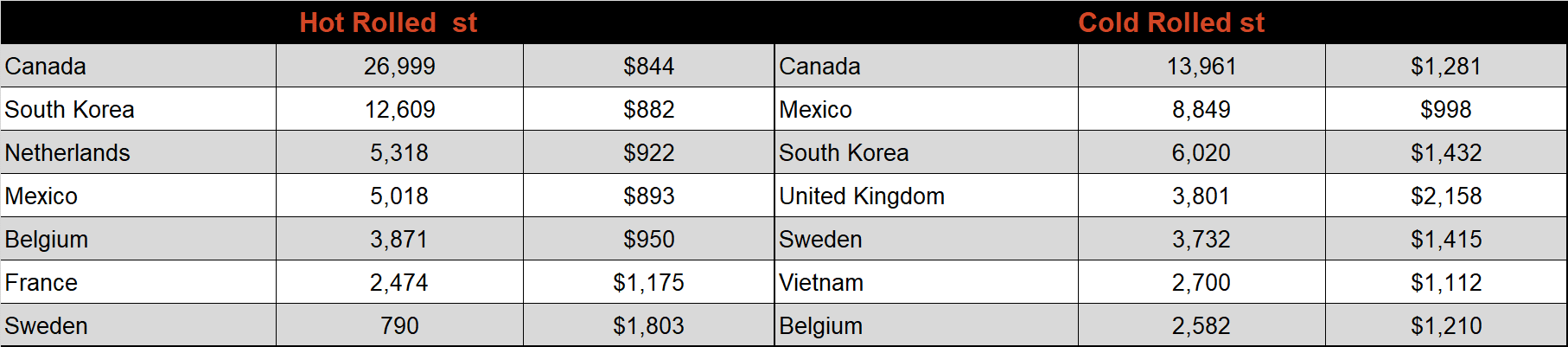

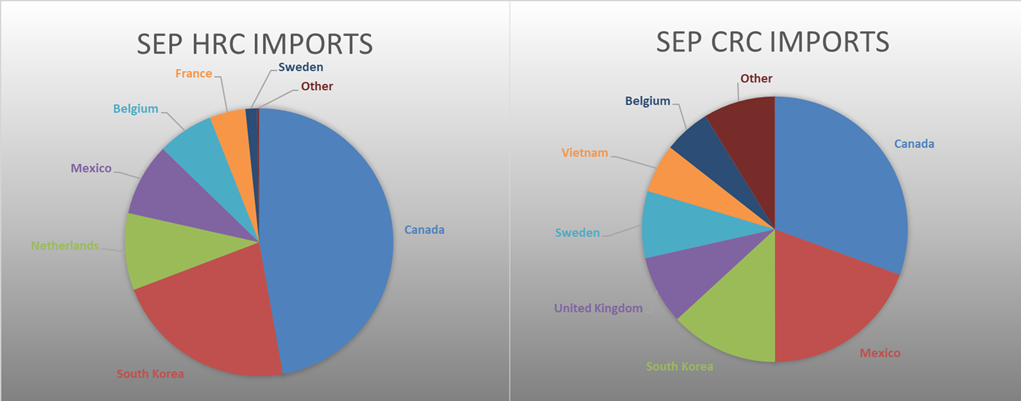

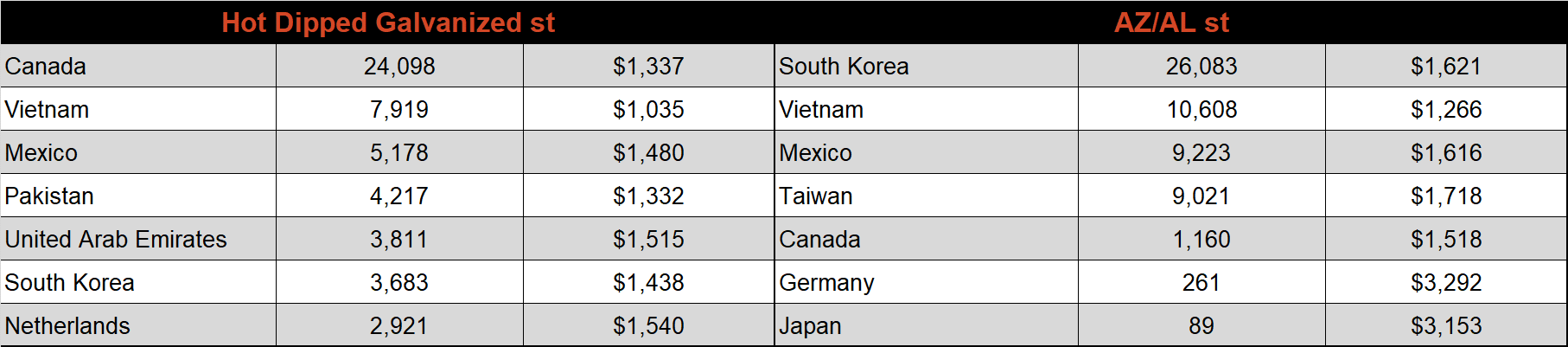

Below is September import license data through September 12th, 2022.

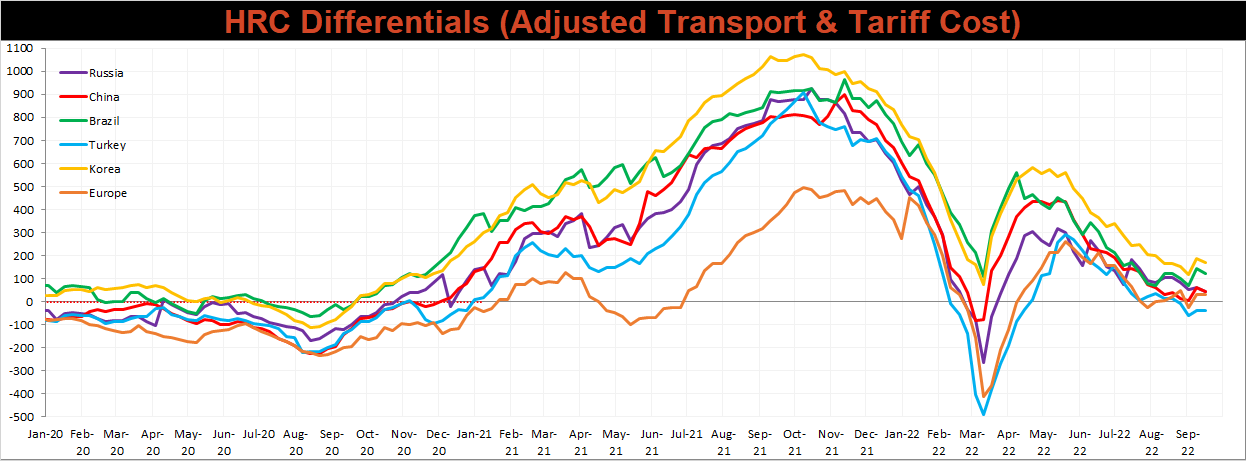

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials decreased for Russian, China, Brazil, & Korea, but they ticked slightly higher for Northern Europe and Turkey.

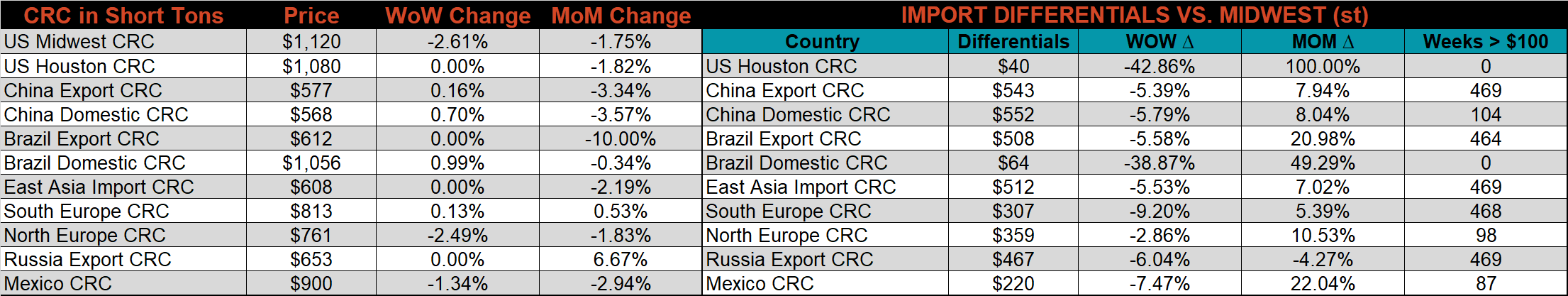

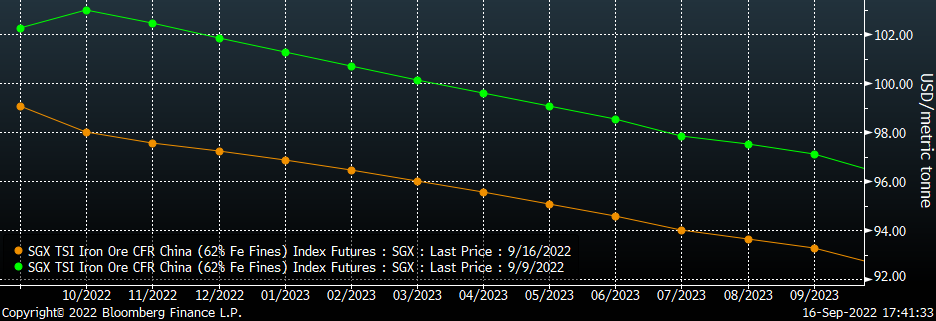

SBB Platt’s HRC, CRC, and HDG pricing is below. The Midwest CRC, HRC, & HDG prices were all down 2.6%, 2.4%, and 1.7%.

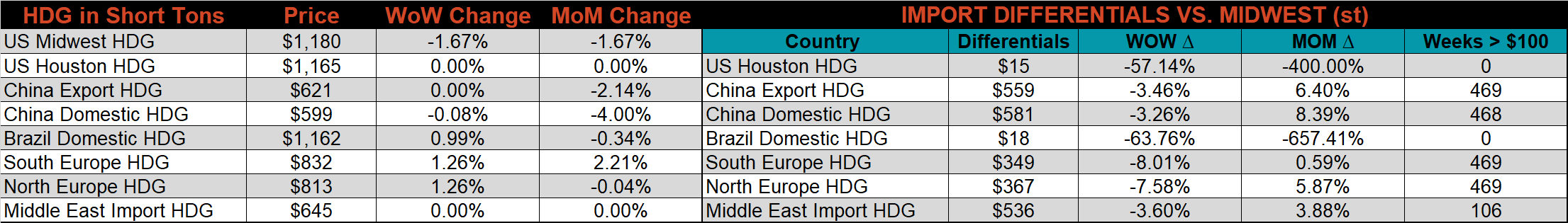

Raw material prices were mostly lower again last week, with Aussie coking coal down 7.7%, while pig iron del to NOLA gained 2.6%.

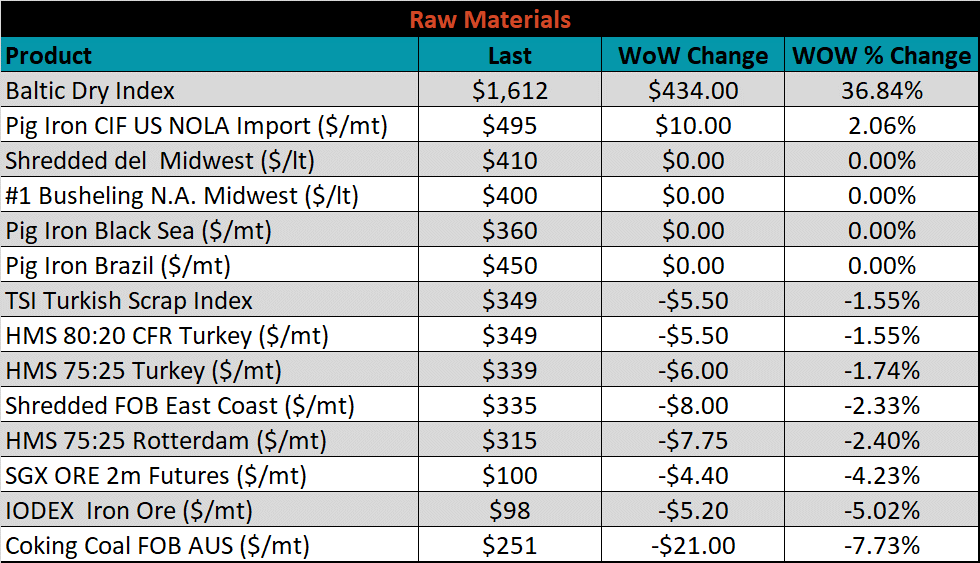

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve shifted lower, most significantly in the front of the curve.

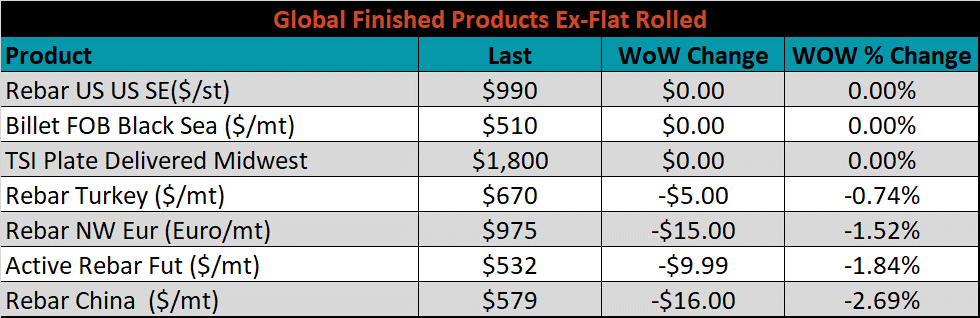

The ex-flat rolled prices are listed below.

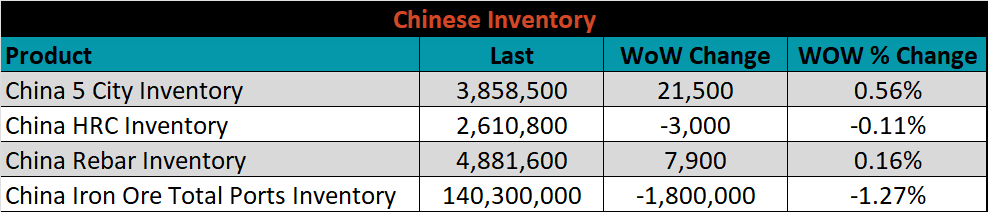

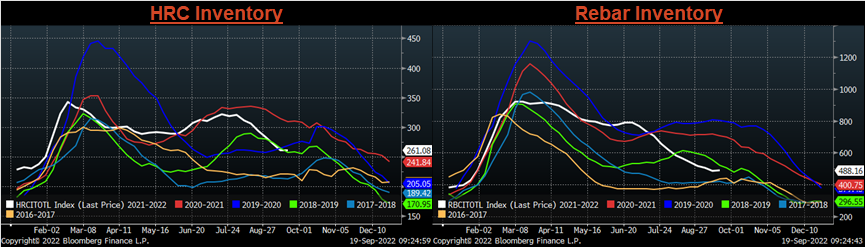

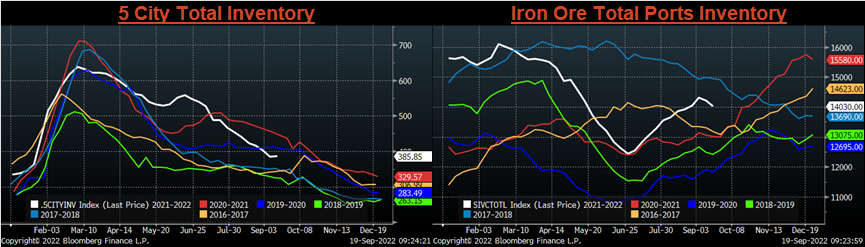

Below are inventory levels for Chinese finished steel products and iron ore. This week, we saw a slight reversal of the recent inventory trend for 5-city and rebar, where both ticked higher. Iron ore ports inventory sank for the second week in a row and HRC inventory slipped as well, albeit at a slower pace than recent weeks.

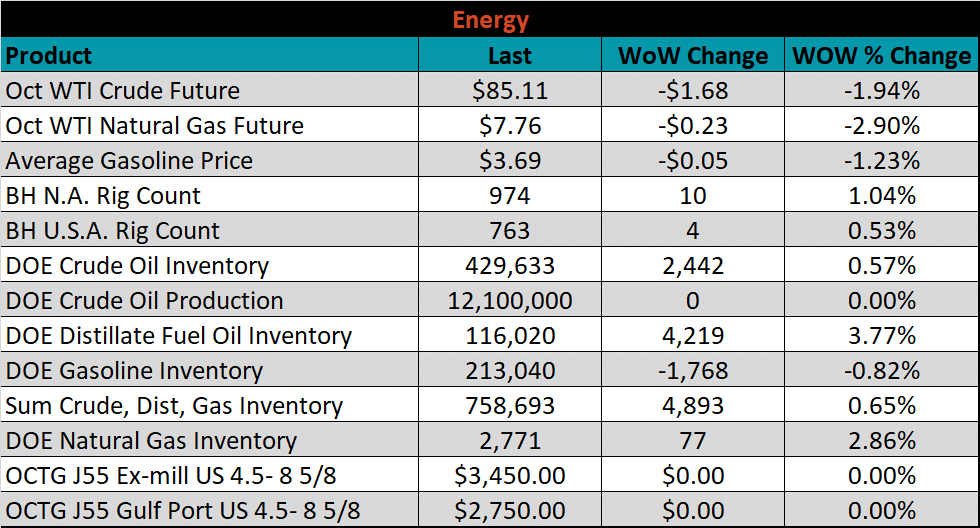

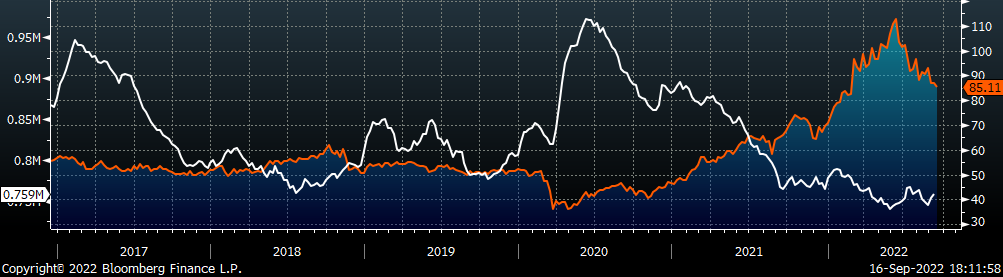

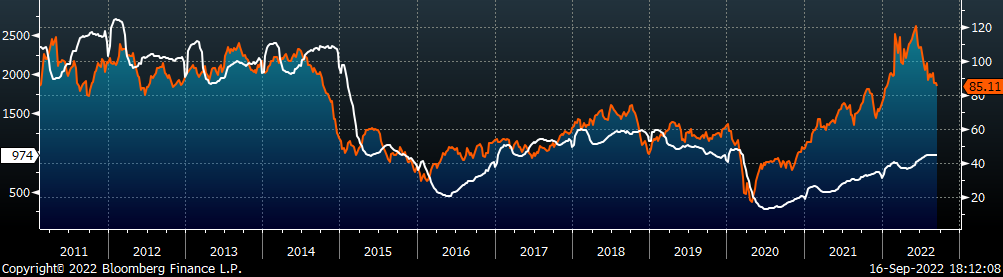

Last week, the October WTI crude oil future lost $1.68 or 1.9% to $85.11/bbl. The aggregate inventory level increased another 0.7%. The Baker Hughes North American rig count increased by 10 rigs, while the U.S. rig count increased by 4 rigs.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: