Content

-

Weekly Highlights

- Market Commentary

- Risks

This week has been very quiet in the physical steel market with transaction prices creeping lower, albeit on very limited activity. Mills have maintained higher offer prices in quotes, but they appear willing to negotiate when buyers have an actual order to place. However, there are very few spot orders being placed and a wide range of transaction prices, creating uncertainty over the actual spot market price. Additionally, discussions about contracts for next year have begun, but very few final agreements have actually been made. Until these contract agreements are finalized, pricing expectations will be very much up in the air.

Uncertainty is also prevalent across economic data and news. Global and domestic manufacturing PMIs have been weak in recent months, and confidence in the economy among business leaders has declined. There has been very little discernable progress in trade talks with China, with the structure and contents of a deal still unclear.

With all of this uncertainty radiating in the steel buyer’s environment, purchasing decisions are delayed until material is absolutely needed. With lead times shrinking and prices drifting lower, they are being rewarded for postponing these decisions. Additionally, organizations throughout the steel supply chain are focusing on slimming their inventory levels after declining prices over the last 14 months have shocked their company’s financial performance. Service center and end user inventory levels have been at historic lows for an extended period. The recent price rally failed to spur any significant restocking.

This uncertainty in the steel market is exhibited in the elevated volatility of multiple different Midwest HRC price indices as well as the futures curve. When volatility is present within a business’s operations, it becomes more difficult to maintain steady earnings, create budgets and plan for future capital expenditures. We recommend using options to protect against this rising volatility in pricing.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

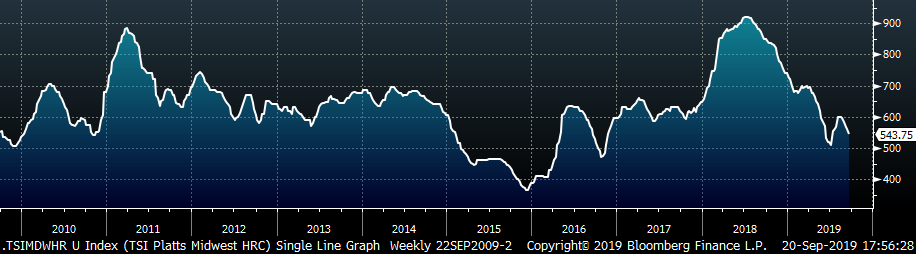

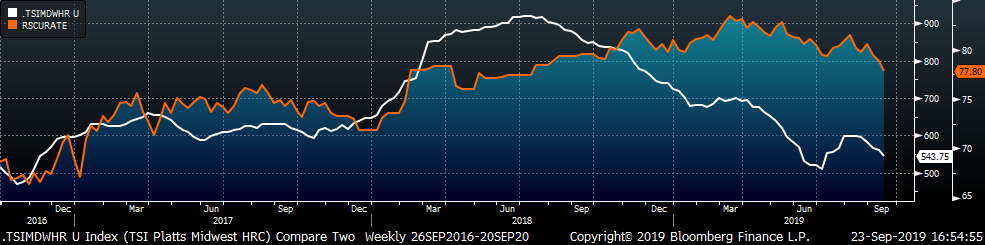

The Platts TSI Daily Midwest HRC Index was down $16.25 to $543.75.

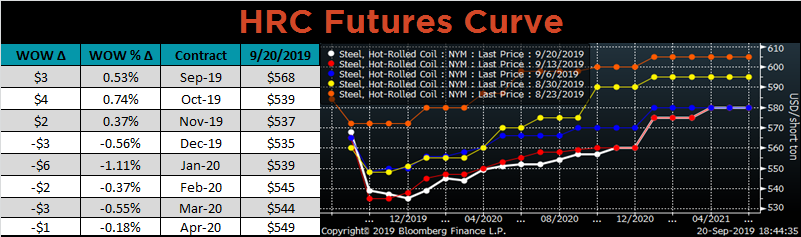

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The curve was mostly flat on the week.

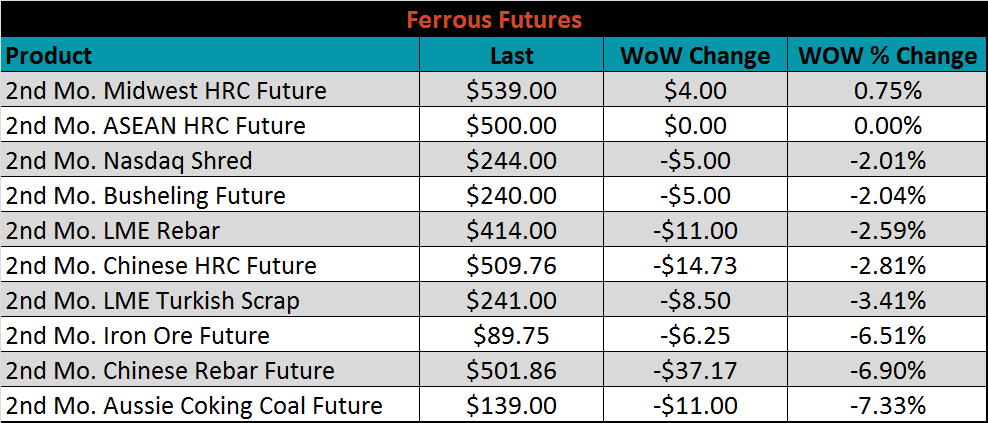

October ferrous futures were mostly lower. Aussie coking coal lost 7.3%.

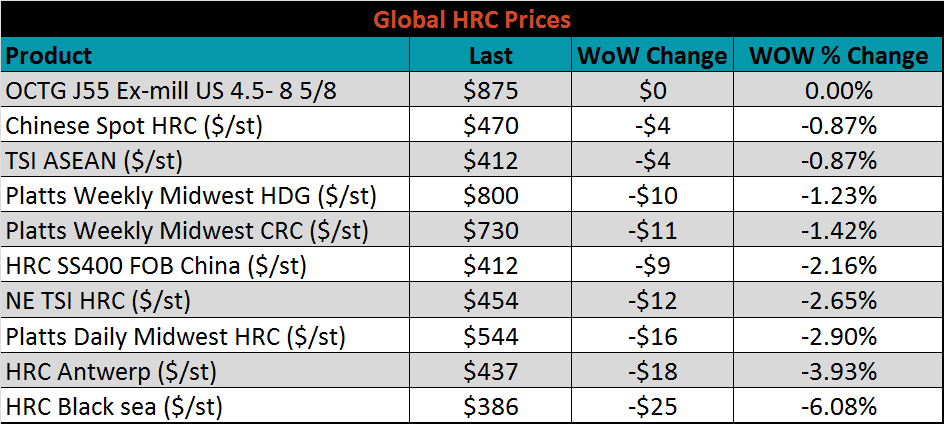

The global flat rolled indexes were all lower. Black Sea HRC was down the most, at 6.1% while Midwest HRC was also down 2.9%.

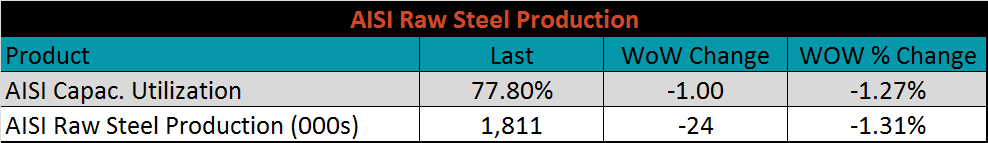

The AISI Capacity Utilization Rate was down another 1% to 77.8%. From here, it is difficult to foresee how the 80% goal set by the Trump administration can be maintained in the short term. Upcoming planned outages and a lack of apparent demand at current prices suggest that raw steel production will continue to decline.

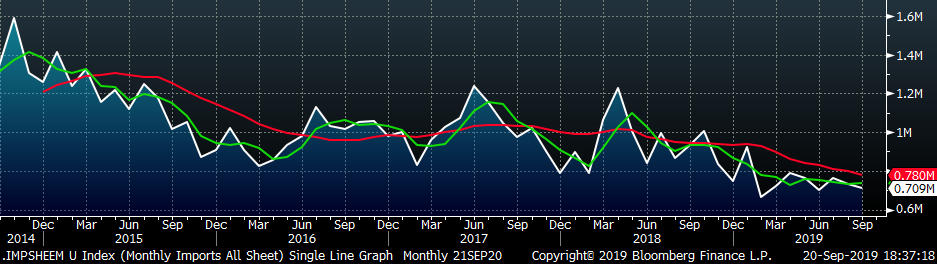

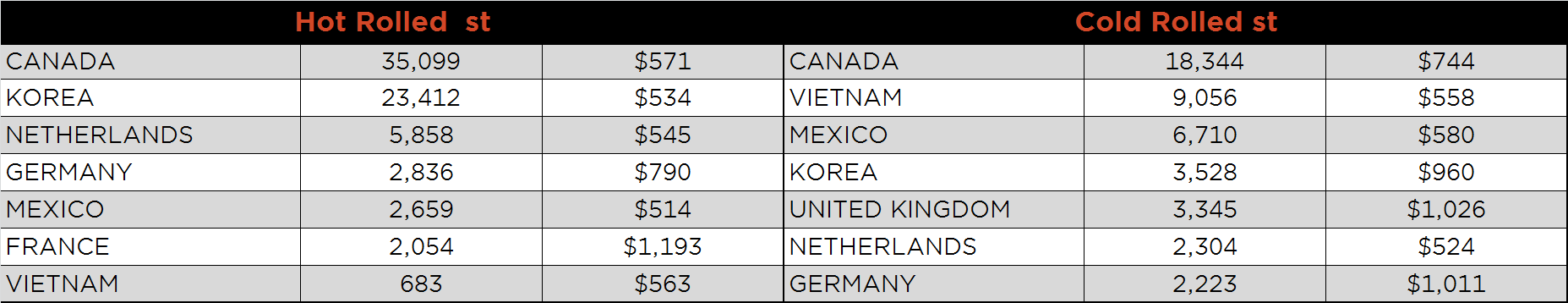

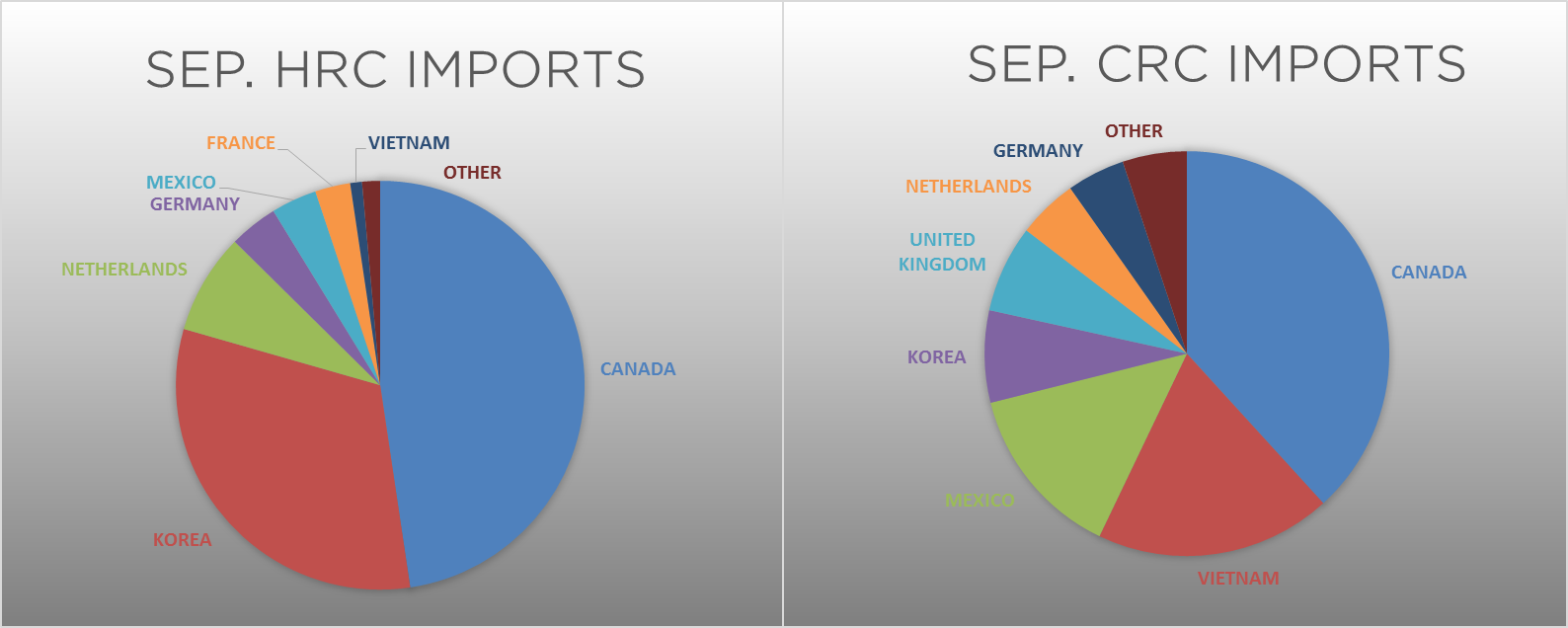

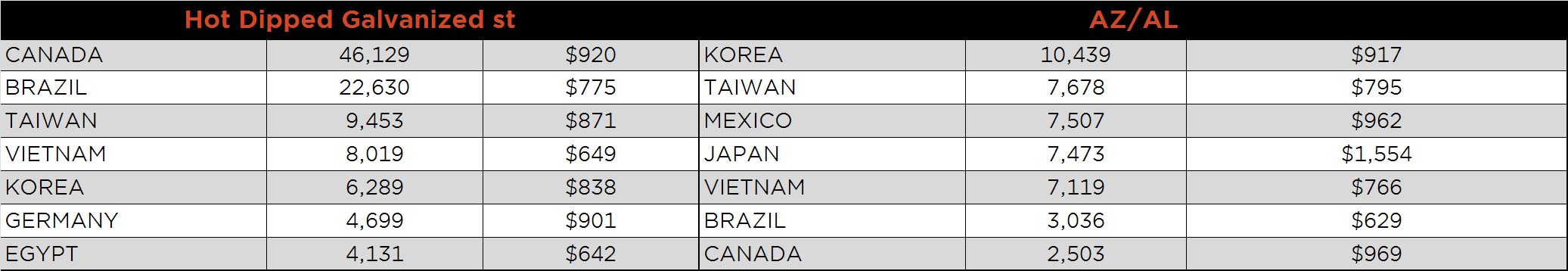

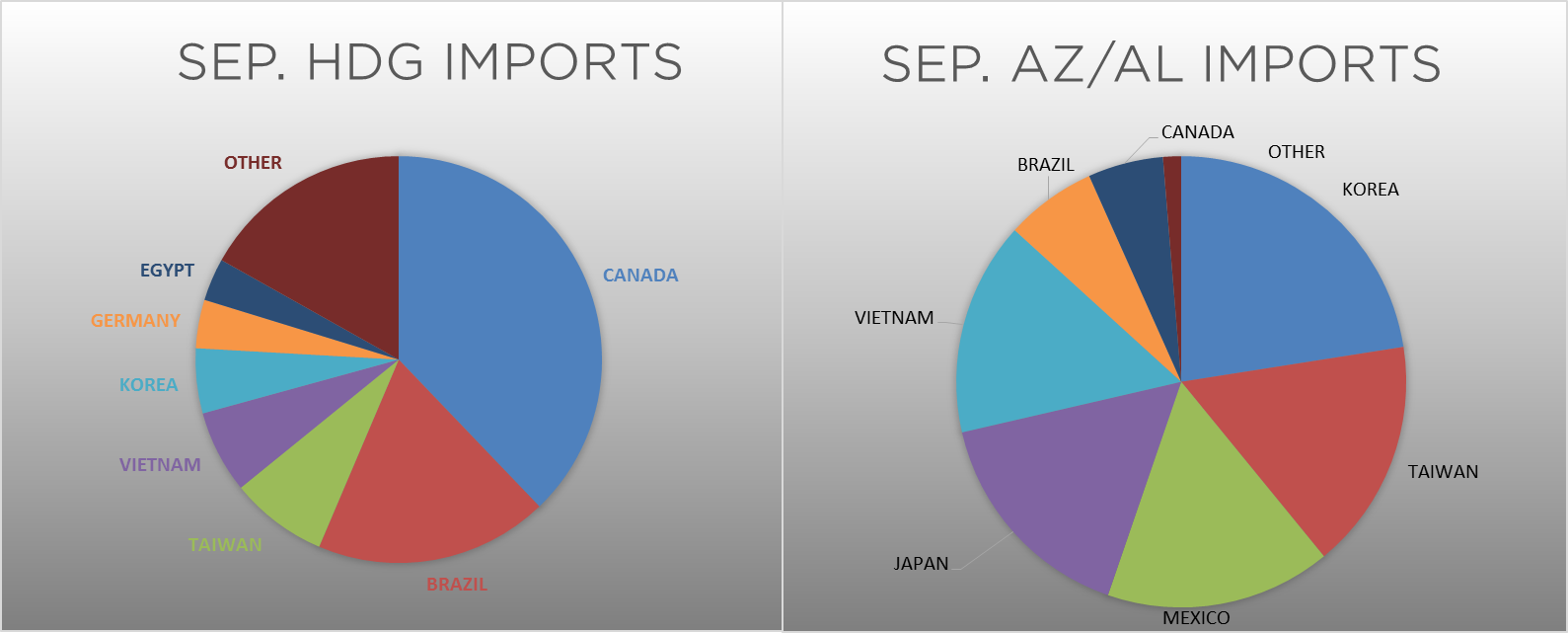

September flat rolled import license data is forecasting a decrease of 25k to 709k MoM.

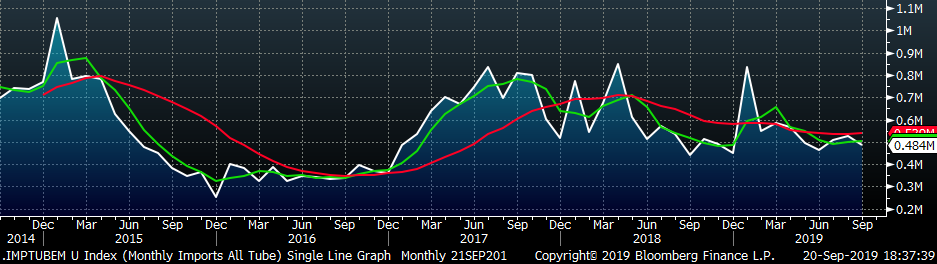

Tube imports license data is forecasting a MoM decrease of 40k to 484k tons in September.

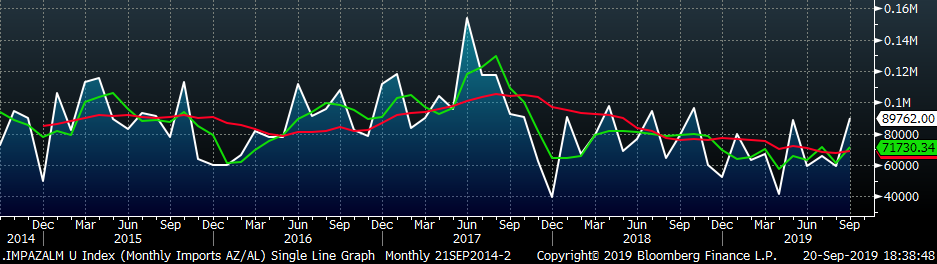

AZ/AL import license data is forecasting an increase of 30k in September to 90k.

Below is September import license data through September 17, 2019.

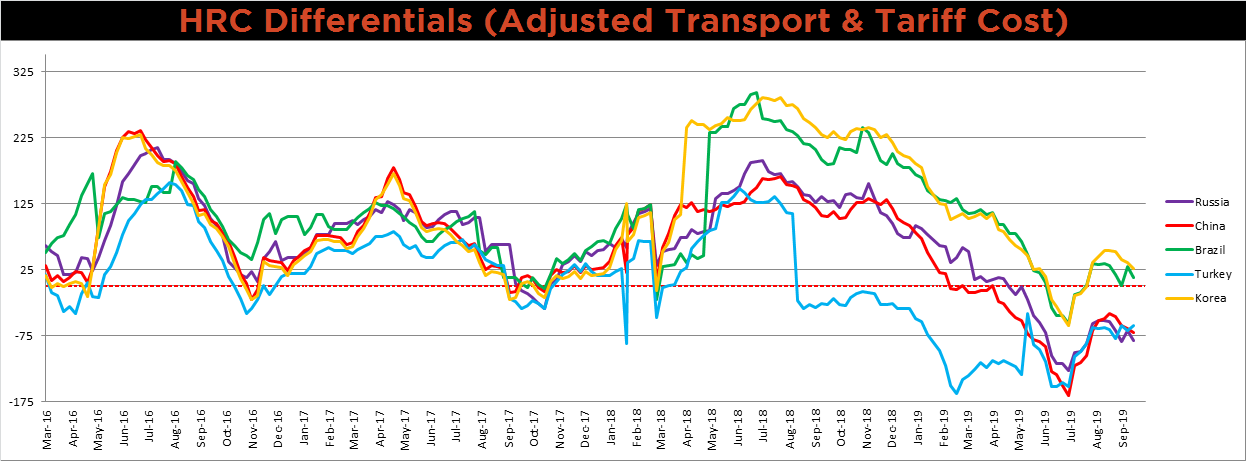

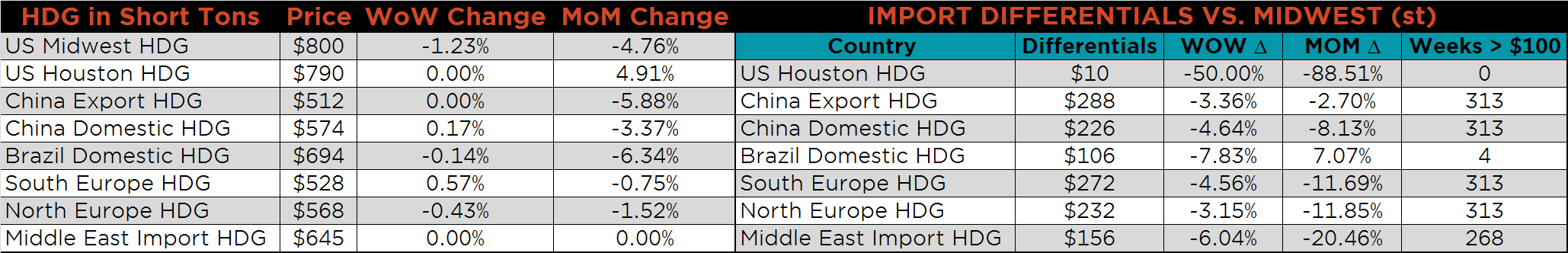

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The Turkish differential was higher as prices dramatically fell, while the remaining global differentials continued lower.

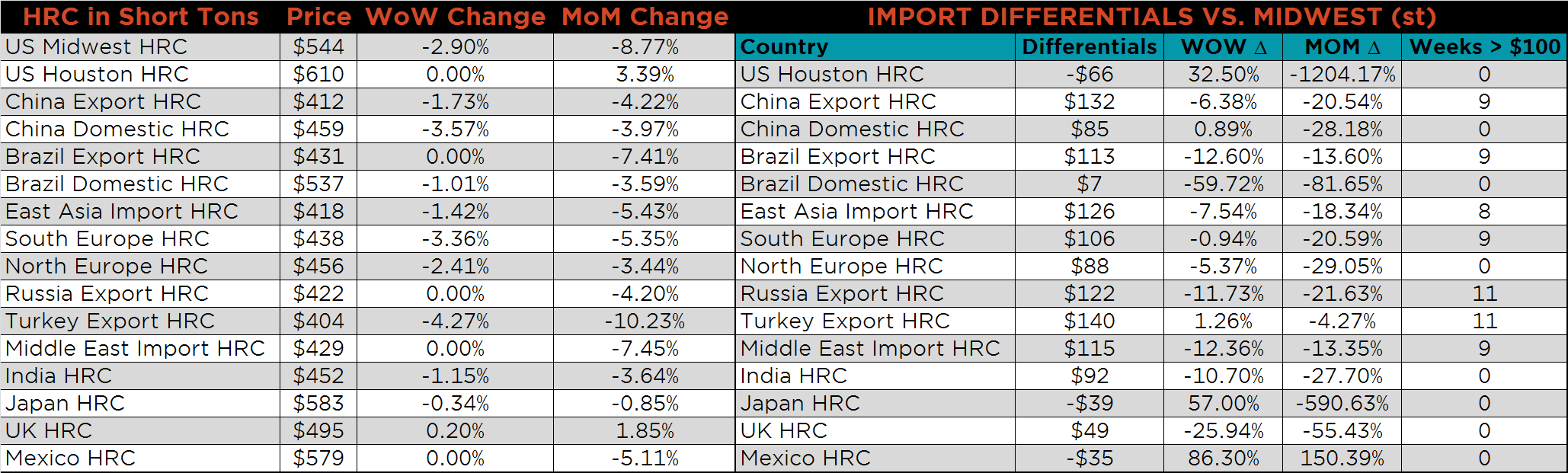

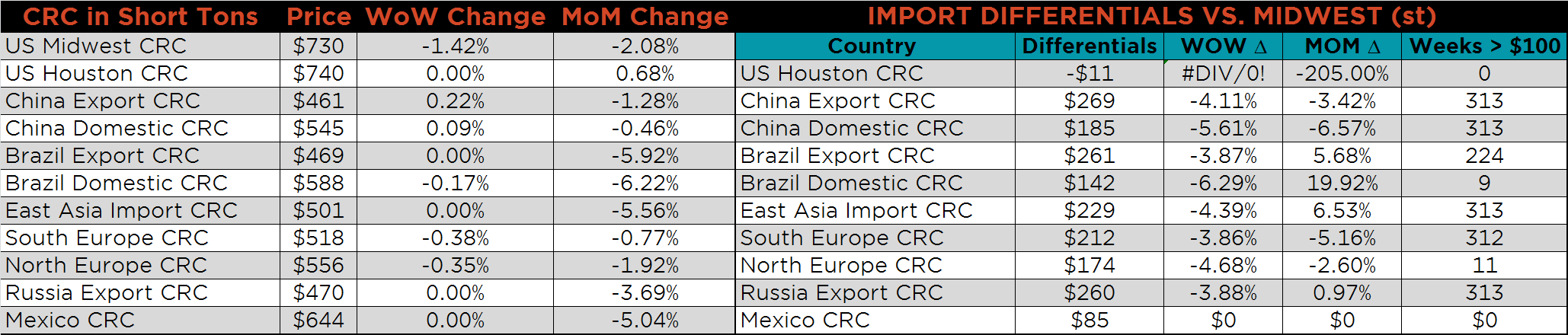

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC, CRC and HDG prices were all down on the week, 2.9%, 1.4% and 1.2%, respectively. Turkish and Chinese HRC export prices were lower, 4.3% and 3.4% respectively.

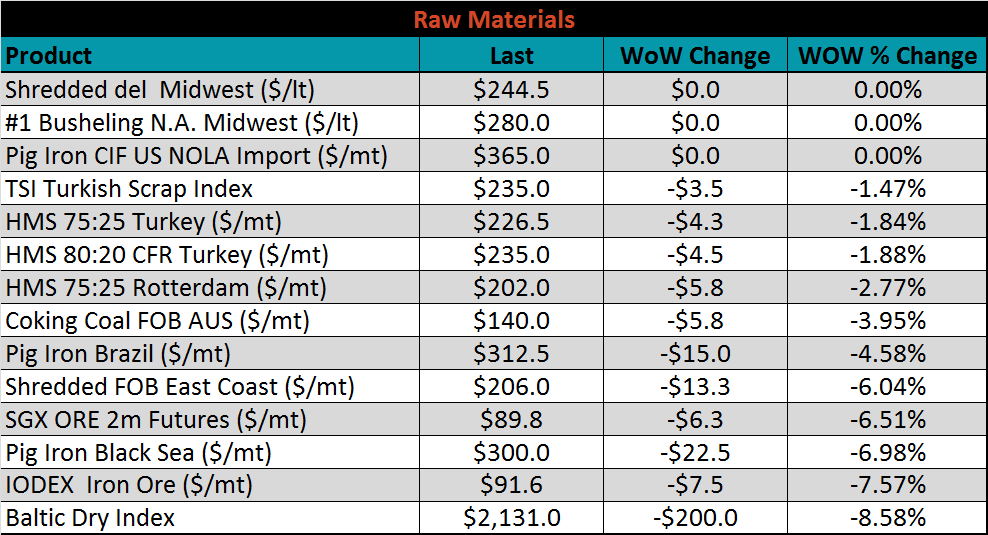

Raw material prices were mostly lower. The IODEX was down the most, 7.6%.

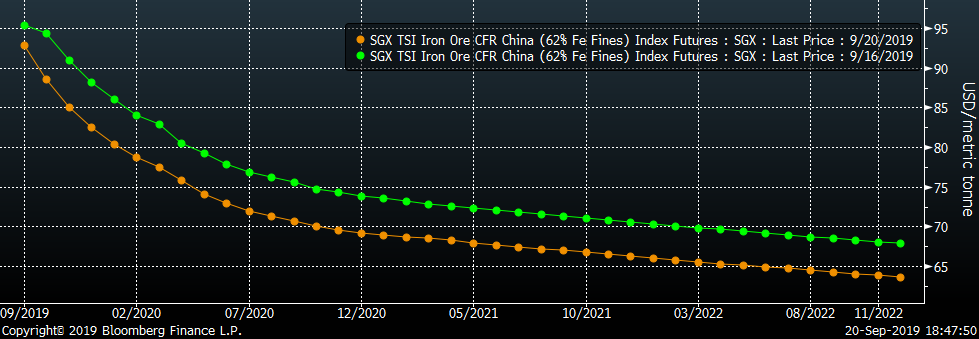

Below is the iron ore future curve with Friday’s settlments in orange, and the prior week’s settlements in green; the entire curve shifted higher.

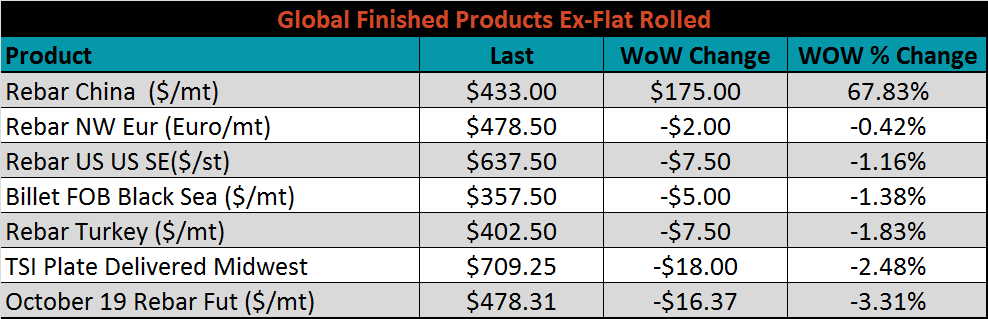

The ex-flat rolled prices are listed below.

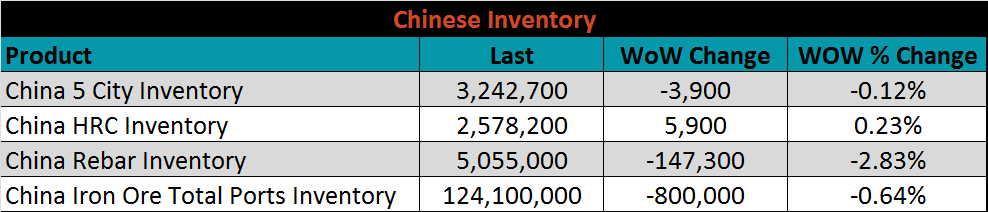

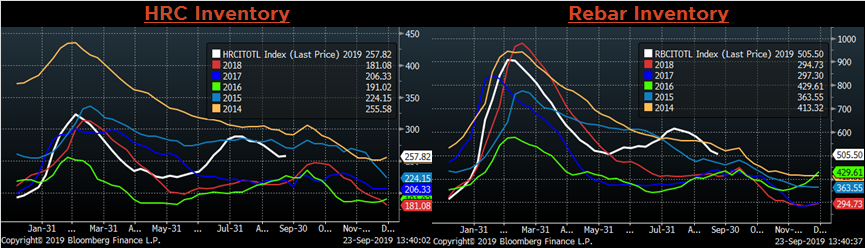

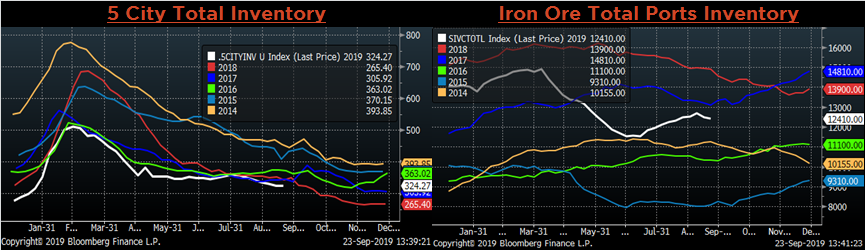

Below are inventory levels for Chinese finished steel products and iron ore. HRC, Rebar and 5-City inventory levels were lower again, while Iron Ore port inventory has continued to increase. Another month of poor manufacturing data suggests that the trend of destocking finished products will likely continue.

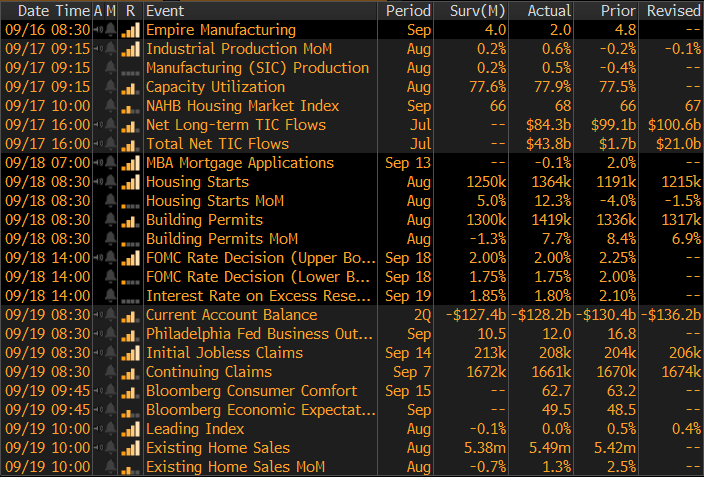

Economically speaking, the most significant piece of news was the FOMC lowering rates by 25 basis points. Additionally, the New York FED (Empire) Manufacturing Index printed down at 2 from 4.8, below expectations; the Philadelphia FED Business Outlook Index printed down at 12 from 16.8, above expectations of 10.5. Mixed printings of these two regional manufacturing indexes reflects uncertainty within the market. Certain manufacturing indexes show weakness, while Consumer Confidence and spending continue to be as strong point in the economy.

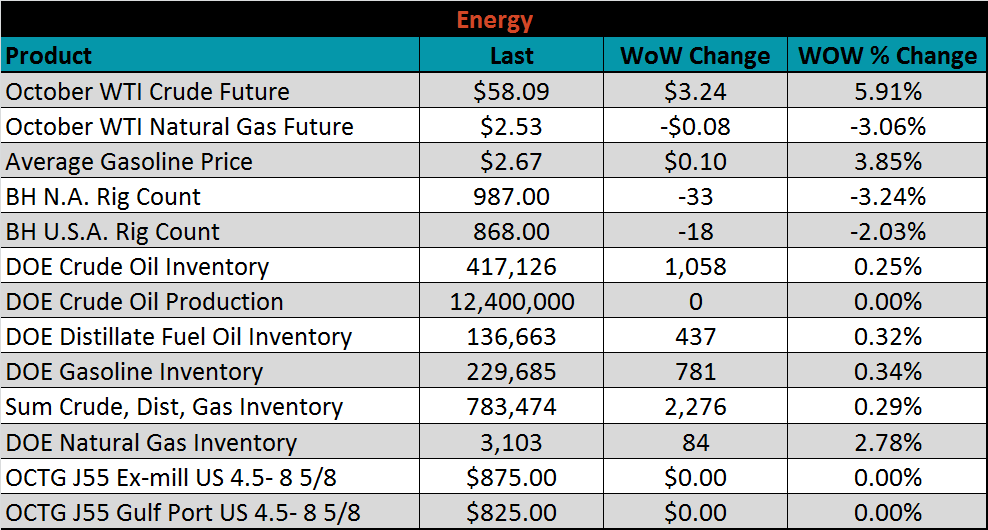

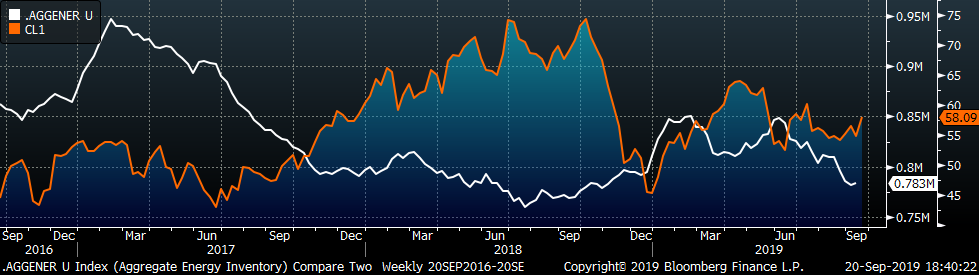

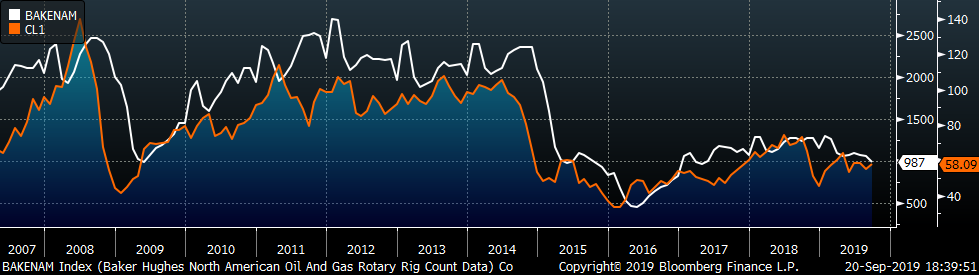

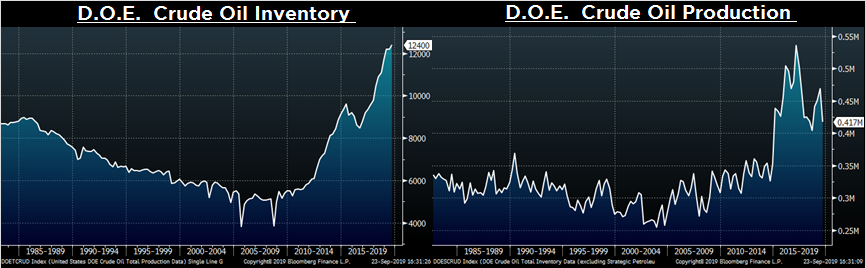

Last week, the October WTI crude oil future gained $3.24 or 5.9% to $58.09/bbl. The aggregate inventory level was 0.3% higher, and crude oil production was unchanged 12.4m bbl/day. The Baker Hughes North American rig count lost thirty-three rigs and the U.S. count lost twelve. The recent spike in oil prices does not appear to be influencing the domestic steel market.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: