Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

After another week of stable spot prices, the physical market lacks additional clarity on pricing direction for the remainder of 2021. The recent slowing down of momentum continues to suggest the rally is nearing its end, while the rumors of heavily discounted transactions over the last three weeks are not showing up in hard data and have not led to capitulation on behalf of the mills. In fact, compared to last week, offers from most mills have increased. This indicates their current leverage and confidence at these historic price levels, but clear buyer hesitance suggests there is not another “jump higher” left in the rally. Additionally, now that the market has had time to digest the influx of offers resulting from auto production slowdowns, which initially spooked both the physical and financial markets, we see that demand for steel has not eroded to a point that would indicate a collapse is eminent either. Both sides continue to hold the line and remain comfortable in their positions. The major risk on the horizon is the continued global logistics nightmare that continues stretching across all industries. In the remainder of the report, we will expand on how this is both a significant upside and downside risk going forward.

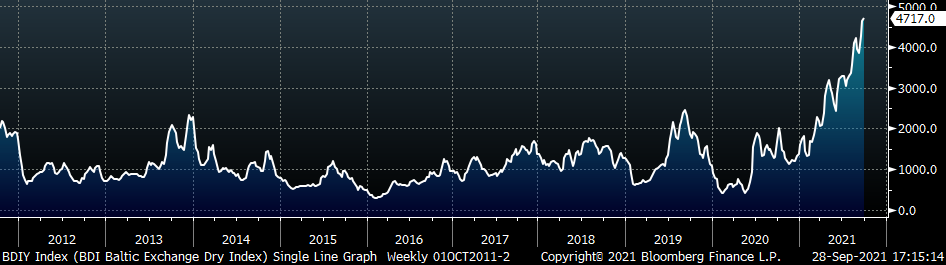

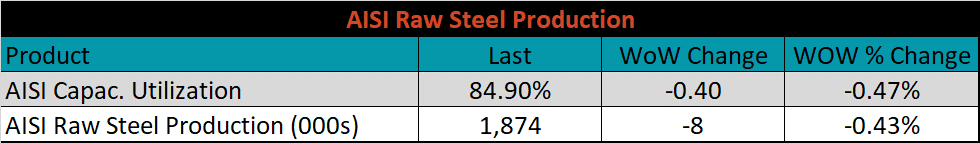

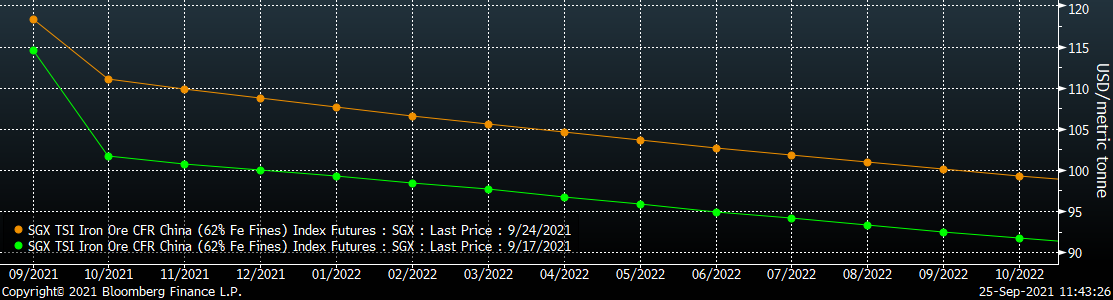

While ripples from supply chain disruption caused by the global pandemic will continue to be felt indefinitely in cost and availability, it is nearly impossible to know how or when these issues will start to ease and eventually be resolved. The fact of the matter is that logistics issues are capping current consumption, for many in the steel consuming industries this has looked like an increased backlog and sustained long-term demand, leading to higher prices. The chart below shows the Baltic Dry Index, used to track the global cost of shipping iron ore and coal, which has nearly doubled it’s 10-year peak from September 2019.

This dramatic increase in price is emblematic of how severe the shipping constraints are in the face of rising global demand. Additionally, with fears of global natural gas outages caused by bottlenecks, there is no reason to believe global shipping will ease in the coming 6 months. With the limited vessels available and booked out until further notice, it is hard to see how this will not impact steel imports planned to arrive next year. From a domestic perspective, log jams at every port, lack of available drivers and inclement weather have left us with a logistics crisis leading to regional shortages and surpluses and rapidly increasing prices. Inventory short buyers waiting on material may be forced back into the market to fulfill short-term needs with the newly available spots tons. However, this squeeze will not last forever, and as an increasing number of deliveries continue to be delayed, the possibility of these older, less expensive tons arriving all at once also increases.

Superficial analysis of these dynamics may lead buyers to believe this eventual influx of material will cause the collapse in domestic prices they have been calling for. As the year-long rally progressed, consistent predictions that “a collapse in domestic prices was around the corner” have resulted in an unwillingness to buy any speculative material. Because of this, our outlook is that even though the rally is in its late stages and lower prices are ahead, too many buyers have been gambling on a lower spot market and allowing mills to retain their leverage. The recent sell off has provided another opportunity to start fixing 2022 material $600 below today’s spot market. The price may go up, it may go down, however waiting to see what will happen will always end up being a losing strategy.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

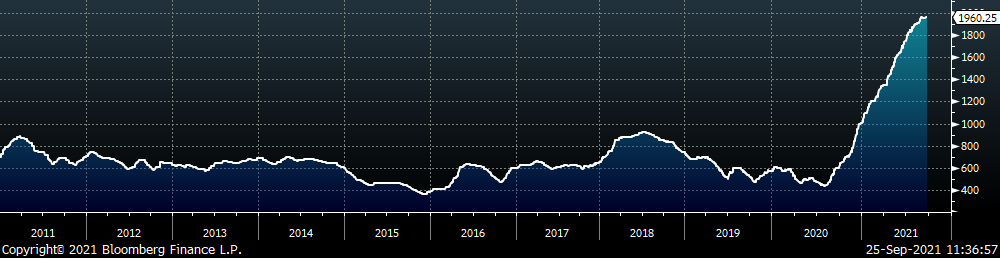

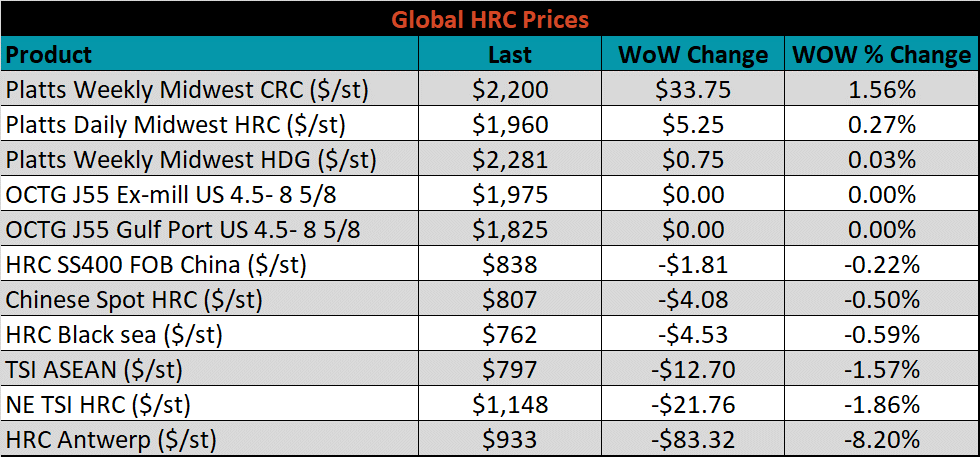

The Platts TSI Daily Midwest HRC Index increased by $5.25 to $1,960.25.

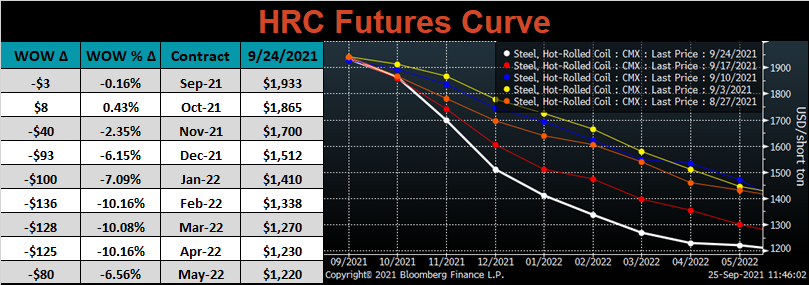

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The futures sell-off for 2022 expirations continued early last week but stabilized going into the weekend.

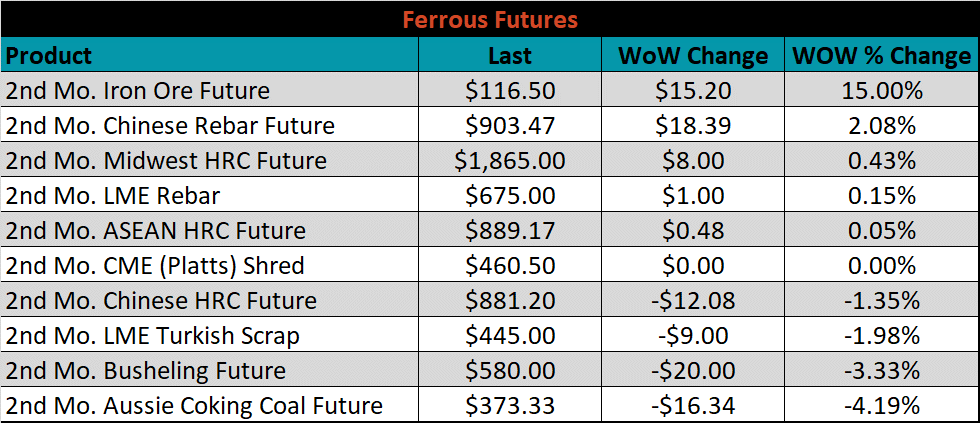

October ferrous futures were mixed, with iron ore up 15%, while Aussie coking coal lost 4.2%.

Global flat rolled indexes were mixed. The Platts Midwest CRC price was up 1.6%, while HRC Antwerp was down another 8.2%.

The AISI Capacity Utilization was down 0.4% to 84.9%.

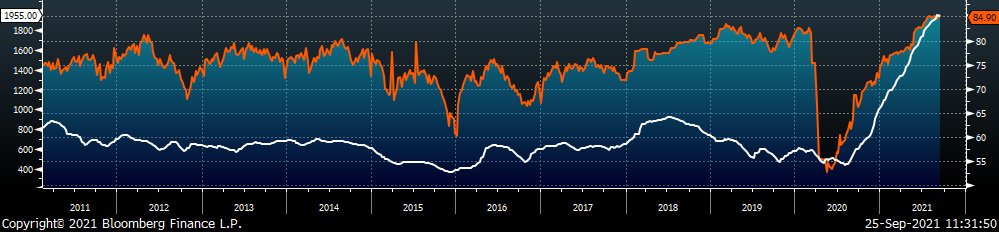

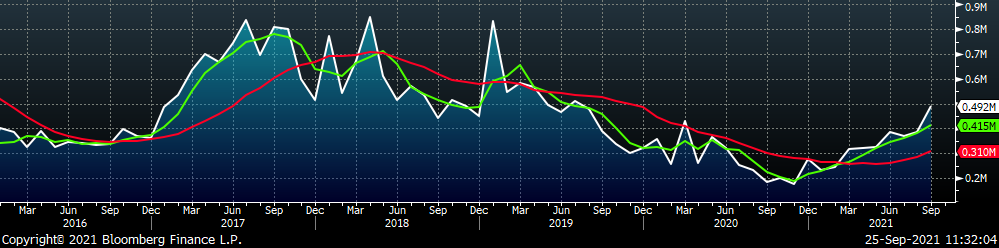

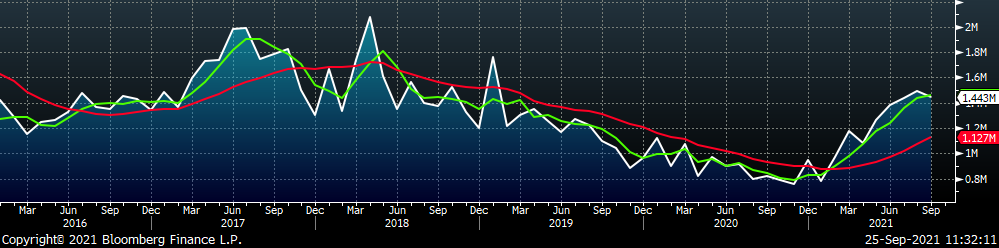

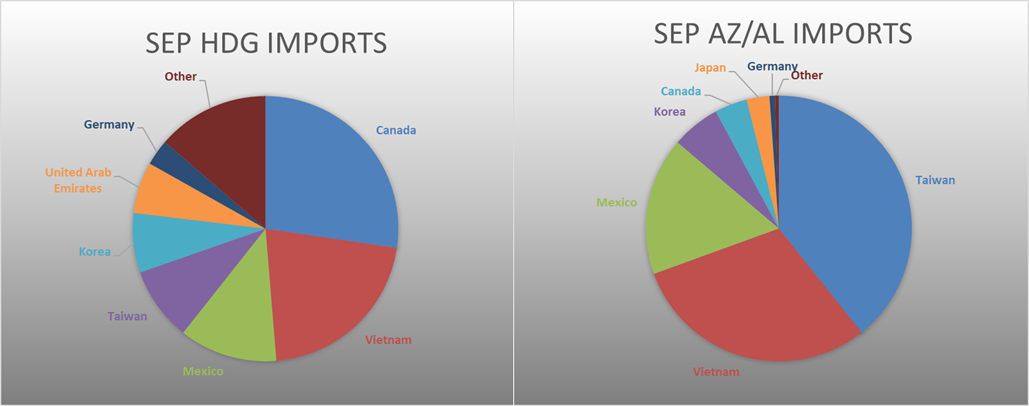

September flat rolled import license data is forecasting a decrease of 157k to 951k MoM.

Tube imports license data is forecasting an increase of 106k to 492k in September.

September AZ/AL import license data is forecasting an increase of 6k to 116k.

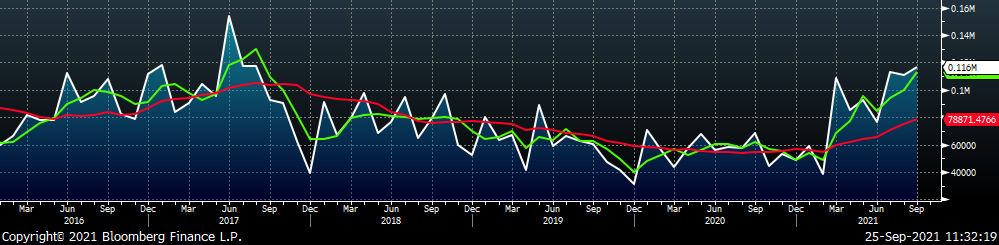

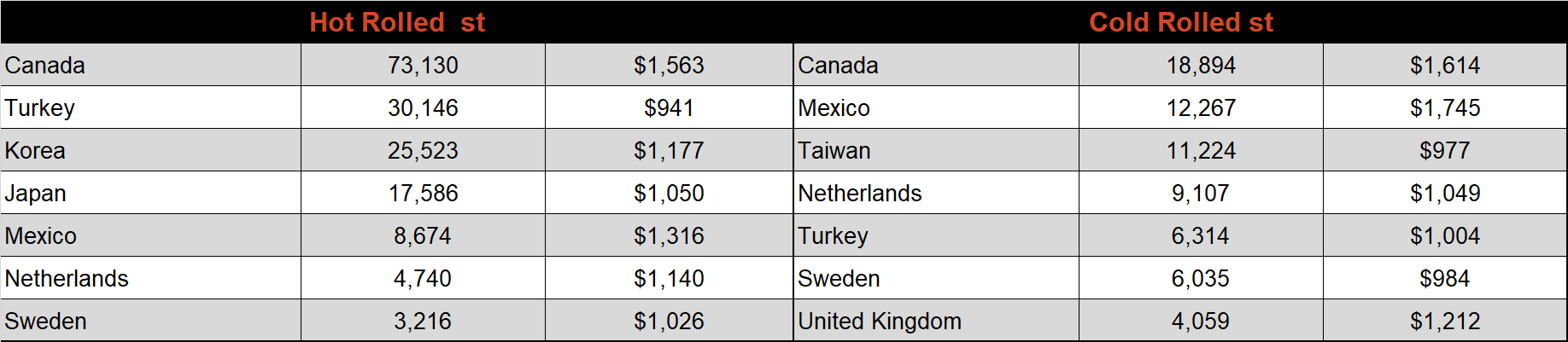

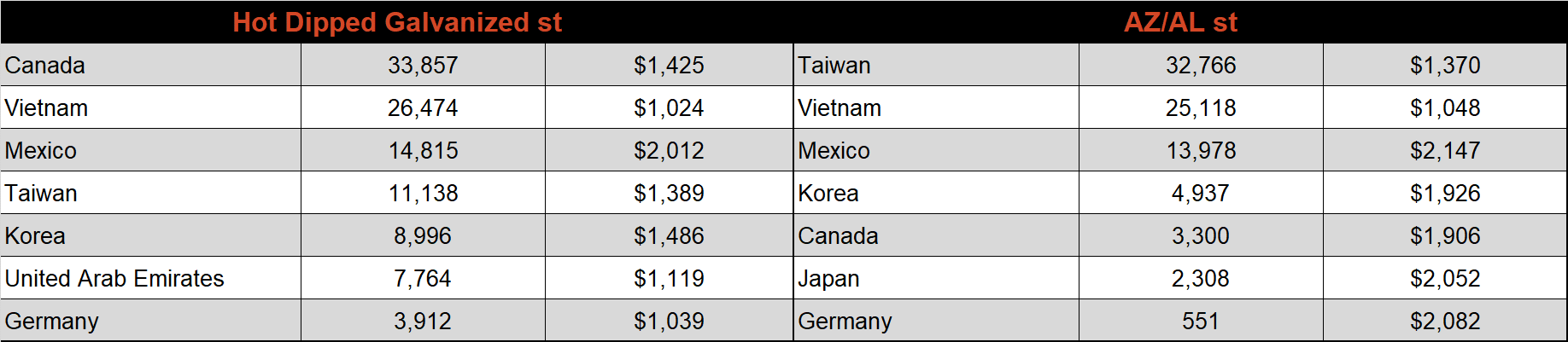

Below is September import license data through September 20th, 2021.

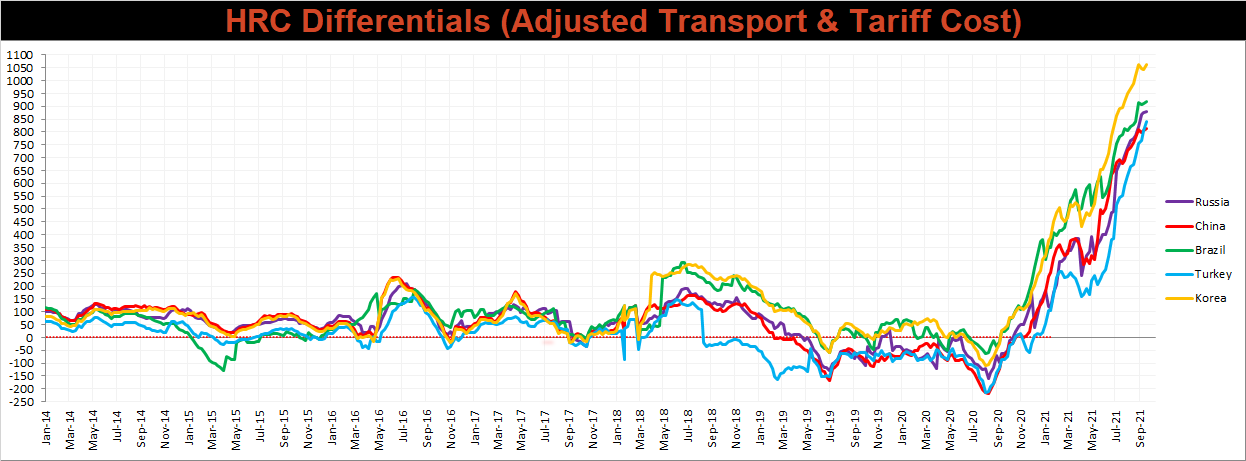

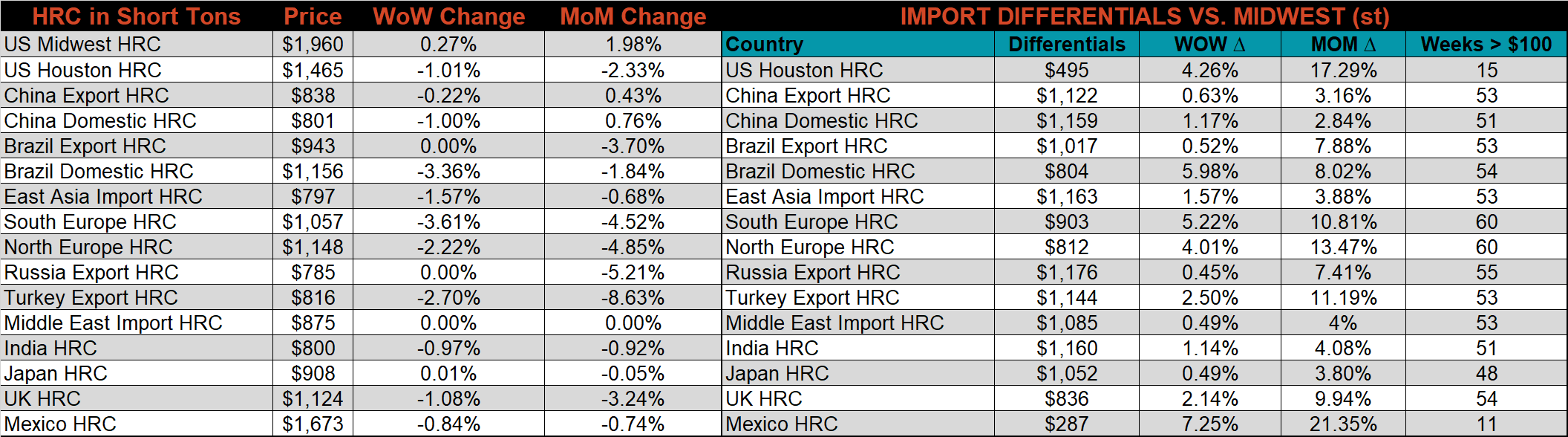

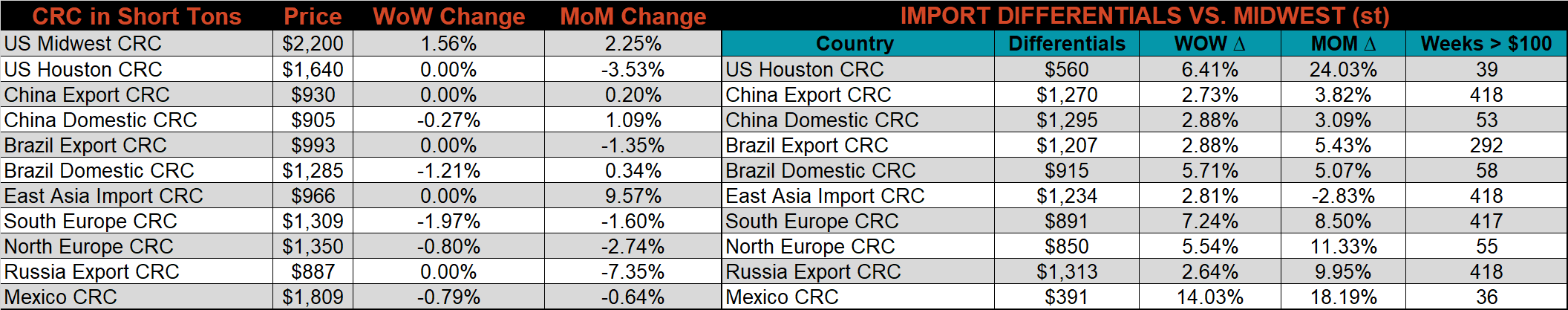

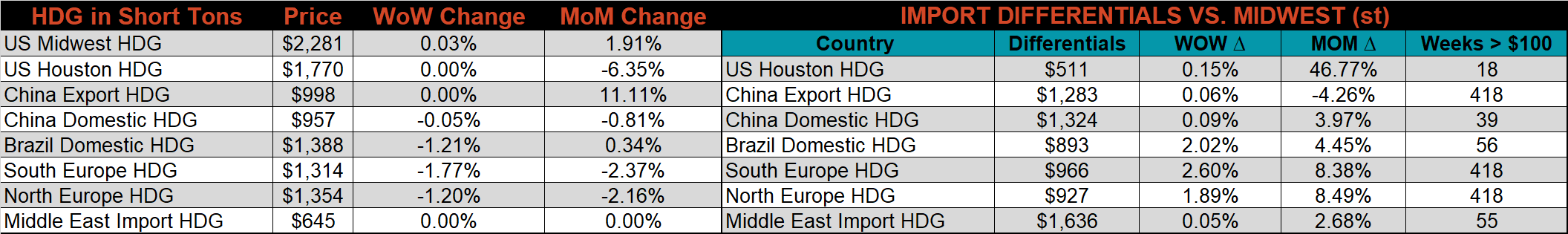

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials increased slightly for all the watched countries with the U.S. domestic price slightly outpacing global prices.

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest CRC, HRC, & HDG prices were up by 1.6%, 0.3%, and 0.1%, respectively. Outside of the U.S., the Southern European HRC price was down 3.6%.

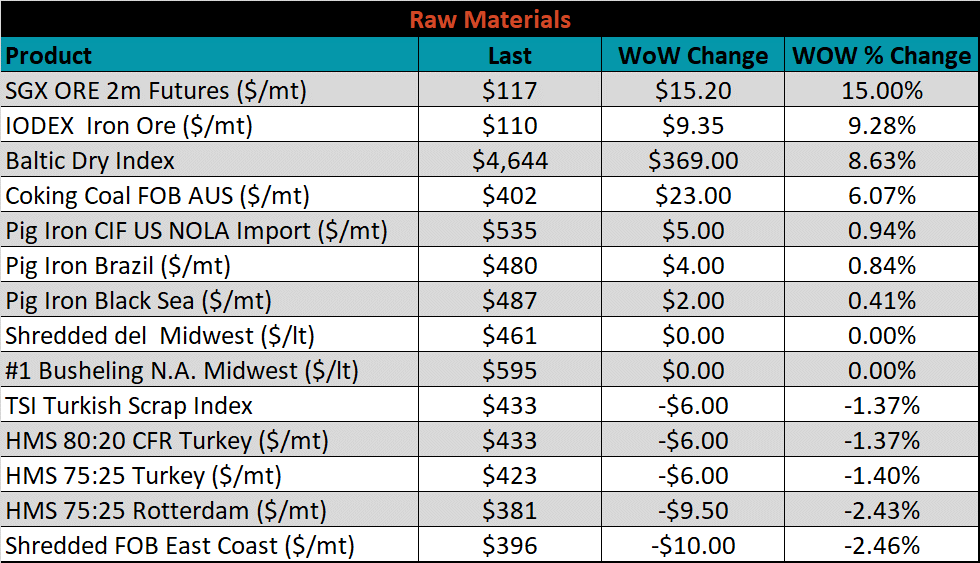

Raw material prices were mixed. Iron ore futures were up 15%, while East Coast shredded lost 2.5%.

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve shifted higher, after being under significant pressure since July.

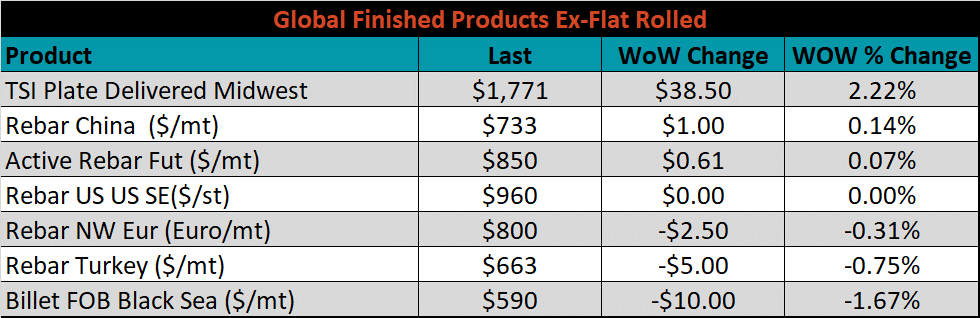

The ex-flat rolled prices are listed below.

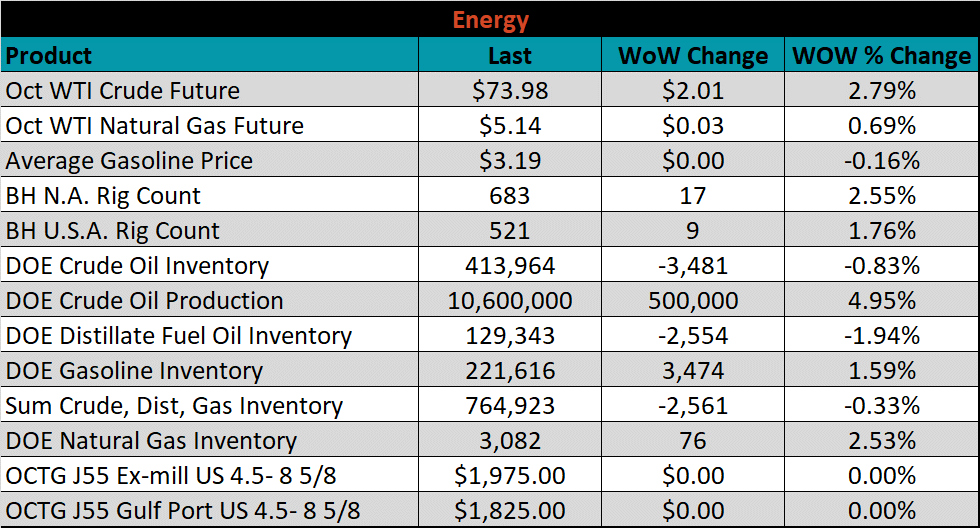

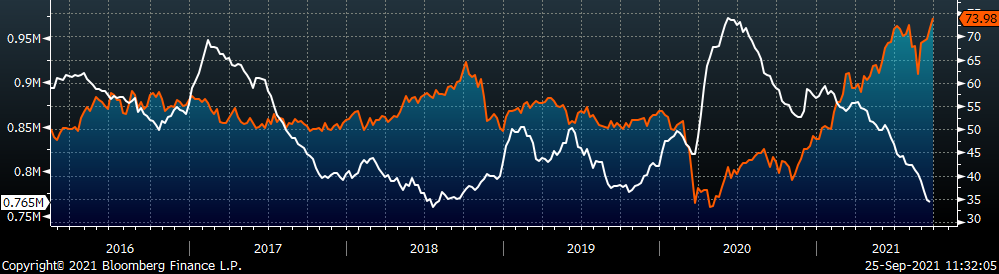

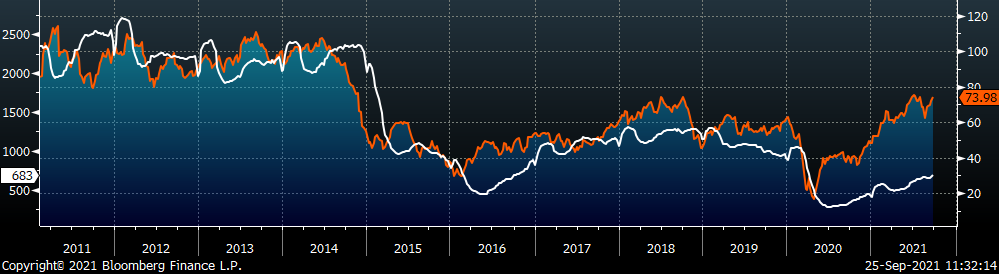

Last week, the October WTI crude oil future was up another $2.01 or 2.8% to $73.98/bbl. The aggregate inventory level was down another 0.3%, while crude oil production increased to 10.6m bbl/day. The Baker Hughes North American rig count was up 17 rigs, and the U.S. rig count was up 9 rigs.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: