Content

-

Weekly Highlights

- Market Commentary

- Risks

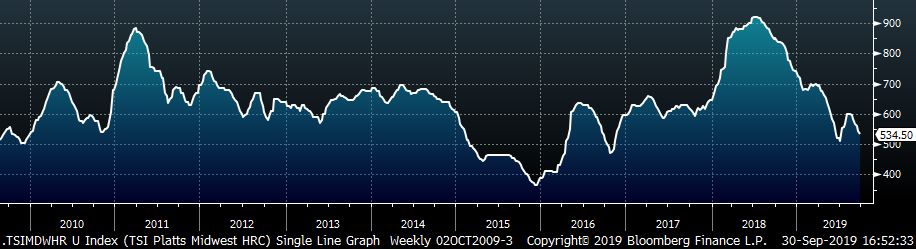

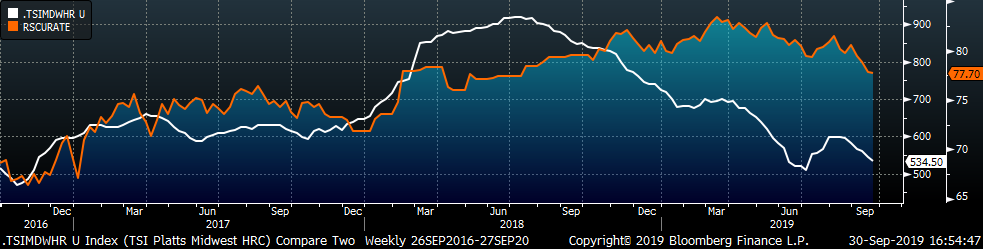

Spot Midwest HRC prices are down over $60/st over the last two months after a short-lived rally in July. Before the $100/st rally in July, this report pointed to multiple data points and dynamics that were supportive of higher prices. This week we will analyze these same indicators to see if we are near a similar inflection point in spot pricing.

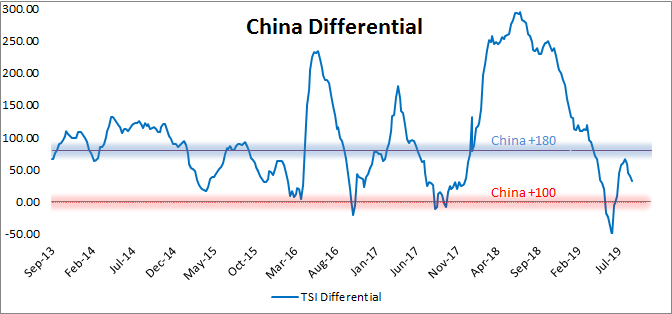

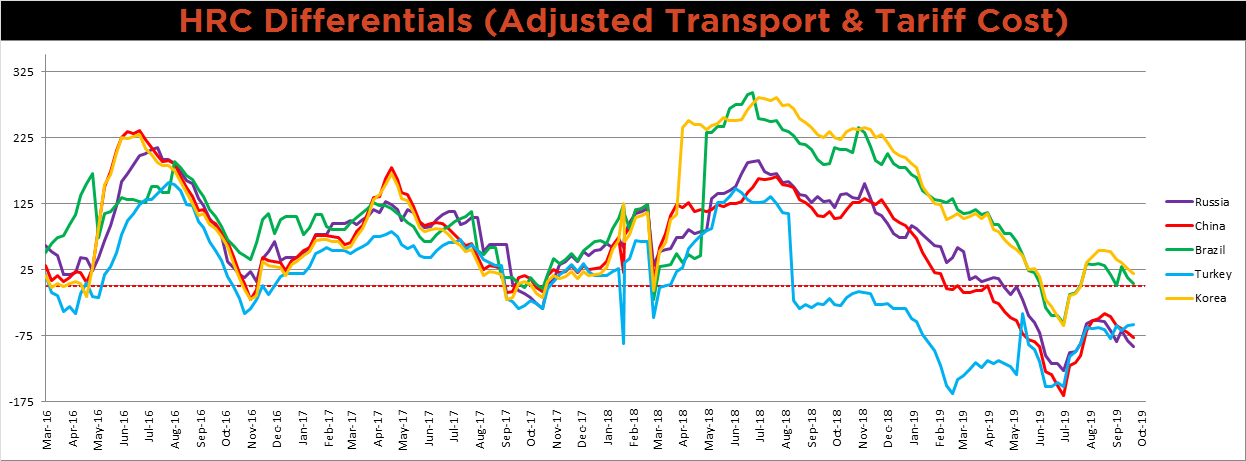

One indicator that we repeatedly reference and follow is the China price differential, the difference between the Platts TSI Daily Midwest HRC Index and the Platts China Export price, including transportation costs. In the beginning of July, this differential reached a bottom, and the US Midwest price was below the delivered China export price, which we noted as unsustainable. After recovering to normal levels as the domestic price rallied, the differential has begun to fall again. However, it currently sits near $25/st, which is $75 above its previous low. There is not currently the same upward global price pressure on the domestic price as there was in July.

Throughout the month of June, this report highlighted declining and negative profitability for the marginal ton produced, noting that unprofitable production was unsustainable. US Steel’s announcement to idle two blast furnaces in June preceded the ensuing price rise. However, current profitability estimates for the marginal ton produced at both EAFs and BOFs remains positive, despite shrinking over the last two months. Raw material costs today, for both iron ore and scrap, are significantly lower than they were in July. Therefore, it is less likely that mills will remove production from the market, reducing this upside risk.

Finally, lead times have been shrinking which emboldens the buyer’s cycle of delaying purchases to obtain lower prices in the future. However, lead times are still at levels well above the lows they reached in late June, suggesting they can continue to decline before they reach their bottom. Further declines in lead times will continue to pressure spot prices.

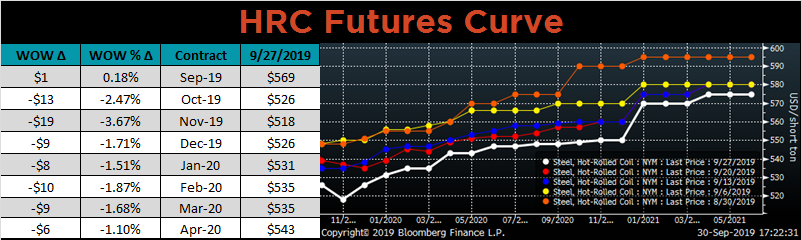

These indicators point to lower spot prices in the coming weeks. However, as we saw in the spring, spot prices can decline significantly with the forward curve declining less, creating a steep contago in the curve. For a steel buyer, this means prices on the forward curve may not get lower, even if spot prices decline. We suggest locking in a portion of future buys at current levels, which are over $75 below the historical average HRC price.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

The Platts TSI Daily Midwest HRC Index was down $9.25 to $534.50.

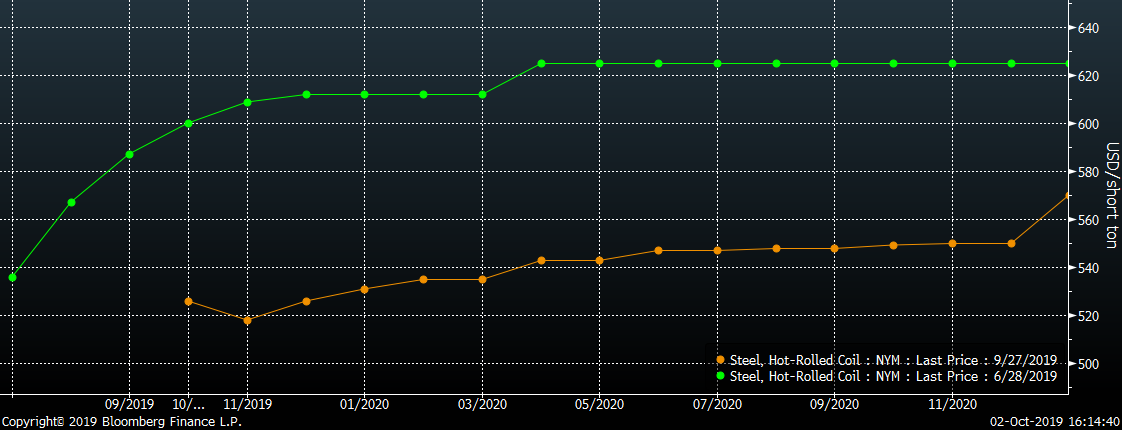

The CME Midwest HRC futures curve is below with last Friday’s settlements in white. The curve moved lower across the board, and significantly in the front as spot prices continue to fall.

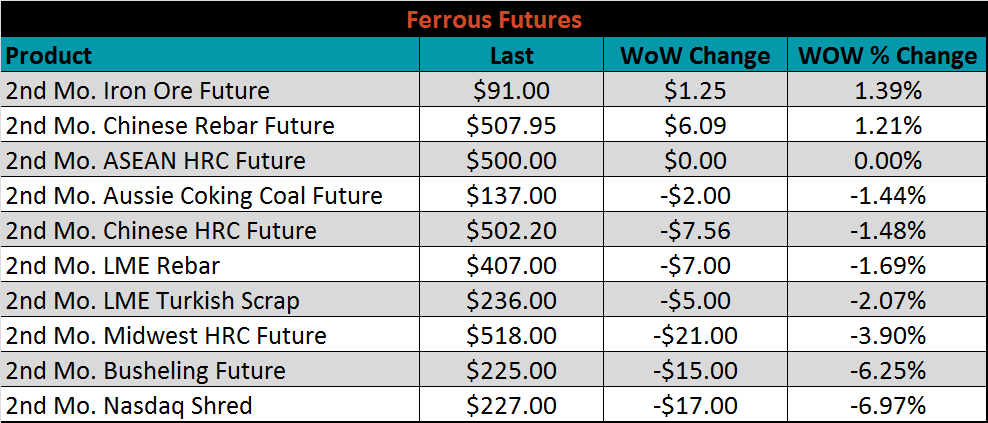

November ferrous futures were mixed. The Nasdaq shred future lost 7%, while the iron ore future gained 1.4%.

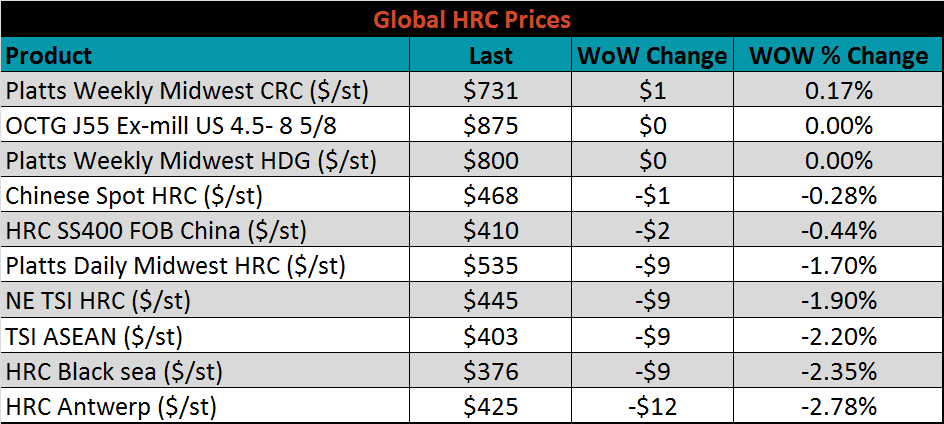

The global flat rolled indexes were mostly lower. Midwest CRC was up slightly, while HRC Antwerp was down 2.8%.

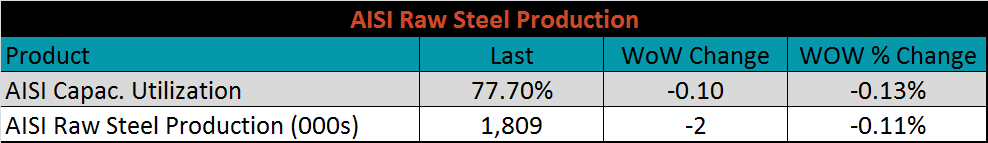

The AISI Capacity Utilization Rate was down another 0.1% to 77.7%, and remains below the 80% goal set by the Trump administration. Prices do not yet appear to be at level where production will be pulled off.

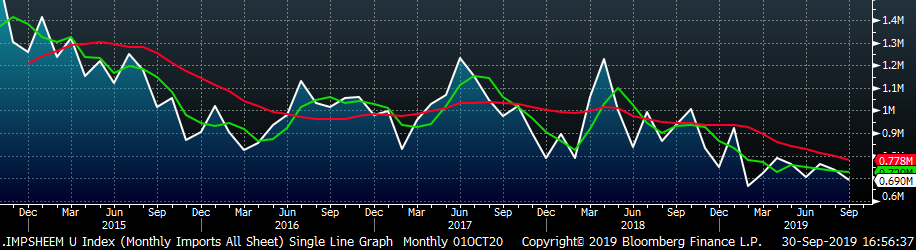

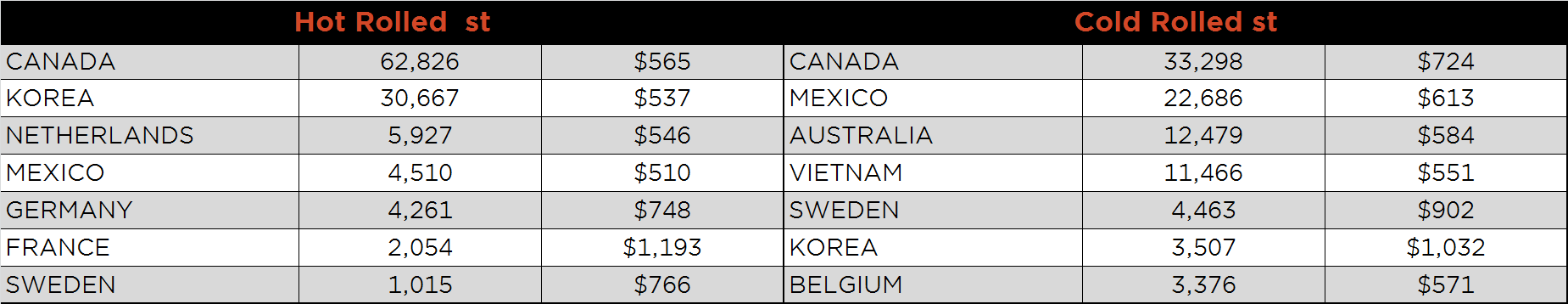

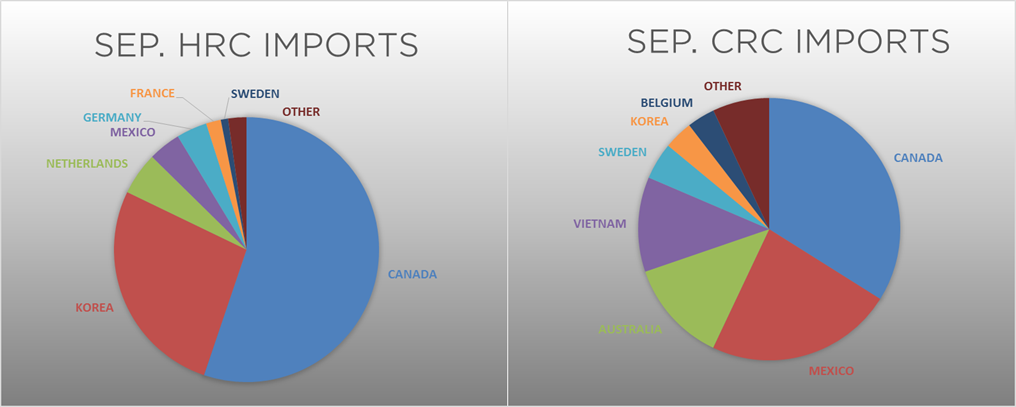

September flat rolled import license data is forecasting a decrease of 53k to 689k MoM.

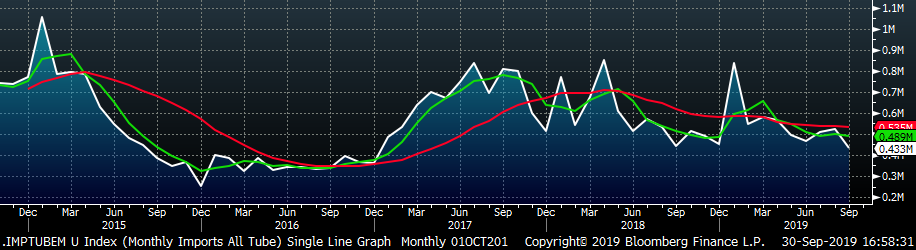

Tube imports license data is forecasting a MoM decrease of 46k to 432k tons in September.

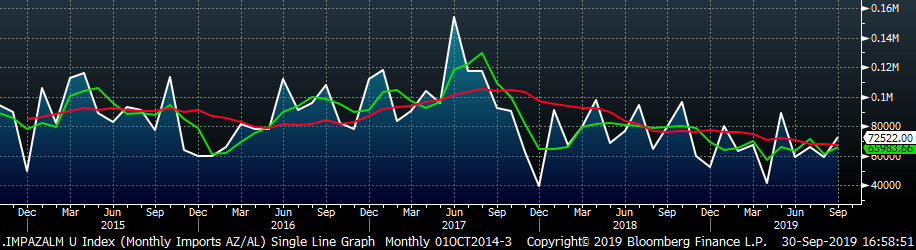

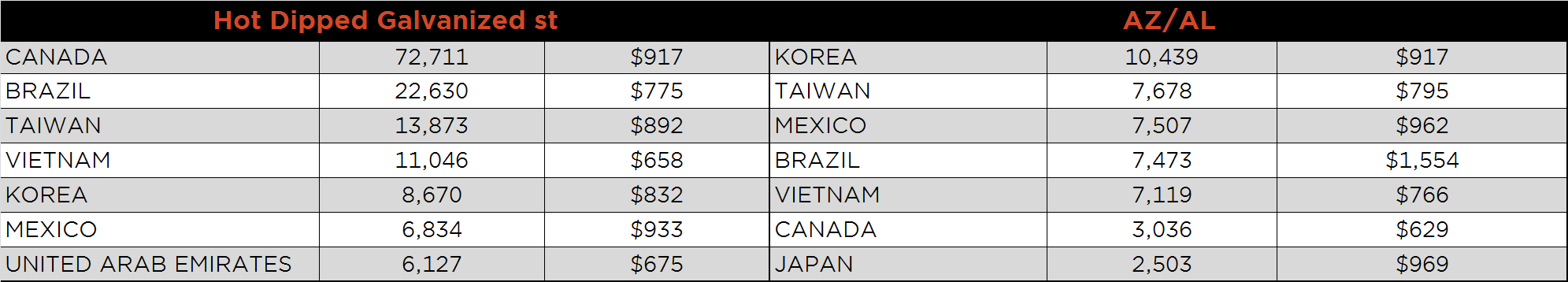

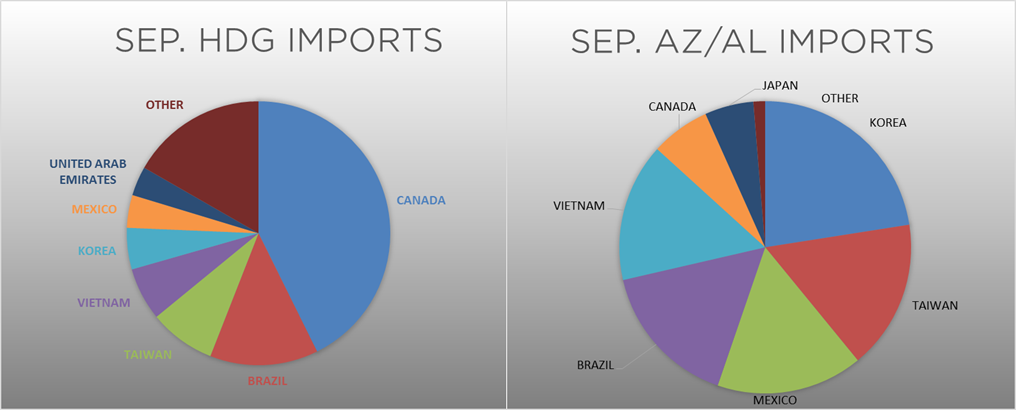

AZ/AL import license data is forecasting an increase of 10k in September to 73k.

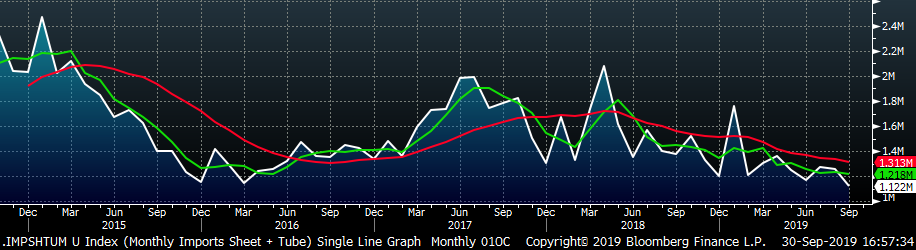

Below is September import license data through September 24, 2019.

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. The Turkish differential continued slightly higher, while the other four tracked differentials moved lower.

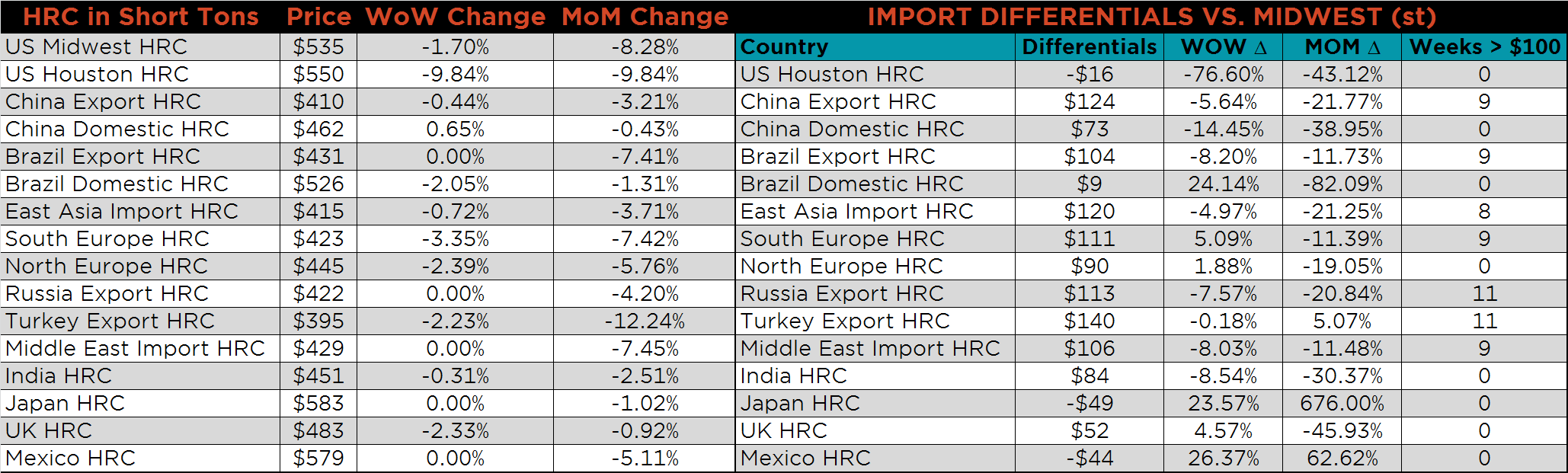

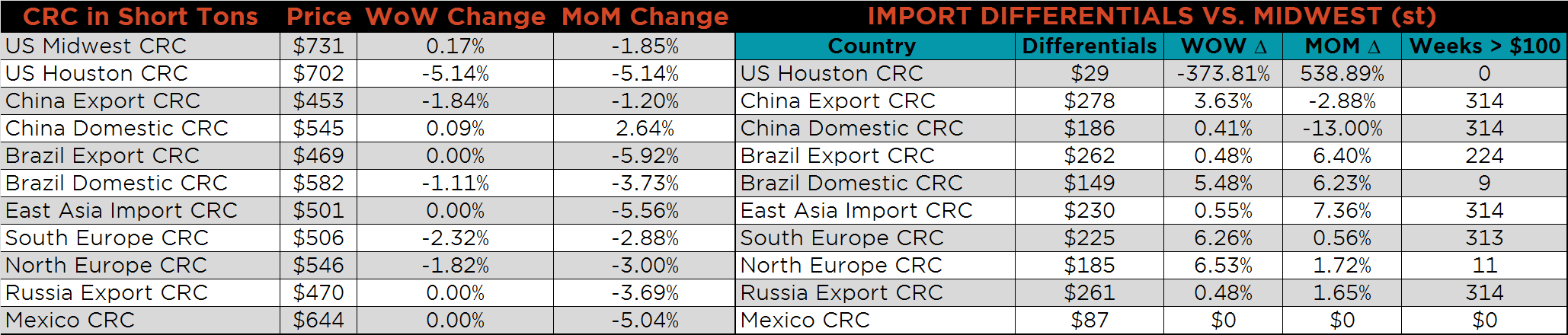

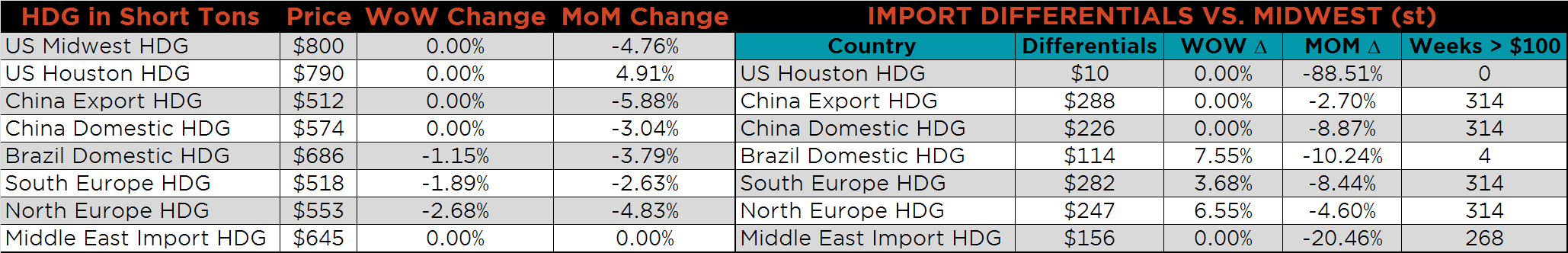

SBB Platt’s HRC, CRC and HDG pricing is below. The Midwest HRC price was down 1.7%, while CRC and HDG prices were essentially flat. Turkish HRC and Chinese CRC export prices were lower, 2.2% and 1.8%, respectively.

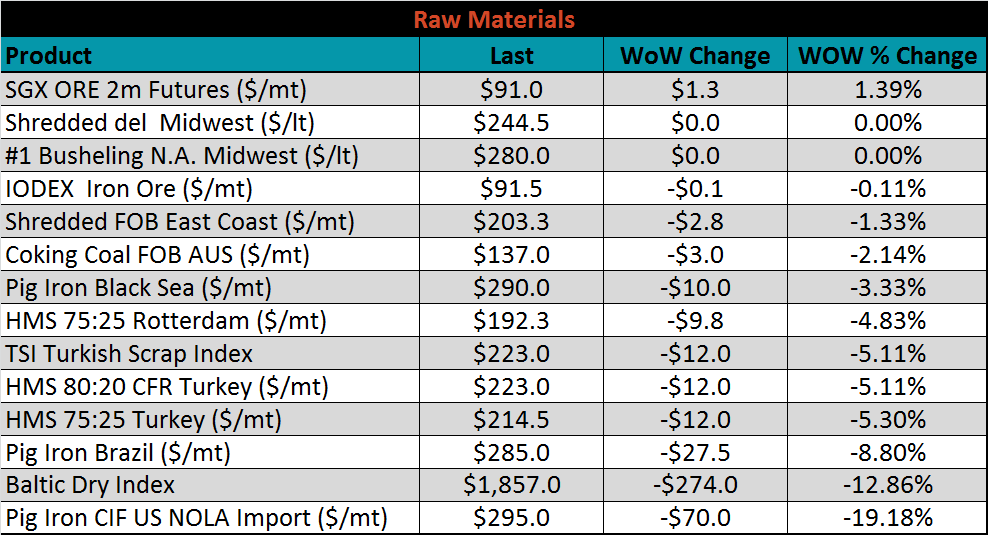

Raw material prices were mixed. Pig iron delivered to New Orleans was down 19.2%, while SGX ore was up 1.4%.

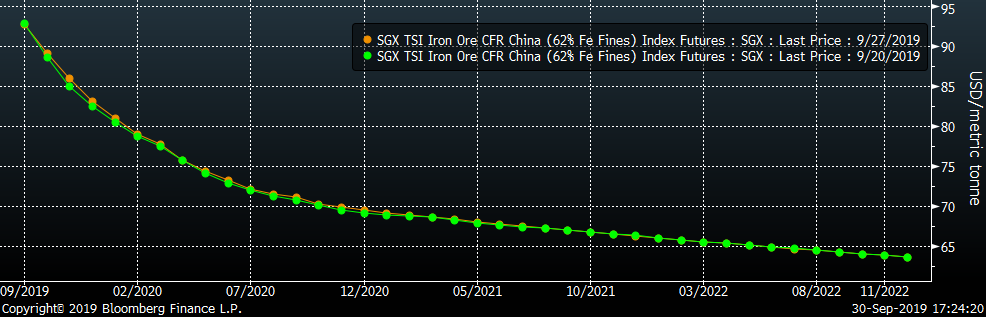

Below is the iron ore future curve with Friday’s settlments in orange, and the prior week’s settlements in green. There was very little change in the curve since last week.

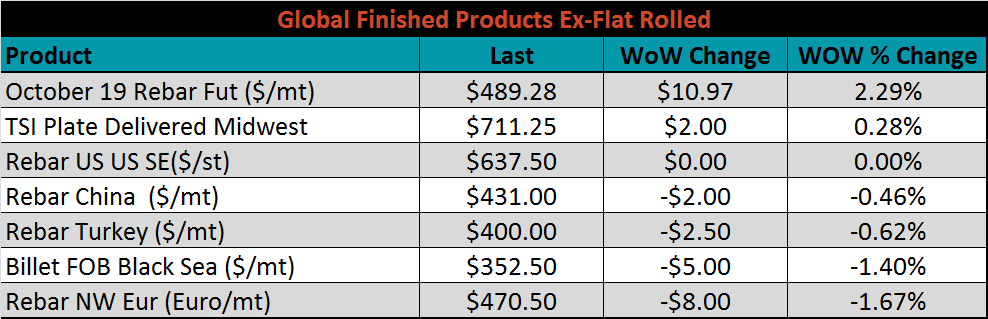

The ex-flat rolled prices are listed below.

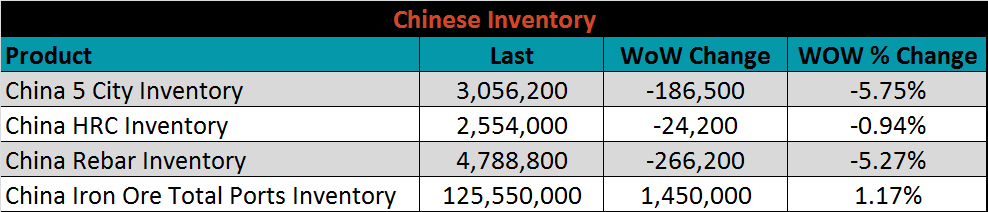

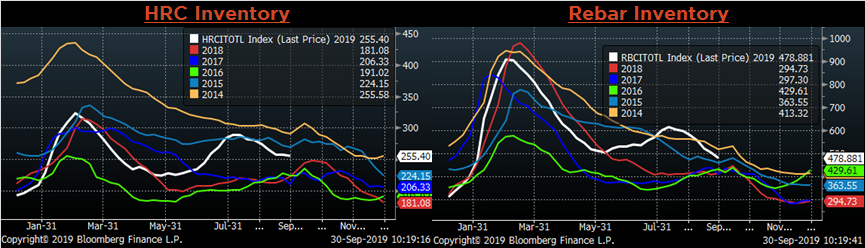

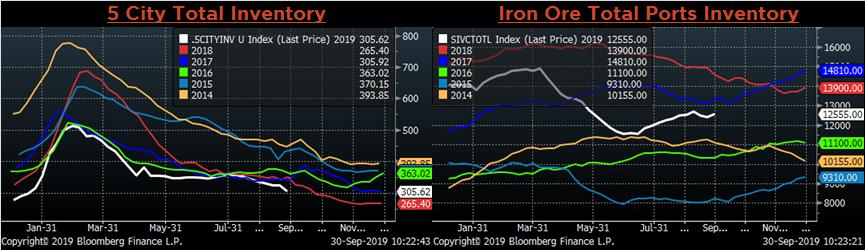

Below are inventory levels for Chinese finished steel products and iron ore. Rebar, HRC and the 5-city inventories all moved lower while iron ore inventory increased. As mentioned in previous weeks, poor global economic data and seasonality suggest the downward trend in inventory levels should continue through the end of the year.

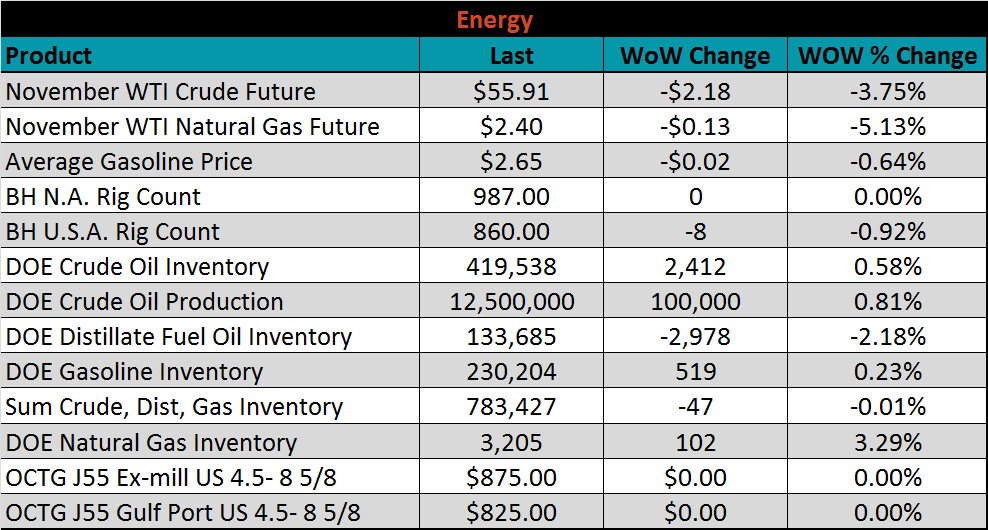

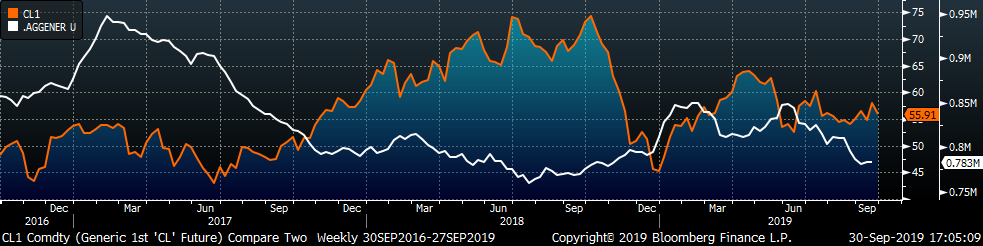

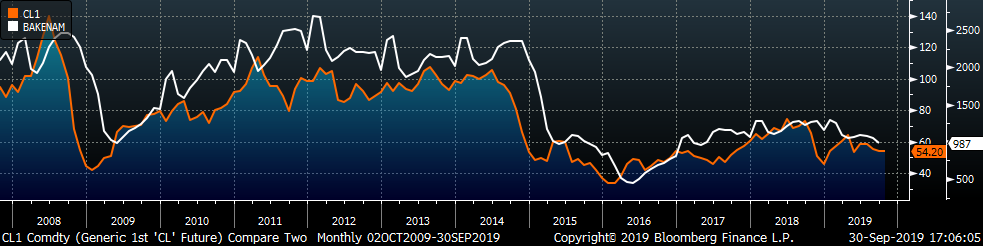

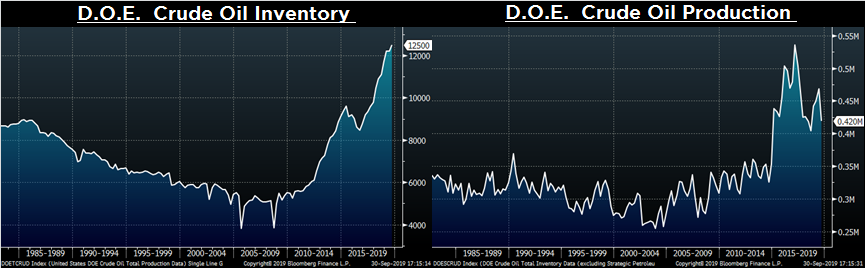

Last week, the November WTI crude oil future lost $2.18 or 3.8% to $55.91/bbl. The aggregate inventory level was essentially flat, and crude oil production rose to 12.5m bbl/day. The Baker Hughes North American rig count was flat, while the U.S. count lost eight.

The list below details some upside and downside risks relevant to the steel industry. The orange ones are occurring or look to be highly likely. The upside risks look to be in control.

Upside Risks:

Downside Risks: