Content

-

Weekly Highlights

- Market Commentary

- Upside & Downside Risks

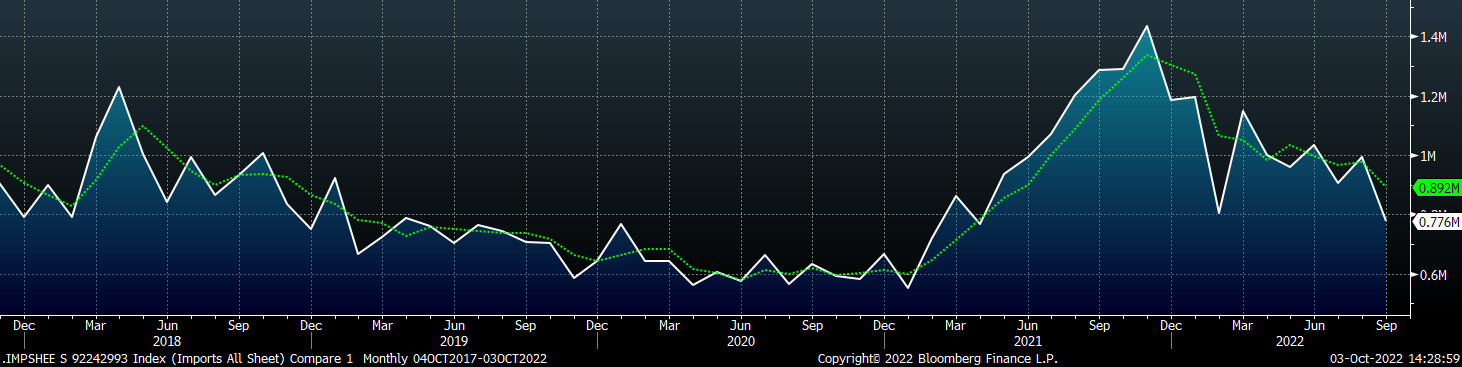

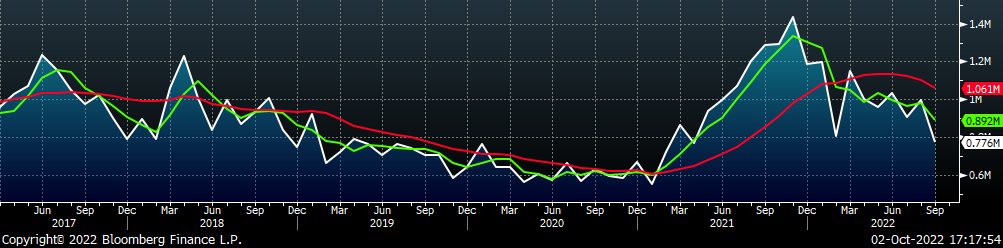

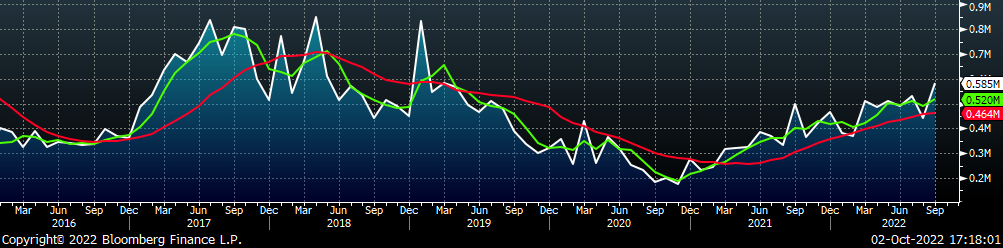

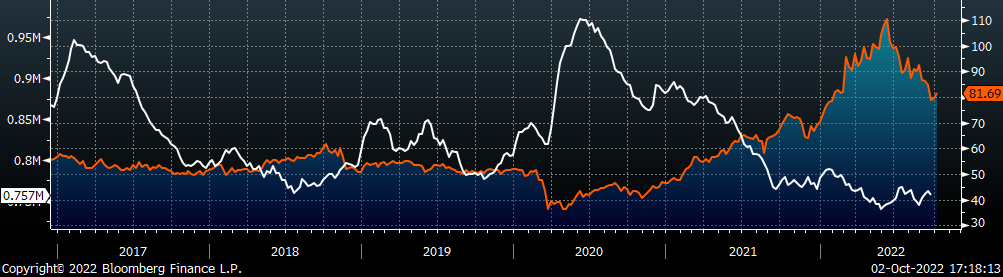

Persistent inflation and the rapid escalation in interest rates over the last 6 months have culminated in demand destruction and a worsening outlook in the U.S. economy and across the globe. Our domestic steel industry, while holding up better than many other countries, has also been impacted by the downward pressure, with the HRC price falling 48% from its peak in April. In a clear reaction to the slowing global demand, domestic production and imports have also been trending lower. The chart below shows sheet steel imports (white) and their 3-month moving average (green).

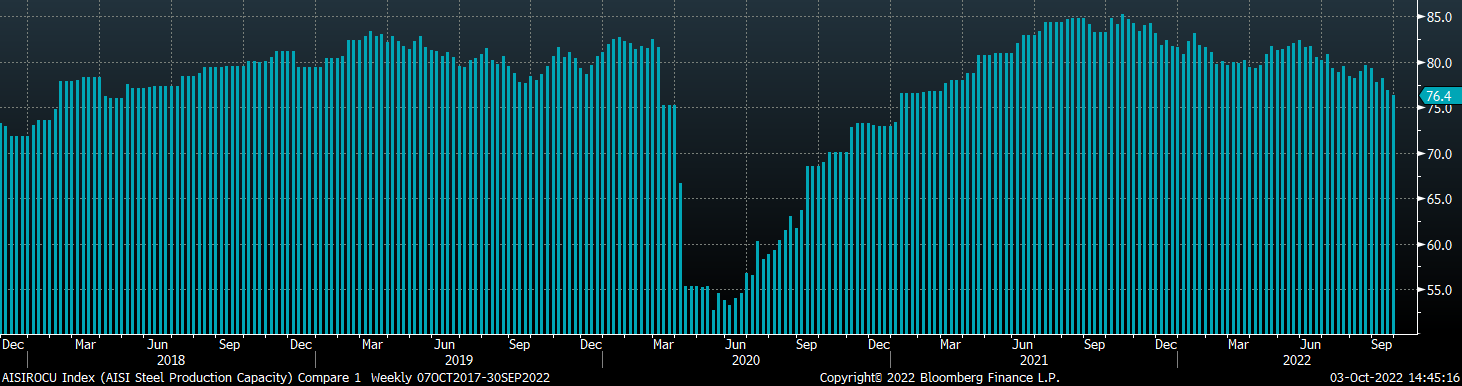

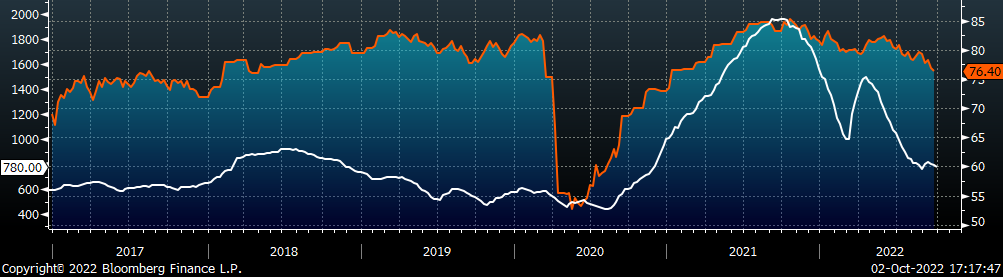

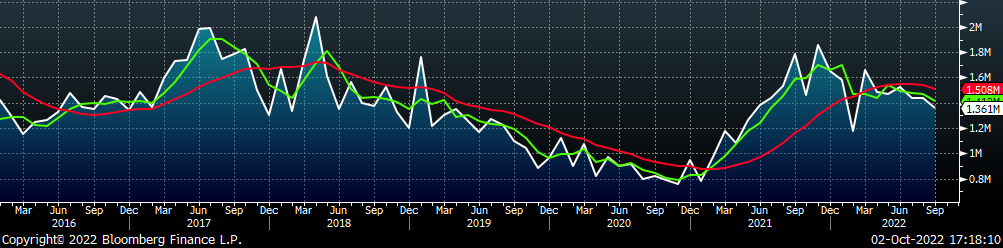

Since peaking in November of last year, import arrivals have been trending lower but the moving average has been surprisingly stable around 1M tons per month, well above normal levels in the post-232 era. While the data is still preliminary, it appears that steel sheet imports in September will fall to the lowest level since March 2021. Furthermore, the chart below shows the U.S. domestic capacity utilization (AISI), which is now at the lowest level since the first week of January 2021.

These two closely watched data points indicate a proactive reduction in supply, even culminating in the indefinite idling of multiple BOF mills both domestic and abroad, an action typically viewed as a “last resort.” However, our view is that neither of the supply side factors will be enough of a catalyst to cause a rally. Instead, we will look for destocking inventories and increasing lead times as signals that the floor has been reached. Depending on how long it takes for this to occur, these supply-side factors will play a key role in how high prices climb once demand concerns abate.

Below are the most pertinent upside and downside price risks:

Upside Risks:

Downside Risks:

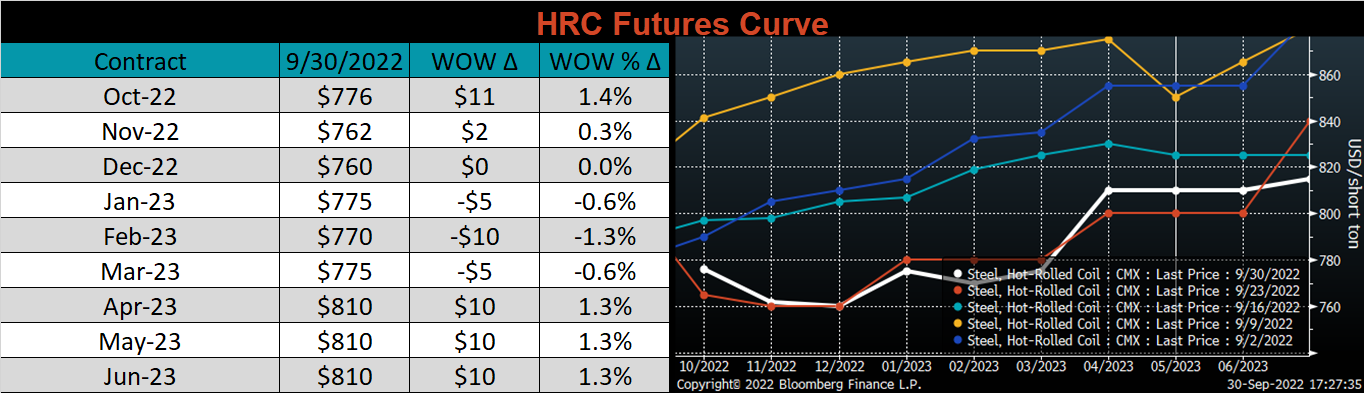

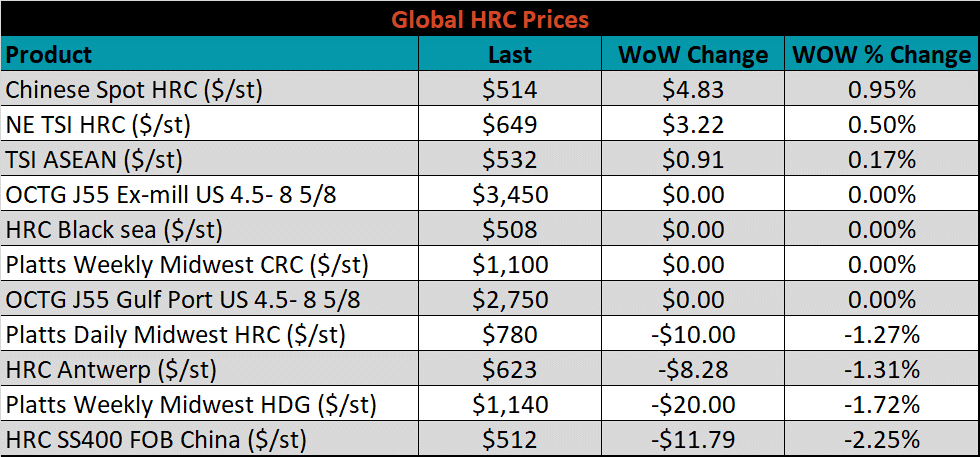

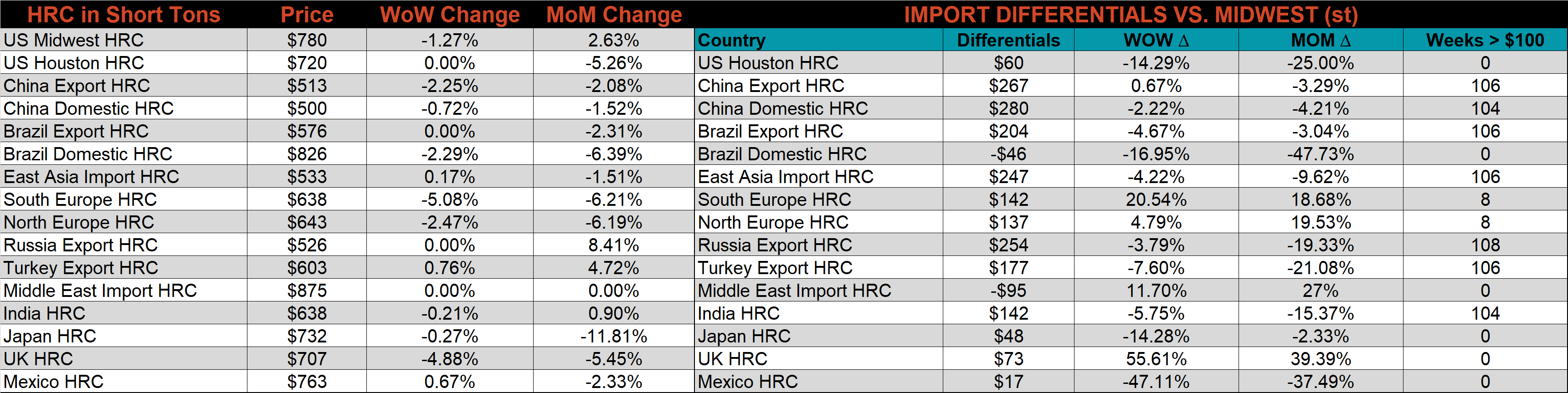

The Platts TSI Daily Midwest HRC Index was down another $10 to $780.

The CME Midwest HRC futures curve is below, with last Friday’s settlements in white. The curve traded higher early in the week before erasing those gains on Thursday and Friday, leaving most expirations only slightly higher on the week.

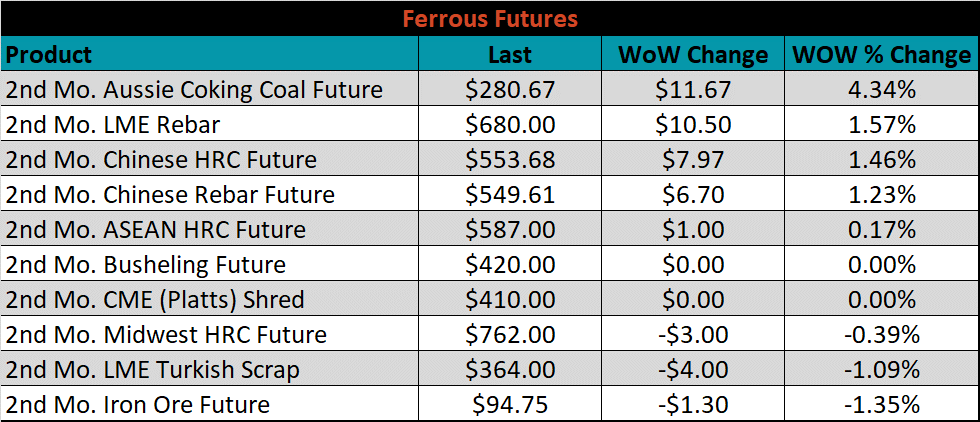

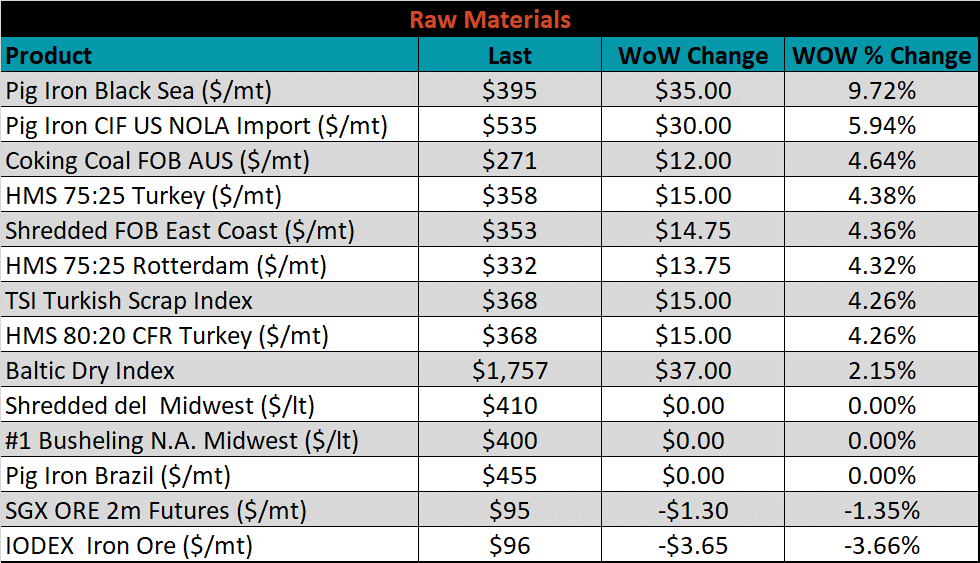

The 2nd month ferrous futures were mixed with Aussie coking coal gaining another 4.3%, while iron ore lost 1.4% going into the Chinese holiday week.

Global flat rolled indexes were mixed last week. The most significant moves came from Chinese spot HRC which was up 1%, which the Chinses Export price was down 2.3%.

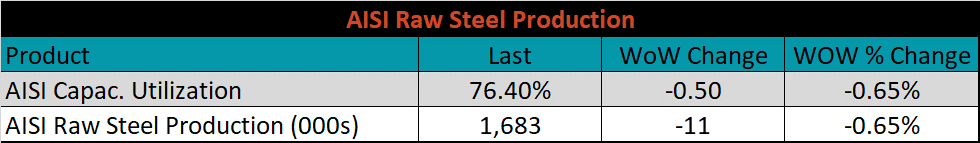

The AISI Capacity Utilization was down another 0.5% to 76.4%.

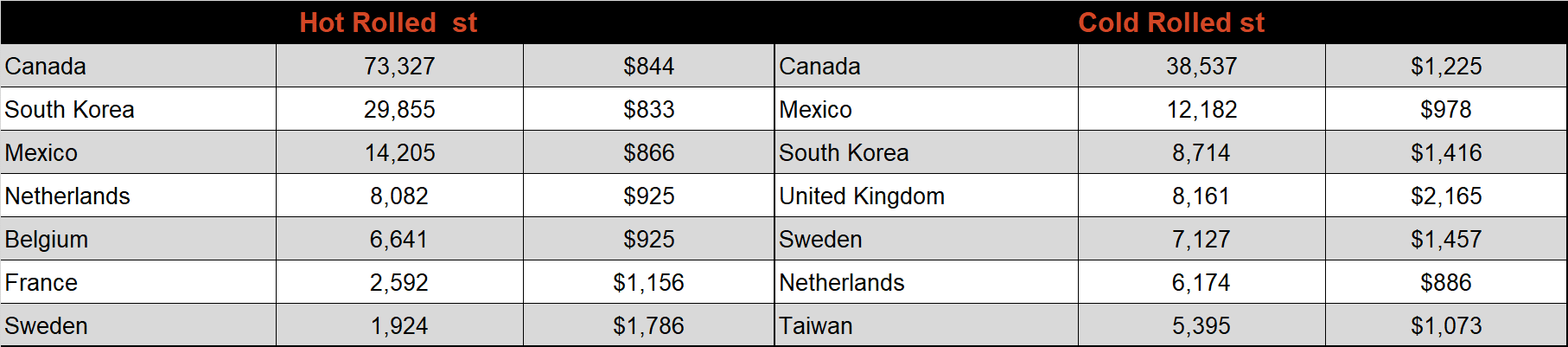

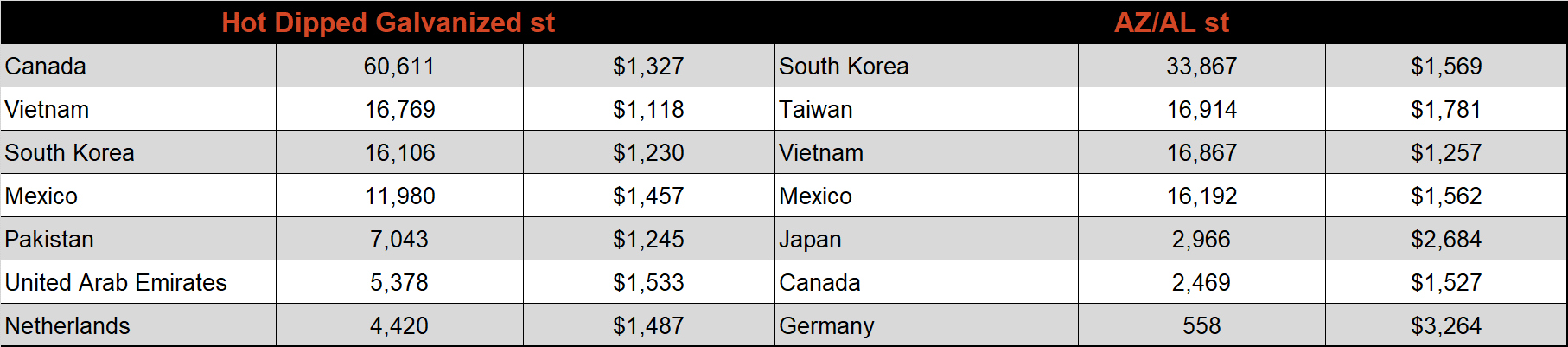

September flat rolled import license data is forecasting a significant decrease of 219k to 776k MoM.

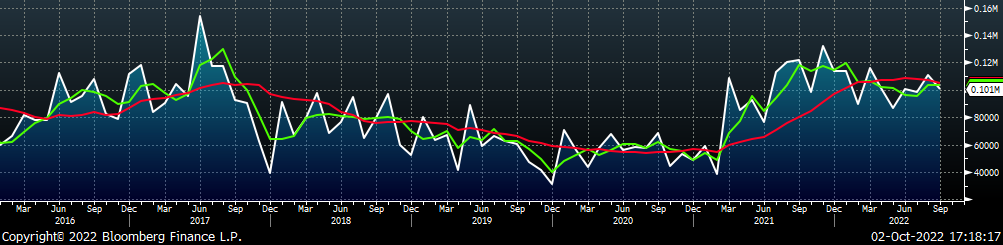

Tube imports license data is forecasting an increase of 142k to 585k in September.

September AZ/AL import license data is forecasting a decrease of 10k to 101k.

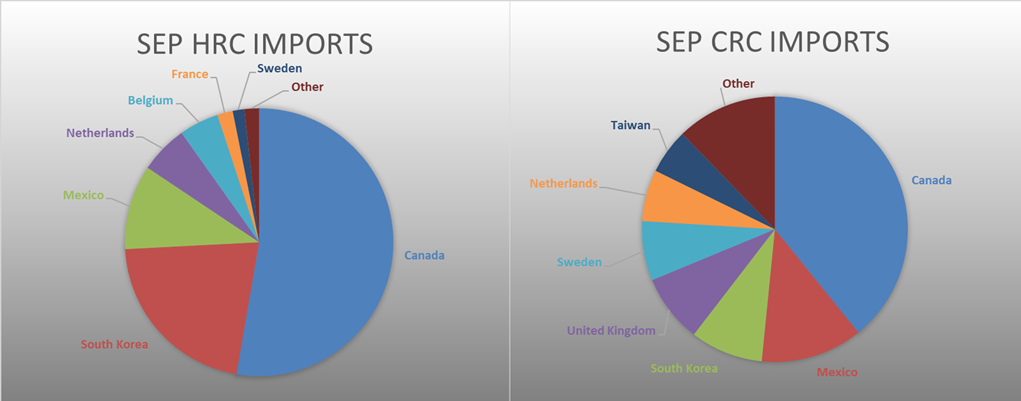

Below is September import license data through September 25th, 2022.

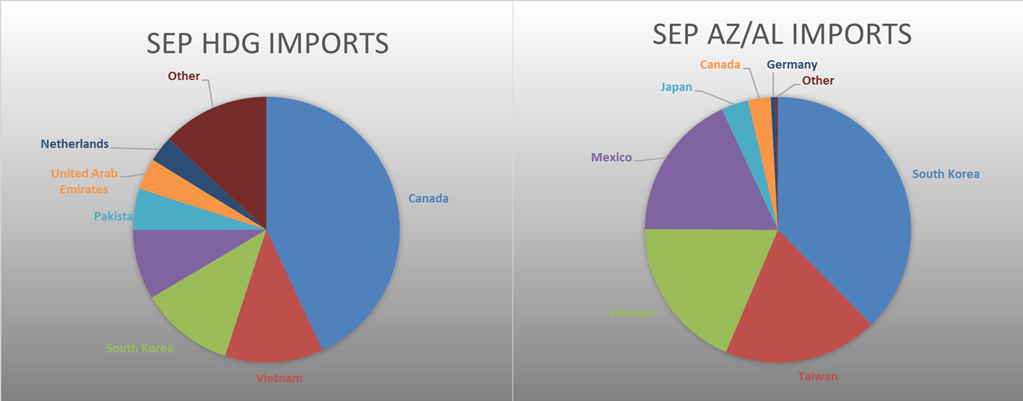

Below is the Midwest HRC price vs. each listed country’s export price using pricing from SBB Platts. We have adjusted each export price to include any tariff or transportation cost to get a comparable delivered price. Differentials decreased slightly for all the watched countries, apart from Northern Europe, and China which were both weaker than U.S. domestic HRC.

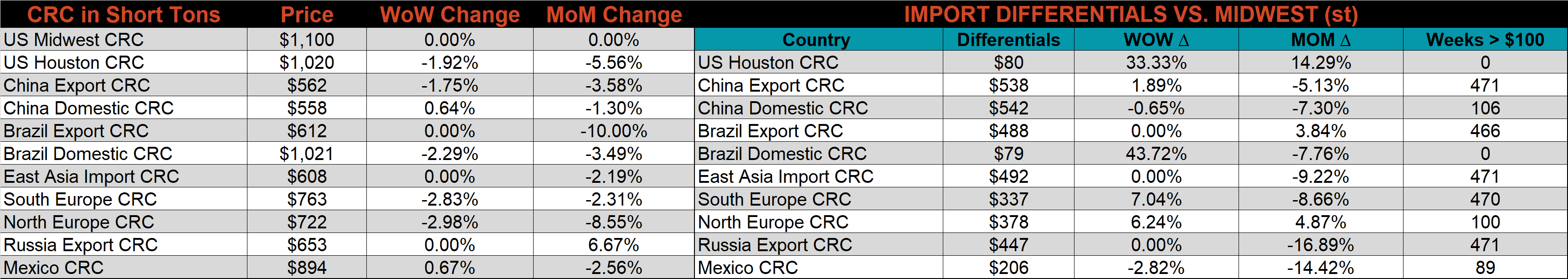

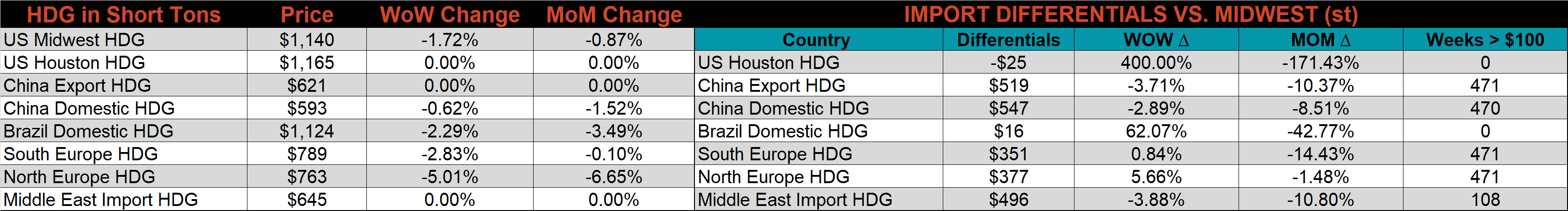

Global prices were mostly lower, led by the Southern European HRC price, which was down 5.1%, while Mexican HRC and CRC were up 0.7%.

Raw material prices were mostly stable or higher again this week, with Black Sea pig iron up 9.7%, while the IODEX iron ore index was down 3.7%.

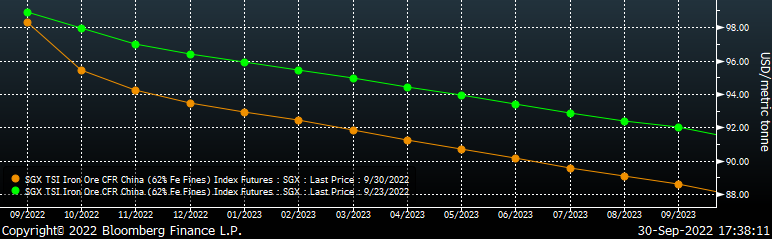

Below is the iron ore future curve with Friday’s settlements in orange, and the prior week’s settlements in green. Last week, the entire curve shifted lower again, most significantly in the back of the curve.

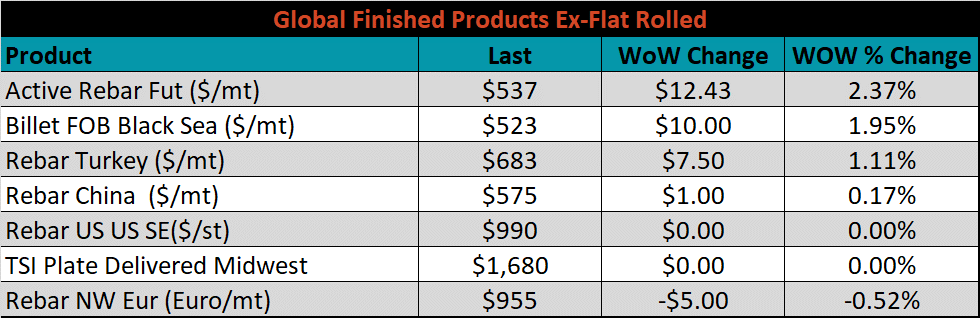

The ex-flat rolled prices are listed below.

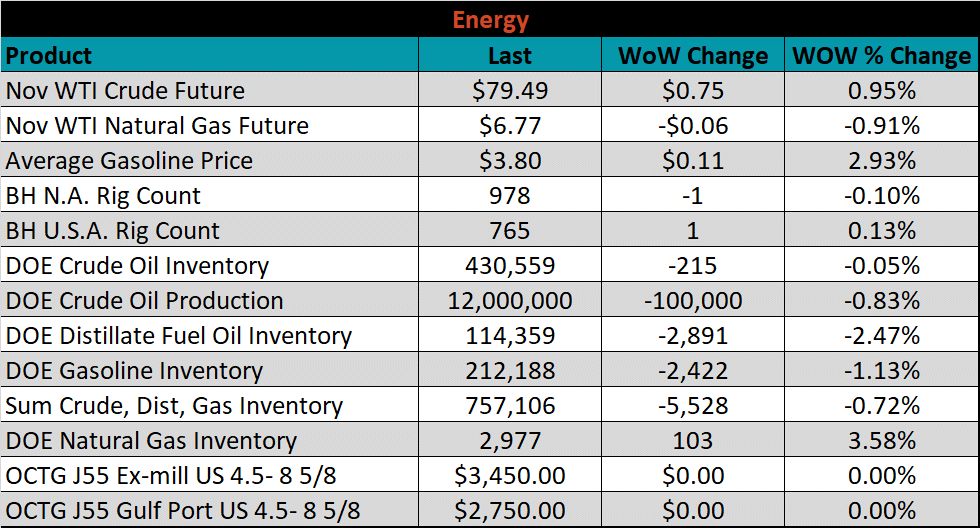

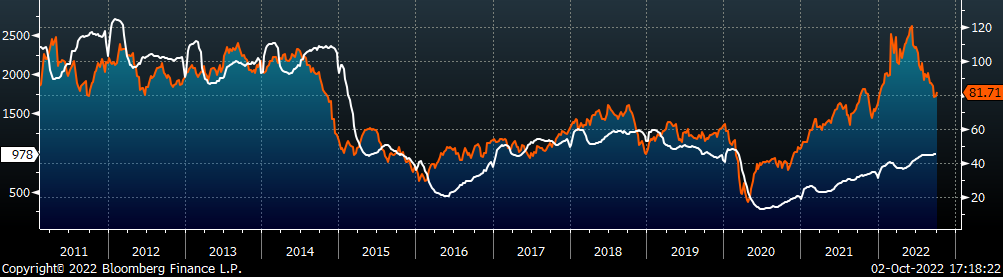

Last week, the November WTI crude oil future gained $0.75 or 1% to $79.49/bbl. The aggregate inventory level was down 0.7%. The Baker Hughes North American rig count decreased by 1 rigs, while the U.S. rig count increased by 1 rig.

The list below details some upside and downside risks relevant to the steel industry. The bolded ones are occurring or highly likely.

Upside Risks:

Downside Risks: